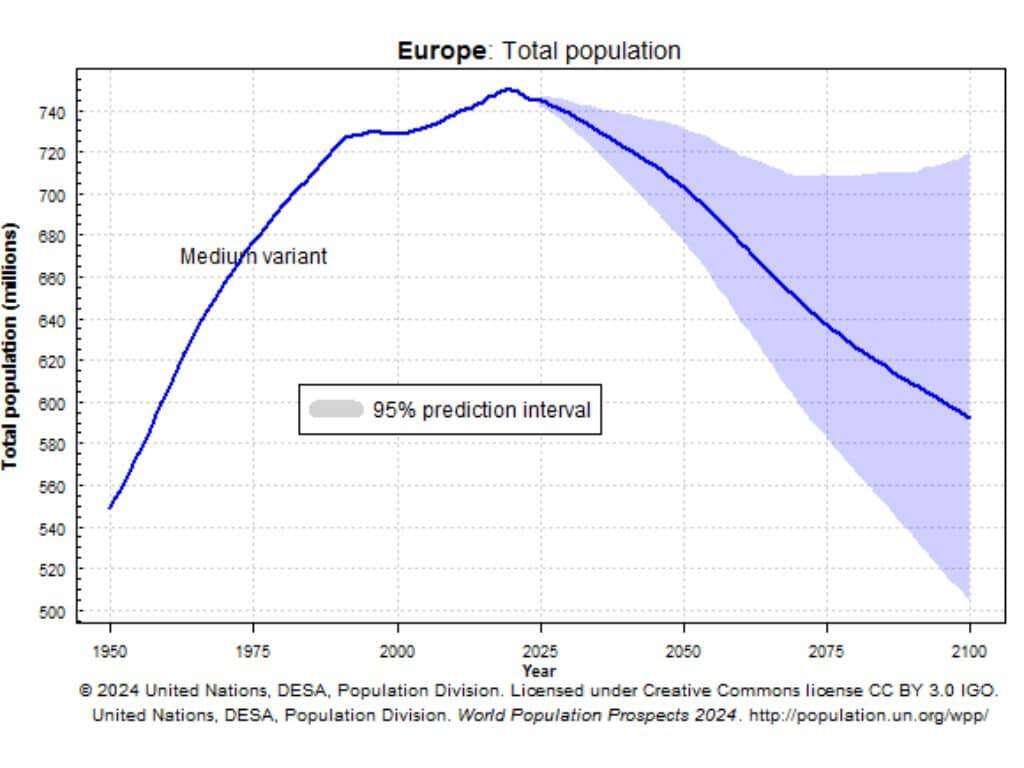

Please, people, don't buy real estate with debt in Europe. It's a capital grave. #btc #demographics #realestate

Discussion

you're right, dont buy land. pay a landlord and when they raise your rent to just above what you can afford, then what?

debt should be leveraged. if you're not, you're falling behind, because they are.

You never witnessed falling real estate prices,my young friend

Why should I care about the value of my house when I have no plan to sell it? It’s a shelter, not a speculative asset?

Also inflation is just gonna go up forever and faster than before so the debt will be easier to pay back over time.

I see deflation on the horizon

Maybe in a few decades once all fiat currencies have collapsed and we’re back to sound money. Until then, nothing stops the money printer and it will only accelerate.

Remember 2008-2009? Now add AI and the debt spiral

Sorry but I completely disagree if it's your first home and not a speculative investiment. In an inflationary system, it's much better to have a fixed-rate mortgage backed by fiat currency from a bank than to be at the mercy of your landlord, who can adjust the rent price with inflation.

And even as an investment, undervalued Real Estate (expecially agricultural land) is oftentimes a better asset class than bond, bills and currency on bank accounts.

Ok, course....Bitcoin and Gold are in another league..

When RE markets enter a secular decline You'll see what happens to Your 'fixed-rate' mortgaged

To be honest, I don't like being in debt, and I'm lucky enough not to have a mortgage or any other debt burden.

However, it's common knowledge that using the leverage to purchase capital assets in an inflationary environment is not necessarily a bad thing. Monetary 'hyper-inflation' will likely compensate for the demographic-driven real estate bear market you foresee. I.e.: real house prices will decline less or on par with the real value of your debt -> all remains basically equal cereris paribus.

In other words you cannot really print houses and even less arable land.

Scarcity scale:

Bitcoin>Precious Metals>Art>Real Estate>Equity>Non precious commodities>Consumer Goods>Currencies

What do you mean? You expect rents and prices to dip?