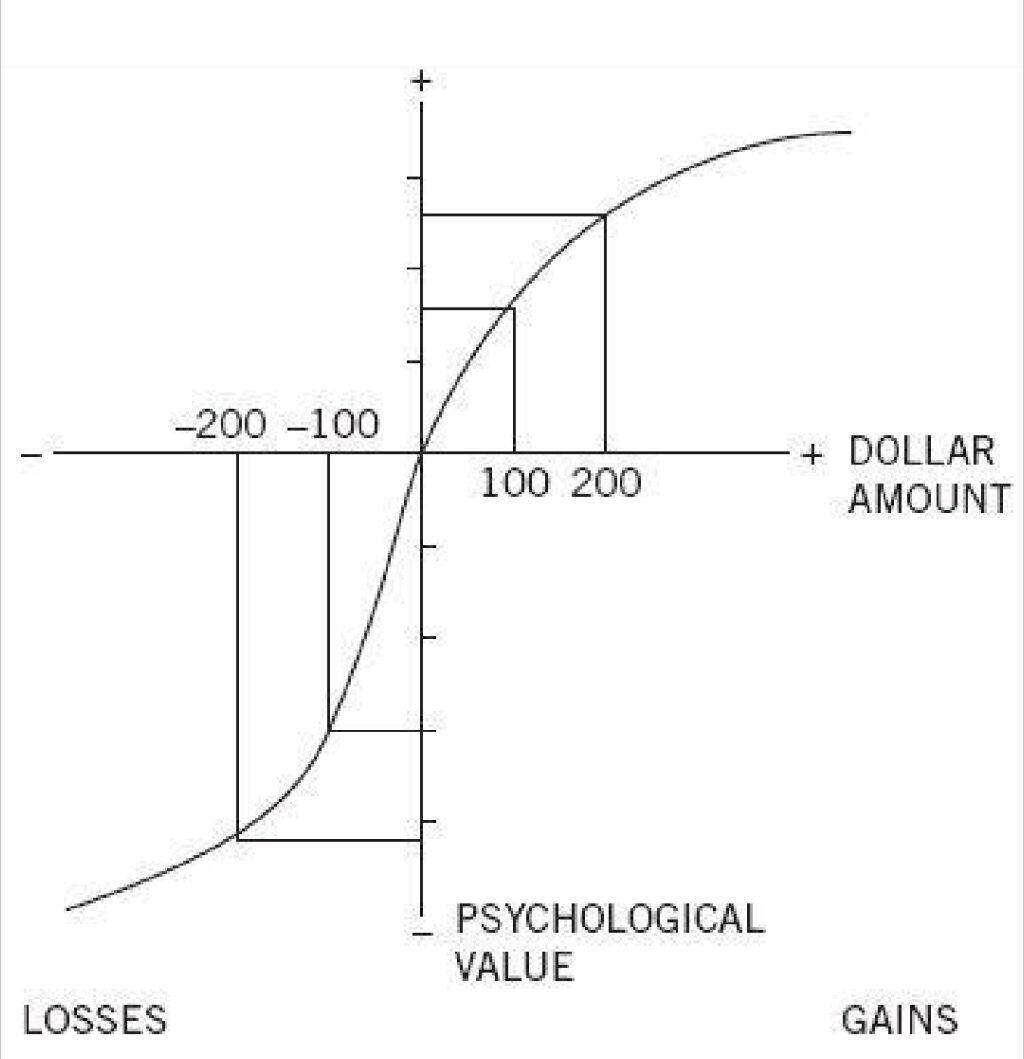

Well defined, but in terms of measurement, here is one way we could go about measuring our openness. Ideally, the psychological value between gains and losses are symmetrical, and given the magnitude of the gain or loss, the psychological value gets skewed. To provide an example based on your definition, swap out money with time. Time is more universal. This is why children feel more open to the teacher. The humble may be humble because they have very little to lose. If they do have a lot to lose, and they are still open, I would imagine they feel the stakes are in their favor (They are willing to risk it). So you could define openness based on the mathematical term 'expected value' witj how well they adhere to it, and their ability to calculate it effectively.

The graph above is a measurement taken based on this.

Thinking Fast and Slow

Loss Aversion

Problem 5:

You are offered a gamble on the toss of a coin.

If the coin shows tails, you lose $100.

If the coin shows heads, you win $150.

Is this gamble attractive? Would you accept it?

To make this choice, you must balance the psychological benefit of getting it? Although the expected value of the gamble is obviously positive, because you stand to gain more than you can lose, you probably dislike it the critical inputs are emotional responses that are generated by System.

1. For most people, the fear of losing $100 is more intense than the hope of gaining $150. We concluded from many such observations that “losses loom larger than gains” and that people are loss averse.

You can measure the extent of your aversion to losses by asking yourself a question: What is the smallest gain that I need to balance an equal chance to lose $100? For many people the answer is about $200, twice as much as the loss. The “loss aversion ratio” has been estimated in several experiments and is usually in the range of 1.5 to 2.5. This is an average, of course; some people are much more loss averse than others. Professional risk takers in the financial markets are more tolerant of losses, probably because they do not respond emotionally to every fluctuation. When participants in an experiment were instructed to “think like a trader,” they became less loss averse and their emotional reaction to losses (measured by a physiological index of emotional arousal) was sharply reduced.

In order to examine your loss aversion ratio for different stakes...