I would actually say Lightning is economically unsuitable for micropayments. I'm not sure where the general misconception stems from but it's plainly false when you have some experience running a node at scale

I'm not sure what the technical definition of a "micropayment" is, but for the sake of argument let's say it's a payment below the dust threshold and thus not possible on-chain.

So in the event of a force closure, these are not recoverable

They wear out my SSDs just the same as any other payment. Replacing SSDs is one of the main, if not the largest OPEX of running a Lightning node, especially when you factor in redundancy, downtime etc

Although the absolute fee they pay are usually lower than a larger payment, in relative terms they are very expensive (1 sat base fee is almost 5% on 21 sat micropayment)

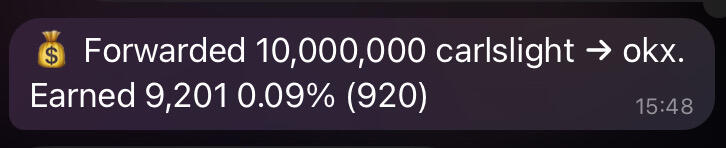

Anecdotally in the past I have been routing what I suspect to be podcasting 2.0 payments with 5 sat base fees, which paid 500% fees on 1 sat payments, every minute

In most cases it makes more sense economically to accumulate in a mint then cashing out