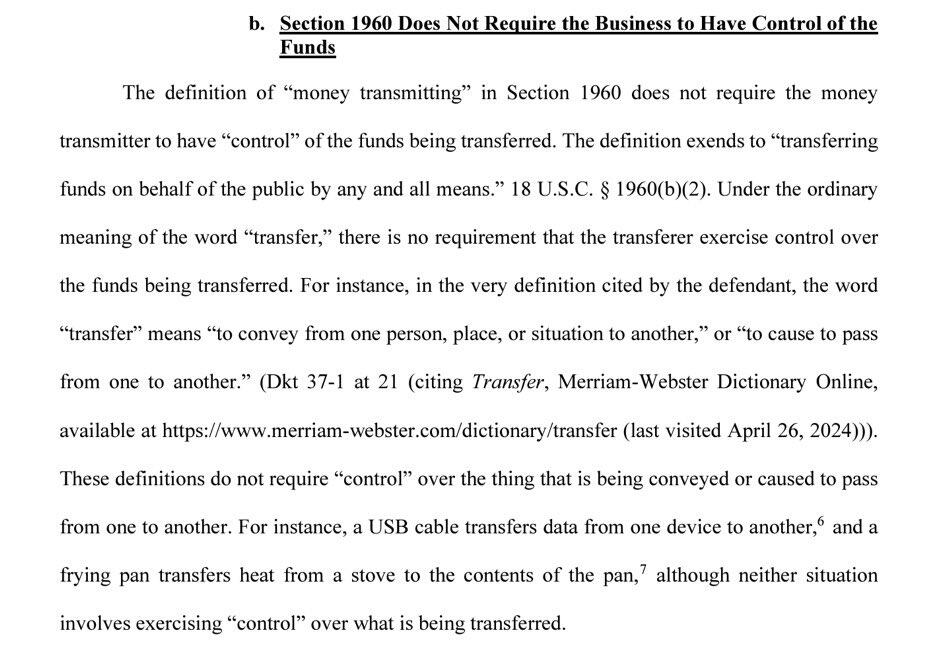

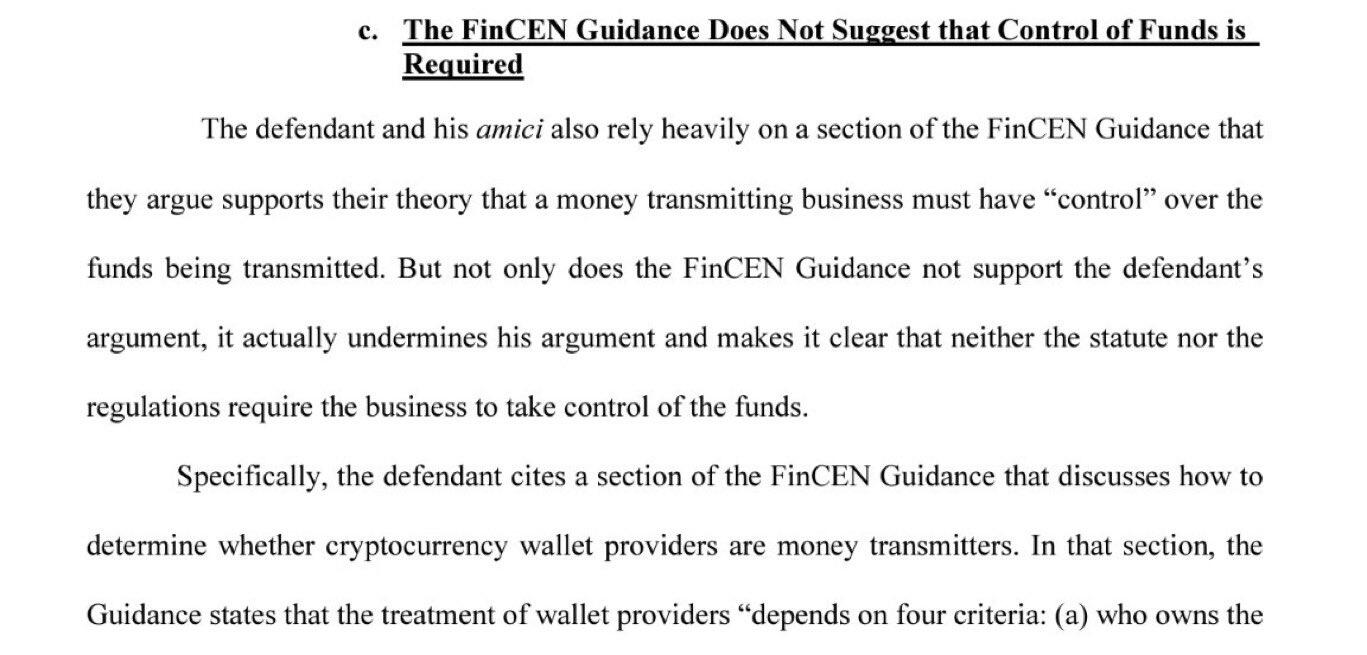

The tornado cash case is going to likely set the precedent for what “money transmitting” means for purposes of bitcoin. The case will mostly hinge on how “transfer” should be defined within the meaning of Section 1960. As these screenshots show, the government argues that it means “by any and all means” and that “control” is not a prerequisite to be considered a transferor. They use examples like a USB cable being a transferor of data and a frying pan transferring heat from a stove.

By this logic, anyone operating hardware or software which Bitcoin runs through could be deemed a money transmitting business. However, this is obviously overly broad. My guess is, if the judge has common sense, he will see that a line needs to be drawn somewhere. The easiest line to draw is by making control a prerequisite. Otherwise the governments reasoning opens up liability to almost any tech company providing software or hardware.

The line of reasoning is simple:

Are dell and Microsoft money transmitting businesses because their laptops and software enable you to send money to someone in e-commerce? No. What about your ISP whose internet connection enables the transfer of data to complete an internet purchase? No. Why? Because they aren’t exercising control over the transaction, they are just providing the rails that make it possible - and have no further involvement.