I like charts to look at the past, I don't use it to predict future. Here I'll make an exception - not to predict, but to say this time it might be different. And there's no price (only indirectly).

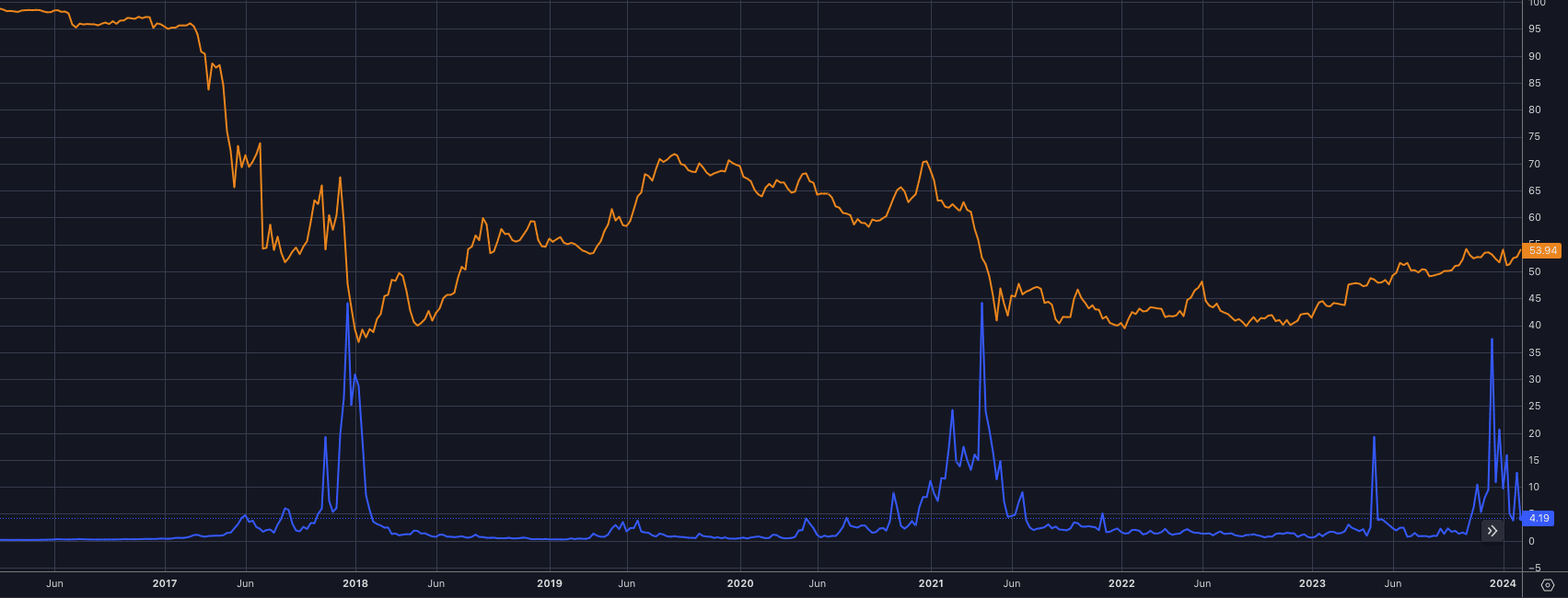

People are expecting an "alt season", meaning altcoins will have their market cap comeback. In the past, when the fees (blue line, median Bitcoin transaction price in USD) went up, altcoins made a comeback - decreasing Bitcoin dominance (orange lines, percent of crypto market cap in Bitcoin).

This time it might be different. We see that rise in fees this time did not lead to decrease of Bitcoin dominance (there was a slight increase). My favorite possible explanations are:

- rise in Lightning as a solution to high fees, people don't need to run to altcoins to pay for coffee

- ETF pushes Bitcoin dominance up, there are no altcoin ETFs

I am not saying that there will not be an altcoin season (and with altcoin season, no one knows which altcoins are going to pump, so it's a fool's bet - your favourite altcoin might not pump), but there is no reason why it should be a rule.

(I also think halving is not automatic moon signal either - the supply effect of mined coins is minimal compared to trading volume, but hopefully this halving we'll get a big fat green god candle).

Disclaimer: My predictions are usually wrong. I am not saying what will happen, I am just saying that what masses think will happen is not a necessity.