When you get (read: sell) a mortgage, you sell a contract to the issuer that states how much interest you'll pay for how many years and how much you get paid in full for selling the contract.

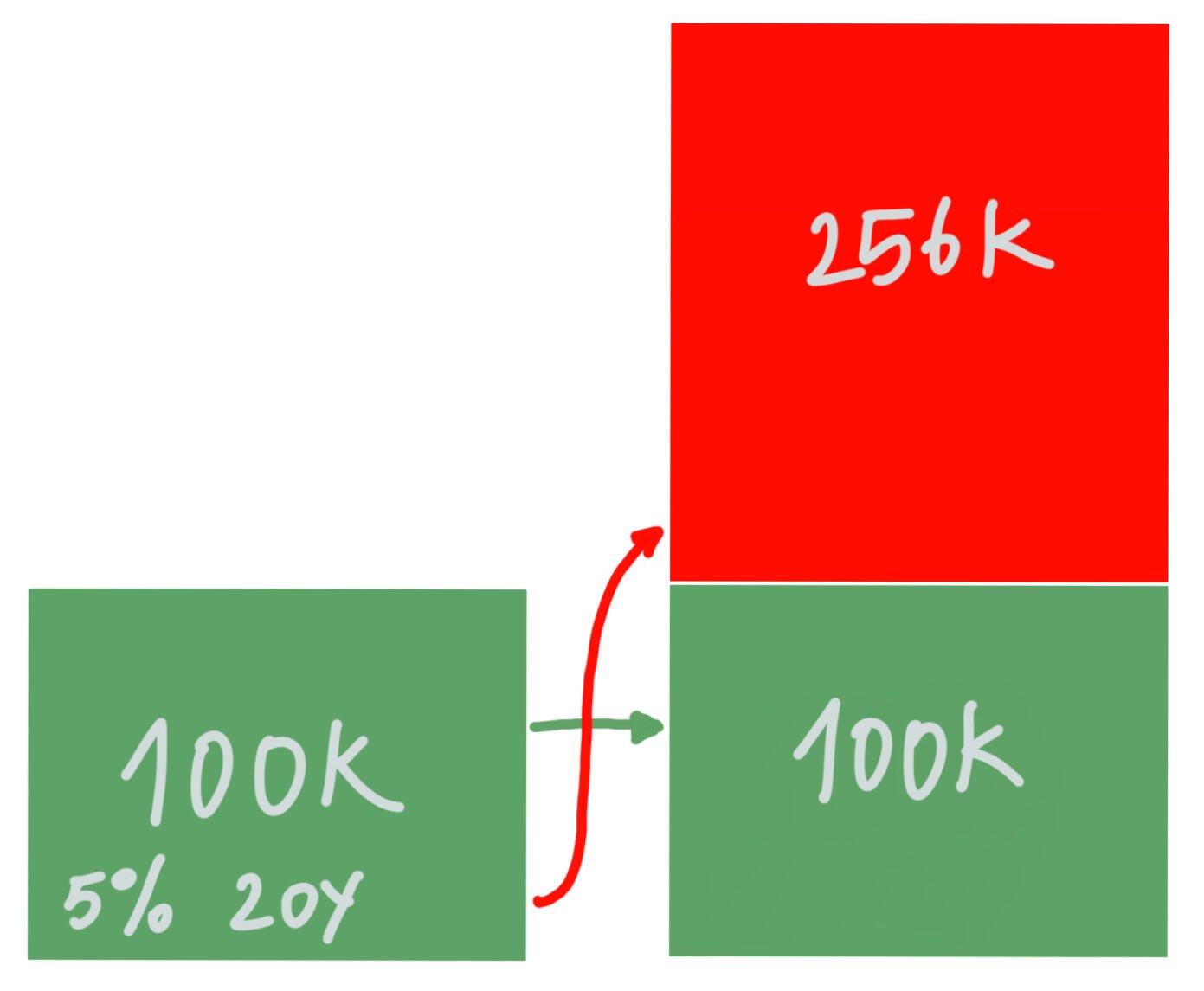

Let's say you get a $100k mortgage at 5% for 20 years, you get paid $100k and the issuer gets $256k spread over 20 years in interest plus the original $100k. That means $100k new money is created, and the $256k needs to come from somewhere. Guess what? That also needs to get borrowed, by someone at some point. New money creation at interest means exponentially more money creation in the future. This is the mathematical reality of a credit system.