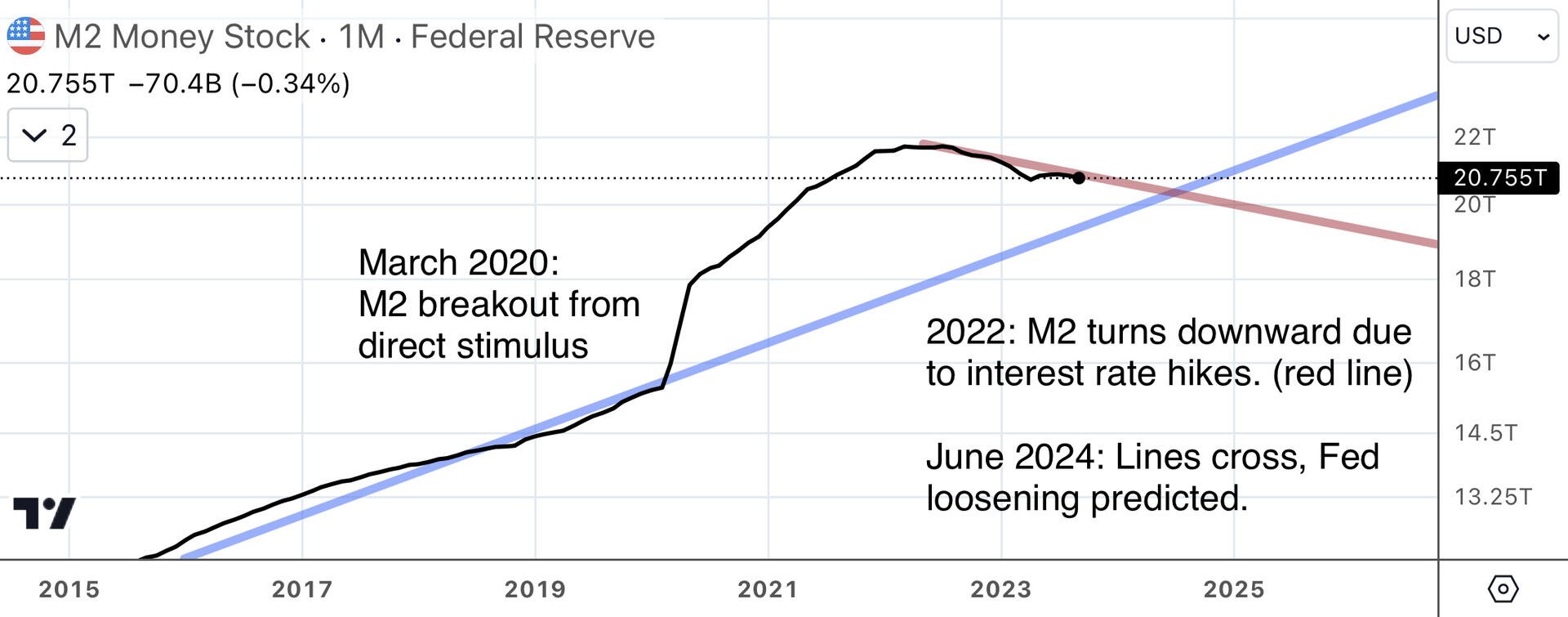

To see why 2020 has played out so differently from 2008, take a look at the asset side of the Fed balance sheet. In principle, this should track M2. Every dollar is a Fed liability, so the Fed assets should match up.

Fed assets grew markedly in both 2008 and 2020, but only the latter caused growth of M2 and thus price inflation. Why? Because in 2008, the Fed printed money stayed in the banking sector. Gun shy commercial banks, newly free of their toxic assets, sat on their Fed balances. The money never hit the broader economy, and so the goldbugs’ predicted hyperinflation never materialized.

But in 2020, the money went out to regular people as a stimulus checks. Those checks directly increased M2, leading to the predicament we are now in.