What are the alternatives out there for turning a direct deposit into xpub UTXOs?

Discussion

Strike no longer supports direct deposit, but I believe that River and Swan both do (assuming you’re in the US).

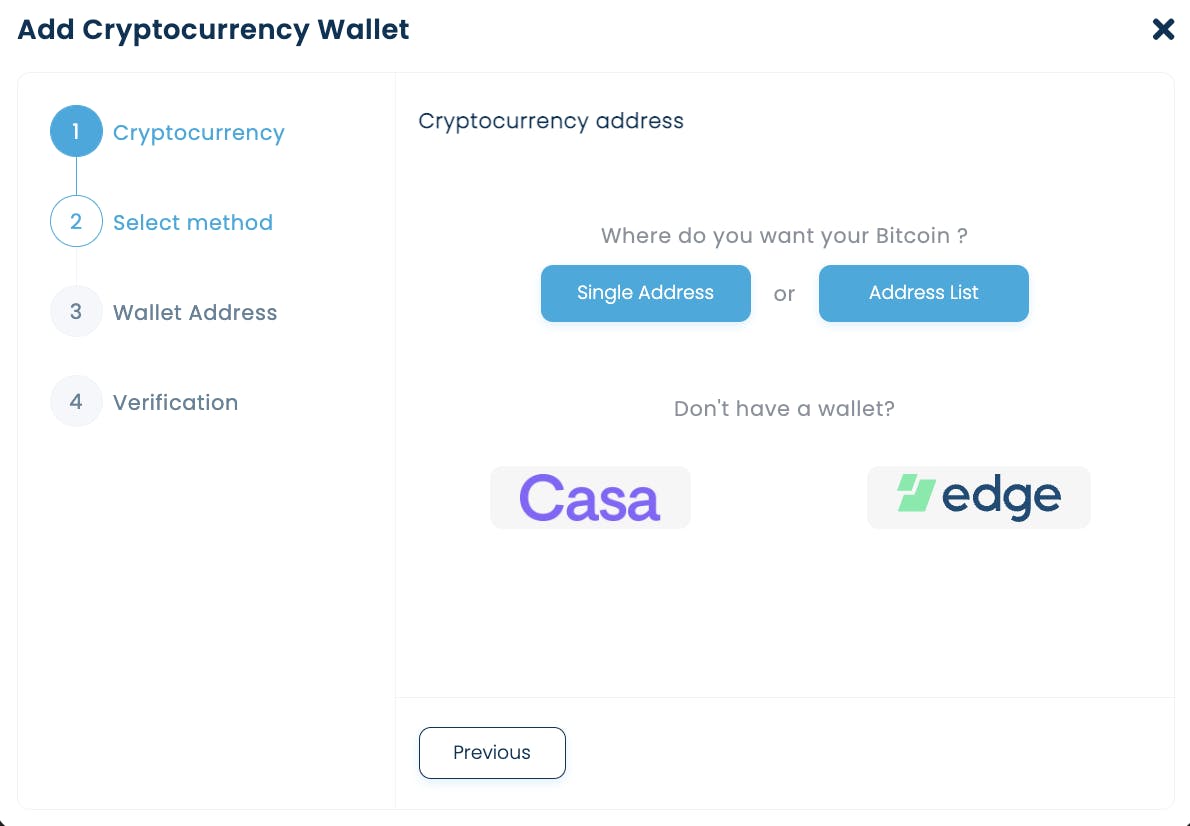

I checked and looks like River only has single-sig automated withdrawals currently. I reached out to their support to ask if they were planning to implement xpub support.

Swan does but it's entirely manual set up for that use case. That's why I'm looking for options.

Strike was really promising as a lightning first company. I even pre-emptively set up direct deposit when they had it. But they never implemented lightning withdrawals from a btc balance.

In the end, if I'm going to do anything manually I may as well be using Bisq.

single-address rather, not single-sig*

I know it’s a pain in the butt, but why not auto-withdraw to a single sig wallet and then send from there to your preferred self-custody arrangement? I assume for the convenience of auto-pilot “set it and forget it?” It would be cool to see more services like the one you are describing.

I am still rooting for Strike to be successful, but I had a few disappointing experiences with their customer service that have caused me to reconsider. If you end up finding a solution that works, I would definitely be interested to hear what you come up with.

Bitwage is probably the most straightforward for this conversion, conversions go straight to your wallet

Is it actually an xpub though or are they just having you paste in an array of addresses? Better than single-sig I suppose but seems tedious and error prone.

It’s an array of addresses. You don’t really want to give them an xpub for privacy purposes

You're right, and that's probably a fine arrangement for some people.

Deterministic wallets have a multiple account hieararchy. You can create an account (using a 13th word, for example) that is solely for this custodian. I don't need to reveal any information to them that they won't eventually know at some point.

I have no expectation of privacy between myself and a KYC broker. Which means the only trade-off worthy of this arrangement is extreme convenience. If it is not absolute convenience, then I'd rather just do this myself without KYC.

I guess I am just discovering that having to ask Swan to set up or fix my Bitcoin stacking is unacceptably inconvenient. And I'm starting to realize the advantage of KYC brikers is simply not worth the cost.

In 2023, my only alternative is to either be paid directly in Bitcoin (my employer doesn't do this) or politely ask my KYC bank to let me transfer funds to some other KYC service like Swan for auto-debit DCA. The usual pull-based system everyone seems to be using that has their bank permitting the exchange every time it takes place.

Seems like all the wiser folks have already gone KYC-free.

The only sensible answer in the long run is to transact end-to-end in Bitcoin