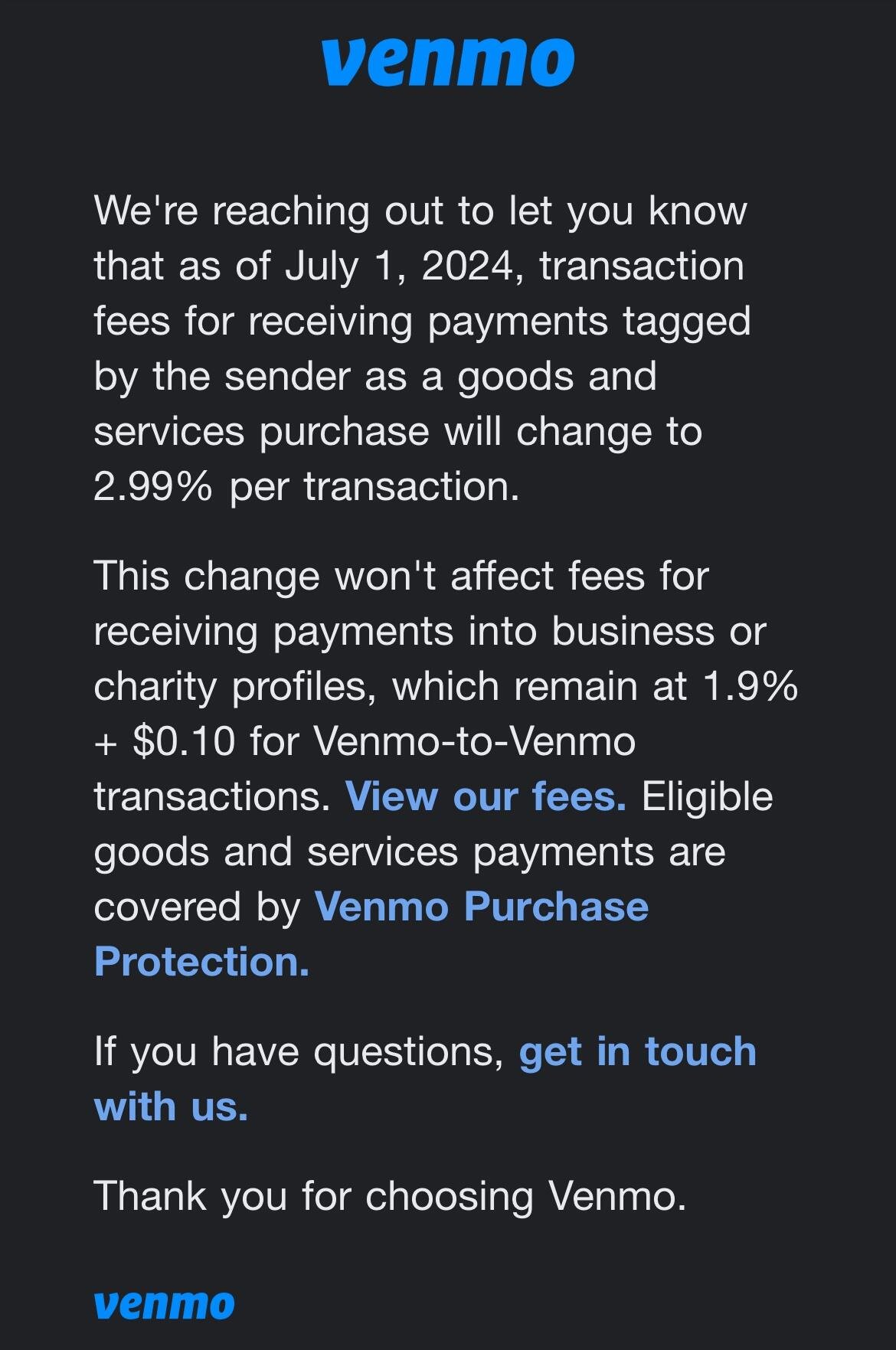

Yup, because you or I could undercut those fees if we wanted to.

Discussion

Not without having adequate liquidity and technical knowledge to run a routing node. Most people don’t.

pretty confident that there are more people who are capable of running a LN node than there are people capable of bootstrapping a tradfi Venmo competitor. Not to mention the reduced friction of "adopting" a new routing node (i.e. zero friction) vs adopting a new tradfi payments app.

pretty confident that there are more people who are capable of running a LN node than there are people capable of bootstrapping a tradfi Venmo competitor. Not to mention the reduced friction of "adopting" a new routing node (i.e. zero friction) vs adopting a new tradfi payments app.

That's like saying you could undercut Venmo too. You just need to go through whatever licensing process Venmo went and have the people, infrastructure and knowledge to run the business.

You don't honestly think those are the same, right?

A) one is a completely free fee market on an open payment protocol with bearer asset finality

B) one is a highly regulated market of closed payment platforms layered on top of more highly regulated closed platforms/custodians

What's the friction for a user migrating from Venmo to Cash app? High and you have to convince your peers to make the switch also.

What the friction for a user when routing a LN payment through a different route? Zero. You don't even know it's happening.

Thats one aspect, I could go on and on... They are not remotely similar.