Banks loan money to the government with interest that they print from nothing forcing the Gov to loan more and more to pay back interest.

That's not how monero works.

Like it literally says a fixed supply in the picture you shared

Fiat also has inflation because central banks print fiat out of thin air. But they are not bad in your opinion? They who actually financially enslave ordinary people?

Did you know about the second successful 51% attack on Monero?

"What happened technically: An 18-block "reorg" (reorganization) hit the Monero network - meaning that 18 blocks the entire network believed to be valid and permanent were suddenly discarded and replaced by an alternative version of history. To put this in perspective, reorganizations of more than 2-3 blocks are extremely rare in established blockchain networks.

The financial outcome: 55 confirmed double spends (the same money spent twice) and 115 transactions completely invalidated. While we cannot know whether these were merchants, exchanges, or individuals transacting, this matters little in the face of real double spending scenarios - someone lost real money."

https://www.eddieoz.com/monero-under-attack-how-the-community-responds-to-selfish-mining-attacks/

Have fun.

Banks loan money to the government with interest that they print from nothing forcing the Gov to loan more and more to pay back interest.

That's not how monero works.

Like it literally says a fixed supply in the picture you shared

And we agreed its more like the inflation in Gold. Fixed inflation. Forever.

Bitcoin on the other hand is fixed supply. 21 Million Bitcoins forever and after that 0 inflation. There will be actually deflation due to lost coins. Which much much better store of value money.

Greshams law says "bad money drives out good"

So even in your framework the more valuable coin (Bitcoin) will be hoarded and driven out of circulation and less valuable coins (Monero) will be used more

BS.

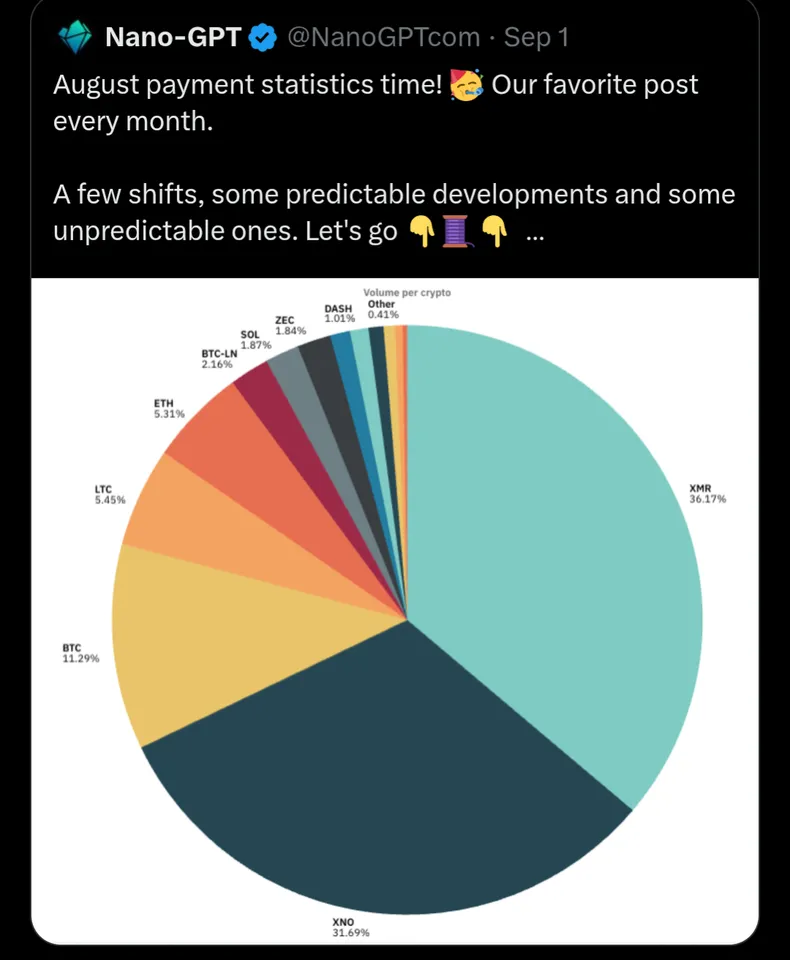

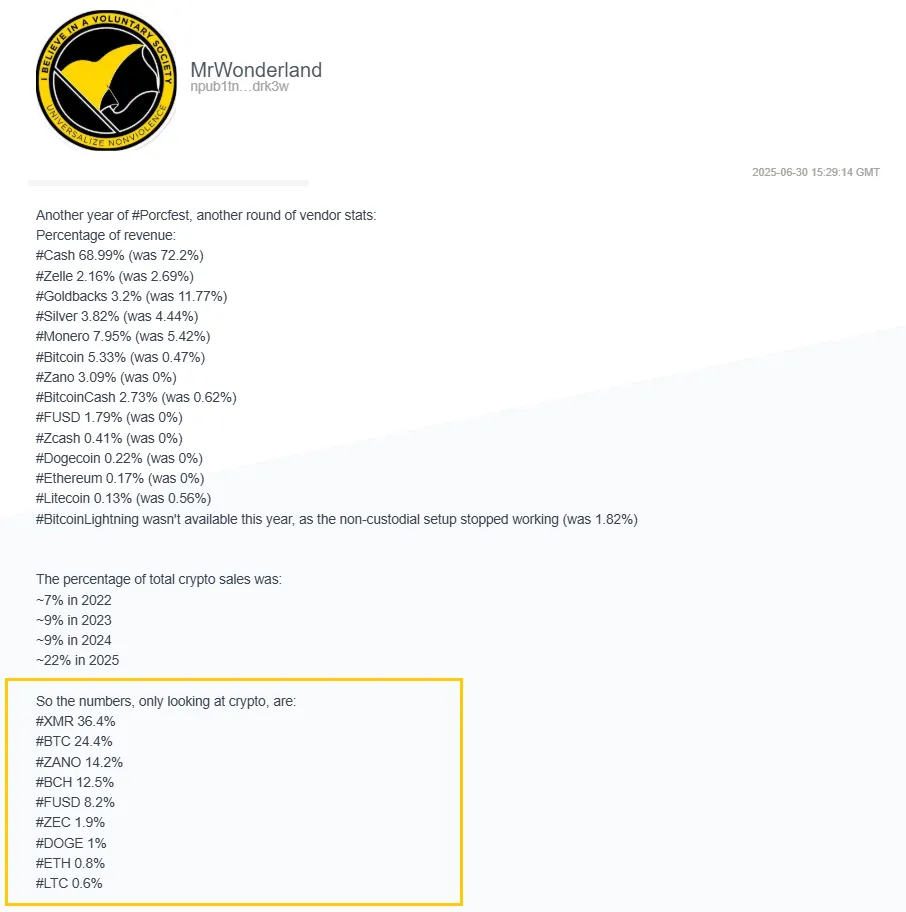

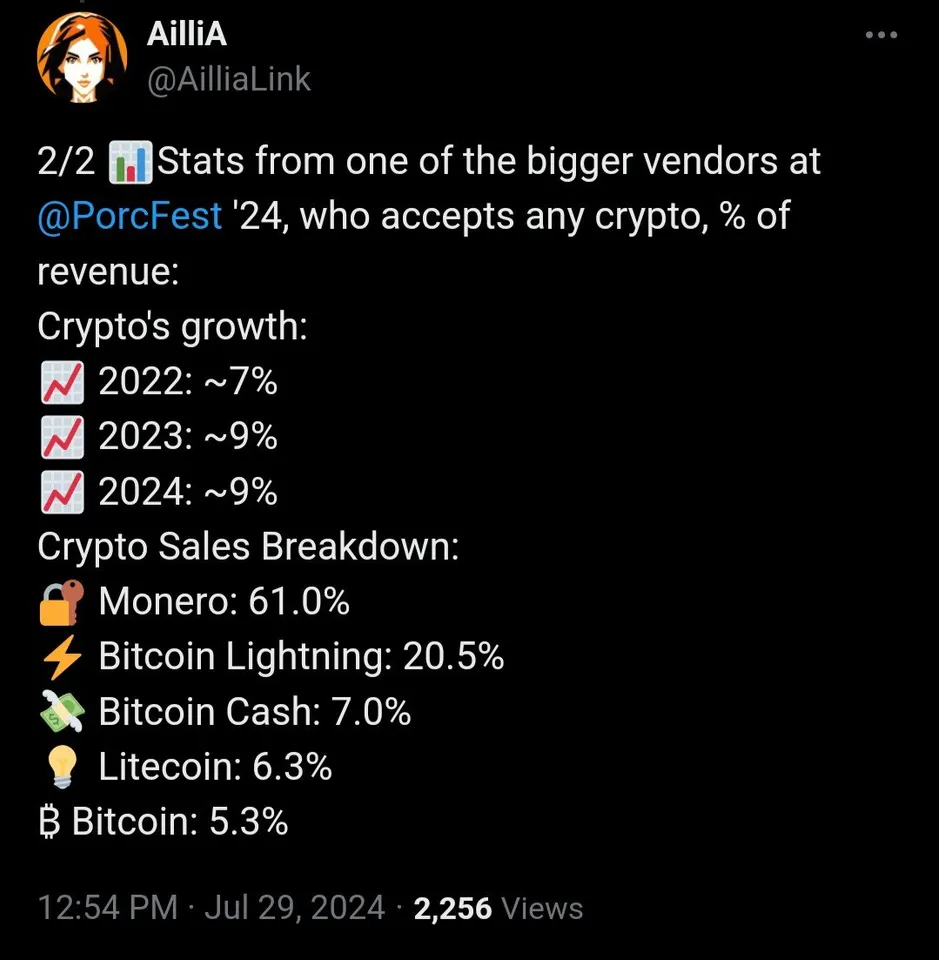

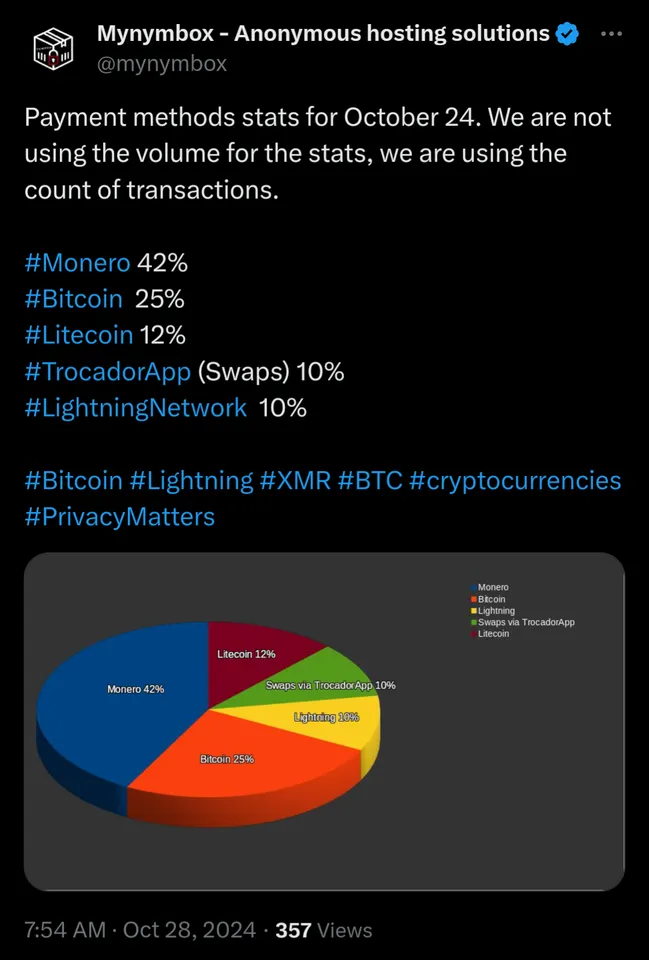

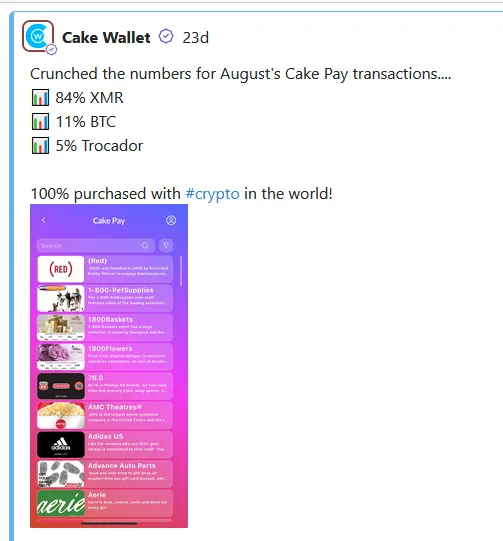

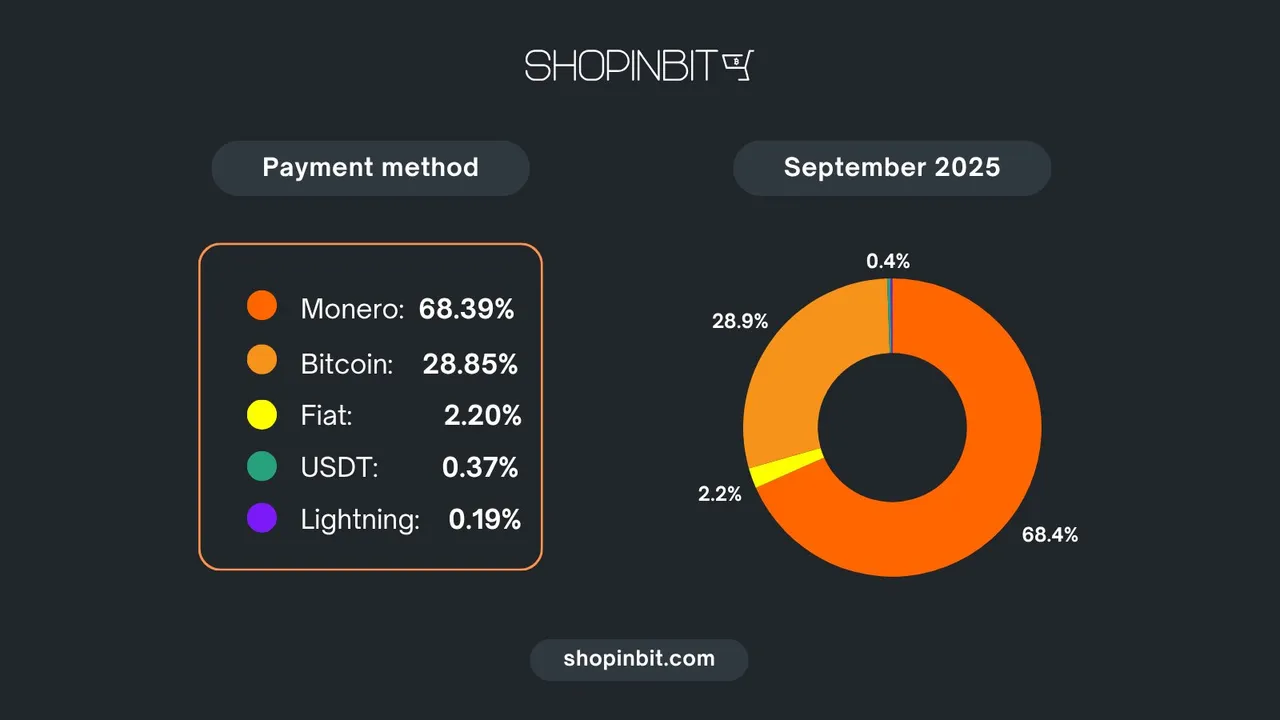

You think Shopinbit represents the market? Some cryptoshit marketplace that focuses on shitcoins?

Why not look at the market cap, when we talk about Money?

Monero, having the fixed inflation will double its supply in 117 years.

Bitcoin inflation in 117 years will be 0 and its supply will be fixed at 21 Million forever.

After Monero doubles its supply, it will continue to inflate.

Also you did more than 15 HARD FORKS on Monero and got two successful 51% attacks.

Monero is not money. Its a token that really wants to be private and is still less private than Bitcoin Lightning Freedom Money.

Greshams law is in full swing and shows Bitcoin as The

Global Most Secure Decentralized Unconfiscatable Peer-to-Peer Scarce Hard Sovereign Freedom Money and Greatest Store of Value.

Bitcoin Market Cap $2.15T

Monero Market Cap $5.71B

Tail emission rate = 0.6 XMR per block.

Block time ≈ 2 minutes → 30 blocks/hour → 720 blocks/day → 262,800 blocks/year.

Annual tail emission = 0.6 × 262,800 = 157,680 XMR/year.

Use current total supply ≈ 18,430,000 XMR (approximate).

18,430,000 ÷ 157,680 ≈ 116.9 years.

Dude you're all over the place. There are many examples not just Shopinbit. I'm simply saying Monero competes with Bitcoin/Lightning at nearly any merchant that offers both as a payment method despite being SO MUCH smaller and difficult to get. It doesn't conflict with anything you're saying if you believe in Greshams law.