ie market neutral?

Discussion

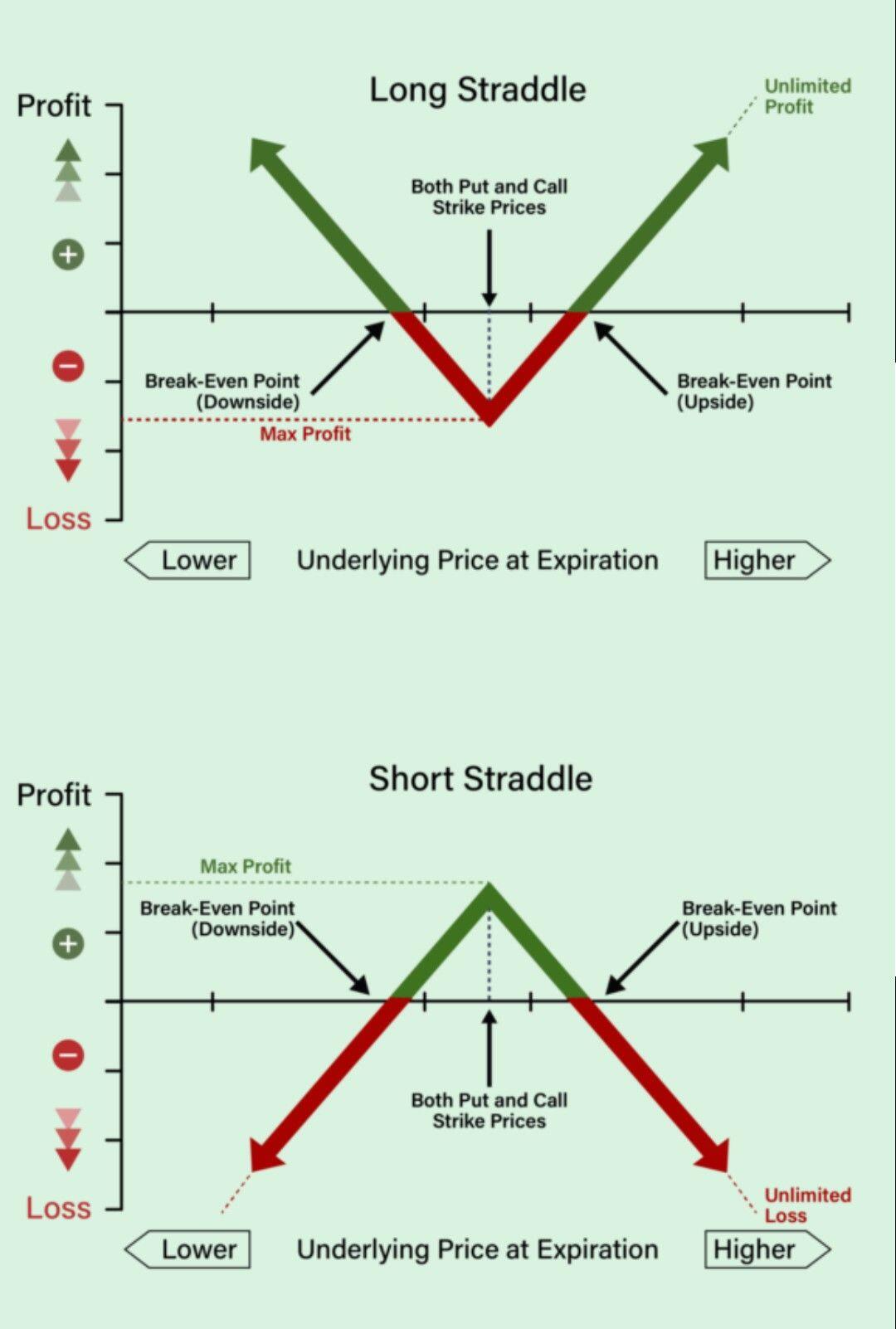

Yeah. Its been a long time since I studied these, but a straddle is doing a put and a call simultaneously so you make money on volatility. Less money, but the only way to lose is if the security stays inside the two strike prices. If I'm remembering... College is fading...

I need a meme to explain that strategy to me.

I forgot there were short straddles... I recall now thinking, "that's stupid," in the class I learned it in. So I was assuming it was long in my previous comment.

Also yeah, I did forget stuff... Points if you see it... I'm going to have to read about it again. Pointless, since I'll never use it, since I'm pretty sure you have to be "accredited" to do it, and I'm not... But still.

Accredited by whom? If I wanted to test a $20 straddle right now, what are the call and put options I set?

I thiiiiink, lol, its a misleading name. There's no body giving the accreditation. But a brokerage would be breaking the law if they let you do it without accredited status, which is basically "be rich."

This is part of why I want stocks to become Cryptos and trade on Liquid. Everything can be automated and the rules can become unenforceable. Crypto degens can probably already do it, but I hate shitcoins and won't touch them until they make their transformation into corporate equities, which is obviously inevitable.

Accredited status = be rich. So if you’re poor, you’re not accredited.

Yep

😄

I was wrong. You don't have to be accredited. So just read about straddles on investopedia and get a brokerage account.

Oh yeah I think I remember you saying you actively trade... Straddle is made for you. I'd say volatility is easier to bet on than market rationality.

I think what I’ve been doing is basically a straddle but without the options and the premiums (sorta). It started as a test because I was bored during covid, it’s still valid and running. Call it a “poor man’s straddle”.

It makes 2 big assumptions: btc is not going to zero and there be volatility.