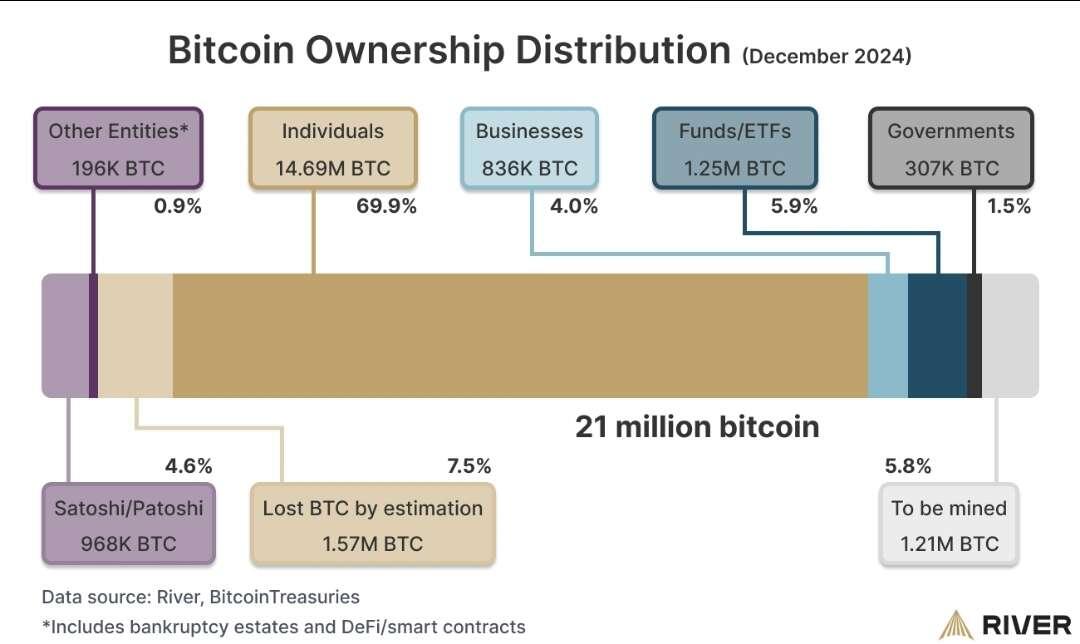

70% of the bitcoin is in the hands of private individuals. at a certain point, they will be more powerful than the government. you're probably right that govts will try to get the bitcoin out of the hands of the people, but once fiat is worthless or back on a commodities standard, the govt isn't going to be able to afford to use its money to oppress the people.

my view is that we are more likely to enter a golden age of free markets that generate wealth Venetian style than 1984-scale poverty and tyranny.