How come?

Bitcoin wealth holders are growing, in numbers and in wealth!

According to Henley & Partners‘s most recent report, these are the numbers:

-85,400 fiat millionaires (1 year growth 112%)

-156 centi-millionaires (1 year growth 100%)

-11 billionaires (1 year growth 83%)

The implications of #bitcoinaires supplanting today's fiat cantillonaires is something most people do not give enough thinking power to.

With #Bitcoin increasing in price, much of what we take for granted today will change. This change will be driven by the ones arbitraging the understanding of Bitcoin's ascent.

Here are a few thoughts:

-Banking and financing landscape will change as financial institutions will increasingly align their products with the demands of bitcoiners.

-Regulations will change in many different areas as bitcoiners will have the power to lobby successfully. Because of their influence (financially and culturally), politicians will increasingly suck up to bitcoiners.

-Global Power dynamics will change as the influence of wealthy Bitcoiners will have geopolitical consequences across the spectrum of nations.

-Money funding innovation will be channeled into the areas that are dearest and nearest to bitcoiners. Study their values and ethics to anticipate where this money is headed.

-Architecture and sceneries are going to change in accordance with the long-term, low-time preferences of bitcoiners.

-Wealth inequality between the top 0.1 % of bitcoiners and the recent will increase as information disseminates and information distribution is not equal, leaving too many Bitcoins for the ones stacking today!

Would love to hear, what others think. Anecdotes and concrete examples showing us a glimpse of the future would be very much welcomed!

Link to report: https://www.henleyglobal.com/publications/crypto-wealth-report-2024?adname=XPostCryptoReport

I saw that I can set different sat ranges for zaps.

However, if I zap, it has always just zapped the „first“ rate I set.

How can I choose?

Thx

Not sure who I can give props to for creating this image.

However, I know exactly who to give props to for making non-inflatable money possible and making hodling worth my while!

#satoshi #nakamoto

Great man! Thanks. Learning as I go.

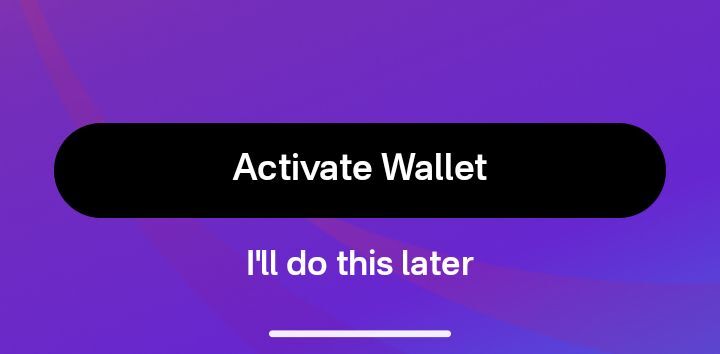

I‘d love to learn more about the wallet context. I am currently using the wallet by nostr:npub12vkcxr0luzwp8e673v29eqjhrr7p9vqq8asav85swaepclllj09sylpugg. It‘s custodial I guess? I‘d love to connect my own, non-custodial one. Any good guide on how to best do this?

New to Nostr? Introduce yourself in the comments and I'll zap you 210 sats to get started! Everyone else, please tag some newcomers here so I can zap them and follow ⚡⚡⚡

The easiest way to get a Lightning address is to set up Nostr through the nostr:nprofile1qqs9xtvrphl7p8qnua0gk9zusft33lqjkqqr7cwkr6g8wusu0lle8jcpp3mhxue69uhkyunz9e5k7qg6waehxw309a3kzcmgv5ejuurjd9kkzmpwdejhgtmkxyq32amnwvaz7tm9v3jkutnwdaehgu3wd3skueq4089x0 app. They have a wallet setup from the get-go. Other easy options to get a Lightning address are Wallet of Satoshi, nostr:nprofile1qqsrf5h4ya83jk8u6t9jgc76h6kalz3plp9vusjpm2ygqgalqhxgp9gpz9mhxue69uhkummnw3ezuamfdejj79p99e5, and Getalby.

During nostr:nprofile1qqs9xtvrphl7p8qnua0gk9zusft33lqjkqqr7cwkr6g8wusu0lle8jcpp3mhxue69uhkyunz9e5k7qg6waehxw309a3kzcmgv5ejuurjd9kkzmpwdejhgtmkxyq32amnwvaz7tm9v3jkutnwdaehgu3wd3skueq4089x0 setup, hit the 'Activate Wallet' button 👇

The same, I am new here but I can feel the vibes🤝😎

nostr:npub1840xda9g0khyunsu6442n6magvtqv27x5xdj3ydl4zgww4zt6fkqn259sx thanks for the zap.

What are best practices in terma of zapping? Any thoughts from your side?

Since I am new to #nostr, I’d love to learn:

-How to properly set up my nostr account? What are the tricks and tips?

-How can I choose me relays for the most stable connection? Is it the more relays the better?

-How do zaps work? How much sats is recommended to keep in one‘s Nostr wallet?

-I have set up a nostr:npub12vkcxr0luzwp8e673v29eqjhrr7p9vqq8asav85swaepclllj09sylpugg wallet, the one that‘s in-built. I guess that‘s custodial? How can I connect my own non-custodial lightning wallet? Does anyone wallet work? Probably not as I will need a “static” lightning address or LNURL, right?

-Any other learnings you guys can share?

Thanks🤝

And above all, I hodl

Am I the first #banker to have joined #nostr?

If so, don‘t worry. I come in peace. And for tumhe record: I do understand Bitcoin, I do hold my own keys, I do run my own node!

And there will be more of us

#Bitcoin #BitcoinBanking

Am I set up? And what is the lightning setup you recommend?

Yes, better to go for low-fat quark. Most underrated protein food in the world

I feel the same way. Just coming back from #bh2024 and nostr seems like place you definitely want to be!

I had an amazing time in Riga at #BH2024!

Huge thanks to nostr:npub1797h37mc98f6363m5nysxd0t2swuz7nxq4z83saw77em3czld6xqvuar68 and the team for giving me the opportunity to present on how we’re pitching Bitcoin to boomers at Maerki Baumann.

There's still a long way to go, but Bitcoin’s favorablr risk/return ratio will do the trick, and more money managers will start adding #BTC to their clients' portfolios. A 10% performance boost with just a 2% allocation to BTC will be hard to ignore!

A special shoutout to nostr:npub1s5yq6wadwrxde4lhfs56gn64hwzuhnfa6r9mj476r5s4hkunzgzqrs6q7z for the insightful conversations about how traditional banks that embrace Bitcoin will ultimately lead the pack. Again, there’s still plenty of work to do—like educating them on how Bitcoiners actually think (low-time preference, full custodial transparency, etc.) and showing that peer-to-peer lending is the future, instead of adding unnecessary risks by tranching collateral.

Who to follow to get as much signal as possible?