Lawyers are the CPUs of the state.

Software doesn’t help people, people help people!

Nah! Software helps people!

Cashu is a money warehouse receipt, its not strictly speaking a credit layer, it's not even debit banking in the classical sense, as the mint doesn't loan out the deposited money.

Bills of exchange are peer to peer generated and transferable credit, which if bought by a discont bank, can be bundled in a credit money token issued by that bank. This token could use a slightly modified cashu stack.

nostr:nprofile1qqsv7exgrnd0xd3gfhw5jl45596zuawudu39nzctk7vhxy58y4nr7mcpzdmhxue69uhhqatjwpkx2urpvuhx2ue0uy7suh is what you're actually referring to in your post.

Right now, Cashu is being used as a money warehouse receipt. In history, it actually started that way when people deposited their gold and started to use the receipts as cash. The warehouse operators discovered when holding all that gold, they could issue bogus receipts, so long as they could cover redemptions.

Bills of exchange are a little bit different. If I couldn’t pay for something right away, I could issue a ‘promise to pay’ sometime in the future. This promise could be transferred by endorsing it. When the promise to pay came due, someone else could present the note, I could look at the string of signatures and say, ‘yep, that’s mine, I’ll pay’.

So both are treated as ‘cash’ but slightly different mechanisms. In the end, what is acceptable as ‘cash’ is in the eye of the beholder and whatever is used to facilitate a trade transaction.

Cashu can serve both use cases. The first, you’ll have mint operators that are in the business, the second is a more distributed case where everybody is their own mint. Who knows what will play out? I’m all in for the experimentation.

This is what it’s like to build a wallet that supports multiple mints and multiple payments using #nostr nostr:note1qqqzztshyw8ma3r3n72sz7k9rtw4lwp7qtre4jq24j3nsryf6wequ33wjc

Proof of Work > Make Work nostr:note1n7r5xcq9zac5j2qasev4cd6g5y2rywlzcy2szvc6twc9j8rv6hssspgcy4

This was the big innovation. Reducing all possible futures of to-be-minted coins to a single future. It eliminated the one variable that all central banks and governments use to ‘manage’ the economy. nostr:note1zzugv7x4fylje0p9hunnweqf8vkm64lftsl6cm49gwjpl39w663qmd5637

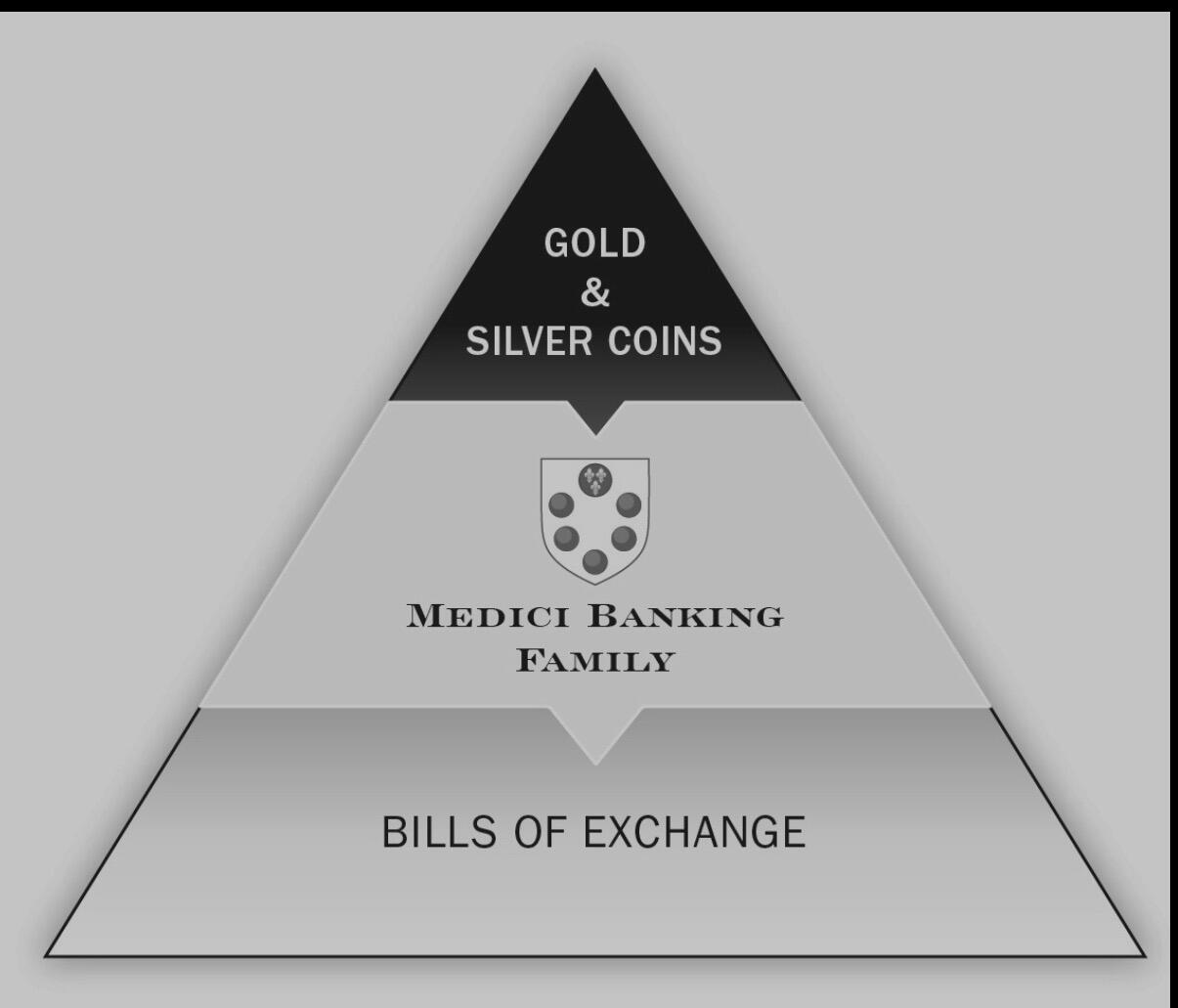

Layer 1 is the commodity layer (Bitcoin)

Layer 2 is the collateral layer (Lightning)

Layer 3 is the credit layer (Cashu)

I know it’s uncool to refer to these as ‘layers’, but this exactly reflects the evolution of layered money since the Medici Family. The ‘standardized’ interface between the layers was the balance sheet, enabled by double entry accounting.

What is different today, is that the monetary technology is wildly different - the speed of settlement has caught up to the speed of transaction that scales globally and on the micro-level. And it’s all cryptographically enforced- no need for the Medici goons.

Figure credit: Nik Bhatia, Layered Money.

For the reading list nostr:note1mp443z3u6cpw52f9ceapu5ax7am6t7a3cte3u5lxza59ln7h7p3qapr88s

Should be “Pay By Zap”

Articles like this being shared on that other platform...

If anything the other social media platform alternatives buy us time so we can get it right.

Someone associated with the WEF is proposing that gender be a 32 bit integer.

I was in the ‘hood

“Good design is correct and simple.”

#justevilenough

Physical books are useless except as artefacts for membership.’

#justevilenough

Seniors Discount for the over 50 crowd.

Remember:

The first order of business of any grifter over the long run is not to gain your trust, but have you compromise your own integrity. That way, in your own mind, you become like them, and when your trust is betrayed, you think you deserved it, or worse, you fall into league with the grifter.

In the Cold War days, there was a term for this: #kompromat. Don't become a #kompromat

I like notes and npubs - easy to enter in a command line app or generate a QR code for capture.

I find adding the protocol clunky and add modify for internal app use. I hate dealing with percent encoding. Ok, for deep link handling by apps/platforms but that’s not my context.

This is what I do:

npub -> hex string, bytes, or object

note -> hex string

relay url -> add wss:// or ws:// add - if already specified leave alone

mint url -> add https:// or http:// - if already specified, leave alone

Same applies for non-poets

I like McLuhan’s characterization of centre-margin. When a margin becomes strong enough, it becomes its own center.