I think I was talking about the following situation: You deposit some cash to Strike and send it to a friend, say, in the US (as cash). If I understand Strike correctly, the transactions are so fast and cheap, because they first swap your cash into BTC, then send this BTC to the friend‘s Strike wallet via Lightning, where it gets immediately swapped back to cash (in this case dollars) and shows up in the cash tab.

Now, this first swap is theoretically a taxable event for the friend (selling BTC) or, when the friend sends you some cash, it’s a taxable event for you.

No, sending sats between your wallets is never a taxable event. But for example sending some cash to a friend via Strike could be in theory considered as one because there’s a swap in the middle. But I hope it’s a taxable event for Strike, not for us simple users…

Honestly, I am very surprised it’s not yet available in the UK… I would expect Germany to be the last country on Earth to approve something like this. I am sure it’s simply because our government has not realized yet what Strike actually is.

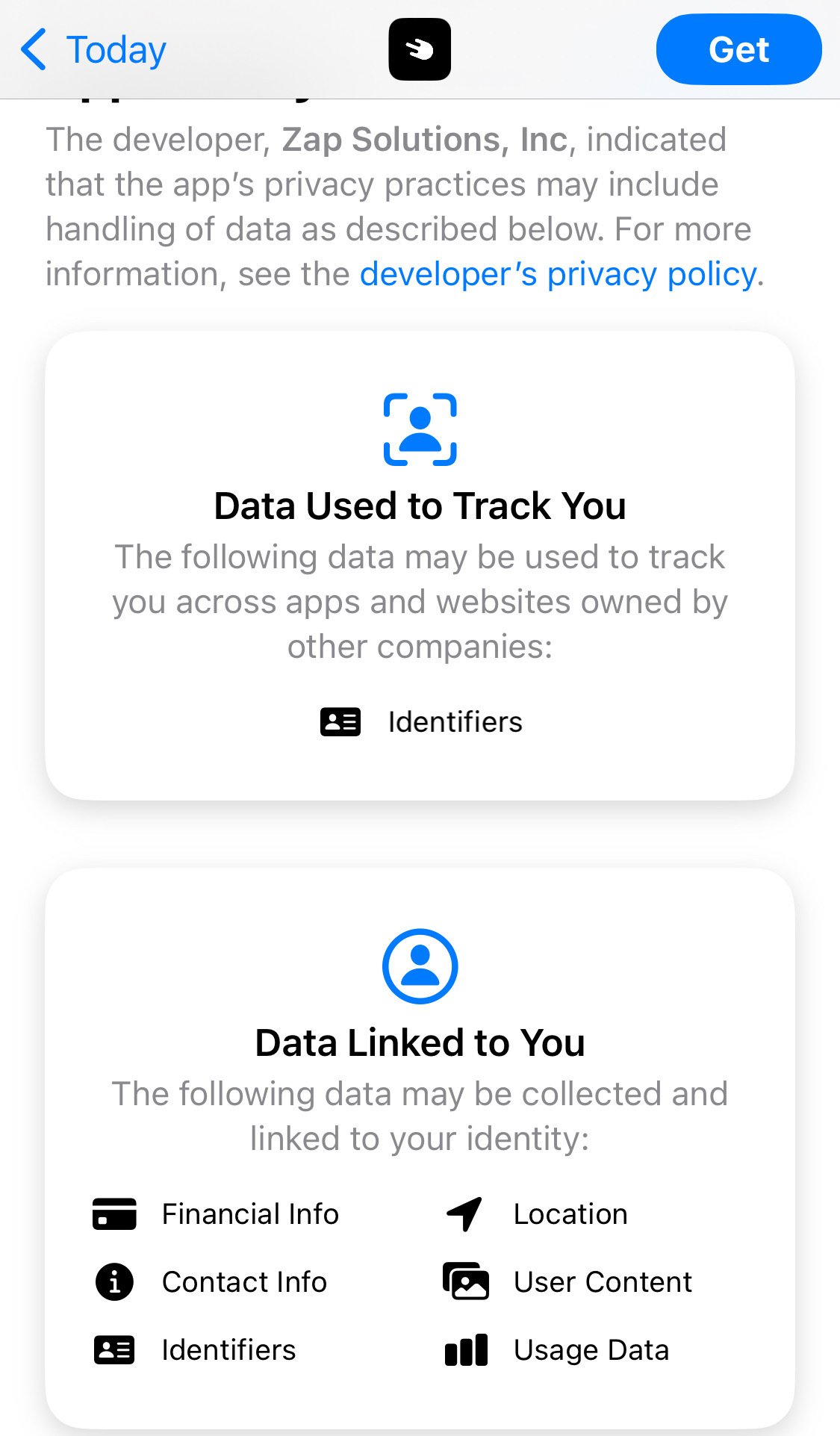

Absolutely not. You upload your ID when you sign up. It’s more like Revolut or Wise, but with cool bitcoin features.

So far my experience has been smooth. I deposited a few tens of euros, converted them to bitcoin, and sent to my Phoenix wallet – all worked like magic for me. The fees are only a little bit higher than what Relai and Pocket offer (1.29% vs. 1.5%), but if you stack above €1k/months, the fee drops below 1%. Also, I found that Strike covers on-chain fees, so you can send bitcoin directly to cold storage.

🤓🤓🤓 Strictly speaking, Europe is not a continent, it is part of Eurasia, which is the actual continent.

ID and financial data can also be read out by banks and services from your IBAN. I‘d treat Strike as Relai or Pocket. Small DCA once in a while, send/receive cash to/from other plebs.

I think going above this level of stacking bears serious risks anyways, regardless of KYC or not. So breaking down the fiat stack and purchasing small portions of corn sounds like a reasonable alternative to me.

Also, afaik, Bisq has no limits for buying/selling Bitcoin (depends on the payment method though), so technically you could buy/sell corn within 0.1-1 BTC (insanely high amounts for me, some people can apparently afford it).

Yeah... In those cases it's going to be hard. On the other hand, nobody prevents you from spamming Robosats and Bisq with $2k buy order at a reasonable premium 😂 You'll have to spend a few days managing all these orders and transferring fiat to many people, but I would say there's no conceptual limitation 😂

Just another dollar? 🤣

Unfortunately, it’s not my level of concern at the moment as I can’t afford purchasing large stacks anyways…

You can see it the other way around: KYC services offer you a discount to buy their KYC bitcoin.

The bigger the missiles, the smaller the dick.

Robosats, Bisq, Peachbitcoin

GM ☀️🤙

Crazy… Even at 900 sats/vbyte the total block reward barely reaches the pre-halving 6.25 BTC. Supply shock is coming…

#gm #plebchain #coffeechain

I think bitcoin is (will be) the first truly deflationary currency so it’s hard to predict how it would affect the technological progress if it was the only money, whether it will accelerate it or slow it down. But at the same time, Edison and Tesla, Popov and Marconi, Wright brothers and many others didn’t have access to massive loans of unsupported paper dollars, and still they made breakthroughs. I think fundraising for new experiments and development will have to be revisited completely. It will have to be efficient, reasonable, with proof of concept, and clear documentation (well, how it is actually supposed to be…).

#plebchain