I have finally finished my book where I outline how I achieved Financial Freedom and retired early. If you want to do the same you can get my book via the following link:

Netflix just told me my iPhone wasn’t part of my household account whilst sitting IN MY HOUSE and USING MY HOME WIFI.

They are very close to losing my custom.

They suggest I log in to Netflix via my phone at least once per month to avoid this.

A great user experience - NOT

Sorry for the repost but I'm still learning how to use muliple Nostr-apps correctly, so one more try hoping the link and the tags are correct this time:

‐----------------------------

Here is the free PDF of my bitcoin novel „Walking Banks“ for everyone to download (hosted on nostr.build):

https://d.nostr.build/UlE0X93faO1XxD9l.pdf

It is a murder mystery thriller with Bitcoin as a key plot element without being the focus of the story itself. Please feel free to share it with fellow Nostriches if you like.

I wrote this book for two reasons:

a) To provide a couple of hours of enjoyment. „Walking Banks“ does not aim to be high literature, but rather an entertaining read.

b) To contribute in my own small way to the growth of the Bitcoin community and network. Bitcoin has become well integrated into the lives of those interested in finance and freedom, but discussions about it often remain confined to those bubbles, reaching only a select niche. I believe the next important step for Bitcoin is to become a common topic in everyday pop culture - whether in art, music, films, books, or other media. This book is thus my attempt to "orange pill" a broader audience by weaving Bitcoin into a fictional story. My hope is that it sparks curiosity about it in the reader in a natural way, without being too forceful or preachy, for readers who might not usually consider these topics but enjoy a good murder mystery.

I believe Bitcoin and Nostr are joined at the hip, as both stand for freedom, sovereignty, and independence in an increasingly controlled and surveilled world. Everything that helps Nostr also helps Bitcoin, and vice versa, so I hope I can contribute a bit this way to Nostr's exclusivity and value content proposition.

Thanks to nostr:npub1qny3tkh0acurzla8x3zy4nhrjz5zd8l9sy9jys09umwng00manysew95gx whose advocacy for Nostr brought me here, nostr:npub1trr5r2nrpsk6xkjk5a7p6pfcryyt6yzsflwjmz6r7uj7lfkjxxtq78hdpu whose work at the HRF is inspirational, nostr:npub1r0rs5q2gk0e3dk3nlc7gnu378ec6cnlenqp8a3cjhyzu6f8k5sgs4sq9ac who told me about nostr:npub1nxy4qpqnld6kmpphjykvx2lqwvxmuxluddwjamm4nc29ds3elyzsm5avr7 so that I can host the file and to nostr:npub1smreuk4gcs0k3jdz8zzckzxy6c7pkr8x6nafd5e2jr0jt0vrkpeqvpxn8w, who first put the idea of sharing the book on Nostr into my head!

I hope you enjoy the read.

AH White

#nostr #bitcoin #books #grownostr #literature #artstr #nostrplebs #btc #freedom #artonnostr #bookstr

Thanks, have sent to my Kindle to have a read. 👍🏼

Found on the beach in Somerset

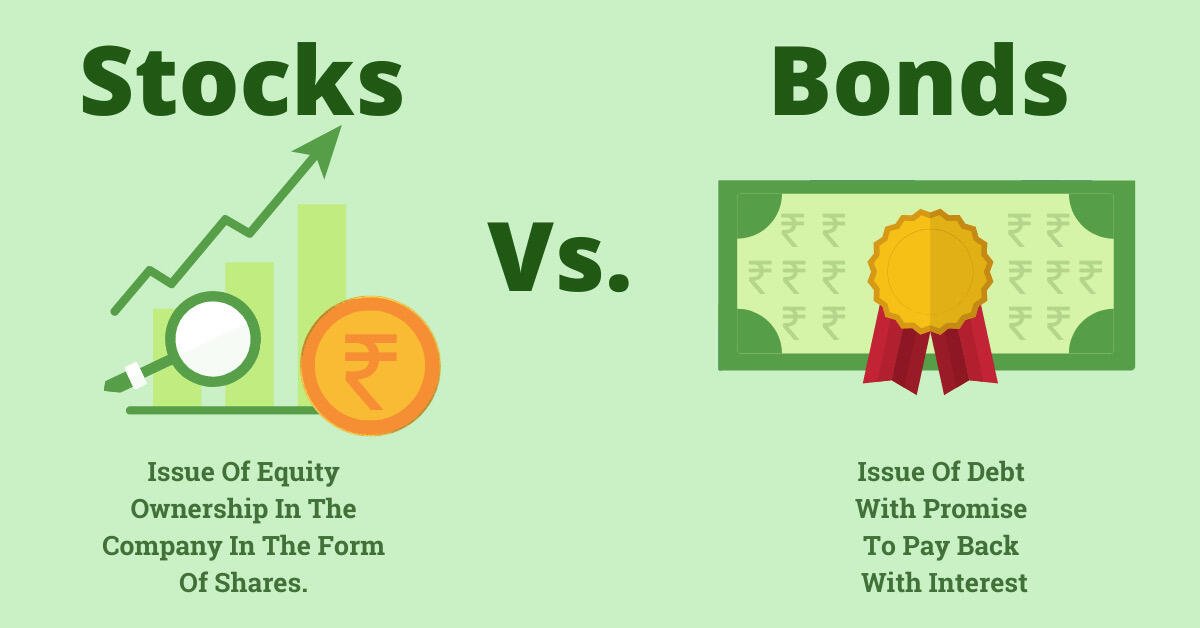

If you have ‘bonds’ in a company, then you are lending the company money

There is a clear difference between owning shares and bonds

When you have ‘shares’ in a company, you own a part of the company

When companies issue bonds, they are often referred to as Corporate Bonds

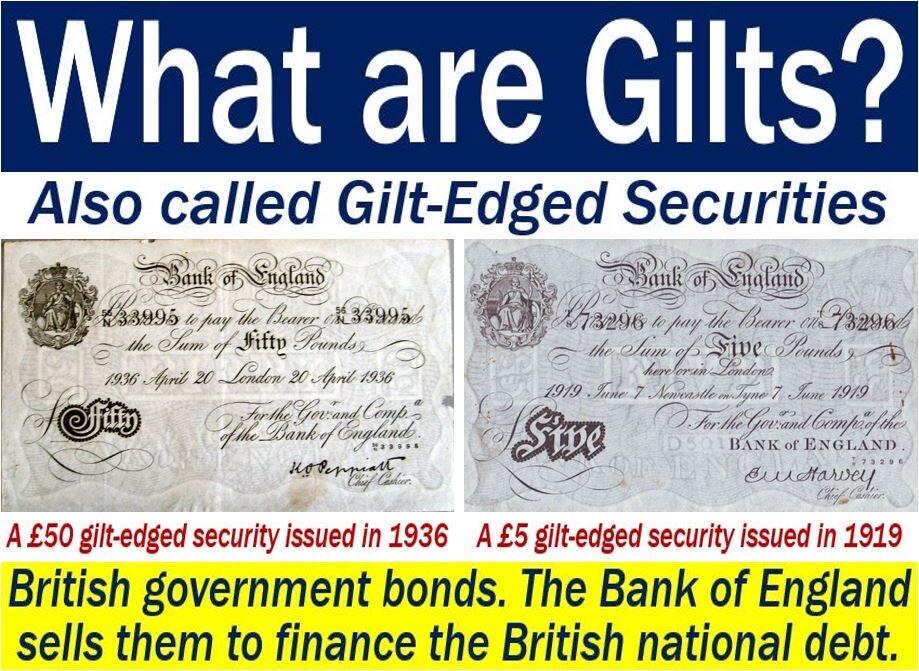

In the UK, when the government issues bonds they are sometimes called ‘Gilt-Edged Securities’ or Gilts for short

When a company or a government require extra money they may issue a ‘bond’ in order to borrow the money they need

A bond is therefore a form of IOU that can be traded by investors and usually has a fixed regular income

The terms ‘stocks’ and ‘shares’ tend to be used somewhat interchangeably

However, there is a subtle difference

The term ‘stocks’ should be used when discussing ownership of companies in general

And the term ‘shares’ is used to describe ownership of a specific company

Know the difference between an #asset and a #liability

-and then buy assets!

Assets are your friend

Liabilities are your enemy

Three steps to financial success:

1️⃣ Pay off your #debt

2️⃣ Build an emergency #fund

3️⃣ #Invest for the future

👉🏼 Finance CAN be simple

When younger I held #Index funds due to their low cost

Once I started to think about #retirement, I switched to income funds

These give me some growth AND a regular #income

It’s possible to get 4 - 5% income via this approach without selling any of your holdings

What does ‘retirement’ mean to you?

Will you give up work completely and focus on your hobbies or will you need some sort of work to give your life meaning?

Knowing the answer to this will help you plan for ‘retirement day’

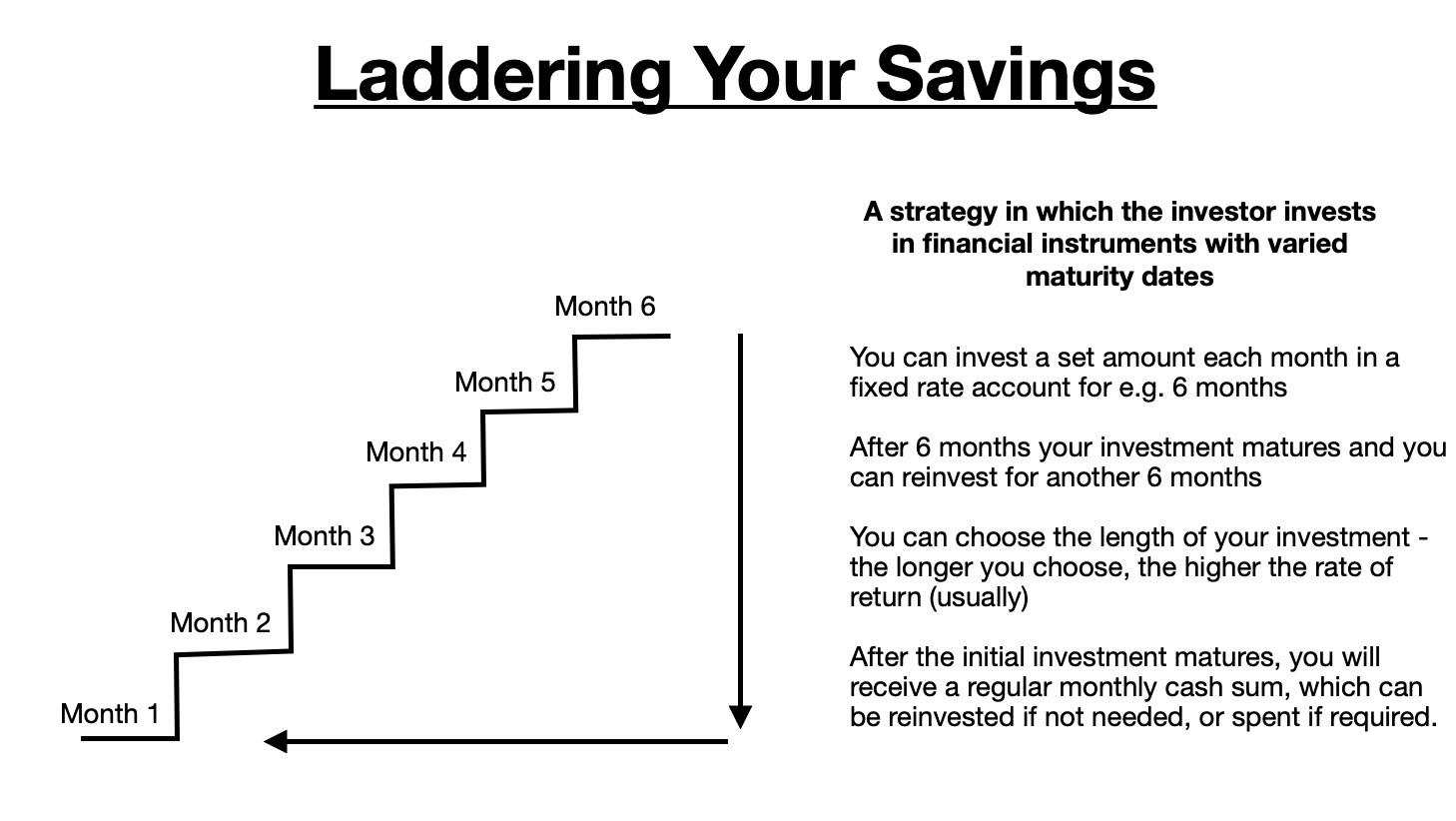

You should have easy access cash available for an emergency

This doesn’t have to be in a low interest account

You can ‘ladder’ your savings in fixed term accounts that release a set amount each month

Be clear on your #financial objectives

Why do you #invest?

Are you growing ‘net worth’ or are you building a ‘monthly income’

This will guide which #assets you are going to buy

A key step to #Financial #Freedom is to know where your #money is spent

Call it a #budget, a financial plan or whatever

It could just be a list

But you need to know

Been gaming for about 40 years now.

To become “Financially Independent” your first step should be to reduce #debt

Have you checked how much interest you pay on any debt you have?