Peter, did you read the article? I just did.

It says “migrants”, not “illegals“. The equivalence of “migrants” and “illegals” here is your personal conflation.

The article says that all this puts pressure to crack down on illegal migrants, a subset of migrants, but the article does not say, in any way, what you are ranting about.

Pay attention, and do better.

Genuinely curious: why BitPay (ugh)?

I’m in Canada. Haven’t come across it despite seeking out btc points of sale.

(Also, given the choice, paying in fiat, as in, no upside to keeping that in my leather wallet.)

Also maybe the `getblocktemplate()` api call is useful for your use case?

@RooSoft if you're running Bitcoin Core, RPC has the following APIs which appear useful.

* `getmempoolancestors()`

* `getmempooldescendants()`

* `getmempoolentry()`

* `getmempoolinfo()`

* `getrawmempool()`

Note that you can control the size of your local mempool with Bitcoin Core config.

Sonos is garbage.

nostr:npub1hea99yd4xt5tjx8jmjvpfz2g5v7nurdqw7ydwst0ww6vw520prnq6fg9v2 I have a question.

One of the nice features of sparrow wallet is, it clearly shows the distinction between receive addresses and change addresses, and shows lists for both.

What would happen if a user inadvertently chooses a change address instead of a receive address to receive funds?

Should we put the text of Craig Wright’s legal disclosure in a block on the Bitcoin blockchain?

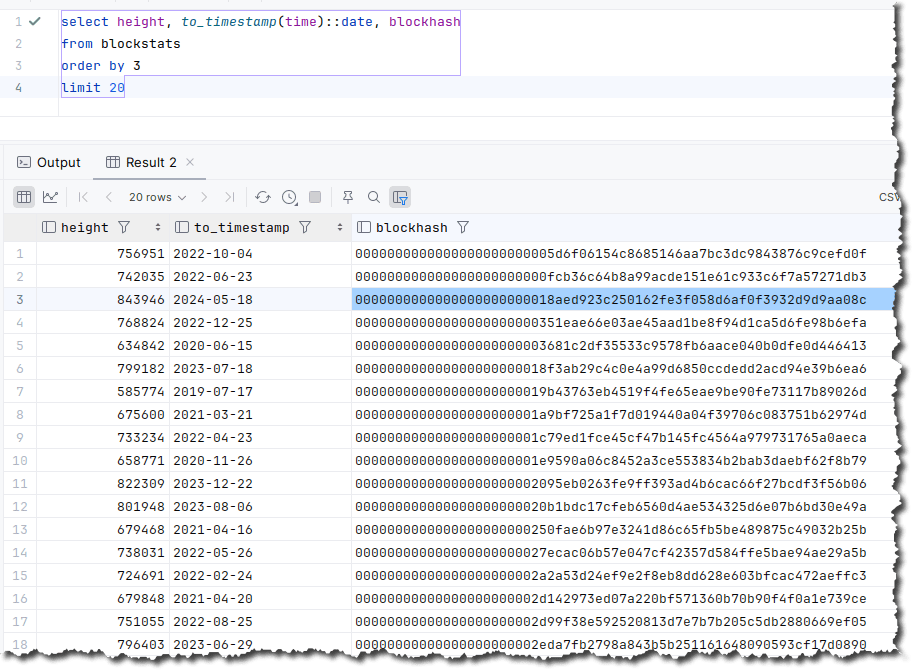

That block hash: 23 zeros followed by 1 and 8

0000000000000000000000018aed923c250162fe3f058d6af0f3932d9d9aa08c

Yesterday (May 18th) the third lowest block hash ever was added to the blockchain, in block 843946.

The other consideration here is, maybe you are seeing poor Tor network connection quality.

You could always pause your node, turn off Tor, and finish your initial block download over a clear network.

Earlier this week I installed bitcoin core on a new Lenovo laptop running Fedora 40. The entire IBD was done in under 14 hours, over home Wi-Fi.

The takeaway from this is: IBD is extremely sensitive to hardware. You get what you pay for.

I don’t think a Raspberry-Pi should be the basis for any inference about bitcoin, the BTC blockchain, or the bitcoin network.

In winds of 25 knots and above, flags start to occasional point upwards as they flap. That’s a nice heuristic, and a clear tell when estimating wind velocity.

A bit harsh on France, but nonetheless that’s a great take.

We know who else is based in France: Ledger.

Ledger doesn’t have a Lightning piece, but it’s certainement une shitcoinerie, which comes with its own set of potential legal foot guns, I’m sure.

Ledger, or say Ledger Live, could be next.

Yay because Bolt 12 enables common payment modes that don’t presently exist on lightning

When trying to unboost an old boosted note, it boosts it again, which is unexpected behavior, and counter to intent.

See my recent timeline, it contains two successive boost of something I boosted once, weeks ago. I was trying to clear that boost.

I hope this helps, and thank you for eliciting this comment.

Sorry, found a bug in Damus.