if you think it would take 100 years for qubit multiplexing to make a dent into ECC encryption...

2025

2017

https://link.springer.com/article/10.1007/s10909-017-1787-x

2014

this is the current estimate and assurance that ECC is currently impossible to crack.

2022

this is the paper that describes on page 12, Section 3.4.2, how multiplexed processing negates the requirement for physical large number of qubits.

https://eprint.iacr.org/2025/017.pdf

the Itoh-Tsujii method is not the primary means. Use of another number system is a lot faster.

I am no hater of whatever. The intent is simply to present what is the writing on the wall.

if you think it would take 100 years for qubit multiplexing to make a dent into ECC encryption...

2025

2017

https://link.springer.com/article/10.1007/s10909-017-1787-x

2014

do you know what this means?

> its the best place to bring someone you really don't like. make a stupid grin when they bite into that tasty nugget.

tell me, if you have a 0.8 meter rusty iron pipe that is 3mm thick, diameter of 2 inches, and you have a pair of industrial leather gloves; what's the very first thing that comes into your mind? then, think about it, very. carefully.

for weekend listening. very liberating.

in addition to all the bio-materials mentioned in the article below, seaweed can also be used as a raw material to make biodegradable plastics ("bioplastics")

https://www.ars.usda.gov/oc/utm/repurposing-ag-waste-to-create-bioplastics/

as rightly pointed out, shelf life of the bio-polymer is the key design challenge for this still emergent material synthesis method to become a viable replacement to fossil-oil based polymers.

#materials #sustainability #plastics

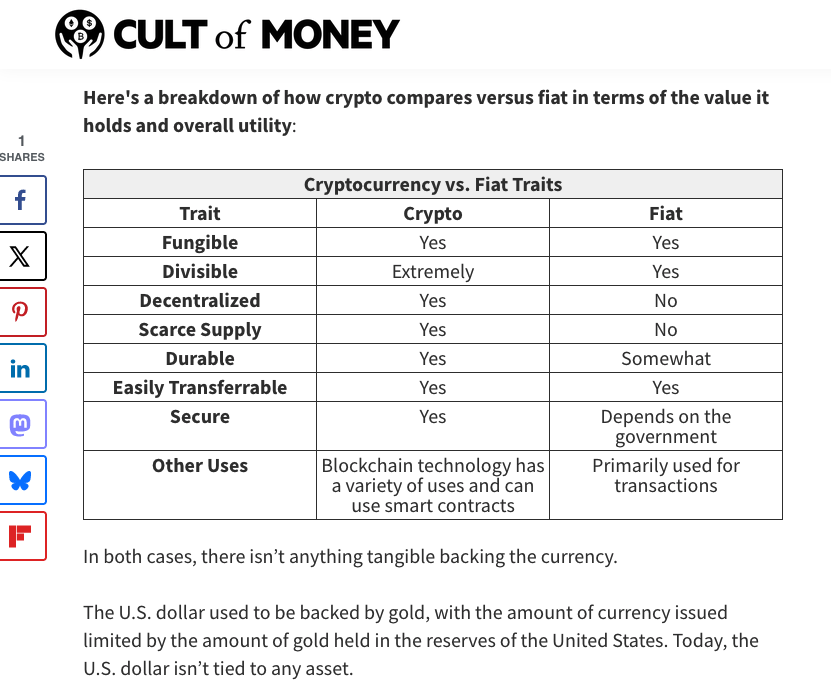

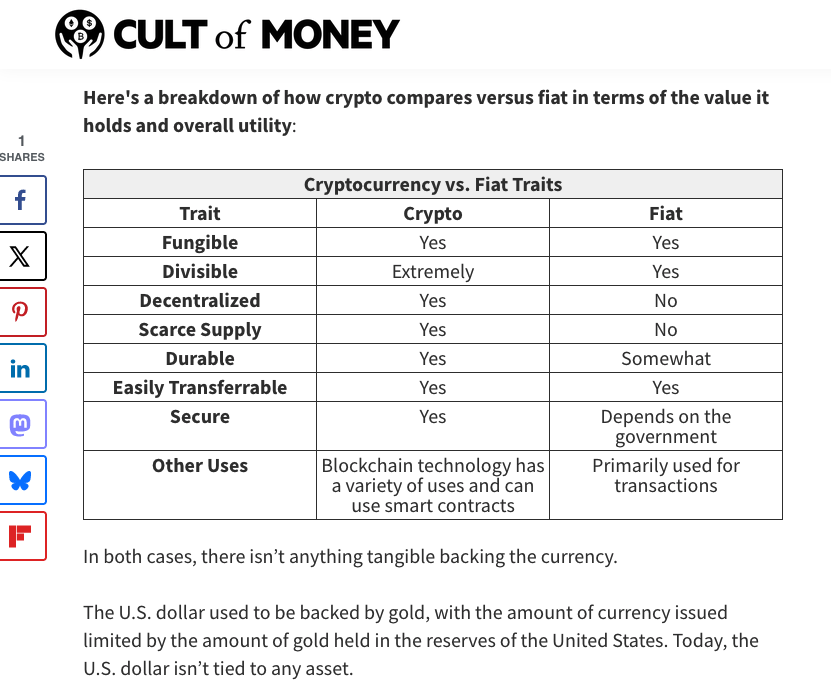

the difference between crypto and currencies.

https://www.cultofmoney.com/is-crypto-backed-by-anything/

it is very important to understand that currencies, is not money.

the last paragraph, says it all.

what backs and underwrites paper, is money.

consider the following > based on the 120 odd year trajectory of the mining schedule of bitcoin, followed by the transaction fee driven revenue support model thereafter, what is the possibility of using a basket of stuff to place a floor value to bitcoin?

1.S.1 - it is important that we note prior to the extremely stupid move of 1971 to delink the reference peg of gold to that of the USD, where thereafter you can see the issuance of the USD based on the full confidence of the Federal government of the United States to conduct prudent monetary policy.

1.S.2 - the impending "liberation day" launch of tariff-driven deal making can be only described at best, as one of the most speculatively risky moves made of the US since 1971, because the short-term effect is essentially inflationary. T-bills and US notes will see recalibration in the coming months and years ahead.

1.S.3 - family offices, institutional funds are quietly rethinking one of the most important long term strategic implication; namely, beyond the current adminstration, based on the possibility of risk, it is now possible that either side (Democrat, Republican), may display sudden and sharp change in macro-economic policy, either within a single or 2 elected terms. thus, purely from a perspective of risk diversification, investment portfolios will need substantial currency-denominated recalibration, in addition to the usual themes of sector/industry, sovereign risk*, etc.

* sovereign risk (credit standing) will now have to be separate and distinct from immediate or near term currency trade-weighted valuation cycles.

I think it is notable to observe that since 2006, 2008, (various cycle-driven economic crisis) drove the adoption of digital currencies such as bitcoin from a largely "retail" demographic base, the impending shift of how institutionals view their risk profile, is playing out as events unfold at a pace which I had not anticipated prior.

I used the term monetary policy and Federal government to differentiate the current limitations of fiscal policies now underway to stimulate domestic ecomonic activity from impending tariffs that has the objective to reduce the deficit which will become highly unsustainable by 2032 onwards.

Perhaps another to articulate my post, is simply to point to the historical effectiveness of economic growth and expansion by productivity gains, export diversification, and prudent spending, all of which are within the domain of fiscal policy of the adminstration of the day.

the difference between crypto and currencies.

https://www.cultofmoney.com/is-crypto-backed-by-anything/

it is very important to understand that currencies, is not money.

the last paragraph, says it all.

what backs and underwrites paper, is money.

consider the following > based on the 120 odd year trajectory of the mining schedule of bitcoin, followed by the transaction fee driven revenue support model thereafter, what is the possibility of using a basket of stuff to place a floor value to bitcoin?

1.S.1 - it is important that we note prior to the extremely stupid move of 1971 to delink the reference peg of gold to that of the USD, where thereafter you can see the issuance of the USD based on the full confidence of the Federal government of the United States to conduct prudent monetary policy.

1.S.2 - the impending "liberation day" launch of tariff-driven deal making can be only described at best, as one of the most speculatively risky moves made of the US since 1971, because the short-term effect is essentially inflationary. T-bills and US notes will see recalibration in the coming months and years ahead.

1.S.3 - family offices, institutional funds are quietly rethinking one of the most important long term strategic implication; namely, beyond the current adminstration, based on the possibility of risk, it is now possible that either side (Democrat, Republican), may display sudden and sharp change in macro-economic policy, either within a single or 2 elected terms. thus, purely from a perspective of risk diversification, investment portfolios will need substantial currency-denominated recalibration, in addition to the usual themes of sector/industry, sovereign risk*, etc.

* sovereign risk (credit standing) will now have to be separate and distinct from immediate or near term currency trade-weighted valuation cycles.

I think it is notable to observe that since 2006, 2008, (various cycle-driven economic crisis) drove the adoption of digital currencies such as bitcoin from a largely "retail" demographic base, the impending shift of how institutionals view their risk profile, is playing out as events unfold at a pace which I had not anticipated prior.

RWA tokenization Wall Street style.

https://www.thestreet.com/crypto/markets/top-five-rwa-projects-you-cant-afford-to-ignore-in-2025

other than the RSK protocol, Lighting, is there anything I have missed out?

its very unlikely this will have any effect at all. probably more of a political optics/PR attempt.

please tell me do you use BTC directly for all of your living / business, or 90%, or 40% etc etc?

if so, do you convert them into currencies such as the USD?

truely a sincere thank you if you can reply and educate.

Disclosure > I used to be very critical of bitcoin then some of my friends I personally know started using it and I had to tell myself to be open and not fall into bias. You can call it my ongoing learning curve of sorts.

it is very puzzling and difficult to understand why fact and science flies past some people, and to their own hazard.

wow. what you just said is heavy stuff dude. RESPECT.

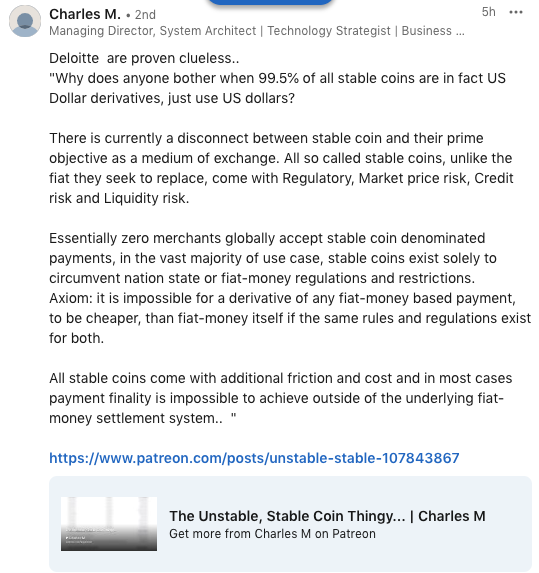

what do you guys think of the following comment on stablecoin from some dude on Linkedin?

#crypto #bitcoin #USDC #EURC #Solana

#RLUSD

this can only happen if Europe has a supra-national army that replaces NATO. when EU Army / Defence service becomes reality, then the Euro's reserve currency status becomes possible. At the moment, highly unlikely to happen.

this is funny.

good news for #crypto #bitcoin #blockchain

I'm going to make a short, unpleasant and concise summary of what will happen to every living child that are currently within the age group of between 3 to 5, on the entire planet, in the decades to come, if the executives of seabed mining companies, are permitted to do what they attempt to do so.

https://substack.com/profile/290864353-ace-fujiwara/note/c-104467971

#bitcoin #finance #crypto #blockchain #money #investment #risk #ocean #environment #sustainability #pollution #energy #minerals