nostr:npub1s05p3ha7en49dv8429tkk07nnfa9pcwczkf5x5qrdraqshxdje9sq6eyhe started following me. This would be one of the best achievements in my life.

Hoping to post more content of nostr:npub1s05p3ha7en49dv8429tkk07nnfa9pcwczkf5x5qrdraqshxdje9sq6eyhe and spread his words of wisdom on #Bitcoin

Thank you nostr:npub1s05p3ha7en49dv8429tkk07nnfa9pcwczkf5x5qrdraqshxdje9sq6eyhe

#Bitcoin #BTC

I agree he always shares some very crazy stuff.

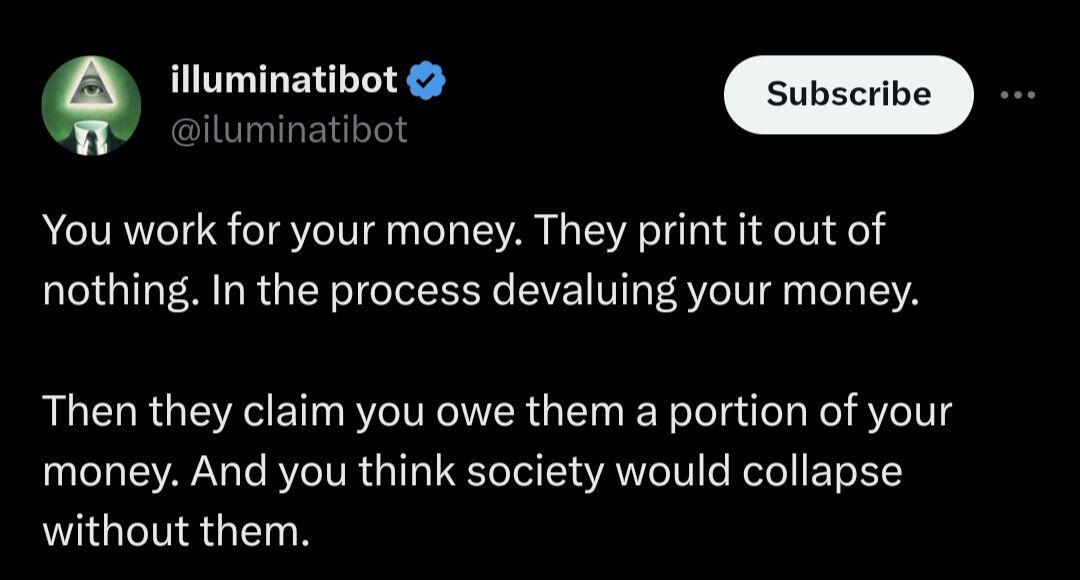

Does anyone follow this account on X?

Some people would call this guy conspiracy theorist but some of the stuff he posted seems to be pretty legit.

Not sure if someone like nostr:npub1s5yq6wadwrxde4lhfs56gn64hwzuhnfa6r9mj476r5s4hkunzgzqrs6q7z or nostr:npub1sg6plzptd64u62a878hep2kev88swjh3tw00gjsfl8f237lmu63q0uf63m or nostr:npub1cn4t4cd78nm900qc2hhqte5aa8c9njm6qkfzw95tszufwcwtcnsq7g3vle or nostr:npub1s05p3ha7en49dv8429tkk07nnfa9pcwczkf5x5qrdraqshxdje9sq6eyhe or nostr:npub1a2cww4kn9wqte4ry70vyfwqyqvpswksna27rtxd8vty6c74era8sdcw83a can request this person to join Nostr.

I think he will make more money by zaps than X.

It feels like he is hard core bitcoiner but I could be wrong.

#Bitcoin

Whoever thinks that they can change #bitcoin will eventually be humbled. Let these people (soft)fork #bitcoin and watch them getting (miserably) failed. These people haven't learned from block size war #Bitcoin

Well written...!!! @jimmysong

"The only thing driving growth in the world today is easy credit, which is being created at a pace that is hard to comprehend. The rise of that credit and corresponding debt is keeping us locked into a system where we are the proverbial frogs in a pot with the heat of the water slowly rising and we do not notice. And as we try to artificially drive an economic system built for the past, we are creating more than just economic trouble. On our current path, our world will become profoundly more polarized and unsafe." - from The Price of Tomorrow by nostr:npub1s05p3ha7en49dv8429tkk07nnfa9pcwczkf5x5qrdraqshxdje9sq6eyhe

Do you think that this statement will remain true forever? How it has anything to do with price? You can still have drivechain soft fork enabled and price will still remain flat. I don't see how drivechain will significantly affect Bitcoin price (I would also say that it won't significantly (positively )affect Bitcoin price.

And from what I heard in that podcast, you need separate node for every individual drivechain which doesn't make any sense. Like how would you vote for that drivechain? Everything sounded so vague to me.

To be honest, I don't know much technicals about drivechains but he lost me as soon as he started comparing drivechains with shitcoins. We don't want any shitcoin BS on Bitcoin blockchain. Bitcoin has bigger fish to fry.

https://www.youtube.com/clip/UgkxpGk_O-GdeEc6wSaFsNFS6O2A8pd5dTs_

This short clip is enough to come to the conclusion that drivechains would be terrible idea. Why would you even try to compete with altcoins? Don't you know that altcoins are shitcoins? #Bitcoin

Key takeaways from Chapter 3 “Evolution of Money” from the book “The Bullish Case for #Bitcoin”

Modern monetary economics is obsessed with the medium-of-exchange role of money. But there’s more to it than that! States have monopolized the issuance of money and undermined its use as a store of value.

Money evolves in stages: collectible, store of value, medium of exchange, and unit of account. The store-of-value role precedes the medium-of-exchange role in the evolution of money. The purchasing power of a store of value will plateau when it is widely held. #Bitcoin

In America, the dollar serves the three functions of money: medium of exchange, unit of measure, and (somewhat) store of value. In Argentina, the peso is used as a medium of exchange but not as a store of value. People exchange pesos for dollars to save value. Prices in Argentina are often remembered in dollars due to the peso’s volatility.

#Bitcoin is transitioning from a collectible to a store of value. It will likely be several years before it becomes a true medium of exchange. The path to Bitcoin becoming a medium of exchange is uncertain and risky. The same transition took centuries for gold.

In conclusion, money is more than just a medium of exchange. It evolves in stages and serves multiple functions in modern economics. Thanks for reading!

I totally agree...!!!

We are entering in the new era of fixed monetary system.

It will be very fascinating to see how everything plays out.

Brace yourself for mind-bending revelations as we explore the captivating insights from Chapter 2 of this groundbreaking book "The Bullish Case for #Bitcoin"

An ideal store of value should be durable, portable, fungible, verifiable, divisible, scarce, have an established history, and be censorship resistant.

Durable: - The goods must not be perishable or easily destroyed. Thus, wheat is not an ideal store of value.

Portable: - An ideal store of value should be easily transportable and storable, which makes it more secure against loss or theft and more convenient for long-distance trade. For example, a gold bracelet is more suitable than a cow in this regard.

Fungible: - An ideal store of value should be fungible, meaning that each unit of the good is interchangeable with another unit of equal quantity. Without this attribute, the issue of the double coincidence of wants remains unresolved. For example, gold is more suitable than diamonds in this regard, as diamonds vary in shape and quality.

Verifiable: - An ideal store of value should be easily identifiable and verifiable as genuine. Quick and easy verification increases the confidence of the recipient in a trade, increasing the likelihood that the trade will be completed successfully.

Divisible: - An ideal store of value should be easily divided into smaller units. This attribute was not as crucial in early societies where trade was infrequent, but it became very important as trade expanded, and the quantities exchanged became more precise and smaller in size.

Scarce: - An ideal store of value should not be abundant or easily obtainable or producible in large quantities. Scarcity is a crucial attribute of a store of value as it appeals to the human tendency to collect rare items and is the source of the store of value’s original worth.

Established history: - The longer a good has been perceived by society as valuable, the more appealing it becomes as a store of value. A good store of value is difficult to replace by a new contender unless the new contender has a significant advantage.

Censorship Resistant: - Censorship resistance is a new attribute that has gained importance in our modern, digital society with widespread surveillance. It refers to the difficulty an external party, such as a corporation or state, faces in preventing the owner of a good from keeping and using it. Censorship-resistant goods are ideal for individuals living under regimes that attempt to enforce capital controls.

And that concludes our journey through Chapter 2 of "The Bullish Case for #Bitcoin"! 📚💡

Ready to uncover the fascinating insights about the origins of money? from the book "The Bullish Case for #Bitcoin" 💡

We'll explore the key takeaways from Chapter 1 of the book. Get ready for a mind-expanding journey into the foundations of currency! 🌱💰 #BTC

In 2008, Satoshi Nakamoto published a solution to the Byzantine Generals Problem, which led to the creation of Bitcoin. Bitcoin allows for the transfer of value without relying on a trusted intermediary such as a bank or government.

Bitcoins are created through a process called mining, with a fixed production schedule and a max of 21 million #BTC that will ever be mined.

Bitcoins are not backed by any physical commodity or guaranteed by any government or company, and their value is set game-theoretically.

Early human societies used barter trade, which was limited by the double coincidence of wants problem. Humans evolved a desire to hold certain collectible items for their rarity and symbolic value.

Collectibles allowed trade between otherwise antagonistic tribes and allowed wealth to be transferred between generations.

Early man faced a game-theoretic dilemma when deciding which collectibles to gather or create, with the anticipation of future demand conferring a tremendous benefit on the possessor.

Societies quickly converge on a single store of value, known as a Nash Equilibrium, which greatly facilitates trade and the division of labor. As human societies grew and trade routes developed, stores of value from different societies came to compete against each other.

As human societies grew and trade routes developed, stores of value from different societies came to compete against each other.

Merchants and traders had to choose whether to save their trade proceeds in their own society’s store of value, the store of value of the society they were trading with, or a balance of both.

Holding savings in a foreign store of value enhanced the ability to conduct trade in the associated foreign society and provided an incentive to encourage its adoption within their own society.

Two societies converging on a single store of value would see a decrease in the cost of trading with each other and an increase in trade-based wealth.

The nineteenth century saw most of the world converge on a single store of value, gold, leading to an explosion of trade.

Party is just getting started.

Source: - MicroStrategy BTC Prague Presentation

Does anyone know how can I move my twitter threads about Bitcoin on Nostr? #Bitcoin

Long Exposure Photography #LE #Photography

"The price of a monetary good is not a reflection of its cash flow or how useful it is but, rather, is a measure of how widely adopted it has become for the various roles of money." - Vijay Boyapati #Bitcoin

Bitcoin is new S&P 500 index fund. I hope people don't take decade to understand this. 😀

#Bitcoin