So badly wanna #zap Optus and laugh

Ringing Optus

Telling them #bitcoin never breaks down

Let me know if u need a hand with custody options / wallets etc 🤝

What don’t you like about it?

I’ve got it set for my zap receiver wallet because I can set custom notifications and have a zap noise thanks to nostr:npub1lrnvvs6z78s9yjqxxr38uyqkmn34lsaxznnqgd877j4z2qej3j5s09qnw5. Works fine for that

Scratch that they’ve upgraded it… I’m just having a buzz through now

The invoice looks cool now

That’s better…. Having a look

What don’t you like about it?

I’ve got it set for my zap receiver wallet because I can set custom notifications and have a zap noise thanks to nostr:npub1lrnvvs6z78s9yjqxxr38uyqkmn34lsaxznnqgd877j4z2qej3j5s09qnw5. Works fine for that

U tried sending from the wallet? I had many glitches that way

Multiple menu drop outs and “can’t send” notifications… but when I get it working it’s 100%

Receive… no issues

There are 21 million #bitcoin that can be audited perfectly when all in self custody

If you have 1 Bitcoin and you hold it on an exchange

There are 21 million and 1 Bitcoin

If you have 10 #btc and you hold them on an exchange

There are 21 million and 10 #Bitcoin

If you have 1,000,000 Bitcoin and hold them on an exchange

There are 22 million Bitcoin

If you hold your coin on an exchange you are:

Suppressing price on your own investment

Increasing the supply via paper IOU which you may not be able to access if physical supply is all in custodial

You will lose all your funds when the site goes offline, down, arrested or any other mishap

Giving $$ to a company that do not buy Bitcoin with it, instead they invest it, keep it or gamble it

ALL THE PHILOSOPHY YOU EMPART ON THE SO CALLED STUPID NO COINERS

YOURE ACTUALLY CREATING THE PROBLEM IN BITCOIN

SELF CUSTODY NOW

OR THIS BECOMES A JP MORGAN GOLD MARKET VERY QUICKLY

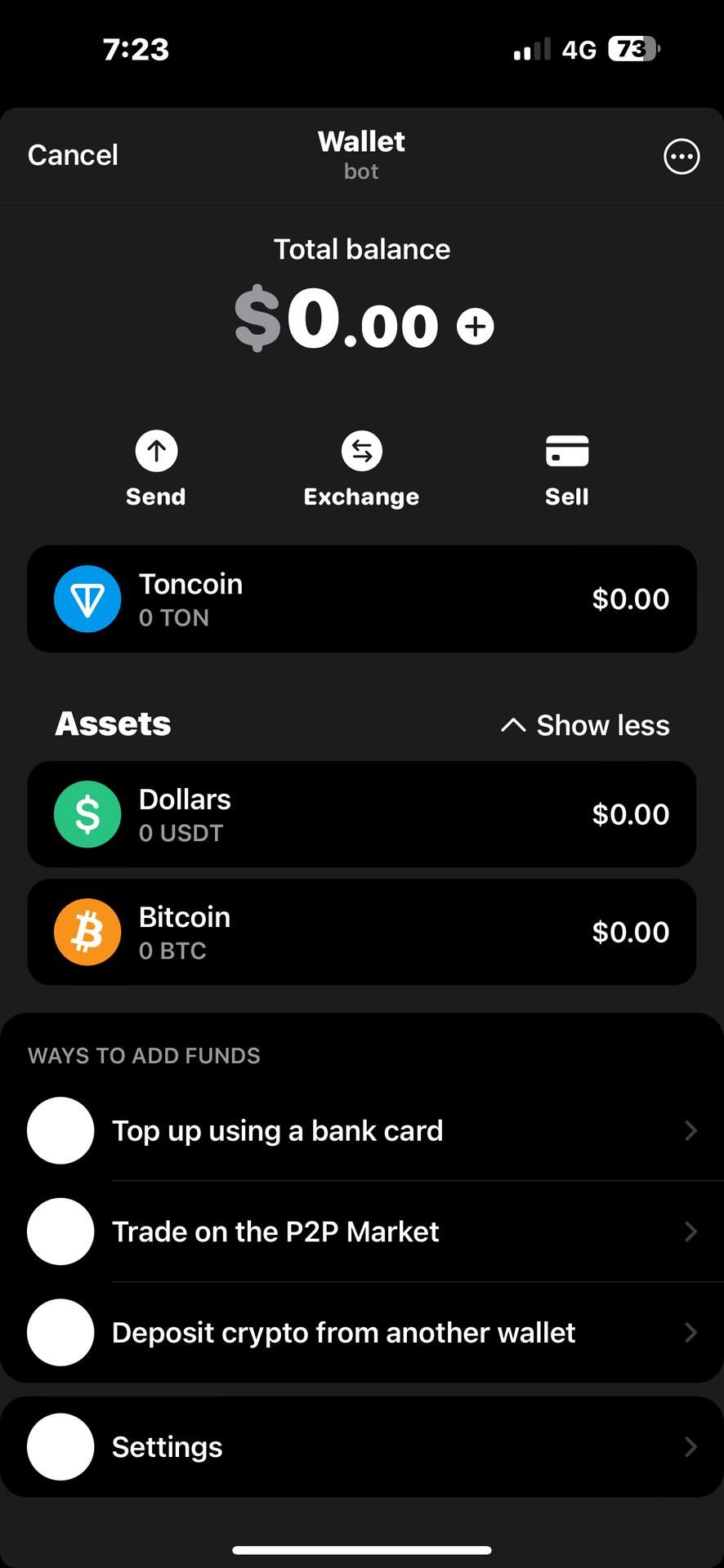

The Telegram wallet is fantastic

But no #lightningnetwork ??

In #bitcoin

If there’s no lightning integration…

What’s the point?

Australians wanted Philip Lowe gone because of the wreckless economic choice to follow USA and raise rates substantially

So Australia fire Lowe for raising rates

Hire a new Director

And she hikes rates 🤣🤣

Should of just kept Lowe 🤣🤣

Australia #bitcoin or ☠️

Do yourself a huge biggie

Head on down your local shop and suggest they accept Bitcoin… I guarantee u you’ll be surprised they’ll be infinitely curious

My strike rate on pilling since I went just on offering or direct is near 100%

I think you’ll not only spend some good orange… but utilise your precious time in Bitcoin with winning

Do yourself another favour… sounds like you’ve heard enough about Bitcoin… you seem like Orange pill good guy

Go do some real bitcoining with good people… sure point people at the conferences if you like… start taking the next step

Lead some people… Trust me 🤝

Empathise with noobs

Here’s is something I either get told nobody is interested or don’t want to hear

2023

Opened lightning economy between USA and Europe of 5000 member organisations that only use Bitcoin and tether (from Australia) all new or never been bitcoiners

I work with the Perth Heat and push their Bitcoin baseball programs to new people never been in bitcoin… they have a stasforstats program that gives away Bitcoin to new bitcoiners

In Adelaide alone I’ve put 27 businesses to accept Bitcoin via Lightning as well as my own business has accepted Bitcoin payments since 2017 and had 7 regular weekly payers and another 8 monthly payers

I show people this…. And all I cop is no one is interested in integration or people don’t want to part with Bitcoin “from the presenters of these conferences”

Literally… nobody gives a shit

That 5000 crew took 20 minutes to have them all transacting….

No videos

No conference

Literally showed them how to use Strike and boom…

People are smarter than you give them credit for, maybe stop treating everyone like an idiot… because they aren’t… they’re literally interested in Bitcoin but get confused with all the content

Maybe orange pill someone… you’ll learn this

Please tell me you self custody your #bitcoin ?

If anyone here does not self custody… be honest and speak up

You need to know 3 things

1: You’re helping suppress the price

2: You have 0 #bitcoin as nothing has moved on chain to a wallet you own

3: you’re adding paper bitcoin to the 21 million supply

You need to fix this today!!

In person talk leads to buy my book and subscribe to my channel

Well while conferences are at all time highs and books / videos

Education seems to be at all time lows… how many “bitcoiners” still hold their coins on exchanges??

Sadly from what our team has seen… the vast majority

These conferences don’t seem to help

Self custody

Lightning usage

Peer 2 peer

Beating the hedge funds

Etc

All I hear is 21m hardest money ever in different pretty words

But hey if people need it all at snail education speed by all means enjoy the repeated talks

I just hope you at-least learned self custody

How many more presentations does everyone need

Saylor

Keiser

Lyn

Foss

Etc

There are over 1 million hours of logged #bitcoin and economy is bad blogs, videos, type and in book form hundreds

Yes I researched Bitcoin in December 2016 and bought Feb 2017… guess what… we didn’t have any of this conference and video “Bitcoin is smart” help

And our guys here did it anyway… at some point u just have to get on with it

There is enough info repeated daily to educate the population 50 times over…. How much more talk does everyone need??

If you’re new it’s all easy to find in multitudes …. It’s been done.. 2021 all the good wholeheartedly information was delivered and 100 x since then

At some point …. It just becomes a support group reassuring u you made the right decision

I’ve got a lot of old skool bitcoiners 10 years or so all saying the same

INTEGRATION TIME!!

Time for talk is over, she wrote a book, she’s done umpteen interviews… going over ground you’ll find causes confusion and turns people away

Too much unneeded info is never good

Bitcoin is basic and simple

Stop complicating it

Debt bad

+

Bitcoin 21m hard cap backed by math and it’s perfect money

+

Here is 3 or 4 interviews

+

Buy

=

Easy!!!

Matter of order

Whoever came out first is the older

Time isn’t a thing cmon 🤣🤣🤣🤣🤣

Open up any app… Anybody them

You’ll hear

“We need to do something”

About whatever War, debt things that have been cried about for 200 years

We!!! Main word!!! WE!

Well what can we do? Actually a lot less than you might think which is a good thing

For one: Protesting in streets is the dumbest form, as you’ll get hungry and need to return to work tomorrow and best forget about in a day or 2

Luckily the 2 least things we can do is highly effective

1: All come together on #bitcoin at once (this seems to be a struggle) but everyone can buy $10 right now together all at once in self custody (remove supply) that does a lot for wealth

2: Walk off the system, stop paying taxes, bank run and close accounts (risky, comes with police intervention and trouble… but easy short the system)

This 3rd one: Talk and talk and talk and talk 10 years go by and things only got worse

Remember 10 years ago: We said “in 10 years time”

Look around… how’d that play out?

If not #bitcoin now

When?

When it’s to late ?? Getting there

Captains of Crush gripper

Elite level grip trainer… I’m trying to get on the level 3 leaderboard

Check em out “Iron Mind” Captains of Crush

Drove 28 on the squat… funny u say that just got shot a 335 for 13 to beat… try that Friday

Barefoot is the go! I share this sentiment