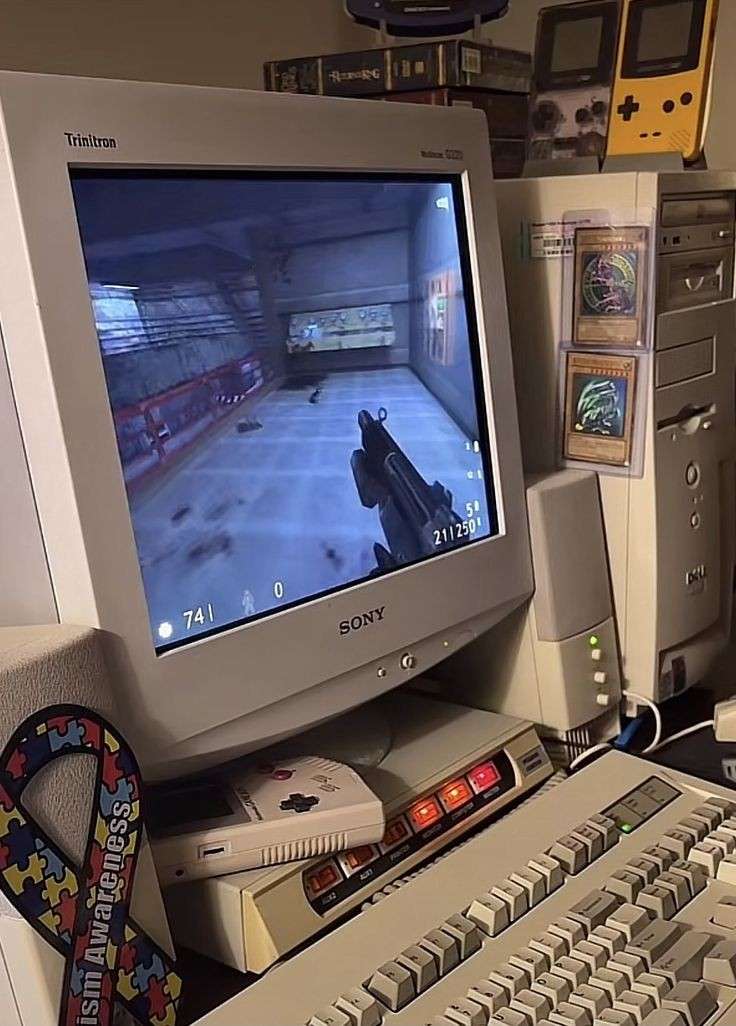

That looks like one of the early QuakeCons. Always wanted to attend one. I still remember the first QuakeCon when Dennis Fong aka Thresh won John Carmack’s Ferrari for taking first place. We used to play against his clan Death Row on Stanford.edu quake servers when we would drag our PC’s to UBC to utilize their T1 internet pipe. We would get our asses beat but it was fun. Gaming, eating takeout and downing can after can of Barq’s till the wee hours.

I miss trimming work parties with the inner circle people where we’d bring them to the site in one vehicle and gradually file everyone up one at a time on a 5-10 minute delay to an outbuilding where the rooms were. Better than a half dozen people being seen all walking up towards the barns all at once. Then serving up Kentucky Fried Chicken for lunch to keep people’s fingers greasy so everyone wouldn’t make off with a golf ball sized “theft ball” of finger hash stuck to their fingers lol. The days before legalization were more fun.

All I did was get a Dell 15 3520 with a 12th gen i5 processor, 2TB SSD and 16GB RAM for $700 CAD with Windows 11 Pro on it so I didn’t have to mess around trying to find one with the OS I wanted pre installed. It also gave me a chance to mess around for a few days with windows 11 pro and recoil in horror at the level of privacy invasion it represents.

Most OEM windows license keys are right in the bios so you can always get it back if you ever want to. But you won’t likely ever want to once you see how much more private everything is by default on Linux.

Get yourself a good mouse, 2-3 thumb drives for rescue media and booting into the OS install itself, and a 2TB external SSD for saving images and critical files to, and you’re stylin.

Hot tip. Having access to your retiring internet connected PC throughout the process, and an AI prompt at the ready for helping you through any technical challenges is a quantum leap from trying to do a new operating system install and the initial learning on a lone machine.

Also look for the YouTube video entitled Introduction to Linux Full Course and others for some command line basics and gaining an understanding of how Linux works vs Windows centralized registry model.

Best thing I ever did for computing life. I should have done it years ago.

Just recently switched to Ubuntu 24.04.1 LTS and it was a seamless process. All of my Bitcoin stuff including usb/card reader connectivity for signing, Sparrow, terminal access to my node, everything. And for a basic FOSS office suite, it comes with Libre Office. I would also recommend getting a copy of Clonezilla on a USB stick and an external 2TB SSD for easily making images of your whole system onto. If you ever have a problem, you can restore your whole system from an encrypted image.

And it’s great too that when you’re doing the OS install, you can have that whole partition encrypted too. I could leave this laptop on a park bench and there isn’t a damn bit of good it would do anyone wanting to look at my files.

You too Karnage

I scrolled the comments before posting “Be careful what you wish for.” 🤙🏽

When I saw this, Snoop’s “The Next Episode” immediately started playing in my brain. I’m officially meme-ified.

Wow this is awesome. Good job Adam. Her great grandkids will thank your great grandkids. 🤙🏽

Lithium ion batteries will be looked at as primitive and dangerous technology within our lifetimes. That we sought to construct buildings full of them in the name of environmentalism will go down in history as one of the most gruesome acts of hubris.

(This is not a post against intelligently built and decentralized home battery systems, resilient device batteries, or even car battery systems for that matter- though they will all get upgraded from lithium ion in due time and so the statement stands)

https://insideclimatenews.org/news/01022025/moss-landing-battery-fire-contamination-health-fears/

https://energycentral.com/c/um/big-calif-battery-storage-facility-fire-burns-11-days

The same way that the brainiacs at the helm of government “green” initiatives favoured filling our homes and landfills with mercury containing compact fluorescent lightbulbs, and ruining people’s brain chemistry with blue light spewing LED bulbs instead of permitting the continued sale of incandescents.

I wonder if the dancers down at The Granville Strip have NFC tags on their g-strings

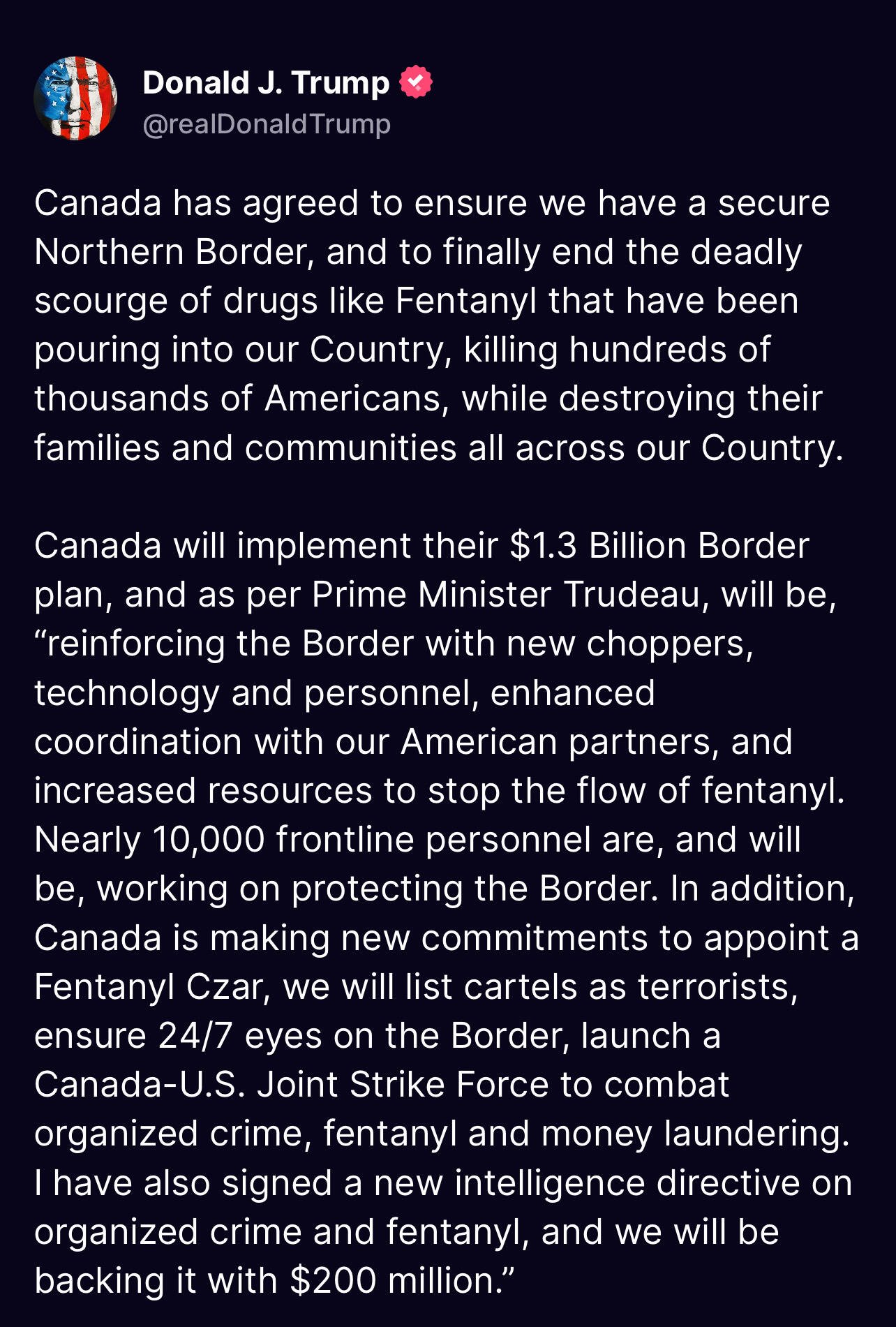

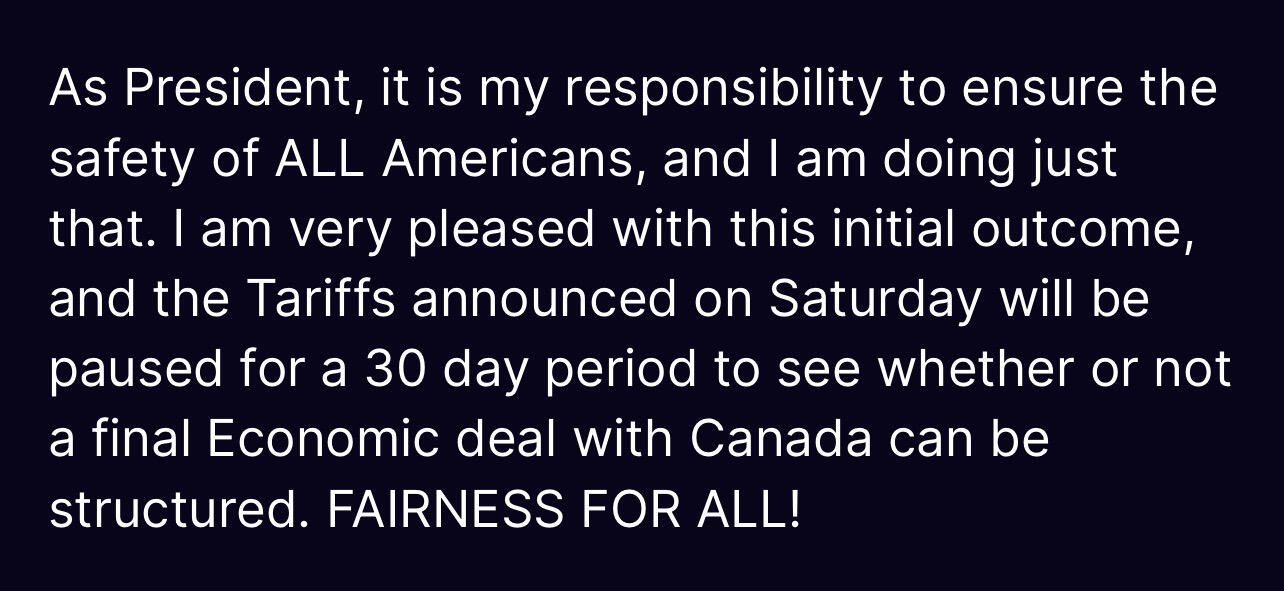

Good step. But he’s wrong about it being his job to ensure the safety of American citizens. It’s each individual’s responsibility. The government just has to protect personal property rights, defend national borders, uphold the rule of law, and otherwise stay the fuck out of citizens’ lives and pocketbooks.

Going out in public must be awkward without pants. Lol

Man am I ever loving PGP now that I’ve finally had the chance to work with it. At work or on the road if I encrypt text or files with my public key to my private key that only resides on my home terminal, Linux laptop or my phone to decrypt, and send them to my Start9 server over Tor, it seems to be a pretty solid way to transfer data in a way that isn’t vulnerable to interception. As long as you’re using 4096 bit RSA and strong passphrases, it seems pretty bombproof. But I’d still never use it to send keyphrases.

#pgp

Natural Reader has a free version but I like the voices and features available in the paid one. This app has supercharged my reading. I’ve read more books in the past year than in the preceding 20 years as a result of being able to convert any free pdf or text copy of a book I find, into audio format.

The app can even do optical character recognition of text from a phot and read it out. And the web plugin can read any webpage aloud. It’s a great app so I don’t mind placing some value in the premium version. But the app is great even without a subscription

Yes it is awesome too. My main reason now is supporting the devs. I’ll see how it goes. At least it’s month to month.

I don’t mind paying a bit of a premium for my US dollar priced nostr:npub1getal6ykt05fsz5nqu4uld09nfj3y3qxmv8crys4aeut53unfvlqr80nfm hub hosting because I am doing it as a means to support lightning development and propagation of the network. But I’m not going to lie, with the US/CAD exchange rate being what it is, paying nearly $20 CAD for monthly hosting to mainly just make zapping seamless on Nostr and V4V podcasting and media apps is feeling a little steep compared to say, a monthly bank service charge. Between an online game service subscription, a VPN subscription, streaming service subscriptions, natural reader (awesome) and an online AI service subscription, it adds up.

A lot of this stuff could be cancelled tomorrow because I’m mostly using a few of them for testing and experimentation purposes so that I know how to use the tech. But I can definitely see a divide being created between the level of technology access that various socioeconomic groups can expect to have in the future.

Not complaining, just making an observation.

Would you elaborate on “changing your cold storage”? Do you mean just swapping out a single signing device for another of a different make? Or swapping out multiple signers to eventually cycle back into the mix. What was the rationale? Potential hardware vulnerabilities? Key storage concerns?

I like learning about other people’s takes on managing cold storage. Thanks