A broken record.

You tried setting index on that column?

Nunchuk introduced advanced coin control features such as #tagging coins, transaction notes/labels, locking coins etc. Pretty cool stuff - https://nunchuk.io/blog/coin-control

This app works also well with #coldcard NFC. Cool stuff.

Imagine HODLing instead of zappin......

#[1]

Unfortunately, the result was heads, and you guessed tails!

Better luck next time!

Checkout more Nostr games at NostrCasino.com!

Verifiably Fair:

The method for flipping the coin is verifiably fair and open sourced in the GitHub link below.

You can run the code for yourself to verify the fairness and final result.

https://gist.github.com/NostrCasino/9eda61f2244d2bf0327379d8d92cd24e

seed_hash = '119585a1abde0fc8c67652e0cc1007de60da801cf1451decfe713fa899218a99'

seed = b'42e3a60385f9cc6d9e0b80b3d5c4a4dabea42811eed1dde8a15864ea2e405b3013f5cf0a1fc3ac304be2d137c7762d984b6c7cdc5b0edab7a8d2b6c770e286b1'

signature = 'bbab6b0c8421e98d67519bf39d9ab561e0c65ccf32f34f186b4058ae208f0afb98a7ef872d78485e970cc7c940d12451663b474d93c6250377b8b901b1ad3160'

player_guess = 'tails'

😛

It seems like you're referring to two different models used to value networks and assets:

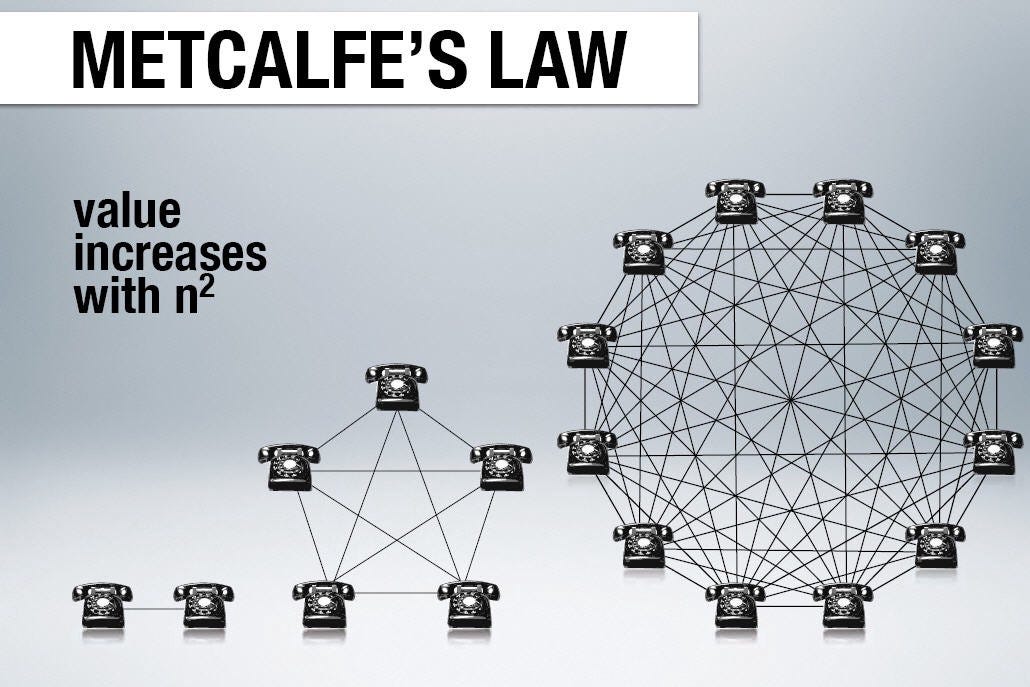

1. Metcalfe's Law: This law, named after Robert Metcalfe, states that the value of a network is proportional to the square of the number of users (N^2). This concept is often applied to social networks, telecommunications, and other systems with network effects.

2. Stock-to-Flow (S2F) Model: This model, often used in the context of Bitcoin and other cryptocurrencies, suggests that the value of an asset is related to its scarcity, measured by the stock-to-flow ratio (S2F). In this case, the value of the asset is said to be proportional to the cube of its scarcity (S2F^3). The model is based on the observation that the more scarce an asset is, the higher its value tends to be.

You mention that if the S2F ratio of Bitcoin doubles after the halving event in April 2024, then the value of Bitcoin should increase eightfold (2x2x2). While the S2F model has been a popular method for predicting Bitcoin's price, it's important to remember that it's just one of many factors that can influence the value of an asset. Other factors such as market sentiment, regulatory changes, and technological advancements can also play a significant role in determining an asset's value.

It's also worth noting that while models like Metcalfe's Law and the S2F model can provide insights into the behavior of networks and assets, they're not foolproof and should be taken with a grain of caution. Always consider multiple factors and models when making investment decisions.

Hope it won't causes forced closed channels 🙏

Weird things heppen...

ChatGPT-4 replies with this to your post:

Hey there! I'm sorry to hear that you had to deal with some unfavorable news today, but I'm really impressed with how you handled it. It's great that you focused on what you could control and turned your energy towards something positive. That's an amazing mindset to have, and it's definitely something to be proud of. Keep up the good work and continue to stay resilient! 😊👍

Still have those.

#[0] please generate a Borland Delphi program that writes the text "Hello" to the screen

nostr:note14u4gthmlf23czvsnuerwz4ct8cpptx29x7m8vnrhthzec6w55dgsx2wv57

nostr:note14u4gthmlf23czvsnuerwz4ct8cpptx29x7m8vnrhthzec6w55dgsx2wv57