Many wallets have a built-in node which calculate routes on their own.

Many others (like Phoenix) delegate this to a node (the wallet providers'), ostensibly to improve user experience, as route calculation on mobile vs their beefy server is slower.

It would be nice to have the option and let the user choose their tradeoffs..

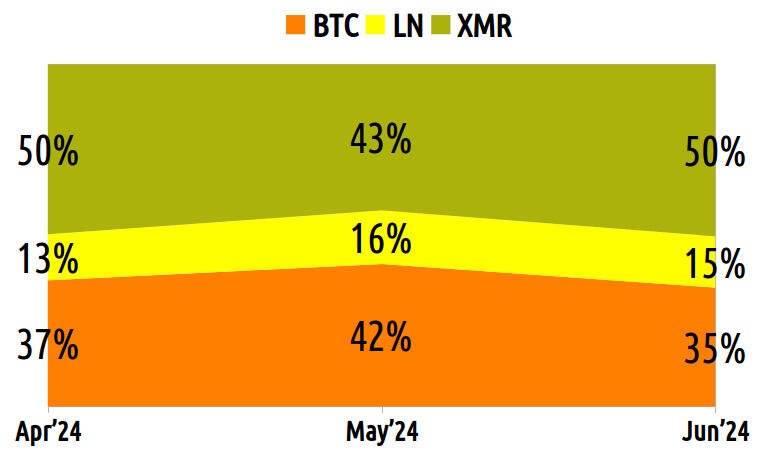

Paying nostr:nprofile1qqsdru78zcu6uwa6zlludjx7k87m8ft9q6e5jgsn6qe49rxzj9frwpqpz4mhxue69uhhyetvv9ujumt0wd68ytnsw43qdgkgx7 with #lightning is excellent.

Much faster than paying with #Monero

It was at the speed of lightning.

Well, it's only a few seconds difference, but yes, in general (when Lightning payments don't fail, which is often if it's a modest amount and one is not connected to a large centralized node) the lighting payment flow is faster and more polished.

Because of the way Monero works (decoy outputs have to be fetched from the node your wallet is connected to and then sent to the client), this will probably always be so.

It depends on what you're optimizing for. I'm willing to wait 3-5 more seconds and enjoy superior privacy.

Where Lightning has the indisputable upper hand is if you need to make multiple small payments in succession - assuming no routing problems, this will be very fast (whereas the 3-5 seconds per tx on Monero will quickly add up).

Furthermore and to finish, change outputs get locked for ~20m in Monero, and usually users don't have many utxos available for quick spending in succession for this reason.

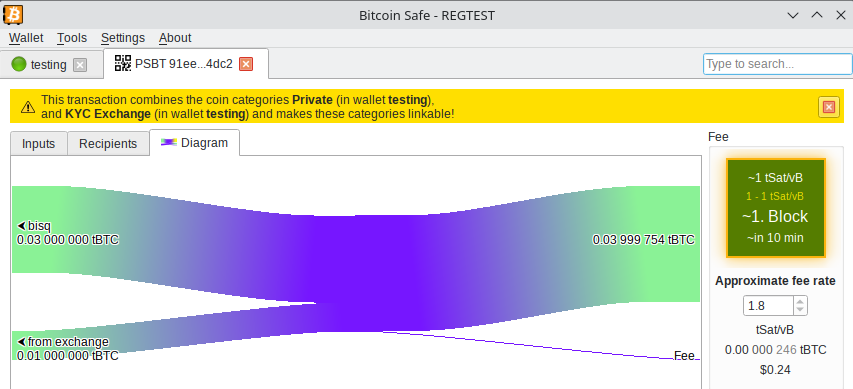

Phoenix is sleek but bear in mind it's ACINQ's server that calculates all the routes, or in other words, they're spying on you.

Ah, reddit leftists.

Never ceases to amaze.

For me it's the assassination of truth. And how many stupid dogmatic people circlejerk endlessly without actually making an effort to understand the truth.

They already know the truth, you see.

Don't even need to look at the facts.

It's true because they believe it, and they believe it because it's true.

No nuance, no depth, just dogma.

They are lost and I doubt many of them will change, if I still bother highlighting their zealotry it's only so that a few fresh noobs here and there might see that there are other perspectives and the rabbit hole goes a bit deeper than "there is no second best bro everything shitcoins bro".

"Bitcoin economy"

All they think about is NGU.

It's the last thing they can hold on to.

Meanwhile too dogmatic and dumb to understand that if you're into monero, you've probably been around for a very long time, and hold even more bitcoin than them.

Sure.. but also, where are the parents?

Something something Orange man bad very nazi threat to our democracy.

You might want to read the reddit comments.

lol, what an idiot, equating privacy with criminality, as if the only use for privacy tech is to commit crimes.

Furthermore and on a technical level, assuming this "exploit" (it's a DoS, dummy) actually works, it will only take down nodes with a RPC port open, which is not most of them.

Therefore the network won't be brought down, as anyone with about 120 IQ could tell.

Get lost, lamer.

They don't like it because it's not Bitcoin. Like a religion or some football club or your favorite beer or something.

Their peers are also maxis, to fall outside of the groupthink would make them outcasts.

After years of repeating the same nonsense, it would also be highly cognitively dissonant to admit that yes, there is good stuff in crypto beyond Bitcoin too.

In other words, a very hard case of ego grasping and attachment.

Can it work without ever more young people at the base of the pyramid?

If it can't, it is a ponzi.

I believe this to be the case.

I'm all for a pure bitcoin (and in my case, monero) standard, setting aside for the moment the fact that neither could scale as they exist today to accomodate for that.

Unfortunately for the moment it's a pipe dream, except in certain small communities around the world, although the situation is improving slowly over time.

Meaning that unfortunately at some level, if one is entirely in crypto, it will be very hard to avoid using some KYC service of some sort.

At which point, I agree, it is essential to safeguard one's own privacy, because to not do so is to put oneself at potential great risk of harm (and also, it's none of their business).

I share your concerns around privacy (and anonymity), there is perhaps an argument to be made over legitimate concerns around source of funds at times, but clearly then ideal equilibrium is not "record every transaction of every amount forever and if any privacy tool was used along the path it must be money laundering", which seems to be the direction we've been heading towards for awhile.

This unfortunate path has been greatly expedited by the normalization of transparency in blockchains, in my opinion. It was already well underway, but a public eternal record of every transaction really sped that along.

Nevertheless, the solution is not only technological. Once upon a time financial privacy was a given, and respected, and it took great effort backed by strong suspicious to break it.

Nowdays it's casually broken pretty much every second of the year. The consequences are dire indeed.

Perhaps one day there will be enough of us spread all over the world, with enough wealth, power and influence, to restore this basic human right to its rightful place.

Liquid is traceable, just the assets & amounts are hidden - but not the addresses.

A transaction graph can and will be built from that.

Different institutions and jurisdictions diverge in how far they are along the path to total financial tyranny.

The problem of course, is that the breadcrumb trail is eternal, so it is a safe bet that this will come back to bite you in the ass.

Also, remember that getting your account closed at even one institution over "money laundering" concerns (aka privacy) could spell doom for all your other accounts as well, since, well, you are identified, and there are backend systems and arrangements in place to share this information.

Be careful out there.