Learned SO much from this despite thinking I wouldn’t going in.

Baking soda and vinegar. Change ur life if you do it right. Make a volcano w/ red food dye.

Consolation prize: “Chinese finger cuffs” w/o the obv racist name you can easily duckduckgo…

“If it isn’t voluntary, then it is coercion.”

Current metrics:

1 BTC = ~367.47bbl WTI crude.

1,170 BTC = 1 (~avg) tanker of light, sweet crude.

MicroStrategy BTC = 120 tankers of WTI equiv crude oil.

Full disclosure: I only fill my gas tank about 1/3 each time unless oil px skyrockets...

If this is less than 5 years off #RemindMeNostr

Sadly, the one’s with the least government right now.

But it is changing so very fast.

Spotted the AI

Yeah no horror show.

Studied Japanese for 4 years.

Don’t have the kougan to open up a Nostr chat in hiragana.

And probably right in my reticence.

If its the bank runs meme, the joke is that April 1st is on a Saturday so it will likely only be a handful of WallStBettors & plebs (who largely don’t keep fiat in banks) who will be withdrawing their money. My 2sats.

For instance: the electricity production industry spent a century under the assumption that the holy grail for solving the wasted production problem was bigger, better batteries that could store unneeded production unproductively…

…when the solution turned out to be utilizing unneeded production productively to realize the value of that energy.

Faith and credit, my friend. Faith and credit.

(read The Mandibles if you think this statement is treasury…)

A number of people have asked me if I agree with the 90-day hyperinflation scenario.

My answer is no.

90-days is more likely what it will take for businesses and firms who’ve been on the fence about Bitcoin to establish and define processes and procedures for taking Bitcoin into corporate account, and perhaps even self-custody.

The incentive to have 1-3 months of expenses outside the banking system - in an asset that allows for global payments w/o interference - is a compelling and real incentive. Dare I say, an existential one.

The value of the Bitcoin token is probably fairly priced rn, imo.

The value of the Bitcoin network and its infrastructure hasn’t begun to be discovered, and that’s a fact.

Needed to hear this today, as my teenage son is fighting small yet overwhelming battles I can’t help him win.

Today’s Citadel Dispatch w/ Jesse Myers & @odell is very significant.

In it they discuss (among other signal) the clear certainty that

— every business & institution MUST take the fiduciary responsibility to have some months worth of Bitcoin in their account…

…to cover the possibility that they may have zero-access to funds to cover expenses & payroll at any time in the future. And this balance is accretive, since it would be added to if BTC/Fiat falls, but there is no such incentive to sell if BTC/Fiat rises.

This is the leverage Managers can take to company Boards to sway any previous FUD.

Circle / USDC was clearly & unambiguously ‘bailed out’ by deep pockets (Blackrock) over the weekend, which means it’s considered too important to fail.

I know this shouldn’t come as any surprise…but there’s something in this that really disturbs me, since 90%+ of our banking system is not considered too important to fail.

Clearly banks are no longer relevant, and the digital components of the coming CBDC are being defended, despite failing before they get off the ground.

But lets be clear…they’ll continue to make depositors whole if the run on banks continues, right?

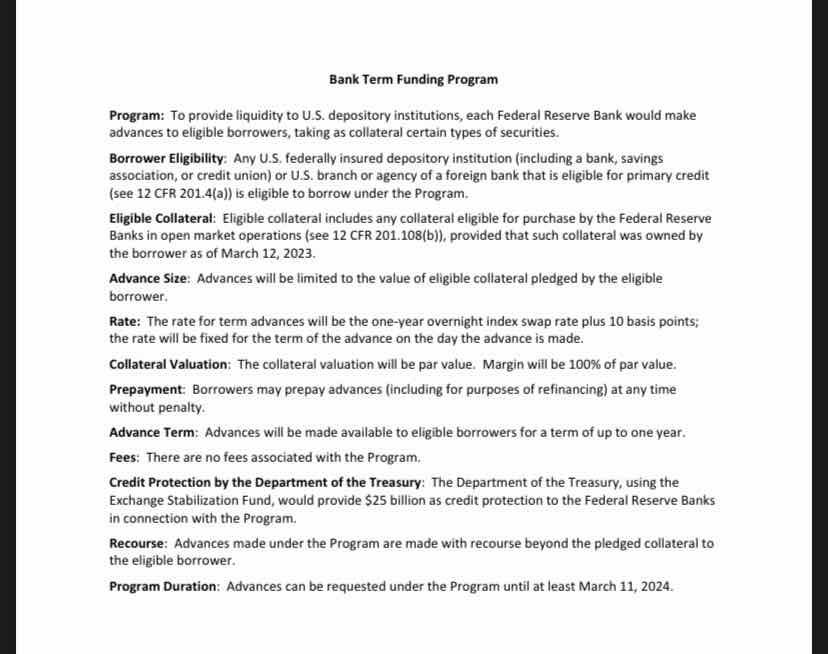

There’s no way this was a ‘one and done’ action if they established the new bank stabilization board…BTFP or whatever its called that I can’t be bothered to look up rn.

At this point I don’t believe, and I don’t see anyone I respect believing, that the $US is not going to suffer over the next 2 or 3 years, via banking failures from every angle.

Even the Fed knows this and have openly admitted.

Sry for spamming that last one…Damus gave me issues.