Hi Daniel, what's with your short summary ? Enquired without prejudice.

This is a use case for Lightening & time locks.

Can I redeem my shares for BTC (depending on conditions) ?

Tether is a shitcoin.

SoftBank is a FinTech.

Cantor Fitzgerald is an inter dealer secuties broker.

CEP is a SPAC profit punt.

You can only accept the cost of you embrace dissonant values.

It's an easy listen and it's an easy read. Worth coming back to after a period if time to revisit. Worth considering .....

GM.

Chapter 13 of Broken Money is called "Heavy is the Head that Wears the Crown".

It focuses on the US trade deficit and why it arises structurally. In short, since the USD is the global reserve currency (for reserve assets, international contracts, FX trading pairs, and cross-border funding), there is tremendous automatic demand for USD in the world compared to other fiat currencies.

To supply the world with that ever-growing need for USD to service all sorts of needs, the United States runs structural trade deficits with the rest of the world. That's how the USD spills out to the rest of the world for them to use. And the mechanism for that is that the overvalued USD boosts Americans' import power, reduces Americans' low-margin export competiveness, and basically forces open that trade deficit.

That trade deficit is the cost of maintaining the benefits USD system as currently structured. The fatal flaw is that those who bear the cost (e.g. industrialists in the Rust Belt) are not the same as those to gain the benefits (e.g. Wall Street and Washington DC folks). And those costs and benefits accumulate over decades, resulting in rising populism and pushback, which is now front and center.

The challenge that the administration faces is that they have identified a real problem, but are tackling the surface issues rather than the underlying structural issues.

Anyway, I uploaded that chapter 13 on my website for free reading:

https://www.lynalden.com/wp-content/uploads/broken-money-chapter-13.pdf

Love your action figure. You've made it now 😜

Includes:

• Mini Fed printer

• Signed copy of Broken Money

• Express train (no brakes)

• Trillion-dollar coin (non-redeemable)

Sir, you travel in rarified circles.

My sense is it's best to be ready for a bit of irrational market action. Game on and don't plan to retire this year.

today is the 15th day of the Lunar New Year which is mostly known for the lantern festival, which is nice family gathering enjoying savory Tang Yuans (湯圓) and lantern decorations are seen in many spots. However in the south of Taiwan (Tainan) there is a peculiar tradition called the Yanshui Beehive Festival (鹽水蜂炮) that happens on this day.

https://www.youtube.com/watch?v=9jPrpOxYcPE

On the day of the lantern festival, people gather around a bunch of fireworks that shoot outward into the crowd. Get hit by a firework and you have good luck for the year. It's crazy and super dangerous

This is a tradition brought over to Taiwan in the 19th century by Ming Rebels/Pirates as a loyalty test and rite-of-passage, somehow this tradition became one of "hey, if i get hit by a lot of fireworks at the start of the year, i'll have good luck!".

Taiwanese are weird sometimes 🤣

Yeah Tainan folk's are a bit different. Big night with my son, light sabres and lanterns 🏮🏮🏮

And it's compounded by a lack of will to fix it. The corruption of honest for honest toil through the mass psychosis of captured consent to loot communities is at the root of much of the current dysfunction. Nobody has the right to usurp honest money except those whose time, energy and skill went into earning it.

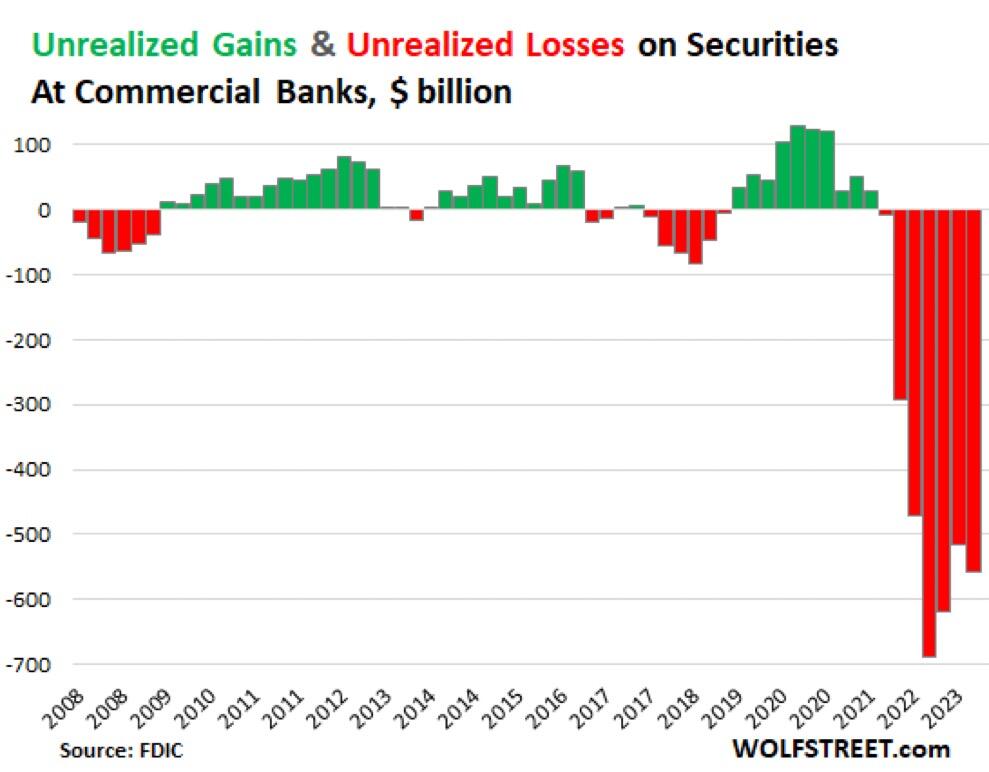

But is it real ?

Don't they have unrealised profit's of equal size on the liability side ?

Or is that what Fed mutualisation is all about. Central Banking is insane.

The other side of the view.

https://research.gavekal.com/article/making-sense-of-the-china-meltdown-story/

Thanks ! Useful perspective and yes it's not same as MSM.

Thou shalt not pass !

(Original non cinematic text: Thou cannot pass.

Can you imagine? Some of her Nostro musings to the agitated middle of the road crowd are "wow" !

Having a bit of a struggle setting up StartOS (non free iso) in a VM. Anybody had better luck ?