The theory of relativity was first studied by an italian Olinto de Pretto. But he didnt have the political backing that Einstein had.

Yeah it does. Similar to the system of Torah and Rabbis who seem to be supreme guides for every fart trying to get out of its pants. But I'm happy to learn if there's anyone more educated on this.

I dont have a definition either, but for example the btc lending that takes 10%pa and your bitcoin with 50% LTV is clearly usurious to me. But people on the other side of the game are more greedy and don't want to let go of their BTC. So to each what he deserves.

I will have to dig into it a bit, no expert either.

Interestingly, the christian bible talked originally about God taking a half (side) of Adam and making Eva to his (equal) partner. But somehow it got co-opted with translations into "the rib", subordinating the position of a woman to the man henceforth.

All these are interesting things to learn, but also a reason why I don't accept religious leaders of any kind.

A whole another topic is how an individual person lives and what moral guidance does he stick to, regardless of their religious scripts.

And so I'm not ready to condemn a Muslim or a Christian or a Jew -- as long as they're not following their "torahs" literally in trying to subordinate every living human to their needs, or keeping women as slaves etc. If they do, I want nothing with such people.

Well I'm dreaming of a babel fish since the moment Arthur hitchhiked the Vogons

There is this invisible lattice of all knowledge that most ppl don't know about.

I thought I explained precisely what was my goal in my OP. I'm happy to learn anything valuable about Islam and its non-compatibility with liberty, so please do share specifics.

Please wherever you travel in spanish speaking lands, don't forget to share a free PDF of El Pequeño Libro de Bitcoin:

https://drive.google.com/file/d/1QS6CJqyrteI1IqqsdLJyskajxurZf_SF/view?usp=sharing

Nope and it magically managed to favor one ethnic group over anyone else..

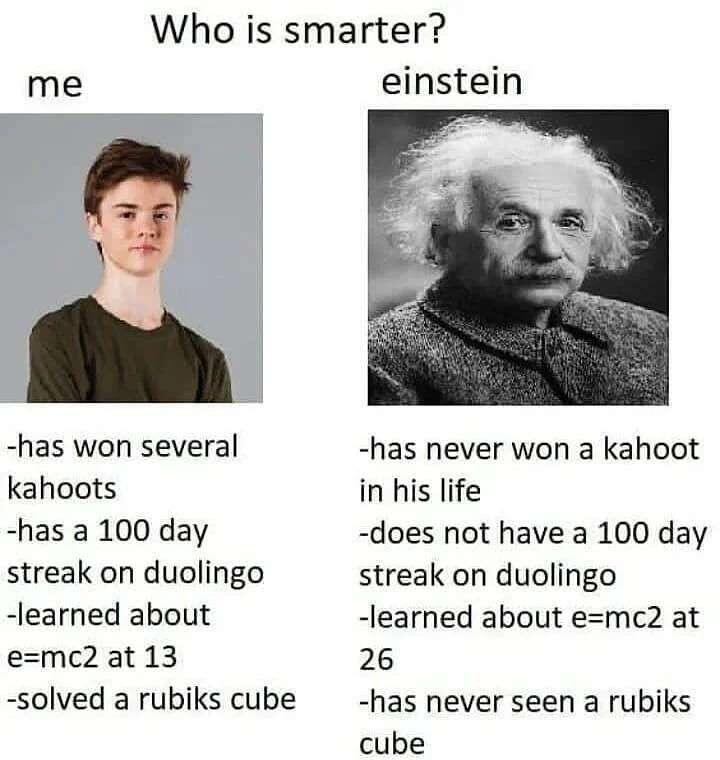

Left column is missing:

Has never stolen credits to someone else's scientific work

The Bible does contain passages that condemn usury. In the Old Testament, Exodus 22:25, Leviticus 25:35-37, and Deuteronomy 23:19-20 prohibit Israelites from charging interest to fellow Israelites, although they were allowed to charge interest to foreigners. (How gracious..)

In the New Testament, Jesus teaches about the importance of lending without expecting anything in return in Luke 6:30-35.

Usury is also addressed in several biblical passages, such as Psalm 15:5 and Ezekiel 18:8-9, which condemn those who lend at excessive interest rates.

I can make a similar analysis of Christian values vs Bitcoin, but there is already the book Thanks God for Bitcoin.

All fiat money, crypto tokens as well gold to an extent seem to be haram

I wanted to understand how Bitcoin resonates with the Muslim world and Sharia law, so I explored a bit and wrote this short article. lmk what you think and whether I made any mistakes in the thinking process or understanding.

---

** IS BITCOIN A SHARIA-COMPLIANT ASSET? **

The question of Bitcoin’s compliance with Islamic finance principles (Sharia) has sparked some debate among scholars, investors and bitcoin / crypto fans.

There seems to be no universal consensus, and I'm no Muslim but it seems to me from what I've read that Bitcoin’s design aligns very well with core Islamic values of transparency, fairness, and resistance to exploitation.

Below, I explore Bitcoin's Sharia compatibility through the lens of ethics, technology, and practical application.

---

1. CORE SHARIA PRINCIPLES AND BITCOIN’S ARCHITECTURE

Islamic finance prohibits *riba* (interest/usury), *gharar* (excessive uncertainty), and mandates *hifz al-mal* (preservation of wealth). Bitcoin’s protocol directly addresses these concerns.

Bitcoin’s code contains no interest mechanisms, making it inherently free from *riba*. Transactions occur peer-to-peer without intermediaries, and mining rewards compensate computational work rather than interest-based returns. This contrasts sharply with fiat systems (or with Proof-of-Stake systems) which rely on fractional reserve banking and debt-driven money creation—practices deeply entangled with *riba*.

The network’s deterministic monetary policy—capped at 21 million coins, with a transparent issuance schedule—eliminates the systemic *gharar* inherent in fiat currencies (subject to central bank manipulation) or that of gold (whose supply fluctuates with mining discoveries). Every transaction and circulating coin is publicly verifiable on the blockchain, ensuring contractual clarity and reducing ambiguity.

As for wealth preservation, Bitcoin’s scarcity and decentralization protect against inflationary devaluation. While its short-term volatility draws criticism, long-term appreciation trends (e.g., compounding growth since 2010) suggest it meets *hifz al-mal* for investors prioritizing durability over stability.

---

2. SCHOLARLY OPINIONS: DIVERGENCE AND PROGRESS

Islamic scholars remain divided on this topic, but momentum is growing in Bitcoin’s favor. In 2018, Indonesia’s National Ulema Council recognized cryptocurrency as a tradable commodity, while Dubai-based scholar Mufti Muhammad Abu Bakar declared Bitcoin permissible (*halal*) if treated as an asset rather than currency.

Others, like Islamic Finance Guru argue Bitcoin is compliant *if* users avoid interest-bearing services (e.g., crypto lending), mirroring rulings on gold, which is permissible as an asset but forbidden in *riba*-based transactions. Critics, including Saudi Arabia’s Grand Mufti, reject cryptocurrencies due to volatility and speculative trading. However, this stance conflates Bitcoin’s *design* with human misuse—a distinction emphasized by progressive scholars.

---

3. BITCOIN VS. TRADITIONAL “COMPLIANT” ALTERNATIVES

Gold-backed assets and Islamic banking products are often touted as Sharia-compliant, but Bitcoin offers distinct advantages. In contrast to gold’s storage costs and opacity in custodianship, Bitcoin’s blockchain provides a public, auditable ledger. Unlike real estate—a popular Islamic investment—Bitcoin democratizes access to scarcity without high entry barriers. Most critically, Bitcoin’s decentralization ensures no central authority can debase it, unlike fiat systems that enable *riba* through interest rate manipulation.

---

4. RISKS AND MITIGATIONS

Bitcoin’s Sharia compliance hinges on ethical usage. To avoid *riba*, investors must steer clear of interest-bearing platforms like crypto lending services. Speculative practices—day trading, derivatives, or leverage—introduce *gharar* and should be avoided in favor of long-term *HODLing*, which aligns with Islamic wealth preservation principles. Prioritizing Bitcoin’s original purpose—a censorship-resistant store of value and medium of exchange—strengthens its ethical case.

---

Conclusion: Bitcoin is not inherently *haram* (sinful, prohibited by Quran). Its architecture—scarce, transparent, and free from centralized manipulation—resonates deeply with Islamic financial ethics. While misuse (e.g., speculation, *riba* services) can render it non-compliant, the same risks apply to gold or real estate.

For Muslims exploring Bitcoin, intentionality is key: use it as a long-term store of value, avoid interest-based platforms. As Islamic finance wakes up to future technology, Bitcoin’s role as a *halal* hedge against fiat injustice will grow.

Same in Europe.

You have to tell the farmer that you're buying raw milk for animals (I have dozens of cats, sir)

And when you explain to friends they still warn you that drinking raw milk will make you sick for sure.

It's hard to change many years of indoctrination.

Thanks for explaining everything, but Im afraid I simply can't. Forcefeeding may bring me to utter disgust.

There is another issue that I have with beef - sometimes I hate its smell (especially broth and steak). i don't mind eating it raw (tartare) or the liver, but I noticed I get disgusted by it more often, and some other females around me experience the same. No idea why. Even though we source nice grassfed beef from a farmer. Do you know why this could be?

I tried long fasting (Alternate day = 40/8), but that resulted in sleeplessness, probably elevated cortisol. I lost weight, which came all back eventually.

Agreed with too much plants eating - it has a lethal potential to destroy fresh air at home and in extreme cases relationships too... :)

Czech president Pavel has nothing to do with this other than putting his final signature.. He looks good, speaks nice, that's all there is to admire.