**Bank Failures - A Push For CBDC?**

Bank Failures - A Push For CBDC?

**Update (1700ET):** Shortly after writing this, Florida Governor Ron DeSantis issued a public statement basically saying that Florida would prohibit any Federal action to impose a CBDC on its citizens...

> Crypto becoming a top 2024 election issue as expected. On one hand you have Pocahontas and her "Anti-Crypto army", and now you have DeSantis going all-in crypto, anti-CBDC and anti-Warren. https://t.co/cmrGcPQIcY (https://t.co/cmrGcPQIcY)https://t.co/vK5MqiOhNj (https://t.co/vK5MqiOhNj)

>

> — zerohedge (@zerohedge) May 2, 2023 (https://twitter.com/zerohedge/status/1653499435400286246?ref_src=twsrc%5Etfw)

\* \* \*

_Authored by Martin Armstrong via ArmstrongEconomics.com,_ (https://www.armstrongeconomics.com/world-news/corruption/bank-failures-a-push-for-cbdc/)

**Monday saw the largest banking failure in the US since 2008 after First Republic went under, marking the third death of a US bank this year.** Regulators took possession of the bank this Monday and JPMorgan Chase will acquire the majority of the bank’s assets and remaining deposits worth around $92 billion. First Republic Bank’s stock fell nearly 50% after reporting a significant drop in deposits in the first quarter of 2023.

First Republic’s stock value tanked 97% on Friday due to fears of a bank run or failure, and **the executives were silent on the health of the bank because they knew they were doomed.**

JPMorgan Chase coming to save the day is not a good sign.

**All of these small and mid-sized banks are struggling with liquidity. The larger banks are gaining more power and influence.**

JPMorgan Chase’s CEO is nothing like the man who founded his company and actually saved the US from a banking disaster.

** ?itok=Lm5XXMo0 (

?itok=Lm5XXMo0 ( ?itok=Lm5XXMo0)**

?itok=Lm5XXMo0)**

**data:image/gif;base64,R0lGODlhAQABAPABAP///wAAACH5BAEKAAAALAAAAAABAAEAAAICRAEAOw==**

CEO Jamie Dimon is a World Economic Forum member (https://www.weforum.org/people/james-dimon) who fully supports the Great Reset. He wants the US to invoke eminent domain (https://www.armstrongeconomics.com/world-news/climate/dimon-suggests-property-confiscation-to-combat-climate-change/) in order for the government to seize your private property.

These are his words, not mine. Dimon noted in his letter to shareholders that **“governments, businesses and non-governmental organizations” may need to invoke “eminent domain” in order to get “adequate investments fast enough for grid, solar, wind and pipeline initiatives.” (https://www.foxnews.com/media/jp-morgan-ceo-suggests-government-seize-private-property-quicken-climate-initiatives)**

** ?itok=iTLEoDZ9 (

?itok=iTLEoDZ9 ( ?itok=iTLEoDZ9)**

?itok=iTLEoDZ9)**

He is adhering to **Agenda 2030 (https://sdgs.un.org/2030agenda)** and believes that our freedoms need to be removed under the excuse of climate change.

> _“The need to provide energy affordably and reliably for today, as well as make the necessary investments to decarbonize for tomorrow, underscores the inextricable links between economic growth, energy security and climate change. We need to do more, and we need to do so immediately,” Dimon added in his letter._

**I will not be surprised if Jay Powell mentions CBDC this Wednesday just to get the public accustomed to the idea.**

?itok=AMla0Mmj (

?itok=AMla0Mmj ( ?itok=AMla0Mmj)

?itok=AMla0Mmj)

**All of these issues can be used as an excuse to implement CBDC as the “safe” alternative to traditional banking.**

It would be easier to implement if there were only a handful of banks working with the government. The US has never canceled its currency but every empire, nation, and city-state falls in the same manner. The plans for the Great Reset are out in the open and the WEF has infiltrated nearly every government cabinet in the world and bought out the bankers. The day will come when the government gives us a deadline to turn in our paper currency to be converted into CBDC, providing them with complete financial domination over the people.

Tyler Durden (https://cms.zerohedge.com/users/tyler-durden)Tue, 05/02/2023 - 17:25

https://www.zerohedge.com/geopolitical/bank-failures-push-cbdc-0

**Murdochs Spoke With Zelenskyy Weeks Before Firing Anti-War Host Tucker Carlson**

Murdochs Spoke With Zelenskyy Weeks Before Firing Anti-War Host Tucker Carlson

Both Rupert and Lachlan Murdoch spoke with Ukrainian President Volodymyr Zelenskyy shortly before firing _Fox News_' anti-war host Tucker Carlson, who has repeatedly asked why the United States is sending vast resources to one of the most historically corrupt nations on the planet while neglecting its own citizens.

?itok=2E32L07J\

?itok=2E32L07J\

_Ukrainian Presidential Press Service/Handout via REUTERS_ ( ?itok=2E32L07J)

?itok=2E32L07J)

"Fox News Executive Chairman Rupert Murdoch held a previously unreported call with Ukrainian President Volodymyr Zelenskyy this spring in which the two discussed the war and the anniversary of the deaths of Fox News journalists last March," according to _Semafor_ (https://www.semafor.com/article/04/30/2023/the-murdochs-ukraine-connection), adding " **The Ukrainian president had a similar conversation with Lachlan Murdoch on March 15,** which Zelenskyy noted in a little-noticed aside during a national broadcast last month."

As _Semafor_ further notes; " **The conversations came weeks before the Murdochs fired their biggest star and most outspoken critic of American support for Ukraine, Tucker Carlson.** Senior Ukrainian officials had made their objections to Carlson’s coverage known to Fox executives, but Zelenskyy did not raise it on the calls with the Murdochs, according to one person familiar with the details of the calls."

Weeks later, **Lachlan Murdoch was credited with the decision to let Carlson go**, according to the _NY Times_.

> _**The decision to let Mr. Carlson go was made on Friday night by Lachlan Murdoch**, the chief executive of Fox Corporation, and **Suzanne Scott**, chief executive of Fox News Media, according to a person briefed on the move. Mr. Carlson was informed on Monday morning by Ms. Scott, another person briefed on the move said._

Carlson, according to the report, has previously described Zelenskyy as a "dictator."

Interestingly, on March 11 - right around the time of the Lachlan Murdoch call, **Carlson suggested to _Redacted_ host Clayton Morris that he could be fired over his anti-war stance**.

"I'm saying what I really think and I think it really really matters and **if I get fired for it, I don't know what to say, I'm not going to change**," he said, adding that one of the top people he worked for at the network texted him to say "For the record, I really disagree with you on Ukraine!"

To which Carlson said: "And I wrote back and said, 'I know you do and I'm so grateful that you let me disagree with you in public," adding "This is someone I work for -- a well known person."

"Whatever you think of Fox ... they are allowing me to say things that they disagree with and I think that's wonderful."

Watch (via _Information Liberation (https://www.informationliberation.com/?id=63737))_:

Tyler Durden (https://cms.zerohedge.com/users/tyler-durden)Tue, 05/02/2023 - 17:05

**Major Banks Could Be Liable For Jeffrey Epstein Sex Trafficking: Judge**

Major Banks Could Be Liable For Jeffrey Epstein Sex Trafficking: Judge

_Authored by Zachary Stieber via The Epoch Times (https://www.theepochtimes.com/major-banks-could-be-liable-for-jeffrey-epstein-sex-trafficking-judge_5235701.html) (emphasis ours),_

**Two major banks and a bank executive could be liable for Jeffrey Epstein’s sex trafficking, a judge has ruled.**

?itok=r7CWFDoU\

?itok=r7CWFDoU\

_The JPMorgan Chase headquarters in New York City on April 17, 2019. (Johannes Eisele/AFP via Getty Images)_ ( ?itok=r7CWFDoU)

?itok=r7CWFDoU)

Plaintiffs have presented enough evidence that JPMorgan Chase, longtime JPMorgan executive Jes Staley, and Deutsche Bank could be liable for Epstein’s sex trafficking, U.S. District Judge Jed Rakoff said on May 1 as he rejected motions to dismiss cases brought against Staley and the institutions.

“ **Plaintiffs have pled sufficient facts to support their allegations that JP Morgan had … knowledge of Jeffrey Epstein’s sex-trafficking venture**, either directly or by recklessly disregarding what was plainly to be seen,” Rakoff, a Clinton appointee, wrote in a 54-page decision (https://www.documentcloud.org/documents/23794698-ruling-in-epstein-cases).

One of the plaintiffs, a woman who says she was abused by Epstein and his associates, has also pled “sufficient facts to support her allegation that Deutsche Bank knew or recklessly disregarded that Jeffrey Epstein ran a sex-trafficking venture,” the judge also said.

The ruling came in cases brought by several alleged Epstein victims and the U.S. Virgin Islands government against JPMorgan and Deutsche Bank. It also covers a claim filed against Staley by JP Morgan.

The banks are accused of violating federal law that prohibits sex trafficking of children by force, fraud, or coercion, with one section of the law allowing for the punishment of people who knowingly benefit financially from participating in a sex trafficking venture.

**Defendants have argued they did not participate in Epstein’s venture because they were only providing typical banking services.** Participation in a venture requires “specific conduct that furthered the sex trafficking venture,” or conduct that is “more than just passive facilitation,” previous rulings have stated. But plaintiffs have presented evidence that both banks structured the voluminous cash withdrawals Epstein enacted in ways that hid how they were suspicious, the judge said, in addition to delaying or failing to file suspicious activity reports.

Plaintiffs have noted that Epstein pleaded guilty to a sex offense in Florida in 2008 and that news articles and lawsuits lodged before and after the plea accused Epstein of sex offenses, including abuse of minor girls. They have released internal correspondence showing JPMorgan officials questioning whether the bank should cut ties with Epstein in light of the allegations.

The ruling means the cases are slated to hear on trial later this year.

Former Executive

Staley was the head of JPMorgan’s private banking division in 2000 when he began to service Epstein’s accounts. Emails indicate the two became friends.

“ **I deeply appreciate our friendship. I have few so profound**,” Staley, who has left the company, said in one missive.

Staley visited homes owned by Epstein on multiple occasions.

One day after Staley went to Epstein’s home in New York, Epstein emailed to say “you were with Larry, and I had to put up with…,” attaching a picture of a young woman posing in a sexually suggestive manner. In another missive, Epstein wrote no words but only sent a picture of a different girl.

Plaintiffs say Staley not only saw one of the alleged victims while visiting Epstein, but that he abused multiple girls himself.

Staley wrote to Epstein after a visit: “That was fun. Say hi to Snow White.” Epstein asked, “what character would you like next?” Mr. Staley responded, “Beauty and the Beast.”

**“If the allegations in plaintiffs’ complaints are taken as true, Mr. Staley had actual first-hand knowledge that Epstein conducted a sex-trafficking venture,” Rakoff said in the new ruling.**

Staley, who was brought into the lawsuits by JPMorgan, has said he was not in charge of Epstein’s accounts.

“The third-party complaints, while creating provocative media fodder, never explain how an employee who is not alleged to have had decision-making authority over Epstein’s accounts—and who is not alleged to have seen any of the suspicious account activity that other JPMorgan employees ignored—caused the plaintiffs’ alleged injuries,” he said in one filing.

Staley has asked the court to dismiss the bank’s claim against him, arguing that the ban…

**WTI Holds Ugly Losses Despite 3rd Weekly Crude Draw In A Row**

WTI Holds Ugly Losses Despite 3rd Weekly Crude Draw In A Row

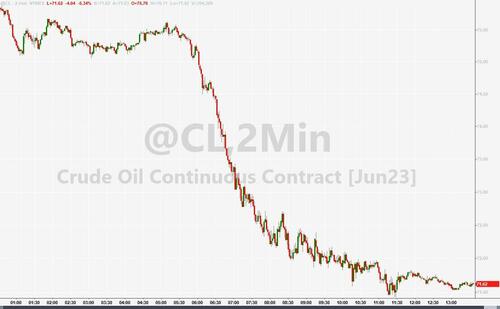

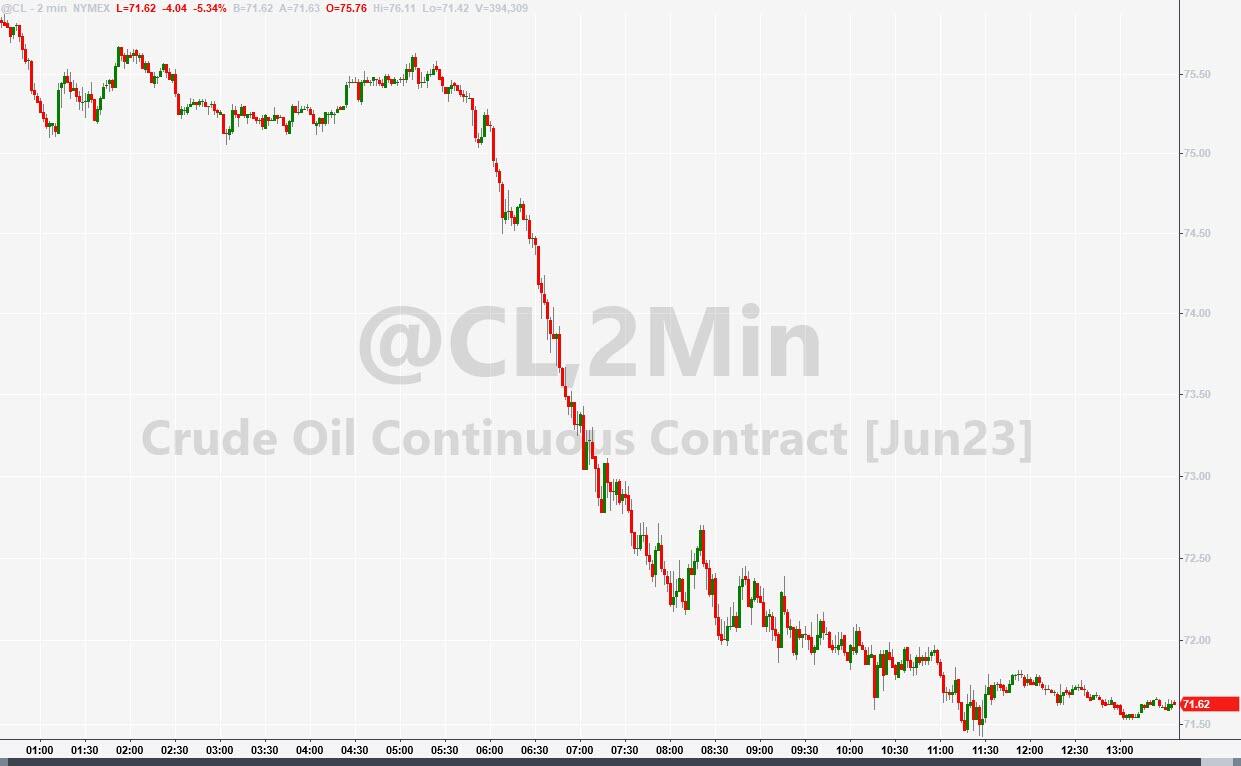

Oil prices cratered today - their biggest drop since the start of January - amid low liquidity and dismal macro data.

> _**“The market is an investor desert,”** said Scott Shelton, an energy specialist at ICAP._

>

> _“The fundamental information that generates predictable price action doesn’t exist.”_

Separately, Bloomberg reported Tuesday that **OPEC's oil production fell last month by 310,000 barrels a day to an average of 28.8 million, the lowest in nearly a year,** as a pipeline suspension reduced exports from Iraq.

Tonight's API data may hint at just how big a downturn we are seeing.

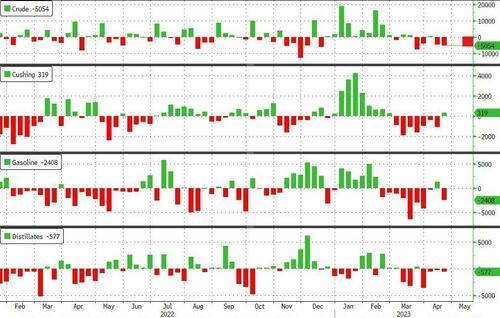

**API**

- **Crude -3.939mm (-3.30mm exp)**

- Cushing

- Gasoline (-300k exp)

- Distillates (-1.5mm exp)

For the 3rd week in a row, crude stocks saw a draw-down (slightly bigger than expected)...

?itok=xsKXUQko (

?itok=xsKXUQko ( ?itok=xsKXUQko)

?itok=xsKXUQko)

_Source: Bloomberg_

The OPEC+ output cuts announced in early April "have only gone into effect this week," so inventory declines may not start until July, he said.

> _**"Recession fear is like a hurricane that destroys everything along its path -- oil included,"** said Manish Raj, managing director at Velandera Energy Partners._

>

> _"It does not matter that fundamentals for oil are now stronger than ever, with rising demand and falling supply in the foreseeable future."_

WTI was hovering just above $71.50 ahead of the API print with little to no reaction after...

?itok=-awq1DbM (

?itok=-awq1DbM ( ?itok=-awq1DbM)

?itok=-awq1DbM)

> _“It’s going to take some evidence in the physical market on the tightening we see in our balances before we see any more positive or committed trading activity,” Emily Ashford, an energy analyst at Standard Chartered Bank, said by phone._

Finally, we note that **Morgan Stanley slashed its forecast for Brent crude prices in the third quarter by $12.50 to $77.50 a barrel**, saying Russian supplies remain high enough and that much of the demand boost from China’s reopening has likely already played out.

Tyler Durden (https://cms.zerohedge.com/users/tyler-durden)Tue, 05/02/2023 - 16:36

https://www.zerohedge.com/energy/wti-holds-ugly-losses-despite-3rd-weekly-crude-draw-row

**Crystal Balls, Soothsayers, And AI; Oh My!**

Crystal Balls, Soothsayers, And AI; Oh My!

_Authored by Charles Hugh Smith via OfTwoMinds blog,_ (http://charleshughsmith.blogspot.com/2023/05/crystal-balls-soothsayers-and-ai-oh-my.html)

_As long as we mint millions from a Never-Ending Bull Market, we'll always stay one step ahead of the Debt Monster. AI!_.

**Of the many astounding developments of the current era (AI!), none is more remarkable than the proliferation of soothsayers peering into crystal balls to predict _The Most Important Trend In The Universe_--a Bull or Bear stock market.** The computing power and wealth thrown at conjuring up charts, statistics and forecasts is astounding in and of itself, but the proliferation of crystal balls and soothsayers is even more astounding.

**After reviewing hundreds of charts, statistics and forecasts on the most arcane correlations and the deepest data-dives (AI!), I've reached _soothsayer satori_:** the secret to insuring a _Never-Ending Bull Market_ in which monumental wealth will be piled up by all those entities (software and wetware alike--AI!) who buy every tiny dip and continuously roll over their zero-expiration-day-call-options is this:

**Say "AI" 300 times with fervent enthusiasm and then click your heels three times.** You will then be transported to a magical paradise where stocks only go down for a few moments to enable dip-buyers the immense satisfaction of buying more stocks at a discount.

**Did I forget to say AI?** I'm on number 199, and I'm trying not to lose count. AI!

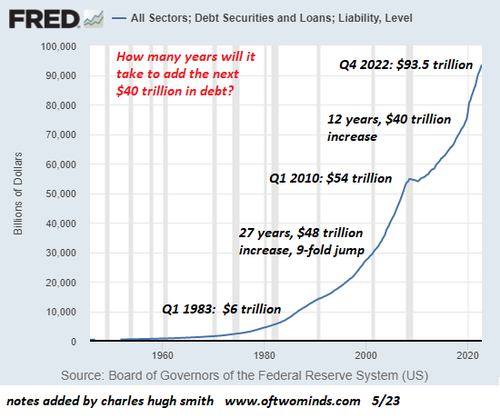

**Setting aside the thousands, or perhaps millions, of charts, statistics and forecasts, let's just ponder one:** TCMDO, Debt Securities and Loans, courtesy of the Federal Reserve System.

**AI, 200, AI, 201--AI!** The first thing we notice is the total debt has been following a parabolic curve since that spot of bother (recession) in 1981-82, increasing 15.5-fold since Q1 1983, 40 years ago, from $6 trillion to $94 trillion.

?itok=7Afzppe8 (

?itok=7Afzppe8 ( ?itok=7Afzppe8)

?itok=7Afzppe8)

Gross Domestic Product (GDP), more or less a measure of the real economy, increased from $3.5 trillion in 1983 to $26.5 trillion in 2023, a 7.5-fold increase, a considerably less stupendous rise than debt.

**This chart raises two questions:**

> _1\. How long will it take to add the next $40 trillion in debt?_

>

> _2\. Precisely how will AI change the trajectory of debt, or the eventual banquet of consequences of parabolic increases in debt?_

**One interesting thing that isn't communicated by the chart is that Americans haven't experienced a _real recession_ for 40 years.** A _real recession_ lasts a long time and grinds down debt via a rising tide of bankruptcies, defaults and writedowns. Thanks to Federal Reserve hocus-pocus, no recession since 1982 has lasted more than a few brief months or been more than a shallow dip.

Only people 60 years of age and older have any experience as working adults of a real recession. For everyone younger, we might as well be talking about the Panic of 1873 or even that spot of bother in Rome circa 14 AD.

Despite poring over hundreds of charts, statistics and forecasts issued by soothsayers peering into digital crystal balls (AI!), not one reflected the possibility that the US was overdue for a _real recession_ that wiped out $40 trillion in debt rather than another Bull Market run that added another $40 trillion in debt.

**Never mind, as long as we mint millions from a _Never-Ending Bull Market_, we'll always stay one step ahead of the Debt Monster. AI!** Crystal Balls, Soothsayers and AI, Oh My...AI, 202, AI, 203...

\* \* \*

_My new book is now available at a 10% discount ($8.95 ebook, $18 print): Self-Reliance in the 21st Century (https://amzn.to/3RbjjUF). Read the first chapter for free (PDF) (https://www.oftwominds.com/Self-Reliance-sample2.pdf)_

_Become a $1/month patron of my work via patreon.com (https://www.patreon.com/charleshughsmith)._

Tyler Durden (https://cms.zerohedge.com/users/tyler-durden)Tue, 05/02/2023 - 16:20

https://www.zerohedge.com/technology/crystal-balls-soothsayers-and-ai-oh-my

**Bonds & Bullion Burst Higher, Banks Battered As JOLTs Plunge Ahead Of Jay Powell**

Bonds & Bullion Burst Higher, Banks Battered As JOLTs Plunge Ahead Of Jay Powell

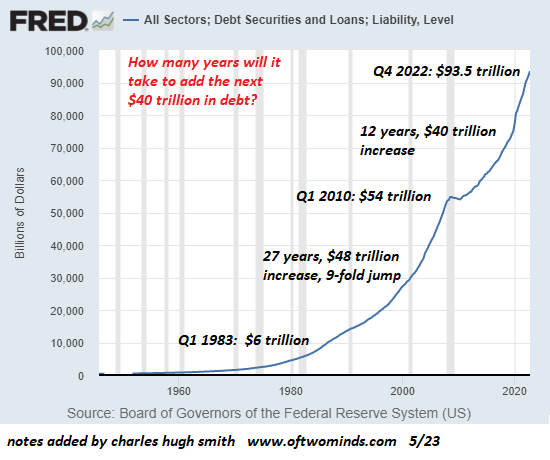

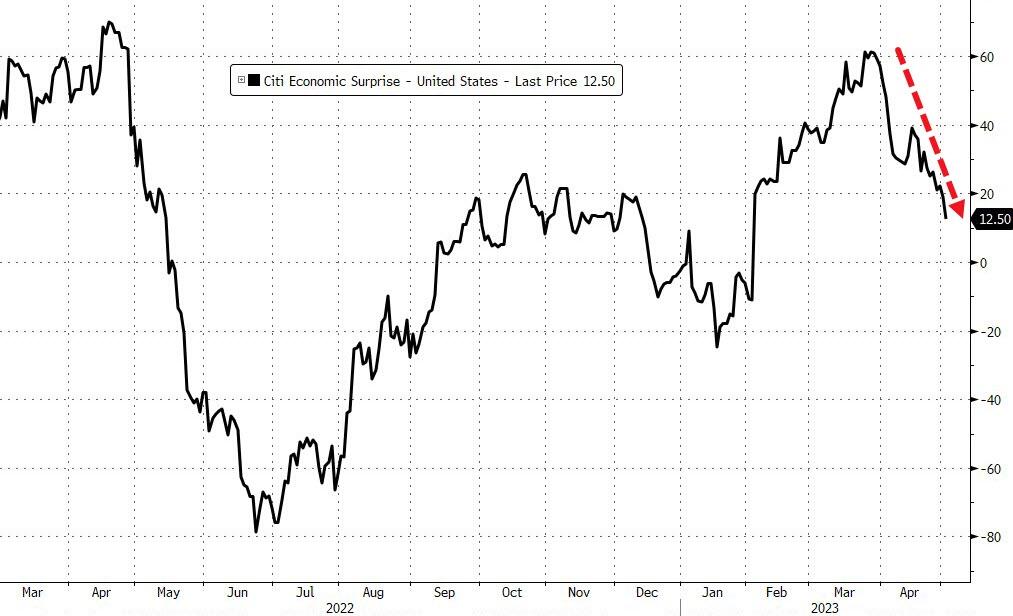

A surprise RBA rate-hike, hotter than expected headline EU inflation, weak JOLTS, poor US factory orders, a sudden realization of the urgency and seriousness of the debt ceiling debacle, Europe back from vacation, and/or just pre-FOMC jitters?

...or was it this?

> As a reminder, the Fed NOW has next week's dire SLOOS report in hand

>

> — zerohedge (@zerohedge) May 2, 2023 (https://twitter.com/zerohedge/status/1653400481199161345?ref_src=twsrc%5Etfw)

US Macro data is serially disappointing...

?itok=BdK4H5gc (

?itok=BdK4H5gc ( ?itok=BdK4H5gc)

?itok=BdK4H5gc)

_Source: Bloomberg_

US debt ceiling anxiety is serially increasing...

?itok=ej7BUS7P (

?itok=ej7BUS7P ( ?itok=ej7BUS7P)

?itok=ej7BUS7P)

_Source: Bloomberg_

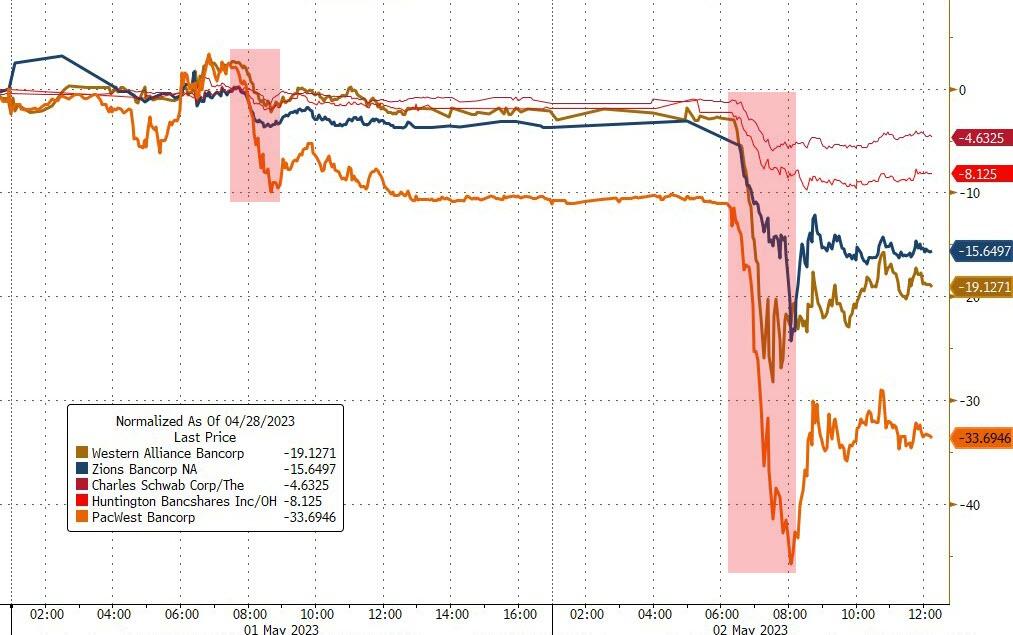

Bank stocks were a bloodbath as the world and his pet rabbit realized JPM hadn't saved the universe. Regionals were smashed lower as whack-a-mole resumes...

?itok=UUGq-iGi (

?itok=UUGq-iGi ( ?itok=UUGq-iGi)

?itok=UUGq-iGi)

_Source: Bloomberg_

And even the big boys suffered...

?itok=ZdBo1R1l (

?itok=ZdBo1R1l ( ?itok=ZdBo1R1l)

?itok=ZdBo1R1l)

_Source: Bloomberg_

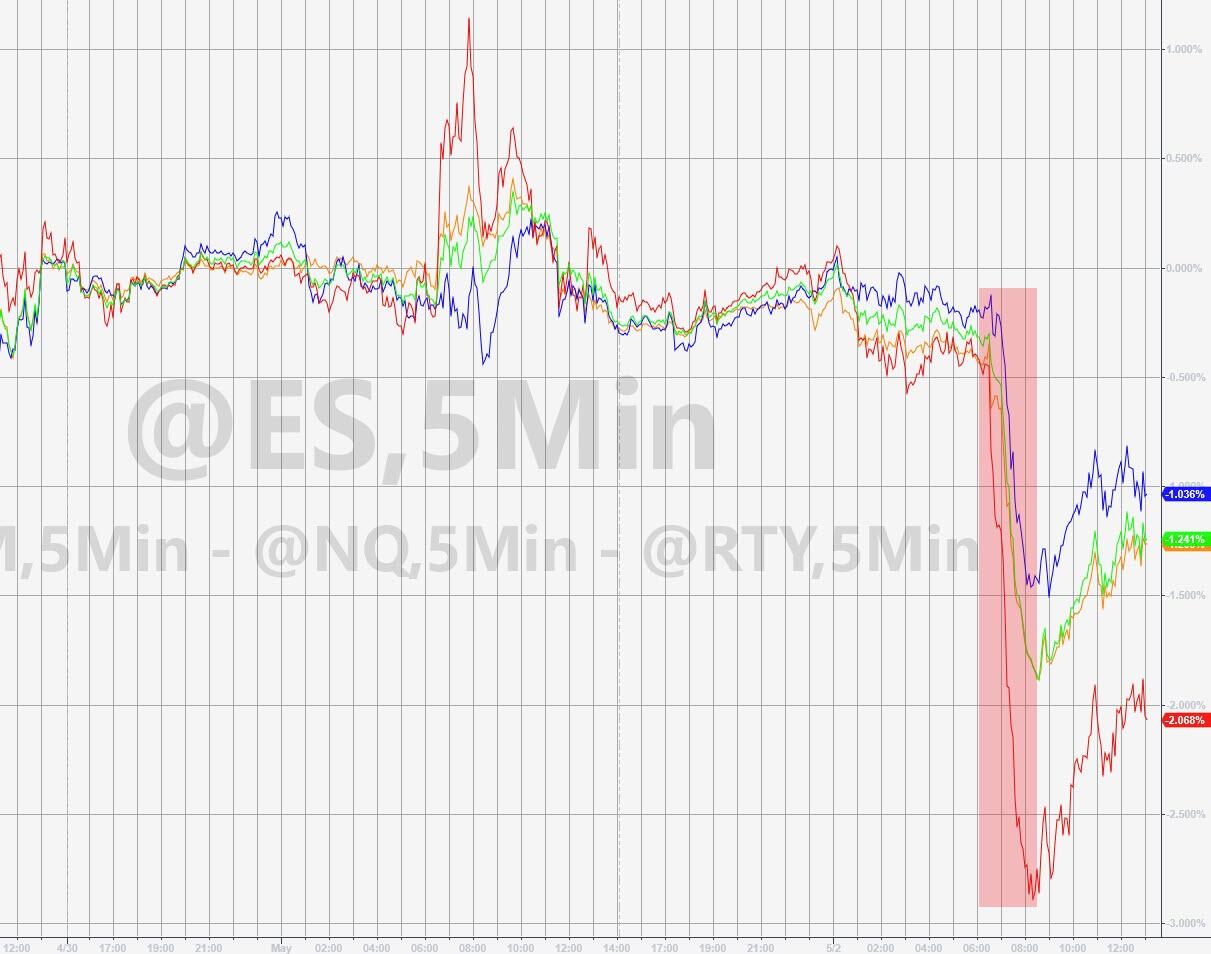

Overall, all the majors were lower today with Small Caps hardest hit...

?itok=KeWWlFXh (

?itok=KeWWlFXh ( ?itok=KeWWlFXh)

?itok=KeWWlFXh)

'Most Shorted' Stocks puked hard...

?itok=YH7lKKdr (

?itok=YH7lKKdr ( ?itok=YH7lKKdr)

?itok=YH7lKKdr)

_Source: Bloomberg_

0-DTE fought hard against the initial down-thrust in stocks from the cash-open. Stocks stalled around 4100 then rebounded and then around 1400ET, 0-DTE call-buyers took profits...

?itok=zWCms02y (

?itok=zWCms02y ( ?itok=zWCms02y)

?itok=zWCms02y)

_Source: SpotGamma_ (https://spotgamma.com/hiro-indicator/)

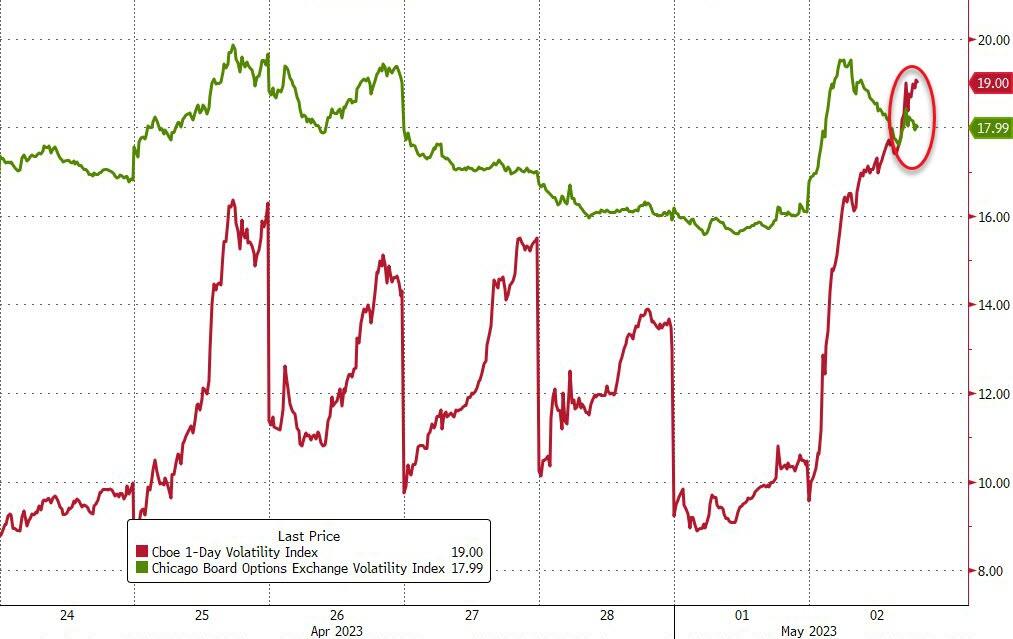

VIX1D soared today, breaking back above VIX for the first time since April 11th (ahead of CPI) and April 6th (ahead of payrolls)...

?itok=XDT9hM63 (

?itok=XDT9hM63 ( ?itok=XDT9hM63)

?itok=XDT9hM63)

_Source: Bloomberg_

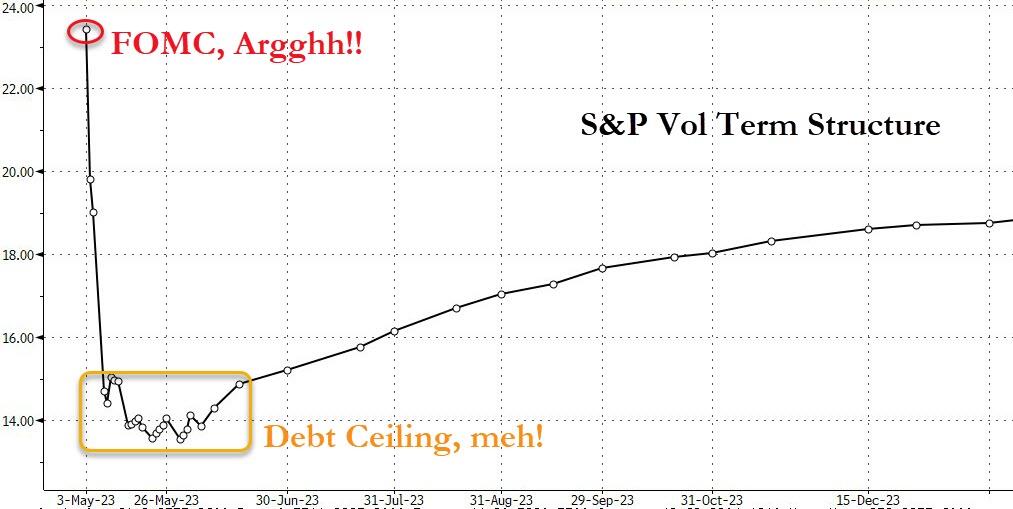

And as we noted earlier, equity markets remain somewhat more sanguine about the debt ceiling threat that other markets

?itok=AgLJqgIG (

?itok=AgLJqgIG ( ?itok=AgLJqgIG)

?itok=AgLJqgIG)

_Source: Bloomberg_

And then there was Chegg, down 50%... AI's first victim...

?itok=Xk0e2B9M (

?itok=Xk0e2B9M ( ?itok=Xk0e2B9M)

?itok=Xk0e2B9M)

_Source: Bloomberg_

Treasuries were aggressively bid as Europe's liquidity returned and the heavy corporate calendar eased up. **The long-end underperformed but the entire curve plunged** (30Y -10bps, 5Y -18bps, 2Y -16bps)...

?itok=7G4n9SzL (

?itok=7G4n9SzL ( ?itok=7G4n9SzL)

?itok=7G4n9SzL)

_Source: Bloomberg_

2Y Yields fell back below 4.00%...

?itok=NnsQN1_X (

?itok=NnsQN1_X ( ?itok=NnsQN1_X)

?itok=NnsQN1_X)

_Source: Bloomberg_

Rate-hike odds plunged today ahead of tomorrow's FOMC statement. The market adjusted down to an 85% chance of a 25bps hike tomorrow...

?itok=00Ehy-Xb (

?itok=00Ehy-Xb ( ?itok=00Ehy-Xb)

?itok=00Ehy-Xb)

_Source: Bloomberg_

...but most notably, June went from a 35% chance of 25bps hike to a 15% chance of a 25bps rate-cut today...

?itok=PHS4LNqG (https://cms…

?itok=PHS4LNqG (https://cms…

**Why The Long-Awaited Ukrainian Counteroffensive Is Delayed**

Why The Long-Awaited Ukrainian Counteroffensive Is Delayed

The much-touted and anticipated spring counteroffensive by the Ukrainian army is still on hold, and according to both Ukraine military and Western officials, it's all due to mud. And yet, the White House has still offered an upbeat assessment (https://www.zerohedge.com/markets/kirby-claims-whopping-100000-russian-casualties-bakhmut-alone) of how Ukraine is fairing militarily. US National Security Council spokesman John Kirby only yesterday declared of Russia's offensives against key holdout towns in Donetsk and Luhansk, "Most of these efforts have stalled and failed." He asserted that "Russia has been unable to seize any real strategically significant territory."

So Kirby paints a picture of a teetering Russian army (https://www.zerohedge.com/markets/kirby-claims-whopping-100000-russian-casualties-bakhmut-alone), and still there's no counteroffensive on the horizon. "But for the moment, they are barely moving forward, stalled not by ferocious Russian attacks, **but by an enemy no less tenacious: the viscous central Ukrainian mud**," _The New York Times_ (https://www.nytimes.com/2023/05/01/world/europe/ukraine-mud-counteroffensive-weapons.html) wrote Monday. A Ukrainian officer interviewed by the _Times_ acknowledged that "Until the weather improves, there will be no counteroffensive." This is because: "the vehicles will get stuck and then what will we do if the shooting starts?"

The report further describes why Ukraine is holding off in saying, "Deep and black, with a consistency similar to a mixture of cookie dough and wet cement, the spring mud is one obstacle that the Ukrainian military, for all its ingenuity, finds difficult to overcome." Further "It jams weapons and steals the boots from soldiers’ feet. Wheels and treads spin and spin, **only digging military vehicles deeper into the mire**."

?itok=XSryt0R0\

?itok=XSryt0R0\

_Image: Anadolu Agency, Getty Images_ ( ?itok=XSryt0R0)

?itok=XSryt0R0)

Echoing the same, Kiev’s ambassador to the UK, Vadim Pristayko, told (https://thepressunited.com/updates/bad-weather-delaying-counteroffensive-ukraine/) Sky News on Tuesday, "Obviously, **the weather is not allowing** so far the heavy tanks to move in the Ukrainian usual spring mud." Ukraine's Defense Minister Aleksey Reznikov has also recently stated the weather has played a key role in determining the timing of a counteroffensive. Also, Russia has lately ramped up its strikes across the country. **Is it really just mud and less than ideal weather stalling the counteroffensive? Or is there something more?**

_Geopolitical commentator Melkulangara Bhadrakumar explores the "something more" below via The Ron Paul Institute (http://ronpaulinstitute.org/archives/featured-articles/2023/may/02/whither-ukraine-s-counteroffensive/)..._

_\\* \\* \\*_

The month of May has arrived but without the long-awaited Ukrainian “counteroffensive”. The western media is speculating that it may come by late May. There is also the spin that Kiev is judicious to “buy time.” The chances of Ukraine making some sort of “breakthrough” in the 950-km long Russian frontline cannot be ruled out but a Russian counteroffensive is all but certain to follow. An open-ended war will not suit Western powers.

Last week, NATO’s top commander, US Army General Christopher Cavoli stated that the Russian army operating in Ukraine **is larger than when the Kremlin launched its special military operation** and the Ukrainians “have to be better than the Russian force they will face” and decide when and where they will strike.

Cavoli said Russia **has strategic depth in manpower** and has only lost one warship and about 80 fighters and tactical bombers in an air fleet numbering about 1,000 so far. The general gently contradicted Defence Secretary Lloyd Austin and Chief of General Staff Gen. Mark Milley who have been propagating that Russia is on the brink of defeat.

Speaking at the House panel on Wednesday, Gen. Cavoli said, **“This war is far from over.”** On Thursday, he went further to tell the Senate, **“I think \[the Russians\] can fight another year.”** At the House hearing, Cavoli also said Russian submarine activity has only picked up in the North Atlantic since the beginning of the war and none of the Kremlin’s strategic nuclear forces have been affected by operations in Ukraine.

He said at one point in his written testimony (https://armedservices.house.gov/sites/republicans.armedservices.house.gov/files/04.26.23%20Cavoli%20Statement%20v2.pdf), “ **Russian air, maritime, space, cyber, and strategic forces have not suffered significant degradation in the current war**. Moreover, Russia will likely rebuild its future Army into a sizeable and more capa…

https://www.zerohedge.com/geopolitical/why-long-awaited-ukrainian-counteroffensive-delayed

**Australia Shocks With Surprise 25bps Rate Hike After April Pause; Aussie, Yields Soar**

Australia Shocks With Surprise 25bps Rate Hike After April Pause; Aussie, Yields Soar

What do you do when, unlike the Fed, you can't tighten monetary policy through mandated bank failures (SVB, FRC)? Why you engage in surprise rate hikes, of course.

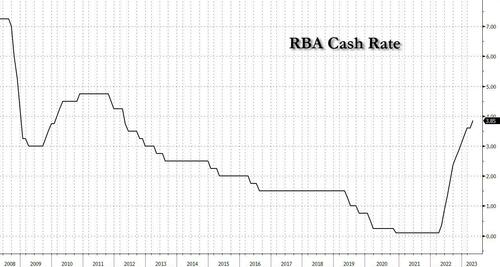

This is what the Reserve Bank of Australia did overnight, when one month after it purportedly paused its tightening campaign, **the central bank unexpectedly hiked the Cash Rate Target by 25bps to 3.85%**\- a move which was seen by just 9 out of 30 Bloomberg forecasters, _with consensus firmly in the no hike camp_ \- while stating that the Board expects "some further tightening of monetary policy may be required to ensure that inflation returns to target in a reasonable timeframe" and "will continue to pay close attention to developments in the global economy, trends in household spending and the outlook for inflation and the labor market." As such, the RBA " _remains resolute in its determination to return inflation to target and will do what is necessary to achieve that."_

?itok=YDSFzJyu (

?itok=YDSFzJyu ( ?itok=YDSFzJyu)

?itok=YDSFzJyu)

The RBA attributed the decision to inflation being “still too high”, and while it had passed its peak at 7% it was still too high, and unit labor costs “rising briskly”, though there was no incremental information on unit labor costs in the month and that the RBA downgraded its end-2023 CPI forecast to 4.5%yoy (from 4.8%) following a weaker-than-expected 1Q2023 CPI print during April. The RBA today also lowered forecast GDP growth to end-2023 by ~35bp to 1.25%yoy. The attending statement retained a (somewhat softer) tightening bias that “ **some further tightening of monetary policy may be required”**(prior: “may well be needed”).

Having paused a 10-month tightening cycle in April, the RBA’s decision to restart after a single month was quite a shock – and particularly given the weaker CPI report in the interim and clear historical precedent for the RBA to observe multi-month pauses. While it is hard to know at this stage, it is possible that fear of spillovers connected to the US banking crisis (although this did not stop the Fed/ECB hiking) and/or considerations around the RBA Review may explain the brief pause in April.

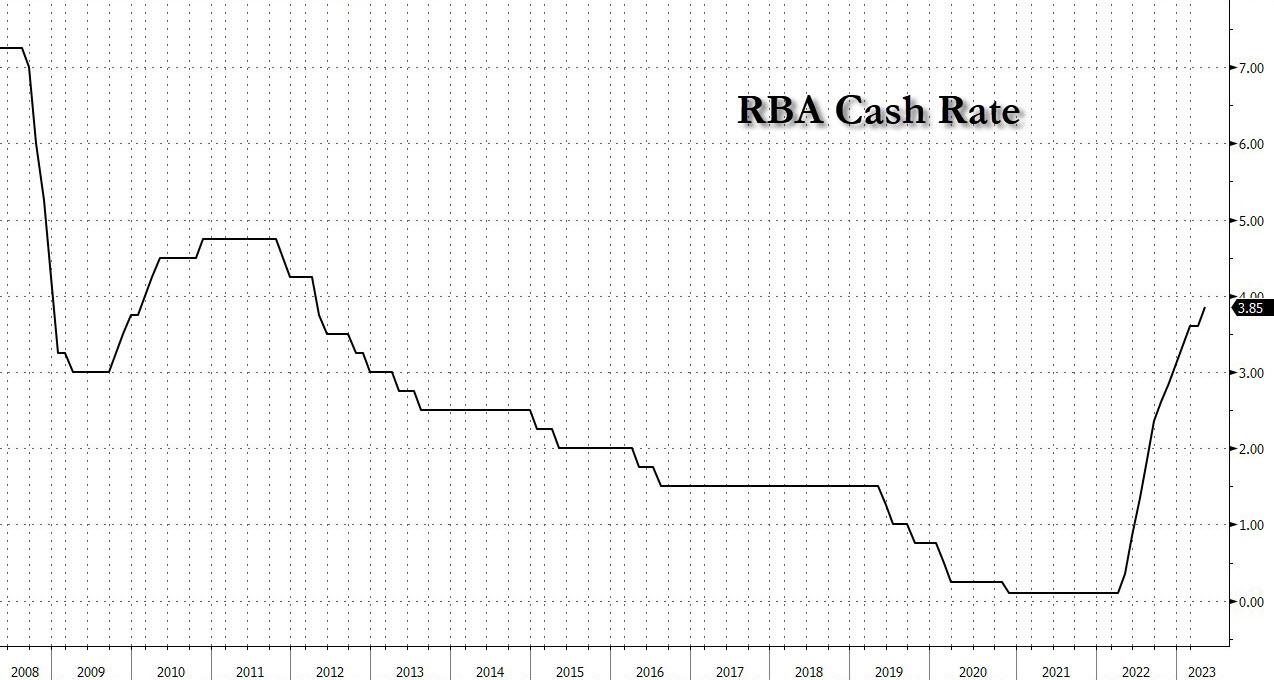

With financial markets pricing just 3bp of tightening prior to the meeting, the rate hike announcement and hawkish guidance came as a shock to markets, sending the aussie soaring and probing 0.6700 and the top end of 1.5 bn expiry options...

?itok=HXvJ2Umg (

?itok=HXvJ2Umg ( ?itok=HXvJ2Umg)

?itok=HXvJ2Umg)

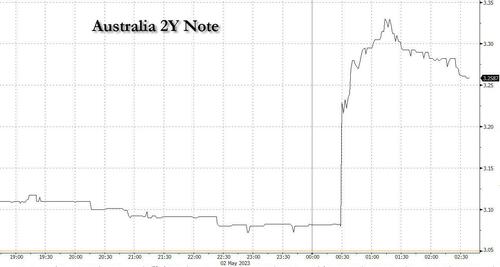

... while the 2Y Australia note soared over 20bps from 3.07% to as high as 3.32% before modestly fading gains.

?itok=IaJygFs6 (

?itok=IaJygFs6 ( ?itok=IaJygFs6)

?itok=IaJygFs6)

Naturally, local stock markets were not happy with the surprise tightening, and the S&P/ASX 200 index fell 0.9% to close at 7,267.40. “A potential higher terminal rate is a risk and negative for equities,” said Matthew Haupt, a fund manager at Wilson Asset Management in Sydney. “ **It’s becoming a credibility issue now, these shocks to markets, and we need to add discount due to policy uncertainty,”** he said.

Commenting on the decision, Chamath De Silva, a senior fund manager for BetaShares in Sydney said that the RBA’s unexpected rate hike is a negative surprise for Australia’s equity and bond markets following the central bank’s April pause.

By ignoring market pricing and only focusing on recent economic data, “you can kind of see why they felt the need to hike, and maybe the pause last month was motivated by some of the banking stress during March,” he said adding that "the market basically had a zero probability attached to today’s move. So this is a huge shock just from that perspective."

**“Most traders here were probably expecting a non-event so they could direct all their attention toward the FOMC, but now they have to deal with their positioning being a bit offside.”**

Looking ahead, Goldman strategists said they continue to expect the RBA to hike to a 4.1% terminal rate. Following today’s decision, they expect a final +25bp increase at July’s meeting (prior: +25bp in July/Aug) – allowing the RBA visibility on key updates on the national accounts, unit labor costs, and the annual resetting of the minimum wage. That said, "the balance of risks is skewed to a higher terminal rate, with a material risk of a back-to-back rate increase in Jun…

**Von Greyerz: Forecasting The Gold Price Is A Mug's Game**

Von Greyerz: Forecasting The Gold Price Is A Mug's Game

_Authored by Egon von Greyerz via GoldSwitzerland.com,_ (https://goldswitzerland.com/forecasting-the-gold-price-is-a-mugs-game/)

Most investors are totally ignorant of the purpose of gold or its historical significance.

After all, Gold is the only money that has survived in history but virtually nobody is aware of this vital information.

That’s why only 0.5% of global financial assets are invested in gold. Still most people put their trust in paper money.

In spite of the title, in this article I will be a Mug for a day and make some gold and silver projections.

Investment managers ignorance of gold is mainly due to the fact that they can’t churn commission by holding physical gold. Their primary job is to convince investors that they have superior skills and knowledge of the market. Still, 99% of these so called _experts_ underperform the market by a wide margin.

Most of them, for example, are not aware that their clients could have put their money into gold at the beginning of this century and today would have seen their investment multiply 7 times or more depending on their base currency.

?itok=rcU0ahwx (

?itok=rcU0ahwx ( ?itok=rcU0ahwx)

?itok=rcU0ahwx)

But that would have been too simple since it takes away the whole mystique of the asset management industry with their trillions of dollars of investments.

Ok, gold was up substantially in the last couple of decades. What about going forward? Should investors put their money with the experts who will then buy stocks, bonds and property investments which have had more than a century of printed money pushing values to bubble territory?

Well, the unequivocal reply to that is obviously YES.

Since governments and central banks are the biggest supporters of gold by continuously destroying the value of paper money, gold ownership is a **SINE QUA NON (Must).**

The Everything Bubble is likely to turn into the “ **Everything Collapse”**(link below) with all the bubble assets declining between 75% and 95% in real terms.

After all; assets inflated by fake money must clearly be fake.

The biggest collapse will obviously be the $300 trillion debt market. But before this debt collapse, Western governments and central banks will have drowned financial markets in what my colleague Matt Piepenburg calls mouse-click money.

And they will wear out many batteries and mice before this is finished.

We saw during the Ides of March (Shakespeare), which is an ominous time in mid March when Julius Caesar was murdered. This Ides of March this year contained the death of 4 banks; one Swiss, and three US within a matter of days.

After the 2008 banking crisis, it was declared that there would be no more bailouts but only bail-ins. They were brave words at the time which we know wouldn’t hold.

The rumours of depositors withdrawing hundreds of millions or billions from Credit Suisse or Silicon Valley Bank meant that the central banks only had hours to save the system.

Bank runs are no longer made by depositors queuing at the door but by spreading the news in minutes via Social Media.

To stop an instant collapse of the system, the Central Bankers had to backstop everything. So we are back to bailouts again. And what we have seen so far is just the sheer beginning. The system is Rotten (BANCA ROTTA) as I wrote in a recent article **–**

_**“FIRST GRADUALLY THEN SUDDENLY – THE EVERYTHING COLLAPSE”** (https://goldswitzerland.com/first-gradually-then-suddenly-the-everything-collapse/) ._

_ ?itok=-yZHMTXn (

?itok=-yZHMTXn ( ?itok=-yZHMTXn)_

?itok=-yZHMTXn)_

The outstanding $2+ quadrillion of global derivatives are very likely to turn into debt as counterparties fail. That’s when the real money printing starts. But there are so many areas of unprecedented global risk of a magnitude never seen before in history. (“WILL NUCLEAR WAR, DEBT COLLAPSE OR ENERGY DEPLETION FINISH THE WORLD?” (https://goldswitzerland.com/will-nuclear-war-debt-collapse-or-energy-depletion-finish-the-world/))

Since Western Governments and Central Banks know that the system is on the verge of collapse, they are doing all they can to control the people. Covid vaccines, lockups, global warming were just the beginning. Next is CBDCs (Central Bank Digital Currencies). This will be the most perfect way for governments to control their people by having full control of their money. So especially the West is at a risk of coming under totalitarian control.

**MITIGATE THE RISK BY OWNING PHYSICAL GOLD AND SILVER**

There are obviously very few who have the possibility to…

https://www.zerohedge.com/personal-finance/von-greyerz-forecasting-gold-price-mugs-game

**Morgan Stanley Prepares To Cut 3,000 Jobs As M&A Activity Sours**

Morgan Stanley Prepares To Cut 3,000 Jobs As M&A Activity Sours

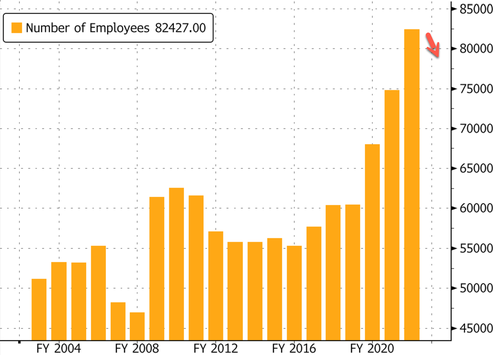

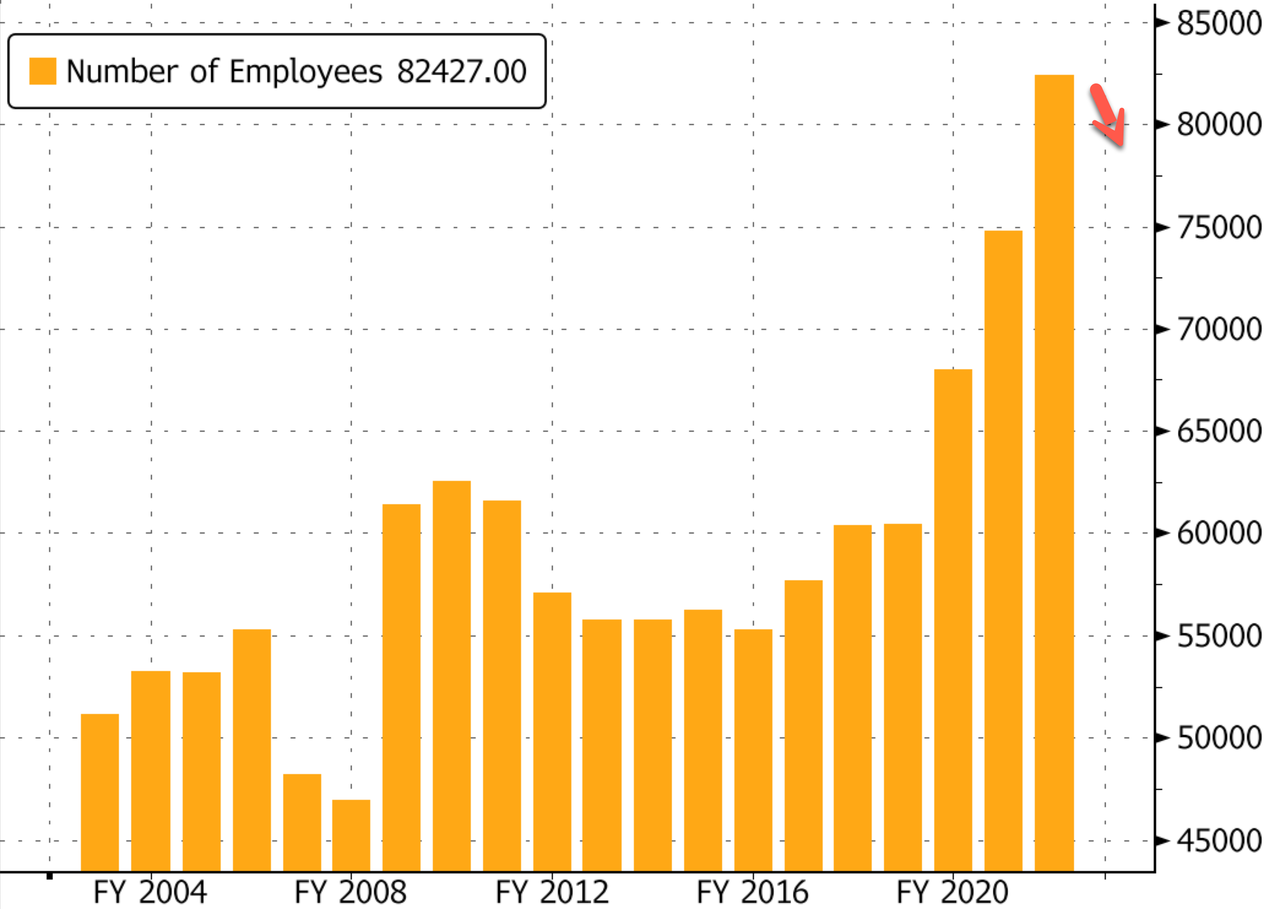

Morgan Stanley is planning to eliminate 3,000 jobs in the second quarter amid the continued slowdown in the merger and acquisition (M&A) space and increasing concerns about recession, as per a source cited by Bloomberg (https://www.bloomberg.com/news/articles/2023-05-01/morgan-stanley-plans-3-000-more-job-cuts-amid-dealmaking-slump).

> _"Senior managers are discussing plans to eliminate about 3,000 jobs from the global workforce by the end of this quarter," according to the source._

This proposed downsizing would equate to roughly a 5% reduction, excluding financial advisors and their support staff in the wealth management division. As of the fourth quarter of 2022, the New York-based investment bank had a workforce of 82,427 employees.

In a separate report, a Reuters (https://www.reuters.com/business/finance/morgan-stanley-plans-3000-more-job-cuts-bloomberg-news-2023-05-01/) source said muted M&A activity and mounting macroeconomic headwinds prompted Morgan Stanley to push forward with headcount reductions to trim costs.

?itok=V23XYizt (

?itok=V23XYizt ( ?itok=V23XYizt)

?itok=V23XYizt)

Last month, Chief Executive Officer James Gorman said subdued M&A activity is expected for this year and that he expects a rebound in 2024.

Morgan Stanley's profit tumbled in the first quarter from a year ago, mostly pulled down by a steep decline in dealmaking, with a 32% plunge in merger advisory and a 22% slide in its equity-underwriting business.

Data from Dealogic shows M&A volumes in the first quarter were halved from a year before. It's unlikely M&A volumes will surge anytime soon as the Federal Reserve is hellbent on raising interest rates to tame the hottest inflation in decades. Also, the regional banking crisis and credit tightening will continue to create pessimism in capital markets.

In December, Morgan Stanley axed 1,600 jobs. Goldman Sachs in January eliminated 3,200 jobs. Just last week, Lazard announced plans to shrink (https://www.zerohedge.com/markets/time-act-lazard-cut-10-jobs-amid-ma-slowdown) its headcount by 10% due to a slowdown in M&A.

With the continuing stagnation in the M&A space, more investment banks are expected to reduce their workforce as the threat of recession looms.

Tyler Durden (https://cms.zerohedge.com/users/tyler-durden)Tue, 05/02/2023 - 06:54

https://www.zerohedge.com/markets/morgan-stanley-prepares-cut-3000-jobs-ma-activity-sours

**In A World First, California Bans New Diesel Truck Sales From 2036**

In A World First, California Bans New Diesel Truck Sales From 2036

_Authored by Tsvetana Paraskova via OilPrice.com,_ (https://oilprice.com/Energy/Energy-General/In-A-World-First-California-Bans-New-Diesel-Truck-Sales-From-2036.html)

- _California’s regulators have unanimously voted to move with a plan to ban the sales of new diesel trucks as of 2036._

- _California has already moved to ban the sales of new passenger vehicles with internal combustion engines from 2035._

- _Large truck manufacturers and the trucking industry have strongly opposed this type of legislation._

California’s regulators have unanimously voted (https://ww2.arb.ca.gov/news/california-approves-groundbreaking-regulation-accelerates-deployment-heavy-duty-zevs-protect) to move with a plan to ban the sales of new diesel trucks as of 2036 as part of the state’s push to clean up its transportation sector emissions.

?itok=zQPkW6QI (

?itok=zQPkW6QI ( ?itok=zQPkW6QI)

?itok=zQPkW6QI)

Late last week, the California Air Resources Board (CARB) approved **a first-of-its-kind rule that requires a phased-in transition toward zero-emission medium-and-heavy duty vehicles.**

Under the new rule, named Advanced Clean Fleets, all truck sales need to shift to zero emissions by 2036, and is especially focused on large fleets of polluting vehicles.

California has already moved to ban (https://oilprice.com/Energy/Energy-General/California-To-Ban-Sales-Of-Gasoline-Cars-By-2035.html) the sales of new passenger vehicles with internal combustion engines from 2035.

> _**“While trucks represent only 6% of the vehicles on California’s roads, they account for over 35% of the state’s transportation generated nitrogen oxide emissions and a quarter of the state’s on-road greenhouse gas emissions,”** California Air Resources Board said in a statement on the moves to accelerate the deployment of heavy-duty zero-emission vehicles (ZEVs) to protect public health._

Between 2021 and 2025, California will have invested nearly $3 billion in zero-emission trucks and infrastructure, CARB said.

This investment is a **part of a $9 billion multi-year, multi-agency zero-emissions vehicle package to decarbonize the transportation sector** that was agreed upon by the Governor and the Legislature in 2021.

Paul Cort, director of Earthjustice’s Right to Zero campaign, commented (https://earthjustice.org/press/2023/california-leads-nation-on-protections-from-truck-and-rail-pollution-with-new-zero-emissions-standards), _**“Diesel trucks are the worst polluters on our roads,** pumping an especially harmful form of air pollution into communities living in the shadow of ports and freeways. This new truck rule will have profound health and economic benefits not just here, but in every other state that adopts these clean air protections.”_

However, the large truck manufacturers and the trucking industry have strongly opposed such legislation, saying that the **deadlines are unrealistic and the cost of making a truck electric is currently too high.**

Tyler Durden (https://cms.zerohedge.com/users/tyler-durden)Tue, 05/02/2023 - 06:30

https://www.zerohedge.com/political/world-first-california-bans-new-diesel-truck-sales-2036

**Biden "Punishes Responsibility" As New Mortgage Equity Program Begins**

Biden "Punishes Responsibility" As New Mortgage Equity Program Begins

Starting today, the Federal Housing Finance Agency's mortgage pricing adjustments will **increase fees for borrowers with high credit scores while reducing costs for those with subpar credit scores**. This upside-down policy is blatantly socialism, and one can't help but wonder if anyone in the Biden administration learned anything from the subprime mortgage meltdown (https://www.zerohedge.com/personal-finance/biden-punish-good-credit-homebuyers-subsidize-high-risk-mortgages) that occurred more than a decade ago.

As part of the Biden administration's plan to **make housing affordable for everyone** (we've seen this story before), upfront fees for loans backed by Fannie Mae and Freddie Mac will be adjusted based on the borrower's credit score. Borrowers with high credit scores will pay more in fees, while those with lower credit scores will pay less.

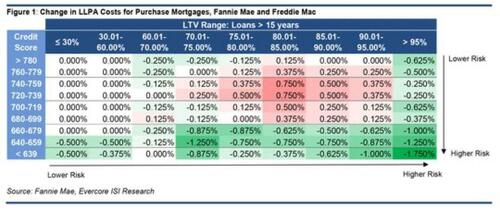

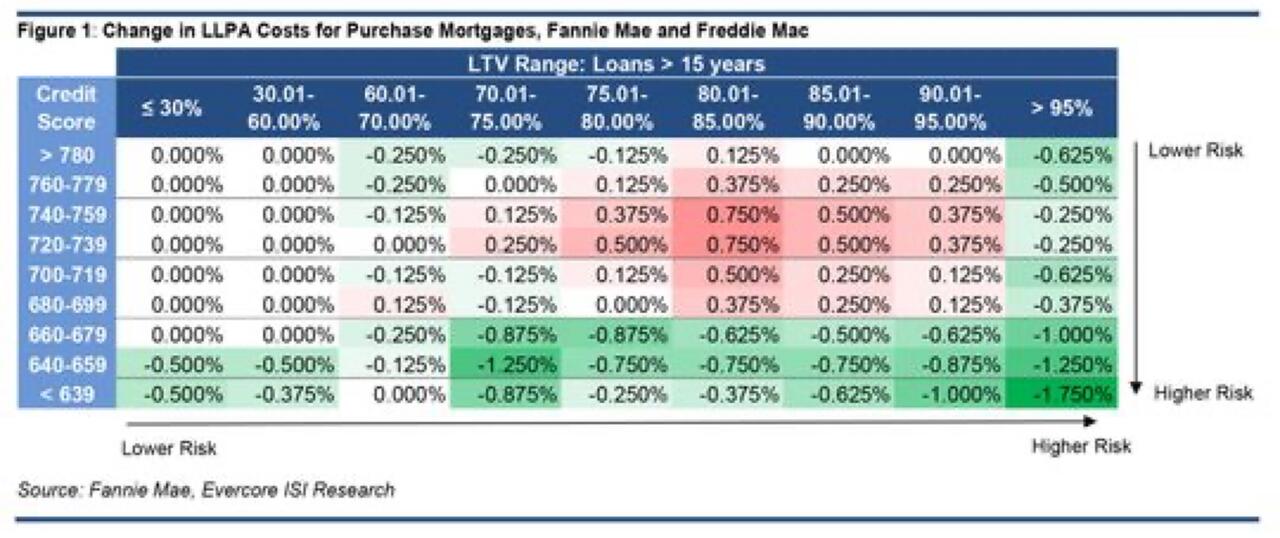

The Wall Street Journal (https://www.wsj.com/articles/federal-housing-finance-agency-sandra-thompson-mortgages-credit-e66fd493) cited data from Evercore ISI that shows borrowers with credit scores between 720-759 who make around 15-20% down payments will see loan-level pricing adjustment (LLPA) costs rise by .750%. Inversely, under the new adjustments, risky borrowers with a credit score below 639 and who put down only 5% of the value of their home will only have to pay 1.750%, compared with 3.750% under old rules.

?itok=xlUqA9TO (

?itok=xlUqA9TO ( ?itok=xlUqA9TO)

?itok=xlUqA9TO)

**Backlash over LLPA changes prompted the FHFA to publish a statement last week, calling such concerns "a fundamental misunderstanding."** The Biden administration ensures the new changes are meant to help those with poor credit scores obtain homes amid the worst housing affordability in a generation.

According to the FHFA, the new adjustments will redistribute funds to reduce the interest rate costs paid by risky borrowers. This sounds like socializing home buying to us.

Even more alarming is data from the American Enterprise Institute found that default rates of Fannie/Freddie owner-occupied 30-year fixed-rate purchase loans acquired in 2006-2007 were between 39.3% and 56.2% for borrowers with credit scores between 620 and 639 and less than 4% down payments. Those with credit scores between 720 and 769 and 20% down payments had default rates between 4.2% and 8.8%.

**The Biden administration is subsidizing irresponsibility, rewarding failure, and discriminating against people with high credit scores.** (https://www.zerohedge.com/personal-finance/biden-punish-good-credit-homebuyers-subsidize-high-risk-mortgages)

Meanwhile, 27 states revolted against Biden's mortgage redistribution rule to subsidize risky borrowers...

> BREAKING: 34 state financial officers from 27 states have signed-on to a letter to the Biden Administration demanding that they end their new mortgage equity program, which forces buyers with good credit to pay higher rates to subsidize loans for riskier borrowers. pic.twitter.com/P8RHbj0zzf (https://t.co/P8RHbj0zzf)

>

> — Will Hild (@WillHild) May 1, 2023 (https://twitter.com/WillHild/status/1653031906454171649?ref_src=twsrc%5Etfw)

Sen. Tim Scott (R-SC) blasted Biden.

> .@SenatorTimScott (https://twitter.com/SenatorTimScott?ref_src=twsrc%5Etfw) slams new federal mortgage rules punishing Americans with good credit scores and urges voters to ‘reverse the curse’ of the Biden administration.https://t.co/15mnVVO7F8 (https://t.co/15mnVVO7F8)pic.twitter.com/8gXOuQANcq (https://t.co/8gXOuQANcq)

>

> — Fox News (@FoxNews) May 1, 2023 (https://twitter.com/FoxNews/status/1652860406384279553?ref_src=twsrc%5Etfw)

_**"Punishing responsibility—that's the Biden way,"**_ tweeted Sen. Tom Cotton (R-AR).

> Biden's mortgage scheme will cost homeowners an extra ~$30k for having a high credit score.

>

> Punishing responsibility—that's the Biden way.

>

> — Tom Cotton (@TomCottonAR) May 1, 2023 (https://twitter.com/TomCottonAR/status/1653100560390709278?ref_src=twsrc%5Etfw)

"While the changes may not be as bad as some headlines suggest, **it still seems illogical to essentially penalize fiscally responsible borrowers in an effort to assist less qualified borrowers**," Federal Savings Bank loan officer Lewis Sogge told us.

There's no logic here, just progressive bureaucrats enacting policies that may ultimately lead to another future crisis. (https://www.zerohedge.com/political/bidens-credit-score-screw-job-mortgage-pricing-even-legal)

Tyler Durden (https://cms.zerohedge.com/users/tyler-durden)Tue, 05/02/2023 - 06:11

https://www.zerohedge.com/markets/biden-punishes-responsibility-new-mortgage-equity-program-begins

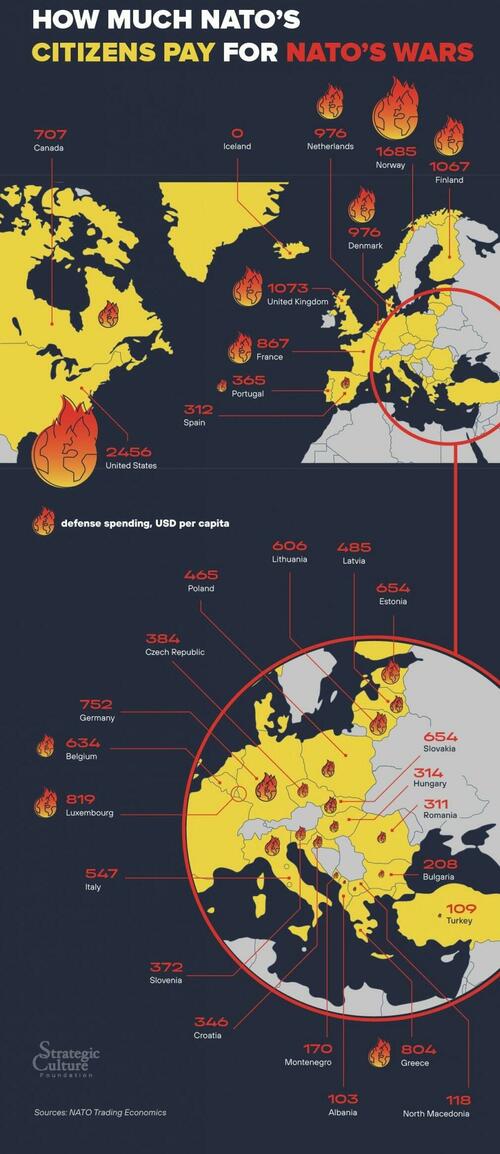

**How Much NATO's Citizens Pay For NATO's Wars**

How Much NATO's Citizens Pay For NATO's Wars

The **United States is indisputable leader** in defense spending both in absolute figures and per capita.

However, on the latter count the gap is not so dramatic with **some Nordic countries demonstrating impressive propensity** for making their citizens pay for war...

?itok=ivHo-GyD (

?itok=ivHo-GyD ( ?itok=ivHo-GyD)

?itok=ivHo-GyD)

_Source_ (https://strategic-culture.org/news/2023/04/30/how-much-natos-citizens-pay-for-natos-wars/)

Tyler Durden (https://cms.zerohedge.com/users/tyler-durden)Tue, 05/02/2023 - 05:45

https://www.zerohedge.com/geopolitical/how-much-natos-citizens-pay-natos-wars

**Ron Paul Warns Congress Is Ignoring The Real Debt-Ceiling Drama**

Ron Paul Warns Congress Is Ignoring The Real Debt-Ceiling Drama

_Authored by Ron Paul via The Ron Paul Institute for Peace and Prosperity,_ (http://www.ronpaulinstitute.org/archives/featured-articles/2023/may/01/congress-ignores-real-debt-ceiling-drama/)

Last week the House passed legislation increasing the debt ceiling. The bill was supported by all but four Republicans. **For some Republicans, this was the first time they had ever voted for a debt ceiling increase.**

Perhaps the reason they did so this time was because the legislation also promised to reduce federal spending by $4.5 trillion over the next decade. Most of those spending reductions are achieved by rolling back Fiscal Year spending to 2022 levels and then limiting increases in spending to one percent for the next ten years. **The bill also returns unspent COVID relief money to the US Treasury and eliminates President Biden’s student loan forgiveness programs.**

?itok=oUx4DjZj (

?itok=oUx4DjZj ( ?itok=oUx4DjZj)

?itok=oUx4DjZj)

**Perhaps the most significant part of the bill is the REINS Act.** This legislation requires congressional approval of any new federal regulation that will have an impact of more than $100 million, will have significant harmful impact on the economy, or will increase consumer prices. Even though the bill increases spending and debt, there are reasons a supporter of limited government might vote for it.

However even in the unlikely event that this bill is passed in the Senate and signed into law by President Biden **, it is unlikely that the one percent spending cap would remain in force for the full ten years.** Historically, spending caps imposed as part of a balanced budget or debt ceiling deal do not last for more than one or two Congressional terms. This is because every spending program is “protected” by members of Congress whose constituents and/or donors benefit from the program. This process already occurred with this bill before it was even voted on, as Speaker McCarthy had to remove provisions limiting ethanol subsidies to appease several farm state Republicans.

Surely lobbyists for the military industrial complex are already plotting to use hysteria over China, Putin, Iran, or one of the US’s many other designed enemies to justify greater than one percent increase in military spending.

**The only reason the US government is able to run up such huge deficits without experiencing a complete economic meltdown is the dollar’s world reserve currency status.** But the growing de-dollarization movement-fueled by the US government’s fiscal recklessness and hyper-interventionist foreign policy should be a wake-up call to Congress.

Sadly, few in DC seem to be paying attention.

**The government’s fiscal situation will soon worsen,** as both the Social Security and Medicare trust funds will likely be bankrupt within the next decade, forcing Congress to find an additional $116 trillion to fully fund them.

**The looming economic crisis is a symptom of our moral and philosophic crisis.** Too many Americans have bought into the lie that government can and should provide them with economic and physical safety while promoting “global democracy” abroad. Therefore, the most important step in the liberty movement now is convincing more people to apply the same moral code to theft and murder committed by government as they apply to those same crimes by private citizens. The government, at the very least, should be held to the same moral codes as the people it governs.

Ensuring that government follows the same nonaggression principle as law-abiding citizens is the key to a society of freedom, peace, and prosperity.

Tyler Durden (https://cms.zerohedge.com/users/tyler-durden)Tue, 05/02/2023 - 05:00

https://www.zerohedge.com/political/ron-paul-warns-congress-ignoring-real-debt-ceiling-drama

**Kirby Claims Whopping 100,000+ Russian Casualties In Bakhmut Alone**

Kirby Claims Whopping 100,000+ Russian Casualties In Bakhmut Alone

In a Monday press briefing National Security Council spokesman John Kirby issued a surprisingly high estimate of Russian casualties which he said took place since December fighting in the contested Donetsk city of Bakhmut.

He said (https://www.washingtonexaminer.com/policy/defense-national-security/russian-offensive-stalling-casualties) Russian forces have suffered over 100,000 total casualties - including **about 20,000 soldiers killed in combat** and **another 80,000 wounded**.

?itok=Hr4kWEln\

?itok=Hr4kWEln\

_Image: AP/Shutterstock_ ( ?itok=Hr4kWEln)

?itok=Hr4kWEln)

He explained that these figures were based on "information and intelligence that we were able to corroborate over a period of of some time."

While presenting these figures he said that the Russian advance in Donetsk and Luhansk provinces had "failed" - despite most international estimates currently indicating Russia holds 80-90% of Bakhmut at this point.

**"Most of these efforts have stalled and failed,"** Kirby said. "Russia has been unable to seize any real strategically significant territory. "

"The only area where Russia has made some incremental gains — and I want to focus on the word ‘incremental’ — is Bakhmut," Kirby acknowledged. "That really holds, as we've said before, very little strategic value for Russia. The capture of Bakhmut would **absolutely not alter the course of the war in Russia's favor**, and Ukraine's defenses in the areas surrounding Bakhmut still remain strong."

He also said that some half of the 20,000 Russians killed there had been fighting on behalf of Wagner.

"Folks he \[Wagner Group founder Yevgeny Prigozhin\] went knocking around on the doors in prison cells throughout Russia to throw human flesh at this fight," Kirby said of a months-long recruitment drive by Wagner, controversially focused on Russian prisons.

But when pressed, the NSC spokesman **refused to give casualty numbers for the Ukrainian side**. "I'm not ever going to put anything out in the public domain that's going to make their job harder," Kirby said. "They are the victims here. Russia is the aggressor."

While very clearly Bakhmut has for months been a tragic "meat-grinder" (https://www.theguardian.com/world/2022/dec/10/russia-ukraine-war-bakhmut-meat-grinder-deadlock) for both sides, the US could be offering this staggering and large Russian casualty count of 100,000 in order **to establish a 'pyrrhic victory' narrative.** Kirby admitted the Russians are winning in Bakhmut, but wants to paint a picture of it losing the overall conflict given the massive cost and sacrifice for Bakhmut.

But to keep this figure in perspective, which to most people is going to seem an extremely high estimate (and thus dubious), the total official American casualties in Vietnam were nearly 60,000 killed in action, and over 150,000 wounded - and that was after a decade of war.

Tyler Durden (https://cms.zerohedge.com/users/tyler-durden)Tue, 05/02/2023 - 04:20

https://www.zerohedge.com/markets/kirby-claims-whopping-100000-russian-casualties-bakhmut-alone

**McCarthy In Israel: Beijing Acts As "Thieves", Urges Scrutiny On Investments**

McCarthy In Israel: Beijing Acts As "Thieves", Urges Scrutiny On Investments

House Speaker Kevin McCarthy was in Jerusalem on Monday where he deliver an address to Israel's parliament, and he focused on an anti-China message, a somewhat rare emphasis given the occasion marking the Jewish state's 75th independence day.

He warned Beijing lawmakers that **Beijing acts as "thieves"** while calling for the close US ally to scrutinize Chinese investments in the country.

?itok=l3tykHcx\

?itok=l3tykHcx\

_US House of Representatives Speaker Kevin McCarthy greeted by Knesset Speaker Amir Ohana at the airport. Image: Knesset Press Office_ ( ?itok=l3tykHcx)

?itok=l3tykHcx)

"While the \[Chinese Communist Party\] may disguise itself as promoters of innovation, in truth, they act like thieves. **We must not allow them to steal our technology**," McCarthy said (https://news.yahoo.com/mccarthy-warns-israel-off-chinese-144628878.html#:~:text=We%20must%20not%20allow%20them,you%20first%20took%20in%202019.%E2%80%9D).

"I’m glad that Israel has put into place a process to review foreign investments. **I strongly encourage Israel to further strengthen its oversight of foreign investment, particularly Chinese investment**, building on the steps that you first took in 2019," he added.

2019 was a reference to Israel establishing a foreign investment oversight mechanism amid US officials warning of the dangers of Chinese companies' expanding role in sensitive technology and infrastructure industries.

China already operates the Haifa port terminal, a major international shipping hub for Israel, after in 2015 its state-owned Shanghai International Port Group (SIPG) won the tender to oversee it for 25 years. The US military from there voiced concerns about American submarines and warships docking in Israel.

McCarthy also called out China as among severe human rights violators (https://www.speaker.gov/speaker-mccarthys-remarks-at-the-knesset/):

> _**"There is no clearer example than the U.N Human Rights Council – which has passed over 90 anti-Israel resolutions since 2006, yet has turned a blind eye to true human rights violations by Iran, North Korea, and China."**_

>

> _“My colleagues and I in Congress will continue to stand with Israel. ”_

>

> _“And we will increase pressure on the United Nations to end these outrageous attacks."_

China recently held itself out as a mediator seeking Israeli-Palestine peace, after recent flare-ups in fighting centered on Al-Aqsa Mosque as well as Gaza and the West Bank.

However, Washington and much of the West have looked cynically on these moves by Beijing, also as it pushes its 12-point peace plan for Ukraine.

Tyler Durden (https://cms.zerohedge.com/users/tyler-durden)Tue, 05/02/2023 - 04:15

**Five Arab States Plus Iran Among 19 Nations Ready To Join BRICS**

Five Arab States Plus Iran Among 19 Nations Ready To Join BRICS

_Via The Cradle,_ (https://thecradle.co/article-view/24119/five-arab-states-plus-iran-among-19-nations-ready-to-join-brics)

Saudi Arabia, the UAE, Algeria, Egypt, Bahrain, and Iran have formally asked to join the BRICS group of nations as it prepares to hold its annual summit in South Africa.

?itok=lQG9Zms3 (

?itok=lQG9Zms3 ( ?itok=lQG9Zms3)

?itok=lQG9Zms3)

In total, 19 nations have expressed interest in joining the emerging-markets bloc of Brazil, Russia, India, China, and South Africa, according to Anil Sooklal, South Africa’s ambassador to the group.

> _**“What will be discussed is the expansion of BRICS and the modalities of how this will happen... Thirteen countries have formally asked to join, and another six have asked informally. We are getting applications to join every day,”**_ the South African official told _Bloomberg_ (https://www.bloomberg.com/news/articles/2023-04-24/brics-draws-membership-requests-from-19-nations-before-summit#xj4y7vzkg?leadSource=uverify%20wall) earlier this week.

BRICS will hold its annual summit in Cape Town during the first week of June. The foreign ministers from all five member states have confirmed their attendance.

**Earlier this month, _Bloomberg_ revealed that BRICS is expected to soon surpass (https://thecradle.co/article-view/23848/brics-set-to-surpass-g7-in-economic-growth) the US-led G7 states in economic growth expectations.**

Per their analysis, while G7 and BRICS nations each contributed equally to global economic growth in 2020, the western-led bloc’s performance has recently declined. By 2028, the G7 is expected to make up just 27.8 percent of the global economy, while BRICS will make up 35 percent.

The estimations came just a few weeks after the Deputy Chairman of Russia’s State Duma, Alexander Babakov, revealed that BRICS is working on developing a “new currency” that will be presented at the organization’s upcoming summit.

**BRICS member states account for over 40 percent of the global population and around a quarter of the global GDP.**

The interest from Global South nations to join the bloc comes at a time when more and more governments move away from the US dollar.

**The greenback has become more unreliable (https://unctad.org/news/high-food-prices-and-strong-us-dollar-are-double-burden-developing-countries-unctad-says) for dollarized economies due to rising interest rates regulated by the US Federal Reserve (FED) and the bank’s weaponization of the dollar through financial sanctions.**

In addition, the west – especially Europe – is facing a growing energy crisis resulting from sanctions targeting Russian energy markets due to its invasion of Ukraine and the US sabotage of the Nordstream (https://www.aljazeera.com/news/2023/2/8/us-has-questions-to-answer-over-nord-stream-blasts-russia-says)pipeline.

Tyler Durden (https://cms.zerohedge.com/users/tyler-durden)Tue, 05/02/2023 - 03:30

https://www.zerohedge.com/geopolitical/five-arab-states-plus-iran-among-19-nations-ready-join-brics

**We Have Met The Enemy**

We Have Met The Enemy

_Authored by James Howard Kunstler via DailyReckoning.com,_ (https://dailyreckoning.com/we-have-met-the-enemy/)

> _“When we see the few truth-tellers who are the stars of their organizations jettisoned – Tucker Carlson from Fox News, Matt Taibbi from Rolling Stone, Glenn Greenwald from The Intercept, James O’Keefe from Project Veritas… we must face the fact that there is an organized conspiracy to suppress truth.”_

>

> _\- Paul Craig Roberts_

**The weird part the news media isn’t telling you about World War Three is that America’s main enemy in this struggle is… the US Government itself!**

America is looking like that crazy person on the street, punching himself in the head. How else do you explain this epic act of national self-destruction?

**The “Joe Biden” regime is “standing up for our democracy” by trying to silence all and any public speech about what it does in the world and how it treats its own citizens.** Meanwhile, the entire scaffold of American life crumbles and you are supposed to not notice it’s happening. The funny part is that the Democratic Party thinks this is an election strategy. The funniest part of the funny part is that we bother holding elections at all.

You understand, “Joe Biden” is only pretending to run for president again, in the same way that he’s only pretended _to be_ president the past two years. Are we to believe, for instance, that the old zombie has become a fervent Maoist? Or that he follows any known structured political philosophy at all, other than cashing checks from favor-seekers from all over the world?

“Joe Biden” is pretending to run — no matter how preposterous it seems — because his handlers know that only a titanic pretense of political strength can stave off the reveal of his family’s awesome criminality and the fall of everyone hitched to that broke-down wagon.

**So much for the funny stuff.** Things are getting to the point where we stop laughing. It’s only a question now of how the calamity rolls out. There are so many more parts to our national fiasco and they are all out-of-hand in the most disastrous way.

?itok=3wIWoiiZ (

?itok=3wIWoiiZ ( ?itok=3wIWoiiZ)

?itok=3wIWoiiZ)

**The Ukraine Fiasco**

The Ukraine project is a big part. It was prodigiously stupid to provoke a war at Russia’s door-step and the side we backed, the corrupt Zelensky regime, has already lost. You just don’t know it because the American news business is a joke on the American public. It reports nothing honestly.

Ukraine is the last in a string of hapless military adventures that has exhausted America’s credibility in the world, especially as regards our military superiority. (Think: Russia’s Kinzhal hypersonic missile.) There will be many unexpected consequences of the Ukraine screw-up. One will be the crack-up of NATO, which has only been a false front for American military power.

Germany couldn’t fight its way out of a duffle bag with what it’s got, and it is supposedly Europe’s leading economic power. The sad truth is that it will stop being any kind of power without the cheap Russian natural gas it was running on, and later this year Germany will be in a panic to try and restore its horribly damaged trade relations with Russia to get that natgas.

Since NATO’s essential mission is to oppose Russia on everything, that will be the end of NATO. Europe will return to what it has always been: a region of squabbling national interests. Let’s hope Europe does not become again the slaughterhouse it was in the last century.

**You Go Broke in Two Ways**

The failure of the Ukraine project could easily stimulate a collapse in Europe’s banking system, which would instantly spread to America’s banking system as obligations dissolve and payments stop.

The net effect of all that will be the vanishing of a whole lot of capital, including the money in bank accounts, the money invested in stocks and bonds, the money lodged in pension plans, and the money controlled by insurance companies.

As I’ve mentioned before — it’s worth repeating — you can go broke two ways: you can have no money, or you can have money that’s worthless. We’ve been steadily following the latter path through the “Joe Biden” years, but we’re close to simply not having money at all. Being broke will get Americans’ attention. And the first place they’ll look is the party in power.

Multiple scandals have finally caught up to “Joe Biden” and are escaping the formidable suppression apparatus erected by the Deep State’s legal department. Attorney General Merrick Garland himself is now directly implicated in obstruction of justice by an IRS whistleblower.

**Election Interference?**

The allegation is that Mr. Garland interfer…

**Earthquake Swarms Rattle Southern California**

Earthquake Swarms Rattle Southern California

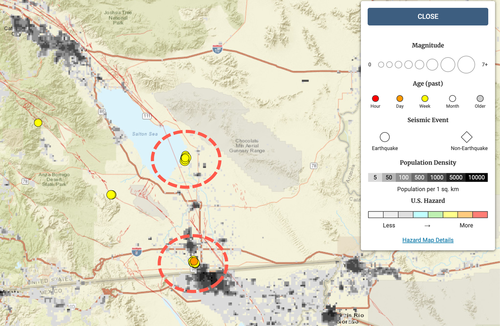

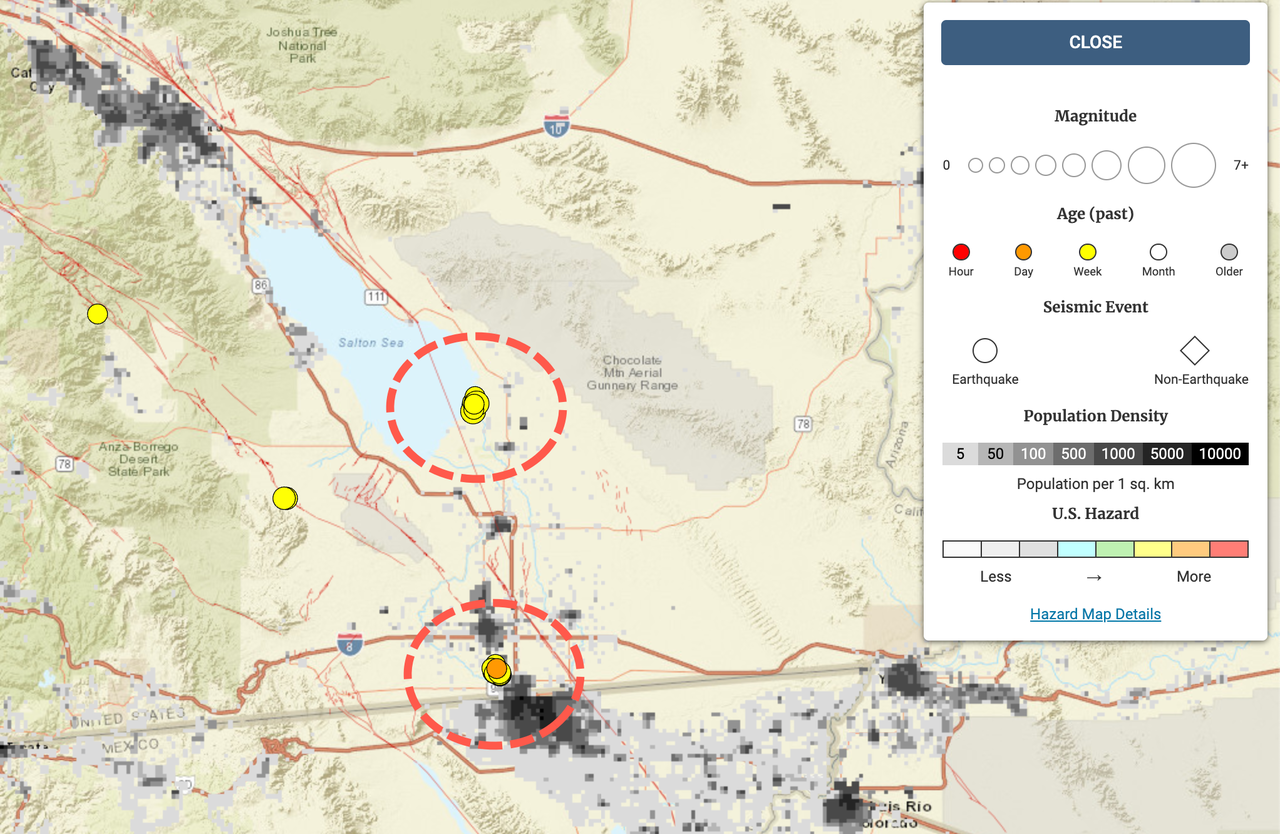

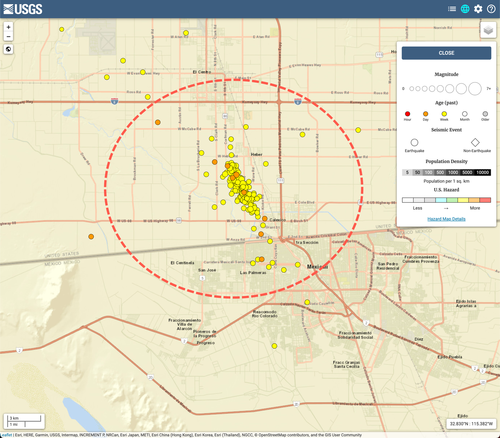

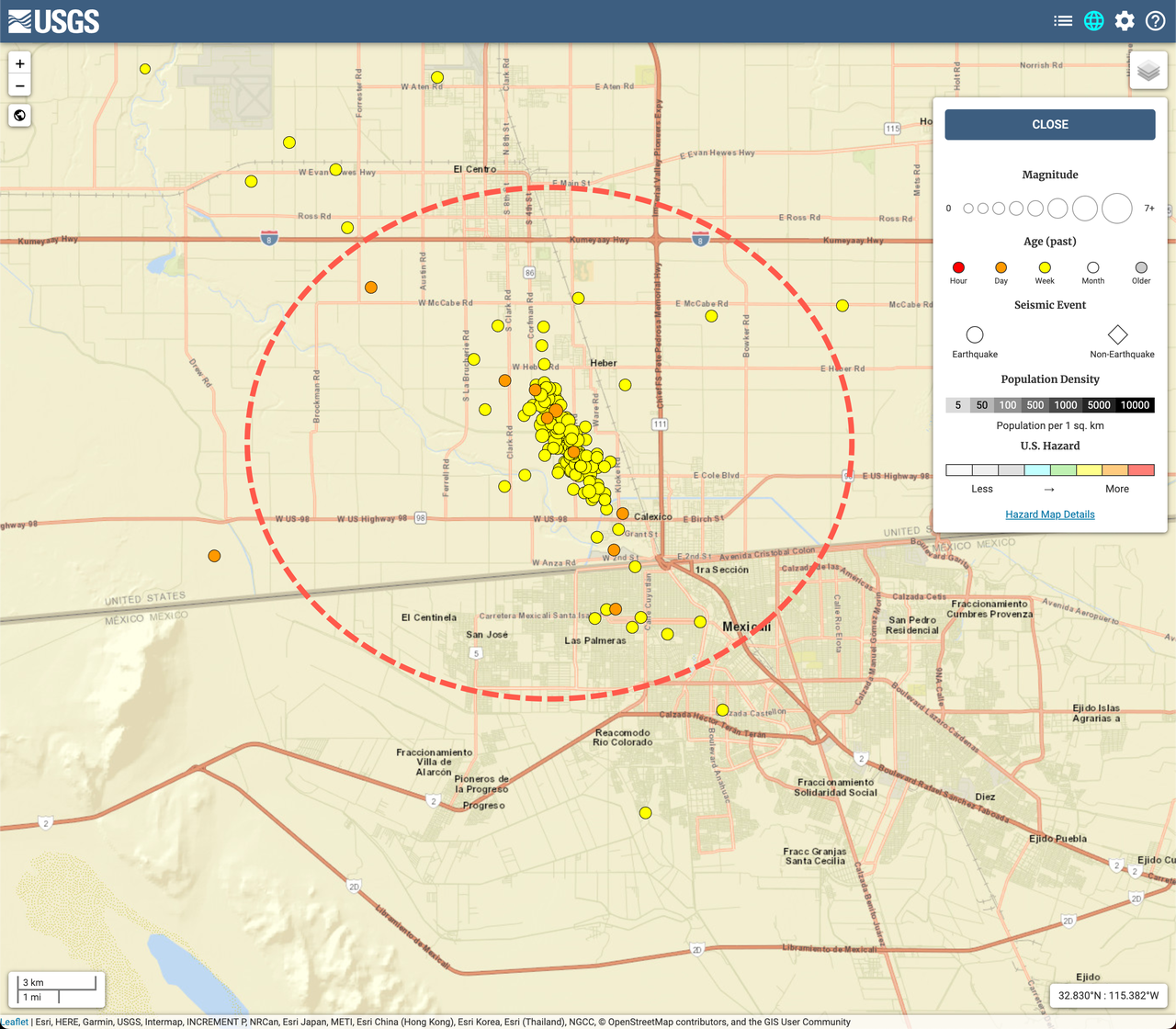

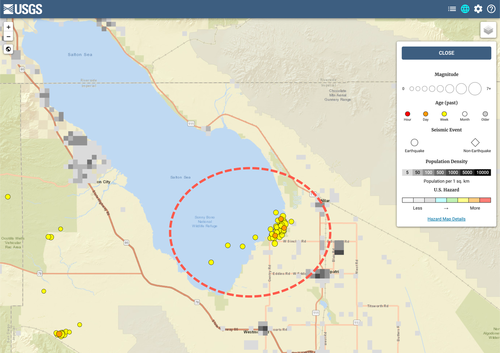

An earthquake swarm rattled the Salton Sea region of Southern California and the US-Mexico border over the weekend, with seismic activity reaching up to 4.5 magnitude, as reported by The Sacramento Bee (https://www.sacbee.com/news/california/article274890211.html).

?itok=UQd4TypT (

?itok=UQd4TypT ( ?itok=UQd4TypT)

?itok=UQd4TypT)

US Geological Survey data shows the first quake struck around 12:08 p.m. local time Saturday in Heber near the US-Mexico border, about 60 miles south of the Salton Sea, measuring 4.1 magnitude. There were dozens of tremors reported after the initial shock.

?itok=Hj6Wx8Ee (

?itok=Hj6Wx8Ee ( ?itok=Hj6Wx8Ee)

?itok=Hj6Wx8Ee)

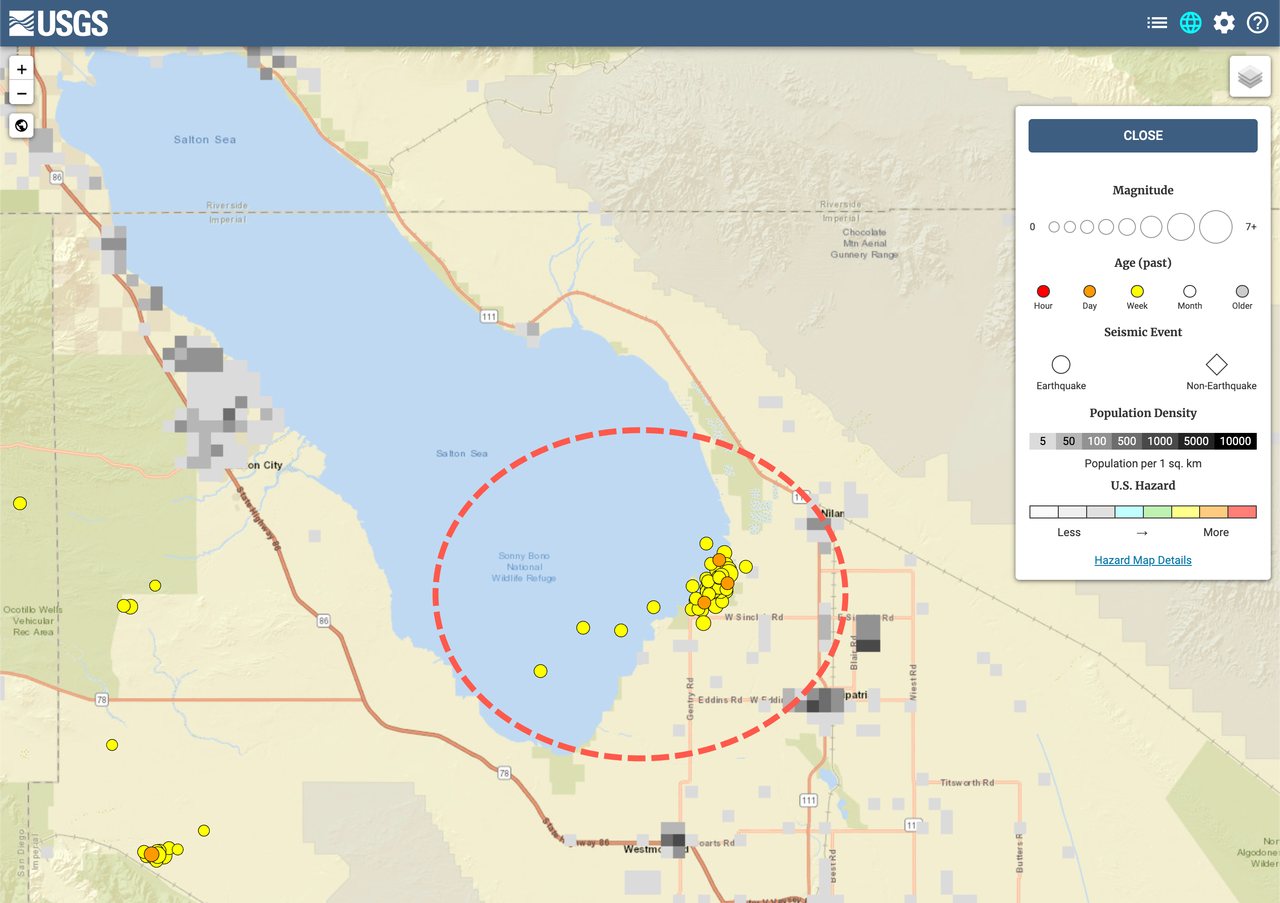

Then on Sunday morning, a 4.5 magnitude quake struck 4 miles west-southwest of Niland and just east of the Salton Sea, USGS data showed. Dozens of tremors were reported as well.

?itok=s9cA6bUu (

?itok=s9cA6bUu ( ?itok=s9cA6bUu)

?itok=s9cA6bUu)

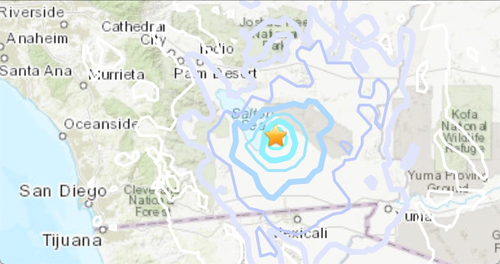

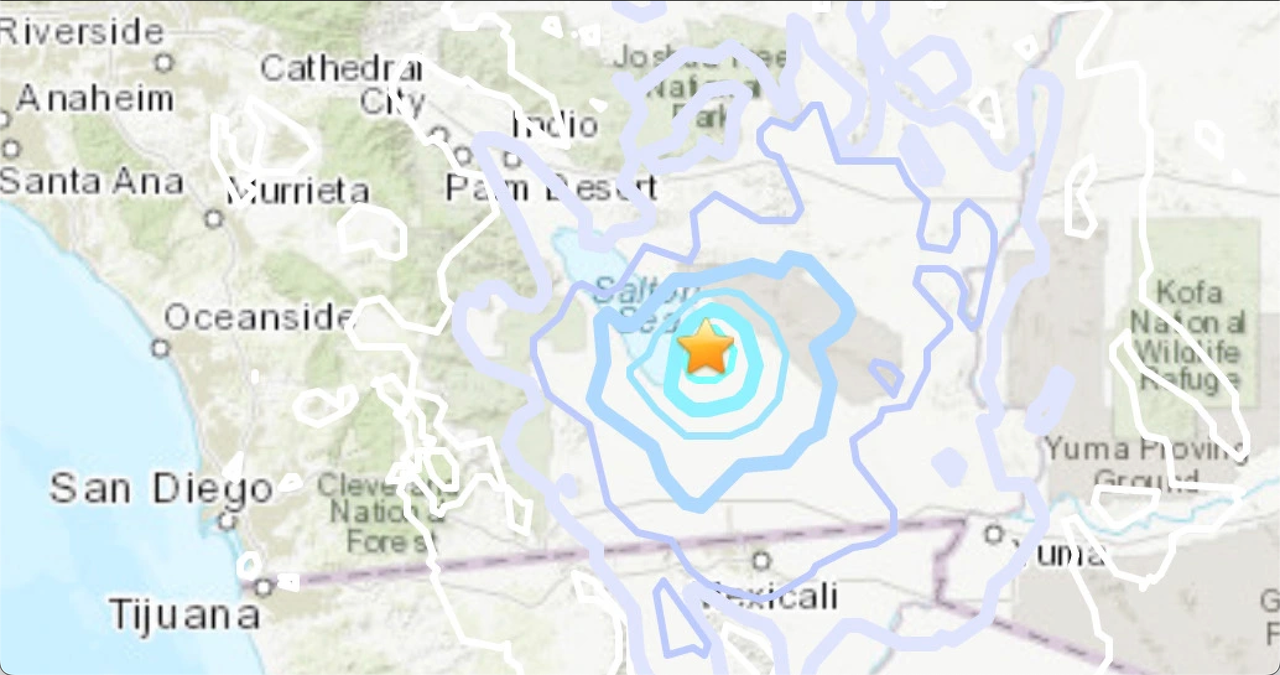

According to a USGS intensity map, the quakes were felt in Palm Desert, Indio, El Centro, and Mexicali.

?itok=KLp1AmRd (

?itok=KLp1AmRd ( ?itok=KLp1AmRd)

?itok=KLp1AmRd)

Last month, a series of earthquakes shook Pacifica in Northern California. Earlier this year, Los Angeles experienced a quake (https://www.zerohedge.com/weather/shaken-awake-earthquake-rattles-los-angeles-followed-multiple-aftershock-quakes), and Humboldt County was hit in December (https://www.zerohedge.com/weather/64-magnitude-earthquake-rattles-northern-california).

As for the state's southern region, it remains to be seen whether these swarms signal the potential for larger quakes.

Tyler Durden (https://cms.zerohedge.com/users/tyler-durden)Mon, 05/01/2023 - 23:40

https://www.zerohedge.com/weather/earthquake-swarms-rattle-southern-california

**Would The Feds Ban Twitter Under The RESTRICT Act?**

Would The Feds Ban Twitter Under The RESTRICT Act?

_Authored by Ben Weingarten via RealClear Wire (https://www.realclearwire.com/articles/2023/04/28/would_the_feds_ban_twitter_under_the_restrict_act_896437.html),_

**Decoupling from Communist China** in every strategically significant realm, from the capital markets to defense and pharmaceutical production, and information and communications technology **is imperative** if we are to counter its hegemonic ambitions and persist as a free and independent nation in something more than name.

_

?itok=aHvxVlkI)_

Banning TikTok – a ubiquitous social media platform that masquerades as a proliferator of harmless dance videos while doubling as a likely tool of Chinese Communist Party surveillance and data harvesting (https://www.heritage.org/technology/report/tiktok-generation-ccp-official-every-pocket), and certain tool of its information warfare, under de facto if not de jure CCP control (https://www.scribd.com/document/633015202/TikTok-ByteDance-And-Their-Ties-to-the-Chinese-Communist-Party) via Beijing-based parent ByteDance – would logically be part of any such decoupling, and manifestly in the U.S. national interest.

But **arguably the most prominent congressional effort putatively aimed at achieving a ban of TikTok, the bipartisan RESTRICT Act, raises concerns that the cure may be worse than the disease – to the extent it even ameliorates it (https://twitter.com/FinancialCmte/status/1640409547532652544?s=20).**

If past is prologue, key language in the bill hiding in plain sight would seem to legitimize the very heretofore lawless targeting of domestic dissent under which Americans have suffered in recent years – undermining the values and principles the bills’ supporters purport (https://twitter.com/MarkWarner/status/1641170109455814656?s=20) to cherish.

Under the bill, one could easily see the likes of a Twitter, or any other platform or service out of favor with authorities nuked, or at minimum under existential threat.

**The RESTRICT Act broadly authorizes the Secretary of Commerce to “review and prohibit certain transactions between persons in the United States and foreign adversaries.”**

Among other provisions, it calls on the Secretary to “take action to identify, deter, disrupt, prevent, prohibit, investigate, or otherwise mitigate” any of a number of “undue or unacceptable” national security risks arising from a slew of transactions past or present, including “any acquisition, importation, transfer, installation, dealing in, or use of any information and communications technology product or service” to which entities tied to China or several other countries, or subject to their jurisdiction, have an interest.

The leading co-sponsors of the RESTRICT Act, Virginia Senator Mark Warner, a Democrat, and South Dakota Senator John Thune, a Republican, frame (https://archive.ph/7MgFd) it as “a holistic, rules-based” effort “narrowly tailored to foreign-adversary companies” that is “more likely to withstand judicial scrutiny” than other proposed bills for combatting TikTok – bills that arose in part because the courts stymied President Donald Trump’s efforts to ban the application using existing executive authorities.

**Some critics (https://www.politico.com/news/2023/03/31/senate-tiktok-bill-restrict-act-00089926), including China hawks, contend that despite the broad authority the bill grants the Commerce Secretary, it may not ultimately lead to a TikTok ban**. The bill does not explicitly call for the banning of the application. Nor does it mention it, or any other application, by name – rather listing broad categories of software and hardware that could be probed under the bill, linked to several foreign foes, including among them China.

Others liken (https://www.foxnews.com/media/bill-ban-tiktok-slammed-patriot-act-digital-age?intcmp=tw_fnc) the legislation to the Patriot Act, just for the digital age. This is not meant to be a compliment. They argue that the RESTRICT Act threatens civil liberties – namely free speech – in the name of security by granting the government sweeping powers to crush communication platforms under the guise of ill-defined risks with extensive criminal penalties (https://reason.com/2023/03/29/could-the-restrict-act-criminalize-the-use-of-vpns/). The vaguer the language (https://reason.com/2023/03/29/could-the-restrict-act-criminalize-the-use-of-vpns/), more pervasive the powers, and fewer the checks and balances (https://www.congress.gov/bill/118th-congress/senate-bill/686/text#idb2a77edcaddb4dd582459974d92f7c08), such critics surmise, the riper the opportunity for government to overreach.

While the bill’s backers may argue (https://twitter.com/Ma…

https://www.zerohedge.com/political/would-feds-ban-twitter-under-restrict-act