**Tucker Carlson Gets $100 Million Offer As MSNBC Dominates Fox In His Absence**

Tucker Carlson Gets $100 Million Offer As MSNBC Dominates Fox In His Absence

What were the Murdochs thinking?

?itok=jy9PEoVY)

Following Tucker Carlson's ouster from _Fox News_, **the network has experienced a precipitous decline in ratings**, while **Carlson has been receiving offers left and right** from other networks.

For starters, Patrick Bet-David, CEO of online content company Valuetainment, offered former Fox News host Tucker Carlson **a $100 million deal over five years, plus a board seat at the company,** in a high-profile courting attempt on Tuesday.

**"Dear Tucker, I’ll get right to the point. We want you to partner with us in what we feel is a noble and necessary effort to define the future of media,"** wrote David, who also hosts the Valuetainment brand’s podcast (https://www.youtube.com/@VALUETAINMENT/videos), in the opening of the letter of intent posted (https://twitter.com/ValuetainmentTV/status/1653461343142330378) on Twitter on May 2 according to the _Epoch Times_ (https://www.theepochtimes.com/tucker-carlson-gets-100-million-offer-from-valuetainment_5237264.html?utm_source=partner&utm_campaign=ZeroHedge&src_src=partner&src_cmp=ZeroHedge).

_Continued_...

The letter outlines David’s offer to Carlson: $100 million over five years, an equity stake in Valuetainment, a position as the President of Valuetainment, a board seat, and other content Carlson may be interested in covering.

“What else? We are all ears,” David wrote. “ **Our convictions about freedom, liberty, and truth run deep and we believe we are the absolute right fit for you and America**.”

With a motto (https://www.youtube.com/@VALUETAINMENT/about) of “to enlighten, entertain and empower,” Valuetainment currently publishes its content, including podcasts and interviews, on YouTube and other social media platforms. Its YouTube channel has over 4 million subscribers, and its social media platforms, Instagram, TikTok, and Twitter, have a following of over 10 million. The brand’s podcast, PBD Podcast, ranks (https://chartable.com/podcasts/the-betdavid-podcast) 12th on Spotify in the platform’s business category as of writing.

The brand’s podcast has hosted prominent figures in various fields, including the late basketball superstar Kobe Bryant, clinical psychologist Jordan Peterson, current presidential candidate Robert F. Kennedy Jr., legal scholar Alan Dershowitz, celebrity scientist Neil deGrasse Tyson, and investor Robert Kiyosaki. The company’s most-watched YouTube video (https://www.youtube.com/watch?v=9ECEWShKAoM), featuring an interview with a mafia boss, has over 18 million views.

**Valuetainment’s Tuesday offer joins a number of media companies—as the first public one—that are reportedly (https://www.cbsnews.com/news/where-is-tucker-carlson-going-next-oan-newsmax-glenn-beck-heritage-see-you-soon/) considering or have extended invites to Carlson to join their roster after the top-rated TV personality parted ways with his former employer last Monday.**

In an interview (https://www.youtube.com/watch?v=TDnI5F8RcQc) with talk show host Megyn Kelly on Tuesday, David, a refugee who fled (https://books.google.com/books/about/Choose_Your_Enemies_Wisely.html?id=eu26zwEACAAJ&source=kp_author_description) from Iran to America at the age of 12, said Carlson should work with him because he has “the vision in place, the cause in place, and is a true believer on how great of a country America is that is worth fighting for.”

**MSNBC tops Fox in primetime ratings**

Meanwhile, left-leaning MSNBC's primetime ratings **dominated _Fox News_ on Monday, May 1**, according to data from Nielsen.

That evening, _Fox News_ had 1.598 million viewers, while _MSNBC_ had 1.693 million viewers. In the valuable 25-54 demographic, _Fox_ _News_ had 164,000 viewers vs. 176,000 for _MSNBC._

As the _Epoch Times_ (https://www.theepochtimes.com/msnbc-tops-fox-news-in-primetime-ratings-after-tucker-carlson-exit_5238721.html) notes;

In terms of total day viewers, Fox News was still No. 1 in total viewers and demographic viewers, the ratings show.

Last week, Brian Kilmeade filled in during Carlson’s 8 p.m. timeslot for a show dubbed “Fox News Tonight.” This week, Lawrence Jones was tapped to host the program, performing those duties on both Monday and Tuesday nights.

**About 2.5 million people watched Kilmeade’s first show on April 24**, while the figure ultimately dropped to about 1.3 million on Friday, April 28, according to Nielsen ratings. Jones’ “Fox News Tonight” drew 1.55 million—more than Kilmeade’s Friday show, but not by much.

In the 8 p.m. slot, “Fox News Tonight” performed better than Anderson Cooper’…

**Confirmed: Jeffrey Epstein’s History As An FBI Source**

Confirmed: Jeffrey Epstein’s History As An FBI Source

Authored by Techno Fog via The Reactionary (https://technofog.substack.com/p/confirmed-jeffrey-epsteins-history) (subscribe here (https://technofog.substack.com/subscribe?)),

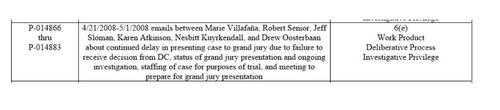

Back in 2007, the Department of Justice gave Jeffrey Epstein a sweetheart deal that deferred prosecuting Epstein for federal offenses – including the interstate sex trafficking of minors and recruiting minors to engage in commercial sex acts – in exchange for Epstein pleading guilty to Florida state-level solicitation of prostitution and procurement charges.

?itok=zL34Gwag (

?itok=zL34Gwag ( ?itok=zL34Gwag)

?itok=zL34Gwag)

The deal was shocking in both its timing and scope. **It was made before (https://twitter.com/Techno_Fog/status/1289039849601761281) the FBI had interviewed all of Epstein’s victims and before the FBI had seized Epstein’s computers.**

?itok=CzbBX2nZ (

?itok=CzbBX2nZ ( ?itok=CzbBX2nZ)

?itok=CzbBX2nZ)

It immunized Epstein’s known and unknown co-conspirators who were credibly accused of trafficking and abusing minors, a rare and troubling agreement you will not find in any other federal non-prosecution agreement:

> _“if Epstein successfully fulfills all of the terms and conditions of this agreement, the United States also agrees that it will not institute any criminal charges against any potential co-conspirators of Epstein, including but not limited to Sarah Kellen, Adriana Ross, Lesley Groff, or Nadia Marcinkova.”_

And it implicated both the US Attorney for the Southern District of Florida (Alex Acosta) and Main Justice in Washington, D.C., which approved (https://twitter.com/Techno_Fog/status/1149421673621458945) of the plea deal, delayed (https://twitter.com/Techno_Fog/status/1289039217553821697) the grand jury, and stopped (https://twitter.com/Techno_Fog/status/1154591014801346560) victims from being notified of the agreement in violation of federal law.

?itok=WJ6X5W3b (

?itok=WJ6X5W3b ( ?itok=WJ6X5W3b)

?itok=WJ6X5W3b)

After that unique and disturbing deal was reached, **questions began to surface regarding Epstein’s relationship with the FBI and US intelligence.** These questions only became more prominent the more we learned of Epstein’s shady financial dealings (https://twitter.com/EricRWeinstein/status/1171794022840459264) and of his relationships with powerful friends (https://www.wsj.com/articles/jeffrey-epstein-documents-woody-allen-larry-summers-edb3e9b2?mod=hp_lead_pos7) and associates in politics, intelligence, business, education, and finance, including: President Bill Clinton, former Prime Minister of Israel Ehud Barak, former CIA Director William Burns, Bill Gates, and former Obama White House Counsel Kathryn Ruemmler.

Adding to the intrigue were the words of Alex Acosta, the then-US Attorney for the Southern District of Florida who gave Epstein his non-prosecution agreement. According to the Daily Beast (https://www.thedailybeast.com/jeffrey-epsteins-sick-story-played-out-for-years-in-plain-sight):

> _Acosta cut the non-prosecution deal with one of Epstein’s attorneys because he had “been told” to back off, that Epstein was above his pay grade. **“I was told Epstein ‘belonged to intelligence’ and to leave it alone.”**_

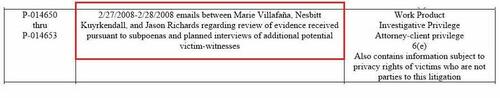

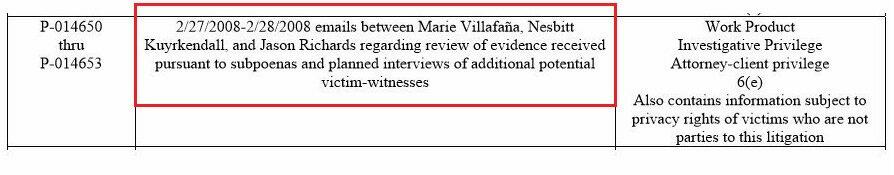

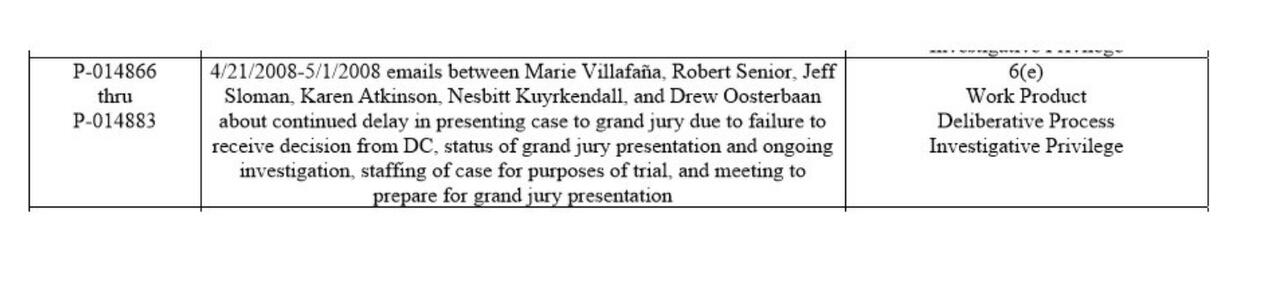

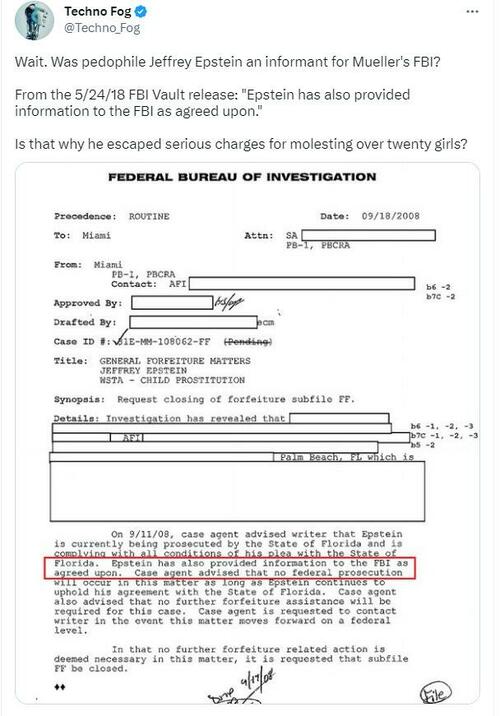

Then we discovered (https://twitter.com/Techno_Fog/status/999708976936767488) (in 2018) that Epstein had been informing the FBI way back in 2008, after his plea deal with the DOJ had been signed.1 (https://technofog.substack.com/p/confirmed-jeffrey-epsteins-history#footnote-1-119087132) In the FBI’s words: “ **Epstein has also provided information to the FBI as agreed upon**.”

?itok=3fjpln4P (

?itok=3fjpln4P ( ?itok=3fjpln4P)

?itok=3fjpln4P)

That raised a red flag, and caused us to suspect that Epstein’s relationship with the FBI went back further than 2008. So we demanded all of Epstein interviews from the FBI. The FBI didn’t deny these records existed; instead, it hid behind (https://technofog.substack.com/p/the-fbi-is-hiding-epstein-records) the FOIA law enforcement exemption.

Good news – we have d…

https://www.zerohedge.com/political/confirmed-jeffrey-epsteins-history-fbi-source

**Stocks & Bond Yields Tumble On 'Hawkish Pause'; Gold Gains As Crude Collapses**

Stocks & Bond Yields Tumble On 'Hawkish Pause'; Gold Gains As Crude Collapses

'Good' headline macro news (strong ADP and ISM Services beat) was somewhat trumped by 'bad' macro news (inflationary pressures re-accelerating under the hood)... all of which do nothing at all to support The Fed's 'easing' anytime soon (strong jobs and resurgent inflation).

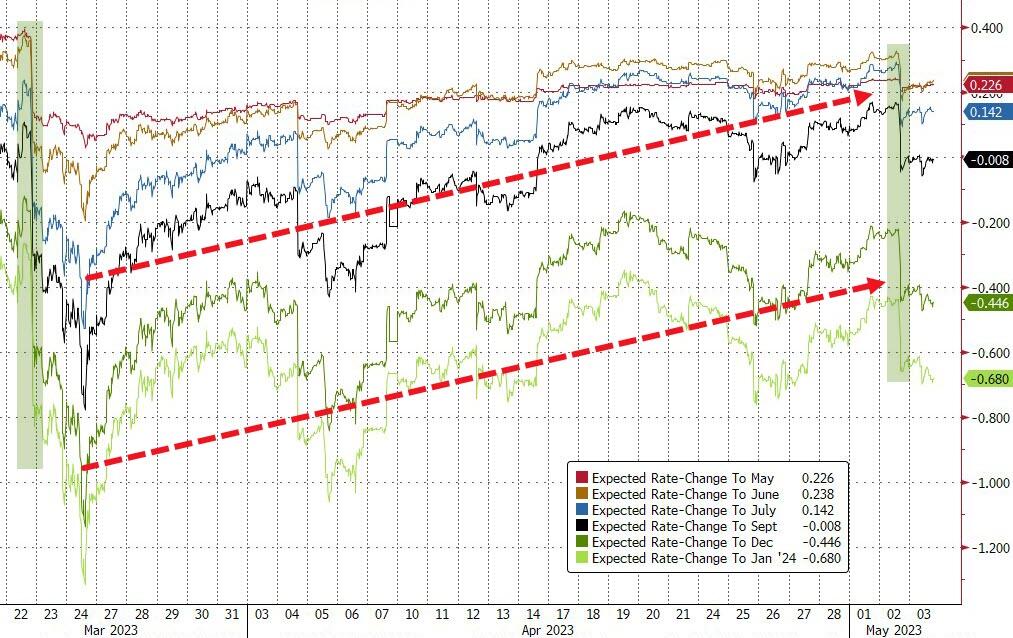

Of course, today was all about Powell and his pals who signaled a 'hawkish pause' (despite the market's very dovish beliefs). June rate-hike odds rose...

?itok=XyWXClbB (

?itok=XyWXClbB ( ?itok=XyWXClbB)

?itok=XyWXClbB)

_Source: Bloomberg_

Now it gets interesting...

?itok=8o4FIv8S (

?itok=8o4FIv8S ( ?itok=8o4FIv8S)

?itok=8o4FIv8S)

_Source: Bloomberg_

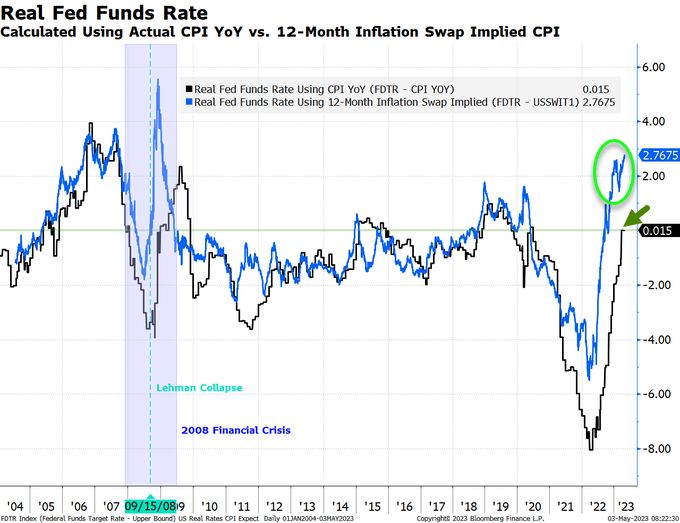

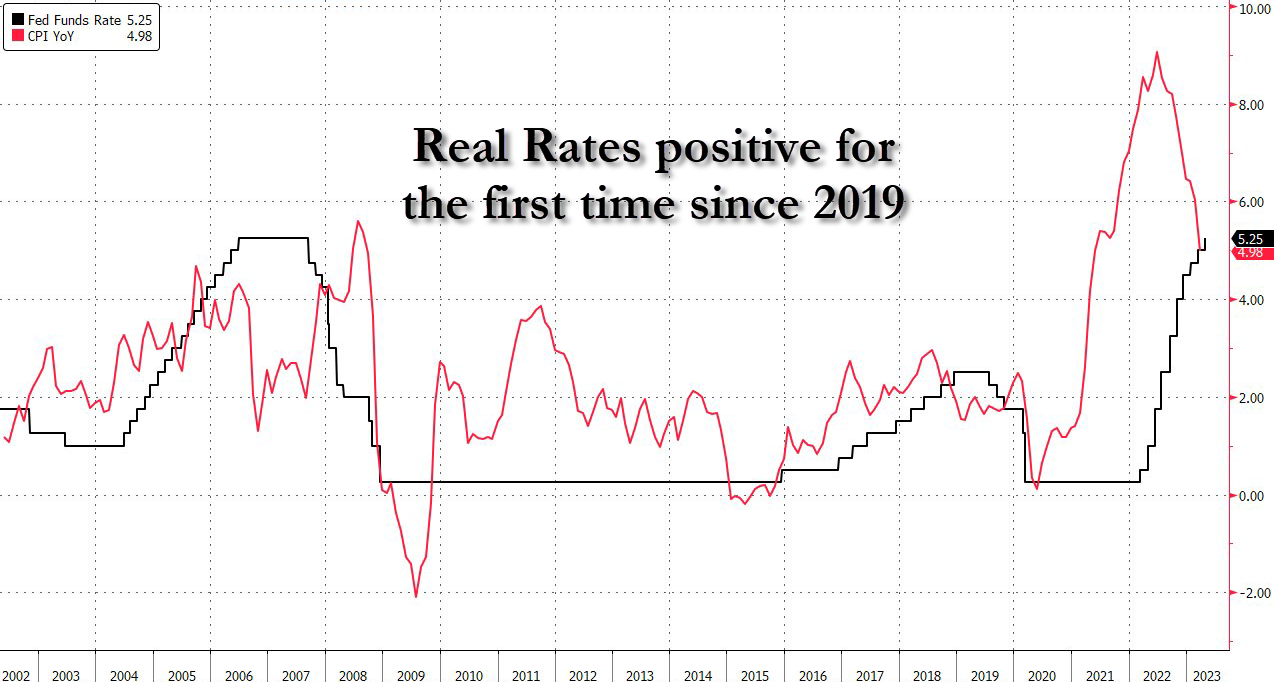

With Real Rates positive for the first time since 2019...

?itok=VVYqHrRL (

?itok=VVYqHrRL ( ?itok=VVYqHrRL)

?itok=VVYqHrRL)

_Source: Bloomberg_

Powell's comments did nothing at all to help (unusually):

- POWELL: **SENIOR LOAN SURVEY CONSISTENT WITH OTHER DATA**

- POWELL: POSSIBLY **AT SUFFICIENTLY RESTRICTIVE LEVEL,** MAY NOT BE FAR OFF

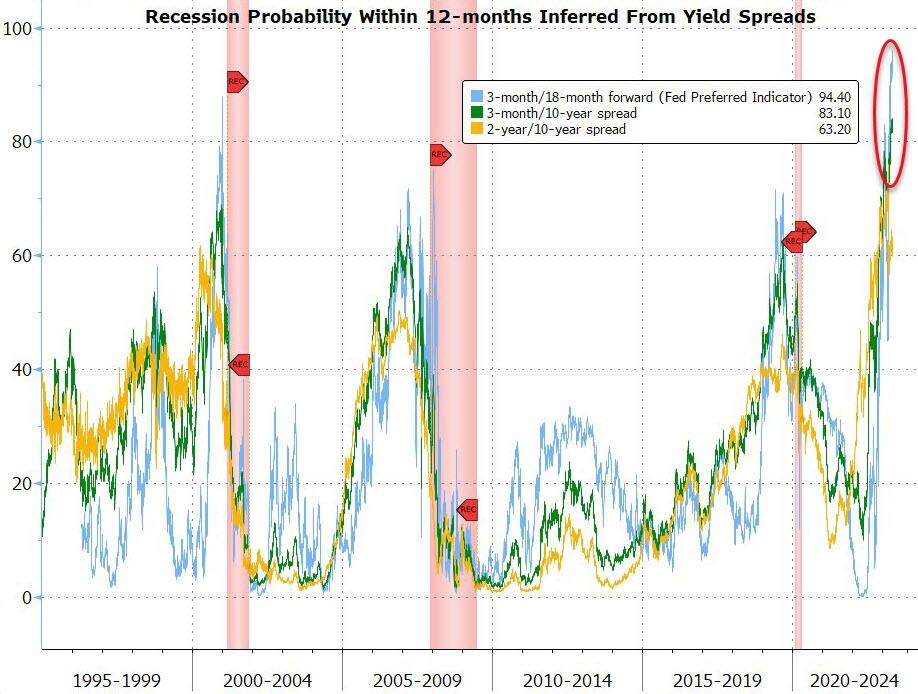

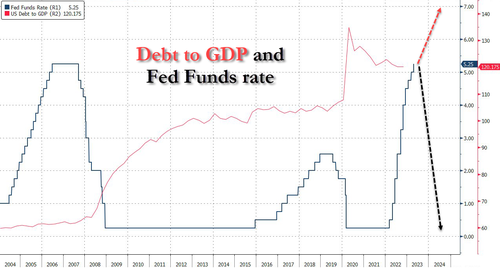

A recession is coming but don't expect rate-cuts...

- POWELL: POSSIBLE **WE'LL HAVE WHAT WOULD BE A MILD RECESSION**

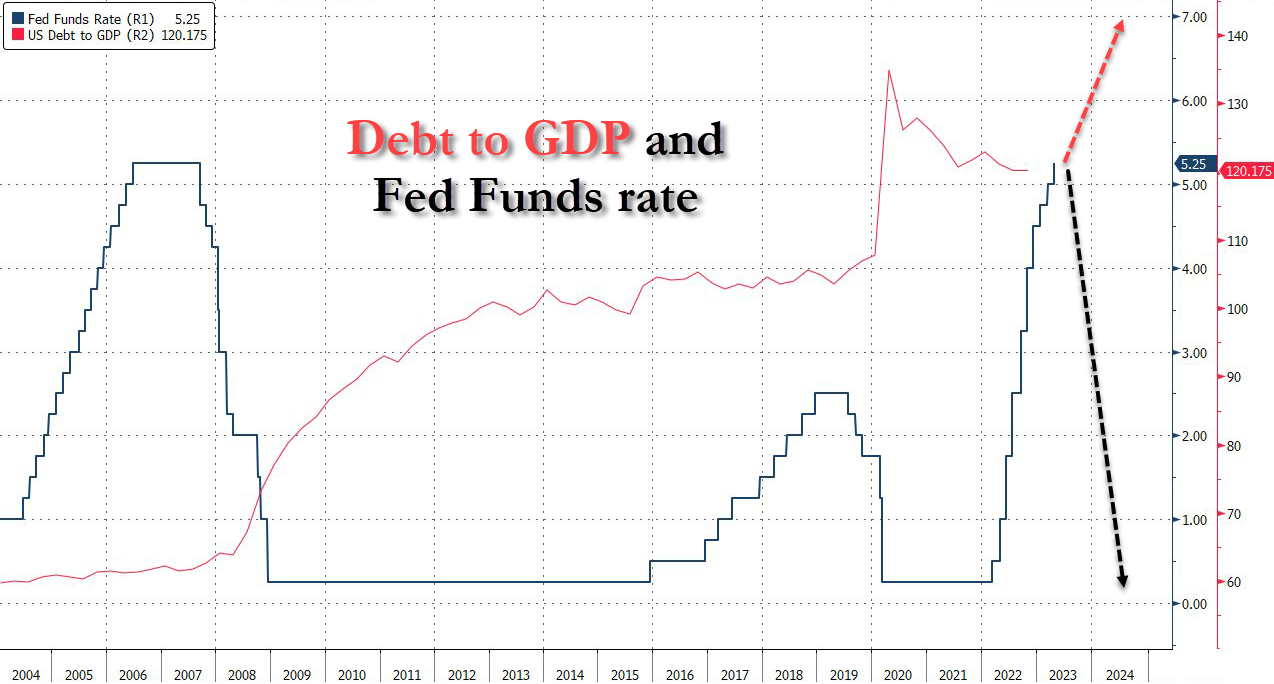

Yield curve gives 94% odds of a recession within 12 months...

?itok=-Bm40F0D (

?itok=-Bm40F0D ( ?itok=-Bm40F0D)

?itok=-Bm40F0D)

Don't believe the market's dovish hype!

- POWELL: **FOMC'S INFLATION OUTLOOK DOESN'T SUPPORT RATE CUTS (the 'inflation is transitory' outlook?)**

And that spooked stocks lower (not helped by Powell's hints at how bad next week's SLOOS data will be). Small Caps managed to hold on to gains but the S&P, Dow, and Nasdaq tumbled...

?itok=Ele_mbfl (

?itok=Ele_mbfl ( ?itok=Ele_mbfl)

?itok=Ele_mbfl)

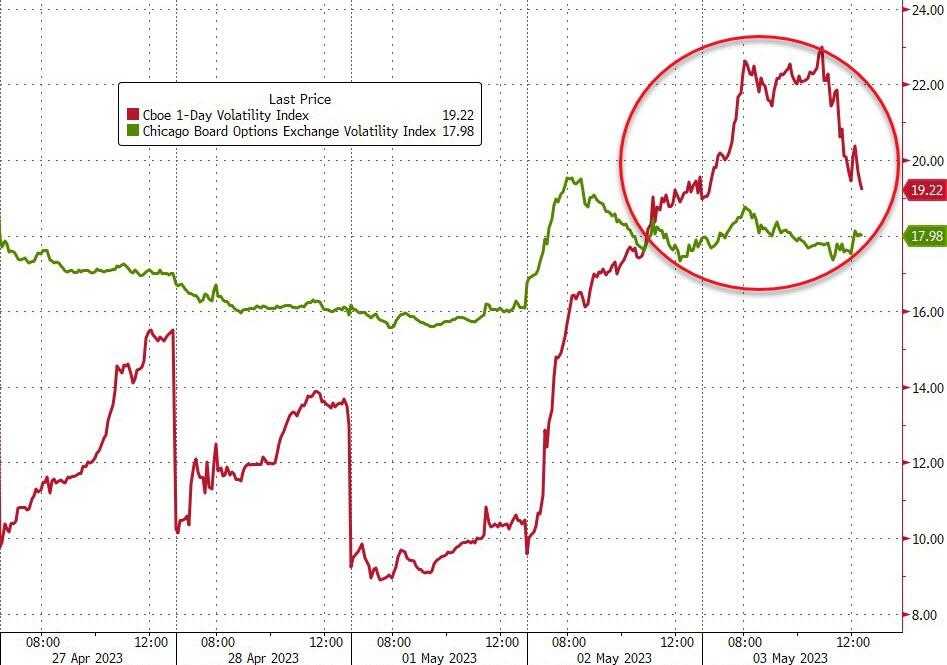

0DTE traders were betting on the downside in a big way today and took profits after the post-Powell puke...

?itok=gB534gK2 (

?itok=gB534gK2 ( ?itok=gB534gK2)

?itok=gB534gK2)

Big reversal in "most shorted" stocks today (which helps explain the early gains in Small Caps)...

?itok=SUfht-YZ (

?itok=SUfht-YZ ( ?itok=SUfht-YZ)

?itok=SUfht-YZ)

_Source: Bloomberg_

**Regional banks puked** after Powell said the banking system was sound and resilient...

?itok=WHqcth7s (

?itok=WHqcth7s ( ?itok=WHqcth7s)

?itok=WHqcth7s)

VIX1D remains notably higher than VIX...

?itok=fE7O0ZO4 (

?itok=fE7O0ZO4 ( ?itok=fE7O0ZO4)

?itok=fE7O0ZO4)

_Source: Bloomberg_

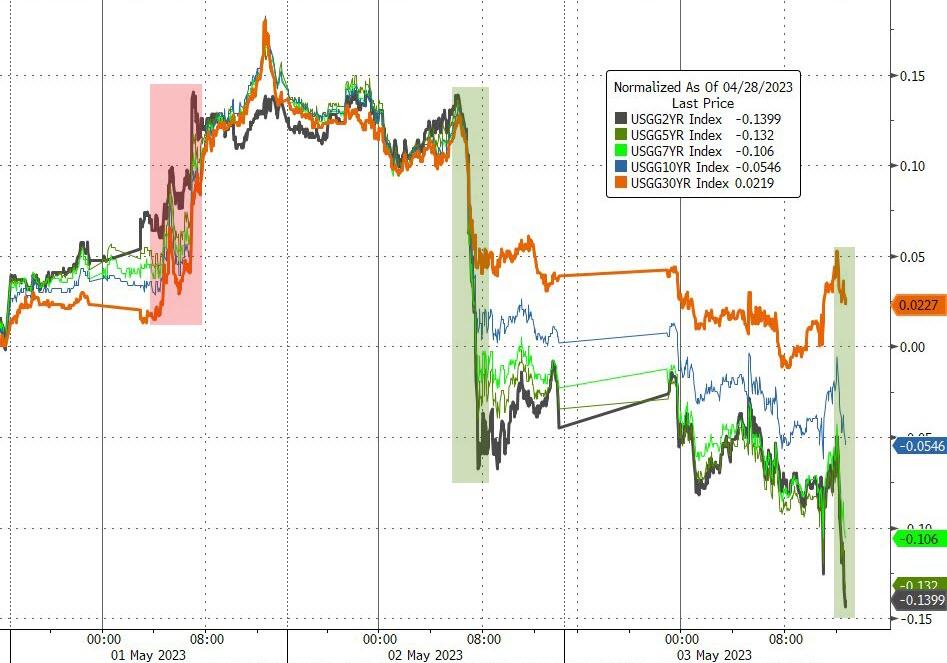

Treasury yields tumbled once again today with the belly of the curve outperforming (5Y -11bps, 30Y -2bps). It's been quite a week in bonds already...

?itok=kVir-bLB (

?itok=kVir-bLB ( ?itok=kVir-bLB)

?itok=kVir-bLB)

_Source: Bloomberg_

The 2Y extended below 4.00%

?itok=iLUTmdUc (

?itok=iLUTmdUc ( ?itok=iLUTmdUc)

?itok=iLUTmdUc)

_Source: Bloomberg_

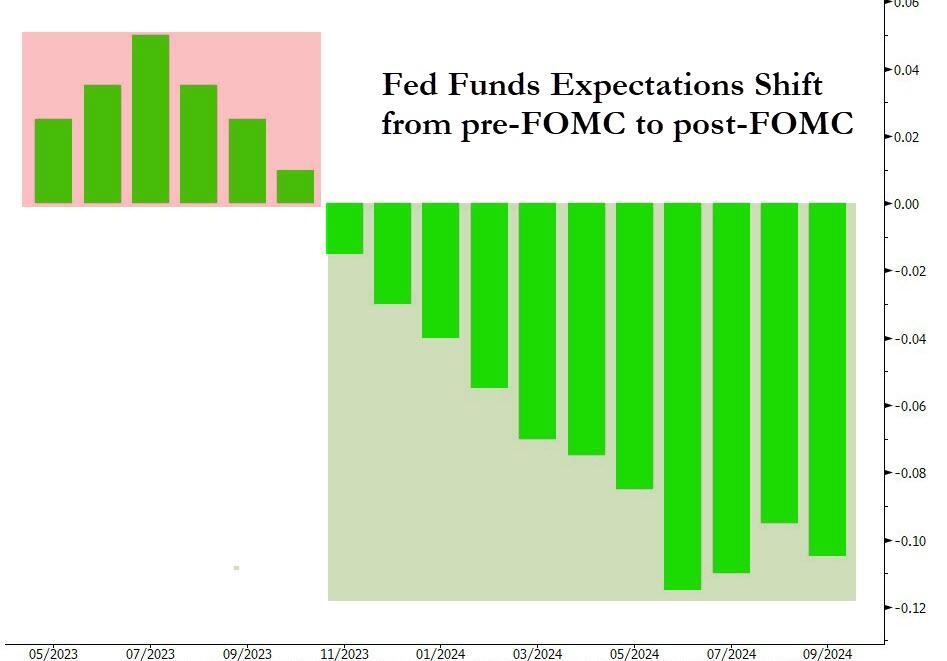

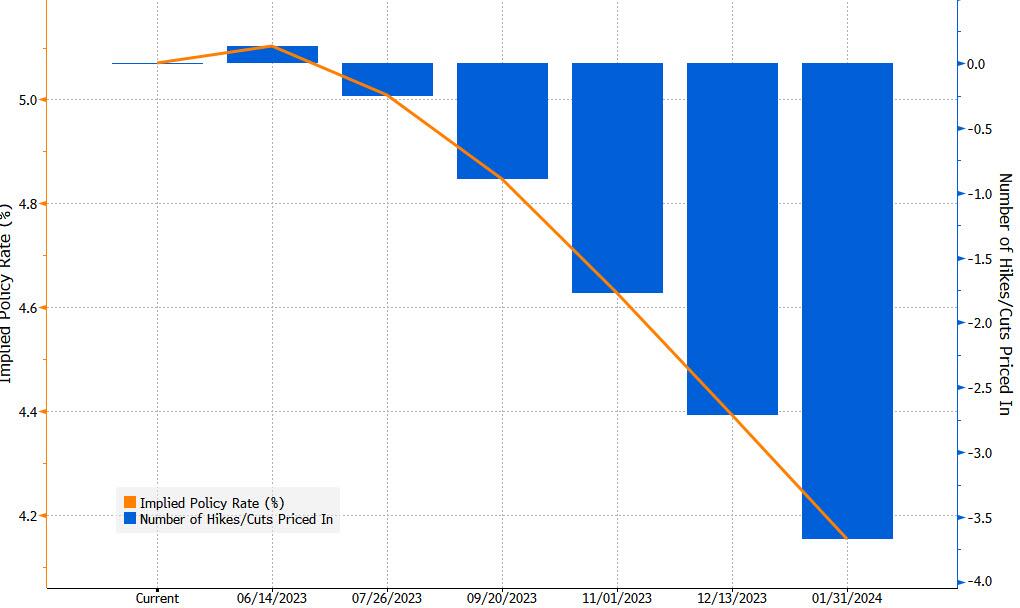

The STIRs curve adjusted (small) hawkishly in the shortest end but notably more dovish next year on...

?itok=IVF-9pLk (

?itok=IVF-9pLk ( ?itok=IVF-9pLk)

?itok=IVF-9pLk)

_Source: Bloomberg_

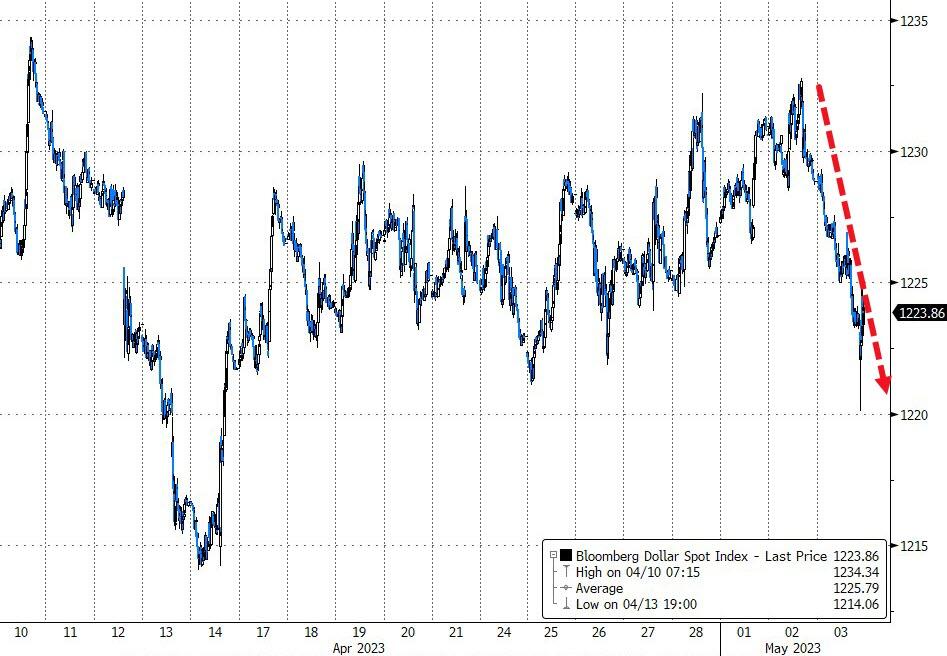

The Dollar dived on the day to two-week lows...

?itok=znY07aCH (

?itok=znY07aCH ( ?itok=znY07aCH)

?itok=znY07aCH)

_Source: Bloomberg_

Bitcoin chopped around but ended marginally lower...

https://www.zerohedge.com/markets/markets-shrug-powells-hawkish-pause-crude-collapse-continues

**One And Done-ish?**

One And Done-ish?

_By Peter Tchir of Academy Securities_

**One and Done-ish**

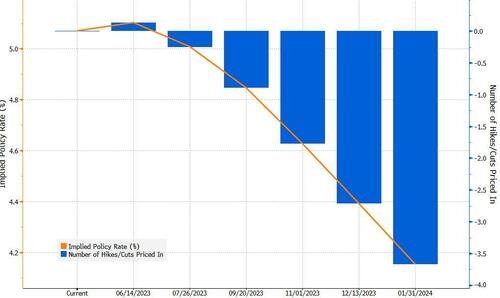

One and Done seems to have been priced in, and we “kind of” got that, though I’ll call it “Donish”. They will decide what to do in June for the June meeting (seems like what they should do at every meeting). So, we are stuck with divining what data they pay more or less attention to, and waiting for that data to roll in.

?itok=_9BESs8F (

?itok=_9BESs8F ( ?itok=_9BESs8F)

?itok=_9BESs8F)

Powell seems to **downplay the risk of financial conditions tightening** as result of ongoing pressure on bank valuations. **Negative for risk**.

**Given where inflation is, and the messaging from today**, it seems that for now markets will have to go between pricing in 0 and 25 bps. With WIRP pricing in about a 10% chance of a hike at next meeting (3 pm EST), that seems about right. **A tiny negative for risk**.

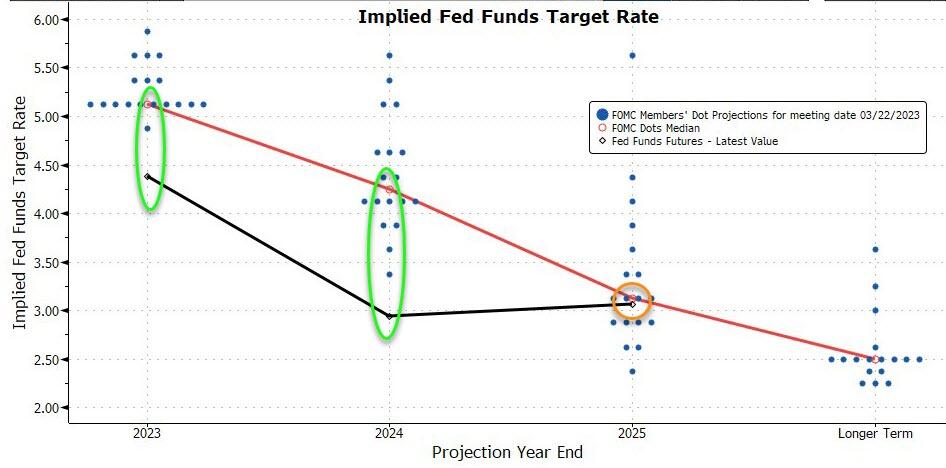

**Markets are still pricing in multiple cuts by year-end.** I agree that should be the path, **but “donish” is far from “dovish”** and that is all we got today. Look for a battle between the Fed and markets in the coming days as they try to jawbone away cuts later this year. Maybe that is why he is so adamant that 2% is their target, not some 3% “soft” target.

**Quantitative tightening remains in play**, as it should, but I continue to believe that QT has more of an impact on risk asset prices, than rate hikes or cuts (at least in the near term). **Negative for risk**.

**My takeaway is that so long as jobs are strong**, 2% is their inflation target and they will push on the economy. I’m okay with that so long as we strength in all segments of the job market (I’m concerned about the state of higher income jobs in this economy).

**The topics from this week’s Smooth Sailing T-Report, remain relevant.**

- Inventories, the Consumer, Inflation, Not a Short Squeeze, M2, the Fed, Jobs, the Debt Ceiling and China and other Geopolitical Risks.

The biggest change from this weekend, to the negative, is the broad pressure on banks again after the FRC deal.

So far, not seeing inordinate buying pressure in markets and even 0DTE options seem reasonably well behaved.

**The bad news for bears** (of which I remain one) is Powell did a very solid job on this press conference. No “gotcha” type of moments and “donish” is better than being hawkish, which was a plausible (unlikely, but plausible) stance for the Fed to take.

**The good news for bears** is that despite all sorts of recent stories about record short positions in stock futures, the market isn’t trading at all like there is a short squeeze, which makes me wonder if there are some very lager long positions (potentially concentrated in a small number of stocks), using the broad market as a hedge. I’m starting to believe that is the positioning, which to me makes me want to start any long positions with the laggards, while avoiding the highest fliers of recent weeks and months.

Tyler Durden (https://cms.zerohedge.com/users/tyler-durden)Wed, 05/03/2023 - 15:51

**Wall Street Reacts To Powell's Hawkish Pause**

Wall Street Reacts To Powell's Hawkish Pause

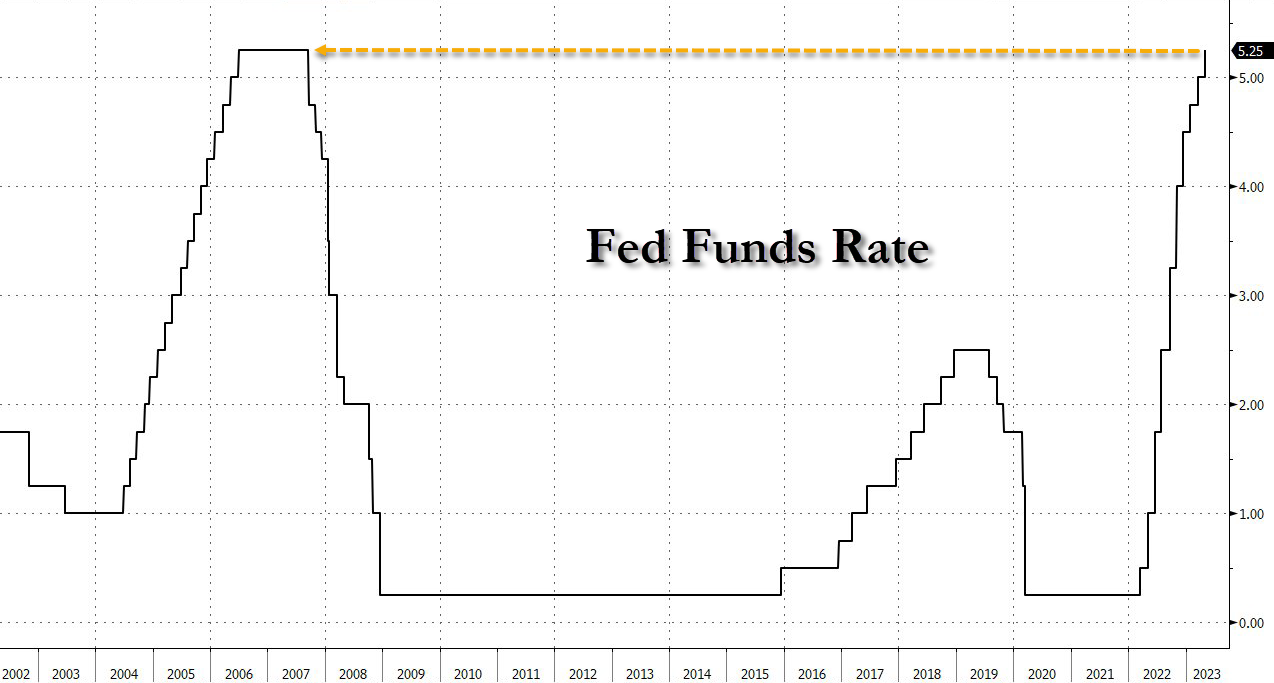

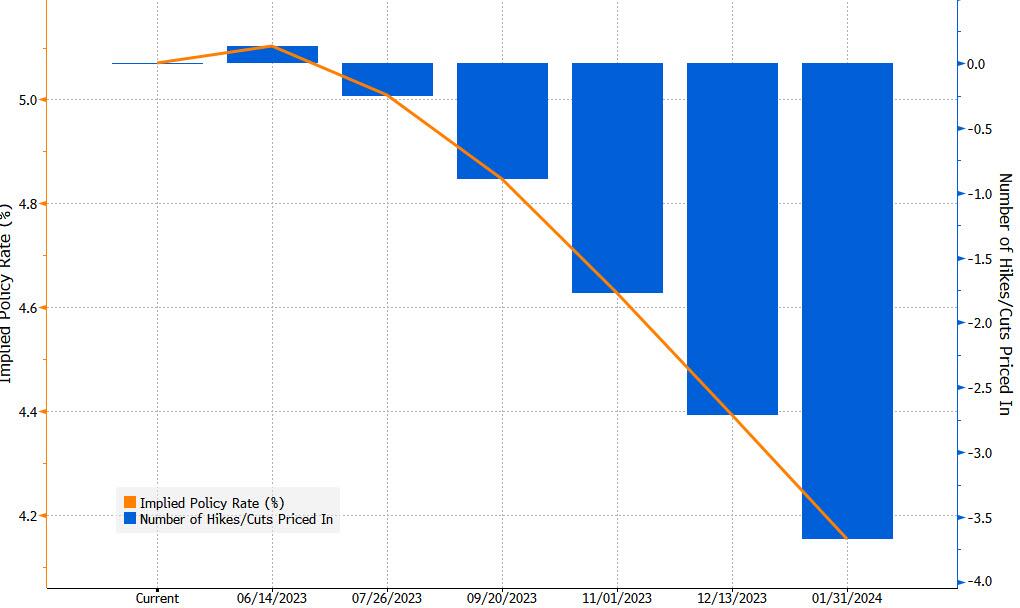

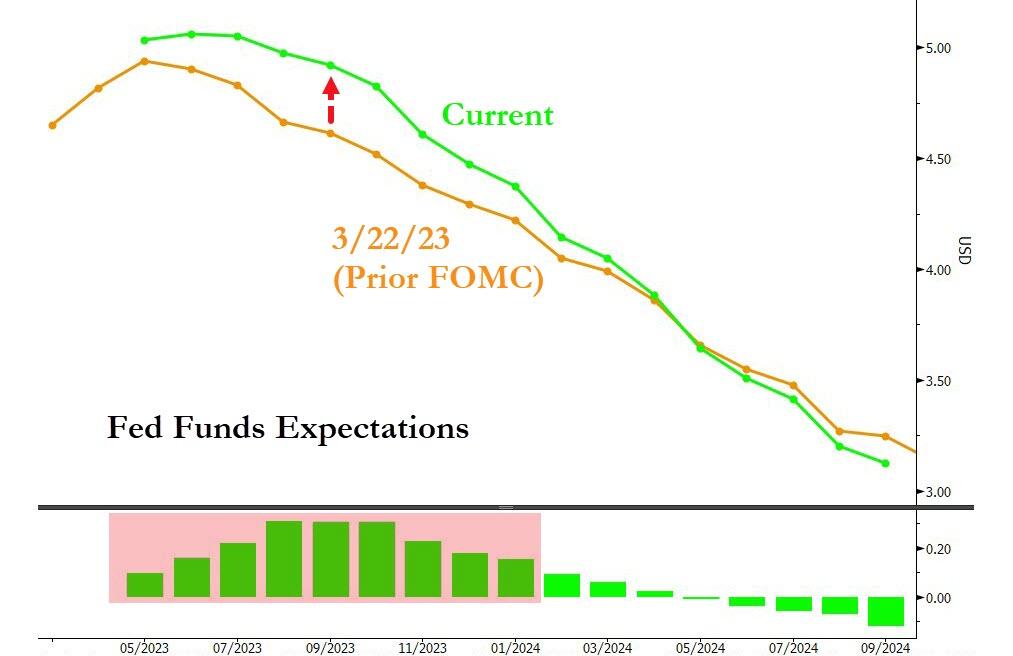

While opinions differed on the margin, the broad consensus is that the Fed just paused its rate hike campaign - pulling a line, literally, from its 2006 FOMC statement when it also was dragged, kicking and screaming, into a Fed pause (before all hell eventually broke loose - after the 10th consecutive rate hike, lifting rates by 25bps to 5.25%. And while the market now sees the Fed as now done and starting to cut as soon as September...

?itok=sN7g6rVI (

?itok=sN7g6rVI ( ?itok=sN7g6rVI)

?itok=sN7g6rVI)

... here is a smattering of Wall Street hot takes on the topic, most of which are largely in agreement.

**Jeff Gundlach, Doubleline:**

> _"I suspect the Fed won't raise rates again"_

**Bloomberg Economics’ Chief US Economist Anna Wong**

> _“The Fed has marked 5.25% as the terminal rate in this tightening cycle, raising rates by another 25 basis points at the May FOMC meeting — and, more importantly, signaling in the policy statement that this will be the last hike for a while. “Bloomberg Economics expects the Fed to pause at its June meeting, at which point the labor market will be showing clearer signs of softening. We expect the Fed to hold rates at this peak level through 1Q24 as inflation comes down only very gradually.”_

**Bloomberg Intelligence Chief Rates Strategist Ira Jersey**

> _"The belly of the yield curve is outperforming given the relatively dovish statement from the FOMC, and that may continue beyond today. The removal of the Fed’s ‘firming’ language is telling. It allows the Fed to hike if needed without pre-committing as they basically have during recent meetings. We think they are likely to pause in June, but that’s not a given.”_

**Bloomberg Economics’ Stuart Paul:**

> _“In his press conference, Powell noted that the balance between labor supply and demand is coming into better balance, with prime participation increasing and job vacancies declining. However, he was clear that the Fed views the labor market as still very tight.”_

>

> _\\* \* \*_

>

> _“In one of the few answers that he didn’t have well-scripted in the presser, Powell was slow to specify just how tight monetary policy would remain if headline inflation stayed around 3% on a year-over-year basis for a prolonged period of time. At 3% inflation, he acknowledged, the employment and price stability mandates would carry equal weight.”_

**George Goncalves, head of US macro strategy at MUFG,**

> _"The statement chimes with the Fed’s take back in 2006, when it pushed the funds rate to a peak of 5.25%. They never flat-out come out with ‘we are done’ but this was as close as they could have done so in my book. It’s codified in the statement -- like 2006.”_

**Jan Hatzius, Goldman Sachs chief economist**

> _"As we expected, the FOMC balanced the hint toward a June pause with a clear message that it retains a hawkish bias, noting that it would take into account “the cumulative tightening of monetary policy, the lags with which monetary policy affects economic activity and inflation, and economic and financial developments” in “determining the extent to which additional policy firming may be appropriate”._

**Ellen Zentner, Morgan Stanley**

> _The May statement held little surprise vs our expectation. The Fed delivered a 25bp hike, setting the range of the federal funds rate at 5.00% to 5.25%, and has moved into a conditional pause... **We also expected the Fed to memorialize how long rates would remain elevated and it chose not to. That can be interpreted as more dovish than we expected,** particularly when compared to Governor Waller's recent - more hawkish - warning that policy would remain tight for "longer than markets anticipate"._

**Ian Lyngen of BMO:**

> _“Powell will strike a dovish tone and stress the heightened uncertainty as the cumulative tightening works its way through the real economy."_

**BE’s Anna Wong:**

> _“It’s notable that Powell openly admits he disagrees with Fed staff’s forecasts. Even though Fed governors and presidents don’t always agree with staff forecasts, staff views are often the benchmark that guide members’ forecasts. For the Fed chair to admit he disagrees with staff forecasts is a vote of no-confidence in their reliability.”_

**Renaissance Macro:**

> _"At this point, the Fed call is a call on the evolution of the economic data. If we are right, the Fed may well be revising up their growth estimates in the June SEP. Events might allow the Fed to skip that meeting, but ultimately, we expect another hike (or two) this year."_

**Viraj Patel, Vanda Research**

> _"Given the amount that Powell is talking about credit tightening... SLOOS clearly tightened quite significantly (from already…

https://www.zerohedge.com/markets/wall-street-reacts-powells-hawkish-pause

**FTC Says "Facebook Repeatedly Violated Its Privacy Promises," Puts "Young Users At Risk"**

FTC Says "Facebook Repeatedly Violated Its Privacy Promises," Puts "Young Users At Risk"

Meta, the parent company of the Facebook platform, has **failed to comply with the Federal Trade Commission's 2020 privacy order** that bars the social media company from profiting off data it collects from young users. Shares of Meta slid as much as 2% on the news.

" **Facebook has repeatedly violated its privacy promises**," said Samuel Levine, Director of the FTC's Bureau of Consumer Protection. He said Meta's " **recklessness has put young users at risk**, and Facebook needs to answer for its failures."

As part of the proposed changes, Meta, which changed its name from Facebook in 2021, would be **prohibited from profiting from data it collects, including through its virtual reality products, from users under the age of 18. It would also be subject to other expanded limitations, including in its use of facial recognition technology, and required to provide additional protections for users**.

**Wednesday's action by the FTC signifies an unwelcome reemergence of controversy for Meta** and its platforms, Facebook and Instagram. Following previous FTC investigations into its privacy practices, the company paid a $5 billion civil penalty in 2019.

This **marks the third time the FTC has pursued action against Meta** for allegedly failing to protect users' privacy. The agency explains the timeline of events:

> _The Commission first filed a complaint against Facebook in 2011, and secured an order in 2012 barring the company from misrepresenting its privacy practices. But according to a subsequent complaint filed by the Commission, Facebook violated the first FTC order within months of it being finalized – engaging in misrepresentations that helped fuel the Cambridge Analytica scandal. In 2019, Facebook agreed to a second order—which took effect in 2020—resolving claims that it violated the FTC's first order. Today's action alleges that Facebook has violated the 2020 order, as well as the Children's Online Privacy Protection Act Rule (COPPA Rule)._

Shares of Meta slid 2% on the news but have rebounded since...

?itok=aBzsFMdC (

?itok=aBzsFMdC ( ?itok=aBzsFMdC)

?itok=aBzsFMdC)

The **FTC requested that Meta respond to its proposed findings within 30 days**.

Meta's spokesperson responds...

> Meta's statement on the FTC's political stunt. pic.twitter.com/XEPHvriKFY (https://t.co/XEPHvriKFY)

>

> — Andy Stone (@andymstone) May 3, 2023 (https://twitter.com/andymstone/status/1653812002819649536?ref_src=twsrc%5Etfw)

... and **calls FTC's move a "political stunt."**

Tyler Durden (https://cms.zerohedge.com/users/tyler-durden)Wed, 05/03/2023 - 15:25

**Fed Hikes 25bps As Expected, Signals 'Hawkish Pause'; Warns Of 'Tighter Credit Standards'**

Fed Hikes 25bps As Expected, Signals 'Hawkish Pause'; Warns Of 'Tighter Credit Standards'

**Tl:dr;** Fed raises rates by 25 bps as expected.

Policy statement softens the rate guidance in a way **consistent with past pauses** and The Fed **deletes reference to "some additional policy firming may be appropriate."**

A clear hat-tip to the banking crisis:

> "Recent development are likely to result in tighter credit conditions" removed and replaced with "Tighter credit conditions"

The decision was **unanimous**.

As WSJ Fed Whisperer Nick Timiraos notes: _"The FOMC statement **used language broadly similar to how officials concluded their interest-rate increases in 2006**, with no explicit promise of a pause by retaining a bias to tighten."_

_ ?itok=sEPD5q7n (

?itok=sEPD5q7n ( ?itok=sEPD5q7n)_

?itok=sEPD5q7n)_

**This is clearly more of a hawkish pause since it doesn't suggest whether 'policy easing' may be appropriate...**

?itok=jivh33TT (

?itok=jivh33TT ( ?itok=jivh33TT)

?itok=jivh33TT)

**...but then again, if Powell had gone that far, markets would have panicked over "what does he know"?**

What happens next?

?itok=EyzrMwvv (

?itok=EyzrMwvv ( ?itok=EyzrMwvv)

?itok=EyzrMwvv)

\* \* \*

Since March 22 (the last FOMC statement, which included the dot-plot and economic projections), markets have been 'just a little bit turbo' but amid all that vol, bonds and stocks are modestly higher while the dollar has tumbled and alternative currencies (bitcoin and gold) have outperformed...

?itok=oRgEK9ZJ (

?itok=oRgEK9ZJ ( ?itok=oRgEK9ZJ)

?itok=oRgEK9ZJ)

_Source: Bloomberg_

However, **The Fed’s preferred recession rate-spread indicator** (3-month/18-month forward) is now flashing red **implying a 94% probability of a recession within the next year**

?itok=o3S499ia (

?itok=o3S499ia ( ?itok=o3S499ia)

?itok=o3S499ia)

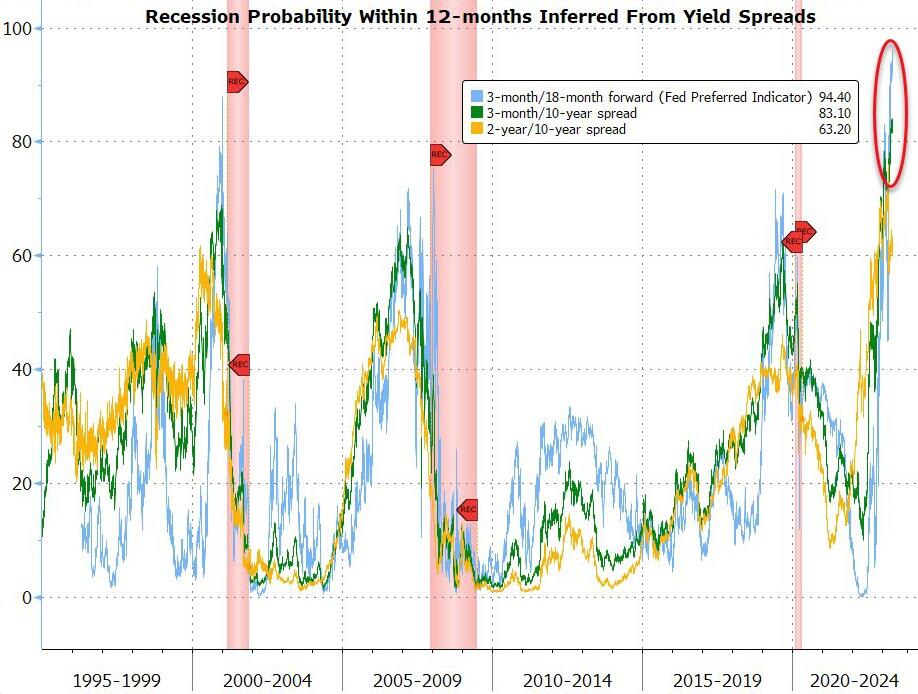

Interestingly, the market's expected rate trajectory of The Fed has shifted somewhat hawkishly, mainly due to the plunge in rate-hike odds that occurred on the day of the FOMC meeting...

?itok=KVpTxzx5 (

?itok=KVpTxzx5 ( ?itok=KVpTxzx5)

?itok=KVpTxzx5)

_Source: Bloomberg_

Rate-hike expectations have drifted higher since the last FOMC...

?itok=ybx4aK3M (

?itok=ybx4aK3M ( ?itok=ybx4aK3M)

?itok=ybx4aK3M)

_Source: Bloomberg_

**Today's 25bp hike is a lock from the market's perspective,** but what is really the focus today is any hints that The Fed is done (and the market for now, is convinced they will be with **just 5% odds of a 25bp hike in June**).

But, **the market remains massively dovishly divergent from The Fed**'s dotplot rate expectations for this year and next...

?itok=ftqaVW46 (

?itok=ftqaVW46 ( ?itok=ftqaVW46)

?itok=ftqaVW46)

As we noted earlier,a single sentence in the FOMC statement (https://www.zerohedge.com/markets/single-sentence-will-define-everything-heres-what-fed-will-say-today) will change everything everything today and all eyes will also be on whether there are any dissents.

- Federal Open Market Committee raises benchmark rate by 25 basis points, as forecast, to target range of 5%-5.25%

This hike moves Real Rates positive for the first time since 2019...

?itok=R0vLSOLY (

?itok=R0vLSOLY ( ?itok=R0vLSOLY)

?itok=R0vLSOLY)

- **FOMC omits prior language saying “some additional policy firming” may be warranted, suggesting Fed could pause at the next meeting**

- FOMC will take into account various factors “in determining the extent to which additional policy firming may be appropriate”

**And the vote was unanimous.**

Additionally, The Fed highlights the impact of the banking crisis:

> **_FO…

**The Path To Full Stagflation**

The Path To Full Stagflation

_Authored by Peter Earle via The American Institute for Economic Research,_ (https://www.aier.org/article/the-path-to-full-stagflation/)

In an article last week, I referred to the combination of rapidly slowing US economic growth and persistently high inflation as “stagflation lite (https://www.aier.org/article/stagflation-lite-1st-quarter-us-gdp-growth-weakens-to-1-1-percent-amid-a-renewed-inflationary-surge/).” Despite receding from the highs of last summer, **inflation remains near its highest levels in decades as disinflation (particularly in services) has recently slowed to a crawl.**

Meanwhile, **US economic growth has been on a downward trajectory over the past few years**, including a brief recession in the middle two quarters of 2022.

?itok=VT3KUj5Y (

?itok=VT3KUj5Y ( ?itok=VT3KUj5Y)

?itok=VT3KUj5Y)

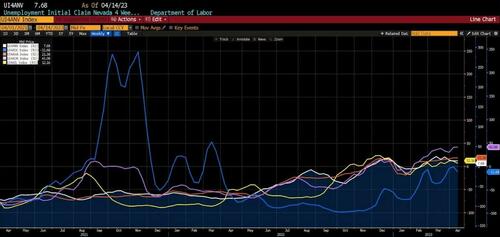

**What’s currently missing from the full stagflationary scenario is elevated unemployment.** The Bureau of Labor Statistics reported the U-3 US unemployment rate (https://fred.stlouisfed.org/series/UNRATE) as 3.5 percent in March 2023, which is near historic lows. Indeed, low employment has been a thorn in Fed officials’ side since they began hiking short-term rates in March of 2022. The below chart depicts the current, stagflation lite conditions: high inflation (March 2023 year-over-year headline CPI at roughly 5 percent), declining economic growth (1st quarter 2023 US GDP at 1.1 percent), and U-3 employment at 3.5 percent.

?itok=a9MA7f_Y (

?itok=a9MA7f_Y ( ?itok=a9MA7f_Y)

?itok=a9MA7f_Y)

_(Source: Bloomberg Finance, LP)_

Could a full stagflationary episode evolve from this? It’s possible that one already is, according to two sources of data.

First, a look at unemployment data on a state-by-state basis. Tracking the 4-week, year-over-year percentage changes in initial filings for unemployment, 24 of 51 states (50 states plus Washington DC) are showing an average 10-percent or greater increase in those filings over the period from mid-March 2023 to mid-April 2023.

The ten US states with the lowest unemployment rates (https://www.bls.gov/web/laus/laumstrk.htm), as of mid-April 2023, include the following: South Dakota (1.9 percent), Nebraska (2.1 percent), North Dakota (2.1 percent), Alabama (2.3 percent), Montana (2.3 percent), New Hampshire (2.4 percent), Utah (2.4 percent), Missouri (2.5 percent), Wisconsin (2.5 percent), and Florida (2.6) percent. Below are the recent trends in initial unemployment filings in those low-unemployment-rate states.

**Initial Unemployment Claims in High Employment States: South Dakota, Nebraska, Alabama, North Dakota, and Montana (April 2021 – April 2023)**

?itok=MmahS5Us (

?itok=MmahS5Us ( ?itok=MmahS5Us)

?itok=MmahS5Us)

_(Source: Bloomberg Finance, LP)_

**Initial Unemployment Claims in High Employment States: New Hampshire Utah, Missouri, Wisconsin, and Florida (April 2021 – April 2023)**

?itok=Y5s_Wzt0 (

?itok=Y5s_Wzt0 ( ?itok=Y5s_Wzt0)

?itok=Y5s_Wzt0)

_(Source: Bloomberg Finance, LP)_

The ten US states with the highest unemployment rates (https://www.bls.gov/web/laus/laumstrk.htmhttps://www.bls.gov/web/laus/laumstrk.htm) (again, as of mid-April 2023) include: Michigan (4.1 percent), New York (4.1 percent), Pennsylvania (4.2 percent), California (4.4 percent), Delaware (4.4 percent), Illinois (4.4 percent), Washington (4.5 percent), District of Columbia (4.8 percent), and Nevada (5.5 percent). Below are the trends in initial unemployment claims in the highest unemployment states.

**Initial Unemployment Claims in Low Employment States: Michigan, New York, Pennsylvania, California, and Delaware (April 2021 – April 2023)**

?itok=knXUdS_w (

?itok=knXUdS_w ( ?itok=knXUdS_w)

?itok=knXUdS_w)

_(Source: Bloomberg Finance, LP)_

**Initial Unemployment Claims in Low Employment States: Oregon, Illinois, Washington, District of Columbia, and Nevada (April 2021 – April 2023)**

?itok=5gX9iAiK (

?itok=5gX9iAiK ( ?itok=5gX9iAiK)

?itok=5gX9iAiK)

_(Source: Bloomberg Finance, LP)_

In most of the ten US states with the lo…

**Joe Biden 'Engaged In A Bribery Scheme With A Foreign National': FBI Internal Document Alleges**

Joe Biden 'Engaged In A Bribery Scheme With A Foreign National': FBI Internal Document Alleges

President Joe Biden allegedly participated in "a criminal scheme" to exchange money for policy decisions, according to Sen. Chuck Grassley (R-IA) and Rep. James Comer (R-KY), citing an internal FBI document they say contains evidence of the alleged bribery which took place when Biden was Vice President.

?itok=orecN4mb (

?itok=orecN4mb ( ?itok=orecN4mb)

?itok=orecN4mb)

"We have received legally protected and highly credible unclassified whistleblower disclosures, " reads a Wednesday letter addressed to Attorney General Merrick Garland and FBI Director Christopher Wray. " **It has come to our attention that the Department of Justice (DOJ) and Federal Bureau of Investigation (FBI) possess an unclassified FD-1023 form that describes an alleged criminal scheme involving then-Vice President Biden and a foreign national relating to the exchange of money for policy decisions.** It has been alleged that the document **includes a precise description** of how the alleged criminal scheme was employed as well as its purpose."

> 🚨🚨🚨@RepJamesComer (https://twitter.com/RepJamesComer?ref_src=twsrc%5Etfw) & @ChuckGrassley (https://twitter.com/ChuckGrassley?ref_src=twsrc%5Etfw) reveal the existence of an FBI record alleging then-VP Biden engaged in a bribery scheme with a foreign national.

>

> According to a whistleblower, this record details an alleged arrangement involving an exchange of money for policy decisions.… pic.twitter.com/6yLwPLi8Hw (https://t.co/6yLwPLi8Hw)

>

> — Oversight Committee (@GOPoversight) May 3, 2023 (https://twitter.com/GOPoversight/status/1653821776227344389?ref_src=twsrc%5Etfw)

"We believe the FBI possesses an unclassified internal document that includes very serious and detailed allegations implicating the current President of the United States," said Grassley in a joint statement (https://oversight.house.gov/release/grassley-comer-demand-fbi-record-alleging-criminal-scheme-involving-then-vp-biden/).

"The information provided by a whistleblower raises concerns that **then-Vice President Biden allegedly engaged in a bribery scheme with a foreign national**. The American people need to know if President Biden sold out the United States of America to make money for himself," said Comer.

> _**Grassley has long raised concerns (https://urldefense.com/v3/__https:/www.grassley.senate.gov/news/news-releases/fbi-possesses-significant-impactful-voluminous-evidence-of-potential-criminality-in-biden-family-business-arrangements__;!!Bg5easoyC-OII2vlEqY8mTBrtW-N4OJKAQ!LEEbtMd8pJylU8I53rOhsYIMT9YH2fP8Wz1MVMxi_LRkszfE56_3B1tUgybXKu7VP4NS__HZ5HKBh4xeAFWHeYVVqBGOI0-guV0ejggD%24) about political bias infecting high-level investigative decisions at the FBI,** including investigations related to the Biden family’s foreign business arrangements (https://urldefense.com/v3/__https:/www.finance.senate.gov/chairmans-news/johnson-grassley-release-report-on-conflicts-of-interest-investigation__;!!Bg5easoyC-OII2vlEqY8mTBrtW-N4OJKAQ!PfiSmmOiufGU3qQPgugbifoIs9DC2YfXXorhEG3z6VtoTglayYN1VbLIp6dh1WPKXTQ0XZiTFgs7DGyC42DP31fZkMqUH2O_7hTsBst7%24) and bank records (https://urldefense.com/v3/__https:/www.grassley.senate.gov/news/news-releases/grassley-johnson-share-investigative-material-with-prosecutors-in-hunter-biden-criminal-probe__;!!Bg5easoyC-OII2vlEqY8mTBrtW-N4OJKAQ!PfiSmmOiufGU3qQPgugbifoIs9DC2YfXXorhEG3z6VtoTglayYN1VbLIp6dh1WPKXTQ0XZiTFgs7DGyC42DP31fZkMqUH2O_7jQ-nD0u%24). While FBI Director Christopher Wray pledged (https://urldefense.com/v3/__https:/www.youtube.com/watch?v=xdipZimIkqc__;!!Bg5easoyC-OII2vlEqY8mTBrtW-N4OJKAQ!LEEbtMd8pJylU8I53rOhsYIMT9YH2fP8Wz1MVMxi_LRkszfE56_3B1tUgybXKu7VP4NS__HZ5HKBh4xeAFWHeYVVqBGOI0-guaQtssfw%24) to prevent any retaliation targeting whistleblowers, the FBI and Justice Department have thus far refused to voluntarily provide responsive records or answers to congressional inquiries related to its handling of these politically sensitive investigations._

>

> _**Comer and the Oversight Committee are investigating the Biden family’s suspicious business schemes (https://oversight.house.gov/landing/biden-family-investigation/) to determine if the Biden family has been targeted by foreign actors,** if President Biden is compromised, and if there is a national security threat. The Oversight Committee has obtained thousands of pages of financial records related to the Biden family and their associates’ business transactions. Recently, the Committee revealed one deal (https://oversight.house.gov/wp-content/uploads/2023/03/Bank-Records-Memo-3.16.23.pdf) that resulted in several members of the Biden family and their companies **receiving over $1 …

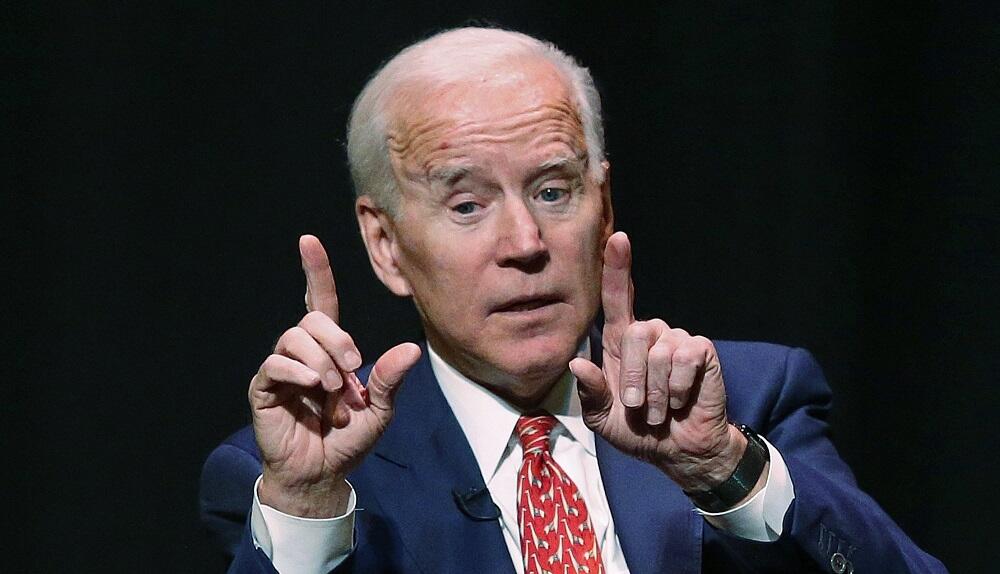

**ADP Payrolls Unexpectedly Surge To 9 Month HIgh Amid "Clear Slowdown In Pay Growth"**

ADP Payrolls Unexpectedly Surge To 9 Month HIgh Amid "Clear Slowdown In Pay Growth"

Following yesterday's ugly JOLTS data, which was so bad it actually sent stocks lower amid fears of a hard landing, moments ago the ADP - always one to surprise with its shocking wrong data, constant revisions notwithstanding - shocked when it printed showing a huge gain for April private payrolls, which more than doubled from a downward revised 142K print in March to 296K in April.

?itok=nxI_ymVA (

?itok=nxI_ymVA ( ?itok=nxI_ymVA)

?itok=nxI_ymVA)

The April number was not only far above the consensus estimate of 148K and also above the highest forecast of 220K, it was also the biggest monthly increase since July 2022.

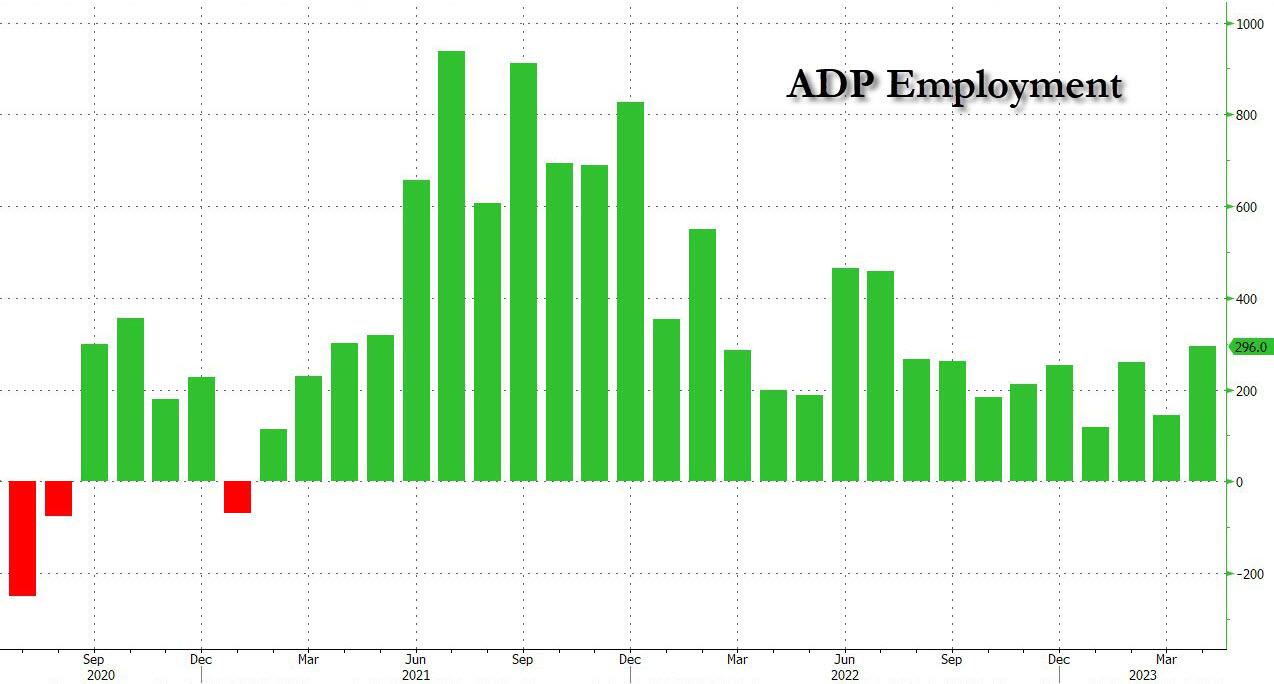

While job gains were mostly uniform, there was some regional weakness in the South where 100,000 jobs were lost. Additionally, there was a drop in Manufacturing workers (-38,000), as well as Financial activities (-28,000) and Professional Business services (-16,000).

?itok=aP28UdnO (

?itok=aP28UdnO ( ?itok=aP28UdnO)

?itok=aP28UdnO)

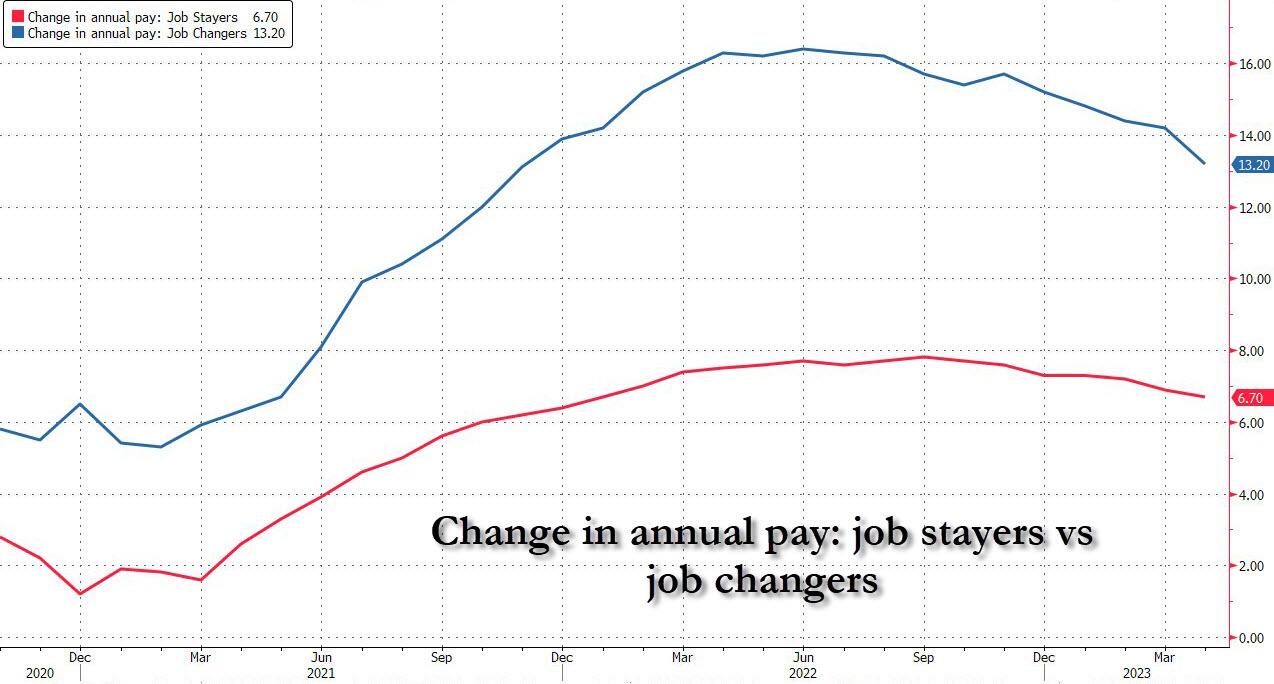

But while the jump in jobs was a hawkish twist ahead of today's FOMC, especially with JOLTS indicating the labor market was finally cracking, the latest change in wages was clearly dovish, with wage growth for both job changes and stayers sliding to the lowest since 2021, to wit:

- Job-stayers 6.7%, down from 6.9% in March and lowest since Dec 21

- Job-changers 13.2%, down from 14.2% in March and lowest since Nov 2021

?itok=YHvTC3L1 (

?itok=YHvTC3L1 ( ?itok=YHvTC3L1)

?itok=YHvTC3L1)

As ADP's Chief Economist Nela Richardson put it, **“The slowdown in pay growth gives the clearest signal of what's going on in the labor market right now,”** said Nela Richardson, chief economist, ADP. “Employers are hiring aggressively while holding pay gains in check as workers come off the sidelines. Our data also shows fewer people are switching jobs.”

Tyler Durden (https://cms.zerohedge.com/users/tyler-durden)Wed, 05/03/2023 - 08:32

**Icahn Sees $3.1 Billion In Wealth Evaporate After Hindenburg Research Report**

Icahn Sees $3.1 Billion In Wealth Evaporate After Hindenburg Research Report

The Bloomberg Billionaires index wiped away (https://www.bloomberg.com/news/articles/2023-05-02/carl-icahn-s-wealth-plunges-10-billion-on-hindenburg-short-seller-report?srnd=premium&sref=6uww027M%5C) $10 billion in wealth from Carl Icahn after yesterday's Hindenburg Research report, which called into question IEP's dividend and portfolio marks.

The $10 billion plunge wasn't just attributed to IEP's fall on Tuesday, but was also due to a margin loan, collateralized by his stake in IEP, that the Billionaire's Index hadn't previously accounted for, the report says.

Icahn's position on the Billionaire's Index fell from 58th to 119th, Bloomberg notes.

In response to yesterday's report, a mid-day statement (https://www.ielp.com/news-releases/news-release-details/icahn-enterprises-issues-statement-regarding-short-seller-report) from Icahn said it was “self-serving” and “intended solely to generate profits on Hindenburg’s short position.”

"We continue to believe that activism is the best paradigm for investing and my activist investments over the last 25 years have well proved this out. We regularly put our activist principles into effect at our majority-controlled companies as well as the minority positions held in our investment segment, and currently have representatives on 14 public company boards. Additionally, we believe strongly in hedging our positions to mitigate risk, especially in markets that we are living in today," it continued.

Recall, yesterday, Hindenburg Research accused (https://www.zerohedge.com/markets/hindenburg-unveils-short-position-icahn-enterprises-says-company-inflated-75) Icahn of "throwing stones from his own glass house".

"Our research has found that **IEP units are inflated by 75%+ due to 3 key reasons:** (1) IEP trades at a 218% premium to its last reported net asset value (NAV), vastly higher than all comparables (2) we’ve uncovered clear evidence of inflated valuation marks for IEP’s less liquid and private assets (3) the company has suffered additional performance losses year to date following its last disclosure," Hindenburg writes.

The research firm also called out the alleged unsustainability of IEP's dividend, stating:

> "The company’s outlier dividend is made possible (for now) because Carl Icahn owns roughly 85% of IEP and has been largely taking dividends in units (instead of cash), reducing the overall cash outlay required to meet the dividend payment for remaining unitholders."

?itok=Wp1RYzZ- (

?itok=Wp1RYzZ- ( ?itok=Wp1RYzZ-)

?itok=Wp1RYzZ-)

Hindenburg takes exception with IEP needing to raise cash to pay its dividend, calling it a "ponzi-like" economic structure. Hindenburg asserts:

> "The dividend is entirely _unsupported_ by IEP’s cash flow and investment performance, which has been negative for years. IEP’s investment portfolio has lost ~53% since 2014. The company’s free cash flow figures show IEP has cumulatively burned ~$4.9 billion over the same period."

The firm also called out Jefferies for its positive coverage of IEP:

> _"Supporting this structure is Jefferies, the only large investment bank with research coverage on IEP. It has continuously placed a “buy” rating on IEP units. In one of the worst cases of sell-side research malpractice we’ve seen, Jefferies’ research assumes in all cases, even in its bear case, that IEP’s dividend will be safe “into perpetuity”, despite providing no support for that assumption."_

And the report concludes that Icahn will eventually have to cut its dividend: "Given limited financial flexibility and worsening liquidity, we expect Icahn Enterprises will eventually cut or eliminate its dividend entirely, barring a miracle turnaround in investment performance."

Tyler Durden (https://cms.zerohedge.com/users/tyler-durden)Wed, 05/03/2023 - 08:31

**Treasury Quarterly Refunding Preview**

Treasury Quarterly Refunding Preview

The Treasury's quarterly refunding announcement on May 3rd is expected to see all coupon sizes left unchanged, again according to Newsquawk. Specifically, it is expected to sell USD 40bln of 3yr notes. USD 35bln of 10yr notes, and USD 21bln of 30yr bonds.

Treasury looks to increase bills as a share of the marketable debt: the share is currently at the low end of the TBAC's recommended 15-20% range. However, the share will not meaningfully increase until a resolution on the debt limit is reached, which desks don't expect until later in the year, although we may get an updated view from the Treasury on when they expect the "X-date" to occur.

Treasury Secretary Yellen recently estimated it to be in early June, although depending on tax receipts, that could extend to later in the summer.

On coupon supply, some desks do expect the Treasury to increase auction sizes again from the end of this year once the debt limit is resolved and bill share has increased, so the TBAC minutes might give us some colour on that.

Finally, a Treasury buyback facility remains the wildcard, where nothing concrete is expected from this refunding, but a facility does appear closer following the recent questionnaire sent out to primary dealers on buybacks. BofA, to wit, "these questions combined with TBAC communication at the February refunding continues to suggest that the rollout of a buyback program at both the 0 - 1Y & 1Y+ tenors is more likely than not.''

Tyler Durden (https://cms.zerohedge.com/users/tyler-durden)Wed, 05/03/2023 - 08:16

https://www.zerohedge.com/markets/treasury-quarterly-refunding-preview

**Futures Grind Higher Ahead Of Fed Hike Amid Continued Regional Bank Jitters, Oil Exten**

Futures Grind Higher Ahead Of Fed Hike Amid Continued Regional Bank Jitters, Oil Exten

S&P 500 futures are marginally higher on the day despite renewed pre-market weakness from US regional banks and a continued plunge in crude, which sent WTI futures lower by more than 3% on the day and below $70 per barrel on demand worries as the global economy slows. Contracts on the S&P 500 edged 0.1% higher while those on the Nasdaq 100 gained 0.2% by 7:30 a.m. ET, bouncing from yesterday’s losses ahead of the Fed decision. Treasury yields are lower, as traders seek out havens, while the Bloomberg dollar index weakened as traders eye recession risks alongside a potential pause in interest rate hikes. Meanwhile, most metals, including gold, decline slightly.

?itok=IrVz1Oao (

?itok=IrVz1Oao ( ?itok=IrVz1Oao)

?itok=IrVz1Oao)

In premarket trading, regional banking stocks including PacWest Bancorp and Western Alliance Bancorp tumbled in early trading, dropping as much as 12% while Western Alliance Bancorp (WAL US) fell 7.8%. before recovering most losses ahead of a Fed rate hike that will only make the deposit outflow from small banks worse. Meanwhile, AMD shares fell as much as 6.3% in premarket trading, after the chipmaker gave a tepid forecast for the current quarter as it wades through a severe PC slowdown. Analysts highlighted mixed results for the quarter, but noted that its server and PC businesses should rebound in the second half of the year. Here are some other notable premarket movers:

- Starbucks shares slid as much as 5% in US premarket trading after the coffee chain operator left guidance for the fiscal year 2023 unchanged. The move disappointed analysts, who called it a conservative stance given the strong second quarter and sales beat, and said it suggests growth will weaken in the second half of the year.

- Ford declined in postmarket trading after the company reiterated its full-year forecast despite strong first-quarter results, and flagged headwinds including economic uncertainty around the globe and higher industrywide customer incentives.

- Amcor shares dropped as much as 8.3% in US premarket trading, set to hit their lowest level since June 2020, after the packaging company cuts its adjusted EPS forecast for the full year, with analysts flagging weakness in volumes. Amcor’s shares also declined 9.5% in Sydney trading.

- Chegg (rose as much as 9.5% in premarket trading, as the online educational services company attempts to recoup some losses after posting its biggest intra-day drop on Tuesday.

- Match Group gained in extended trading, after the online dating company reported its first-quarter results and gave an outlook. While the revenue forecast is below expectations, analysts note strength in the company’s Tinder business.

- Unisys shares jumped 12% in extended trading on Tuesday, after the IT services company reported first-quarter results that were stronger than expected.

- Paycom Software shares gained in extended trading after the human-capital-management software company reported first-quarter results that beat expectations and raised its full-year forecast. It also introduced a dividend.

As we previewed previously (https://www.zerohedge.com/markets/fomc-preview-feds-final-hike-and-what-comes-next), the Fed is expected to deliver a 25 basis-point interest-rate increase **and signal a pause in its aggressive tightening campaign.** Watchers anticipate the central bank will stop raising rates as tighter lending conditions and signs of a slowing economy suggest inflation will cool more meaningfully in the months ahead. Fed-dated OIS currently **prices in around 23bp of rate hike premium for the meeting,** little change vs Tuesday close. Investors will assess impact of current banking sector jitters on future monetary policy, though with inflation stubbornly elevated, Powell is expected to stop short of assuring markets that a pause is a done deal — or that rate cuts are imminent

The US stock rally, supported by better-than-feared earnings and hopes for a less hawkish Fed, lost steam this week amid weak economic data and concerns about the banking sector. The selloff pushed the VIX Index toward 18 after the volatility gauge spent most of April near a 16 handle, while the VIX1D doubled yesterday from 10 to 20.

**“When it comes to thinking about the potential for further hikes from here, I do think the Fed really wants to keep the door open specifically given the fact that the economy has been quite resilient,”** said Madison Faller, global strategist at JPMorgan Private Bank. But “whether the last hike is today or even in June, we’re nearing the end of the Fed tightening cycle.”

In Europe, stocks are higher as they l…

**Putin Targeted In "Terrorist" Assassination Attempt By Drones: Kremlin**

Putin Targeted In "Terrorist" Assassination Attempt By Drones: Kremlin

The Kremlin says two drones were sent by Ukraine in an overnight attack on Moscow and on government buildings which it sees as **an attempt to assassinate President Vladimir Putin**.

A Kremlin press statement called it a **"planned terrorist attack"** against Putin directly, and says Russia has a right to respond "where and when it deems necessary".

?itok=yI6u6eZu\

?itok=yI6u6eZu\

_Getty Images_ ( ?itok=yI6u6eZu)

?itok=yI6u6eZu)

The president was not injured in the attempted attack and is said to be safe and carrying on his regular work schedule after the drones were "downed" - according to the Kremlin statement, as cited in _RIA_.

Further the statement emphasized there was **no material damage to the president's offices from falling debris** after Russian defenses disabled the inbound UAVs.

"The aircraft were downed using electronic warfare measures and caused no casualties or damage, it said in a statement," Russian state media RT reports. "Moscow considers the incident an act of terrorism," and details further:

> _The incident occurred late on Tuesday night, and both unmanned aircraft fell on the grounds of the Kremlin in Moscow, according to the president’s office. His schedule was not affected._

The statement from the Russian presidency's office emphasized: **"We consider this a preplanned terrorist action and an attempt against the Russian president."** It happened "ahead of Victory Day and the parade on May 9, when foreign guests plan to be present." The statement detailed, "Two unmanned aerial vehicles were aimed at the Kremlin. As a result of timely actions taken by the military and special services using radar warfare systems, the devices were disabled."

Initial videos from the attack are being widely circulated, strongly suggesting the accuracy of the Kremlin statements of a nighttime attack on central government buildings in Moscow; however, they do appear to show **a direct strike of at least one of the drones on a building**:

> NEW: Kremlin says “Ukrainian” drones attacked Putin’s residence in Moscow last night, but he is safe pic.twitter.com/nQFDNDhpvw (https://t.co/nQFDNDhpvw)

>

> — Ragıp Soylu (@ragipsoylu) May 3, 2023 (https://twitter.com/ragipsoylu/status/1653727053588451329?ref_src=twsrc%5Etfw)

**Fire can be seen atop the roof of one of the iconic buildings** of the Moscow Kremlin complex...

> Another video purportedly showing the aftermath of the drone attack against the Kremlin pic.twitter.com/GgkwaFl4Em (https://t.co/GgkwaFl4Em)

>

> — Michael A. Horowitz (@michaelh992) May 3, 2023 (https://twitter.com/michaelh992/status/1653732755937566720?ref_src=twsrc%5Etfw)

The Russian presidential spokesman followed-up with this message after the initial Kremlin press release (https://www.rt.com/russia/575704-putin-kremlin-drone-attack/):

> _" **As a result of this terrorist act, the President of the Russian Federation was not injured**. His work schedule has not changed, it continues as usual,"_ the message said.

>

> Putin’s spokesperson Dmitry Peskov explained that the head of state was not in the Kremlin during what he described as a Ukrainian UAV attack on Tuesday night. He noted that President Putin is currently working from his residence near Moscow.

All of this makes a downed Ukrainian drone incident outside Moscow from last week much more interesting in hindsight, which we covered here: Kremlin Rejects German Media's 'Putin Drone Assassination' Report (https://www.zerohedge.com/geopolitical/kremlin-rejects-german-medias-putin-drone-assassination-report). It will also be interesting to see whether Russia points the finger at the United States and West for its longtime intelligence support to Kiev, as we reviewed in December based on this statement: We Are Not "Enabling" Or "Encouraging" Ukraine To Strike Within Russia: White House (https://www.zerohedge.com/markets/third-russian-airbase-set-ablaze-drone-strike-ukraine-extends-war-across-border).

_developing..._

Tyler Durden (https://cms.zerohedge.com/users/tyler-durden)Wed, 05/03/2023 - 08:00

https://www.zerohedge.com/geopolitical/putin-targeted-terrorist-assassination-attempt-drones-kremlin

**The US Banking System Is Sound?**

The US Banking System Is Sound?

_Authored by Michael Maharrey via SChiffGold.com,_ (https://schiffgold.com/commentaries/the-us-banking-system-is-sound/)

**Treasury Secretary Janet Yellen keeps insisting that the banking system is “sound.”**

?itok=XWWVwA-K (

?itok=XWWVwA-K ( ?itok=XWWVwA-K)

?itok=XWWVwA-K)

**Is it though? Because it doesn’t look particularly sound.**

In fact, we just witnessed the second-largest US bank failure ever.

Government regulators seized control of First Republic Bank on May 1 and sold the majority of the bank’s operations to JP Morgan Chase. It was the third major bank failure this year and the biggest bank to collapse since the 2008 financial crisis. It was the second-largest bank by assets to fail in US history.

First Republic went under after it revealed $100 billion in deposit losses in the first quarter.

The beleaguered bank has been struggling for a while. It was initially bailed out back in March with $30 billion in deposits from several large banks, including JP Morgan and Wells Fargo. The bank also borrowed heavily from the Federal Reserve’s bank bailout program (https://schiffgold.com/commentaries/federal-reserve-launches-qe-extra-lite-to-bail-out-banks/). First Republic shares tumbled 75% last week before the FDIC stepped in.

While JP Morgan is taking over First Republic’s business, the FDIC will provide “shared-loss agreements.” As the FDIC website explains it (https://www.fdic.gov/resources/resolutions/bank-failures/failed-bank-list/lossshare/index.html), “the FDIC absorbs a portion of the loss on a specified pool of assets sold through the resolution of a failing bank – in effect sharing the loss with the purchaser of the failing bank.”

**If we are to believe the mainstream narrative, the failures of Silicon Valley Bank, Signature Bank and First Republic Bank were isolated events and do not reflect a broader problem in the banking system.** But as we have reported, these bank failures are just the tip of the iceberg (https://schiffgold.com/commentaries/svb-and-signature-bank-were-just-the-tip-of-the-iceberg/). A report by the _Wall Street Journal_ cites a study (https://papers.ssrn.com/sol3/papers.cfm?abstract_id=4387676) from Stanford and Columbia Universities that found 186 US banks are in distress.

And as Manuel Garcia Gojon pointed out in an article published by the _Mises Wire_ (https://mises.org/wire/charles-schwab-and-other-big-banks-may-be-secretly-insolvent), it’s not just the small and medium-sized banks. Charles Schwab and other big banks may also be insolvent.

One of the biggest problems facing banks is the rapid devaluation of their bond portfolios.

Banks were incentivized to load up on high-priced, low-yield bonds thinking that the Fed would keep interest rates low forever. As the Fed jacked up interest rates to fight price inflation, it decimated the bond market. (Bond prices and interest rates are inversely correlated. As interest rates rise, bond prices fall.) With interest rates rising so quickly, banks have not been able to adjust their bond holdings. As a result, many banks have become undercapitalized on paper as the value of the bond portfolios shrinks. The banking sector was buried under some $620 billion in unrealized losses (https://www.wsj.com/livecoverage/stock-market-news-today-03-13-2023/card/meet-the-btfp-the-fed-s-2023-crisis-facility-Bn7TsQpropbMiW1Z3kdp) on securities at the end of last year, according to the Federal Deposit Insurance Corp.

As the _Washington Post_ reported (https://www.washingtonpost.com/opinions/2023/03/17/svb-first-republic-bank-credit/), this means banks would face unprecedented losses if they were forced to liquidate their bond portfolios. In fact, that is exactly what doomed Silicon Valley Bank. The plan was to sell the longer-term, lower-interest-rate bonds and reinvest the money into shorter-duration bonds with a higher yield. Instead, the sale dented the bank’s balance sheet and caused worried depositors to pull funds out of the bank.

According to the _Post_, the total capital buffer in the US banking system totals $2.2 trillion. Meanwhile, total unrealized losses in the system based on a pair of academic papers is between $1.7 and $2 trillion.

Gojon explains how the big banks have dealt with this problem

> Many big banks in the United States have substantially increased their use of an accounting technique that allows them to avoid marking certain assets at their current market value, instead using the face value in their balance sheet calculations. This accounting technique consists of announcing that they intend to hold such assets to maturity.”

**In other words, this accounting trick makes the bank look far more solvent than it actuall…

**New York Slated To Become First State To Ban Natural Gas Stoves**

New York Slated To Become First State To Ban Natural Gas Stoves

Having solved all other problems in New York, including a decrepit, expensive and dangerous subway in the city, astronomical taxes and surging crime, Democratic Gov. Kathy Hochul is now set to make her state the first to ban natural gas stoves.

And, according to the New York Post (https://nypost.com/2023/04/28/some-new-yorkers-say-future-gas-stove-ban-in-new-buildings-is-not-so-hot-an-idea/?utm_campaign=nypost&utm_medium=social&utm_source=twitter), residents are "furious".

The state's latest budget deal mandates that "all new buildings under seven stories be fully electric by 2026 with larger structures following three years later", the Post reported over the weekend. After all, what would new rules be if they weren't appended to a massive $229 billion spending deal? Spending: _it's the American way._

Meanwhile, the legislation isn't going over quite as well with residents. One resident of Sutton Place told the _Post:_ **“Kathy should mind her own business and get out of our kitchens. Now she’s in our kitchens first, our bedrooms will be next. Why would somebody come into your private home and tell you what to do? We’re not communist yet – we’re getting there – but it’s just an insult.”**

Meanwhile, a poll (https://scri.siena.edu/wp-content/uploads/2023/02/SNY0223-Crosstabs-Final.pdf) conducted at Siena back in Februrary found that only 39% of registered voters supported banning all new fossil fuel equipment for new homes by 2025 and all construction by 2029.

?itok=NeOTvkB8 (

?itok=NeOTvkB8 ( ?itok=NeOTvkB8)Hochul using her gas over . Photo: (

?itok=NeOTvkB8)Hochul using her gas over . Photo: ( ?itok=NeOTvkB8)NY Post (https://nypost.com/2023/01/22/nys-hochul-cooks-with-gas-stoves-while-pushing-future-ban-critics/)

?itok=NeOTvkB8)NY Post (https://nypost.com/2023/01/22/nys-hochul-cooks-with-gas-stoves-while-pushing-future-ban-critics/)

Joseph Hogan, vice president of building services at the Associated Contractors of New York State, told the _Post:_“People are apt to make choices of whether they are located in New York State or somewhere else and this will provide a further strain on the market until there’s certainty about the availability in the grid as we move forward so that’s a real concern.”

And of course - not unlike what we experienced during Covid - it's a case of "do as I say, not as I do". It had previously been reported (https://nypost.com/2023/01/22/nys-hochul-cooks-with-gas-stoves-while-pushing-future-ban-critics/) that Hochul uses gas stoves in her executive mansion in Albany and her home in Buffalo.

Assembly Minority Leader William Barclay said at the time: “The governor’s push to ban gas stoves appears to be as hypocritical as it is ridiculous. **One has to wonder how many times she’s fired up her own gas stove since declaring them environmentally unsafe in her State of the State Address."**

Defending the ban, Hochul said last week: “Everyone knows we’ve seen the effects of climate change, the storms, the hurricanes coming to New York, record snow amounts. Our Budget prioritizes nation-leading climate action that meets this moment with ambition and the commitment it demands.”

One Upper East Side resident retorted: “I’m very much against the change. I don’t see the benefit. Electric stoves don’t cook as well.” Her 70 year old neighbor, Claire Gozzo, agreed, telling the _Post:_“I have electric in Florida and I hate it, you can’t control it. I want a new stove. I don’t like it. I like gas because you can control it and everything cooks good."

_Obviously, based on the above photo of the Governor making gameday eats, that's a lesson Hochul knows firsthand._

Tyler Durden (https://cms.zerohedge.com/users/tyler-durden)Wed, 05/03/2023 - 06:55

https://www.zerohedge.com/markets/new-york-slated-become-first-state-ban-natural-gas-stoves

**"We've Never Seen Such A Dramatic Shift": Bud Light Hopes New Ad Blitz Can Overcome Corporate Suicide**

"We've Never Seen Such A Dramatic Shift": Bud Light Hopes New Ad Blitz Can Overcome Corporate Suicide

Bud Light parent company Anheuser-Busch is desperately scrambling to rehabilitate their image following **corporate suicide** over a transgender ad campaign featuring TikTok influencer Dylan Mulvaney.

?itok=OMUCP7jF (

?itok=OMUCP7jF ( ?itok=OMUCP7jF)

?itok=OMUCP7jF)

In order to make amends with distributors **after off-site sales fell 26.1%** in the week ending April 22 vs. one year ago, the company has pledged to **boost marketing spending on Bud Light** and accelerate production of a new slate of ads, according to the _Wall Street Journal_ (https://www.wsj.com/articles/bud-light-maker-offers-distributors-free-beer-more-ad-spending-after-dylan-mulvaney-backlash-14efac22), which adds that Anheuser-Busch will give a 'case of Bud Light to every employee' of a wholesaler.

> Bud Light sales down 26.1% vs last year in the week ending April 22nd. 📉

>

> Sales of the beer plummeted vs last year due to the ongoing backlash from the brands decision to hire Dylan Mulvaney as a brand ambassador.

>

> Rival beer brands Coors Light sales rose by 13.3% while Miller… pic.twitter.com/6835StMEXH (https://t.co/6835StMEXH)

>

> — Oli London (@OliLondonTV) May 1, 2023 (https://twitter.com/OliLondonTV/status/1653177012368863237?ref_src=twsrc%5Etfw)

Meanwhile, **sales of rival brands Coors Light and Miller Light each grew 21%** during the same period ending April 22.

> _The efforts are continuing a month after Dylan Mulvaney, a transgender social-media star, spoke in an Instagram video about a personalized can of Bud Light that the brewer had sent her as a gift. The April 1 post sparked a boycott (https://www.wsj.com/articles/how-bud-light-handled-an-uproar-over-a-promotion-with-a-transgender-advocate-e457d5c6?mod=article_inline) that caused sales to plummet for both Anheuser-Busch and its independently owned distributors. The distributors’ employees, many of whom drive trucks bearing the Bud Light logo, were confronted by angry people on streets, in stores and in bars. -WSJ_

The deterioration of Bud Light's market share "continued apace through the third week of April — and actually somehow worsened. **We’ve never seen such a dramatic shift in national share in such a short period of time**," according to _Beer Business Daily_ (https://beernet.com/bud-light-demand-continues-to-deteriorate/).

The fallout has spread to other Anheuser-Busch brands as well, including Budweiser, Busch Light, and Michelob Ultra, according to Bump Williams.

" **It sent shock waves through distributors**," according to Jeff Wheeler, vice president of marketing for Del Papa Distributing near Houston, Texas, adding that his staff has fielded "tons of phone calls from people being very hateful."

**Two Bud Light marketing executives have been placed on administrative leave** in the wake of the controversy.

> _Marketing Vice President Alissa Heinerscheid took a leave of absence (https://dailycaller.com/2023/04/22/bud-light-marketing-exec-alissa-heinerscheid-leave-of-absence/) after the Daily Caller reported (https://dailycaller.com/2023/04/11/alissa-gordon-heinerscheid-leaked-social-media-pictures-bud-light-ad-executive-slammed-fratty-culture-seen-partying-drinking-isis-club/) on photos of her at a college party following comments she made slamming (https://dailycaller.com/2023/04/10/viral-video-shows-bud-light-exec-trashing-brands-fratty-and-out-of-touch-marketing/) Bud Light’s customer for being “fratty.” Budweiser reportedly announced (https://dailycaller.com/2023/04/24/anheuser-busch-marketing-executive-dylan-mulvaney-bud-light/) Sunday that Daniel Blake, group vice president for marketing at Anheuser-Busch, was also taking a leave of absence. -Daily Caller (https://dailycaller.com/2023/05/02/bud-light-sales-in-freefall-report-finds/)_

After three weeks of social media silence, Mulvaney posted a TikTok video (https://dailycaller.com/2023/04/28/dylan-mulvaney-breaks-tik-tok-silence-nonconfrontational-uncontroversial-bud-light-controversy/) mansplaining that he wishes he could be reincarnated as someone "non-confrontational and uncontroversial."

"I don’t know if reincarnation is a thing, but in my next life I would love to be someone non-confrontational and uncontroversial — God that sounds nice!" he said, adding "The good news is that the people pleaser in me has nearly died, because there’s clearly no way of winning over everyone."

Mulvaney has also inked advertising deals with Instacart, Nativ, Ulta Beauty, Nike, and others.

Anheuser-Busch will report quarterly earnings on Thursday. We're sure they'll receive some interesting analyst questions... and of course a big q…

**4 Ways That Joe Biden Could Get America Into A Nuclear War**

4 Ways That Joe Biden Could Get America Into A Nuclear War

_Authored by Michael Snyder via TheMostImportantNews.com,_ (http://themostimportantnews.com/archives/4-ways-that-joe-biden-could-get-america-into-a-nuclear-war)

**Have you ever looked at Joe Biden and wondered if this guy is going to get us all killed?**

If so, you are definitely not alone. Biden is an ill-tempered lunatic that is not all there mentally, and his foreign policy team includes well-known warmongers such as Jake Sullivan, Antony Blinken and Victoria Nuland. Over the past two years they have been provoking our enemies every chance they get, and that has pushed us to the brink of war with several of them. They keep telling us that they know exactly what they are doing, but if they get this wrong we are not going to get a “do over”. **Once the missiles start flying, there will be no going back.**

?itok=tEz7jYhF (

?itok=tEz7jYhF ( ?itok=tEz7jYhF)

?itok=tEz7jYhF)

The following are 4 ways that Joe Biden and his minions could get America into a nuclear war…

**#1 Russia**

The war in Ukraine has evolved into a full-blown proxy conflict between the United States and Russia, and both sides just continue to escalate matters.

So where does this end?

At this point, the Biden administration has already announced 36 different military aid packages (https://www.jpost.com/breaking-news/article-739695) for Ukraine since the war started…

> US President Joe Biden’s administration announced $325 million in new military aid for Ukraine on Wednesday to help its military in its war against Russia, including additional ammunition for High Mobility Artillery Rocket Systems (HIMARS), advanced missiles and anti-tank mines.

>

> It is the 36th security package for Ukraine since the Russian invasion in February 2022, and brings total US military assistance for the Kyiv government to more than $35.4 billion in that time.

On the other side, the Russians keep framing this crisis as an existential conflict between east and west, and western leaders have certainly bolstered that perception by publishing maps of Russia broken up into dozens of little countries ( ).

).

At this point, the Russians believe that they are fighting for all the marbles, and Dmitry Medvedev is openly warning that they will use nuclear weapons (https://www.the-sun.com/news/7959111/medvedev-warns-closer-world-war-three-nuclear/) when push comes to shove…

> He spelt out that Russian doctrine “makes it clear that nuclear weapons may be used if Russia faces an act of aggression involving other types of weapons, which threaten the very existence of the state”.

>

> He added: “In fact, it is about using nuclear weapons in response to such actions.

>

> “Our potential adversaries should not underestimate this.

>

> “All these speculations about how the Russians will never do this are worthless.

>

> “The Western analysts and Western commanders – both military and political leaders – should simply assess our rules and our intentions.”

Why won’t our leaders take such threats seriously?

I am entirely convinced that the Russians are not bluffing.

And it should greatly alarm all of us that Russian submarines are becoming increasingly active in the Atlantic Ocean (https://www.usnews.com/news/national-news/articles/2023-04-26/u-s-russian-subs-in-atlantic-more-active-than-weve-seen-them-in-years)…

> “The Russians have been more active than we’ve seen them in years,” Army Gen. Chris Cavoli, the top commander for NATO and U.S. military operations in Europe, told Congress on Wednesday of Moscow’s undersea capabilities.

>

> “Their patrols into the Atlantic and throughout the Atlantic are at a high level most of the time, at a higher level than we’ve seen in years,” Cavoli testified before the House Armed Services Committee. “And this, despite all the efforts they’re undertaking in Ukraine.”

Eventually, the Russians could use subs to launch a surprise first strike on the U.S., and if that happens it will be the end of our nation as we know it today.

**#2 China**

As I have detailed in previous articles, the Chinese have been feverishly expanding and modernizing their strategic nuclear arsenal.

At one time, their capabilities paled in comparison to our own, but now they have substantially closed that gap.

Unfortunately, the Biden administration is still choosing to treat them like a vastly inferior power.

We do not want a war with China, and under previous administrations such a war was not e…

https://www.zerohedge.com/geopolitical/4-ways-joe-biden-could-get-america-nuclear-war

**Global Rice Shortage Looms, Set To Be The Biggest In Decades**

Global Rice Shortage Looms, Set To Be The Biggest In Decades

Rice is the primary food source for over half of the global population, especially in emerging markets, where it plays a crucial role in feeding people. Last year, we highlighted the potential for a severe global rice shortage. A new report reveals that rice production this year could be at its lowest in decades.

A report by Fitch Solutions forecasts this year's global rice production will log its biggest shortfall in two decades. The deficit will be a major headache for countries relying on grain imports.

> _"At the global level, the most evident impact of the global rice deficit has been, and still is, decade-high rice prices," Fitch Solutions' commodities analyst Charles Hart told CNBC (https://www.cnbc.com/2023/04/19/global-rice-shortage-is-set-to-be-the-largest-in-20-years-heres-why.html?taid=644e5849e664fc0001f7a1d5&utm_campaign=trueanthem&utm_medium=social&utm_source=twitter)._

Sliding rice production in China, the US, and Europe is already causing grain prices to increase for 3.5 billion people, particularly in the Asia-Pacific region -- this region of the world accounts for 90% of the world's rice consumption.

> _"Given that rice is the staple food commodity across multiple markets in Asia, prices are a major determinant of food price inflation and food security, particularly for the poorest households," Hart said._

Hart said this year's global shortfall would be around 8.7 million tons, the largest global rice deficit since 2003/2004 of 18.6 million.

As a result of tightening global supplies, rough rice futures trading on the CBoT recently peaked at $18 per cwt, the highest level since September 2008. Cwt is a unit of measurement for certain commodities such as rice.

?itok=aJ0VF_1T (

?itok=aJ0VF_1T ( ?itok=aJ0VF_1T)

?itok=aJ0VF_1T)

CNBC provides a breakdown of why rice supplies are strained.

> _There's a short supply of rice as a result of the ongoing war in Ukraine, as well as bad weather in rice-producing economies like China and Pakistan._

>

> _In the second half of last year, swaths of farmland in the world's largest rice producer China were plagued by heavy summer monsoon rains and floods._

>

> _The accumulated rainfall in the country's Guangxi and Guangdong province, China's major hubs of rice production, was the second highest in at least 20 years, according to agriculture analytics company Gro Intelligence._

>

> _Similarly, Pakistan — which represents 7.6% of global rice trade — saw annual production plunge 31% year-on-year due to severe flooding last year, said the US Department of Agriculture (USDA), labeling the impact as "even worse than initially expected."_

>

> _The shortfall is partly due to result of "an annual deterioration in the Mainland Chinese harvest caused by intense heat and drought as well as the impact of severe flooding in Pakistan," Hart pointed out._

>

> _Rice is a vulnerable crop, and has the highest probability of simultaneous crop loss during an El Nino event, according to a scientific study._

Recall in the late summer of 2022. We told readers:

- _The Stage Is Being Set For A Massive Global Rice Shortage_ (https://www.zerohedge.com/commodities/stage-being-set-massive-global-rice-shortage)

- _"Situation Is Really Precarious": World's Largest Rice Exporter Faces Output Decline Amid Heatwave_ (https://www.zerohedge.com/markets/situation-really-precarious-worlds-largest-rice-exporter-faces-output-decline-amid-heatwave)

... and just recently.

- _Thai Rice Prices Jump As Global Food Crisis Reignites_ (https://www.zerohedge.com/commodities/thai-rice-prices-jump-food-crisis-stalks-world)

The takeaway is that a tight global rice market will raise food inflation for major rice importers such as Indonesia, the Philippines, Malaysia, and Africa. Elevated food inflation is dangerous for governments because it increases social instability risks.

Tyler Durden (https://cms.zerohedge.com/users/tyler-durden)Wed, 05/03/2023 - 05:45

https://www.zerohedge.com/commodities/global-rice-shortage-looms-set-be-biggest-decades

**Scientists Say Meat Is Crucial To The Human Diet - Warn Against Vegan 'Zealotry'**

Scientists Say Meat Is Crucial To The Human Diet - Warn Against Vegan 'Zealotry'

Dozens of experts were asked to look into the science behind claims that meat eating causes disease and is harmful for the planet in a special issue of a journal called Animal Frontiers (https://academic.oup.com/af). They have warned against a widespread societal push towards plant-based diets, arguing that poorer communities with low meat intake often suffer from stunting, wasting and anemia driven by a lack of vital nutrients and protein.

Thousands of scientists across the globe have also joined The Dublin Declaration, a group stating that livestock farming is too important to society (https://www.msn.com/en-ie/health/nutrition/meat-is-crucial-for-human-health-scientists-warn/ar-AA1awMph) to “become the victim of zealotry.” They say that many of the negative claims about meat in our diet are simply not true.

The Dublin Declaration (https://www.dublin-declaration.org/) group has published a statement allowing global signatories to join them in defending meat supported diets and contradicting common claims made by establishment institutions against livestock in agriculture. In particular, the scientists stress that meats provide vitamin B12 intake in human diets, play a major role in supplying retinol, omega-3 fatty acids and minerals such as iron and zinc, as well as important compounds for metabolism, such as taurine and creatine. There is no vegan equivalent that fills these nutritional needs and a number of supplements are often required to keep them healthy.

Scientists note that only well resourced (wealthier) people have the means to abandon meat in their diets and consume vegetables and carbs alone. In other words, veganism is a first world ideology that is impractical for the majority of global population. Even India, a developing nation often cited by anti-meat activists for it's religious stance against killing animals, still has a 70% meat eating population (https://www.indiatoday.in/diu/story/india-meat-map-people-relish-non-vegetarian-items-east-south-lead-way-1878313-2021-11-18).