That I know, I meant is that chart real, because would be super cool if it were.

the chef pushed the guy in the hat back inside, I bet that attitude was also part of the flavor

Am looking into mining Bitcoin.

https://www.bitcoinmining.com/getting-started/ is a bit outdated, only useful for a general idea.

https://www.forbes.com/sites/digital-assets/article/how-to-mine-bitcoin/ is targetted more a beginners (which I am at mining, but not at theory).

Don't see the point if cloud mining. The Antminer S21 Hyd looks like a good option.

Would very much appreciate any tips/ideas.

You're doing a good thing.

Depends on one's reasons. I don't know anyone here to be sending zaps in the short term, and precisely because I don't know anyone, I don't expect to be receiving any either.

In this case, you're treating the casino as trusted third party (TTP). If that trust is broken for any reason (due to a flawed implementation, or due to a malice, etc), then your coins are nit non-KYC.

In the nutshell you are asking if we should trust mixnets (coin mixing services), there is plenty if research literature on it but I don't know if there's a well known implementation.

😀 no worries.

Yes I understand it has fixed supply, and while this design has many benefits (and one or two concerns), I am not convinced that it is enough to declare it anti-RIBA.

Get some rest :-)

I would extend this by saying if you want to diversify, invest in academically sound currencies. Look into the research and the research team behind them. Just because a currency is commercially successful, doesn't mean it is sound (any one remember Terra/Luna?).

Note: Bitcoin is academically sound although we don't know the creator(s) behind it.

I am asking a question. The example in the question is to demonstrate that it is not anti-riba (or pro-riba) any more than any other commin monies of the preset and past (fiat, coins, salt, etc).

In the Indian sub-continent, private minting was practice till late 19th century when East India Company (and later the British govt) eventually outlawed it

False. If a rich guy buys 10 miners for each of your miners, he has 10x hash rate, and 10x power. And depending on hiw much is at stake, that power translates to control. Do you remember ETC/ETH split?

(1) sure, but Bitcoin has been being mined on FPGAs and then ASICs since at least 2013. Unlike GPUs, these are not off the shelf components. Usually an implementation is developed/funded by a business/whale, and by the time it reaches common individuals, the businesses/whales are close to rolling out next generation for in-house needs.

(2) Sure, although I put traditional institutions (banks, hedge funds, etc) interest around 2018. But these institutions are not the only businesses in Bitcoin ecosystem, you'll find pictures from 2014 of mining forms with tens of thousands of ASICs in colder parts of Europe. Some of these could be rich individuals, i qm not convinced that most of them were.

But it is still possible that individuals hold most BTC. If majority hashing power came from mining pools (there was one that famously got close to 51% and started kicking people off to reduce its hash rate), then most if mined BTC went to its members, and mining pools were popular among individuals.

#introduction academic and engineer. Blockchain is a research interest, am also building one. The way forward is decentralized and trustless systems.

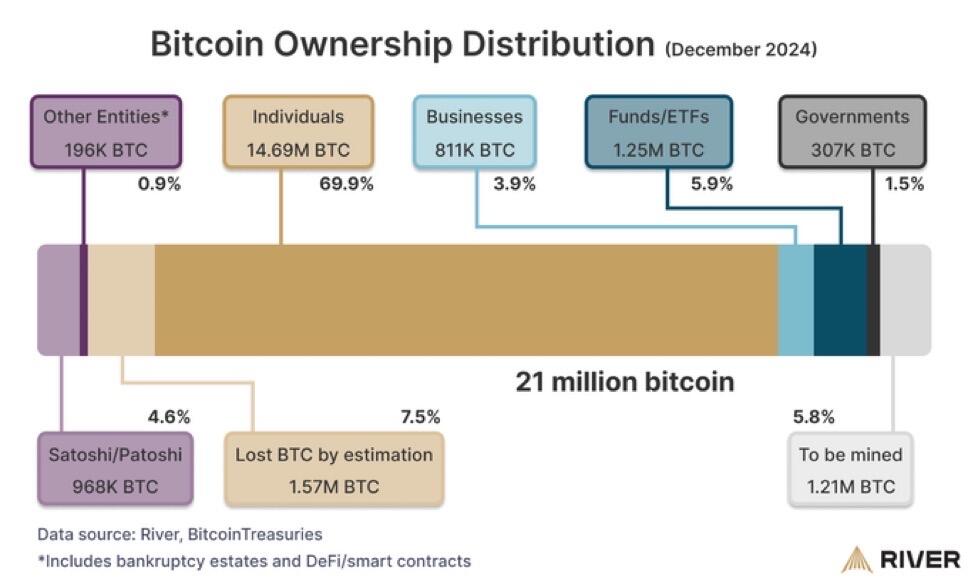

I took a quick look at the source: https://river.com/learn/who-owns-the-most-bitcoin/ . River didn't do original research. The numbers seem to have been collected from a few sources.

The claim that 16M+ BTC are held by individuals is unconvincing because (a) it is hard to detect it from typical blockchain analysis techniques (e.g., graph analysis), and (b) it contradicts the intuition from mining power distribution--most of the mining power is concentrated among a handful of players.

It is certainly possible that 16M+ BTC is held by individuals, but the claim would have been more convincing if they had stated the methodology upfront.

How does the data source identify a business vs an individual? Do they base it on the mapping between addresses and businesses? If so, then wouldn't they incorrectly categorize a huge pool of non-KYC addresses (including those of large mining operations) as individuals?

Correction: Nostr and Primal are working, for now.