2 stories with #bitcoin that always happens:

1) it’s a macro asset

2) it’s early in in the lifecycle

Right now this is all adoption (cycle). New buyers coming in and being told the big picture story.

It’s still a macro asset, and the Fed pivoting on interest rates will affect the price of bitcoin.

Live charts for #MSTR

BTC / sh

NAV Premium

MSTR / BTC

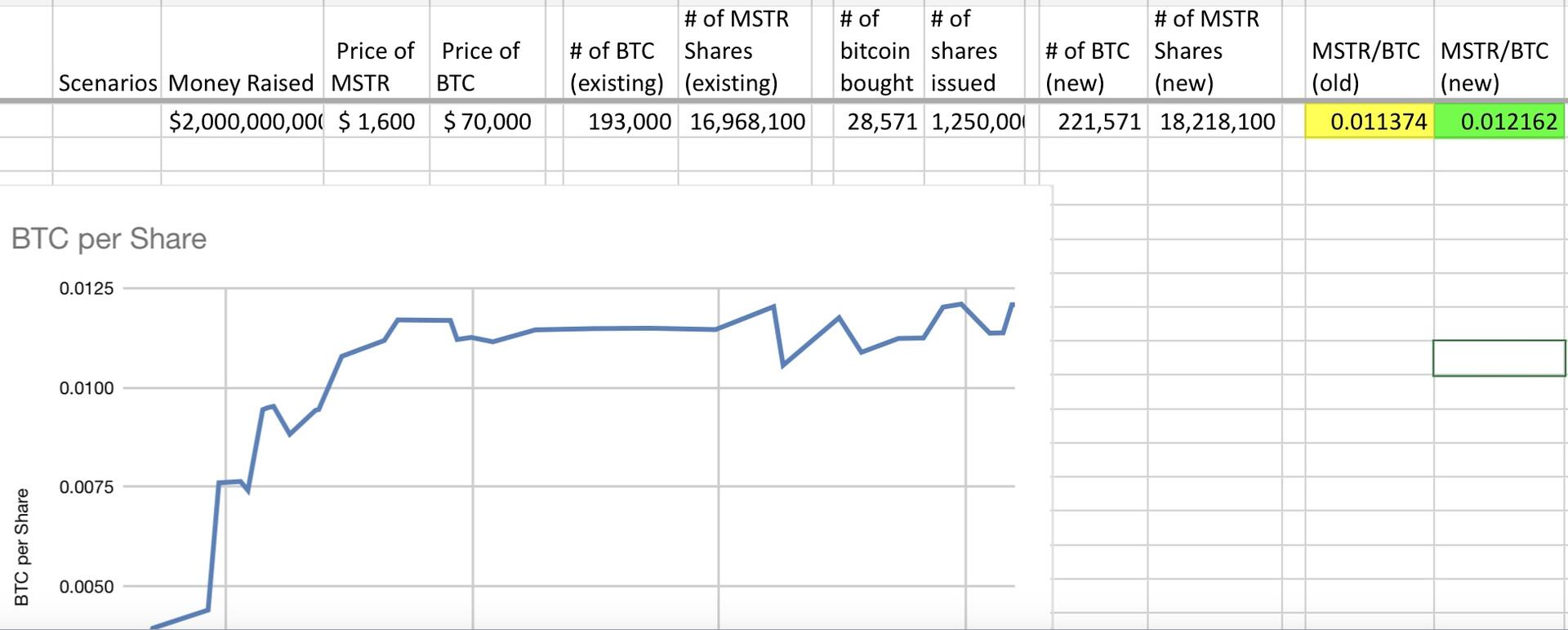

#MSTR share conversions to buy #Bitcoin at these prices haven’t been dilutive (slightly accretive).

I was confused at first bc it seemed they were producing much more shares than the number of bitcoin they were buying.

What I was missing was that they had a very large base of existing shares compared to their number of bitcoin.

Issuing shares when the price of MSTR is high and BTC is low has the largest accretive effect.

However, it doesn’t seem like nostr:npub15dqlghlewk84wz3pkqqvzl2w2w36f97g89ljds8x6c094nlu02vqjllm5m is more interested in increasing the total amount of BTC as he never really mentions BTC/ sh.

“If they're not raising interest rates then I do think that it creates tailwinds for #Bitcoin and we're easily going in the six figures this year.

If we zoom out and look 18 months after the having where are maybe we are touching a million dollars.

There's not anything stopping us from getting there and there's lots of catalysts pushing us towards that that price point.”

nostr:npub1hxwmegqcfgevu4vsfjex0v3wgdyz8jtlgx8ndkh46t0lphtmtsnsuf40pf nostr:npub1s5yq6wadwrxde4lhfs56gn64hwzuhnfa6r9mj476r5s4hkunzgzqrs6q7z

nostr:npub1hxwmegqcfgevu4vsfjex0v3wgdyz8jtlgx8ndkh46t0lphtmtsnsuf40pf & nostr:npub1s5yq6wadwrxde4lhfs56gn64hwzuhnfa6r9mj476r5s4hkunzgzqrs6q7z believe #bitcoin will have a CAGR of 30-50% going forward

“If they're not raising interest rates then I do think that it creates tailwinds for #Bitcoin and we're easily going in the six figures this year.

If we zoom out and look 18 months after the having where are maybe we are touching a million dollars.

There's not anything stopping us from getting there and there's lots of catalysts pushing us towards that that price point.”

nostr:npub1hxwmegqcfgevu4vsfjex0v3wgdyz8jtlgx8ndkh46t0lphtmtsnsuf40pf nostr:npub1s5yq6wadwrxde4lhfs56gn64hwzuhnfa6r9mj476r5s4hkunzgzqrs6q7z

Before taking on debt/equity #MSTR asks themselves:

- Is this prudent?

- Is this accretive?

- Is this going to be good for our shareholders?

“We don’t want too much leverage, just the right amount without creating undue uncertainty.

We pride ourselves in being nimble and taking advantages as they present themselves

Sometimes it’s appropriate to go fast, go slow, or do nothing and wait for a better opportunity.”

- nostr:npub15dqlghlewk84wz3pkqqvzl2w2w36f97g89ljds8x6c094nlu02vqjllm5m

They never mention the “BTC/ Sh” metric.

Instead they make decisions “accretive to shareholders”

Big tech is cash flow rich and asset poor.

- it gets harder to produce greater cash flows as the companies get larger

Bitcoin is asset rich.

- it becomes more compelling as its value increases

- as it gets larger the liquidity and the network of holders increases

Before taking on debt/equity #MSTR asks themselves:

- Is this prudent?

- Is this accretive?

- Is this going to be good for our shareholders?

“We don’t want too much leverage, just the right amount without creating undue uncertainty.

We pride ourselves in being nimble and taking advantages as they present themselves

Sometimes it’s appropriate to go fast, go slow, or do nothing and wait for a better opportunity.”

- nostr:npub15dqlghlewk84wz3pkqqvzl2w2w36f97g89ljds8x6c094nlu02vqjllm5m

They never mention the “BTC/ Sh” metric.

Instead they make decisions “accretive to shareholders”

With the approval of the #Bitcoin ETPs, the Bitcoin deniers are being discredited and the skeptics are being silenced.

If you don’t think it’s a legitimate asset there’s no way the sec would have approved an ETP for “tulip bulbs.”

It’s not going to be banned because it’s being viewed and accepted as an asset not a currency via Fidelity, BlackRock, etc.

All that remains are traders, investors, or maximalists.

Awareness and acceptance is spreading.

“The historical track record of old white men who don't understand technology crapping on new technology is I think at a 100%." #bitcoin

- Marc Andreessen

#MSTR a company that’s able to reinvest their capital at high rates of return via #bitcoin

#100baggers

“#bitcoin isn’t digital currency, it’s digital property

Once you make that big leap, the compelling use case is capital preservation for everyone in the world.

Medium of exchange is only worth $1T

Store of value is worth $100T

No ones trying to buy a cup of coffee with fraction of their building

Medium of exchange is a distraction”

nostr:npub15dqlghlewk84wz3pkqqvzl2w2w36f97g89ljds8x6c094nlu02vqjllm5m

https://x.com/saylor/status/1767178599390458285?s=46&t=ps6aTw4ibalKEFrDR9D5og

“#bitcoin has no cash flows

The critics think it’s a defect…it’s a feature

With no cash flows, quarterly results, no product cycles, this is the longest lived asset in the financial ecosystem with the least uncertainty.

We’re buying it to hold it for 100 years.”

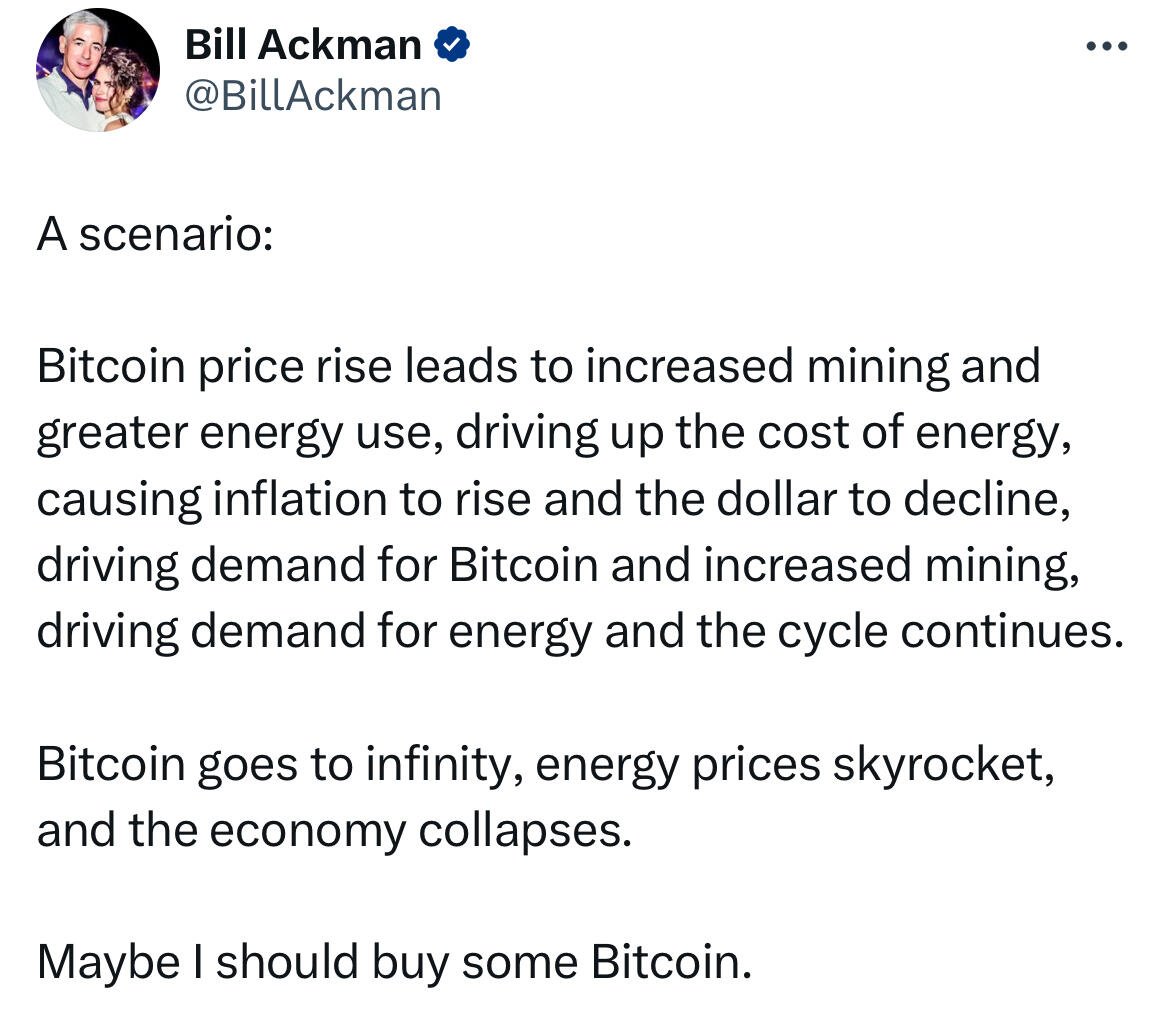

“With Bitcoin it’s been the case that people basically make up their mind first, and then look for the confirming evidence.

With Warren and Charlie it’s easy, it’s not a productive asset.

That’s all they need to know, and therefore they don’t like it.”

Bill Miller III

“#bitcoin isn’t digital currency, it’s digital property

Once you make that big leap, the compelling use case is capital preservation for everyone in the world.

Medium of exchange is only worth $1T

Store of value is worth $100T

No ones trying to buy a cup of coffee with fraction of their building

Medium of exchange is a distraction”

nostr:npub15dqlghlewk84wz3pkqqvzl2w2w36f97g89ljds8x6c094nlu02vqjllm5m

https://x.com/saylor/status/1767178599390458285?s=46&t=ps6aTw4ibalKEFrDR9D5og

Samantha Mclemor’s path from skeptic to believer of #bitcoin as digital gold starting in 2020 via Bill Miller III

Each cycle brings in another cohort #bitcoin

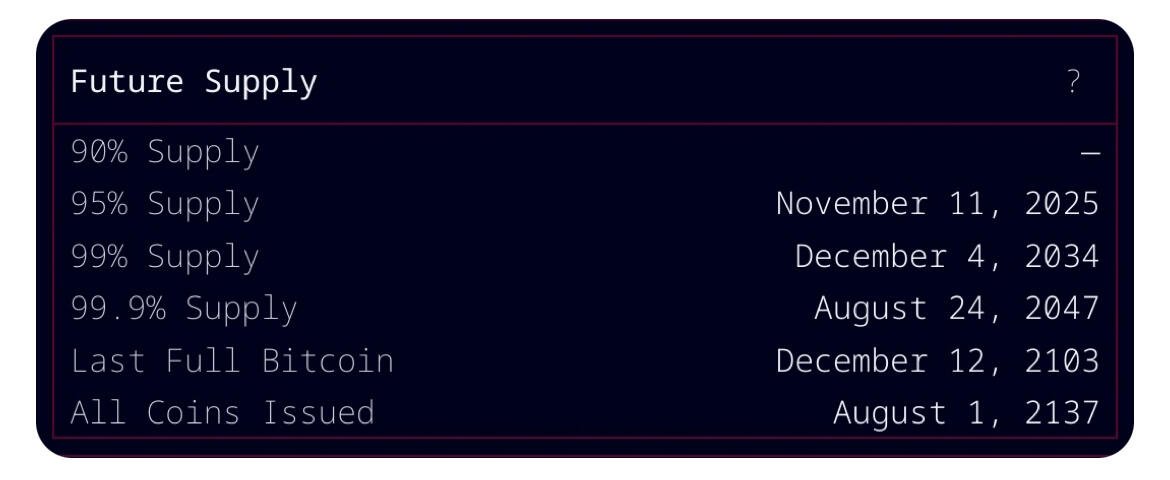

“I think we’re in the #Bitcoin gold rush era.

It started in January of 2024 (w Bitcoin ETFs) and it will run until about November 2034.

In November 2034, 99% of all Bitcoin will have been mined.

The last 1% will comes out over the next 100 years.”

nostr:npub15dqlghlewk84wz3pkqqvzl2w2w36f97g89ljds8x6c094nlu02vqjllm5m

https://www.youtube.com/live/SKAHlCpwsLc?si=psuXebi61vVIid4P&t=29748

The beginning of the gold rush #bitcoin

Seen at LaGuardia Airport