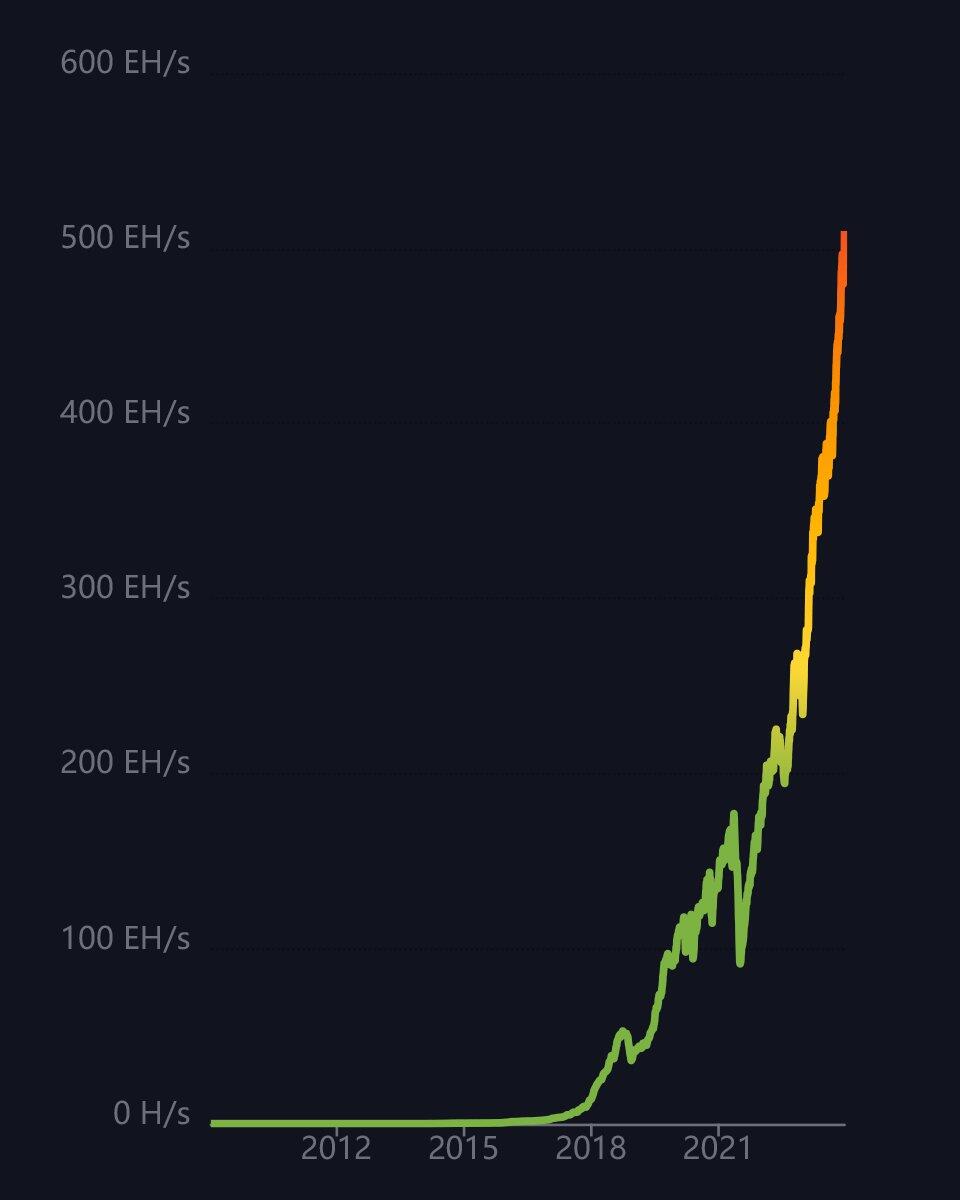

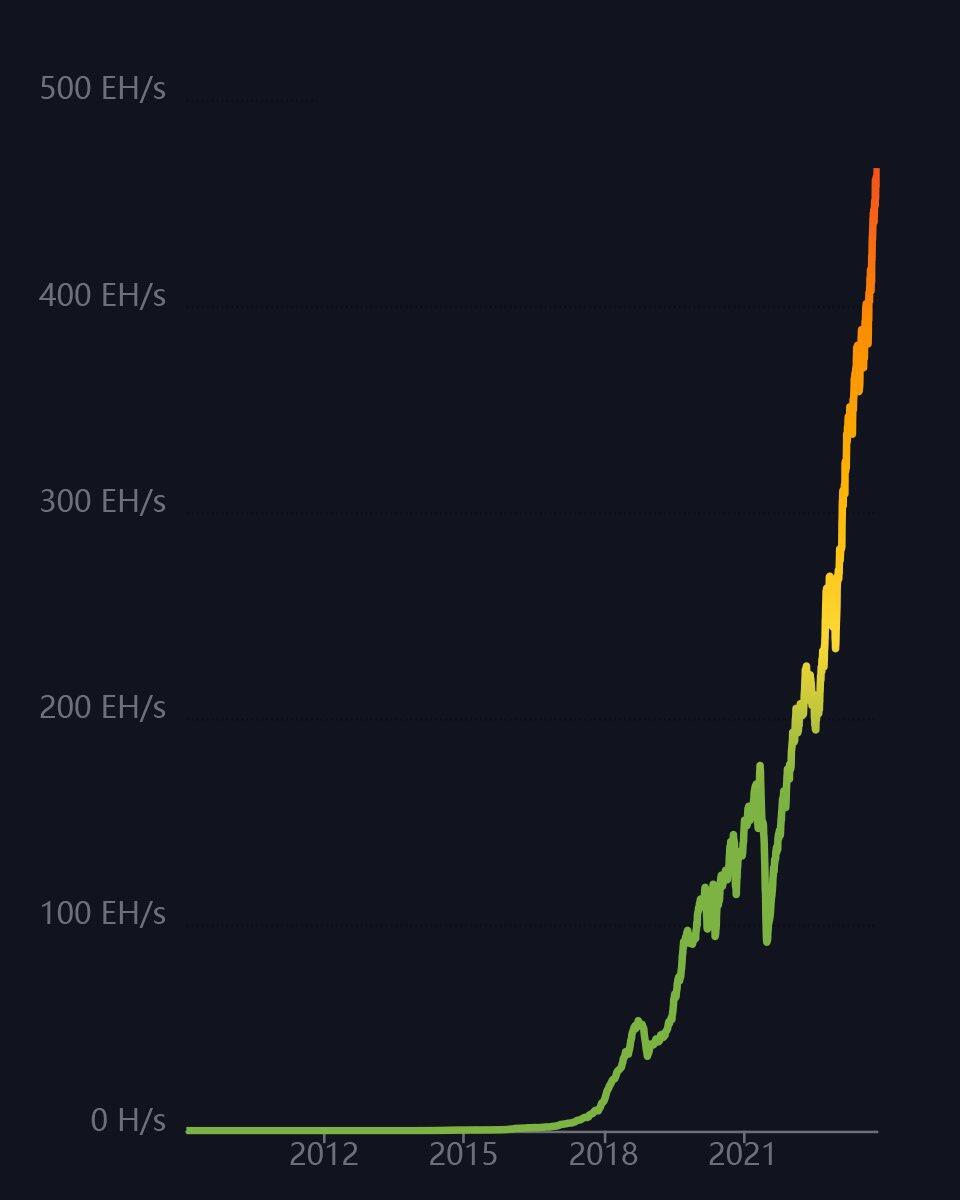

New Record Bitcoin Hashrate 🔥

510,000,000,000,000,000,000x

Hashes Per Second

Proof of work!🧡

Study, learn, hodl, decouple.

#bitcoin 🧡

▃▃▃▃▃▃▃▃▃▃▃▃▃▃▃

My savings account: Bitcoin

The tool I recommend for setting up a Bitcoin savings plan: The @Relai 🇨🇭 app is especially suited for beginners or people who want to invest in Bitcoin with an automated investment plan once a week or monthly. Hence a DCA, Dollar cost Average Strategy. Check out my tutorial post (guide) and video for more info.

Get your Bitcoin out of exchanges. Save them on a hardware wallet, run your own node... be your own bank. Not your keys, not your coins. It’s that simple.

Do you want to know more about this? Check out my daily stories on Instagram. (yeah I know IG sucks🥴)

Is this post helpful to you? If so, please share it!🧡

If you have any questions, let me know in the comments or send me a DM!⬇️

▃▃▃▃▃▃▃▃▃▃▃▃▃▃▃

Like my content?🙏🏽

Please consider dropping some sats, following, comment✅

⭐ Many thanks⭐

Felipe - Bitcoin Friday!

▃▃▃▃▃▃▃▃▃▃▃▃▃▃▃

#zap 🧡 #nostr #plebchain #grownostr #stacksats #bitcoineducation #adoption #proofofwork

🧠Quote(s) of the week:

"A control structure disguised as a free market will do everything in its power to retain control. and... it gets stronger, by the division of you within it. All you have to do is stop playing by its rules. Bitcoin"- Jeff Booth

As I said so often. Bitcoin is financial inclusion and financial empowerment. Our current system consolidates power, evident in the 1% owning 43% of global wealth. Bitcoin is promoting inclusivity with its 2.7 billion unbanked potential users worldwide.

🧡Bitcoin news:

➡️ FASB has officially adopted Fair Value Accounting for Bitcoin for fiscal years beginning after Dec 15, 2024. This upgrade to accounting standards will facilitate the adoption of $BTC as a treasury reserve asset by corporations worldwide.

Now why is this huge? Previously companies could only value their bitcoin at the lowest price since they bought it, which meant they would have to record losses, but not the gains when the price recovered. This is an amazing step in the adoption process. This move by FASB is a landmark decision in the accounting treatment of Bitcoin. The tide is turning for Bitcoin. Slowly, then suddenly.

Source: https://www.fasb.org/page/getarticle?uid=fasb_Media_Advisory_12-13-23

For those who want more context and a super simple explanation, here's a thread all about it from last year:

https://twitter.com/jameslavish/status/1592228100934438913

Or ELID (Explain like I’m degenerate)

"If you YOLO’d your company’s bag into Bitcoin, your balance sheet would only reflect the price at its most REKT. Thanks to the new rules, if Bitcoin pumps you can reflect the ACTUAL price (fair value), and show your shareholder what a Chad you are." - @DAzaraf

Michael @saylor said this one year ago:

These 3 catalysts will take Bitcoin to $5 million:

1. Spot ETF approval

2. Traditional bank custody of Bitcoin

3. Fair value accounting rules from FASB

It seems like we are getting the first two fairly soon and the third one in 2025. Please forget the price (5 million), it's about how the network is growing and how the network getting more and more mature. Bullish!

➡️ In the face of a bear market, Bitcoin's transaction volume share tells a story of unwavering adoption across the globe. Western economies don't dictate its fate. As economic challenges mount worldwide, Bitcoin shines as a beacon, driving its adoption ever upward. If the West stops Bitcoin nothing changes for Westerners. It’s different in the Global South. Bitcoin can not be stopped there. The people won’t allow anything to stop it. And it’s only getting stronger." - Sooly

Bitcoin is the only asset that anyone in the world can hold.

(picture - chainanlysis)

➡️ "BlackRock has amended its Bitcoin ETF structure to make it easier for Wall Street banks like Goldman and JP Morgan to own Bitcoin — even though regulations prevent banks from holding Bitcoin directly. This model is designed to improve investor protection and reduce transaction costs, both key SEC requirements for approval." - Bitcoin Archive

➡️ The narrative amongst the institutional and leftward-leaning is changing: the ESG criticisms are moot, and Bitcoin is a force for good.

Last week the Financial Times published its first cautiously pro-Bitcoin ESG article.

If they are writing pro-bitcoin ESG material it’s because the decision makers on high have finally allowed it.

Funny isn't it how the narrative has shifted a complete 180? Ow well, let's have a look at a 'decision maker':

https://twitter.com/PrestonPysh/status/1734992631535386766

➡️ Last week Bitcoin price closed UP 8 weeks in a row for the first time since 2017.

Last week I wrote the following:

"If you have a Ledger you might want to consider another hardware wallet, you should at least stop using Ledger Live and switch to Sparrow Wallet.

When it comes to privacy and potential downsides of Ledger in the future, I would not recommend Ledger anymore.

In summary / Red flags for Ledger:

User data leaked (3rd party - supplier got hacked). Now people are being scammed or harassed by phone. It's not entirely Ledger's fault, but still very unpleasant.

Marketing/gear: Caps and chains to hang or store your ledger in. In my opinion, it makes no sense for a company, especially a hardware company, to sell such merchandise. It goes against the ethos of Bitcoin/Cypherpunks regarding privacy.

Closed source - in short, preferably you want a hardware wallet that is open source. Like the hardware wallets mentioned below.

Recovery service is perhaps my biggest concern. Ledger can/does possess your private key. This could, for example, be given away if a government were to intervene. Or if a server at Ledger were to be hacked, your private key could (theoretically) be stolen."

This week we learned the following.

"Ledger Connect Kit Breach: Hacker Siphons $484K, Company Rolls Out Version 1.1.8

The unknown attacker that compromised Ledger’s Connect Kit Library has reportedly siphoned $484,000 from wallets, according to the on-chain intelligence firm Lookonchain. Ledger disclosed a former employee fell victim to a phishing attack and the attacker gained access to the Ledger Connectkit Library and uploaded a malicious bug." -BitcoinNews

If you want to learn more on this matter: https://twitter.com/MatthewLilley/status/1735285684070461534

Ledger has learned nothing about opsec from multiple breaches. At this point, I don't think anyone should in good conscience recommend their hardware or use their libraries. What happened?

I bet 80% of Ddefi and blockchain projects have the same level of opsec or worse than Ledger. They have yet to be attacked.

That's why I get mad that so-called influencers are promoting Ethereum and calling DApps a great feature.

Picture (story)

These affiliate-larping individuals are in my opinion more harmful to the space than hacks.

I will quote nostr:npub1az9xj85cmxv8e9j9y80lvqp97crsqdu2fpu3srwthd99qfu9qsgstam8y8 (CEO Coldcard):

"It's not just Ledger; any client software that maintains 1,000s of coins will have the same problem. It's just too much bloat to maintain and secure. Put your precious bitcoin on COLDCARD and your altcoins stay on the exchanges, where you doing the speculation anyways."

So what about Trezor? "IMO That's just virtue signaling, the codebase still has all the shitcoins to be reviewed and share resources, and the desktop client has all the shitcoins in it."

Which hardware then?

Blockstream Jade for affordability, Bitbox02 (Bitcoin only or the multi-edition if you have shitcoins...but check the above statement), Foundation Passport for user-friendliness, and Seedsigner for trustlessness. You might want to drop the Coldcard in the mix, but one trade of... closed sourced.

Order your Jade here: https://bitcoinbrabant.com/product/blockstream-jade-2/

Order your BitBox 02 Bitcoin Only here: https://bitbox.swiss/bitbox02/?ref=IYjAmzKEXw

But when it comes to privacy and potential downsides of Ledger in the future, I would not recommend Ledger.

(Picture Ledger)

➡️ "Ledger and other wallets offer a desktop or mobile companion app. (Ledger + Ledger Live) I would recommend using an open-source hardware wallet in combination with the use of Sparrow, Electum, Nunchuk, and other clients. By doing that you increase security and privacy incentives by splitting this into two vendors." -NVK

➡️ US Senator Elizabeth Warren introduces bill to crack down on crypto and Warren adds 5 new Senators as co-sponsors to The Digital Asset Anti-Money Laundering Act of 2023.

A reminder that Elizabeth Warren is one of the worst legislators of all time Lifetime stats for Warren Bills:

- 305 introduced, 0 became law

- 1766 Co-sponsored, 45 became law

Warren sponsored:

36 bills in the 118th Congress (2023-24). 0 passed.

103 bills in the 117th Congress (2021-22). 0 passed.

98 bills in the 116th Congress (2019-20). 0 passed.

80 bills in the 115th Congress (2017-18). 0 passed.

27 bills in the 114th Congress. (2015-16). 0 passed.

She’s just a loud-mouthed engagement-bait troll.

Thank god Elizabeth Warren sucks at her job

https://twitter.com/stackhodler/status/1734871663450226762

They are scared because of this:

https://twitter.com/thomas_fahrer/status/1734519981675839940

➡️ "Bitcoin is pseudonymous and permissionless. The protocol does not know the number of users, only the number of addresses. This makes all claims relating to concentrated ownership fundamentally flawed."- Anil

(picture Anil)

➡️ Valkyrie CIO Steve McClurg on the spot Bitcoin ETF: "We know for a fact that insurance companies and pension funds are looking at Bitcoin as an investment"

➡️ On the 15th of December Marathon broke their own record and mined 125.8 Bitcoin (worth ~$5.3M) in the last 24 hours.

➡️ Former CEO of Google, Eric Schmidt on Bitcoin:

"Bitcoin is a remarkable cryptographic achievement, and the ability to create something that is not duplicable in the digital world has enormous value"

"As Bitcoin network grows the value of Bitcoin grows. As people move into Bitcoin for payments and receipts they stop using US Dollar, Euros, and Chinese Yuan which in the long-term devalues these currencies” - Andrew Howard

💸Traditional Finance / Macro:

👉🏽Week ahead: In the US we have consumer confidence, PCE deflator, and new/existing home sales. In Europe, it’s the Euro Area consumer confidence, German IFO survey, UK CPI, and retail sales. In Asia we have the BOJ meeting, and Japan CPI.

👉🏽 3,200 venture-backed U.S companies have gone out of business in 2023 Collectively they raised $27.2B in venture funding.

👉🏽The stock market is near all-time highs with:

1. Core inflation is still at 4%, double the Fed's target

2. The Fed beginning to backtrack on its "pivot"

3. Markets expecting 6-8 rate CUTS in 2024 while the Fed expects 3

4. The $VIX is trading at its lowest since 2020

5. US interest expense on track to top $1 trillion in 2024

The stock market seems to be disconnected from the economy and reality. Remember, the financial economy and the real economy are two different beasts.

👉🏽 https://twitter.com/lopp/status/1736397634925949114

What do we learn from this?

1. $1.45B in legal fees

2. Bankruptcy lawyers are the real criminals. the greatest legal scam on record.

3. FFS! Please self custody your Bitcoin, this is the way!

🏦Banks:

👉🏽no news

🌎Macro/Geopolitics:

👉🏽Last week the Federal Reserve kept the rates unchanged! Significantly lower inflation forecast!

SUMMARY OF FED DECISION (12/13/23):

1. Fed leaves rates unchanged for third straight meeting

2. Fed says the growth of the economy "has slowed" since Q3 2023

3. Most Fed officials see interest rate cuts in 2024

4. Median projection shows 3 rate cuts in 2024

5. Fed sees 4.1% unemployment by the end of 2024

6. The Fed sees US GDP growth at 2.6% in 2023 and 1.4% in 2024.

The market is pricing in double the number of rate cuts in 2024 than the Fed projects.

Here you can find a more in-depth summary of Powell's speech: https://twitter.com/macro_dose/status/1735049579425370605

The Fed admitted they're going to cut. They blinked and said the silent part out loud, right?

The first comment after the blackout ended was by NY Fed President Williams. He said the Fed is NOT talking about rate cuts now. This is the exact OPPOSITE of what Powell said on Wednesday. To make it even more funnier. Fed member Bostic sees only 2 rate CUTS in 2024 and expects cuts to begin in the third quarter. This comes just hours after NY Fed President Williams said the Fed "isn't really discussing rate cuts."

The Fed messed up.

What is a Fed blackout? It's a period of time around Fed meetings where Fed members are restricted in speaking about Fed policy. This is designed to limit conflicting messages and market confusion around Fed meetings. The blackout period ended yesterday at midnight. (15th of December)

Please have a look at the following tweets. It will show you how the global base ledger is managed in the 21st century.

https://twitter.com/LynAldenContact/status/1735673431662739593

https://twitter.com/WalkerAmerica/status/1735060271712858187

If you are lazy and not checking the links above, to sum it up:

"The Fed Since November 1st:

1. Nov. 1: Getting inflation to 2% "has a long way to go"

2. Nov. 21: "No indication of rate cuts at last meeting"

3. Dec. 1: Talks about rate cuts are "premature"

4. Dec. 1: "We are prepared to tighten policy further" if needed

5. Dec. 13: Rates have peaked, 3 rate cuts coming in 2024

6. Dec. 15: Fed "isn't really talking about rate cuts"

I thought the Fed could not embarrass themselves anymore. Yet they keep surprising me.

I hope we will get a global base ledger like this:

(picture Bitcoin Insurance Schedule)

👉🏽"The current gap between the "price" and "value" of many things in many minds is at/near the widest in history.

For example, if $AAPL dropped by 50% it would be still worth more than the entire German or French market. That’s just one company out of many vs. former European heavyweight countries. The failed experiment called Euro makes out 57% of DXY."

https://twitter.com/LukeGromen/status/1735711892213997850

Compared to before the pandemic, real wages in Germany have fallen by 7.2%, in Italy even by 9.1%. In comparison, real wages in the US have grown by 2.8% (over q3-2019/q3-2023).

👉🏽 President @JMilei of Argentina signed an executive order on his first day in office to cut 21 government departments down to 9. Reducing bureaucracy and government is the model to succeed as a society. Smaller governments are better for growth, liberty, and overall well-being.

His official signature in the inauguration book says: ''VIVA LA LIBERTAD CARAJO'' English translation: "Long Live F*cking Freedom"

" Argentina's President Javier Milei announces currency devaluation by 54% and spending cuts in an effort to revive the economy. The new exchange rate has been adjusted to 800 Argentine Pesos per US dollar. Spending cuts include suspending public works, cutting subsidies on transport and energy sectors, and more. Their economy minister said Argentina has an “addiction” to fiscal deficits." - TKL

https://twitter.com/samcallah/status/1734717431711404280

👉🏽"Central banks are on pace to buy over 1,000 tons of gold in 2023. This would be the second-ever year with 1,000+ tons purchased with 2022 being the first. Purchases of gold are 2.5X larger than purchases in 2021 and 4X larger than purchases in 2020. Currently, central banks hold just 20% of their reserves in gold. Historically speaking, central banks hold ~40% of their reserves in gold on average. Are central banks bracing for a massive gold-buying spree?" - TKL

Bitcoin is the best protection from the falling purchasing power of the dollar, (and every other fiat currency), ongoing for 110 years and likely to continue. Central banks seem to be betting on this trend continuing and, perhaps, accelerating.

(picture gold)

There is no alternative. With US debt-to-GDP at 985 today and on pace to triple by 2050. Not my words, but by the CBO (Congressional Budget Office). (picture CBO)

👉🏽 https://twitter.com/WallStreetSilv/status/1736575595645927464

The US added another $2.6 trillion of debt between June 2023 and December 2023. $31.4 trillion to $34 trillion now. The rate of growth in the US national debt is accelerating into a hockey stick chart and nobody in Washington DC is even talking about it.

And some fin-influencers are still trying to downplay this? The money in your bank account is losing its value, FAST!

"While you were sleeping, the US added $12 billion to the national debt. A person making $100k per year and paying zero taxes would have to work for 120,000 years to reach $12 billion. And they can print it with a snap of their fingers.

Opt out: Bitcoin"- Mitchell

🎁If you have made it this far I would like to give you a little gift.

I want to share this episode of Bitcoin Fundamentals where @PrestonPysh and @sebbunney discuss 'The Hidden Cost of Money,' exploring money's deep impact on society, politics, and mental health in a revealing interview.

I just listened to this for the second time.

I can say hands down that this was the best explanation of current economics, the monetary system, and our overall societal situation I have yet heard and the fact that it is presented in a way that is understandable to almost all makes it even more valuable. Seb Bunney is very good at making Bitcoin easy to understand, and how Bitcoin changes everything!

or watch it on YouTube: https://www.youtube.com/watch?v=JoxqSbwWx-c

Credit: I have used multiple sources!

My savings account: Bitcoin

The tool I recommend for setting up a Bitcoin savings plan: @Relai 🇨🇭 especially suited for beginners or people who want to invest in Bitcoin with an automated investment plan once a week or monthly. Hence a DCA, Dollar cost Average Strategy. Check out my tutorial post (Instagram) & video (YouTube) for more info.

⠀⠀⠀⠀

Get your Bitcoin out of exchanges. Save them on a hardware wallet, run your own node...be your own bank. Not your keys, not your coins. It's that simple.

⠀⠀⠀⠀⠀⠀⠀⠀

Is this post helpful to you? If so, please share it and support my work with sats. #zap 🧡 #weeklyrecap #nostr #plebchain #grownostr #stacksats

https://void.cat/d/UH5NHmsdgnp3SYzheSRBsx.webp

https://void.cat/d/KKUwtzYWKiKxTQsgMHKmeJ.webp

Great day!

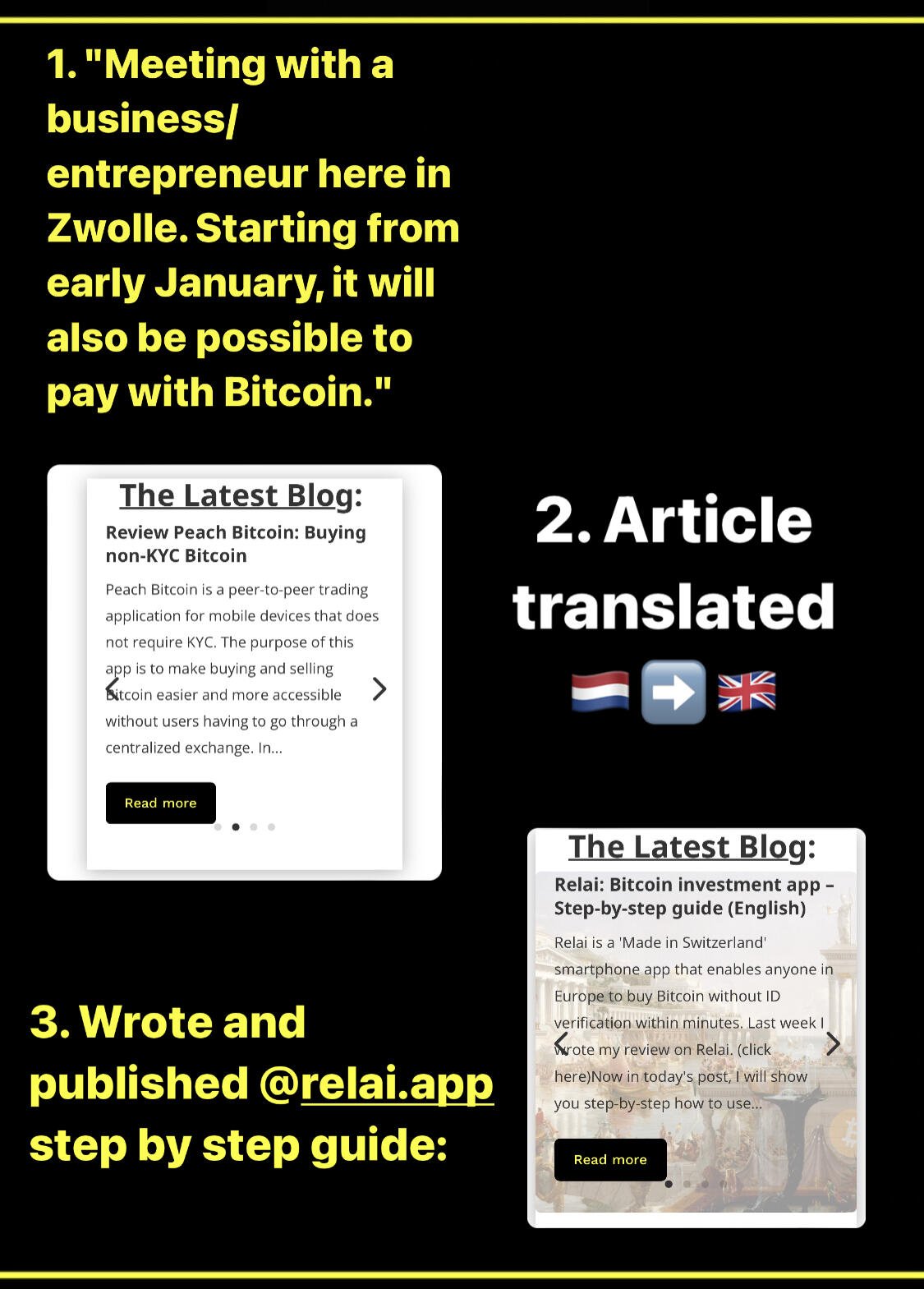

1. New merchant on our list. This morning I had a meeting with a business owner /entrepreneur here in Zwolle. Starting from early January, it will also be possible to pay with Bitcoin.

2. Translated my Peach review from 🇳🇱➡️🇬🇧: https://cryptofriday.eu/index.php/2023/12/16/review-peach-bitcoin-buying-non-kyc-bitcoin/

3. And finally I wrote and published a new Relai guide: how to setup & use nostr:npub1sqzr42dj8vx32yd5jcvvl3ytux45kl0etgf6y2ymjvmd7lqmuwmqk9vk7v

Proof of work🧡😏

Study, learn, hodl, decouple.

#bitcoin 🧡

▃▃▃▃▃▃▃▃▃▃▃▃▃▃▃

My savings account: Bitcoin

The tool I recommend for setting up a Bitcoin savings plan: The @Relai 🇨🇭 app is especially suited for beginners or people who want to invest in Bitcoin with an automated investment plan once a week or monthly. Hence a DCA, Dollar cost Average Strategy. Check out my tutorial post (guide) and video for more info.

Get your Bitcoin out of exchanges. Save them on a hardware wallet, run your own node... be your own bank. Not your keys, not your coins. It’s that simple.

Do you want to know more about this? Check out my daily stories on Instagram. (yeah I know IG sucks🥴)

Is this post helpful to you? If so, please share it!🧡

If you have any questions, let me know in the comments or send me a DM!⬇️

▃▃▃▃▃▃▃▃▃▃▃▃▃▃▃

Like my content?🙏🏽

Please consider dropping some sats, following, comment✅

⭐ Many thanks⭐

Felipe - Bitcoin Friday!

▃▃▃▃▃▃▃▃▃▃▃▃▃▃▃

#zap 🧡 #nostr #plebchain #grownostr #stacksats #bitcoineducation #adoption

🧠Quote(s) of the week:

"Here’s the question you must ask yourself: Do you trust a group of unelected, corrupt old central bankers to completely control the value of your money? That’s fiat. Or do you trust energy, math, and the free market? That’s Bitcoin" - Walker

"No one will exchange their Bitcoin for less than $1 ever again. That ship has sailed.

No one will exchange their Bitcoin for less than $10 ever again. That ship has sailed.

No one will exchange their Bitcoin for less than $100 ever again. That ship has sailed.

No one will exchange their Bitcoin for less than $1,000 ever again. That ship has sailed.

No one will exchange their Bitcoin for less than $10,000 ever again. That ship has sailed.

How much longer before no one will exchange their Bitcoin for less than $100,000 ever again? That ship will soon sail." - Wicked

🧡Bitcoin news:

➡️ "El Salvador, in partnership with Tether, launches its “Freedom Visa” program that will offer residency and a pathway to citizenship for investors who commit $1 million in Bitcoin or USDT.

This program, limited to 1,000 participants yearly, aims to attract wealthy individuals by offering residency and eventual citizenship in exchange for their investment. This follows El Salvador's decision to make Bitcoin legal tender in 2021.

The initiative, seen as a significant opportunity for investors to contribute to El Salvador's future, requires a substantial investment for citizenship eligibility. Adriana Mira, the Vice Minister of Foreign Affairs, emphasizes the program's potential to shape the nation's future. The program is expected to generate around $1 billion annually and has Tether, the world's largest stablecoin issuer, as a technology partner. The high investment threshold has not deterred interest, with strong demand reported for the program." h/t Scott Melker

Of course, this is a bit expensive for a new passport haha, but make no mistake. Game theory is at play here. The future competition over top talent / wealthy entrepreneurs will be fascinating to watch unfold.

➡️ Decentralized Bitcoin exchange Bisq sees a significant increase in Exchange Trade Volume.

Love to see it!

➡️ Bitcoin has surged 166% since the European Central Bank said it was on the 'road to irrelevance'

➡️The New Hampshire Commission on Nuclear Energy produces a report on “Next-Generation Nuclear Reactor Technology” which mentions Bitcoin over 40 times.

Full report available at the commission website. Report: https://nuclearnh.energy/wp-content/uploads/2023/12/NH-Nuclear-Study-Commission-2023-Final-Report.pdf

➡️Mining Stocks Year-to-Date: Bitfarms $BITF: +382% Iris $IREN: +377% CleanSpark $CLSK: +354% Marathon $MARA: +349% Riot $RIOT: +339% Hive $HIVE: +173% Hut8 $HUT: +123% $BTC: +161% (data: Yahoo Finance)

➡️ https://twitter.com/rektbuildr/status/1732542258698694875

If you have a Ledger you might want to consider another hardware wallet, you should at least stop using Ledger Live and switch to Sparrow Wallet.

When it comes to privacy and potential downsides of Ledger in the future, I would not recommend Ledger anymore.

In summary / Red flags for Ledger:

User data leaked (3rd party - supplier got hacked). Now people are being scammed or harassed by phone. It's not entirely Ledger's fault, but still very unpleasant.

Marketing/gear: Caps and chains to hang or store your ledger in. In my opinion, it makes no sense for a company, especially a hardware company, to sell such merchandise. It goes against the ethos of Bitcoin/Cypherpunks regarding privacy.

Closed source - in short, you preferably want a hardware wallet that is open source. Like the hardware wallets mentioned below.

Recovery service is perhaps my biggest concern. Ledger can/does possess your private key. This could, for example, be given away if a government were to intervene. Or if a server at Ledger were to be hacked, your private key could (theoretically) be stolen.

Which hardware then?

Blockstream Jade for affordability, Bitbox02 (Bitcoin only or the multi-edition if you have shitcoins), Foundation Passport for user-friendliness, Seedsigner for trustlessness.

Order your Jade here: https://bitcoinbrabant.com/product/blockstream-jade-2/

Order your BitBox 02 Bitcoin Only here: https://bitbox.swiss/bitbox02/?ref=IYjAmzKEXw

But when it comes to privacy and potential downsides of Ledger in the future, I would not recommend Ledger anymore.

Great reply by BitBox:

https://twitter.com/BitBoxSwiss/status/1733263812311064868

➡️ The Financial Times says "Everything has been thrown at Bitcoin and it’s held up. Whether you like it or not, Bitcoin going to command a place in portfolios"

Bloomberg, Aaron Brown a former head of financial market research at AQR Capital Management, says "Even skeptical investors should accept it’s safer to have a small allocation to Bitcoin than to ignore it".

Hello, narrative shift!

➡️ The VanEck spot Bitcoin ETF ticker will be $HODL. "VanEck's bitcoin ETF ticker will be $HODL.. a departure from the more boring Boomer-y choices from BlackRock, Invesco, and Fidelity. Who knows though, maybe smart to differentiate here. Plus, VanEck specializes in niche and has a solid retail base." - Eric Balchunas

Talking about VanEck, they just released their 15 predictions for 2024:

"The US recession will finally arrive, but so will the first spot Bitcoin ETFs. Over $2.4B may flow into these ETFs in Q1 2024 to support Bitcoin’s price."

➡️$4.5 trillion Fidelity Director of Global Macro, Jurrien Timmer, says owning a little Bitcoin "could go a long way."

Foto

Owning 0 Bitcoin is irresponsible. The writing is on the wall.

A couple of days later Jurrien dropped another great Bitcoin thesis:

https://twitter.com/TimmerFidelity/status/1732847992183349706

Look at the following chart…and connect the dots.

https://twitter.com/WClementeIII/status/1733178059602231303

https://twitter.com/WClementeIII/status/1733180221048713614

If you want to read the full report; https://www.fidelitydigitalassets.com/sites/default/files/documents/valuing-bitcoin-report.pdf

➡️Cathie Wood says a Bitcoin ETF is the 'final seal of approval' for institutions, that will drive the price higher for "5 to 10 years".

➡️Bitcoin mining company Riot Blockchain acquires 66,560 ASICs from MicroBT for a staggering $290.5M, averaging around $4,360 per machine

➡️Jack Dorsey / BitKey launched their new hardware wallet: https://twitter.com/DocumentingBTC/status/1732803467775795220

"We’re excited to announce people in 95+ countries can now pre-order Bitkey! Bitkey is a self-custody bitcoin wallet with an app to send on the go, hardware to protect your savings, and recovery tools in case you lose your phone, or hardware, or both."

The following threads are important to read before you decide to buy the Bitkey:

"Mainly concerned here that people won't grasp that a U.S. publicly traded company will get 100% visibility into their transactions whenever Bitkey is involved. Initial thoughts below:

Pros:

1. Interesting and well-thought-out backup architecture (with major con below) that is very detailed and publicly published (https://bitkey.build/content/files/2023/11/Bitkey-Recovery-Features.pdf…)

2. Gets many more people thinking about self-custody in Bitcoin

Cons:

1. Not open source software/hardware

2. No clear commitment to open-source software/hardware made

3. Block gets 100% visibility into all transactions due to 2-of-3 multi-sig architecture

4. No ability to verify addresses or amounts (no screen)

5. Still $150 + shipping w/o screen" - SethforPrivacy

Please also read a well-thought-out thread on their screen-less architecture by Zach Herbert that is worth a read for broader context:

https://twitter.com/zachherbert/status/1674532618644144128

For me it sounds like moving it to BitKey won't be that big of an improvement.

I think @Bitkeyofficial is positioning itself as an entry-level self-custodial option for customers who don't care about their privacy. They just want ease of use.

➡️Companies in Japan would no longer have to pay tax on unrealized cryptocurrency gains if they hold on to the digital assets under a proposal being discussed by the country's ruling coalition.

"People in this space have been talking about this game theory playing out (no tax on gains) for nearly a decade at this point. Tick Tock Next Block" Preston Pysh

I love the game-theory angle. Game theory is the probability of an outcome given human behavior. We are more primal than we think and therefore quite predictable. That would accelerate adoption dramatically. I would use Bitcoin as much as possible if I didn’t have to worry about capital gains tax.

➡️The following article by Preston Pysh is especially for my US followers, but make no mistake Europe/World you can learn from this.

This article by Preston Pysh is an insanely comprehensive takedown of FinCEN's recent Patriot Act anti-privacy reporting requirements proposal:

https://egodeath.capital/blog/fincen-may-be-violating-your-rights-bitcoin

Context: Recently the Financial Crimes Enforcement Network (FinCEN) has proposed FINCEN-2023-00016. This robust policy proposal is a gross overreach of your freedoms as an American, and this analysis intends to document where, how, and what you do about it.

This article clearly explains 1) what this repressive action by the state means to you and 2) how to easily add your voice to stop it.

➡️ JPMorgan CEO Jamie Dimon says he would "close down" Bitcoin if he were the government. "The only true use case for it is criminals, drug traffickers, money laundering, tax avoidance."

Watch my response on here:

note1wylqln56cxrjzydfzrcddecqsqmkjtjgw57frue6mhsayftrwrmq7qhuy4

If you are too lazy to watch the clip ;)

Context: JPMorgan Chase's parent company is the second most penalized financial institution with close to $40 Billion in fines for 272 violations since 2000. Fines for securities abuses, cheating worker pay, anti-competitive practices, currency manipulation, predatory lending practices, and gross misconduct. They are the criminals and they have no moral authority to stand on when it comes to Bitcoin.

I quote Guy Swann: In other words: “Anyone who uses a tool that I don’t have control and total surveillance of, is de facto committing a crime.” “All tech that works without me as a gatekeeper should be illegal.” Bitcoin exists to protect us from these exact sorts of sociopaths."

Oh by the way: Jamie Dimon (Oct 17, 2017): "When I made that stupid statement... called [Bitcoin] a fraud, my daughter sent me an email saying, 'Dad, I own 2 bitcoins.'" Jamie wants to implicate his own daughter as a criminal because he's embarrassed she has outperformed him by nearly 900%"

➡️BlackRock receives $100K as “seed capital” for its spot Bitcoin ETF, selling 4K shares at a per-share price of $25.00. A flood of money will pour in!

➡️ This is a horrendous level of centralization within the proposed Bitcoin ETFs. It seems Fidelity is the only one doing it right.

(see picture)

💸Traditional Finance / Macro:

👉🏽Week ahead: In the US, the highlights will be CPI, retail sales, and industrial production data, along with the final FOMC meeting of the year. In Europe, we have industrial production data and the ECB and BOE meetings. In Asia we have China monthly activity data, the Japan Tankan report, India industrial production and CPI data, and central bank meetings in Taiwan and the Philippines.

🏦Banks:

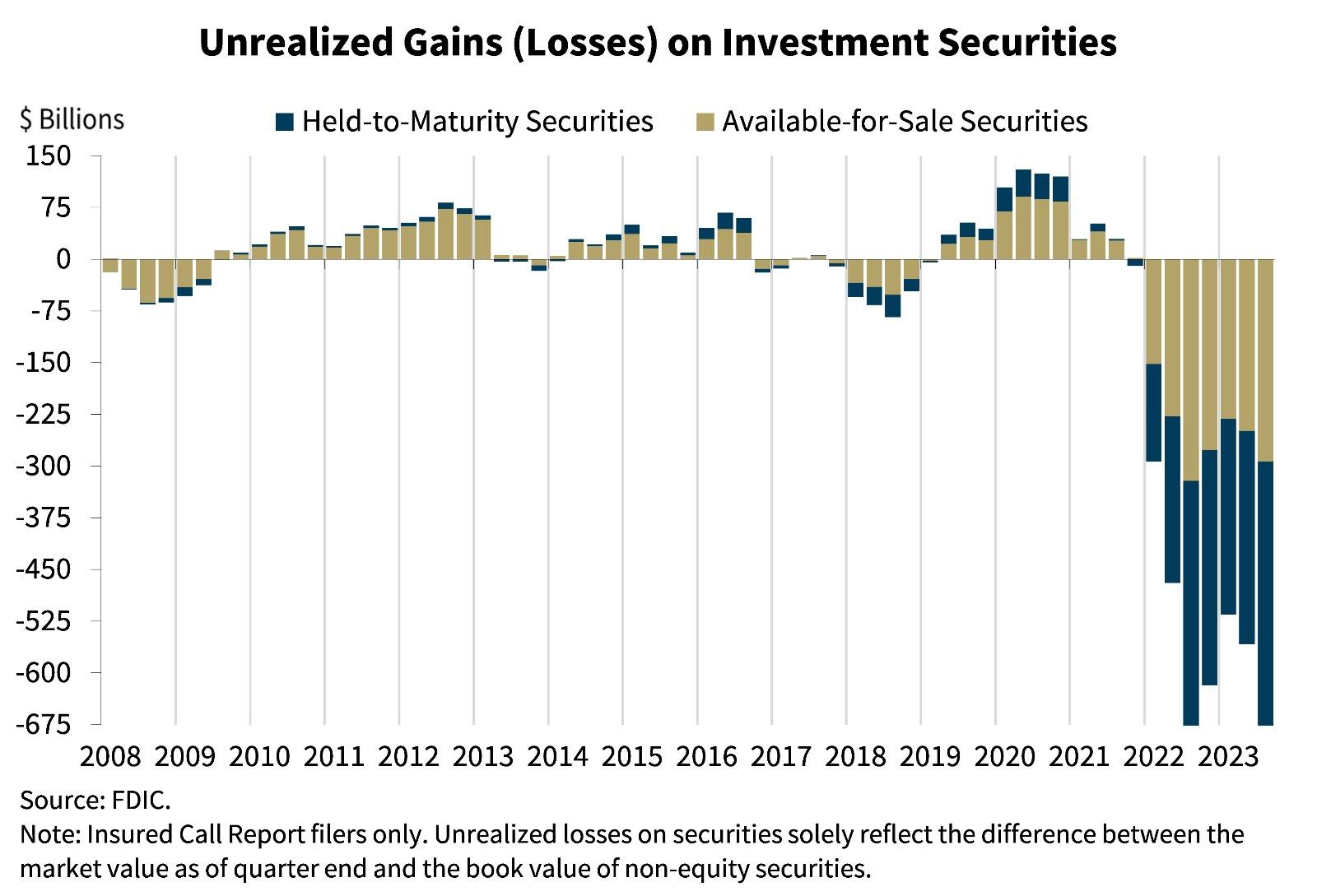

👉🏽"UNREALIZED losses US Banks Up 22% to USD 683.9 billion in Q3! We'll need BTFP 2 soon, Jerome. Let's just change it to the Bank Forever Funding Program (BFFP) to make things simpler." This was the text from last week's weekly recap, let's have a look at the current state of unrealized losses:

https://twitter.com/AndreasSteno/status/1733196154643358155

The BTFP is scheduled to end on March 11, 2024, FYI, this won't end, they will just extend the program.

🌎Macro/Geopolitics:

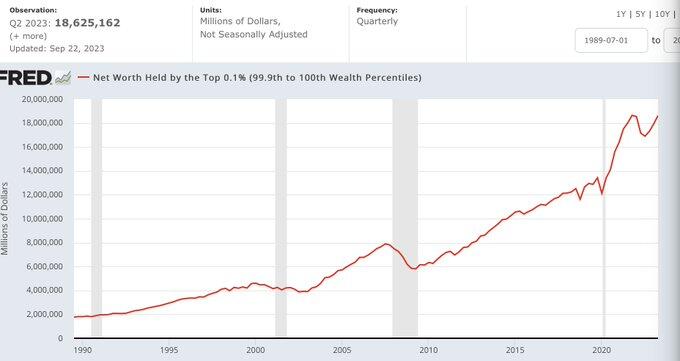

👉🏽Ever widening wealth inequality on steroids: Since 2000: 132,000 households have added $14 trillion in total wealth while 66,000,000 households have added $2.5 trillion in total wealth. Since Covid $5 trillion went to the top 0.1% while $1.5 trillion went to the bottom 50%.

https://twitter.com/NorthmanTrader/status/1732492229715919126

America's retirement problem in a nutshell: 1) too little saved (remember this $107k is a mean, not a median) 2) it's not growing (in nominal terms!) 3) while the cost of living is up over 19%+ since 2020 (according to govt numbers, which likely underreport).

"The result: A decades-long shrinking of the middle class. And nothing, no party, no policy has changed this structural trend. People scream at the right & and the left. Yet the result is always the same. Why? Because the Fed's policies disproportionately benefit the asset owners." - Sven Henrich

I have one word for you: Cantillion Effect.

This will lead to social and political instability/fragmentation which we are already in the midst of. The unfair and accelerating concentration of wealth is breaking the social contract. Now read the first quote at the top of the blog post.

👉🏽 "Job growth in the US labor market is set to turn negative in 2024. Since the Fed started raising rates in March 2023, job growth has moved in a straight line lower. Currently, the 3-month moving average of job growth is down to ~200,000. The Fed has maintained the view that weakness in the labor market is likely needed to tame inflation. We expect to see the unemployment rate approaching 5% in 2024." - TKL

👉🏽"Pending home sales just hit their lowest level in history. In October, US pending home sales fell 1.5% putting sales down 6.6% over the last year. This also marks the 23rd STRAIGHT decline in US pending home sales. To put this in perspective, pending home sales are more than 10% BELOW what they were in 2010. They are also ~3% below the pandemic low when the global economy was in lockdown. All mortgage demand is at its lowest levels since 1994. The housing market is coming to a complete halt." -TKL

No worry! we aren't in a recession and we will have a "soft landing", right? The economy, the real economy is not going to withstand this much longer. "The full effects of the Feds rate hikes are yet to be felt" Jpow

So what can the Fed do...?

👉🏽 Odds of rate cuts beginning as soon as January 2024 are rising quickly. There is now a ~15% chance of rate cuts beginning next month. The base case shows a ~56% chance of rate cuts beginning in March 2024. Markets are currently expecting a total of FIVE 25 basis point rate cuts in 2024. Still, the Fed has yet to discuss the possibility of any rate cuts at all. Markets are fully bought into the "Fed pivot." - TKL

(foto)

Oh by the way regarding the soft landing shenanigans:

👉🏽 https://twitter.com/MichaelKantro/status/1733145538348916875

We have heard this before, right?

Nov 29, 2006: "Fed Chief Optimistic of Soft Landing With Eye on Inflation and Jobs, Bernanke Remains Upbeat"

👉🏽Are we in a bubble? You tell me,..whooozzaaa! QE is a helluva a drug!

https://twitter.com/NorthmanTrader/status/1732781675803734470

👉🏽The U.S. employment diffusion index dropped to 57.8 in November, reaching a new low in over three years. This signifies a decrease in the number of industries experiencing positive job growth

👉🏽The US economy added 199,000 jobs in November, above expectations of 180,000. The unemployment rate fell to 3.7%, below expectations of 3.9%. This means that the US economy has now added jobs for 35 consecutive months.

👉🏽https://twitter.com/NorthmanTrader/status/1732860857409806725

This is safe. We are fine.

👉🏽 https://twitter.com/LynAldenContact/status/1733525036621758833

Just look at the picture. The money went into the financial system (economy), not the consumer (real economy).

A lot of people are mixing that up. The value of the economy is not based on the PE of stock or the value of stock... above picture and text really puts the debasement (ergo: robbery) of the working class into context. Now look at my first point of this segment.

👉🏽Ray Dalio warns that the United States is on the verge of a sovereign debt crisis, citing weakening demand for U.S. Treasuries.

👉🏽 "According to Apollo, the debt-to-GDP ratio in the US is on track to hit 200% within the next 15 years. Less than 20 years ago, the debt-to-GDP ratio was just ~50%. The current debt-to-GDP ratio in the US is at 120%, nearly 2.5x what it was before 2008. To put this in perspective, even in World War 2 the debt-to-GDP ratio peaked at 106%, below current levels. 2024 will be the first year with over $1 trillion in interest expense." -TKL

To summarize everything discussed above, just have a look at the following tweet.

https://twitter.com/jameslavish/status/1733535612744216577

👉🏽"One of Germany's main political parties, the CDU, has gone all in on supporting nuclear!! (Article linked here)https://www-bild-de.translate.goog/politik/inland/politik/schluss-mit-der-teuer-energie-union-plant-atom-wende-86370820.bild.html?_x_tr_sl=auto&_x_tr_tl=en&_x_tr_hl=de&_x_tr_pto=wapp&_x_tr_hist=true

Their demands:

1) Join the (over) 22 countries (for example the Netherlands) that have pledged to triple nuclear capacity by 2050.

2) Restart six of Germany's closed plants.

3) Build new, "next generation" reactors."

The funny thing about this is that the CDU decided to end the nuclear times in Germany in 2011. So for now let's see if they really talk the talk, walk the walk.

Going to leave this here, without promoting one side of the political spectrum over the other:

https://twitter.com/MichaelAArouet/status/1733456315039481997

👉🏽Javier Milei has officially been sworn in as President of Argentina. His official signature in the inauguration book says: ''VIVA LA LIBERTAD CARAJO'' English translation: "Long Live F*cking Freedom"

On the night before @JMilei's inauguration, Argentines are gathering outside of the Central Bank to do a candlelight wake and say goodbye to it.

🎁If you have made it this far I would like to give you a little gift.

I want to share a great article by Preston Pysh on how to ACTUALLY get free speech on social media.

https://bitcoinmagazine.com/technical/preston-pysh-how-to-actually-get-free-speech

Credit: I have used multiple sources!

My savings account: Bitcoin

The tool I recommend for setting up a Bitcoin savings plan: @Relai 🇨🇭 especially suited for beginners or people who want to invest in Bitcoin with an automated investment plan once a week or monthly. Hence a DCA, Dollar cost Average Strategy. Check out my tutorial post (Instagram) & video (YouTube) for more info.

⠀⠀⠀⠀

Get your Bitcoin out of exchanges. Save them on a hardware wallet, run your own node...be your own bank. Not your keys, not your coins. It's that simple.

⠀⠀⠀⠀⠀⠀⠀⠀

Is this post helpful to you? If so, please share it and support my work with sats.

New blogpost online:

nostr:npub1sqzr42dj8vx32yd5jcvvl3ytux45kl0etgf6y2ymjvmd7lqmuwmqk9vk7v review, both in English & Dutch.

https://cryptofriday.eu/index.php/2023/12/09/relai-review-best-for-buying-bitcoin-in-europe/

Study, learn, hodl, decouple.

#bitcoin 🧡

▃▃▃▃▃▃▃▃▃▃▃▃▃▃▃

My savings account: Bitcoin

The tool I recommend for setting up a Bitcoin savings plan: The @Relai 🇨🇭 app is especially suited for beginners or people who want to invest in Bitcoin with an automated investment plan once a week or monthly. Hence a DCA, Dollar cost Average Strategy. Check out my tutorial post and video for more info.

Get your Bitcoin out of exchanges. Save them on a hardware wallet, run your own node... be your own bank. Not your keys, not your coins. It’s that simple.

Do you want to know more about this? Check out my daily stories on Instagram. (yeah I know IG sucks🥴)

Is this post helpful to you? If so, please share it!🧡

If you have any questions, let me know in the comments or send me a DM!⬇️

▃▃▃▃▃▃▃▃▃▃▃▃▃▃▃

Like my content?🙏🏽

Please consider dropping some sats, following, comment✅

⭐ Many thanks⭐

Felipe - Bitcoin Friday!

▃▃▃▃▃▃▃▃▃▃▃▃▃▃▃

#zap 🧡 #nostr #plebchain #grownostr #stacksats #bitcoineducation #adoption

I just talked with a nocoiner, topics:

Unit bias (I am too late)

Shitcoins

Want to get rich quick

Saw a video online - the government will ban Bitcoin

Proof of Work vs. PoS🥴

And so on💀💀

HFSP,

Ffs!

▃▃▃▃▃▃▃▃▃▃▃▃▃▃▃

#zap 🧡 #nostr #plebchain #grownostr #stacksats #bitcoineducation #adoption

Read the text below & the picture and check my previous note:

▃▃▃▃▃▃▃▃▃▃▃▃▃▃▃

‘JPMorgan CEO Jamie Dimon says he would “close down” #Bitcoin & crypto if he were the government.

“The only true use case for it is criminals, drug traffickers, money laundering, tax avoidance.”’

▃▃▃▃▃▃▃▃▃▃▃▃▃▃▃

According to data, criminals carry out 97% of money laundering activities through financial institutions. Banks mediate millions of financial transactions daily; Banks are at significant risk for financial crimes.

The estimated amount of money laundered globally in one year is 2% -5% of global GDP, or $800 billion - $2 trillion in current USD. Due to the clandestine nature of money laundering, it is however difficult to estimate the total amount of money that goes through the laundering cycle.

The global GDP in 2021 was $94 trillion in current USD.

Just four countries—the U.S., China, Japan, and Germany—make up over half of the world’s economic output by gross domestic product (GDP) in nominal terms. In fact, the GDP of the U.S. alone is greater than the combined GDP of 170 countries.

TL;DR: GFY Jamie Dimon

Study, learn, hodl, decouple.

#bitcoin 🧡

▃▃▃▃▃▃▃▃▃▃▃▃▃▃▃

My savings account: Bitcoin

The tool I recommend for setting up a Bitcoin savings plan: The @Relai 🇨🇭 app is especially suited for beginners or people who want to invest in Bitcoin with an automated investment plan once a week or monthly. Hence a DCA, Dollar cost Average Strategy. Check out my tutorial post and video for more info.

Get your Bitcoin out of exchanges. Save them on a hardware wallet, run your own node... be your own bank. Not your keys, not your coins. It’s that simple.

Do you want to know more about this? Check out my daily stories on Instagram. (yeah I know IG sucks🥴)

Is this post helpful to you? If so, please share it!🧡

If you have any questions, let me know in the comments or send me a DM!⬇️

▃▃▃▃▃▃▃▃▃▃▃▃▃▃▃

Like my content?🙏🏽

Please consider dropping some sats, following, comment✅

⭐ Many thanks⭐

Felipe - Bitcoin Friday!

▃▃▃▃▃▃▃▃▃▃▃▃▃▃▃

#zap 🧡 #nostr #plebchain #grownostr #stacksats #bitcoineducation #adoption

They, the banks/government are so afraid of what is coming.

JPMorgan CEO Jamie Dimon says he would “close down” #Bitcoin & crypto if he were the government.

“The only true use case for it is criminals, drug traffickers, money laundering, tax avoidance.”

Criminals. 🤦♂️How much has JPM paid in fines over the past few years? A quick Google search suggests $35-$39 Billion over the past 5 years. Now let that sink in for a moment.

Opt out: Bitcoin🧡

Study, learn, hodl, decouple.

#bitcoin 🧡

▃▃▃▃▃▃▃▃▃▃▃▃▃▃▃

My savings account: Bitcoin

The tool I recommend for setting up a Bitcoin savings plan: The @Relai 🇨🇭 app is especially suited for beginners or people that want to invest in Bitcoin with an automated investment plan once a week or monthly. Hence a DCA, Dollar cost Average Strategy. Check out my tutorial post and video for more info.

Get your Bitcoin out of exchanges. Save them on a hardware wallet, run your own node... be your own bank. Not your keys, not your coins. It’s that simple.

Do you want to know more about this? Check out my daily stories on Instagram. (yeah I know IG sucks🥴)

Is this post helpful to you? If so, please share it!🧡

If you have any questions, let me know in the comments or send me a DM!⬇️

▃▃▃▃▃▃▃▃▃▃▃▃▃▃▃

Like my content?🙏🏽

Please consider dropping some sats, following, comment✅

⭐ Many thanks⭐

Felipe - Bitcoin Friday!

▃▃▃▃▃▃▃▃▃▃▃▃▃▃▃

#zap 🧡 #nostr #plebchain #grownostr #stacksats #bitcoineducation #adoption https://video.nostr.build/5ea9f9f40b8eaefe94a2532ecd1876629c617c3890d700e954205666c24cf3c1.mp4

https://x.com/thetrocro/status/1732296237418979572?s=46&t=F791BMa98sP9DJoLz_JvoA

1BTC = 1BTC

Price doesn’t affect those who have decoupled when purpose over price is real to you.

Normally this takes a few cycles.

Study, learn, hodl, decouple.

#bitcoin 🧡

Be like Troy!

My savings account: Bitcoin

The tool I recommend for setting up a Bitcoin savings plan: The nostr:npub1sqzr42dj8vx32yd5jcvvl3ytux45kl0etgf6y2ymjvmd7lqmuwmqk9vk7v app is especially suited for beginners or people that want to invest in Bitcoin with an automated investment plan once a week or monthly. Hence a DCA, Dollar cost Average Strategy. Check out my tutorial post and video for more info.

Get your Bitcoin out of exchanges. Save them on a hardware wallet, run your own node... be your own bank. Not your keys, not your coins. It’s that simple.

nostr:npub1qny3tkh0acurzla8x3zy4nhrjz5zd8l9sy9jys09umwng00manysew95gx : “If short-term price movements shake you out of Bitcoin, you never had a chance.” - “Stay humble & stack sats”

Do you want to know more about this? Check out my daily stories on Instagram. (yeah I know IG sucks🥴)

Is this post helpful to you? If so, please share it!🧡

If you have any questions, let me know in the comments or send me a DM!⬇️

▃▃▃▃▃▃▃▃▃▃▃▃▃▃▃

Like my content?🙏🏽

Please consider dropping some sats, following, comment✅

⭐ Many thanks⭐

Felipe - Bitcoin Friday!

▃▃▃▃▃▃▃▃▃▃▃▃▃▃▃

#zap 🧡 #nostr #plebchain #grownostr #stacksats #bitcoineducation #adoption

🧠Quote(s) of the week:

Nayib Bukele (President El Salvador:

"El Salvador's Bitcoin investments are in the black! After literally thousands of articles and hit pieces that ridiculed our supposed losses, all of which were calculated based on Bitcoin’s market price at the time... With the current Bitcoin market price, if we were to sell our Bitcoin, we would not only recover 100% of our investment but also make a profit of $3.620.277.13 USD (as of this moment). Of course, we have no intention of selling; that has never been our objective. We are fully aware that the price will continue to fluctuate in the future, this doesn’t affect our long-term strategy. Nonetheless, it is important that the naysayers and the authors of those hit pieces take back their statements. The responsible thing to do would be for them to issue retractions, offer apologies, or, at the very least, acknowledge that El Salvador is now yielding a profit, just as they repeatedly reported that we were incurring losses. If they consider themselves true journalists, they should report this new reality with the same intensity they reported the previous one. We’ll see… Stay tuned!"

🧡Bitcoin news:

➡️ "Warren Buffett has called Bitcoin "rat poison squared" and stated that "it is an asset that creates nothing". On the 3rd of December, the market capitalization of BTC surpassed that of his company, Berkshire Hathaway." - Mark Harvey

➡️ The president of Colombia met with Samson Mow and Jan3 to discuss how Colombia can adapt. "can be promising for the prosperity of the people."

➡️ Samson Mow, Jan3, and fellow Noderunner Maya told the country's press the Government of Suriname and JAN3, are exploring ways to boost Bitcoin usage. They're even considering converting 1% of the central bank's reserves into Bitcoin. Outcome? A potential safeguard against inflation and a new economic boost.

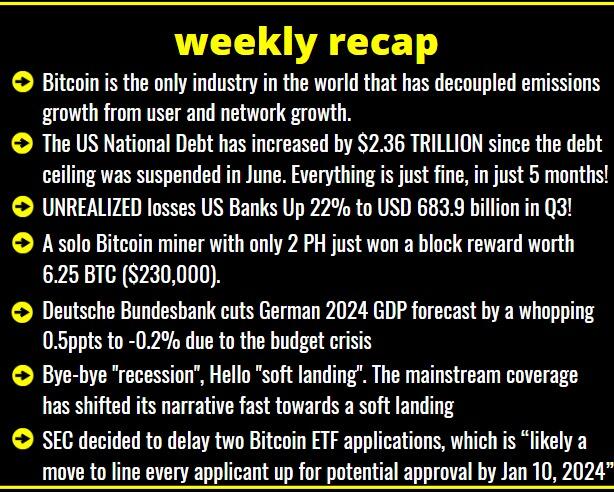

➡️ Over past 4 years:

👉🏽Hashrate ⬆️475%

👉🏽Price⬆️163%

👉🏽Total users⬆️289%

👉🏽Emissions⬇️by -9.4%

Bitcoin is the only industry in the world that has decoupled emissions growth from user and network growth.

➡️Great response by RFK Jr on what brought Bitcoin to his attention "If the government can punish you by shutting down your bank account without even charging you with a crime, they have the ultimate power to turn us into slaves."

Full interview: https://www.youtube.com/watch?v=TceuggOE-EI

➡️$1.5 trillion Franklin Templeton filed an update to its Bitcoin ETF application. After that, the SEC opened a 21-day window for public comment on Franklin Templeton's proposed Bitcoin ETF.

On top of that, the SEC decided to delay two other Bitcoin ETF applications, which is “likely a move to line every applicant up for potential approval by Jan 10, 2024” - Bloomberg ETF analyst James Seyffart

I will quote The Bitcoin Therapist on this one: "The SEC is really about to approve a Bitcoin ETF at the same time the Federal Reserve is about to pivot at the same time the FASB accounting rules will be applied at the same time the halving is about to take place all during a presidential election."

➡️ Jack Dorsey funds a $6.2 million initiative OCEAN to decentralize Bitcoin mining globally with a transparent, non-custodial mining pool.

➡️ A solo Bitcoin miner with only 2 PH just won a block reward worth 6.25 BTC ($230,000). A miner this size solves a block on average only once in every 5 years! Madness

➡️Relai has partnered with Swissquote Bank, the Swiss leader in Online Banking providing online banking and trading services. This partnership means everything from banking to exchange aspects at Relai is now under one roof – 100% made in Switzerland. Swissquote is the perfect partner due to its unparalleled reputation in secure online financial services, aligning perfectly with Relai’s commitment to offering a trustworthy and efficient Bitcoin investment experience.

For more info: https://relai.app/blog/relai-and-swissquote-partnership/

➡️A new working paper co-authored by former ERCOT & NYISO CEO highlights Bitcoin mining as a critical tool for clean energy and balancing the grid.

Abstract: “This review examines the role of Bitcoin mining as a possible catalyst for accelerating the global shift towards clean energy and effective power grid management."

Conclusion: “In the rapidly evolving realm of energy systems and grid management, the significance of DR and flexible load resources is more pronounced than ever. Our review highlights the emergence of Bitcoin miners as a potentially unique and adaptable load category. With their innate interruptibility and swift response capabilities, these miners may offer revolutionary potential for grid flexibility." - Dennis Porter

You can read the full paper here: https://papers.ssrn.com/sol3/papers.cfm?abstract_id=4634256

In the upcoming days, I will publish my blog post on Bitcoin and energy (mining), so stay tuned.

➡️ If you had invested $50 per day into the following assets over the past 9 years, this is how much you would have:

👉🏽Bitcoin: $4,580,000

👉🏽Tesla: $635,000

👉🏽Dow Jones: $233,000

👉🏽Gold: $222,000

After investing a total of $164,300 over the past 9 years, deciding to DCA daily into Bitcoin was your best decision by an order of magnitude.

➡️Since Halloween, a particular Bitcoin address has amassed 8,674 BTC, equivalent to $323 million. Moreover, they've consistently added 1,000+ Bitcoin to their holdings for the past three consecutive days. This was on the 26th of November.

➡️ "A user recently made headlines for an eye-watering mistake, unintentionally paying a staggering $3.1 million in transaction fees for a transfer worth $2.1 million. On November 23, an unsuspecting Bitcoin user, utilizing the address “bc1qn3d7vyks0k3fx38xkxazpep8830ttmydwekrnl” initiated a transaction to transfer 55 BTC to another address.

However, what should have been a routine transaction took a drastic turn when an astronomical fee of 83 BTC, equivalent to approximately $3.1 million, was attached to the transfer." - BitcoinNews

Always, ALWAYS check the receiving address and the fees.

💸Traditional Finance / Macro:

👉🏽Week ahead: In the US, non-farm payrolls, ISM services, and the University of Michigan sentiment survey. In Europe, it’s the euro area Sentix survey and wage data, the ECB consumer inflation expectations survey, and the UK’s REC Report on Jobs survey. In Asia, with China CPI, Tokyo CPI, and the RBA policy decision

"The S&P 7, also known as the 7 largest tech stocks in the S&P 500, is up a massive 80% in 2023. Meanwhile, the S&P 493, or the remaining 493 companies in the S&P 500, is up just 4%. In other words, the S&P 7 is up 20 TIMES as much as the S&P 7. A few key stocks have become the entire market. The fate of the stock market is in the hands of tech companies and AI hype." -TKL

🏦Banks:

👉🏽UNREALIZED losses US Banks Up 22% to USD 683.9 billion in Q3! We'll need BTFP 2 soon, Jerome. Let's just change it to the Bank Forever Funding Program (BFFP) to make things simpler.

"Unrealized losses on investment securities held by US banks hit $684 billion in Q3, according to the FDIC. This marks a 22.5% jump compared to unrealized losses seen last year. The jump was primarily driven by rising mortgage rates reducing the value of mortgage-backed securities held by banks. Despite these challenges, the FDIC states that banks remain "well capitalized." This comes as usage of the Fed's emergency funding facility for banks hit another record high of $114 billion." - TKL

See picture below.👀

🌎Macro/Geopolitics:

👉🏽The US National Debt has increased by $2.36 TRILLION since the debt ceiling was suspended in June. Everything is just fine, in just 5 freaking months...5!

It’s simple … We use a DEBT-based monetary system. The debt-based monetary system requires that debt always grows. Countries and people must become deeper in debt so that there's more money in the system. More money in the system increases the total money supply. Increased money supply leads to higher Inflation. To have a growing economy we need more DEBT (debt = money *from a different perspective). Having more DEBT = high INFLATION. Using that DEBT system, the INFLATION must go only up.

The US unfunded liabilities today on the 3rd of November just surpassed $212 TRILLION.

Do you get the picture? Opt out; Bitcoin

If you don't believe well listen to what Jamie Dimon (CEO of JP Morgan) has to say on this topic:

Jamie Dimon says: "The U.S is addicted to debt and it’s created a dangerous “sugar high” in the economy. He points to the enormous surge of new debt taken on during the pandemic He says that money is like "heroin" in the hands of consumers "We're on this sugar high and I'm not saying this ends in a depression [but] I think there's more inflationary forces out there…There's a higher chance that rates go higher, inflation doesn't go away, and all these things cause more problems of some sort."

Take this with some salt as Jamie is the heroin dealer in this analogy. You know we're on thin ice in the credit cycle when the pusher starts to complain about the drug he has been the prime beneficiary of, caveat emptor.

But he, Dimon, has been warning of this for some time! Also, Ray Dalio has expressed this for some time.

Oh well, probably nothing. Go on son...watch some sport or Netflix and stay in the rat race called life.

Do you get the picture? Opt out; Bitcoin

👉🏽 I quote Sam Callahan: "Bloomberg shared some evidence of the cost of living crisis many Americans face today. Since 2020:

Groceries: +25%

Home Values = +42%

Electricity Bills = +25%

Natural gas = +29%

Rent = +20%

Used Car = +35%

Car Insurance = +33%

Child care = +32%

Food at restaurants:

Chicken dishes = +32%

Burgers = +23% Pasta = +14%

Pizza: = +17%

Meanwhile, instead of addressing the problem, the government is worsening it and choosing to gaslight the public by saying this Thanksgiving was the "fourth cheapest ever."

source: https://www.bloomberg.com/graphics/2023-inflation-economy-cost-of-living/

👉🏽"New home prices just crashed by the largest amount on record, down 18% over the last year. According to Reventure, this is the biggest annual decline back to 1965. Even in the worst month of the 2008 financial crisis, the biggest decline was 15%.

The worst part?

New home prices are still up ~24% from their pre-pandemic levels. As mortgage demand hits its lowest since 1994 and affordability is at all-time lows, builders are in trouble. The average selling price for a new home is down almost $90,000 since last year. How can this end well?" - The Kobeissi Letter

👉🏽Deutsche Bundesbank cuts German 2024 GDP forecast by a whopping 0.5ppts to -0.2% due to the budget crisis following the Constitutional Court hearing.

"The state pension is looking increasingly shaky. The federal govt now has to contribute more than €100bn a year. And the fact that the introduction of the so-called equity pension, i.e. the funded pension, has now also been postponed does not make things any easier."

"There was a statement last year by the president of the Confederation of German Employers’ Associations: “Germany’s pension system is “on the verge of collapse. It won’t be financially viable in five years without reform. The costs will explode” Labor shortages, an aging population, and lower productivity - are all material factors for the viability of this system"

Germany is the sick man of Europe. This is going to be a massive issue in so many countries, not only in Germany.

👉🏽"German inflation sinks more than expected as energy retreats & costs of fuels & travel fell sharply from the prior month. Headline CPI slows to 3.2% YoY in Nov from 3.8% in Oct & vs 3.5% exp. Food inflation slowed to 5,5% from 6.1%, Core CPI dropped from 4.3% to 3.8%, so a long way to go to the 2% goal." - Hilger Zschaepitz

👉🏽https://twitter.com/POTUS/status/1726257145551654981

See picture below how that is working.

- Bye-bye "recession", Hello "soft landing" The mainstream coverage has shifted its narrative fast towards a soft landing, which makes me worried ahead of 2024.

👉🏽Nigeria will spend at least six times more on servicing its debt next year than on building new schools or hospitals.

This debt trap has been proudly brought to you by the IMF and World Bank, thanks for the help and playing. You would think that a major oil-production nation like Nigeria could fight out of this debt trap...

If you have made it this far I would like to give you a little gift.

I want to share Michael Saylor's keynote at @labitconf discussing economic wars, the power behind Bitcoin, why Bitcoin is destined to be the apex commodity, technology, property, money, & ETF asset, winning & losing investment strategies, management of counterparty risk, & capital markets digital disruption.

Click on the link and watch the 50min video:

https://twitter.com/saylor/status/1731088400025850201

Credit: I have used multiple sources!

My savings account: Bitcoin

The tool I recommend for setting up a Bitcoin savings plan: @Relai 🇨🇭 especially suited for beginners or people who want to invest in Bitcoin with an automated investment plan once a week or monthly. Hence a DCA, Dollar cost Average Strategy. Check out my tutorial post (Instagram) & video (YouTube) for more info.

⠀⠀⠀⠀

Get your Bitcoin out of exchanges. Save them on a hardware wallet, run your own node...be your own bank. Not your keys, not your coins. It's that simple.

⠀⠀⠀⠀⠀⠀⠀⠀

Is this post helpful to you? If so, please share it and support my work with sats.

#zap 🧡 #nostr #plebchain #grownostr #stacksats #bitcoineducation #adoption #weeklyrecap

Today we had an interview on the local radio station (Radio Zwolle - Bijna Weekend) talking about Bitcoin and our group Zwolle Bitcoinstad.

It is in Dutch but if you want to listen to the full interview:

https://dutchbtc.ddns.net/zwolle.mp3

It’s Bitcoin 101 stuff as the host had 0 knowledge.

*You can skip the first 13min

Block by block!🧡

#zap 🧡 #nostr #plebchain #grownostr #stacksats #bitcoineducation #adoption

🧠Quote(s) of the week:

"Politics is only a control structure on top of manipulated money." - Jeff Booth

"There is an uncanny historical justice aspect to Bitcoin where generally speaking, the less financially privileged you are, the faster you understand how useful it is. The more financially privileged you are, the slower you understand how useful it is." - Alex Gladstein

🧡Bitcoin news:

➡️ Last Saturday we held in my hometown the last Bitcoin meetup in 23'.

The message is in Dutch. “Thank you very much for the warm and friendly welcome and all the information I received today!! I found it very educational and will continue with my Bitcoin "study". Greetings”

This is why we do what we do. This is why I am creating content!

On Friday I will be live on the local radio station (Radio Zwolle - Bijna Weekend) talking about Bitcoin and our group Zwolle Bitcoinstad.

➡️ Bitcoin hashrate hits an all-time-high, surpassing 500 exahash per second (EH/s).

https://twitter.com/danieleripoll/status/1728486701490942427

➡️ "Plebs who started daily DCAing Bitcoin at the all-time-high 748 days ago are now officially in profit +40%" - Wicked

➡️Wallet of Satoshi, a Bitcoin wallet app known for its focus on Lightning Network usability, has decided to remove its app from the U.S. Apple and Google app stores and will no longer serve U.S. customers.

WHY? WoS needs to comply with local regulations or laws in ways that it cannot, or doesn't not want to.

It still works, but if you lose your phone you can't re-download the app. No rugpull, just tech degradation driven by regulations. US residents should get their coins off of WoS.

Great work US. Land of the free, home of the brave.

This is exactly the reason why you should use a non-custodial app/wallet! The regulatory squeeze in the U.S. continues to get tighter.

➡️Changpeng Zhao (CZ) resigns as Binance CEO and faces up to 18 months in prison as part of his plea deal with the US Government. He pleads guilty to violating criminal anti-money laundering requirements.

$1.3 billion in user funds withdrawn from Binance following US Government indictment.

➡️"Since Halloween, a particular Bitcoin address has amassed 8,674 Bitcoin, equivalent to $323 million. Moreover, they've consistently added 1,000+ Bitcoins to their holdings for the past three consecutive days." - Bitcoin News

➡️ "Cornell University (world rank #13) just covered a new paper that suggests what Bitcoin mining companies have been saying for years: Bitcoin mining helps solar developers generate more profits that can be invested in future renewable energy projects" - Daniel Batten

Source: https://news.cornell.edu/stories/2023/11/bitcoin-could-support-renewable-energy-development

Bloomberg, Forbes, TVNZ, MSN, Financial Times, The Hill, The Independent (Ireland), Euro News, Technology Review, One Green Planet, Yahoo Finance +, and other mainstream media all published positive press on the environmental benefits of Bitcoin mining this year!

Probably nothing!

BUT, ask yourself why is the narrative shifting. Is it because they now fully understand that Bitcoin is something positive for society OR..more like BlackRock will list an ETF...

- Bitcoin mining is expanding in Argentina British firm FMI Minecraft plans a $45M crypto farm in Patagonia There will be no taxes to import ASICs or anything else, thanks to the mine’s proposed location within a free trade zone.

➡️"Bitcoin has risen ~119% since the beginning of 2023. At the same time, 70% of all coins have not moved in over a year, a new record high. This suggests that a large majority of the outstanding supply will only start moving if the price increases many multiples higher." -Unchained

Or to put it slightly differently, despite a 126% performance over the last year. Once you understand Bitcoin, you aren’t selling!

➡️ Former NYSE President: “Money will flood into the industry with a Bitcoin ETF, it’s just easy to buy.” “Bitcoin is a great invention. It is a store of value.

➡️ The Kingdom of Bhutan has secretly spent millions building a national Bitcoin mining operation to avert “economic crisis” - Forbes

➡️A Bitcoin whale unloaded 636 BTC ($23.46M) just before the US Department of Justice revealed significant crypto enforcement actions on the 21st of November.

➡️ Hillary Clinton DOES NOT want you to own Bitcoin because it undermines the "rope of the dollar".

Watch the clip here: https://twitter.com/hoardingsats/status/1726720299675390456

This is exacly why Bitcoin was created.

I quote Preston Pysh on this one:

"What's ACTUALLY undermining the role of the dollar is all the people in Congress who continuously decide to spend beyond our tax revenues (voting money into their districts with no term limits).

ALSO,

Government bureaucrats that have never served a day in the military but suggest we can afford another few wars while already fighting two proxy wars (which were never even voted for in the first place). That's what's undermining the dollar! Bitcoin is simply the pristine mirror that ALL governments get to view their violent and self-serving policies through. Enjoy the view"

The funny part on this matter is that some people in the US government do get it, for example:

US Presidential candidate Vivek Ramaswamy:

"The problem isn't that they [the US govt] don't know what Bitcoin represents, it's that they do and that's actually what creates the anaphylactic response"

OR, Senator Cynthia Lummis explains that in the future Bitcoin will be the apex-saving technology. She believes it will serve as a global reserve currency amongst a basket of goods.

➡️U.S. Securities and Exchange Commission classifies altcoins as securities in Kraken lawsuit.

The following tokens are listed:

- Solana (SOL)

- Cardano (ADA)

- Polygon (MATIC)

- Internet Computer (ICP)

- Cosmos (ATOM)

- Algorand (ALGO)

- Sandbox (SAND)

- Decentraland (MANA)

- Chiliz (CHZ)

➡️Argentina has become the first G20 nation to elect a pro-Bitcoin President, Javier Milei.

“With legal tender, they scam you with the inflationary tax… Bitcoin is the natural reaction against central bank scammers; to make money private again.” - Javier Milei, President of Argentina

Ergo:

- Central Banks are a scam.

- Bitcoin returns money to the private sector.

“Today is the end of Argentina’s decline” - Milei With 143% inflation and 950 pesos to the dollar, I really hope he's right. A few years ago, nobody expected El Salvador to become the safest country in Latin America. Time for an economic turnaround in Argentina! Buena suerte Javier" - StackHodler

Although through a Bitcoin lens, this is a great step for Argentina. But life itself is not only Bitcoin. For example, Milei's views on abortion are (in my opinion) concerning. He opposes it even in the case of rape. I can’t square that with his views on other freedoms.

I hope he makes good changes for Argentina. They have suffered enough from a bad monetary policy from their Central Bank in conjunction with the debt trap by the IMF.

Talking about the IMF and Argentina:

https://twitter.com/Excellion/status/1726716583551414472

➡️ "Joana Cotar, a member of the German Bundestag, federal parliament, has recently declared her support for recognizing BitcoinBTC 0.0% as legal tender in Germany. This revelation came to light during an interview, where Cotar discussed her ambitions to bring Bitcoin into the mainstream of German finance."

Why is this so important?

https://twitter.com/skwp/status/1726387239305842745

I will quote Alex Gladstein (Human Rights Foundation): "It would be hard for the IMF to exist in a world with one universal currency The IMF needs a currency caste system to execute: -Discounts on exports via currency devaluation -Lending in dollar-denominated debt -Privileging dollar-based foreign megacorps Bitcoin fixes this

💸Traditional Finance / Macro:

Week ahead: In the US, we have the Fed Beige Book, core PCE inflation data, jobless claims, and the November manufacturing ISM report. In Europe, the highlight will be flash inflation data for the euro area, UK lending data, and euro area unemployment. In Asia, we have the RBNZ, Bank of Thailand, and Bank of Korea meetings, Japan industrial production and unemployment data, India GDP, China PMI, and Australia and Indonesia CPI inflation data.

"CEOs at JP Morgan, Blackrock, Amazon, Apple, and now Facebook are dumping large amounts of shares in their own companies. China is dumping U.S. Treasuries at the fastest pace in 3 years while the Japanese are offloading US Corporate bonds at the fastest pace in recorded history."

"A few days later also former Chairman of Walmart has dumped $336.7 million of Walmart shares, continuing the recent trend of high-level executives offloading shares in their own companies" - Ben Rickert

Is it a planned sale? Any particular reason for the inside selling? Interesting to see how this will unfold in the upcoming weeks/months.

🏦Banks:

👉🏽Argentina President Javier Milei confirms he will shut down the Central Bank.

🌏Macro/Geopolitics:

👉🏽 "US consumer inflation expectations for the next five years jumped to 3.2%, matching the highest level since 2008!

US Consumer inflation expectations are on the rise. They increased to 4.5% for the next 12 months, which is very high from a historical perspective. Add to this that Powell's (former) CPI darling - 3-month annualized Core Services ex Shelter - hit 5.5% in October to understand that the FederalReserve cannot give up on its 'higher for longer ' narrative just yet".- Jeroen Blokland

https://twitter.com/SecYellen/status/1726702716108640678

Like always in politics, they will kick the can down the road. They have no intention to reign in on fiscal overspending.

Even if they will reach their goals, what will that do? Nothing, maybe just pay the interest..

The US is literally paying $1,000,000,000,000 just in interest every year!!!!

When she says "reduce the deficit by $1 trillion over the next ten years", she really means reduce the growth in the deficit from some imaginary number we projected.

read the following tweet:

https://twitter.com/PrestonPysh/status/1726809611976769749/photo/1

👉🏽Now we know for real, the truth has been revealed. Sen. Warren:

“Let’s do a central bank digital currency … I think it’s time for us to move in that direction.” Amid Sen. Warren’s moralizing on crypto money laundering, never forget what her ultimate goal is: the destruction of Bitcoin to make way for a CBDC. Warren is usually effective at hiding her true intentions. But on this rare occasion, she let her guard down—and she could barely contain her excitement at the prospect of a CBDC.

See for more info the great tweet by Sam Lyman:

https://twitter.com/SamLyman33/status/1727327677399400893

Politicians will push for a CBDC. It's all about control. Politicians are not against Bitcoin, they are against not government-controlled Bitcoin...crypto...whatever you want to call it.

James Lavish": CBDCs are a bridge for the government to cross from taxing your earnings to overseeing and controlling every single penny you earn *and* spend. Forever."

No matter if it is the ECB, the FED, the BoJ, the BoE, or China's CBDC...it will enable unelected technocrats to program how, when, where, on what, and by whom it can be spent, including the imposition of social credit, carbon allowance, etc.

It's coming.

Opt-out: Bitcoin

👉🏽Check out the CBDC tracker by the Human Rights Foundation.

The Tracker will go online for the first time, providing the public with a resource to examine the progress and risks of CBDC implementation worldwide.

It shows you information on each country's central bank digital currency project.

HRF believes CBDCs pose a significant threat to human rights work worldwide, especially for people living under tyranny. More than 100 countries are researching CBDCs, while more than 20 have pilots, and a handful of governments have already launched some kind of retail product.

Source: https://hrf.org/hrf-to-launch-cbdc-tracker-on-nov-14-in-d-c/

Tracker: https://cbdchumanrights.org/home

Absolutely a must-have tool in your toolkit and an invaluable resource to share with friends and family!

Digital identity and CBDC pose a severe risk to human rights and have the potential to limit individual freedom.

👉🏽China's major shadow bank Zhongzhi declares 'severe insolvency' with a $36 billion shortfall, signaling liquidity problems in the $2.9 trillion Chinese shadow banking sector. Known for real estate investments, Zhongzhi attributes the deficit to internal management issues facing operational risks. The crisis further highlights instability in China's real estate market, raising concerns of possible contagion effects. Source: El Pais

What is the love of god is 'severe insolvency'. You are either insolvent or not.

🎁If you have made it this far I would like to give you a little gift.

The November newsletter by Lyn Alden, in which she is discussing how emerging monetary technologies have the potential to disrupt the existing global financial system over the long term.

read here: https://www.lynalden.com/november-2023-newsletter/

Credit: I have used multiple sources!

My savings account: Bitcoin

The tool I recommend for setting up a Bitcoin savings plan: @Relai 🇨🇭 especially suited for beginners or people who want to invest in Bitcoin with an automated investment plan once a week or monthly. Hence a DCA, Dollar cost Average Strategy. Check out my tutorial post (Instagram) & video (YouTube) for more info.

⠀⠀⠀⠀

Get your Bitcoin out of exchanges. Save them on a hardware wallet, run your own node...be your own bank. Not your keys, not your coins. It's that simple.

⠀⠀⠀⠀⠀⠀⠀⠀

Is this post helpful to you? If so, please share it and support my work with sats.

Last meetup 23’ - Zwolle Bitcoinstad

The message in Dutch:

“Thank you very much for the warm and friendly welcome and all the information I received today!! I found it very educational and will continue with my bitcoin "study". Greetings”

This is why we do what we do. 🧡

Next Friday we will be live on the local radio station (Radio Zwolle - Bijna Weekend) talking about Bitcoin and our group Zwolle Bitcoinstad.

Block by block!🧡

#zap 🧡 #bitcoinmeetup #nostr #plebchain #grownostr #stacksats #bitcoineducation #adoption  https://video.nostr.build/bd897a688a86e2c47c1196850f19b6082f34fa2e3186e727c0fce9be9e05c9b6.mp4

https://video.nostr.build/bd897a688a86e2c47c1196850f19b6082f34fa2e3186e727c0fce9be9e05c9b6.mp4

New Record #Bitcoin Hashrate

470,000,000,000,000,000,000x per second.

The beauty of the protocol. Some countries will ban it, while other countries will benefit of that ban.

Bhutan has been mining #Bitcoin since 2019 and has secretly spent millions building a national Bitcoin mining operation to avert “economic crisis”.

On top of that we received the news that: “Bitcoin mining is expanding in 🇦🇷 Argentina 🙌

British firm FMI Minecraft plans a $45M crypto farm in Patagonia.

There will be no taxes to import ASICs or anything else, thanks to the mine’s proposed location within a free trade zone.”

Hello game theory 🧡👀

Is this post helpful to you? If so, please share it and support my work with sats. #zap 🧡 #weeklyrecap #nostr #plebchain #grownostr #stacksats

🧠Quote(s) of the week:

"Debt-based fiat currency system… Steal from the future for better living today.

Equity/saving-based Bitcoin monetary system… Build for the future for better lives for our children and grandchildren.

Which future will you choose?

I remain convinced that Bitcoin is better money for a better world." - Dr. Jeff Ross

"Fear is "unfortunately" an effective way to consolidate power. Hope is its antidote - and it's much stronger. because when people see themselves as part of a more hopeful future, they realize a sense of agency in creating it. Bitcoin" - Jeff Booth

🧡Bitcoin news:

➡️At the time, I am writing this blog post Argentina's presidential election is underway. Argentina could elect a Pro-Bitcoin President and it's poetic that Bitcoin is approaching yet another ATH in the Peso! Argentina is voting with its money.

It's quite astonishing to think that by the year 2023, a country as significant as Argentina (a G20 nation) now has a President who is a Bitcoiner.

Bitcoin has become so relevant that Presidential Candidates have no choice but to have a stance on it.

Gradually, then suddenly.

➡️For the first time, more than 70% of all Bitcoin has been HODLed for more than 1 year. Watch the animation made by Wicked here:

https://twitter.com/w_s_bitcoin/status/1726296303712587842

➡️ "64% of institutional investors currently invested in bitcoin and shitcoins plan to increase their exposure to crypto within the next three years, according to a Coinbase survey" - Bitcoin News

➡️Bitcoin halving is in ca. 150 days.

➡️Bitcoin held by addresses owning over 1,000 BTC hit a new yearly high this week, reaching 7.67 million Bitcoin.