🧠Quote(s) of the week:

'The road to independence and autonomy from all kinds of systems is a journey that needs effort and time on your part. Bitcoin is the same.' -Bitcoin Friday

'Over the last year, the US Government borrowed approximately $99,802 per second.' -James Lavish

🧡Bitcoin news🧡

Before we start I want to share some deep knowledge:

'If, like many of us, you feel a bit taken aback by events of the past week in Bitcoin, you may be wondering about what you can do, practically, to maintain your ability to transact freely and to preserve your privacy.'

Great thread by Freddie New, worth your time: https://twitter.com/freddienew/status/1784218269542498318

22nd of April:

Swiss Bitcoiners to launch a petition for the National Bank to buy Bitcoin for its national reserves.

"By including Bitcoin in its reserves, Switzerland would mark its independence from the European Central Bank. Such a step would strengthen our neutrality."

They need over 100K signatures to trigger the vote. Technically, it's not a petition, but a Popular Initiative, which is quite different. This concise amendment allows the Swiss National Bank flexibility in implementation. The initiative aims to spark a debate about Switzerland's future amid global uncertainties, emphasizing sovereignty and neutrality.

But the Chairman of the Swiss National Bank said the following: "We have not yet decided that we want to invest in Bitcoin.

Currency reserves are international payments:

1. They have to be liquid.

2. They have to be sustainable.

3. And we have to be able to see and buy them." -Bitcoin Archive

➡️In 2023 I have said the following multiple times regarding politicians & Bitcoin: "My personal opinion. Be wary of politicians who promise to give you exactly what you want. Politicians are just politicians! Bitcoin doesn't need politicians, politicians need Bitcoin (and votes). Don't lose the plot. And stop larping! Stay humble & stack sats."

A lot of people on Bitcoin Twitter, telegram, and so on were larping and routing for RFK. jr.

Last week he made the following statement:

“I’m gonna put the entire US budget on blockchain", “Every American can look at every budget item in the entire budget, anytime they want, 24 hours a day.”

“We’re gonna have 300 million eyeballs on our budget!”

This kind of statement reveals he doesn't get any of this, does he? On February 24' he also mentioned that he is buying ETH for his kids. Time to study Bitcoin RFK or is it just another fiat politician like Javier Milei (yes I am still not convinced)? Trying to gather as much support as possible, then crawl back to central bankers if elected.

'If the government wants to publish real-time budgets they can already do this on their websites. The blockchain adds nothing to this. The problem is reporting, not storage. This is no different than saying the government will publish their budget to “the cloud”.'- Yan

➡️Bitcoin may be due for a surge, as the MVRV ratio dips below its 90-day average again.

Historically, this has led to a 67% gain on average.

➡️ 'BlackRock now holds 273,596 Bitcoin worth $18 billion for its spot Bitcoin ETF.

BlackRock's ETF holds 59,350 more bitcoin than MicroStrategy.' - Bitcoin Magazine

➡️ S&P 500 company Raymond James subsidiaries declare holdings of Bitcoin ETF GBTC worth $3m.

Combined AUM $625B.'- Julian Fahrer

Although it is only $3M to me it's a sign, that the institutions are coming.

24th of April:

➡️26+ Bitcoin companies signed a letter to FinCEN against proposed surveillance rules that would seriously harm privacy by effectively prohibiting basic Bitcoin best practices such as not reusing addresses and collaborative Bitcoin transactions. (Picture1)

25th of April:

➡️FBI warns Americans against using non-KYC Bitcoin and crypto money transmitting services.

It's becoming clearer that the U.S., but also here in the EU governments pursue surveillance policies and work to suppress the rights of their citizens to (financial) privacy and financial opportunity. They don't like competition. They don't believe in a real free market.

Remember "KYC is a security hole. Businesses are just bullied/forced by governments to collect customer information. It’s really difficult to secure information in the internet age. Some of the largest and most capitalized companies still get hacked regularly." - Gabor Gurbacs

1. Approve ETFs to create a honeypot.

2. Criminalize privacy tools by labeling it ML.

3. Go after self-custody Bitcoin by labeling it black market.

4. Execute 6102 on ETF honeypots.

*all while the price of real BTC pumps really hard and game theory plays out on the global stage.

It is so freaking obvious.

These actions directly incentivize the development of decentralized protocols by anonymous devs. Instead of scaring people, they lit the fire.

"They're going to go after self-custody because they need capital controls to properly execute financial repression. Capital is sufficiently captured in walled-garden ETFs. Widely adopted self-custodial Bitcoin used as an MoE with privacy tools present an existential threat."

Anyway why do we need privacy, why does the world need privacy, and why do we need uncensorable money:

https://journalofdemocracy.org/online-exclusive/how-to-dictator-proof-your-money/

➡️"The State of Ohio has officially introduced a bill to protect 'fundamental Bitcoin rights'.

The right to buy & sell Bitcoin.

The right to mine Bitcoin

The right to run a full node

The right to self-custody your digital assets" - Dennis Porter

➡️ "Morgan Stanley is shifting to enable its 15,000 brokers to recommend Bitcoin ETFs to their clients.

This is a big change from their "if they ask" approach, which is how they've managed ETF allocations thus far." -Thomas Fahrer

➡️BlackRock’s Bitcoin ETF sees its streak of 71 straight days of inflows come to an end, bringing in $0 yesterday. IBIT had the 10th longest streak of inflows in ETF history.

➡️ '$140B Global Retirement Partners has reported exposure to 7 Bitcoin ETFs + 1 Bitcoin mining ETF in SEC filings. GRP has more than 1.6 MILLION retirement accounts.' - Bitcoin Archive

26th of April:

➡️Japanese public company Metaplanet has announced it purchased ¥1b ($6.25m) of Bitcoin, equivalent to ~30% of the company's current market cap.

➡️ BNY Mellon reported owning shares in BlackRock and Grayscale Bitcoin ETFs - SEC filing

America's oldest bank is buying Bitcoin...

💸Traditional Finance / Macro:

👉🏽 no news

🏦Banks:

👉🏽US prepared for the potential failure of a major Wall Street bank, says FDIC.

👉🏽Fed Chair Jerome Powell on Bank Failures (March, 2024):

"I’m sure there will be bank failures, but this is not the big banks."

Last night, the 26th of April, Republic First Bancorp officially collapsed and was seized by regulators.

🌎Macro/Geopolitics:

On the 22nd of April:

'Emerging market countries (excluding China) owe a staggering *$421 billion* of government debt this year

The majority of this is owed to multilateral institutions, foreign creditors, the IMF, and the Paris Club (deferred debt from the IMF, etc)'

You can also call this financial slavery or financial colonialism.

On the 25th of April:

👉🏽'For those who do not understand what just happened:

First, Q1 2024 GDP growth slowed to just 1.6% which is less than HALF of the 3.4% Q4 2023 number.

This reading is roughly 50% BELOW Goldman Sachs's expectations.

But it gets even worse.

At the same time, the US Core PCE Price Index soared from 2.0% to a staggering 3.7%.

This crushed estimates of 3.4% and further suggests that inflation is on the rise.

We have a weakening economy with rising inflation.

The worst possible outcome for the Fed.' - TKL

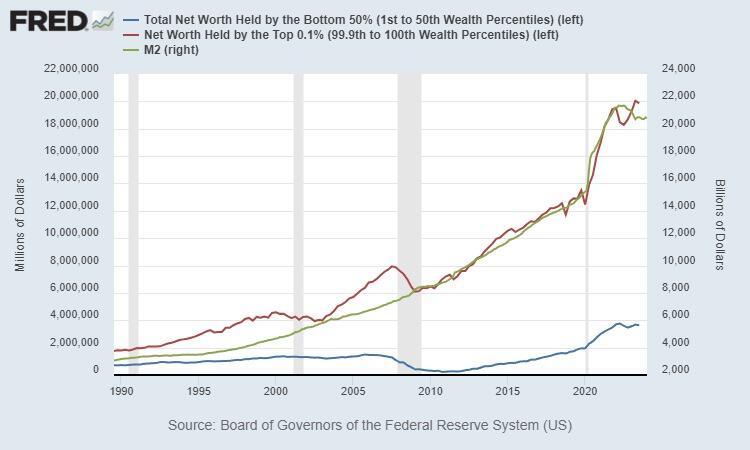

(Picture 2)

Ergo from "transitory" to "soft landing" to stagflation.

the work product of academics with over 800 PhDs at the Federal Reserve.

I let James Lavish do the talking:

"A Fed nightmare. When GDP (economic activity) slows down, yet prices continue rising (stagflation), and the government refuses to curb reckless deficit spending, this puts the Fed and Treasury in an impossible position that no matter what they do, it will lead to issuing more and more Federal Debt. This leads to the need to monetize the debt with more money printing, inflation surges, rates rise, and we do it all again."

QE Forever!

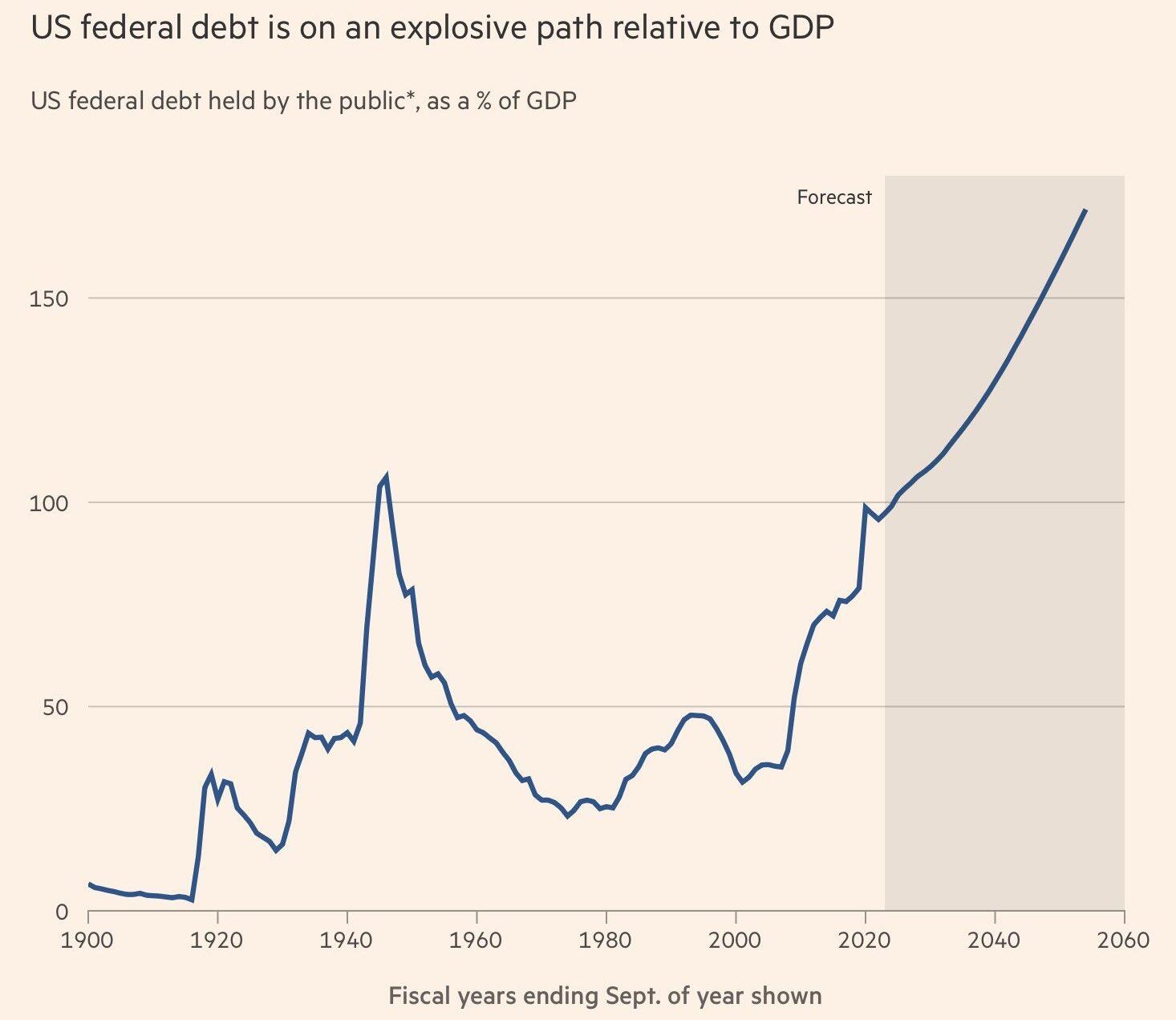

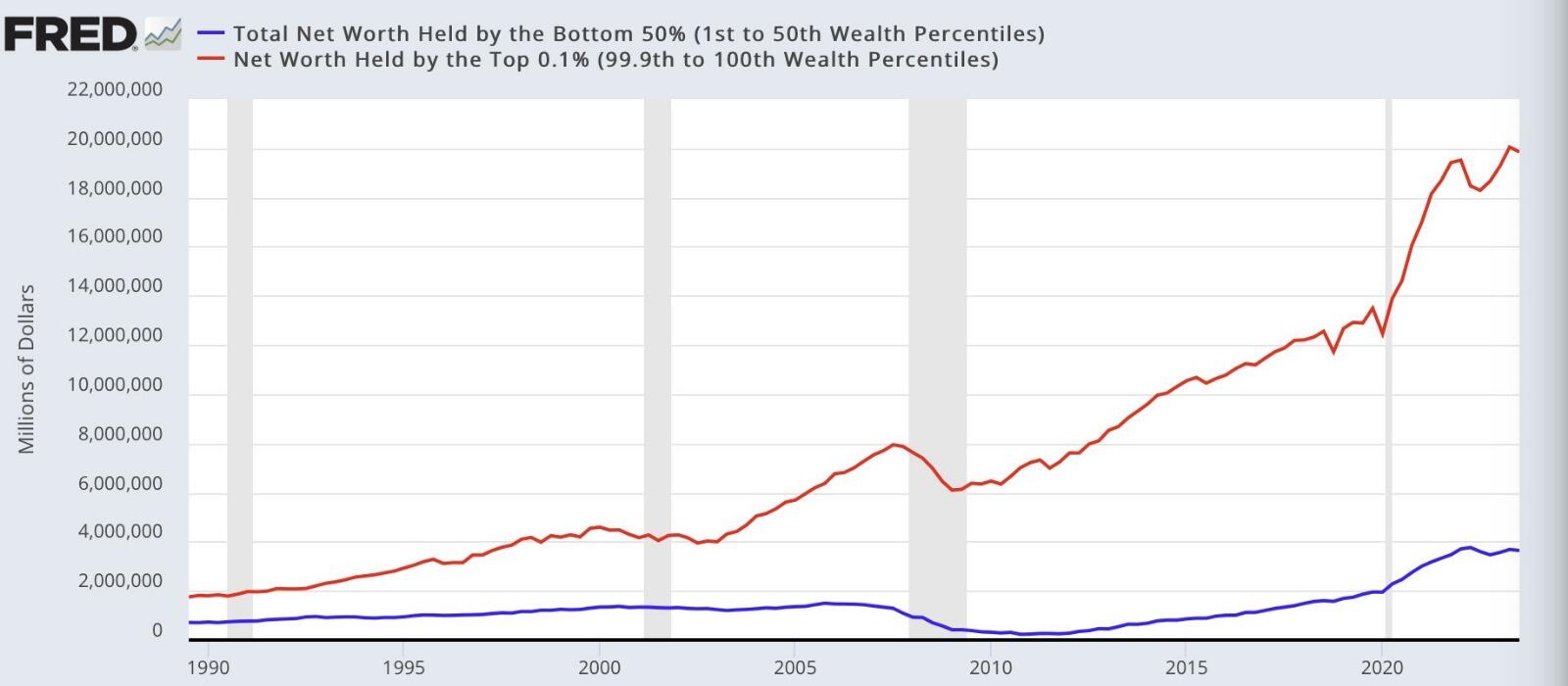

Now have a look at the following chart posted by Luke Gromen. (Picture 3)

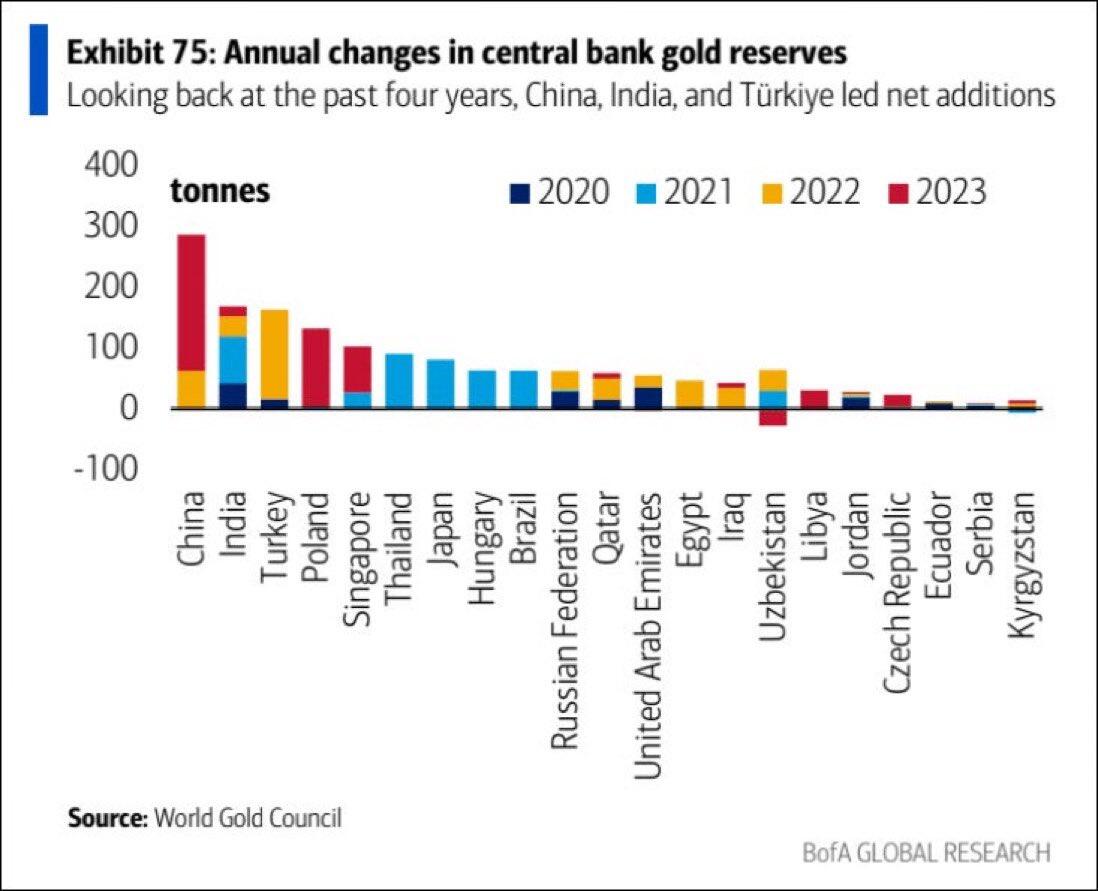

The rest of the world started to wise up back in 2024. (remember the clip by Putin in 2014 saying how the Dollar/the US is a weapon and fucking everything up), moving away from continuing to fund US government spending & stupidity. This trend has intensified after Covid, countries are now parking their savings in Gold and eventually in Bitcoin.

"The Dollar is the emperor walking down the street naked."

Who is buying post-2014 (red line): The Fed, US banks, MMFs, and foreign tax shelters.

👉🏽President Biden proposes a 44.6% capital gains tax, the highest in history.

The proposal also includes a 25% tax on unrealized gains for high-net-worth individuals.

👉🏽'Savings rates in the US fell from 3.5% to 3.2%, the lowest since November 2022, according to Zerohedge.

Over the last year, savings rates have fallen from 5.2% to 3.2%.

All as credit card debt continues to push above a record $1.1 trillion with 25%+ interest rates.

On the 26th of April:

👉🏽 Currently the Yen is imploding. Japan's bonds and currency are crashing again. Now the following thread will give you a great overview and help people to understand why this is important and what is happening. https://twitter.com/peruvian_bull/status/1784020167141318860

The Japanese have lost 6% of their purchasing power in the last 3 weeks.

The Japanese were the first to "experiment" with QE, in their 1989 property crash. The US, then the UK then the EU copied them in 2008-2010 as they had no better ideas. So, the demise of Japan today, we can see happening to the rest of us in 10-15 years... or maybe less.

Read the thread, because it will show you why it is important to self custody your Bitcoin, and why Bitcoin is important.

On the 27th of April:

👉🏽The United States dollar has lost over 25% of its purchasing power since January 2020.

On the 28th of April:

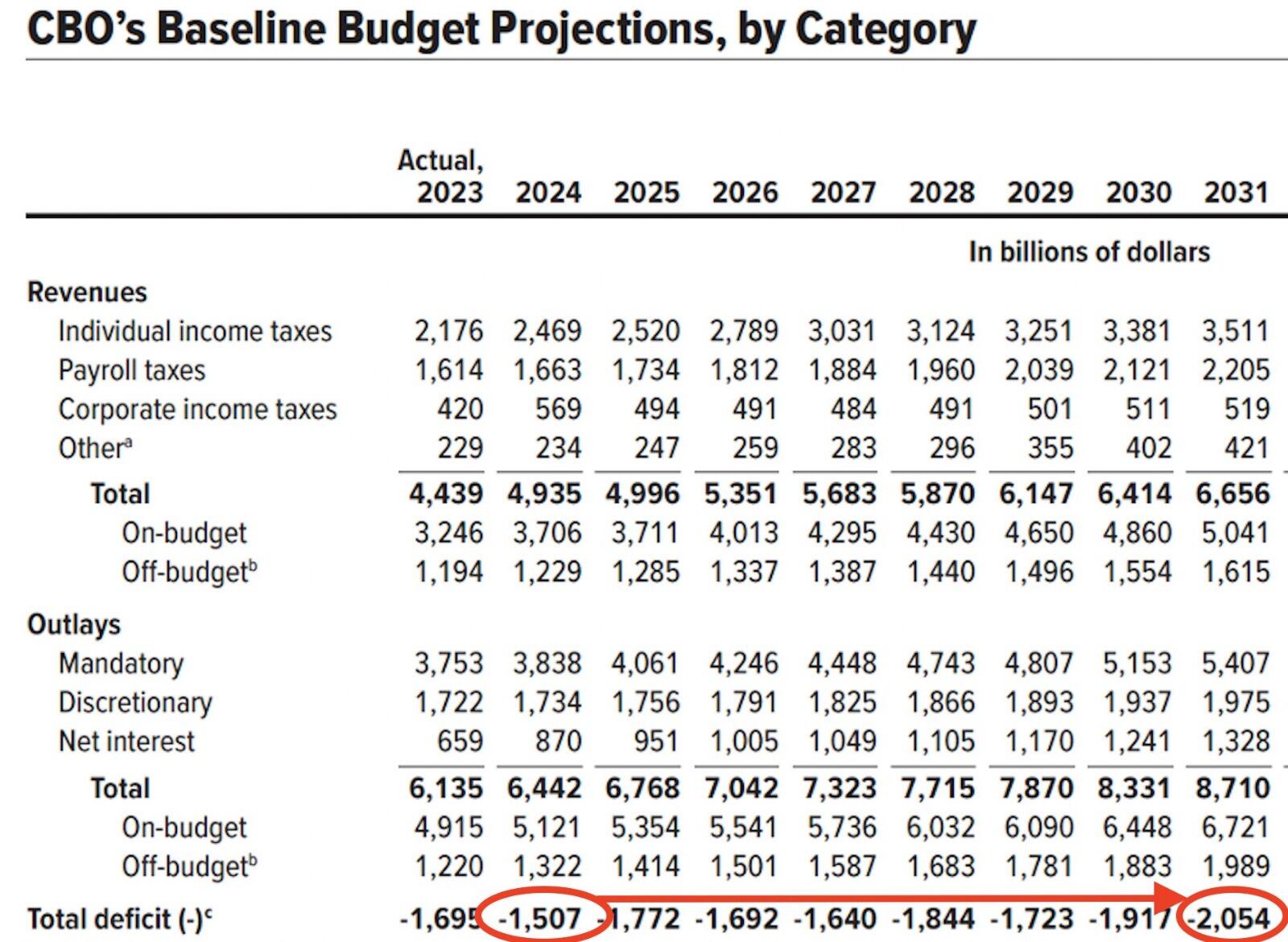

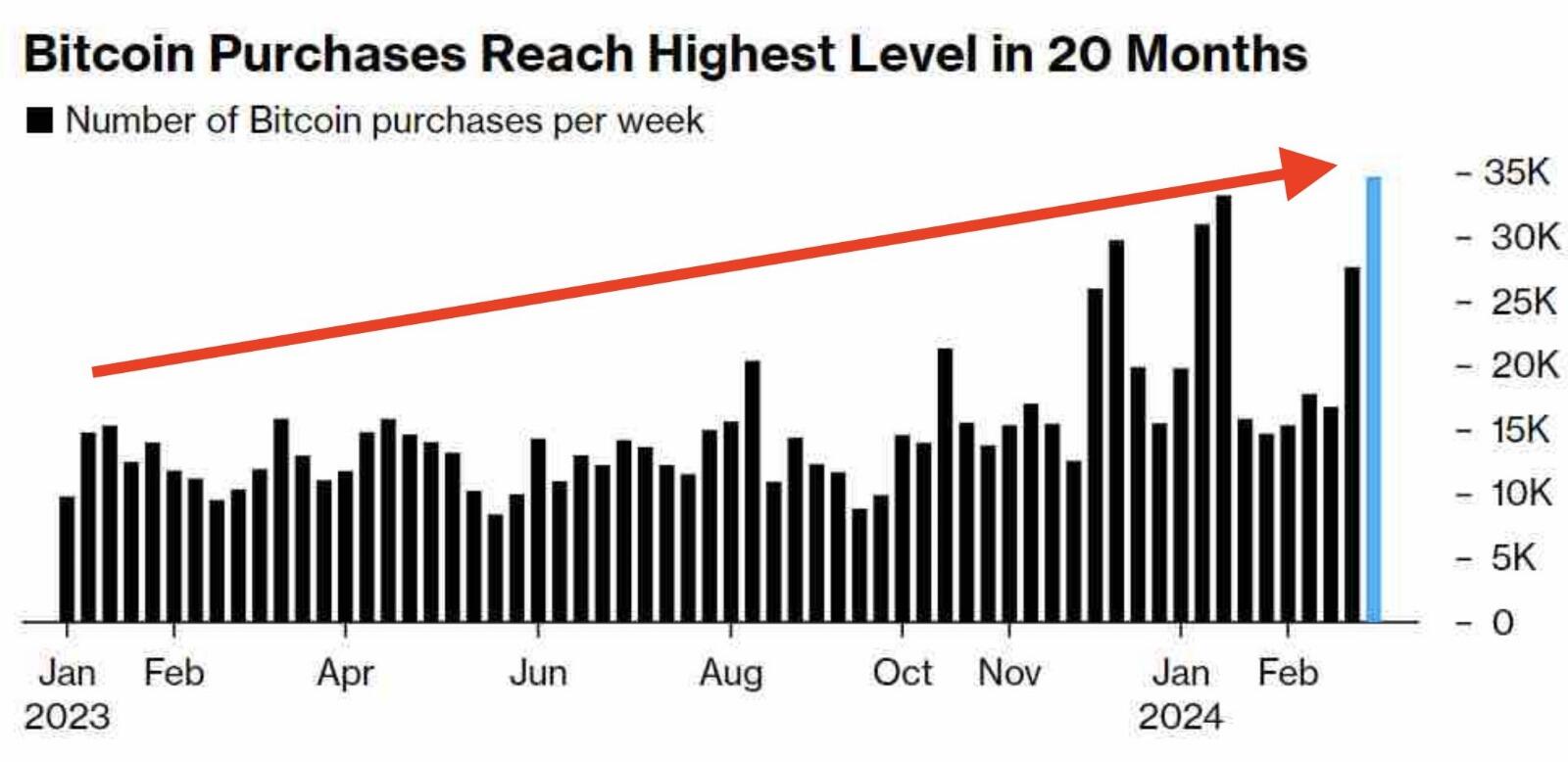

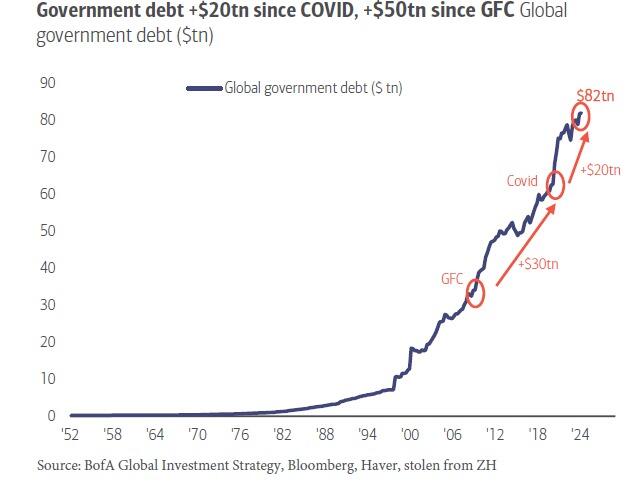

'The US government has issued a whopping $11 TRILLION of debt over the last 4 years.

By comparison, it took the US 220 years to add the first $11 trillion of Federal debt.

Within the next 2 months, total US debt is on track to cross above $35 trillion for the first time in history.

Since June, the US debt has been rising by $1 trillion every 100 days.

If the current pace continues, another $11 trillion will be added in just three years putting us at ~$45 trillion by 2027.' (foto)

Anyway to put it in some perspective, over 75% of U.S National Debt was created after Bitcoin’s 1st block….

(Picture 4)

🎁If you have made it this far I would like to give you a little gift:

A masterclass by Saylor. (16min) This is next level. This is a lesson in financial literacy.

https://twitter.com/bleighky/status/1783551971682640241

TLDR: He is playing chess while everyone else plays checkers.

Full interview: https://youtu.be/bUfVLzNdOyc?feature=shared https://youtu.be/bUfVLzNdOyc?feature=shared

Only invest in Bitcoin what you can’t afford to have gradually stolen from you by the government.

Credit: I have used multiple sources!

My savings account: Bitcoin

The tool I recommend for setting up a Bitcoin savings plan: @Relai 🇨🇭 especially suited for beginners or people who want to invest in Bitcoin with an automated investment plan once a week or monthly. Hence a DCA, Dollar cost Average Strategy. Check out my tutorial post (Instagram) & video (YouTube) for more info.⠀⠀⠀⠀

Get your Bitcoin out of exchanges. Save them on a hardware wallet, run your own node...be your own bank. Not your keys, not your coins. It's that simple.⠀⠀⠀⠀⠀⠀⠀⠀

Do you think this post is helpful to you? If so, please share it and support my work with sats.

#zap 🧡 #weeklyrecap #nostr

#plebchain

#BTC

#Bitcoin

#zap🧡

#grownostr

#stacksats

#bitcoineducation

#adoption

🧠Quote(s) of the week:

'If you made $500.000 per day, every single day since the Great Pyramids were built, you would have less than half of what the US government has borrowed since June.'

Although this quote is a bit outdated it is actually nuts when you contemplate it...perspective is nice when it comes to large numbers.

Let me do the math for you: 4.700(years) * 365 (days/year) * 500.000$ (/day) = 857.750.000.000 - Less than a Trillion

(barring the likely inaccuracy of our understanding of the Pyramids timeline)

Which means you would still have less than 3% of what the US government has in total debt.

No matter your thoughts on Bitcoin, think about those numbers for a minute and let that sink in.

After that, you should probably buy some Bitcoin.

🧡Bitcoin news🧡

Before we start I want to share some deep knowledge:

"Bitcoin didn't appear out of thin air - it is the result of decades of work. Many digital currency projects failed before they succeeded. Understanding how we got here will help you understand where we're going. Learn the history behind Bitcoin here:" - Jameson Lopp

https://www.lopp.net/bitcoin-information/history.html

16th of April:

➡️Bitcoin Core 27.0 released:

https://github.com/bitcoin/bitcoin/blob/master/doc/release-notes/release-notes-27.0.md

TLDR: Bitcoin has now better privacy by default. An important and welcome change to Bitcoin core, by finally supporting encryption between nodes. This is a massive improvement.

For the technical readers of the Weekly Recap, I would recommend to following article and podcast

https://stephanlivera.com/episode/433/

➡️Google has opened a new office in El Salvador to support the country’s digital transformation and modernization of government services. Furthering President Bukele’s goal of turning the country into a tech hub. Bukele managed to lower crime, a growing economy, and higher foreign investment + more tourism.

Eat that IMF

➡️BYBIT RESEARCH: "With only 2 million Bitcoin left, if we assume a daily inflow of $500 million to Bitcoin Spot ETFs, the equivalent of around 7,142 bitcoins will leave exchange reserves daily, suggesting that it will only take nine months to consume all of the remaining reserves." -Bitcoin News

➡️ "$400 Billion Banco Do Brasil holds BlackRock's Bitcoin ETF

It is the BIGGEST financial institution in Latin America!"- Bitcoin Archive

➡️"Mr. 100" is an unknown entity known for buying 100 Bitcoin every day since Nov 2, 2022. They now hold 60.600 BTC (!) worth $3.8 Billion ($1.6 Billion in profit)

Due to the size of the investment, many people speculate this is a nation-state buying Bitcoin. But who is it?" - Bram Kanstein

Great thread: https://twitter.com/bramk/status/1780243283060371717

I personally and I really do hope it is Brunei. They are mining Bitcoin and hopefully also buying Bitcoin.

But probably it is an exchange. Some people say this is an exchange wallet by Upbit Global.

17th of April:

➡️'Hong Kong Bitcoin ETFs to start trading by 30th April and could bring in $25 billion: Matrixport and OSL reports.' -Radar

➡️Last week I wrote a bit on UFC lightweight Renato Moicano: "If you care about your country, read Ludwig Von Mises' 6 lessons of the Austrian Economic School motherf*ckers".

He was referring to, it’s a series of six lectures Mises gave in Argentina in 1958, later combined into a book: “Economic Policy: Thoughts for Today and Tomorrow”.

'Fifty years after his death, Mises gets more downloads in three days than what 95% of living economists get in their entire lifetime. Regurgitating fiat propaganda may give you fiat jobs & titles, but pursuing truth gives you immortality.'- Saeifedean Ammous

➡️Blackrock spot Bitcoin ETF IBIT closing the $2.3B gap on Grayscale's GBTC in assets, could be ahead by month's end, according to Bloomberg Senior ETF Analyst Eric Balchunas

➡️ Now that the halving has passed us, and Bitcoin has become the hardest money in the world. Bitcoin’s most explosive gains are typically post-halving. Great chart from VanEck. (Picture 1)

18th of April:

Just the IMF putting time, effort, and money into reporting on Bitcoin.

They published a paper on Bitcoin cross-border flows, and here are three major takeaways:

'1.) The study provides evidence that increased Bitcoin activity occurs as investors move away from risk assets and supports the findings of other studies that Bitcoin can be used to hedge global uncertainty.'

2.) The study concludes that people appear to be turning to Bitcoin to flee instability in their local economies and currencies and to circumvent capital controls.

3.) The findings highlight that Bitcoin flows are typically larger in emerging and developing markets, like Argentina and Venezuela, compared to advanced economies with sophisticated financial markets.' - Sam Callahan

To sum it up the IMF just said :

1. Bitcoin is increasingly used as a hedge against risk

2. Bitcoin is used as freedom money in autocratic regimes

3. Bitcoin’s biggest use case is the global south to protect against currency debasement and financial instability

Cope from the IMF? The IMF just realized that Bitcoin nullifies the need for their existence.

For sure it is a surprising study, but I am not surprised by the outcome.

➡️Riot has started mining Bitcoin at its new Corsicana Texas facility.

With a capacity of 1 GW, it is projected to be the biggest in the world.' - Pierre Rochard

➡️ Jamie Dimon says Bitcoin is a fraud and a Ponzi scheme.

- JP Morgan funds hold Bitcoin

- JPMorgan, His firm is an Authorized Participant (AP) for the BlackRock spot Bitcoin ETF and gets paid for trading “fraud”.

➡️Binance dumps over 16,000 Bitcoin to back up their SAFU fund with ~$1 billion USDC

➡️'When Nobel Peace Prize nominee Félix Maradiaga tells you that Bitcoin is truly a tool for freedom after discussing the egregious human rights violations carried out by the Ortega regime, you listen.'

https://twitter.com/btcpolicyorg/status/1780983728858087893

Bitcoin serves as a tool to ensure human rights. Important for all world citizens, but especially for those living in Africa & South America.

19th - 20th of April:

Now I can explain to you what the halving is, but I rather let some Bitcoin OG's do that:

'The Bitcoin halving is not a day to celebrate because the price will immediately go up (it probably won't) but because it's a quadrennial reminder that we now have a means of saving free of debasement and resistant to censorship. For that I'm thankful.

Thank you, Satoshi' - Vijay Boyapati

'The Bitcoin halving is an anticipated event, one of those Bitcoin holidays that happen every once in a while. Along with Soft Fork Activation and various financial instrument introduction days, it's one of those not-quite-predictable days that occur every few years which give Bitcoiners reason to pay attention and mainstream media to speculate.'- Jimmy Song.

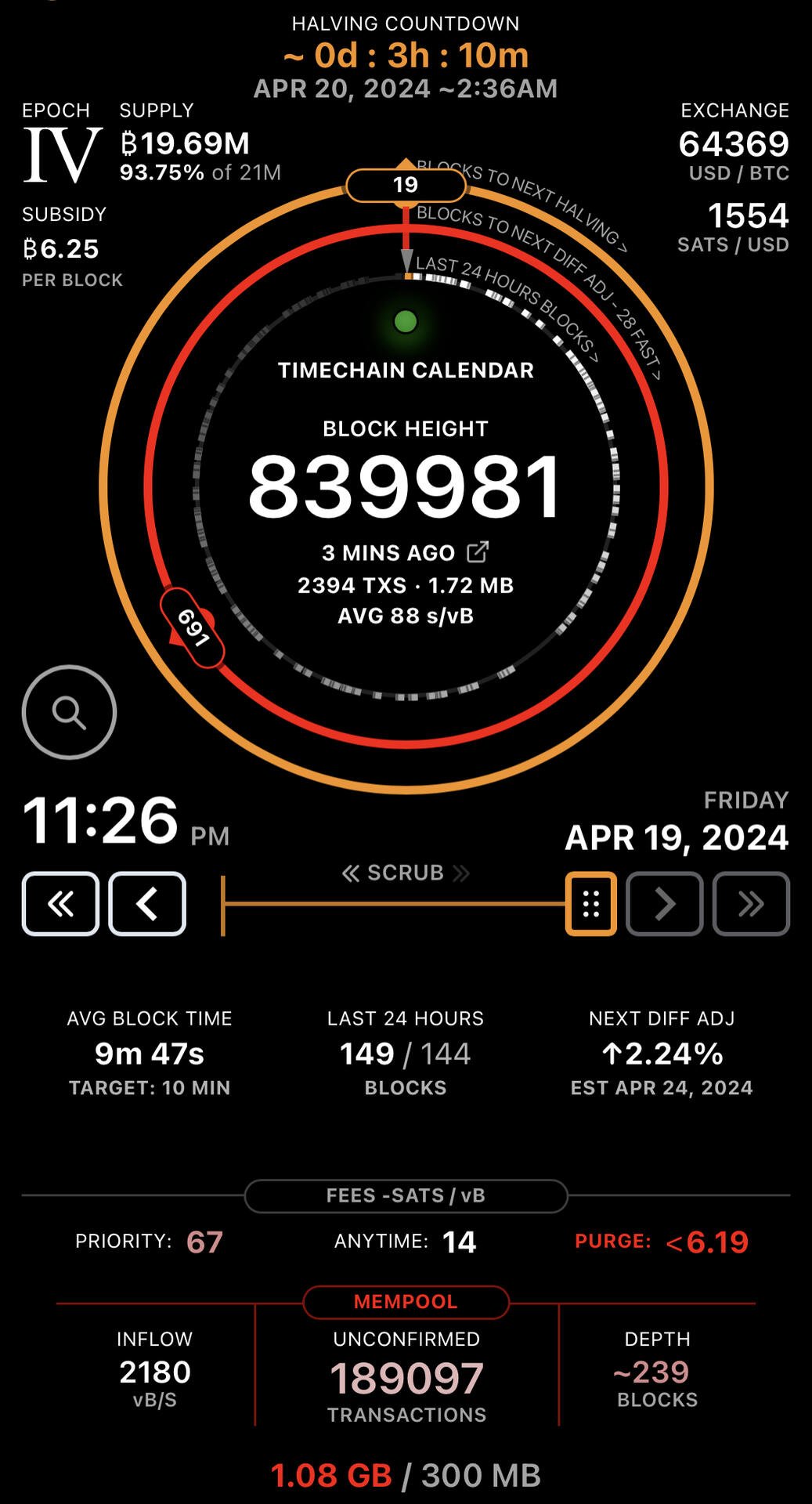

'Every node on the Bitcoin network divides the block height by a fixed issuance halving interval, 210,000 blocks. Rounding to the nearest whole number gives us how many halvings to apply to the 50 BTC initial per-block subsidy.

Halvings are applied by "right shifting" the binary representation of the subsidy, where the last bit is dropped and a zero is prepended in front. Each right shift applied causes a halving of issuance.' - Pierre Rochard (picture 2)

Andreas Antonopoulos explaining the halving:

https://www.youtube.com/watch?v=vwkRsp0gqX4&feature=youtu.be

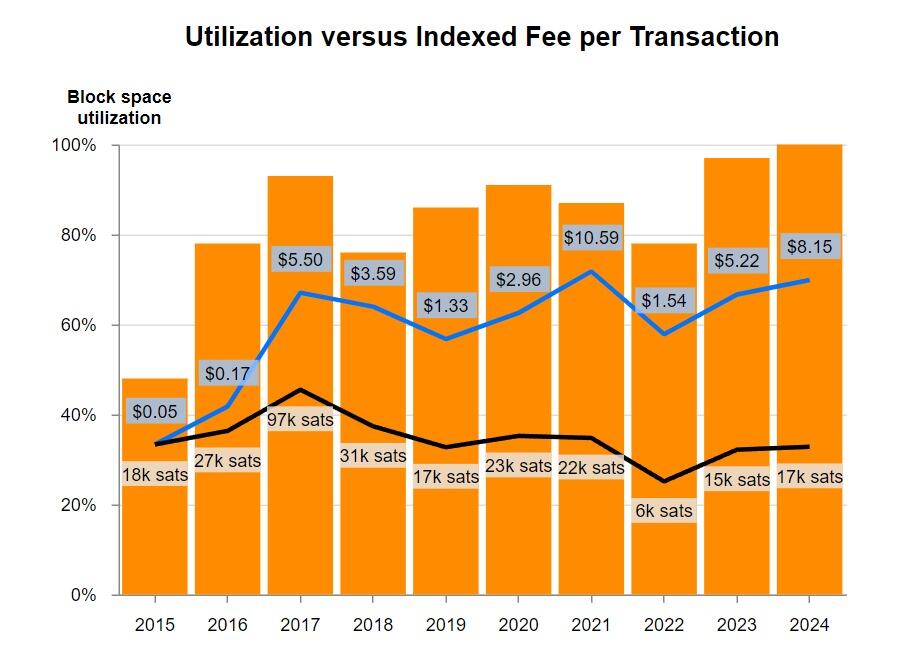

The halving block, block 840.000, had 37.6 Bitcoin worth of fees... It wasn't just blocked 840,000 that had high fees, over the next 5 blocks, we had fees of 4.486, 6.99, 16.068, 24.008, and 29.821 BTC respectively. The fees are the highest it's ever been. This situation in Bitcoin is unprecedented.

If you want to know more on this topic (high fees - post halving) I highly recommend:

https://twitter.com/jimmysong/status/1781518918001078441

➡️'In the first 60 blocks since the 4th Bitcoin halving, miners have collected 860.2 BTC in transaction fees alone. Equivalent to over $54m, this has already smashed the previous single-day all-time high transaction fees of $24m.' - Jameson Lopp

21st of April:

'In the 130 blocks post-halving, Bitcoin miners earned 1,675 BTC ($109 million)

Of this, 75% (1,262 BTC worth $82 million) came from transaction fees.

For context, miners received 1,349 BTC in fees from April 1 to April 19.' - Bitcoin News

💸Traditional Finance / Macro:

👉🏽 'US Treasury Bills now yield 4 TIMES more than the S&P 500's dividend, the most since the Dot-com bubble.

Over the last 100 years, a multiple this high has only been seen ONE time.

By comparison, even in the 2008 Financial Crisis, this metric peaked at ~3x.

With interest rate cuts being priced out, we likely see interest rates on bonds continue to push higher.

This will keep US T-Bill rates elevated and perhaps push this ratio to its 2000 highs.

Yet another Dot-com bubble similarity.'- TKL

🏦Banks:

👉🏽no news

🌎Macro/Geopolitics:

On the 16th of April:

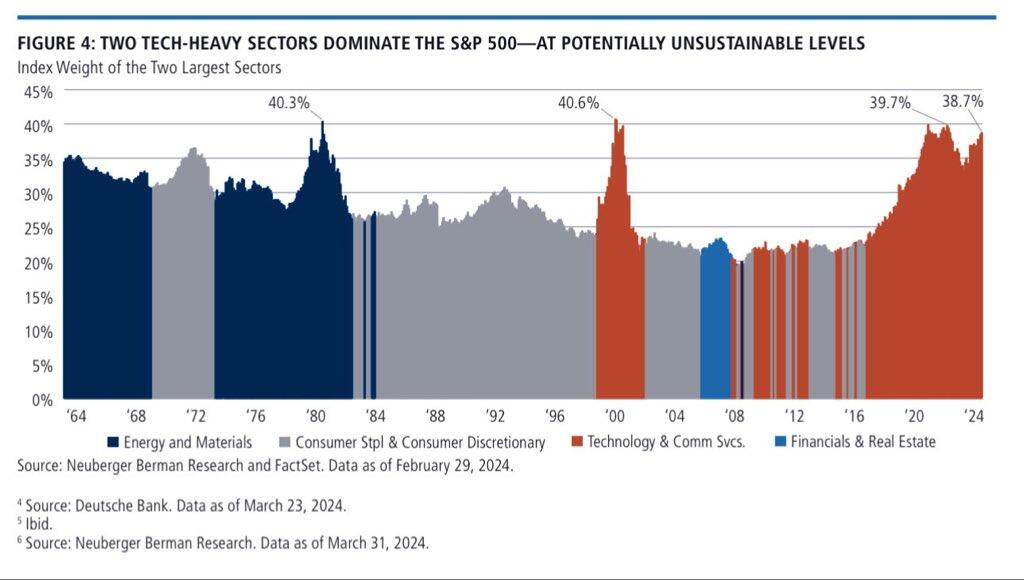

👉🏽You are being told that we are in the greatest economy ever. Yet, every indicator shows we are in a terrible failing economy across the board, the US, Europe, etc. Stagflation is here and will only accelerate.

Although this is just a graph/ratio, AI will surely save us, right guys? (Picture 3)

We all know what followed, right? Populist leaders (please look around in your country) and a world war...

“The first panacea for a mismanaged nation is inflation of the currency; the second is war. Both bring temporary prosperity; both bring a permanent ruin. But both are the refuge of political and economic opportunists.”

- Ernest Hemingway

The US military is in a symbiotic relationship with the Dollar. If one part fails, it will drag the other down. Do understand that once Rome also spent more on 'defense' than others. Fiat currency is always about political faith. Always.

(Picture 4)

👉🏽"The IMF has cut Germany's economic growth in 2024 to 0.2%, after projecting a 0.5% rise in its January forecast. Europe's biggest economy is predicted to have the weakest growth of all G7 industrialized nations for the current year. For 2025, the IMF revised German growth to 1.3% from the previous 1.6%. IMF said this is due to persistently weak consumer sentiment. In the long term, the IMF's main concerns for Germany are structural problems such as the decline in the working population and obstacles to investment." - Holger Zschaepitz

I think the first time I spoke publicly on this matter was like three years ago. Germany is a slow-motion train wreck without cheap Russian natural gas. The green agenda isn't working, closing nuclear power plants isn't working...Europe's engine is on the ropes.

Oh well, this is an IMF so-called forecast.

👉🏽'The average rate on a 30-year fixed mortgage in the US rises to 7.43%, a new 2024 high.

We have not seen mortgage rates this high since early December 2023, when the Fed said rate cut talks were "premature."

This means that the monthly mortgage payment on a $500,000 house with 20% down is now $3,500/month.

The $3,500/month figure also does not include property taxes, insurance, or maintenance.

Meanwhile, the median US home is now selling for a whopping $417,700.'- TKL

I guess it is a great time to be a rental property owner. Yikes!

This thought-provoking thread has a very counterintuitive, contrarian take:

https://twitter.com/VincentDeluard/status/1780679971146731837

TLDR: 'This sums it up pretty well. Sound money helps slow the process, too. The fiat advent coupled with Keynesian asset inflation policies created a perfect storm. The rise of Chinese deflation exporting was the nail in the coffin because it made this reflexive.' -Nelson Alves

On the 17th of April:

👉🏽'The US is expected to collect $2.9 trillion in tax receipts during FY2024 as of Q1.

Government expenditures over that period are expected to be over $9.7 trillion.

The thousands of dollars you remitted to TurboTax today won't cover even 1/3rd of US expenditures.'- Joe Consorti

👉🏽UK Inflation at 3.2% — the lowest in more than 2 years from a peak of 11.1%

On the 18th of April:

👉🏽'Want to be in the top 1% in the United States?

You now need a net worth of a whopping $5.8 MILLION.

This is up 15% from the $5.0 million threshold seen just one year ago.

The top 1% threshold in the US is only lower than Monaco, Luxembourg, and Switzerland.

As equity markets and real estate prices have skyrocketed, the wealth gap is widening.

Since 2020, the wealth of the top 1% in the US has risen by almost $15 trillion to a record $44.6 trillion.

The rich are getting richer faster than ever before.' -TKL

👉🏽IMF Prepares Financial Revolution – Say Goodbye To The Dollar

https://www.zerohedge.com/markets/imf-prepares-financial-revolution-say-goodbye-dollar

The only thing I can say on this is:

- I am not surprised

- Please reject CBDCs with everything you have. The centralization of digital currencies will never work!

- The IMF is not elected!

Anyway, no need to panic whatsoever. The IMF probably goes before the dollar. The dollar is and will be the number one (fiat) currency of the world.

On the 20th of April:

👉🏽'The Congressional Budget Office expects that about $20 trillion in net new federal debt will be issued over the next decade.

As part of this, they assume 1) no recessions but also that 2) that interest rates will go down starting here in 2024.

Otherwise, probably >$20 trillion.'

Now go back to the top of this article and read the start quote.

(Picture 5)

'Over the same next decade:

At current production rates and prices, about $2.5 trillion in new refined gold will be created. Prices and supply rates could change.

At current prices, about $70 billion in new bitcoin will be created. Prices could change, but not supply rates.' - Lyn Alden

On top of that:

👉🏽'The U.S. has $4.4 Trillion annual revenue, prints $1 Trillion every 100 days and there is still somehow a need to vote for $100 Billion aid to countries on top of everything else. House approves aid for Ukraine, Israel, and Taiwan. House Rejects Border Security Bill.

The U.S. doesn’t have a revenue problem, it has a government spending problem.

'A child born in 2024 in the U.S. is born with ~$85,000 debt.

The median U.S. bank account balance is $8,000 and over half of the population has less than $500 in savings.

So, printing $ Trillions and sending $100s of Billions abroad is not without consequences.' - Gabor Gurbacs

Politicians celebrating sending another $60B to fund a foreign war. Perfect more DEBT!

Context:

$34.6 trillion in debt.

123% Debt to GDP

Nearly a $3 trillion deficit this year.

video: https://twitter.com/MDBitcoin/status/1781786149071032712

Separate money and state.

To sum everything up from above:

The US hasn’t generated a surplus consistently since the 1990s.

The trend over the past 50 years has been:

Larger and larger monthly deficits.

Monthly surpluses are getting few and far between.

That’s why the debt can only continue rising exponentially.

Deficit is destiny. That means increasing the rate of debasement of the US$.

21st of April:

'Who is supposed to pay for pensions and healthcare entitlements in Italy in a few years?

BTW, it’s a similar picture in Germany. Demographics is one of the main reasons why the US will be much better off than Europe as we go forward.' -Michael A. Arouet

If I were 50 years old in Germany, Italy, and the Netherlands we are starting to see the same effect, I'd start wondering who will pay my state-funded pension.

You need either economic growth, acceptance of high migration, or healthy demographics. Italy has none of the three. What will give?

https://twitter.com/MichaelAArouet/status/1781978599391674470

Please click on the link and have a look at the graph.

🎁If you have made it this far I would like to give you a little gift:

Lyn Alden's April newsletter is out. Well, worth your time to read this:

https://www.lynalden.com/april-2024-newsletter/

Only invest in Bitcoin what you can’t afford to have gradually stolen from you by the government.

Credit: I have used multiple sources!

My savings account: Bitcoin

The tool I recommend for setting up a Bitcoin savings plan: @Relai 🇨🇭 especially suited for beginners or people who want to invest in Bitcoin with an automated investment plan once a week or monthly. Hence a DCA, Dollar cost Average Strategy. Check out my tutorial post (Instagram) & video (YouTube) for more info.⠀⠀⠀⠀

Get your Bitcoin out of exchanges. Save them on a hardware wallet, run your own node...be your own bank. Not your keys, not your coins. It's that simple.⠀⠀⠀⠀⠀⠀⠀⠀

Do you think this post is helpful to you? If so, please share it and support my work with sats.

#zap 🧡 #weeklyrecap #nostr

#plebchain

#BTC

#Bitcoin

#zap🧡

#plebchain

#grownostr

#stacksats

#bitcoineducation

#adoption

Dutch Noderunners Halving Party🧡✅

19blocks👀✅🧡

Study, learn, hodl, decouple.

#bitcoin 🧡

▃▃▃▃▃▃▃▃▃▃▃▃▃▃▃

My savings account: Bitcoin

The tool I recommend for setting up a Bitcoin savings plan: @Relai 🇨🇭 🇨🇭 especially suited for beginners or people who want to invest in Bitcoin with an automated investment plan once a week or monthly. Hence a DCA, Dollar cost Average Strategy. Check out my tutorial post (Instagram) & video (YouTube) for more info.

⠀⠀⠀⠀

Get your Bitcoin out of exchanges. Save them on a hardware wallet, run your own node...be your own bank. Not your keys, not your coins. It’s that simple.🎯

⠀⠀⠀⠀⠀⠀⠀⠀

Do you think this post is helpful to you? If so, please share it and support my work with sats. 🧡

Felipe - BitcoinFriday

#zap 🧡 #nostr #BTC #Bitcoin #plebchain #grownostr #stacksats #bitcoineducation #adoption

🧠Quote(s) of the week:

‘When you understand Bitcoin there is no way back. You will look at the system in a whole new way. Your friends and family will think you’re crazy. Choose wisely.’

― Bitcoin for Freedom

"3 rules that are a cheat code for life:

1. Create value for others

2. Spend less than you earn

3. Save in Bitcoin"

― BTC Sessions

🧡Bitcoin news🧡

9th of April:

➡️Japanese firm Metaplanet buys ¥1B ($6.5M) of Bitcoin, mirroring MicroStrategy's strategy. The company's shares jumped 90% following the announcement.

11th of April:

➡️SEC to file lawsuit against defi crypto platform Uniswap - Reuters

This is why Satoshi disappeared and made Bitcoin impervious to government attacks.

12th of April:

➡️IMF demands El Salvador change its Bitcoin law in return for a $1.4 billion loan. (please read the part on the IMF below -> segment Macro/geopolitics.) How I read this statement, the IMF is annoyed at the mere existence of Bitcoin. Basically, they are saying: Sell your 'hard' money and get indebted to us.

➡️"The more energy Bitcoin mining uses, the more emissions it can reduce

35 midsized venting landfills running Bitcoin mining is all it takes for Bitcoin mining to be the

world's first emission-negative industry

Achieved organically, without subsidy, without purchasing offsets." - Daniel Batten

Could it be possible for Bitcoin to save the environment with its Proof-of-Work design and be the main player in the 'green' energy revolution?

13th of April:

➡️Paraguay Senate approves resolution to sell energy surplus to bitcoin miners, criticizes sale of energy to Brazil for 25% of what bitcoin mining generates, directs this energy to 20 new bitcoin mining companies instead. Remember Paraguay is a large hydroelectricity producer and Bitcoin could be the answer.

I am pretty sure that Bitcoin will be the primary engine of prosperity in the 21st century. Countries like El Salvador, and Paraguay but also several countries in Africa will lead the way.

14th of April:

➡️UFC lightweight Renato Moicano: "If you care about your country, read Ludwig Von Mises' 6 lessons of the Austrian Economic School motherf*ckers".

He also demanded his fight bonus in Bitcoin.

He is referring to, it’s a series of six lectures Mises gave in Argentina in 1958, later combined into a book: “Economic Policy: Thoughts for Today and Tomorrow”:

1. Capitalism

2. Socialism

3. Interventionism

4. Inflation

5. Foreign Investment

6. Policies and Ideas

Full read: https://cdn.mises.org/Economic%20Policy%20Thoughts%20for%20Today%20and%20Tomorrow_3.pdf

➡️The number of addresses holding more than 1 Bitcoin peaked in January 2024 at 1,024,484 and has fallen by 13,000 since.

15th of April:

➡️Norway became the first country in Europe to introduce regulations for data centers aimed at controlling which projects are permitted.

Cites emissions, and energy consumption control. They state Bitcoin mining “is an example of a type of business we do not want in Norway”

They are not going to ban mining. They want to force data centers to report to the government what kind of processes they are doing. Still bad though! Why, because it is misguided, ineffective, and futile. If electric cars = zero-emission... electric miners too. Are they going to ban or regulate EV cars too?

Clown policy that will backfire badly for a country already going through a currency crisis and for a failing continent, Europe.

Read the following thread by Daniel Batten.

https://twitter.com/DSBatten/status/1779859225809990116

Ergo: Politicians have no clue or are being paid to not understand things that benefit society/their people.

➡️Germany's biggest Federal bank LBBW to launch Bitcoin custody services to institutional customers.

Bitcoin ETF news:

"Weekly Bitcoin ETF Flows:

IBIT +7,000 BTC

FBTC + 1,300 BTC

GBTC -11,000 BTC

Net Flows - 1,100 BTC

In a week of GBTC Sales, CPI freak outs and War fears, Bitcoin holds 67K and has slight outflows."- Thomas Fahrer

On the 9th of April:

➡️The value of BlackRock’s Bitcoin holdings jumps to $18.9 Billion.

➡️Fidelity now holds 150K Bitcoin worth over $10 Billion.

On the 11th of April:

➡️Asia ETF's

- Hong Kong approving Bitcoin ETFs

- South Korea will approve Bitcoin ETFs

- Chinese fund managers launching Bitcoin ETFs

US Bitcoin ETFs pushed the price from $38K to $73K.

South Korea's pro-Bitcoin Democratic Party has won the national election to form a government. More than 6 million South Koreans — over 10% of the population own Bitcoin or crypto.

DP: "We're going to allow the ETFs, domestic or overseas."

➡️GBTC sees the smallest outflow since the launch of the Bitcoin ETFs with just $17.5 million leaving the fund on the 11th of April.

15th of April:

➡️Hong Kong just approved the first batch of Bitcoin ETFs

➡️"Since launching on Jan 10, U.S. ETFs, even including all GBTC sales, have amassed 222,000 Bitcoin in just 65 trading days—that's 3,415 BTC daily!

Now Hong Kong ETFs join the game, just as the weak hands have folded and miners have half as much to sell." - Thomas Fahrer

💸Traditional Finance / Macro:

👉🏽 'BlackRock is eating the world: Hits record $10.5tn in assets under management in Q1 2024, +15% YoY, boosted by $57bn of total net inflows to its investment products.'

👉🏽Here's a crazy stat that no one will believe.

The universal investment benchmark is the 60/40 portfolio of stocks and bonds.

What if you replaced the bonds entirely with gold....crazy right?

Turns out it makes no real difference.

(picture 2)

Now wait till they do Bitcoin.

👉🏽This time is different:

(picture 3)

🏦Banks:

👉🏽no news

🌎Macro/Geopolitics:

On the 9th of April:

👉🏽"The EU must find ‘enormous amount’ of money to face global challenges, says former ECB chief Mario Draghi."

Money Printer go brrrr to infinity…because 'Whatever it takes' - Draghi

How?

Confiscate

Tax(visible)

Tax (hidden)

Government “Innovation”.

👉🏽Constant QE or default are the only ways out. And financial repression is the default, just in slow motion.

(See picture 4)

'This assumes no recessions or geopolitical events for the next few decades.

Japanese-style financial repression is the only way out of this mess. Or what other viable options are there?'

👉🏽"The federal budget deficit totaled $1.1 trillion in the first half of fiscal year 2024, CBO estimates"

'And yet, just over a month ago, the same CBO released their report projecting a $1.5T deficit for the entire year. At this rate, the deficit will be $2.2T, a 47% overshoot and even higher than the projected deficit in 2031.' - James Lavish

The US spending is out of control and it's getting worse at an exponential rate. Within one month, they (CBO) posted a 47% overshoot on the largest budget in world history.

The whole US budget, but also here in Europe, implodes around 2030 - 2035 at the latest. A new system will rise...the only question you need to ask yourself will it be Bitcoin or CBCD's? (Picture 5)

On the 10th of April:

👉🏽March CPI inflation rate UP to 3.5%

- Above expectations of 3.4%.

- Cor inflation is 3.8%, also higher than expected rate of 3.7%.

3 straight years with inflation over 3%

They said "Inflation is transitory"

'Inflation has not fallen in a single month since Biden's term began (the closest was July 2022 when it was unchanged), which leaves overall prices up over 19% since Bodenomics was unleashed. And prices have never been higher.'- Zerohedge

This means that overall prices are up a whopping 19% in less than 4 years.

We have not had a year-over-year inflation print below 3% in 36 consecutive months.

Furthermore, inflation has been above the Fed's 2% target for 37 straight months.

Inflation is now building on previous years of inflation; we effectively have compounding inflation. Everyone should be asking for a 20% raise.

👉🏽For the less informed.

Price inflation at every fast food restaurant in the US has far exceeded CPI inflation since 2014.

Prices at McDonald's have DOUBLED since 2014 while official inflation data shows just 31% inflation.

Prices at Popeyes, Taco Bell, and Chipotle have risen by 86%, 81%, and 75%, respectively.

Traditionally, fast food was considered to be a "cheap" food option.

The CPI is a lie it’s manipulated to be lower than real inflation.

👉🏽On the same day, the US 10-year Treasuries had their worst day since May 2023, with yields surging after the one-two punch of a hot CPI and a bad auction. Peter Boockvar: "10-year auction was bad...Dealers were left with 24% of the auction, which is the most since Nov. 2022."

👉🏽China has been buying more gold than any other nation since 2020, with India in second place.

Can we call this DeDollarization?

(picture 6)

More on China...

👉🏽"Following Moody's in December, Fitch Ratings revised the China debt outlook to negative from stable.

China's pace of debt accumulation is very problematic. Public debt has more than doubled since the Great Financial Crisis and is heading to above 100% of GDP.

More importantly, total debt has ballooned from 133% in 2008 to 272%(!) in 2022. It will have risen again in 2023.

The current 10-year Chinese bond yield is at 2.29%, which is extremely low for a country that expects to grow by 5% annually. Coincidence? Of course not! China has the same debt sustainability issues as every other major economy, and rating agencies must act." - Jeroen Blokland

On the 11th of April:

👉🏽IMF Prepares Financial Revolution – Say Goodbye To The Dollar

https://www.zerohedge.com/markets/imf-prepares-financial-revolution-say-goodbye-dollar

The only thing I can say on this is:

- I am not surprised

- Please reject CBDCs with everything you have. The centralization of digital currencies will never work!

- The IMF is not elected!

Anyway, no need to panic whatsoever. The IMF probably goes before the dollar. The dollar is and will be the number one (fiat) currency of the world.

On the 12th of April:

👉🏽"Another strange sign that someone knows something:

Gold is up ~20% over the last 5 months and has doubled the S&P 500's return.

Meanwhile, bonds are down nearly 9% as interest rate cuts are priced out.

Historically speaking, gold and bonds have almost always traded together.

There is now a ~30% GAP between the performance of gold and bonds, one of the 5-month divergences largest on record.

Gold is completely ignoring the fact that higher interest rates are here to stay while bonds are getting crushed." - TKL

Central banks /countries are selling their debt portfolios and buying gold. That would be my take. The financialization of everything era is over.

On the 15th of April:

👉🏽'The US credit card delinquency rates are now at their highest on record, according to the Philadelphia Fed.

In Q4 2023, more credit card balances were 30+ and 60+ days past due compared to any other period in history.

The percentage of credit card balances at least 30 days past due is now ~3.5%.

Meanwhile, total credit card debt has skyrocketed in recent months and is now at a record $1.3 trillion.

The average credit card interest rate is also at a record 28%, according to Forbes.' - TKL

🎁If you have made it this far I would like to give you a little gift:

Warmaking has become increasingly unlimited in the fiat age, as financing has moved away from war taxes and war bonds and towards quiet borrowing

This is a very well-documented essay and thread with data and statistic by nostr:npub1trr5r2nrpsk6xkjk5a7p6pfcryyt6yzsflwjmz6r7uj7lfkjxxtq78hdpu :

https://bitcoinmagazine.com/culture/how-the-fed-hides-costs-of-war

Book tip: Read The Creature from Jekyll Island.

Extra gift!🎁

Your wealth is melting—the first report by Joe Burnett is 37 pages exploring how humanity's relationship with wealth has changed after the discovery of Bitcoin.

https://8198895.fs1.hubspotusercontent-na1.net/hubfs/8198895/PDFs/Your%20wealth%20is%20melting-1.pdf

nostr:npub1z5ds93lv6uky7n4676txw7aqp9qdcyhs00qdsmy96s4k6qd8rvaqnzmqhw

Only invest in Bitcoin what you can’t afford to have gradually stolen from you by the government.

Credit: I have used multiple sources!

My savings account: Bitcoin

The tool I recommend for setting up a Bitcoin savings plan: @Relai 🇨🇭 especially suited for beginners or people who want to invest in Bitcoin with an automated investment plan once a week or monthly. Hence a DCA, Dollar cost Average Strategy. Check out my tutorial post (Instagram) & video (YouTube) for more info.⠀⠀⠀⠀

Get your Bitcoin out of exchanges. Save them on a hardware wallet, run your own node...be your own bank. Not your keys, not your coins. It's that simple.⠀⠀⠀⠀⠀⠀⠀⠀

Do you think this post is helpful to you? If so, please share it and support my work with sats.

#zap 🧡 #weeklyrecap #nostr

#plebchain

#BTC

#Bitcoin

#zap🧡

#plebchain

#grownostr

#stacksats

#bitcoineducation

#adoption

UFC lightweight Renato Moicano 🎤:

"If you care about your country, read Ludwig Von Mises' 6 lessons of the Austrian Economic School motherf*ckers"

MMA fighters shilling Austrian Econ, classic!👀🔥

Ludwig von Mises - 6 Lessons of Austrian Economics School 🧵

1. Subjective Value Theory: Economic value is subjective and varies from person to person. This theory underlines the idea that individuals assign value to goods and services based on their own preferences and needs.

2. Methodological Individualism: Methodological approach that focuses on individual human action as the fundamental unit of analysis in economics. This perspective highlights the importance of understanding the actions and decisions of individuals in shaping economic outcomes.

3. The Calculation Problem: In a centrally planned economy, without the use of market prices for the means of production, rational economic calculation becomes impossible, leading to inefficiency and resource misallocation.

4. Spontaneous Order: Suggests that complex social phenomena, including economic systems, emerge organically from the interactions of individuals pursuing their own interests. This idea contrasts with central planning and highlights the benefits of decentralized decision-making.

5. Time Preference Theory: It explains how individuals value present consumption over future consumption. This theory helps to understand saving, investment, and interest rates in the economy.

6. The Business Cycle Theory: Business cycles are primarily caused by fluctuations in the money supply, particularly through credit expansion by central banks. He emphasized the importance of maintaining a stable monetary system to avoid economic instability.

Read Mises, study Bitcoin!🧡

Study, learn, hodl, decouple.

#bitcoin 🧡

▃▃▃▃▃▃▃▃▃▃▃▃▃▃▃

My savings account: Bitcoin

The tool I recommend for setting up a Bitcoin savings plan: @Relai 🇨🇭 🇨🇭 especially suited for beginners or people who want to invest in Bitcoin with an automated investment plan once a week or monthly. Hence a DCA, Dollar cost Average Strategy. Check out my tutorial post (Instagram) & video (YouTube) for more info.

⠀⠀⠀⠀

Get your Bitcoin out of exchanges. Save them on a hardware wallet, run your own node...be your own bank. Not your keys, not your coins. It’s that simple.🎯

⠀⠀⠀⠀⠀⠀⠀⠀

Do you think this post is helpful to you? If so, please share it and support my work with sats. 🧡

Felipe - BitcoinFriday

#zap 🧡 #nostr #BTC #Bitcoin #plebchain #grownostr #stacksats #bitcoineducation #adoption

🧠Quote(s) of the week:

"FIAT = politics for growing your own currency and its dominance at the expense of others.

BITCOIN = a movement for growing a currency and its dominance at the expense of no one else, but through synergy and spontaneous emergence.

They are not the same.

They are the opposite."

― Arnold Hubach

🧡Bitcoin news🧡

➡️El Salvador offers 5,000 free passports to highly skilled scientists, engineers, doctors, artists, and philosophers from abroad.

This will grant them full citizen status, including voting rights.

Nayib Bukele, President of El Salvador:

'We're offering 5,000 free passports (equivalent to $5 billion in our passport program) to highly skilled scientists, engineers, doctors, artists, and philosophers from abroad.

This represents less than 0.1% of our population, so granting them full citizen status, including voting rights, poses no issue.

Despite the small number, their contributions will have a huge impact on our society and the future of our country.

Plus, we will facilitate their relocation by ensuring 0% taxes and tariffs on moving families and assets. This includes commercial value items like equipment, software, and intellectual property.'

➡️On-chain data from GlassNode reveals that approximately 1.876 million Bitcoin, or 9.5% of the total supply, have been acquired above $60,000.

➡️ 'The satoshi millionaires continue to gain ground, now holding over 17% of the total supply. Stay humble and stack sats.' - Wicked

➡️Bitcoin has been a profitable investment 99.92% of the days since its launch on January 3, 2009.

This means there have only been a tiny handful of days, just six to be exact, where investing in Bitcoin wouldn't have turned a profit.

➡️Bitcoin miner Bitfarms invests $240M to acquire 28,000 Bitmain T21 miners.

➡️Talking about mining.

'In the last four years, emission intensity has fallen by 348g/kWh.

That's 29x faster than the banking sector is greening its emission intensity.

No industry has ever dropped its emission intensity so fast. It happened primarily because Bitcoin sustainable energy mix rose 56%.' -Daniel Batten

➡️Kingdom of Bhutan to increase mining capacity 6x ahead of the Bitcoin halving to 600 megawatts.

➡️On the first of April:

'Exactly 11 years ago, Bitcoin broke a $1 billion market cap for the 1st time.

1000x later, economists are still "mystified".

Mainstream economists are mystified because they can’t deal with reality most of the time.

At $1.3+ Trillion, Bitcoin's market capitalization exceeds the top 4 largest banks in the world, COMBINED. No wonder banksters are afraid.

➡️"Financial planning firm Burkett Financial Services, reported owning 602 shares of BlackRock's Bitcoin ETF as of March 31. This kicks off what is expected to be a HUGE month of SEC filings by firms that own

Bitcoin ETFs."- Bitcoin Archive

➡️Coinbase integrating Lightning.

Bitcoin on lightning rails isn't just the future - it's here! Coinbase has over 100 million users. Better late than never Coinbase, it only took them like 7 years. Oh well, it's great news to see more adoption of the Lightning Network.

➡️"The State of Louisiana (with a unanimous 103-0 vote) Passes a Bill To Protect Your 'Fundamental Bitcoin Rights' out of the State House.

Louisiana is taking decisive steps to safeguard the freedom of Bitcoin-related activities within the state.

Upon enactment, this legislation will explicitly ensure protection for:

-The guaranteed right to purchase Bitcoin.

-Your freedom for Bitcoin mining.

-The right to self-custody of your digital assets.

-The freedom to operate a full node." - Dennis Porter

➡️$932 Billion asset manager DWS launches physical Bitcoin ETC in Germany.

DWS partners with Galaxy Digital to offer the "Xtrackers Galaxy Physical Bitcoin ETC" in Germany.

The product is 1:1 "physically backed" utilizing two cryptocurrency custodians, Zodia Custody and Coinbase

Source: https://bitcoinmagazine.com/markets/900-billion-dws-launches-physical-bitcoin-etc-in-germany

Not sure about the 'physically backed' part, but still kinda bullish.

Bitcoin ETF news:

➡️Eric Balchunas reports that BlackRock has updated its Bitcoin ETF prospectus, adding Citadel, Goldman Sachs, UBS, and Citigroup. This marks a major shift: big firms are now eager and comfortable with public association with Bitcoin.

➡️Australia's first Bitcoin ETF to go live this year, says asset manager Monochrome

➡️Morgan Stanley and UBS Reportedly Competing to Launch First Bitcoin ETF.

Reports suggest that Morgan Stanley appears poised to edge out UBS in this race, with insider sources indicating that an announcement could be imminent.

➡️Korea to approve Bitcoin ETFs if pro-Bitcoin opposition wins election in 4 days – Bloomberg

"We're going to allow the ETFs, domestic or overseas."

More than 6 million South Koreans — over 10% of the population own Bitcoin or crypto.

➡️ Bitcoin spot ETFs have siphoned over 4% of the total supply of Bitcoin since January 11, according to analysis from IntoTheBlock.

💸Traditional Finance / Macro:

What can you expect this week in the traditional financial market?

Main highlight ahead:

In the US, we have CPI, the FOMC minutes, and PPI. In Europe, it’s the euro area Sentix, ECB policy meeting, and UK GDP. And in Asia, we have the China and India CPI and RBNZ meeting.

👉🏽 'The US stock market now accounts for a massive ~45% of total global market cap.

Since 2008, the US share has risen by ~15% to its largest since 2004.

The US equity market size is now larger than India, China, Australia, Switzerland, Germany, Canada, UK, France, and Japan COMBINED.

US stocks also account for almost 65% and more than 70% of the MSCI ACWI and the MSCI World indexes, respectively.

To put this in perspective, Nvidia, alone exceeds the GDP of all but 11 countries in the world. The top 10% of S&P 500 stocks now account for 75% of the index's market cap.

This is an even higher percentage than the peak of the Dot-com bubble.' - TKL

👉🏽Gold price surged over $2300 an ounce, a new record high.

Since February 14th, gold is up an incredible $300/oz or 15% in less than 2 months.

Even as 3 interest rate cuts have been removed from market forecasts, gold is pushing higher.

Geopolitical tensions and renewed inflation worries have been the primary drivers.

🏦Banks:

👉🏽no news

🌎Macro/Geopolitics:

👉🏽"This week, France reported a 5.5% budget deficit for 2023 and that it won't be able to push the deficit to below 3% of GDP until at least 2027. Italy will post a 7% deficit for 2023, not declining to less than 3% until at least 2026. In the US, the budget deficit for 2023 will be over 6% and remain above 5% until 2027, after which it will start to increase again.

Meanwhile, there is no recession, economic momentum (using the Citi global economic surprise index as a proxy) is improving, and global #nflation remains nearly two percentage points above the pre-COVID average.

And yet, central banks around the globe are ready to cut rates. Imagine what will happen when we do get a recession, inflation drops and governments accumulate even more debt. Or will this time be different?"

As Lyn Alden would say: Fiscal dominance.

Fiscal dominance at the end of a long-term debt cycle. We are accelerating debasement to offset the deflationary effects of technology on debt markets.

And will it be different this time? No, I don't think so. Do you really think they can bring down deficits? Why will they be able to do so in 2026 or 2027? As always they will kick the can down the road.

Explanation of Fiscal Dominance:

The Fed has no choice. If rates (more on that below) are not cut we get a financial crisis. There is too much government debt!

We now live in an era of Fiscal Dominance.

The term "fiscal dominance" refers to a situation in which the government's fiscal policy (Deficits of 6% and Debt to GDP at WWII levels) significantly influences or dominates the monetary policy set by the central bank.

This occurs when a government's debt level is so high that it restricts the central bank's ability to control inflation through monetary policy tools, such as setting interest rates.

If rates don’t come down, and the value of the USD does not come down then there is a very high probability that the US will experience a failed bond auction.

Or....they can cut government spending but we all know that's not going to happen, innit?

Now scroll back up and read that part again on France & Italy's deficit.

Remember what I shared last week?

The last time France didn't have a budget deficit: 1974

👉🏽Last week I already mentioned that the US debt outlook isn't looking good and rather unsustainable.

(please read that part again in last week's Weekly Recap)

On the 1st of April after finishing that Weekly Recap Bloomberg released an article with the title:

A Million Simulations, One Verdict for US Economy: Debt Danger Ahead"

Bloomberg Economics ran a million forecast simulations on the US debt outlook. 88% of them show borrowing on an unsustainable path.

''In the end, it may take a crisis — perhaps a disorderly rout in the Treasuries market triggered by sovereign US credit-rating downgrades, or a panic over the depletion of the Medicare or Social Security trust funds — to force action.''

Remember the Treasury chief (Janet Yellen) herself acknowledged in a Feb. 8 hearing that “in an extreme case” there could be a possibility of borrowing reaching levels that buyers wouldn’t be willing to purchase everything the government sought to sell.

Even with a miracle, they get it done in the treasury market, but they still won't fix the deficit. (again read last week's Weekly Recap - segment Macro/Geopolitics)

'Medicare is $79 trillion underfunded & Social Security $15 trillion underfunded. With another $29 trillion in various other underfunded liabilities, for a total of $123 trillion. Plus $34 trillion of debt.

That's not enough to cause a panic & force action?'

These are just the facts.

Please read the full article here: https://archive.ph/lOvx6

👉🏽Talking about the treasury market:

Federal Reserve's Jerome Powell says no interest rate cuts until inflation improves.

The 10-year note yield is now trading at its highest level since November 2023, at 4.39%

Stronger-than-expected inflation data and rising oil prices have added to inflation worries over the last month.

The 10-year note yield is now just 11 basis points away from crossing 4.50%.

Meanwhile, less than 3 interest rate cuts are now expected in 2024.

Higher for longer has quickly returned.'- TKL

In plain English: It is forecasting extended inflation and possibly stagflation.

The Fed knows that lowering interest rates leads to the re-steepening of yield curves, which leads to recession and stock price drawdowns.

So they wind down QT (and possibly restart QE) to kick the can until after the election. (I have discussed this scenario now for a year, and it looks like this will be the playbook.)

Higher for longer, until something breaks. In the meantime, stocks, assets, and Bitcoin will rise.

👉🏽Now that we know that the rates will remain higher what could go wrong?

'Currently, there is roughly $6 TRILLION of Commercial Real Estate (CRE) debt in the US.

Banks hold a whopping $3 trillion, or 50%, of this outstanding debt.

This year, ~$929 billion, or one-sixth of this debt is set to be refinanced, according to Goldman Sachs.

Rates on these loans are set to double or even triple since they were taken.

All while many of these CRE projects are bankrupt or cash flow negative.' (Picture 2)

Ergo: There's simply too much debt all around, and all of it arising from too many years of easy monetary policy. Let's see which regional bank or market player will bite the dust next.

What do I mean by there is simply too much debt all around?

'U.S. debt always goes up. The only time it decreased in the post-war era was for an 18-month stretch around 2009. That's when private debt growth slowed down and public debt growth took over.

It's almost at $100 trillion.' - Lyn Alden

(Picture 3)

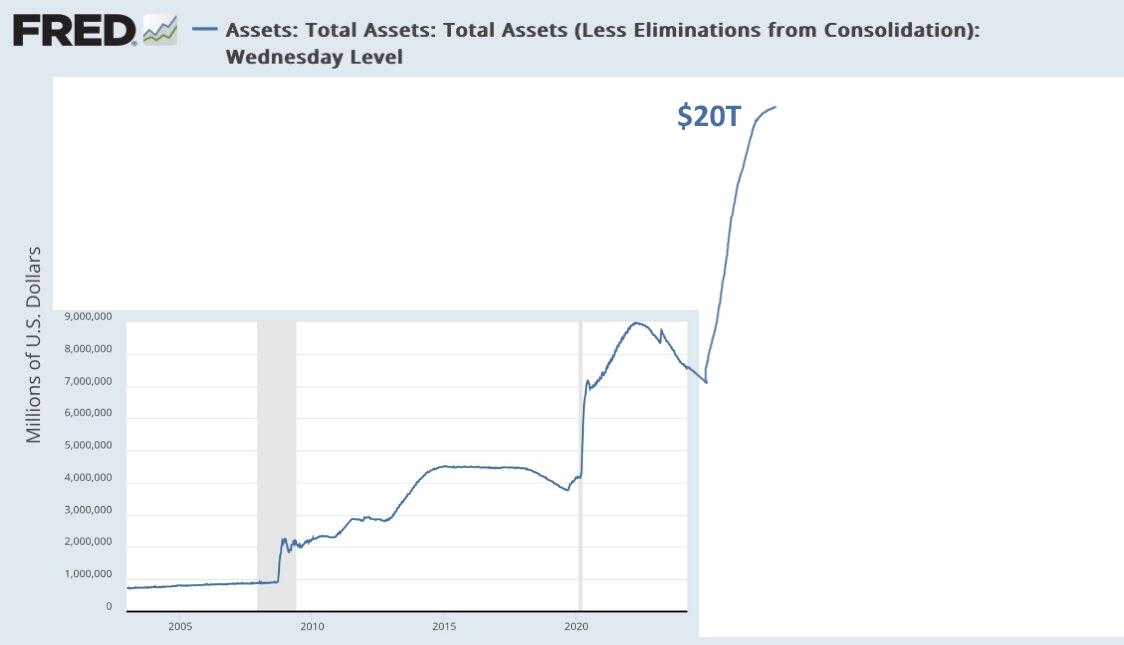

👉🏽"Total wealth held by the top 1% of Americans is now at a record $44.6 trillion.

This means that the top 1% of Americans now control 30% of all wealth in the US.

In Q4 2023 alone, the top 1% saw their net worth increase by $2 trillion as the stock market soared.

Since 2020, the wealth of the top 1% has risen by almost $15 trillion.

That's a ~50% increase in just three years all as affordability has hit record lows.

The wealth gap is widening."- TKL (picture 4)

To the extent the stock market and other assets rising in price creates this wealth gap (since a small percentage of Americans, but also here in Europe, own stocks and other assets), Fed intervention meant to support the price of these assets is a large part of that wealth gap. Sound money is essential to defending freedom. If you look at the chart...please compare that with the chart of the US debt chart. I will give you a hint, it is almost as vertical.

Our world is quickly being divided into those who own assets, and those who pay asset owners. In general (our history) that's not a good thing, as inequality continues to rise.

👉🏽Eurozone inflation cools, setting the stage for June rate cut: Headline CPI slowed to 2.4% YoY in March from 2.6% in Feb below the consensus forecast of 2.5%. Core CPI slowed to 2.9% from 3.1%, again below economists' expectations to reach the lowest level in >2yrs. But there were signs that inflationary pressures have yet to ease in labor-intensive parts: Service Price inflation +4.0% YoY, same as the 4 preceding months. (via DJ)

👉🏽The US Dollar is down 11% against gold and down 40% against bitcoin in 2024.

👉🏽All of the headlines focused on how the "US added 303,000 jobs in March."

However, if you dig further into the data, ALL of the job gains came from part-time jobs, according to ZeroHedge.

Last month, the US added a whopping 691,000 part-time jobs while LOSING 6,000 full-time jobs.

The worst part?

Over the last year, the number of full-time jobs is DOWN 1.347 million.

Meanwhile, the number of part-time jobs is up by 1.888 million, according to ZeroHedge.

To make it even worse: 71,000 govt jobs were added. 0 manufacturing jobs added.

Now ask yourself in a well-functioning economy do people hold one or more than one job?

What we see overall is a massive disconnect between data and reality.

🎁If you have made it this far I would like to give you a little gift:

"We constantly hear from politicians and pundits that Bitcoin has no use case. In the next video, Peter McCormack & Alex Gladstein cover *dozens of specific, critical Bitcoin use cases* across global commerce, human rights, and energy.

They discuss:

- Bitcoin for commerce, freedom, & power

- Broken money for billions

- Why Bitcoin is bad for dictators

- How Bitcoin fixes wasted power

https://www.youtube.com/watch?v=TI3Xcei8d_I

“If you take savings, commerce, freedom, and power, that’s the bedrock of civilization; so if you don’t have these things…you’re living in a very poor country.” - Alex Gladstein

Only invest in Bitcoin what you can’t afford to have gradually stolen from you by the government.

Credit: I have used multiple sources!

My savings account: Bitcoin

The tool I recommend for setting up a Bitcoin savings plan: @Relai 🇨🇭 especially suited for beginners or people who want to invest in Bitcoin with an automated investment plan once a week or monthly. Hence a DCA, Dollar cost Average Strategy. Check out my tutorial post (Instagram) & video (YouTube) for more info.⠀⠀⠀⠀

Get your Bitcoin out of exchanges. Save them on a hardware wallet, run your own node...be your own bank. Not your keys, not your coins. It's that simple.⠀⠀⠀⠀⠀⠀⠀⠀

Do you think this post is helpful to you? If so, please share it and support my work with sats.

#zap 🧡 #weeklyrecap #nostr #plebchain #BTC #Bitcoin #grownostr #stacksats #bitcoineducation #adoption

🧠Quote(s) of the week:

Bitcoin is the:

Math class you never had.

History class you never had.

Finance class you never had.

Physics class you never had.

Economics class you never had.

Philosophy class you never had.

― The Bitcoin Therapist

🧡Bitcoin news🧡

➡️Last week I showed you guys with data and charts how the US, the world reserve currency, our current system, is leading our society to 'death'.

This is not something new. The Dutch eventually lost their reserve currency status and after that the British (Empire). Why? Too much debt.

Our current system needs to consume to pay off our debt. It's that simple...

If you look at last week's Government Debt chart you will notice that this doesn't include the debt of households & businesses, the nature of the money multiplier & fractional reserve banking means the total outstanding debt in the world is much higher.

Again, high-time preference culture and borrowing from our future will lead to the death of society. As we have seen in the past...

Unless we have something that will rise out of the ashes...

Bitcoin.

➡️Tether has added another 8,888.88888888 Bitcoin to their reserves, bringing their total treasury to 75,354 BTC. This is consistent with Tether's Treasury Reserve Strategy of saving 15% of profits in Bitcoin.

➡️Bitmain has unveiled the Antminer S21 Pro, the newest iteration of its flagship Bitcoin mining ASIC.

Boasting a hash rate of 234 TH/s and an energy efficiency ratio of 15.0 J/TH, the Antminer S21 Pro “has the ability to deal with more challenging environments.”

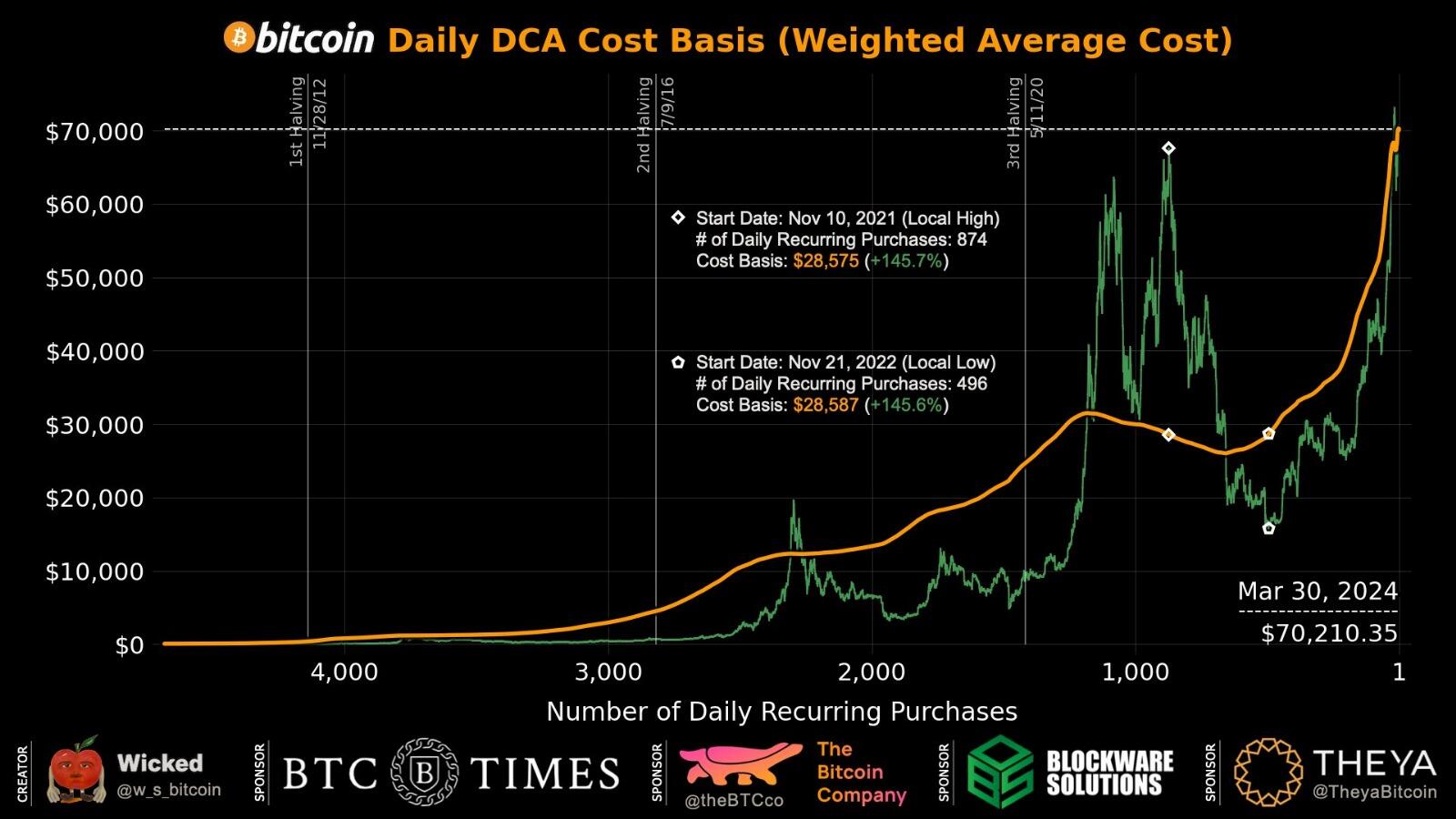

➡️"The daily DCAers who started stacking Bitcoin at the all-time high in late 2021 now have a lower cost basis than the daily DCAers who started stacking at the bear market low in late 2022.

Proving once again that with Bitcoin, time in the market beats timing the market." - Wicked (picture 2)

Ergo: get off zero. The biggest mistake you can make is being on the sidelines as Bitcoin is the greatest savings technology ever devised.

➡️On the 30th of March someone bought or transferred $1.1 Billion worth of Bitcoin at $70K.

1.1 Billion...I wish I had cash like that available. Oh by the way the fee was only 17 dollars. Classic!

➡️Bitcoin closed its 7th straight green month for the first time in history.

➡️Coinbase Bitcoin reserves hit a 9-year low on the 26th of March.

➡️Cryptocurrency exchange Kucoin and two of its founders criminally charged with bank secrecy act violations and unlicensed money transmission offenses.

➡️On the 28th of March it was exactly 27 years ago, Adam Back invented Proof-of-Work, the bedrock of Bitcoin. It's how Satoshi harnessed time and energy to create the best money in human history.

Bitcoin ETF news:

➡️Two months in, Bitcoin ETFs have ~$60B AUM

Gold ETFs had $60B AUM after 15 years.

However, you can't really compare both assets with each other as the USD had a completely different value back then. Still an impressive growth for the Bitcoin ETFs. The move from analog to digital is always exponential.

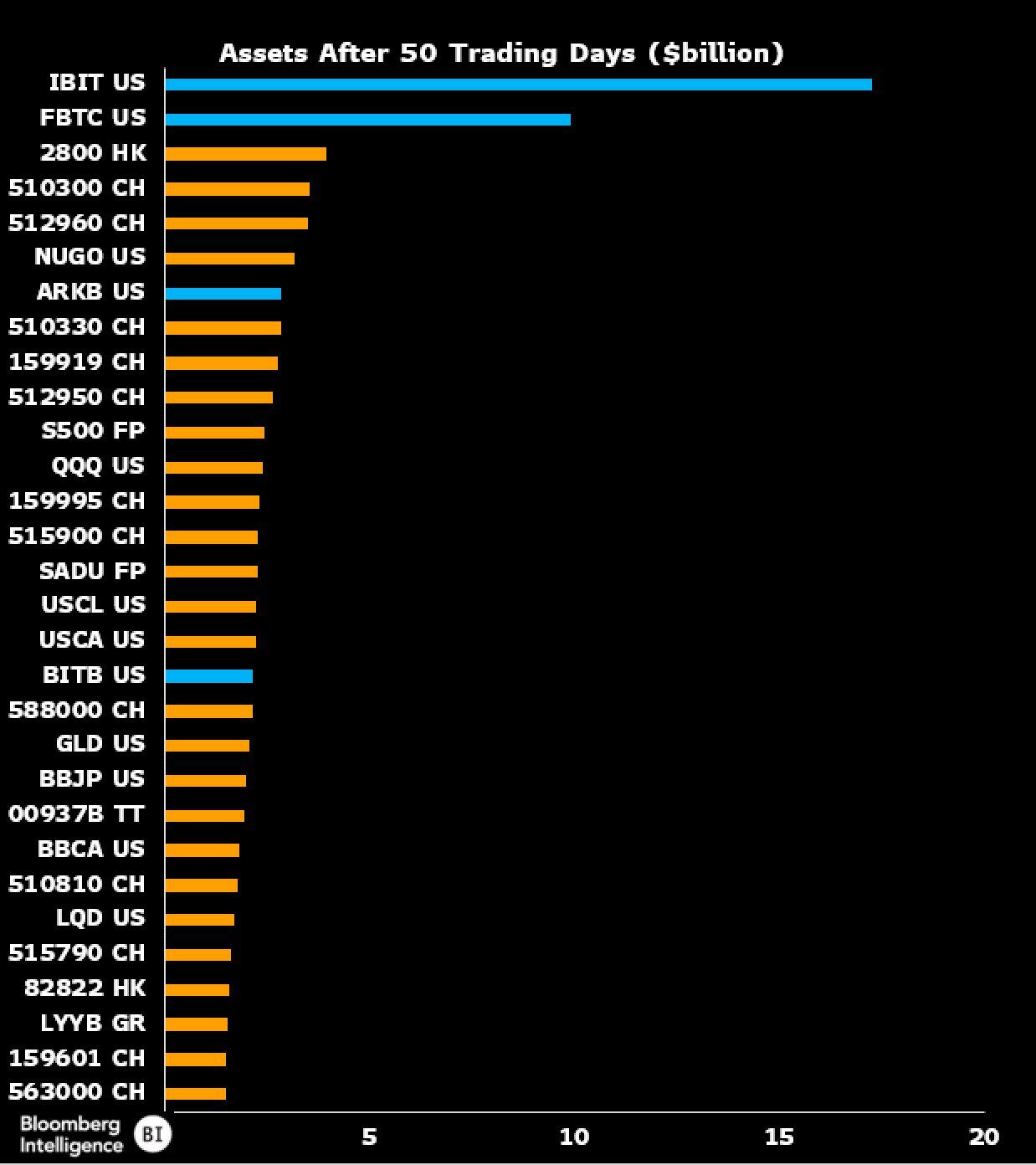

➡️Here's a look at the Top 30 ranked by assets in the first 50 days on the market. Went global for this so this is out of 11,338 funds. Four BTC ETFs made the list.

Out of 11,338 global funds, the two with the largest AUM in history after 50 trading days are both Bitcoin ETFs, and it isn’t particularly close. (Picture 3)

One thing to consider this is not adjusted for inflation.

At this rate, BlackRock could overtake Grayscale's Bitcoin stack by this month's halving.

Blackrock's spot Bitcoin ETF IBIT holdings have now surpassed 252,011 BTC ($18B)

"I’m pleasantly surprised and I’d never have predicted it before we filed it that we were going to see this type of retail demand," says Blackrock CEO Larry Fink.

➡️WisdomTree gained approval to purchase spot Bitcoin ETFs for its $206 million and $117 million funds.

➡️Bitwise CIO Matt Hougan: 3% is the new 1%

He reports professional investors' potential Bitcoin allocation has shifted from 1% to 3%+ since 2018, primarily due to ETFs mitigating "going to zero" risk.

For wealth investors, 3%+ is the new norm.

➡️ Rumours that Morgan Stanley will approve Bitcoin ETFs on their platform in the next 2 weeks are getting stronger.

Early this month Morgan Stanley filed with the SEC that 12 of their funds may buy Bitcoin ETFs, and last week they sent Bitcoin compliance & education materials out to all advisors.

Morgan Stanley has $1.5 Trillion in assets under management.

➡️Hong Kong Bitcoin ETFs are expected to be approved in Q2

Including the ability to withdraw Bitcoin (No paper bitcoins!). (source: https://finance.yahoo.com/news/hong-kong-likely-allow-kind-162521543.html?soc_src=social-sh&soc_trk=tw&tsrc=twtr&guccounter=1&guce_referrer=aHR0cHM6Ly90LmNvLw&guce_referrer_sig=AQAAADQ9lwMOgCrUeYU0wXFR-I3VLIKK-KPVw7jOrmT28h7AkgQov2AuXnkaTT2jaFgNCEnYB4HKsdsctI_6_qKwmpCImH9bSY7Urg2Jc31A2ESgCz8C3zt7ijbuasbFwUFkEscFEHe_VrX4FeEzOtzzvr61eM2d_A9C4_TQql_qEu0l)

➡️SBF sentenced to 25 years in jail.

Judge Kaplan: you are sentenced… for a total of 300 months [25 years]."

This is blasphemy as SBF stole billions of customers' money, and lied in court.

Ross Ulbricht created a website and is still serving 2 life sentences in prison.

Injustice at its finest.

A double life sentence + 40 years with no chance of parole.

Ross was sentenced at the age of 29.

On the 28th of March, he turned 40.

His “crime” was building a website where people could trade freely without government permission.

In the process, he introduced the world to Bitcoin.

If you want to know more about Ross read this excellent thread by Pete Rizzo:

https://threadreaderapp.com/thread/1774052843562889450.html?utm_campaign=topunroll

Just to make one thing clear. He's definitely a legend. Ross Ulbricht's story is remarkable and complex, highlighting the early days of Bitcoin and the challenges faced by its pioneers. But making a black market is not something good, he got what he deserved. But the sentence is way too harsh.

➡️Since 2022, someone has consistently bought 100 Bitcoin at any price.

They now hold 53,733 Bitcoin worth $4 billion, making them the 13th largest Bitcoin holder.

➡️The latest Bitcoin difficulty adjustment came in on the morning of the 28th of March at -0.98%

There is only one more difficulty adjustment before the halving.

Everything is lining up perfectly for the halving to occur on 4/20.

💸Traditional Finance / Macro:

What can you expect this week in the traditional financial market?

Main highlight ahead:

In the US, we have ISM, payroll reports, and communication from key Fed officials. In Europe, we have PMI, inflation, and unemployment data. In Asia we start the week with a central bank meeting in India, the Bank of Japan Tankan survey, and PMI and inflation releases across the region.

🏦Banks:

👉🏽no news

🌎Macro/Geopolitics:

👉🏽"If US government debt averages 4% across the weighted duration spectrum, that would be about $1.4 trillion in annual interest expense.

At $50 trillion in debt (which will get us there quickly), it’ll be $2 trillion in annual interest expense." -Lyn Alden

The US Government currently makes about $12.2B while spending $17.7B per day. That's overspending by $5.5B per day, which will add up to a total of $2T of overspending for the year.

Drowning in debt. Totally normal phenomenon and sound finance, right? This is why US interest rates can't rise much more and also why they should. More on this topic the great thread by Bob Elliott

https://twitter.com/BobEUnlimited/status/1772229788737913036

Remember we are not in a pandemic, we’re not in a World War, and the US is in an allegedly healthy economy. When any of those changes, debt will skyrocket.

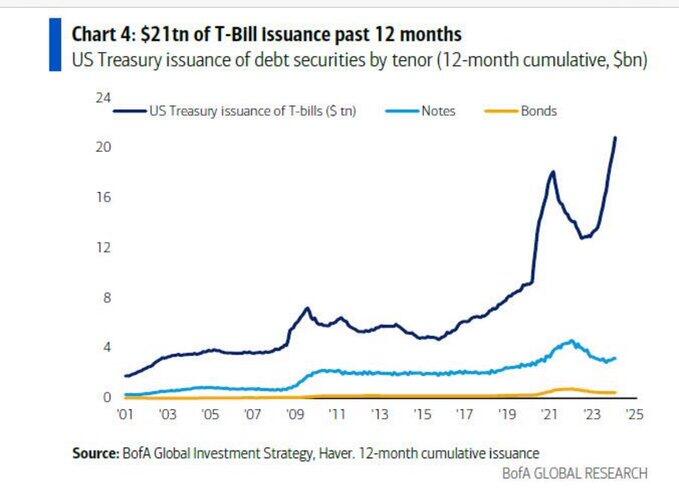

With US national debt up $10 trillion since the pandemic, and roughly sixfold the 2008 crisis. The Treasury issued $7 trillion of debt in just 3 months. (Picture 4)

That matches the worst of Covid -- no pandemic needed. And it's double the previous record that had stood for 231 years.

Again I don't want to be doom and gloom, but these are just the facts. Issuing more t-bills at an accelerating pace is a precondition to becoming a banana republic. This is the type of thing you see emerging markets do, not the issuer of the world's reserve currency and neutral reserve asset.

Just to make it even worse, the US Bond Market has now been in a drawdown for 44 months, by far the longest bond bear market in history.

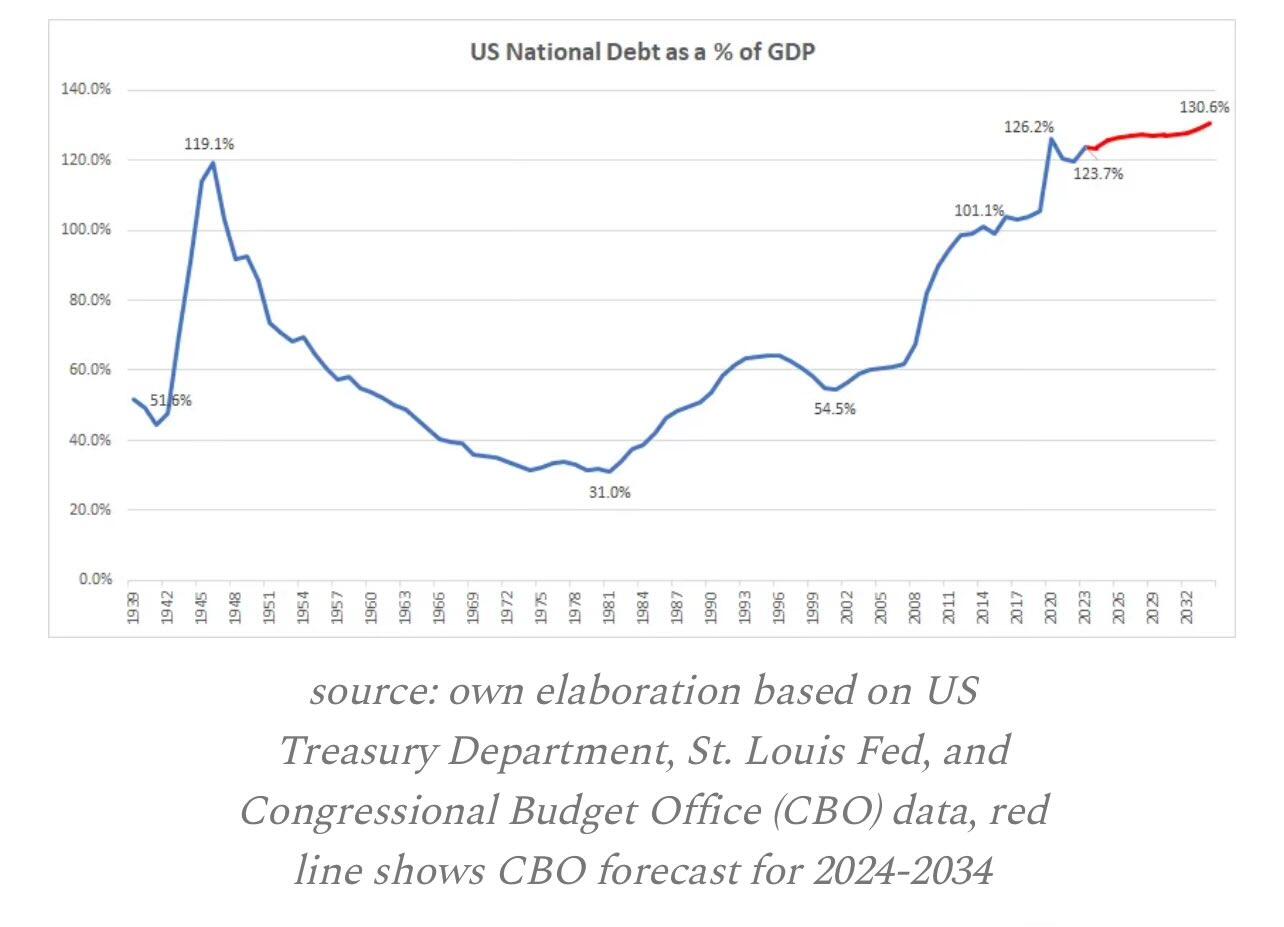

👉🏽"Since 1800, 51 out of 52 countries who have reached a 130% Debt-to-GDP ratio have defaulted.

According to the US CBO itself, debt-to-GDP in the US is on track to hit 130% for the first time by 2033.

In 2007, debt-to-GDP in the US was just 60% and it has quickly doubled since then.

Currently, debt-to-GDP is at ~124% which is HIGHER than the peak of World War 2, at 119%.

Since 2020, debt-to-GDP is up a whopping 20% after the government's massive borrowing spree.

Simply put, this is unsustainable." -TKL (picture 5)

As you can see in the picture the red line is based on the 'optimist' forecast by the CBO.

As mentioned at the start of this week's 'Weekly Recap' the world is changing that hasn't happened before in our lifetimes but has many times in history.

Please watch the following video by Ray Dalio in which he explains the 500 years of economic rise and downturns of nations brilliantly.

https://www.youtube.com/watch?si=de7o5anFfpSmqVno&v=xguam0TKMw8&feature=youtu.be👉🏽The Federal Reserve’s expenses exceeded its earnings in 2023 by $114.3 billion — its largest operating loss ever. Source: https://archive.ph/7rcCv

"In plain English: The Fed printed $114B (net) out of thin air & handed it to banks, essentially to bribe them not to lend excess reserves into the economy."- Luke Gromen

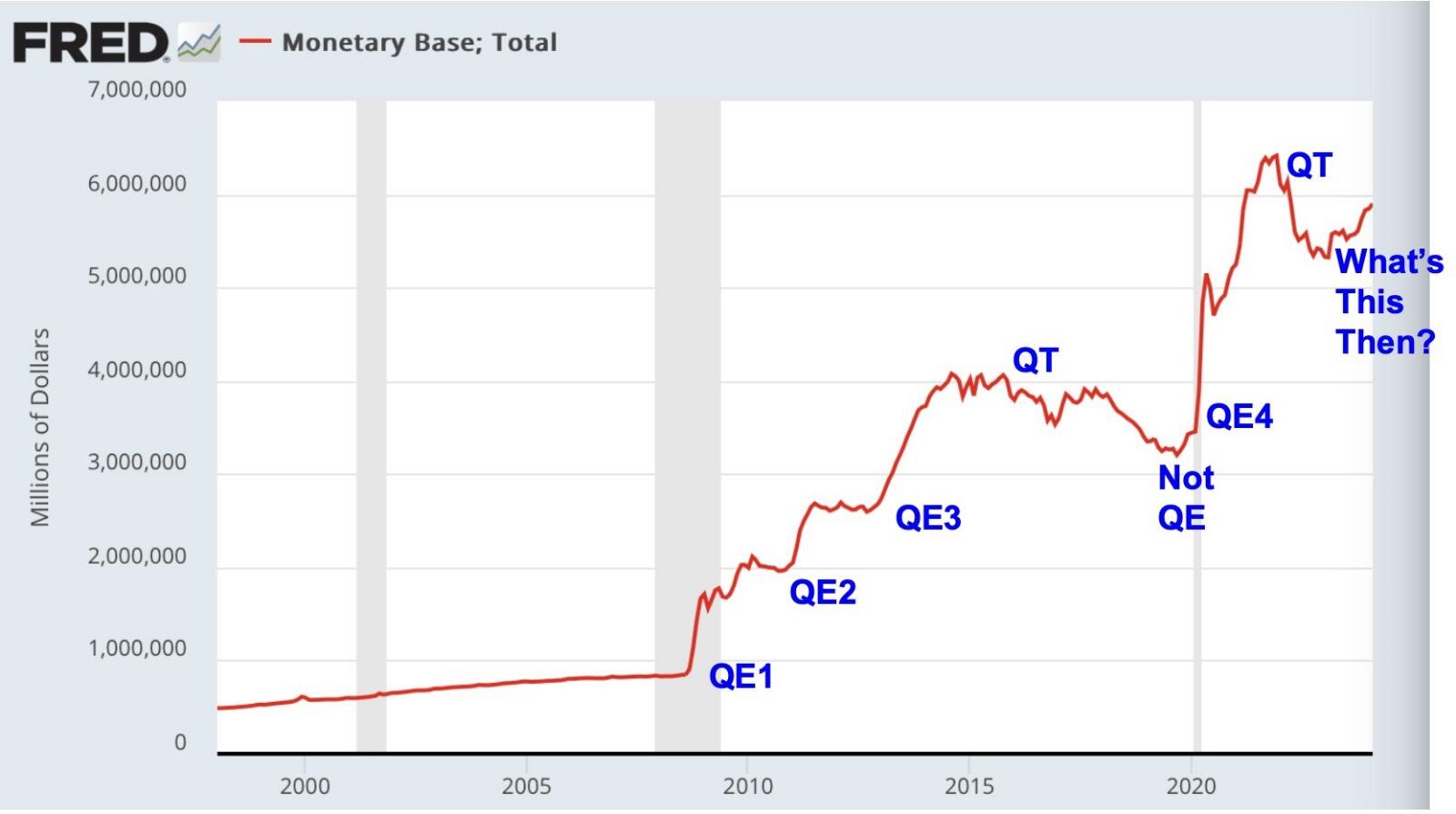

👉🏽"Since 2008 the monetary base expanded during times of Fed intervention and shrunk during times of QT.

Markets bottomed in October 2022 as the shrinking of the monetary base ended.

It has expanded since then. Hence the question:

What's this then?" - Sven Henrich (picture 6)

Answer: Fiscal dominance.

👉🏽 SWIFT is planning the launch of a new central bank digital currency platform in 12-24 months. (source: Reuters)

Kinda funny innit? The world banks are on the brink of collapse (DEBT) and switch everyone over to their new CBDC in 2024-2025 and stop printing physical cash. According to the central bank's white papers (BoE, ECB), they are planning to release CBDCs in 2025. It's not like they are hiding it. It's just that nobody is bothering at the moment.

I don't know about you but I stick with my 12-24 words!

CBDC is financial slavery.

👉🏽Now let's put another phrase in the mix. Financial Colonialism...

"Over the next two years, low-income countries need to refinance about $60 billion of external debt each year, about three times the average in the decade through 2020. More in this blog:"

Low-income countries never seem to be able to pay back their debts. This might be the reason why they got to be low-income in the first place, innit?

Anyway, low-income countries need to mine Bitcoin (Africa, South America, etc) and escape the debt slavery by the central bankers / IMF / World Bank.

👉🏽"Core PCE inflation, the inflation measure the Federal Reserve looks at most, declined to 2.78% in February. This marks the slowest pace of core inflation in nearly two years. Given that the Fed needs little to start cutting rates from levels that should be highly restrictive, assuming a neutral rate of 2.50%, markets price a 70% chance of the first rate cut in June. Hence, equities up, gold up, yields down." - Jeroen Blokland

👉🏽Commodity prices across the board seem to be permanently elevated.

Cocoa prices have skyrocketed to nearly $10,000, a fresh all-time high.

In 2024 alone, Cocoa prices are up 130% and outperforming most assets.

To put this in perspective, Nvidia, one of the hottest stocks in the world, is up ~30% LESS than Cocoa in 2024.

Cocoa prices are at record highs due to the:

* Weather damage in West Africa

* Supply constraints

* Increased demand

* Poor farmer returns

* EU rules impacting supply

First, it was Orange Juice and Olive Oil, now it's Cocoa prices exploding.

Commodity prices are outperforming many hedge funds.

The days of low oil prices are gone and consumers are feeling the pain.

The purchasing power of the US Dollar is down over 20% in just 4 years.

👉🏽France's public sector deficit for 2023 climbed to 5.5% of GDP, or €154bn, statistics agency INSEE said, undermining President Macron’s credibility as an econ reformer capable of resolving the country’s fiscal challenges. The earlier official govt deficit est was 4.9% of GDP.

The last time France didn't have a budget deficit: 1974

👉🏽Palestinian banks could be cut off from the Israeli banking system starting next week following.

The decision made by Israel's finance minister to isolate Palestinian Authority banks would paralyze the Palestinian economy. Anyway, Bitcoin fixed this! (source: https://www.middleeasteye.net/news/israel-may-cut-off-palestinian-banks-global-banking-system-next-week?utm_source=twitter&utm_medium=social&utm_campaign=Social_Traffic&utm_content=ap_6ej2zdsxqj

👉🏽65 million AT&T customers have had their personal data leaked on the dark web. Yikes! That's a lot of social security numbers on the dark web.

👉🏽"Warren Buffett, the billionaire head of Berkshire Hathaway, will probably go down as the greatest investor in history... Berkshire shares have seen an average annual return of 20.0%..."

Meanwhile: https://twitter.com/Snowden/status/1774577333820629449

Just some members of Congress outperforming the greatest investor in history. we are surely fortunate to be represented by such extraordinary talents." - Edward Snowden (picture 7)

🎁If you have made it this far I would like to give you a little gift:

Lyn is one of my favorite macroeconomists. The interview below is her most recent interview about U.S. fiscal dominance, China, energy, tech, and Broken Money.

https://www.youtube.com/watch?v=jVFkv7fezxE

Anyway, that's it for today.

Only invest in Bitcoin what you can’t afford to have gradually stolen from you by the government.

Credit: I have used multiple sources!

My savings account: Bitcoin

The tool I recommend for setting up a Bitcoin savings plan: @Relai 🇨🇭 especially suited for beginners or people who want to invest in Bitcoin with an automated investment plan once a week or monthly. Hence a DCA, Dollar cost Average Strategy. Check out my tutorial post (Instagram) & video (YouTube) for more info.

⠀⠀⠀⠀

Get your Bitcoin out of exchanges. Save them on a hardware wallet, run your own node...be your own bank. Not your keys, not your coins. It's that simple.

⠀⠀⠀⠀⠀⠀⠀⠀