Supply shock

Supply shock

Supply shock

Supply shock

Study, learn, hodl, decouple.

#bitcoin 🧡

▃▃▃▃▃▃▃▃▃▃▃▃▃▃▃

My savings account: Bitcoin

The tool I recommend for setting up a Bitcoin savings plan: @Relai 🇨🇭 🇨🇭 especially suited for beginners or people who want to invest in Bitcoin with an automated investment plan once a week or monthly. Hence a DCA, Dollar cost Average Strategy. Check out my tutorial post (Instagram) & video (YouTube) for more info.

⠀⠀⠀⠀

Get your Bitcoin out of exchanges. Save them on a hardware wallet, run your own node...be your own bank. Not your keys, not your coins. It’s that simple.🎯

⠀⠀⠀⠀⠀⠀⠀⠀

Do you think this post is helpful to you? If so, please share it and support my work with sats. 🧡

Felipe - BitcoinFriday

#zap 🧡 #nostr #BTC #Bitcoin #plebchain #grownostr #stacksats #bitcoineducation #adoption #supplyanddemand

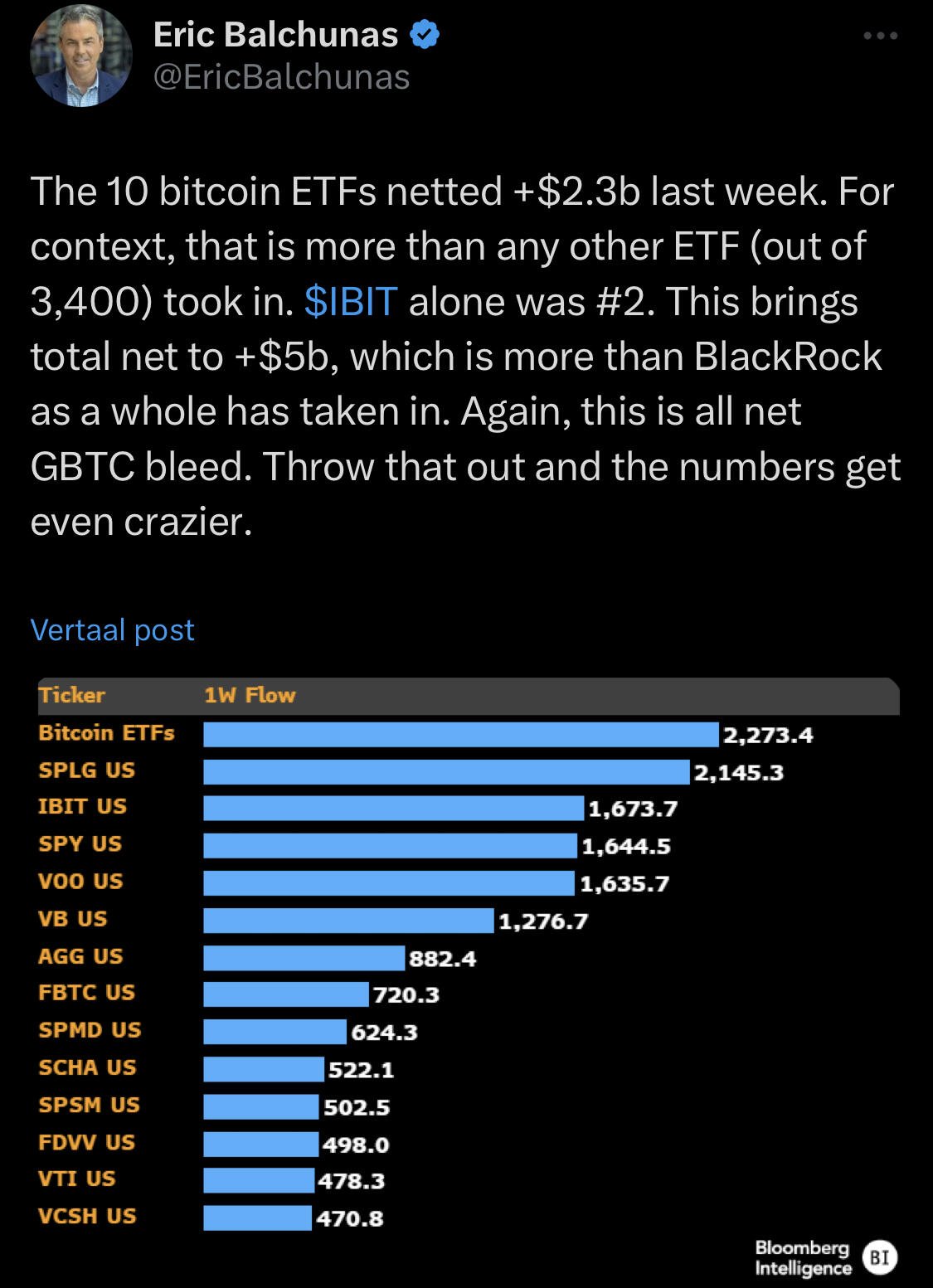

The demand for Bitcoin is outpacing every other ETF, and it’s the only one with a fixed supply. You do the math!

It is just freaking basic math anon!

Study, learn, hodl, decouple.

#bitcoin 🧡

▃▃▃▃▃▃▃▃▃▃▃▃▃▃▃

My savings account: Bitcoin

The tool I recommend for setting up a Bitcoin savings plan: @Relai 🇨🇭 🇨🇭 especially suited for beginners or people who want to invest in Bitcoin with an automated investment plan once a week or monthly. Hence a DCA, Dollar cost Average Strategy. Check out my tutorial post (Instagram) & video (YouTube) for more info.

⠀⠀⠀⠀

Get your Bitcoin out of exchanges. Save them on a hardware wallet, run your own node...be your own bank. Not your keys, not your coins. It’s that simple.🎯

⠀⠀⠀⠀⠀⠀⠀⠀

Do you think this post is helpful to you? If so, please share it and support my work with sats. 🧡

Felipe - BitcoinFriday

#zap 🧡 #nostr #BTC #Bitcoin #plebchain #grownostr #stacksats #bitcoineducation #adoption #supply&demand

🧠Quote(s) of the week:

"How it will play out:

1. Bitcoin Halving in 67 days; Bitcoin halving sparks anticipation and price speculation.

2. BTC surpasses the market cap of gold; Bitcoin's market cap surpasses gold, signaling a significant milestone.

3. Game theory between countries starts; Strategic game theory dynamics emerge among nations regarding Bitcoin.

4. Every Central Bank starts to print; Central banks resort to increased money printing, potentially fueling inflation fears.

5. BTC gets seized on exchanges and ETFs; Regulatory scrutiny intensifies, leading to the seizure of Bitcoin on exchanges and ETFs.

6. Self-custody becomes illegal; Authorities impose restrictions on the self-custody of cryptocurrencies.

7. CBDC gets introduced; Central Bank Digital Currencies (CBDCs) are introduced, challenging Bitcoin's decentralized nature.

8. Plebs move to countries that allow BTC; Individuals seek residency in countries with favorable Bitcoin regulations.

9. Woke people lose trust in the CBDCs; Growing disillusionment with CBDCs among informed individuals.

10. BTC becomes global money; Bitcoin gains broader acceptance as a global medium of exchange and store of value."

🧡Bitcoin news🧡

Before I kick off with today's Weekly Recap I start with a great quote by Dr. Jeff Ross:

"I’m not sure who needs to hear this today, but the Bitcoin bull market hasn’t even started yet.

Instead of fixating on price, I suggest the following:

- Head down

- Work hard

- Stack sats (while they’re still super cheap)"

➡️Bitcoin Market Cap is now the 10th largest asset in the world by market capitalization, surpassing giants such as JPMorgan, Berkshire Hathaway, Tesla, and Visa.

➡️Wall Street ETFs are buying 12.5x more Bitcoin per day than the network can produce, increasing the demand and price. Hello, supply shock!

➡️Bitcoin ETF inflows are accelerating and so is the price of Bitcoin. Today ETF inflows broke $500m in one day. Meanwhile, retail is completely sidelined. Wait before the FOMO really kicks in. (picture 4)

➡️BlackRock now holds $4.1 billion worth of Bitcoin.

The 9 new Bitcoin ETFs now hold more than $10 BILLION in assets.

Ergo: Wall Street loves Bitcoin.

"Proof: There’s been over 5500 ETF launches in history.

NEVER before has an ETF reached $3 Billion AUM in less than 30 days… until now.

Both Blackrock and Fidelity’s Bitcoin spot ETFs have just done it."

➡️"Bitcoin has had a great run of +20% in 18 days. What happens next? This type of rally has happened 440+ times in the past 9 years.

-> continued up 88% of the time

-> typical gain +20% => $60k

-> only 6-12% downside historically.

So a non-trivial possibility of a new ATH in perhaps 30 days?" -Timothy Peterson

➡️92.75% of the Bitcoin circulating supply is now in profit.

Values above 95% have historically indicated local tops, and the last time this threshold was reached was during November 2021's all-time high of $69K.

➡️"This is what Bitcoin looks like for the citizens of Turkey, Egypt, Nigeria, Argentina, Lebanon, and Pakistan.

A combined population of 725 MILLION people.

Nigeria and Argentina prices more than doubled since I posted this 2 months ago."

https://twitter.com/TheRealTahinis/status/1756709193904439560

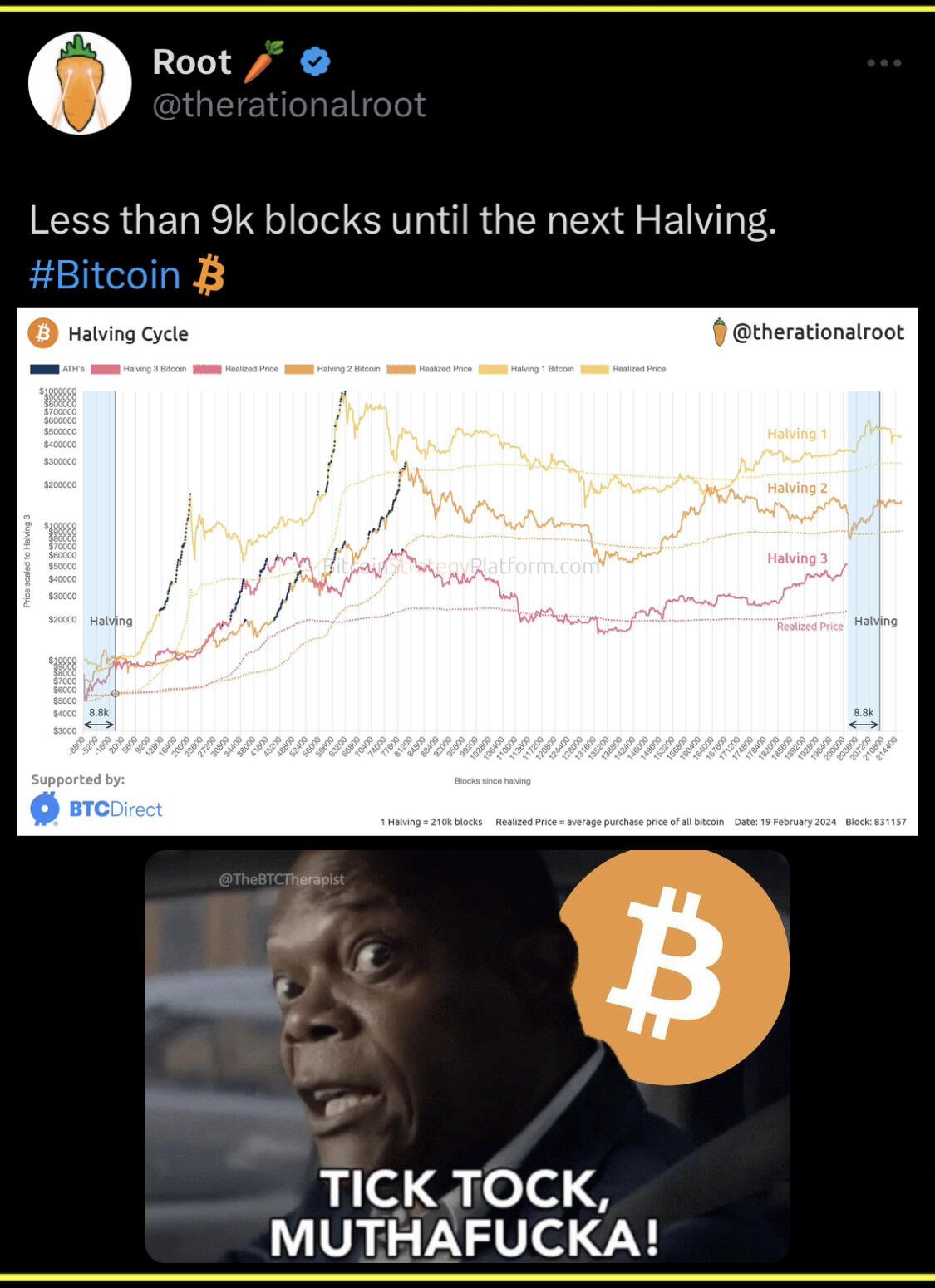

➡️Less than 10,000 blocks remain until the Bitcoin halving. The halving is scheduled for April 2023.

"There is an absolutely relentless pursuit for blocks with a block subsidy of 6.25 BTC.

In a couple of months, miners will be forced to only reward themselves with a subsidy of 3.125 BTC.

Bitcoin is in high demand, and it's about to get even more scarce." - Joe Burnett

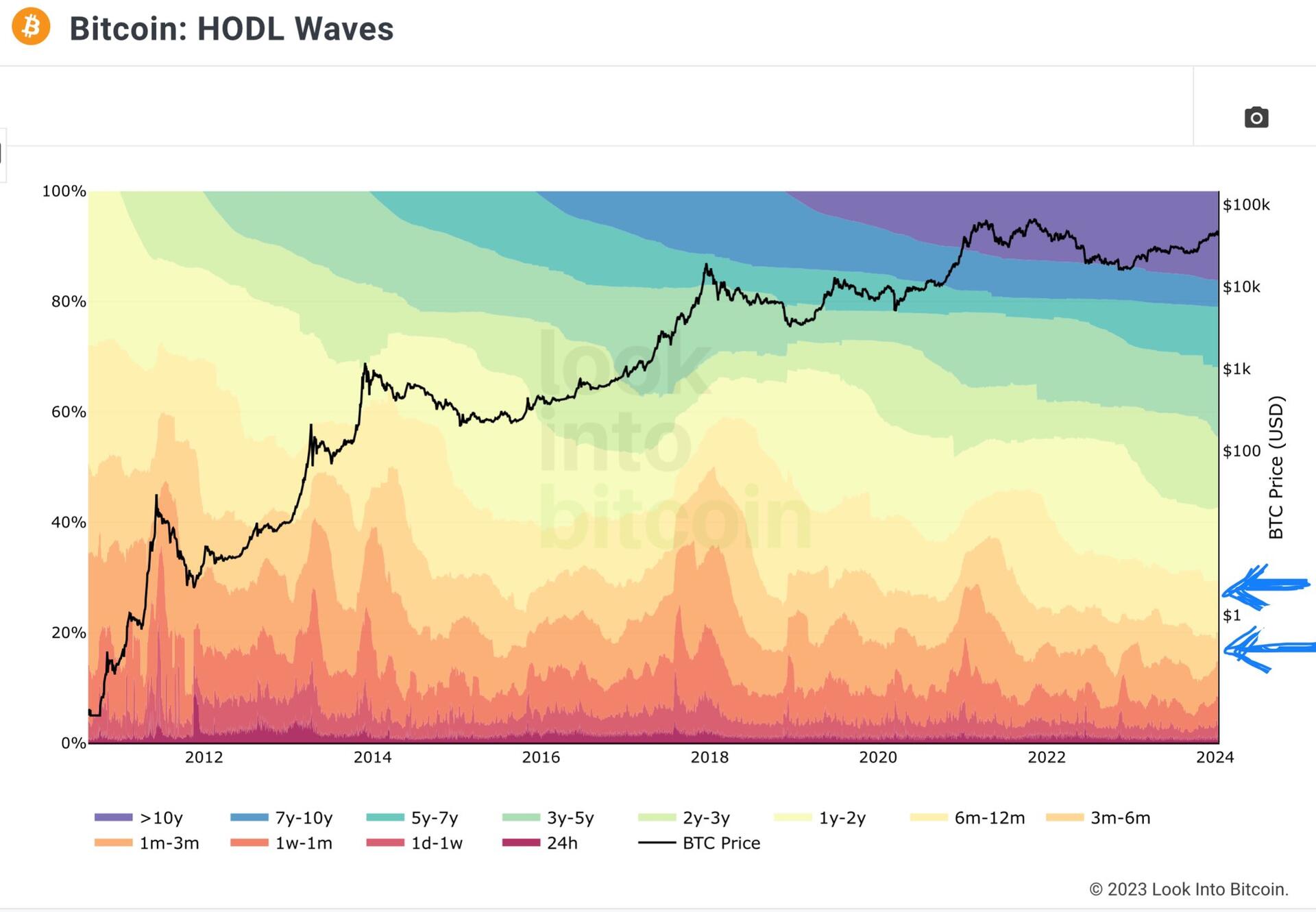

➡️79.26% of Bitcoin haven't changed hands in the last 6 months.

➡️Americans could have saved at least $74 billion in 2022 by using cryptocurrency payment systems instead of credit cards, according to Coinbase’s “State of Crypto” report.

➡️On the 10th of February, Ark became the third Bitcoin ETF to pass $1 billion in Bitcoin holdings.

➡️ World's largest asset manager BlackRock says Bitcoin is creating a "global internet of value."

➡️Bitcoin hashrate at a new all-time high! (picture 3

➡️The world’s largest Bitcoin mine begins construction in Texas.

Riot's Corsicana Facility will harness an impressive one gigawatt of electricity. The project will cost an estimated $333,000,000.

More miner news:

➡️America’s first nuclear-powered Bitcoin computer mine is online at the 2.5 gigawatt Susquehanna power plant in Pennsylvania.

Located at the 2.5 GW nuclear energy facility in the PJM interconnection is Nautilus Cryptomine, a Bitcoin mining facility jointly owned by

TeraWulf and Talen Energy.

- 16,000

Bitcoin machines

- 1,900,000,000,000,000,000x hashes per second at total capacity.

More miner news, now from Africa:

https://twitter.com/GridlessCompute/status/1756164755398578542

Nice drone shots of a hydropower station in Kenya by Gridless.

More miner news:

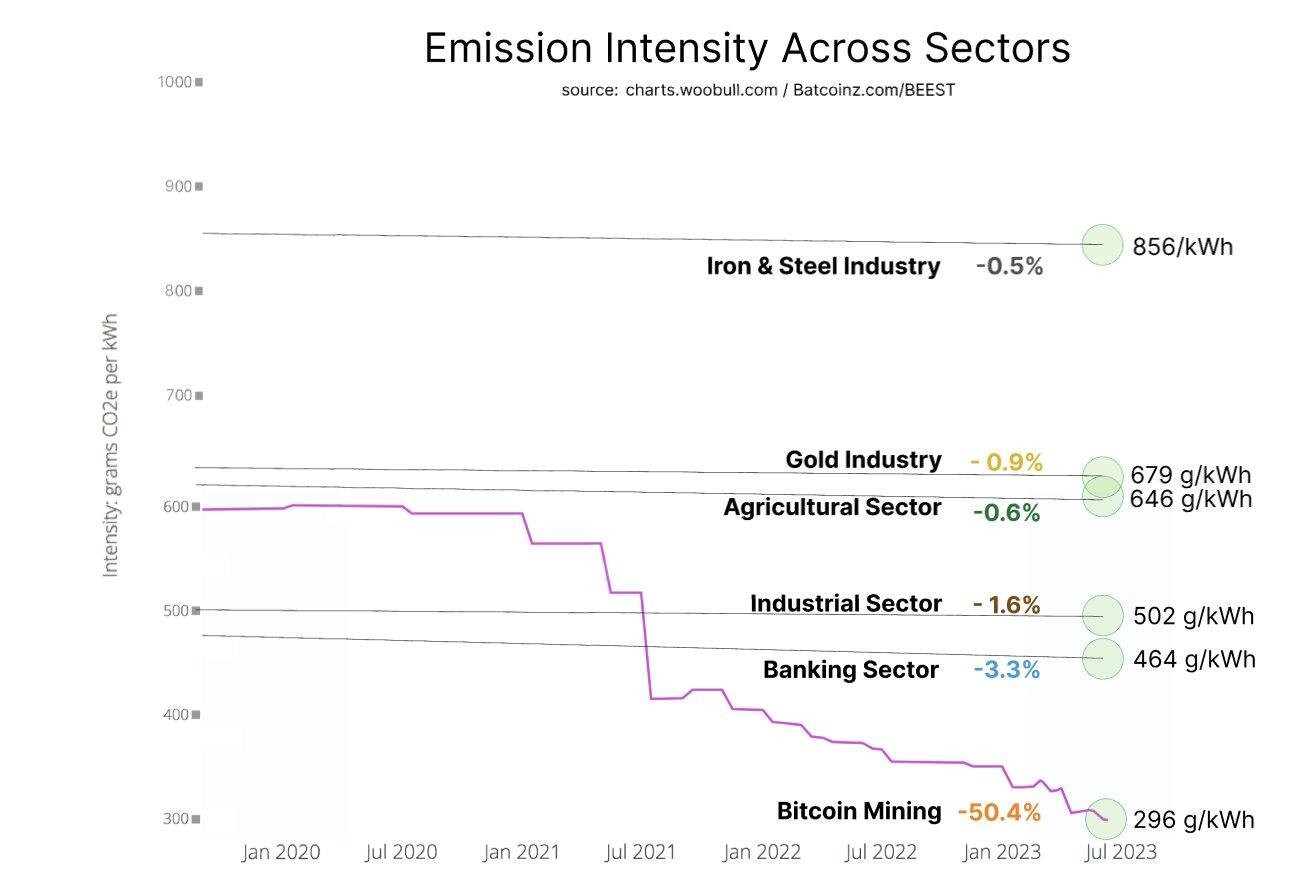

"Bitcoin mining now has lower emission intensity than any other industry.

It is literally the "Roger Bannister" of emission reduction, showing other industries that what was once thought impossible is possible.

full story and source data": - Daniel Batten

https://www.batcoinz.com/p/issue-001-the-narrative-is-shifting

➡️ Bitcoin whales are on the move as 1K-10K BTC wallets hit the highest since Nov '22 (1,958), while 100-1K BTC wallets see a new low (13,735). Bitcoin

whales have acquired 140K BTC ($6.16B) in the last three weeks.

➡️On the 6th of February: BlackRock's Bitcoin ETF is now among the Top 5 ETFs in year-to-date flows, indicating that it has attracted more cash than 99.98% of ETF

➡️ Michael Saylor’s MicroStrategy just bought another 850 Bitcoin worth $37.2m and now holds 190.000BTC.

The company is now at a $3,500,000,000 unrealized profit.

➡️El Salvador's Bitcoin portfolio is in the green with ~$21 million in gains.

💸Traditional Finance / Macro:

What can you expect this week in the traditional financial market?

Main highlight ahead:

In the US, we have CPI, retail sales, industrial production, and PPI. In Europe, it’s the UK CPI, GDP, labor market data, and the German ZEW. In Asia, we have the Australian labor market report, India CPI, and Japanese GDP

👉🏽"The combined revenue of the 4 largest US companies hit a record $1.5 trillion over last 12 months...

Amazon: $575 billion

Apple: $386 billion

Google: $307 billion

Microsoft: $228 billion

That's larger than the GDP of all but 14 countries." - TKL

👉🏽"Nvidia, NVDA, is now the 4th most valuable public company in the world, worth $1.84 trillion.

Today, Nvidia's market cap passed both Google and Amazon for the first time in history.

Since January 1st, Nvidia has officially added $650 BILLION in market cap.

That's more than the entire value of Tesla in less than 6 weeks." - TKL

🏦Banks:

Last week I mentioned that the FED announced that the Bank Term Funding Program (BTFP) will cease making new loans as scheduled on March 11.

Last week we witnessed how New York Community Bank stock, NYCB, the bank that acquired the collapsed Signature Bank, fell 40% after earnings.

"On the 6th of February New York Community Bank stock NYSB, the bank that acquired the collapsed Signature Bank, crashed another 25%.

The stock is now down a massive 61% in 2024 to its lowest level since June 2000.

Currently, roughly 40% of NYCB's assets are not under FDIC insurance.

The stock's decline accelerated after the bank posted an unexpected $260 million loss in Q4 2023." - TKL

Please read the bit on commercial real estate in last week's Weekly Recap and... check out the picture. (picture 1)

US Regional Bank Stocks 1 Month Into 2024:

1. NY Community Bank, NYCB: -60%

2. Valley National Bank, VLY: -25%

3. Metropolitan Bank, MCB: -15%

4. HarborOne, HONE: -14%

5. Comerica Bank, CMA: -13%

6. Zions Bank, ZION: -12%

7. Western Alliance, WAL: -11%

8. Citizens Financial, CFG: -6%

9. KeyCorp, KEY: -5%

Regional bank worries resurfaced as New York Community Bank which acquired the collapsed Signature Bank, cut their dividend by 70%.

These are the same banks that hold nearly 70% of commercial real estate loans.

Just 10 months ago, the regional bank crisis "ended." - TKL

🌎Macro/Geopolitics:

👉🏽Another reason there's so much pressure for rate cuts:

Debt servicing costs on US debt have skyrocketed since the pandemic.

Servicing costs have gone from ~1.5% of GDP to nearly 3.0% of GDP since 2020.

According to US projections, debt servicing costs are set to rise by 3.5%.

For years, low-interest rates meant deficit spending was fairly "cheap."

Now, we are paying for years of historically low-interest rates.

The era of "free" money is over." - TKL

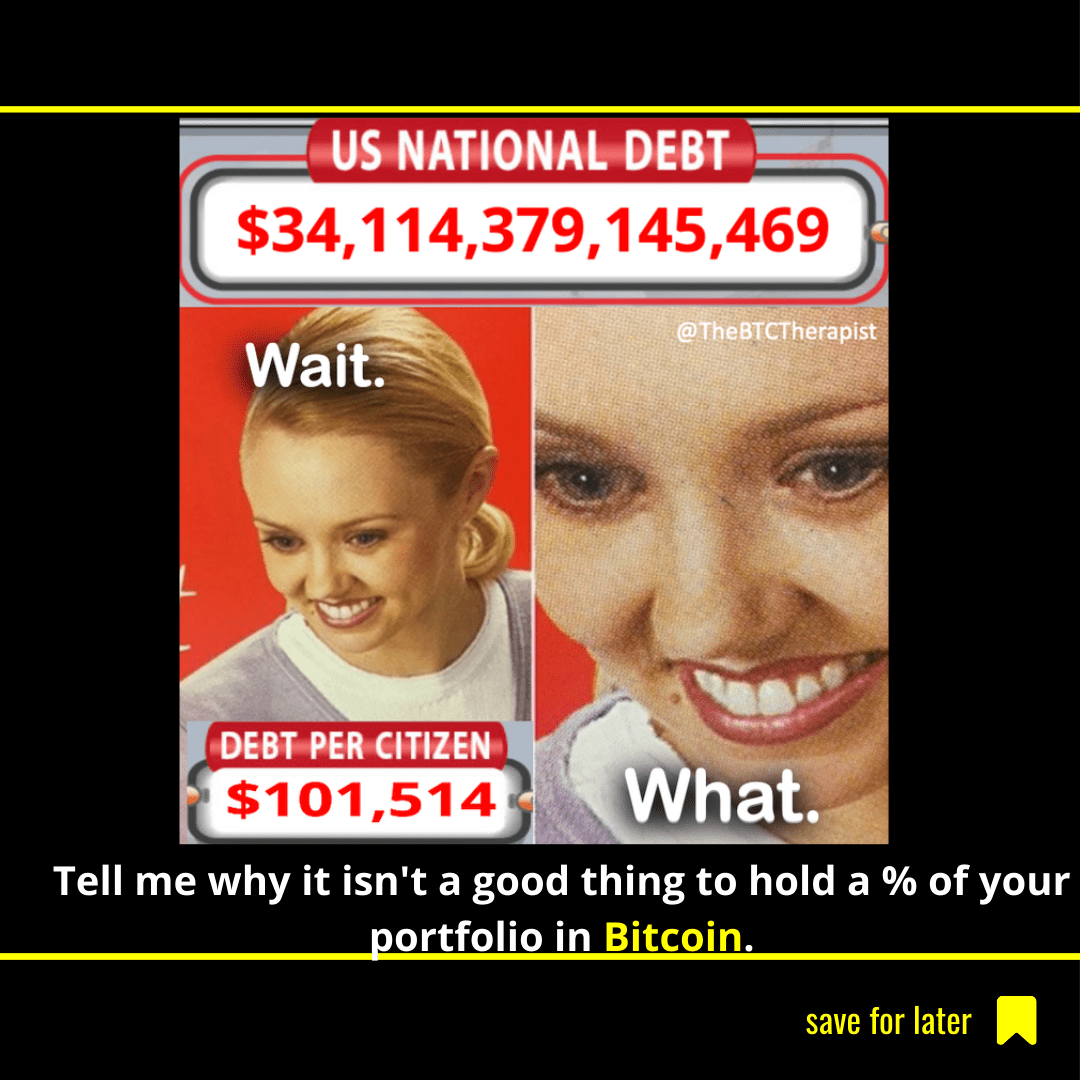

Total debt +$31BN today to a record high of $34.229 Trillion.

+$229 Billion since Jan 1

+$2.8 trillion in the past year.

$35 trillion by June.

BTC is worth less than 3% of the US national debt. Humanity holds ~37x more wealth in debt from a bankrupt government than in the world’s best money. we are so early!

"It took 17 years for the US to add $3.4 trillion of credit card debt, but less than 4 years for it to add another $340 billion.

Price increases are outpacing wage gains, and people are resorting to piling on credit card debt to pick up the difference."

(picture 2)

“The U.S. federal government is on an unsustainable fiscal path. And that just means that the debt is growing faster than the economy… We're borrowing from future generations,” says Fed chief Jerome Powell.

👉🏽Combine the above with the following statement:

The US Office of Management and Budget has said they see a deficit at 5%+ of GDP through 2033.

This means that a budget deficit of $1.4 trillion is expected in 2024.

By 2033, projections show that deficit spending will equal 6.9% of GDP.

There have only been 5 times in US history where deficit spending hit 6.5%+.

In 2033, this would imply an annual budget deficit of $2.7 trillion.

I don't want to be doom & gloom, but can anyone tell me how this can end well?

The debt is growing at ~10% per tear, plus a debasing currency, plus global competition intensifying.

👉🏽"While the rest of the world battles inflation, China is battling DEFLATION.

China's CPI just fell by 0.8% with prices suffering their biggest drop since the global recession in 2009.

This also marked the 4th consecutive monthly decline in China's CPI.

Weak consumer demand has been weighing on prices with prices of many food items falling by double-digit percentages.

The price of pork plunged by 17% and vegetable prices slid nearly 12%.

The economic slowdown continues." TKL

👉🏽Everyone could have seen this a mile away. Many choose not to look:

https://twitter.com/LukeGromen/status/1756343413253812722

More news on the sick man of Europe, Germany.

Its days as an industrial superpower are coming to an end. As pol paralysis grips Berlin, the energy crisis was the final blow for a growing number of manufacturers. German comps pay some of the highest electricity prices in the EU. https://www.bloomberg.com/news/features/2024-02-10/why-germany-s-days-as-an-industrial-superpower-are-coming-to-an-end

The risk of recession has increased significantly. Economists polled by BBG see the probability of a recession happening over the next 12 months at 75%.

"While US growth continues to positively surprise, the Eurozone goes in the opposite direction. But hey, let’s add some more regulations in Europe and decrease working time to four days per week." - Michael Arouet

(picture 5)

This chart ends in 2000, but I believe what it illustrates remains true today.

https://ourworldindata.org/working-hours

👉🏽https://twitter.com/LukeGromen/status/1757076757977387164

🎁If you have made it this far I would like to give you a little gift:

https://www.youtube.com/watch?v=DnBuIla9nGU&t=3s

Free knowledge!

Credit: I have used multiple sources!

My savings account: Bitcoin

The tool I recommend for setting up a Bitcoin savings plan: @Relai 🇨🇭 especially suited for beginners or people who want to invest in Bitcoin with an automated investment plan once a week or monthly. Hence a DCA, Dollar cost Average Strategy. Check out my tutorial post (Instagram) & video (YouTube) for more info.

⠀⠀⠀⠀

Get your Bitcoin out of exchanges. Save them on a hardware wallet, run your own node...be your own bank. Not your keys, not your coins. It's that simple.

⠀⠀⠀⠀⠀⠀⠀⠀

Do you think this post is helpful to you? If so, please share it and support my work with sats. #zap 🧡 #weeklyrecap #nostr #plebchain #BTC #Bitcoin #zap🧡 #plebchain #grownostr #stacksats #bitcoineducation #adoption

https://void.cat/d/XrWehT4qzhVakdCkrripE.webp

https://void.cat/d/6eHcx5CPLAs3oTDFdAGLaR.webp

https://void.cat/d/DCcR6jm9d14qqW9f5w4tTN.webp

https://void.cat/d/46TfTZwG7g7okinjWzdKWc.webp

🧠Quote(s) of the week:

"FED Chair, Jerome Powell on the US national debt:

• We’re on an unsustainable path

• Debt is growing faster than the economy

• We’re borrowing from future generations

Projected debt in 30 years: $144 Trillion"

We need Bitcoin now more than ever!

🧡Bitcoin news🧡

➡️ Satoshi Act Fund aids in introducing pro-Bitcoin legislation in Tennessee, marking the fifth state this year so far. The bill safeguards the rights to custody, mine, and run a node.

The Governor of Texas announced, “We want to be the home of innovation and Bitcoin is the cutting edge of innovation”.

➡️ Ark Invest’s “Big Ideas 2024 research report visualizes the long-term returns of buying and holding Bitcoin.

“Historically, investors who bought and held bitcoin for at least 5 years have profited, no matter when they made their purchases.” Next to that according to ArkInvest’s “Big Ideas 2024” report, the price of 1 Bitcoin is projected to reach $2.3 million if 19.4% of the $250 trillion global investable asset base is allocated to Bitcoin.

➡️All-Time High for Bitcoin Network Difficulty & New Record Bitcoin Hashrate! 550,000,000,000,000,000,000x per second

➡️A report by the US Energy Information Administration (EIA) reveals Bitcoin mining uses 0.6-2.3% of US electricity, and 0.2-0.9% globally.

2% to secure the world's next reserve currency. Less than 1% for powering the world with the only truly free, sound version of money while wasting over 1% on appliances like TVs on standby... I'd call that good numbers (picture 1)

➡️BlackRock's Bitcoin ETF IBIT now has +$3.1 BILLION Bitcoin in just 3 weeks since launch. They currently hold >72,466 BTC.

➡️Over the last decade, Bitcoin has ridden on the back of global liquidity as the world's M2 money supply increased from $56 trillion in 2014 to $92 trillion today. And the printing will only continue, more on that in the segment below (macro-economics)

(picture 3)

➡️Cathie Wood's ARK says optimal Bitcoin allocation for portfolios is 19.4%.

Up 3x from 6.2% in 2022.

➡️The Biden Administration has issued an "emergency" data collection initiative to identify the electricity usage of the Bitcoin mining industry in America

Miners who do not comply are threatened with fines of up to $10,633 for EACH DAY they do not respond

This is the type of stuff you would expect in countries like Iran, North Korea, and China. Countries that would not allow any progress outside what the state deems within its plans for the people. I am sure the EU will follow suit. Unfortunately.

➡️UK police have seized £1.4 BILLIONBitcoin during an attempt to launder proceeds of a £5b investment fraud carried out in China.

➡️Milei strategically removes Bitcoin taxes from the "Ley Ómnibus" reform, aiming for swift approval.

The bill initially demanded the declaration of undeclared assets, including cryptocurrencies.

In his first 50 days as president, this man has:

👉🏽Fired 50,000 government employees

👉🏽Deregulated legal tender laws

👉🏽Abolished taxes on Bitcoin

But sure, Javier Milei is "controlled opposition."

➡️Someone just moved 35,049 Bitcoin worth $1.5 billion for a transaction fee of $3.21.

➡️According to Tether's latest Q4 attestation, the company holds $2.8 billion worth of Bitcoin on its balance sheet.

➡️REKT! Great post and great chart for everyone who is considering enjoying the pump & dumps in the world of altcoins. Please reconsider.

The point of this post is that these coins weren't considered shitcoins by most people, they were contenders to be the next big thing. Almost all shitcoins will trend toward zero, especially as priced in Bitcoin.

https://twitter.com/duczko/status/1752574281610051800

➡️Entities holding at least 1K Bitcoin are up 4.50% over the past two weeks.

➡️Putting it in perspective.

The 9 New ETFs hold more Bitcoin than Tether, Tesla, Block and all the of the Public Miners combined.

Soon they eclipse MSTR. Later GBTC. Regarding GBTC, the dumping of GBTC by FTX is over and bitcoin ETFs see a big whoosh of net inflows.

➡️Education will be the key to resisting CBDCs. Great thread by Daniel Batten:

https://twitter.com/DSBatten/status/1752262434264604844

➡️BlackRock's Bitcoin ETF becomes first to break $2b in assets and now holds more than 52,000.

➡️https://twitter.com/TuurDemeester/status/1752075827804516392

Please also read Samson Mow's explanation Tuur is referring to.

Another great explanation by Samson...

➡️UTXO Management for Dummies: If everyone pays you in quarters you’ll have to lug around a big heavy bag. It’ll also cost you more time to spend as you have to count quarters when paying. So ask for $20s or $100s as payment, or change your quarters into bills from time to time.

Now I hear you say...wtf is a UTXO?

A UTXO stands for unspent transaction output. Don’t worry about those unnecessarily complicated words. Just use “UTXO” and understand the concept of what it is…

If you want to learn/study the topic: https://armantheparman.com/utxo/

➡️ "CBDC Is a calamity for human and civil rights. Bitcoin gives you better protection than cash. It also gives you protection from inflation and all of the other hazards that come along with FIAT currencies," says US Presidential Candidate Robert F. Kennedy Jr.

➡️"One of China's largest fund managers, Harvest, to launch a spot Bitcoin ETF in Hong Kong after the Securities Commission said it is ready to accept applications.

China coming to the party!" - Bitcoin Archive

💸Traditional Finance / Macro:

What can you expect this week in the traditional financial market?

Main highlight ahead:

In the US, we have the service sector ISM report and the Fed’s latest Senior Loan Officer survey. In Europe, the focus will be on German industrial production, the February Sentix survey of investor sentiment, and the latest ECB bulletin. In Asia, we have China CPI and Japan earnings data, along with central bank meetings in India and Australia.

👉🏽Meta just gained $200 billion in market cap.

It's the biggest one-day gain in stock market history. CEO Mark Zuckerberg stands to receive a payout of ~$700 Million a year from Meta's first-ever dividend which was announced today - Bloomberg

🏦Banks:

Last week I mentioned that the FED announced that the Bank Term Funding Program (BTFP) will cease making new loans as scheduled on March 11.

"This week we witnessed how New York Community Bank stock, NYCB, the bank that acquired the collapsed Signature Bank, fell 40% after earnings.

The bank announced they will cut their dividend by 70% to meet regulatory requirements.

They also reported a 4th quarter LOSS of $260 million while expectations were for a GAIN of that size.

This comes just a few weeks before the Fed's emergency loan program is set to expire. Many of these small banks hold tons of exposure to commercial real estate loans.

70% of all CRE loans in the US are held by small banks.

If CRE project defaults continue, we could see more pressure on banks." - TKL

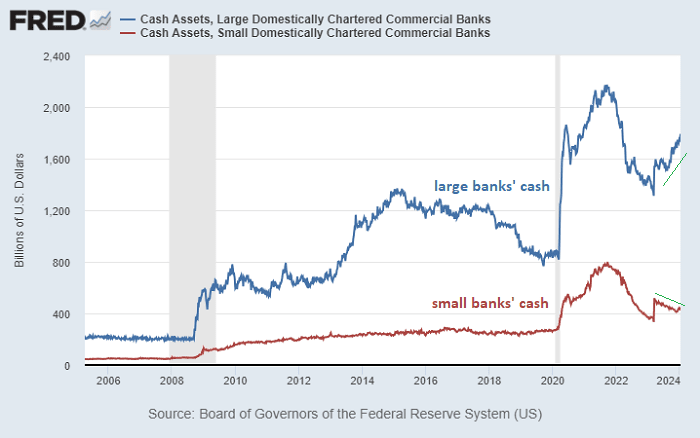

Are (small) banks still feeling the pain? I guess so...why? What is predominantly in their (NYCB) loan portfolio? It's the same thing that's in basically every bank portfolio - a large % of CRE & USTs? And it is not only in the US.

Shares of Japanese bank Aozora are collapsing. The stock's on the steepest 2-day drop since it became a public company.

Why? The Bank reported massive exposure to US commercial real estate.

(picture 4)

Regarding CRE. "Another sign the Commercial Real Estate (CRE) crisis is worse than we thought?

The Xerox building in Washington DC just sold for $25 million.

It was last purchased for $145 million just over a decade ago, in 2011.

This reflects an 83% LOSS on the 19-story office building.

The buyer of the property plans to convert it to an apartment building."

"44% of office loans carry outstanding loan balances higher than the property value and are at risk of default according to the NBER."

🌎Macro/Geopolitics:

👉🏽"SUMMARY OF FED DECISION (1/31/24):

1. Fed leaves rates unchanged for 4th straight meeting

2. The Fed does not expect rate cuts until "greater confidence" inflation is moving to 2%

3. "Highly attentive" to inflation risks with economic uncertainty

4. Job gains have moderated but remain strong

5. Upcoming policy will be based on incoming data

6. Fed sees evolving outlook while balancing risks.

This seems to be a different tone than their December meeting.

Particularly, the new statement about not expecting rate cuts until "greater confidence" about inflation."- TKL

It seems like they are backtracking. The FED is really caught between a rock and a hard place of its own making.

1. election year pressure to cut rates.

2. Govt cost of debt increasing, pressuring rate cuts. (the banks and national budget, and other parts of the indebted economy)

3. The FED knows inflation still has the potential to tick up.

👉🏽The U.S. added a blowout of 353,000 jobs in January, far above the 185,000 expected.

November and December growth were also revised up substantially. BUT... it seems like all "jobs" added in the past year have been part-time workers.

https://fred.stlouisfed.org/series/LNS12500000

Especially if you read the following bit:

Latest List of Layoffs Over Last 3 Months:

1. Twitch: 35% of workforce

2. Hasbro: 20% of workforce

3. Spotify: 17% of workforce

4. Levi's: 15% of workforce

5. Zerox: 15% of workforce

6. Qualtrics: 14% of workforce

7. Wayfair: 13% of workforce

8. Duolingo: 10% of workforce

9. Washington Post: 10% of workforce

10. eBay: 9% of workforce

11. PayPal: 9% of workforce

12. Business Insider: 8% of workforce

13. Charles Schwab: 6% of workforce

14. Macy's: 4% of workforce

15. Blackrock: 3% of the workforce

16. Citigroup: 20,000 employees

17. UPS: 12,000 employees

18. Deutsche Bank: 3,500 employees

19. Pixar: 1,300 employees

20. Salesforce: 700 employees

21. American Airlines: 650 employees

January 2024 saw a total of 82,000 layoffs, the second-worst January since 2009. Meanwhile, the US just reported that 353,000 jobs were created in January.

The jobs at all of these companies seeing layoffs tend to be full-time, high-pay, high-benefit jobs. The jobs number from yesterday includes many more part-time, lower pay, smaller benefit jobs than the ones mentioned above that have been lost.

If you lose your full-time job and have to take 2 or 3 part-time jobs to keep paying your mortgage, the current administration counts that as job growth.

That's how messed up the system is right now.

Just going to leave this here:

https://twitter.com/mtmalinen/status/1753700241465835732

👉🏽"BTC has allowed anyone to cut to the front of the “fiat currency Cantillon Effect benefit line”. - yes!!

Please read both tweets: https://twitter.com/LukeGromen/status/1753854390367039907

To make it extra 'special': "10% of the world‘s population own 75% of all wealth, get 50% of all income and account for nearly half of all CO2 emissions.

source IMF: (picture 5)

👉🏽Germany: Retail sales have fallen by 4.4% in Dec YoY. This means that even Christmas sales fell through. Germans have gone on a buyers' strike since the outbreak of inflation and have even cut back on gifts for children during the Christmas season. This also explains why Germany has some of the toughest competition in the retail sector and the lowest profit margins there." Zschaepitz

Basically, all categories are down except gas stations and clothing & textiles. Hello, buyers strike!

German inflation slows to 2.9% in January from 3.7% in December, the lowest level since June 2021. Core CPI slows to 3.4% in Jan from 3.5% in Dec, lowest level June 2022. Energy in deflation, Energy prices dropped -2.8% YoY, while Food CPI slowed to 3.8% from 4.5% in Dec.

👉🏽 The two largest economies in Africa are under huge financial strain.

On the 30th of January, Nigeria de facto devalued the naira by ~30% (after another ~30% devaluation in June). And Egypt is under pressure to devalue too, with the pound ~50% weaker in the black market. The Naira has moved from ~470 vs the USD in June last year to now at 1452 as of the 1st of February.

Bitcoin could step in as an economic life raft. It offers a robust alternative to national currencies prone to devaluation, providing a measure of financial sovereignty to individuals.

I will quote Alex Gladstein on this topic:

"In neither case did the government ask the people for permission to dramatically reduce their wages, purchasing power, or living standards.

Now hundreds of millions will suffer

Currency devaluation is a crime against humanity."

https://twitter.com/DSBatten/status/1753171731521691872

👉🏽US Treasury Department cuts Jan-Mar borrowing estimate to $760 billion from $816 billion and estimates $202 billion net borrowing for Apr-Jun, per Bloomberg.

Are they smoking crack?

The Treasury has issued $134BN in debt in the past 4 weeks but expects to issue $202BN in all of Q2.

"if anyone expects any econ data in the election 2024 year to be i) accurate or ii) make any sense, you will be severely disappointed."

👉🏽https://twitter.com/jameslavish/status/1753804440166125702

"We're getting to the point now where the interest expense on the debt is so high that it's going to eat up our ability to basically service the next generation"

"I'm not even sure about the current one"

"We are in deep trouble"

"By 2027, the interest expense alone on the debt eats all healthcare spending"

"By 2047, it eats all discretionary spending"

👉🏽"A record $8.9 trillion of government debt will mature over the next year.

Meanwhile, the government deficit in 2024 is projected to be $1.4 trillion.

This means that someone will need to buy more than $10 trillion in US government bonds in 2024.

That's nearly a third of all outstanding US federal debt right now.

All the while the Fed is expected to start cutting rates, making buying these bonds less attractive.

One of the biggest issues with a higher for the longer environment is US debt.

Debt service costs for the US government have more than doubled since the Fed started raising rates."

Yesterday Fed Chair Powell said it best himself:

Scott Pelley (60 Minutes): “Is the national debt a danger to the economy in your view?”

Fed Chairman Jerome Powell on the US national debt:

• We’re on an unsustainable path

• Debt is growing faster than the economy

• We’re borrowing from future generations

Projected debt in 30 years: $144 Trillion"

We need Bitcoin now more than ever.

"Under current fiscal policies, the Debt to GDP ratio in the US is projected to hit 200% within 20 years.

Before 2020, Debt to GDP in the US was ~100% and before 2008 it was ~60%.

Current estimates show the US hitting $50 trillion in total debt by 2033.

This means that the US will add $218 million in debt EVERY HOUR until 2033.

Just imagine what would happen if the Fed doesn't in fact achieve a soft landing."- TKL

This is unsustainable.

👉🏽Nearly 30% of ALL stocks in China have trading stopped as the CSI 1000 index falls 8%. Healty world economy, right?

🎁If you have made it this far I would like to give you a little gift:

https://www.youtube.com/watch?v=IyMKjrNxaGo

Free knowledge!

Credit: I have used multiple sources!

My savings account: Bitcoin

The tool I recommend for setting up a Bitcoin savings plan: @Relai 🇨🇭 especially suited for beginners or people who want to invest in Bitcoin with an automated investment plan once a week or monthly. Hence a DCA, Dollar cost Average Strategy. Check out my tutorial post (Instagram) & video (YouTube) for more info.

⠀⠀⠀⠀

Get your Bitcoin out of exchanges. Save them on a hardware wallet, run your own node...be your own bank. Not your keys, not your coins. It's that simple.

⠀⠀⠀⠀⠀⠀⠀⠀

Do you think this post is helpful to you? If so, please share it and support my work with sats. #zap 🧡 #weeklyrecap #nostr #plebchain #BTC #Bitcoin #zap🧡 #plebchain #grownostr #stacksats #bitcoineducation #adoption

https://void.cat/d/KMeCzUjTw546VNFZXp2sfH.webp

https://void.cat/d/6zWM9muJ5vrYTZpZLiRcC2.webp

https://void.cat/d/5v2jTLuun4MXh4NZptnWBW.webp

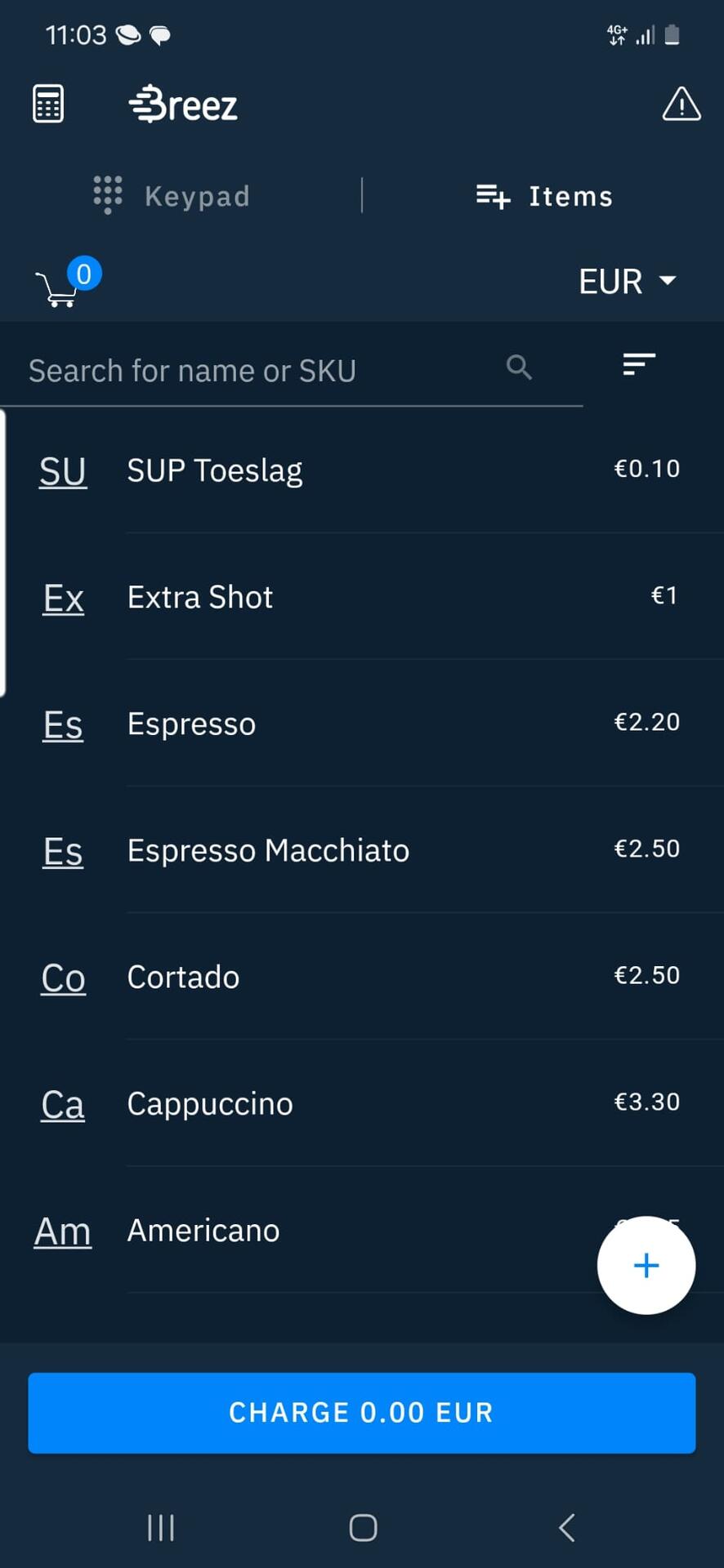

At the Bitcoin conference 23’in Amsterdam, I had the pleasure of having a chat with an old chap called Bert. It was his second time at the conference. He had a spot at the expo area with his mobile espresso bar.

I showed him the beauty of Bitcoin and insisted on paying for a coffee with Bitcoin.

After that, a quick demonstration of Breeze and he received his first 'coffee' sats.

Now fast forward to the beginning of 2024.

I met him in Amsterdam, at his 'normal' spot at the entrance of the Vondelpark, near Vondelchurch.

https://btcmap.org/merchant/node:11380255884

I helped him to set up Breeze - items and had a nice chai latte.

Unfortunately, people didn't know that you can pay for your coffee with Bitcoin/sats. No problem, after our appointment, I sent him some stickers. Look at the result.

So please plebs...if you are visiting Amsterdam. Check out the Vondelpark ,and whilst doing that, get yourself a coffee at First Coffee and drop some sats.

Study, learn, hodl, decouple.

#bitcoin 🧡

▃▃▃▃▃▃▃▃▃▃▃▃▃▃▃

My savings account: Bitcoin

The tool I recommend for setting up a Bitcoin savings plan: @Relai 🇨🇭 🇨🇭 especially suited for beginners or people who want to invest in Bitcoin with an automated investment plan once a week or monthly. Hence a DCA, Dollar cost Average Strategy. Check out my tutorial post (Instagram) & video (YouTube) for more info.

⠀⠀⠀⠀

Get your Bitcoin out of exchanges. Save them on a hardware wallet, run your own node...be your own bank. Not your keys, not your coins. It’s that simple.🎯

⠀⠀⠀⠀⠀⠀⠀⠀

Do you think this post is helpful to you? If so, please share it and support my work with sats. 🧡

Felipe - BitcoinFriday

#zap 🧡 #nostr #BTC #Bitcoin #plebchain #grownostr #stacksats #bitcoineducation #adoption #🍊💊 #orangepilled

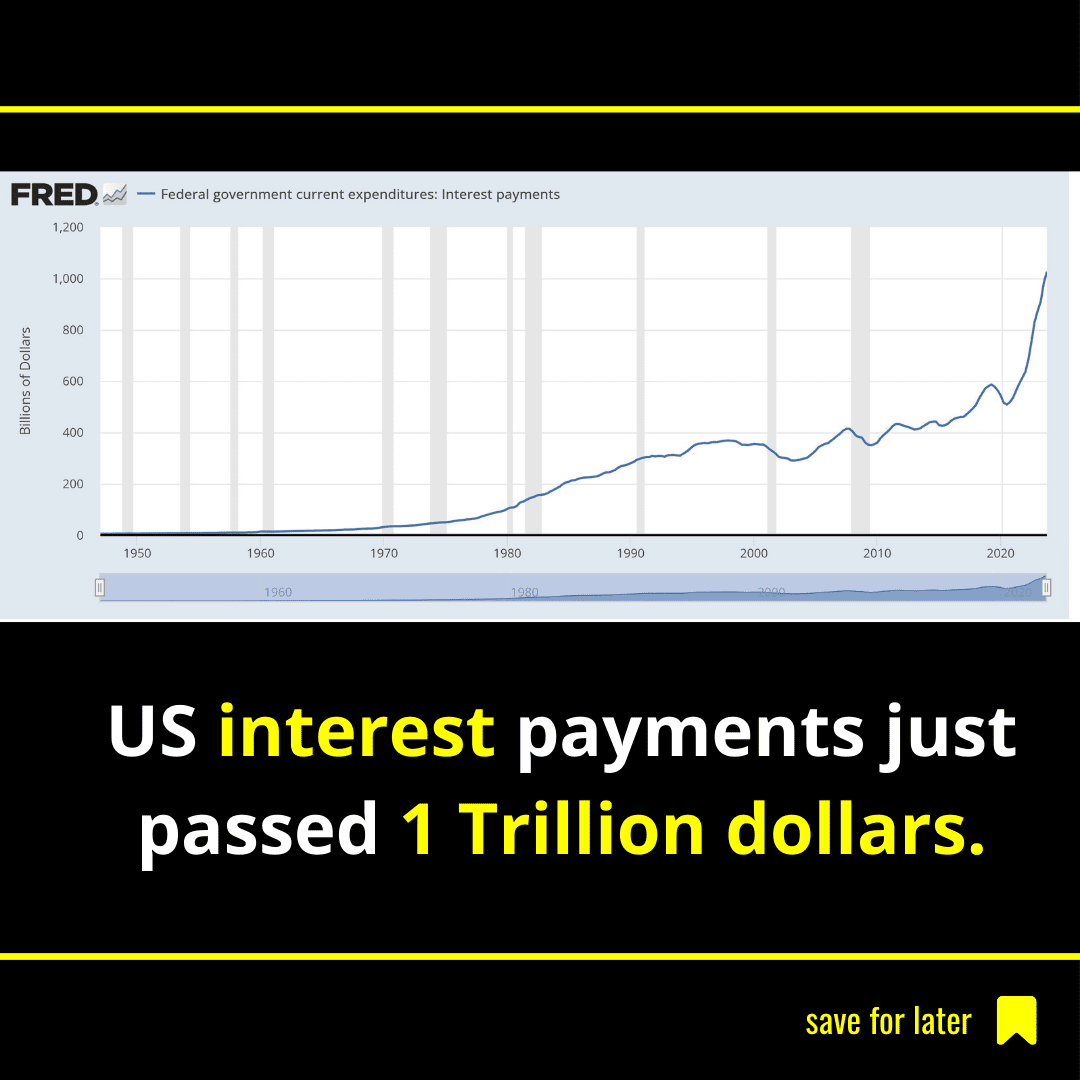

👉🏽 US interest payments just passed 1 Trillion dollars. (First picture)

Although some financial influencers did mention that the US economy is strong and thriving based on the Q4 GDP report they are missing or leaving one tiny part out of that same report.

Annualized interest on the federal debt now exceeds $1 trillion and is projected to reach $3 trillion, annualized rate, by Q4 2030 - INSANE and UNSUSTAINABLE.

Even if you adjust for inflation and put everything in real terms (chained 2017 dollars), interest is still going to skyrocket with the current trends.

Now on that chart... It assumes steady growth rates for gov't expenditures, GDP, price indices, etc. - the line is rising rapidly because of the size of the debt and the cost to service it along with the institutionalization of multi-trillion-dollar deficits in the absence of either war or recession...

Ergo: This number goes up because of refinancing debt. Most of this was with <1% rates and is now >5%. That's a huge increase and the government can't stop that. Debt rolls over anyway. If no one wants them, the government buys its bonds which causes inflation.

Either 1) rates will go back down to 0% in some fashion which will result in a huge slowdown in growth or deflation, or

2) the government will be forced to cut spending/raise taxes by markets. When was the last time the government cut spending?

There is another option, the option that macroeconomist Luke Gromen already mentioned several times last couple of months/ years.

3) We will have a massive inflationary cycle where inflation makes all those numbers trivial.

Now for the so-called fin fluencers, I have one question. An increase in real GDP of $1.5 trillion with an increase of public debt of more than $2 trillion is that a strong economy?

This so-called "public stimulus" always means more debt, which in turn means more taxes, lower growth, weaker real wages for families, as well as a tougher environment for small businesses. Right?

The above is only focused on the US.

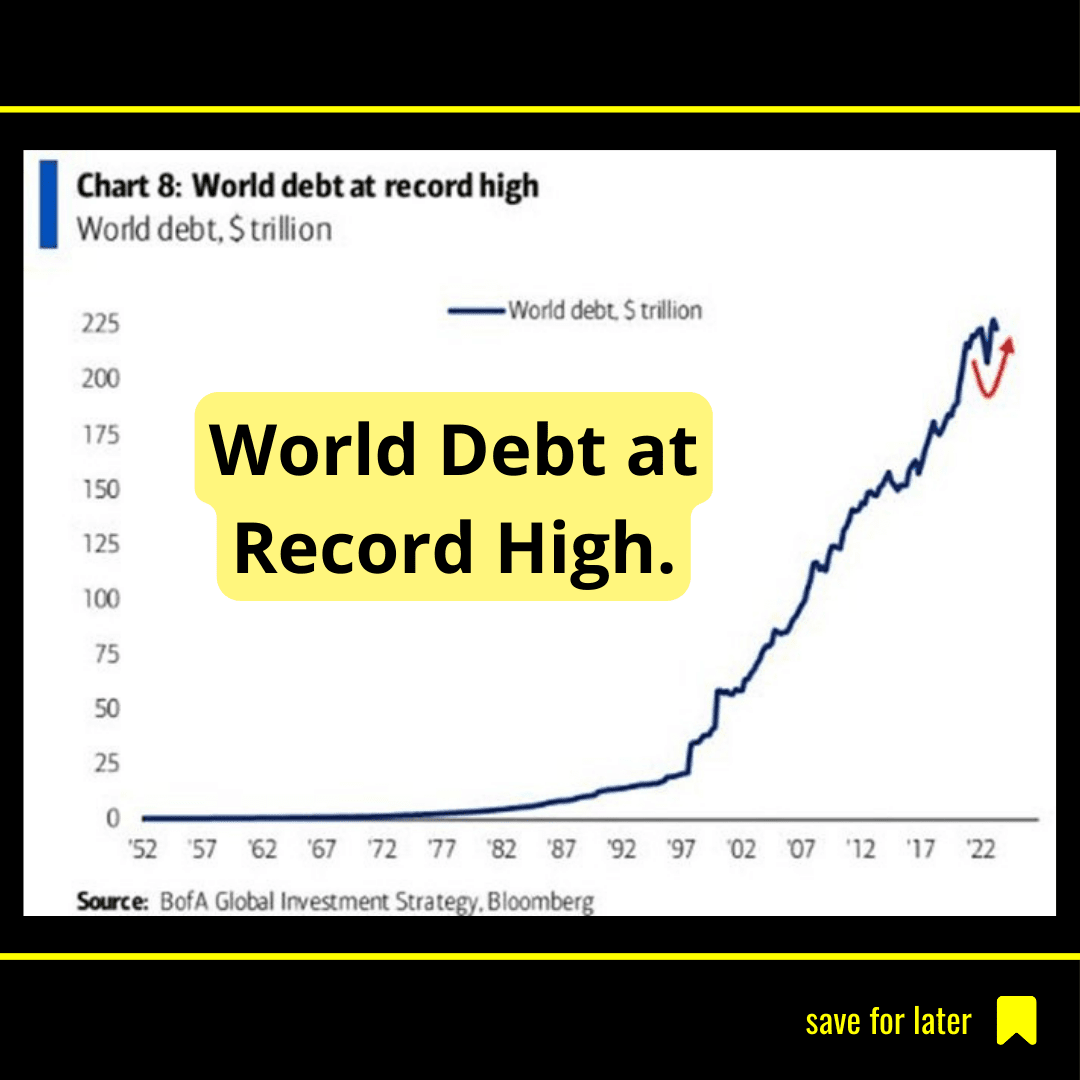

Below you will find a picture of the world debt. (Second slide)

No read the above segment again and tell me why it isn't a good thing to hold a % of your portfolio in Bitcoin.

👉🏽More on the debt part:

"For anyone who's still counting:

The US government borrowed $47 billion of debt on the 28the of January alone.

Since the debt ceiling crisis "ended" in June 2023, total US debt is up ~$3 trillion.

Since October 1st, the US government has borrowed ~$10 billion PER DAY.

The worst part?

For the next 340 days, the US debt ceiling is effectively uncapped.

If we keep borrowing at current rates, we could see over $37 trillion of federal debt this year." - TKL

So tell me why it isn’t a good thing to hold a % of your portfolio in Bitcoin.

Well if you read this on Nostr.. probably you are already 100% in Bitcoin😁🤣🧡

The above is a segment out of my latest Weekly Recap, for more:

Credit picture: TheBTCtherapist

Study, learn, hodl, decouple.

#bitcoin 🧡

▃▃▃▃▃▃▃▃▃▃▃▃▃▃▃

My savings account: Bitcoin

The tool I recommend for setting up a Bitcoin savings plan: @Relai 🇨🇭 🇨🇭 especially suited for beginners or people who want to invest in Bitcoin with an automated investment plan once a week or monthly. Hence a DCA, Dollar cost Average Strategy. Check out my tutorial post (Instagram) & video (YouTube) for more info.

⠀⠀⠀⠀

Get your Bitcoin out of exchanges. Save them on a hardware wallet, run your own node...be your own bank. Not your keys, not your coins. It’s that simple.🎯

⠀⠀⠀⠀⠀⠀⠀⠀

Do you think this post is helpful to you? If so, please share it and support my work with sats. 🧡

Felipe - BitcoinFriday

#zap 🧡 #nostr #BTC #Bitcoin #plebchain #grownostr #stacksats #bitcoineducation #adoption #worldofdebt #usdebt

🧠Quote(s) of the week:

"Our revels now are ended.

This our money, as I foretold you,

Was all numbers, and has melted into air, into thin air:

And, like the baseless fabric of this economy,

The cloud-capp'd towers, the gorgeous palaces, the £1m+ ex-council flats, the great s&p itself,

Yea, all which it inherits, shall dissolve

And, as your insubstantial pension fades, leave not a rack behind.

It is such stuff as dreams are made on, and our little wealth

It ended with a crash." - The ShakespeareanApe

"If you want a market that only goes up (modestly), try stocks.

If you want the potential for outsized returns alongside occasional big drawdowns, try Bitcoin.

If you want to light money on fire, try altcoins."- Joe Carlasare

🧡Bitcoin news🧡

➡️BlackRock’s Bitcoin holdings now valued over $2.18 billion, and hold 52.025BTC.

➡️Bitcoin whales accumulate 76K Bitcoin ($3B) since the beginning of the year.

➡️Google is the biggest advertising network in the world.

+2x bigger than the second biggest ad network Meta (Facebook/IG).

From today on Bitcoin ETFs can start advertising on Google.

BlackRock & VanEck are now advertising Spot Bitcoin ETFs on Google following a new policy update.

➡️After 11 trading days, the 9 new spot Bitcoin ETFs bought ~140,000 BTC worth USD 6 Billion. This excludes GBTC (conversion w/ outflows).

Grayscale outflows of $5b have been absorbed by other Bitcoin ETFs taking in $5.8b.

$759m Net Bitcoin ETF inflows.

➡️Local news station in Georgia reports a new Bitcoin mine could help lower energy bills and property taxes for the entire city of Sandersville.

➡️The fourth Bitcoin halving is expected to occur on April 20th, 2024, at block height 840,000. The block reward will be halved from 6.15 BTC to 3.125 BTC.

➡️On the 26th of January BlackRock held a webinar to educate financial advisors on their Bitcoin ETF and "what makes this a pivotal moment for investors".

That wasn't something I had on my 2024 Bitcoin bingo card.

➡️"Bitcoin has the same number of users as the Internet had in 1997.

We are just getting started."

(picture 1)

➡️"The 9 new Bitcoin ETFs have bought 102,613 BTC in just 7 days of trading.

It took MicroStrategy ~300 days to buy +100K Bitcoin."

➡️On the 24th of January the Bitwise Bitcoin ETF (BITB) became the first U.S. bitcoin ETF to publish the bitcoin addresses of its holdings.

"Now anyone can verify BITB's holdings and flows directly on the blockchain. Onchain transparency is core to Bitcoin's ethos."

Although I think this is a great thing, I do have a couple of questions and remarks.

1. On a positive note, this will be the standard. Try doing this with gold. That's not possible. There is $11 Trillion in physical gold chasing 250 Trillion dollars in paper gold because the is no transparency to the asset. It is hoarded, controlled, and monitored in secret by 200 governments on the planet.

2. While our current system is based on fraction reserve you now actually have proof of reserve. A real-time balance check of a limited supply asset. This has never been done before in human history. A step closer to a more transparent financial future.

3. This address will be held (custodian) by Coinbase. Not sure if multi-signature is safer in this instance, I don't have the technical knowledge to provide you with the correct answer. This all depends on the parties & processes involved. What I do know is that not only the Bitwise ETF but almost every ETF can be confiscated by the government.

4. What if people will send sats to that address? Does it get added to the NAV of the ETF holders?

5. Since revealing their Bitcoin address, the Bitwise ETF address has received 10 "donations" totaling 268,002 satoshis (~$107). Numerous tips have been in denominations of 42069 and 6969 sats.

If you want to learn more about the various Bitcoin addresses, here is a great article: https://unchained.com/blog/bitcoin-address-types-compared/

➡️Also on the 24th: BlackRock & Fidelity now hold more than $3.2b Bitcoin. They're buying +$400m Bitcoin every day on average.

➡️As you might know or feel the same way as me, Bitcoiners care about truth and proof of work.

Recently a new research from the United Nations University came out.

Bitcoin Policy Institute, in particle Margot Paez, uncovered critical shortcomings in that study as it is fundamentally flawed.

"In short, the study falls short of the scientific thoroughness expected in research, rendering it unsuitable as a basis for policymaking.

Our analysis uncovered three critical flaws in the paper.

1. Selective Bias

The study's literature review is based on sources that have been discredited and fail to consider newer research showcasing Bitcoin mining's potential to support grid reliability and advance the shift to renewable energy.

1. Data Misapplication

The authors project past data onto future trends without yearly updates or recognition of discontinued data sources like the CBECI.

1. Flawed Methodologies

Methodologies used are inappropriate for demand-side analysis, leading to unfounded assertions about bitcoin mining's impact on developing economies and social justice."

Read the full report here: https://assets-global.website-files.com/627aa615676bdd1d47ec97d4/65b004ac744cd4c6abb8934e_UN%20Paper%20FINAL%20.pdf

This report deserves way more coverage! On the same day, BPI drops a new scholarship from Margot, and Cornell announces their Bitcoin program. "Patterns tell stories and falsehood flies, and the truth comes limping after it!"

➡️https://twitter.com/TimmerFidelity/status/1749825855449121092

The S-curve nature of the Bitcoin network remains on track. "Bitcoin's network is growing in line with a standard power regression curve". Jurien Timmer - Dir. of Global Macro Fidelity.

Hello network effects, just zoom out for a bit.

➡️"Twice as much Bitcoin is LOST as is currently controlled by institutions and governments.

Only a tiny fraction of the world owns Bitcoin, and after the halving in April, only 1.3125/21M BTC will be left to be mined."

This asset will get more and more scarce until every other currency is phased out. With the current world population, only 27% of the planet (max) could have 0.01BTC if it was evenly distributed and all BTC were mined/ available. The Bitcoin ETFs may accelerate the scarcity aspect (once the GBTC selling is exhausted).

It might make sense to get some, just in case it catches on. (foto)

💸Traditional Finance / Macro:

👉🏽The S&P 500 has officially hit 4,900 for the first time in history.

This puts the index up another 3.5% YTD and 18.5% since October 27th, 2023.

In roughly 3 months, the S&P 500 has doubled the average ANNUAL returnSerious disconnect between the traditional financial markets and the economy. Unfortunately, the price of assets does not necessarily reflect the health of a business.

We were told that the Fed has been tightening the monetary policy. Meanwhile, the monetary base has expanded by $500 BILLION from February 2023.

Two companies, Apple and Microsoft have 6 trillion in combined market cap.

Top 10 companies: $14.6T.

Just 5.5 years ago in 2018, AAPL reached a $1 trillion market cap for the first time.

It has tripled in valuation since then and MSFT more so.

We're witness to the largest market cap expansion in history. Ask yourself, does a market cap expansion of this magnitude signal that this is a healthy market?

For the stock market and the financial system liquidity matters and is one of the main fuels. Make no mistake this is also valid for Bitcoin. Liquidity matters.

"Owning an SP500 fund is no different from holding a tech ETF.

The top 7 components are all tech companies and represent 26% of its holdings.

SPX should no longer be viewed as a diversification instrument. It’s no longer spreading risk across 500 companies to protect you."

🏦Banks:

👉🏽 The FED announces that the Bank Term Funding Program (BTFP) will cease making new loans as scheduled on March 11. The Fed has raised interest rates on its Bank Term Funding Program, the emergency lending program created to support regional banks.

Rate increases are effective immediately, but the Fed will be ending the program on March 11th.

Rates on new loans will be no lower than the rate on reserve balances. Let's see which financial institutions will blow up next then!

Do you need an explanation of the above?

https://twitter.com/Invst_Informant/status/1748116617618235527

🌎Macro/Geopolitics:

👉🏽 US interest payments just passed 1 Trillion dollars. (foto)

Although some financial influencers did mention that the US economy is strong and thriving based on the Q4 GDP report they are missing or leaving one tiny part out of that same report.

Annualized interest on the federal debt now exceeds $1 trillion and is projected to reach $3 trillion, annualized rate, by Q4 2030 - INSANE and UNSUSTAINABLE.

Even if you adjust for inflation and put everything in real terms (chained 2017 dollars), interest is still going to skyrocket with the current trends

Now on that chart... It assumes steady growth rates for gov't expenditures, GDP, price indices, etc. - the line is rising rapidly because of the size of the debt and the cost to service it along with the institutionalization of multi-trillion-dollar deficits in the absence of either war or recession...

Ergo: This number goes up because of refinancing debt. Most of this was with <1% rates and is now >5%. That's a huge increase and the government can't stop that. Debt rolls over anyway. If no one wants them, the government buys its bonds which causes inflation. Either 1) rates will go back down to 0% in some fashion which will result in a huge slowdown in growth or deflation, or 2) the government will be forced to cut spending/raise taxes by markets. When was the last time the government cut spending?

There is another option, the option that macroeconomist Luke Gromen already mentioned several times last couple of months/ years. 3) We will have a massive inflationary cycle where inflation makes all those numbers trivial.

Now for the so-called fin fluencers, I have one question. An increase in real GDP of $1.5 trillion with an increase of public debt of more than $2 trillion is that a strong economy?

This so-called "public stimulus" always means more debt, which in turn means more taxes, lower growth, weaker real wages for families, as well as a tougher environment for small businesses. Right?

The above is only focused on the US.

Below you will find a picture of the world debt. (picture 2)

No read the above segment again and tell me why it isn't a good thing to hold a % of your portfolio in Bitcoin.

👉🏽More on the debt part:

"For anyone who's still counting:

The US government borrowed $47 billion of debt yesterday alone.

Since the debt ceiling crisis "ended" in June 2023, total US debt is up ~$3 trillion.

Since October 1st, the US government has borrowed ~$10 billion PER DAY.

The worst part?

For the next 340 days, the US debt ceiling is effectively uncapped.

If we keep borrowing at current rates, we could see over $37 trillion of federal debt this year." - TKL

(picture 3) credit TheBTCTherapist

👉🏽Job growth is structurally declining from the post-COVID peaks and is below the 2010-2019 average. Many other smaller components are in recessionary rates of change off their lows. Labor turns slowly with inertia until it is suddenly non-linear.

The following thread, click on the link, is worth your time. Excellent analysis.

"State-level unemployment rates were just released and they continue the string of bad news from the household survey.

It's been a while since I've refreshed this dataset and now my updated state-level Sahm-Rule indicator is really heating back up -

in fact, it's now above the threshold that marked the onset of every recession since the 1970s.

Through Dec, 20 states (i.e., 39% of the total in the chart below) had triggered the Sahm Rule, up sharply from just 3 states in September.

Nearly 25% of states had triggered the Sahm Rule last Nov when layoffs were picking up in Tech / Real Estate / Finance, but then those tapered off and the share pivoted sharply lower just below reaching the threshold for typical recessions.

More detail on the states that have deteriorated the most over the past year in the following thread" - Parker Ross

https://twitter.com/Econ_Parker/status/1749939545276141757

"Layoffs Announced Over Last 3 Months:

1. Twitch: 35% of workforce

2. Hasbro: 20% of workforce

3. Spotify: 17% of workforce

4. Levi's: 15% of workforce

5. Zerox: 15% of workforce

6. Qualtrics: 14% of workforce

7. Wayfair: 13% of workforce

8. Duolingo: 10% of workforce

9. Washington Post: 10% of workforce

10. eBay: 9% of workforce

11. Business Insider: 8% of the workforce

12. Charles Schwab: 6% of workforce

13. Blackrock: 3% of workforce

14. Citigroup: 20,000 employees

15. Pixar: 1,300 employees

In 2022 and early 2023, we saw over 300,000 layoffs but they were almost entirely in tech companies.

Now, we are seeing layoffs across all industries as we kick off 2024."- TKL

👉🏽"China in 2024 So Far:

1. China's biggest brokerage restricts short-selling

2. China reportedly weighs a $280 billion stimulus package

3. China unexpectedly cuts reserve ratio for banks

4. China tells funds to stop shorting index futures

5. Hong Kong's stock index hits its lowest level in 2 decades

This all comes after a brutal 2023 for China's real estate sector.

While central banks have been raising rates, China has been cutting rates." TKL

Now you know the reason why I mentioned in last week's Weekly Recap: "China is contemplating issuing 1 trillion yuan ($139 billion) in new debt through a special sovereign bond plan, marking only the fourth such sale in 26 years

The Middle Kingdom appears to be warming up the money printer."

On top of that today a Hong Kong court has ruled that Evergrande, China's largest real estate developer, must be liquidated.

The stock is now down another 20% today on the news and trading has been halted.

Evergrande is now considered the most indebted property developer in the world.

This comes at a time when China's HY Real Estate Index is down 85% in 2 years.

"China's holdings of US Treasuries continue to move in a straight line lower.

Their holdings of US Treasuries have declined by $300 billion since 2021.

Currently, China holds just under $800 billion of US Treasuries, levels not seen since 2009." - TKL

Oops!

👉🏽European Central Bank asks some lenders to monitor social media for early signs of bank runs — Reuters

https://twitter.com/disclosetv/status/1750179011018309974

Hello European lenders!

The ECB tells me you’re reading these posts because you’re having trouble satisfying withdrawal demands.

Is that true, and which European bank is most at risk for that run? Or should we pull our deposits from all of your banks?

"European CBDC is the ultimate test to the European banking system where many banks have nothing to show for assets. Adopting CBDC is like asking banks to convert their cash into gold, but all their cash is long gone and exists only on their fake balance sheets."

The first rule of bank runs is you don't talk about bank runs.

(picture 4)

👉🏽The Bank of International Settlements is moving forward with the second phase of its CBDC and tokenization initiative.

Among the six programs in the initiative is Project Promissa, which aims to build a proof-of-concept platform for digital tokenized promissory notes

🎁If you have made it this far I would like to give you a little gift:

"Stranded: How Bitcoin is Saving Wasted Energy and Expanding Financial Freedom in Africa" by Alex Gladstein

This is Bitcoin, forget all the numbers go up...forget all the ETF talk, forget the halving...this is why Bitcoin:

For those who cannot see how Bitcoin can (and already is in pockets) transform the African continent's financial and energy system - this read lays it out beautifully.

Free knowledge!

Credit: I have used multiple sources!

My savings account: Bitcoin

The tool I recommend for setting up a Bitcoin savings plan: @Relai 🇨🇭 especially suited for beginners or people who want to invest in Bitcoin with an automated investment plan once a week or monthly. Hence a DCA, Dollar cost Average Strategy. Check out my tutorial post (Instagram) & video (YouTube) for more info.

⠀⠀⠀⠀

Get your Bitcoin out of exchanges. Save them on a hardware wallet, run your own node...be your own bank. Not your keys, not your coins. It's that simple.

⠀⠀⠀⠀⠀⠀⠀⠀

Do you think this post is helpful to you? If so, please share it and support my work with sats. #zap 🧡 #weeklyrecap #nostr #plebchain #BTC #Bitcoin #zap🧡 #plebchain #grownostr #stacksats #bitcoineducation #adoption

https://void.cat/d/JLzb5mLLLQwf6nTFukkowT.webp

https://void.cat/d/7qenBZTgfwQDFysE6toCj3.webp

https://void.cat/d/7nviHnjco4ro7TJZqUW6Wd.webp

Anytime!

Pictures as discussed in the latest weekly recap:

nostr:note1nsqf9ul9h3hrxz3zdsasq30hsg0mfsend6636hq958lmgfsacrestztqte

🧡🙏🏽

🧠Quote(s) of the week:

"Imagine working 9-5 for 50 years then The Fed prints 40% of the total money supply and inflates away 20 years of your work."- BTCforFreedom

"Freedom of speech becomes impossible through the incentives of manipulated money!

(regardless of who benefits from said manipulation tells you)

#Bitcoin

Stealing productivity gains (via inflation) that should flow to society in the form of lower prices is the root cause." -Jeff Booth

"In the coming bull run, just about everybody in "crypto" will take credit and revel in the price of Bitcoin. They'll try to trick you by showing you this "other" coin that will do the same thing. This is called affinity scamming, and there are a lot of people who have positioned themselves over the last 4 years to do exactly that.

Save yourself the heartache and go Bitcoin only." - Jimmy Song

🧡Bitcoin news🧡

➡️After seven weeks, Bitcoin falls below $40k and…. no one cares just keep stacking.

Now what is the reason why Bitcoin is dropping?

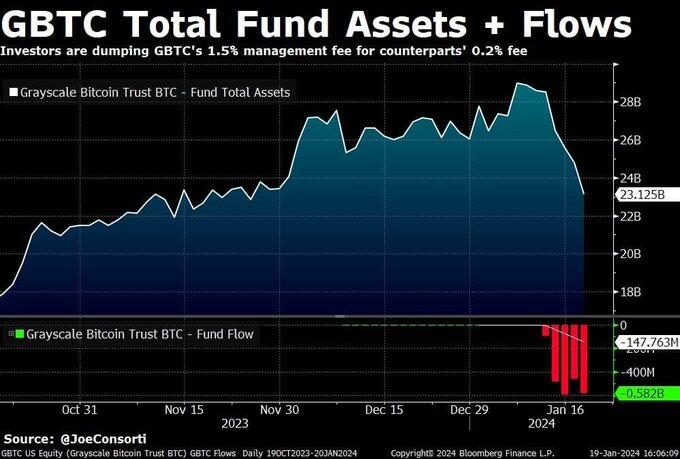

➡️According to reports from CoinDesk, it appears that up to 1/2 of the $2B in GBTC outflows were from FTX liquidating their 22 million shares.

In addition, FTX's sister hedge fund Alameda Research voluntarily drops its lawsuit against Grayscale Investments on the 22nd of january.

Ergo, blame FTX...again!

"It looks like the majority of Greyscale's (GBTC) outflows were not due to its higher fees, but rather due to a legal obligation of bankrupt FTX to liquidate its holdings.

I'll say it again. I suspect with most FTX redemptions out of the way, GBTC outflows will come to a trickle by the end of the month, retaining their kingship of the spot

Bitcoin ETF space by an enormous margin." -Oliver L. Velez

(picture 3)

➡️BlackRock & Fidelity now hold more than 64,000 Bitcoin worth ~$2.6b. They're buying $433m Bitcoin every day on average.

in total 9 Bitcoin ETFs now hold +95,000 Bitcoin worth ~$4 Billion.

Bitcoin ETFs had $17.2b in trading volume in just 6 days.

➡️Bitcoin hits new sustainable energy high of 54.5%, the highest of any global industry:

"Sustainable energy use for Bitcoin (BTC) mining reached an all-time high of 54.5% in 2023, a 3.6% increase throughout the calendar year.

The analysis, conducted by The Bitcoin ESG Forecast, compared Bitcoin’s sustainable energy mix to other industries using publicly available data over the past four years. Furthermore, the industry has made notable progress in increasing its reliance on sustainable energy sources, surpassing other global sectors."

The results indicate that Bitcoin mining currently ranks as the largest consumer of sustainable energy among subsectors. (picture 2)

➡️https://twitter.com/LNMarkets/status/1749387083620257990

LN Markets is killing it! Great volume, incredible achievement!

➡️Bitcoin has been open for 99.99% of the time over the last 15 years.

➡️In full-on dumping mode, Bitcoin miners sold over 10,000 BTC alone on January 17. It marked the biggest daily decline in miner reserves in over 12 months.

Bitcoin miner reserves are at their lowest levels since July 2021.

➡️Bitcoin Whale sells 59K $BTC, purchased 3-6 months ago at an average price of $26K. This could be anyone...profit taking by any major party such as BlackRock etc. as they speculate on the selling of GBTC. (grayscale)

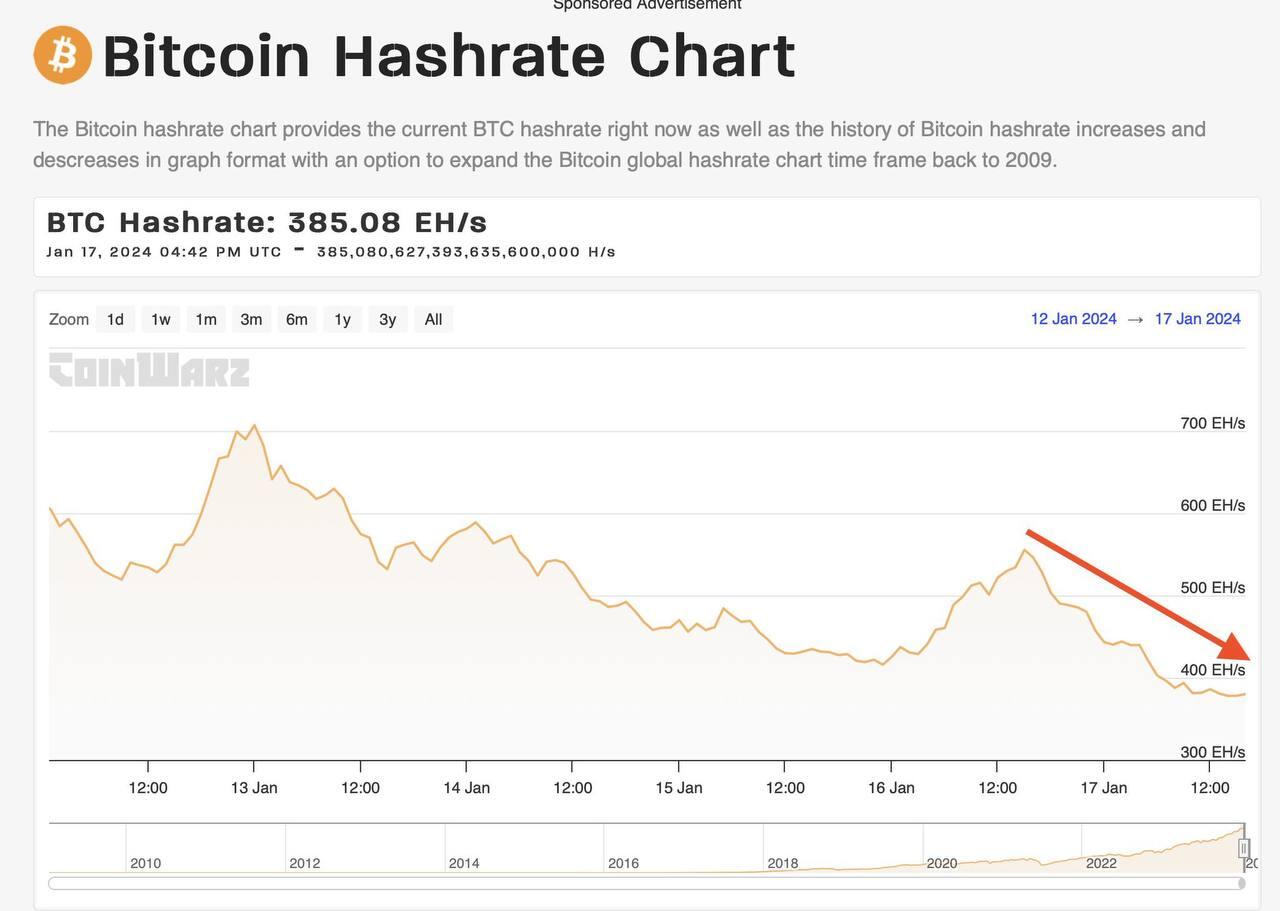

➡️Bitcoin hash rate hits an all-time high of 500 exahashes.

➡️Bitcoin network difficulty drops -3.90%, the largest negative correction since December 5, 2022, amid curtailments of Texas miners due to extreme cold conditions in the Lone Star State.

➡️ Another leak, now at Trezor. On January 17th, 2024, there was unauthorized access to their third-party support ticketing portal. The security incident has implications for customers who have interacted with Trezor Support since December 2021. Based on the ongoing investigation of the incident and the communication with the third-party service provider there is a potential that the contact details of up to 66000 users, customers who have interacted with Trezor Support since December 2021, may have been accessed.

TLDR: Of course, this can happen to everyone. But for the love of god start using Bitcoin-only hardware wallets.

Blockstream Jade

Bitbox 02 - Bitcoin only

Foundation Passport

➡️Over $24 billion worth of cryptocurrency was received by illicit addresses in 2023 accounting for 0.34% of all transaction volume,

Chainalysis has been estimated.

Now ask yourself, why do we need new AML/Money laundering rules and laws, like for example MiCAR or the new anti-crypto law by Senator Warren?

2-5% of traditional finance is estimated to be used for illicit transactions according to the UN. It's the fiat system that facilitates corruption...

➡️$2 Billion of dormant Bitcoin was moved for the first time since 2019. It had only moved once since 2013. - Arkham Intel

➡️Great tweet by Daniel Batten. "By investing in Bitcoin you support:

1. The profitability of renewable energy.

https://news.cornell.edu/stories/2023/11/bitcoin-could-support-renewable-energy-development…

2. the mitigation of methane, our #1 lever to slow climate change.

https://planb.lugano.ch/why-bitcoin-is-the-worlds-best-esg-asset/…

3. The world's least emission-intensive financial instrument.

➡️HODLers are not selling

The HODL Waves chart shows the amount of Bitcoin held for different periods. Long-term holders (see blue arrows - 1yr+ & 6mo+) have NOT sold any BTC to ETFs

(picture 1)

💸Traditional Finance / Macro:

👉🏽The S&P 500 has officially hit a new all-time high for the first time in 2 years.

All 3 major market indices are now in all-time high territory.

An all-time high in fiat terms...in BTC...oh well, just have a look at the picture.

(picture4)

The S&P 500 is now 11% higher than where it was when the Fed started hiking rates in March 2022. Serious disconnect between the traditional financial markets and the economy.

"Owning an SP500 fund is no different from holding a tech ETF.

The top 7 components are all tech companies and represent 26% of its holdings.

SPX should no longer be viewed as a diversification instrument. It’s no longer spreading risk across 500 companies to protect you."

🏦Banks:

👉🏽https://twitter.com/JoeConsorti/status/1748133433761526134

Powell & Co. are planning to FORCE all banks to utilize emergency credit so that the market can’t tell safe banks from distressed banks. For me, the above tweet and the ramifications of that FED rule are yet another sign of the upcoming (necessary event) collapse/recession. They, the FED, did a similar thing in 2007.

In the end, the banking industry is set to consolidate. (picture 5 cash banks)

🌎Macro/Geopolitics:

"The Fed's cumulative losses are nearly $140 billion now, and continuing to grow.

It doesn't really affect the Fed, but it adds to the fiscal deficit. The Fed used to be a profit source for the Treasury.

Now, its operating losses keep digging it into a hole, so no profits flow to the Treasury. The Fed has to once again turn profitable and pay back its cumulative losses before it would resume sending profits to the Treasury".- Lyn Alden (foto)

Meanwhile, the U.S. National Debt has crossed $34 trillion. That’s $102,719 for every single person in America.

👉🏽When asked what is the purpose of his trip to Davos, Javier Milei responds: "Planting the ideas of freedom in a Forum that is contaminated by the Socialist Agenda 2030 will only bring misery to the world."

"As we kick off 2024, the US has already added another ~$200 billion in Federal debt over the last 3 weeks.

This puts annual interest expense on track to hit $1.05 trillion.

To put this in perspective, annual interest expense was less than $500 billion just TWO YEARS ago.

As interest rates rise and deficit spending soars, interest expense is becoming one of our largest costs." - TKL

Ergo: Kicking the can down the road...as usual. With trillions of dollars of debt set to mature in the next 12 months, along with $2 trillion-plus of deficit spending likely for fiscal year 2024, and with the trough of the yield curve now the 5-yr UST bond at 4.04%, interest expense is likely to go much higher.

👉🏽"For 1st time in almost 30 years, China’s GDP in $ fell in 2023 to about $17.5trn, while U.S. gdp rise 6% to about $27trn. The gap widened by about $2trn. And China’s share of world GDP slipped to just under 17%. China's real GDP is now further below its pre-COVID trend than after the 2008 crisis. China will inevitably export its weak domestic demand to the rest of the world via rising current account surpluses and deflation."

China is contemplating issuing 1 trillion yuan ($139 billion) in new debt through a special sovereign bond plan, marking only the fourth such sale in 26 years

The Middle Kingdom appears to be warming up the money printer.

Talking about liquidity:

👉🏽"Money market funds just saw $182 billion of inflows in the first 2 weeks of 2024.

This is the biggest 2-week inflow ever recorded to start a year.

This brings the total assets held by money market funds up to a record $6 trillion.

Since the Fed began raising rates in March 2022, over $1.5 trillion has gone into money market funds.

Now for the trillion-dollar question.

Where does all this capital go once the Fed starts cutting rates?" - TKL

Maybe we can find the answer in the following statement:

👉🏽The top 0.1% (132,000 households) have a combined net worth of $20 trillion.

The bottom 50% (66,000,000 households) have a combined net worth of $3.6 trillion.

The wealth gap keeps widening to ever more extremes with each intervention cycle.

https://twitter.com/NorthmanTrader/status/1747257006497706458

👉🏽 https://twitter.com/DylanLeClair_/status/1748012214794006802

Bingo: Opt Out Bitcoin

The world has now access to the hardest assets in human history.

👉🏽https://twitter.com/Schuldensuehner/status/1748984398135906365

"Why Germany is rich but Germans are poor and angry. Germany’s grossly unequal distribution of wealth is contributing to the country’s malaise. The median household in Germany has just €107k of net assets, while the wealthiest 10% have at least €725k. Reconciling the Free Democrats’ anti-borrowing philosophy w/Social Democrats’ commitment to welfare spending & the Greens’ determination to promote decarbonization has led to bickering & compromises that satisfy almost nobody." - Holger Zschaepitz

🎁If you have made it this far I would like to give you a little gift:

"The focus on security and decentralization is largely what makes Bitcoin different from other cryptocurrency networks"..."Bitcoin is competing in the global marketplace of monies."

Good article for people who don't understand investing in Bitcoin:

https://www.lynalden.com/bitcoin-network-health/

Free knowledge!

Credit: I have used multiple sources!

My savings account: Bitcoin

The tool I recommend for setting up a Bitcoin savings plan: @Relai 🇨🇭 especially suited for beginners or people who want to invest in Bitcoin with an automated investment plan once a week or monthly. Hence a DCA, Dollar cost Average Strategy. Check out my tutorial post (Instagram) & video (YouTube) for more info.

⠀⠀⠀⠀

Get your Bitcoin out of exchanges. Save them on a hardware wallet, run your own node...be your own bank. Not your keys, not your coins. It's that simple.

⠀⠀⠀⠀⠀⠀⠀⠀

Do you think this post is helpful to you? If so, please share it and support my work with sats. #zap 🧡 #weeklyrecap #nostr #plebchain #BTC #Bitcoin #zap🧡 #plebchain #grownostr #stacksats #bitcoineducation #adoption

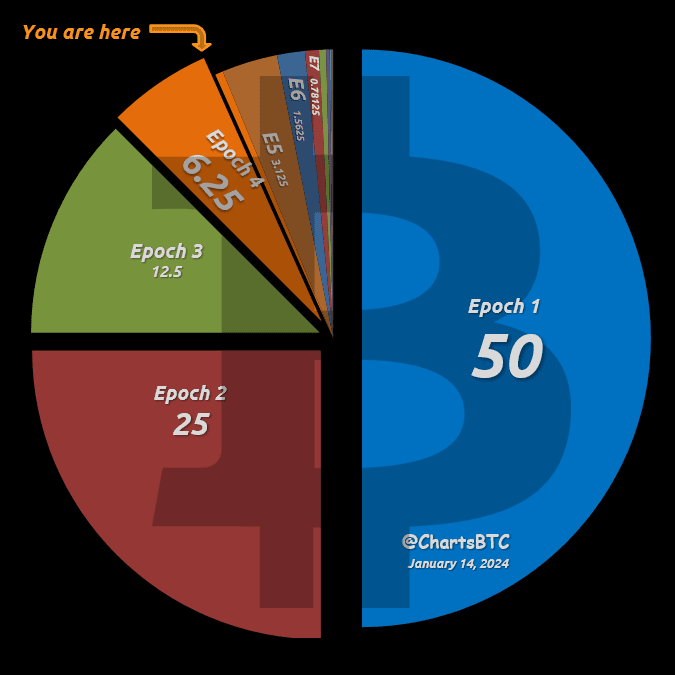

With a current block reward of 6.25BTC, 6.25% of the total Bitcoin supply will be mined in this epoch.

Post halving, the reward will be reduced to 3.125 BTC leaving 6.25% of the total Bitcoin supply left to be mined.

93.3% of all the Bitcoin has officially been mined. Only 6.7% left. It feels like 90% was just yesterday! Scarcity people! Remember from the previous halving to the next one would be the same amount of sats (6.25%) as from the next halving to the final halving in 2140. Let that sink in for a minute, especially now that the big dogs (BlackRock, Fidelity, etc.) finally recognize Bitcoin as a store of value, as a legit asset class.

“When you really sit back and process this, it seems inevitable that there will be a moment of rude awakening among the masses. You’ll probably want to own some Bitcoin before that moment comes.”

What is the halving?

The last Bitcoin halving took place on May 11, 2020, and the next bitcoin halving will likely occur in early 2024. (ETA 23.4.2024)

What is the halving? New bitcoins enter circulation as block rewards, produced by the efforts of “miners” who use expensive electronic equipment to earn, or “mine,” them. Roughly every four years, every 210,000 blocks mined, the total number of bitcoin that miners can potentially win is halved.

The process will end once the number of bitcoin in circulation reaches 21 million. A popular estimate is that it will occur sometime near the year 2140.

Abundant money leads to asset scarcity.

Scarce money leads to asset abundance.

Bitcoin🧡

Credit picture: ChartsBTC

Study, learn, hodl, decouple.

#bitcoin 🧡

▃▃▃▃▃▃▃▃▃▃▃▃▃▃▃

My savings account: Bitcoin

The tool I recommend for setting up a Bitcoin savings plan: @Relai 🇨🇭 🇨🇭 especially suited for beginners or people who want to invest in Bitcoin with an automated investment plan once a week or monthly. Hence a DCA, Dollar cost Average Strategy. Check out my tutorial post (Instagram) & video (YouTube) for more info.

⠀⠀⠀⠀

Get your Bitcoin out of exchanges. Save them on a hardware wallet, run your own node...be your own bank. Not your keys, not your coins. It’s that simple.🎯

⠀⠀⠀⠀⠀⠀⠀⠀

Do you think this post is helpful to you? If so, please share it and support my work with sats. 🧡

Felipe - BitcoinFriday

#zap 🧡 #nostr #BTC #Bitcoin #plebchain #grownostr #stacksats #bitcoineducation #adoption #Bitcoinmining #halving

Bitcoin hashrate plunges, with over a 25% drop from 530 Eh/s (7DMA) to 385 Eh/s.

This is primarily due to miners in Texas powering down to aid the power grid during frigid temperatures.

"Bitcoin hashrate has declined as much as 25% over the past three days as miner operators in Texas curtail power to strengthen the local grid amid a cold outbreak.

Notably, Foundry USA Pool has been the main source of the decline, witnessing its miner customers unplug as much as 75 EH/s of hashrate mainly due to curtailment activities in Texas.

After China’s crackdown on bitcoin mining in 2021, Texas has emerged as the new global hub of bitcoin mining. As of September, more than 28% of the hashrate connected to Foundry’s pool was in Texas."

Texas is home to roughly 13% of the global hashrate.

Sources:

https://theminermag.com/news/2024-01-16/bitcoin-hashrate-drop-texas-miner-curtail-grid/

https://miningpoolstats.stream/bitcoin

I just wrote this post whilst my S9 heater made livingroom 🔥⚡️

Livingroom warm ✅

Mining sats ✅

Opt out: Bitcoin🧡

Study, learn, hodl, decouple.

#bitcoin 🧡

▃▃▃▃▃▃▃▃▃▃▃▃▃▃▃

My savings account: Bitcoin

The tool I recommend for setting up a Bitcoin savings plan: @Relai 🇨🇭 🇨🇭 especially suited for beginners or people who want to invest in Bitcoin with an automated investment plan once a week or monthly. Hence a DCA, Dollar cost Average Strategy. Check out my tutorial post (Instagram) & video (YouTube) for more info.

⠀⠀⠀⠀

Get your Bitcoin out of exchanges. Save them on a hardware wallet, run your own node...be your own bank. Not your keys, not your coins. It’s that simple.🎯

⠀⠀⠀⠀⠀⠀⠀⠀

Do you think this post is helpful to you? If so, please share it and support my work with sats. 🧡

Felipe - BitcoinFriday

#zap 🧡 #nostr #BTC #Bitcoin #plebchain #grownostr #stacksats #bitcoineducation #adoption #Bitcoinmining #S9heater

Massive amount of Bitcoin moves for first time in 5 years…👀

$2 Billion of dormant Bitcoin.

Study, learn, hodl, decouple.

#bitcoin 🧡

▃▃▃▃▃▃▃▃▃▃▃▃▃▃▃

My savings account: Bitcoin

The tool I recommend for setting up a Bitcoin savings plan: @Relai 🇨🇭 🇨🇭 especially suited for beginners or people who want to invest in Bitcoin with an automated investment plan once a week or monthly. Hence a DCA, Dollar cost Average Strategy. Check out my tutorial post (Instagram) & video (YouTube) for more info.

⠀⠀⠀⠀

Get your Bitcoin out of exchanges. Save them on a hardware wallet, run your own node...be your own bank. Not your keys, not your coins. It’s that simple.🎯

⠀⠀⠀⠀⠀⠀⠀⠀

Do you think this post is helpful to you? If so, please share it and support my work with sats. 🧡

Felipe - BitcoinFriday

#zap 🧡 #nostr #BTC #Bitcoin #plebchain #grownostr #stacksats #bitcoineducation #adoption

Zeker heb ik tips! stuur me anders maar even een DM.

🧠Quote(s) of the week:

"The 2020s decade is shaping up to challenge a lot of worldviews on money and energy.

Like, if someone is wrong in their view about the properties of money or energy, the consequences for that will be big. This is true both on the personal level and national level.

During times of abundance, worldviews don’t get tested very strongly and people are shielded from the consequences of being inaccurate.

It’s during times of scarcity that reality reasserts itself and filters out the workable from the unworkable worldviews.

To avoid being caught offsides as an investor, policymaker, or just in your own life, researching money and energy, and frequently re-assessing your own beliefs and understandings on those subjects, will be important.

There's always more to learn." - Lyn Alden

🧡Bitcoin news🧡

See picture ECB down below.

Schnabel is categorically wrong. If she thinks Bitcoin doesn't fulfill the characteristics of money, either she doesn't understand Bitcoin, or she doesn't understand money, or, and that's even worse, she doesn't understand either one of them.

The EURO will lose purchasing power against Bitcoin. I love how based community notes are and how the ECB got slapped in the face with this note for lying about their CBCD. Bitcoin is people's money!

➡️The following tweet by Peter Mccormack can be placed on every EU - global regulations tyranny:

"State of UK regulations -

If you want to buy Bitcoin you have to answer a massive list of questions on any exchange you want to use and potentially be rejected.

If you want to bet on any sports, you can download hundreds of apps and start betting immediately."

Opt out and buy your Bitcoin on platforms like Relai, Peach Bitcoin, 21 Bitcoinapp, Bisq, and Robosats.

➡️Last week I already shared some staggering stats regarding Bitcoin mining. If you haven't read last week's Weekly Recap, I highly recommend the Bitcoin segment of that blog post. More on Bitcoin mining:

"61.5% of all Bitcoin mining companies use sustainable energy.

Overall sustainability stat is lower (still >50%). Even so, this is a startling statistic. I've not seen numbers this high in any industry." - Daniel Batten

(foto)

➡️"New all-time high: off-grid Bitcoin mining reaches 30% of total hashrate.

Cambridge does not measure off-grid mining, resulting in an underestimate of total Bitcoin sustainable energy use.

The BEEST model measures both on-grid and off-grid mining" Daniel Batten

Source: http://Batcoinz.com/BEEST

➡️"Bitcoin emission intensity (emissions per unit of power) is now 269.6 g/kWh.

Emission intensity comparison (g/kWh)

Bitcoin: 269.6

Banking services/fiat: 464

Gold: 679

TLDR: increasing evidence Bitcoin is not only the soundest money, but it's also the greenest" - Daniel Batten

➡️ "only needs to rise 13% to $52,868 for MicroStrategy's holdings to reach a valuation of $10 billion" - BitcoinNews

➡️ Bitcoin setting new ALL-TIME HIGHS in:

- Turkey

- Argentina

- Egypt

- Lebanon

➡️Now for the people who want to know more information on the Bitcoin ETF, read the following bit. I am not going to share the shitshow at the SEC about how their Twitter account got hacked. Nor am I going to share the news that the ETFs went live. By now everyone has read or heard that.

To sum it up:

- SEC fumbles the announcement, validating government incompetence.

- Money managers (Vanguard, Merrill Lynch) blocking people from buying ETFs, proving that trusting your money with trusted 3rd parties is a risk.

"Vanguard issues a statement: “Spot Bitcoin ETFs will not be available for purchase on the Vanguard platform. Our perspective is that these products do not align with our offer focused on asset classes such as equities, bonds, and cash, which Vanguard views as the building blocks of a well-balanced, long-term investment portfolio.

Vanguard CEO, Tim Buckley adds on why he doesn’t believe Bitcoin should be in his client’s portfolios.

- No intrinsic value

- No cash flow

- No long-term potential"

Imagine steering clients away from Bitcoin.

"The Vanguard Group owns 8.2% of MicroStrategy, the 2nd largest of all holders. Somehow they find issues with Bitcoin ETFs.

What this tells you is worse than Vanguard not liking Bitcoin. It tells you that they are either liars, charlatans who haven't done their research, or both" - Gabor Gurbacs

Oh by the way one more stat on Vanguard. They run a $75bil ETF with 30% exposure to China, but you’re not allowed to invest in spot bitcoin ETF. Fuck 'em.

Check out the following clip - Michael Saylor on when Merrill Lynch refused to help him buy Bitcoin:

https://twitter.com/TheBTCTherapist/status/1746566835418321097

Meanwhile, Fidelity is LIGHT YEARS ahead of Vanguard and Merrill Lynch.

On the 12th of January, they called existing customers who were already exposed to Bitcoin-related securities (like mining stocks, etc.) to address any questions about the Bitcoin ETFs. That is how you treat customers.

Let's dive into some stats and the ramifications of that.

➡️Cathie Wood says "We are talking to state pension funds and state treasurers about investing in the Bitcoin ETF"

➡️BlackRock CEO says Bitcoin is "no different than what gold represented for thousands of years. It is an asset class that protects you."

➡️On Saturday after two days in the books, the nine ETFs took in +$1.4b in new cash, overwhelming $GBTC's -$579m of outflows for a net total of +$819m. $IBITnow leading the pack with/ half a bil, Fidelity is a close second though. The newborns' $3.6b in trading volume on 500k individual trades (1.2m incl $GBTC) is very impressive as is the 20bp avg prem.

https://twitter.com/BitcoinNewsCom/status/1746943732736311536

➡️Blackrock's Bitcoin holding reaches 11,500 BTC in ETF's first 2 days of trading