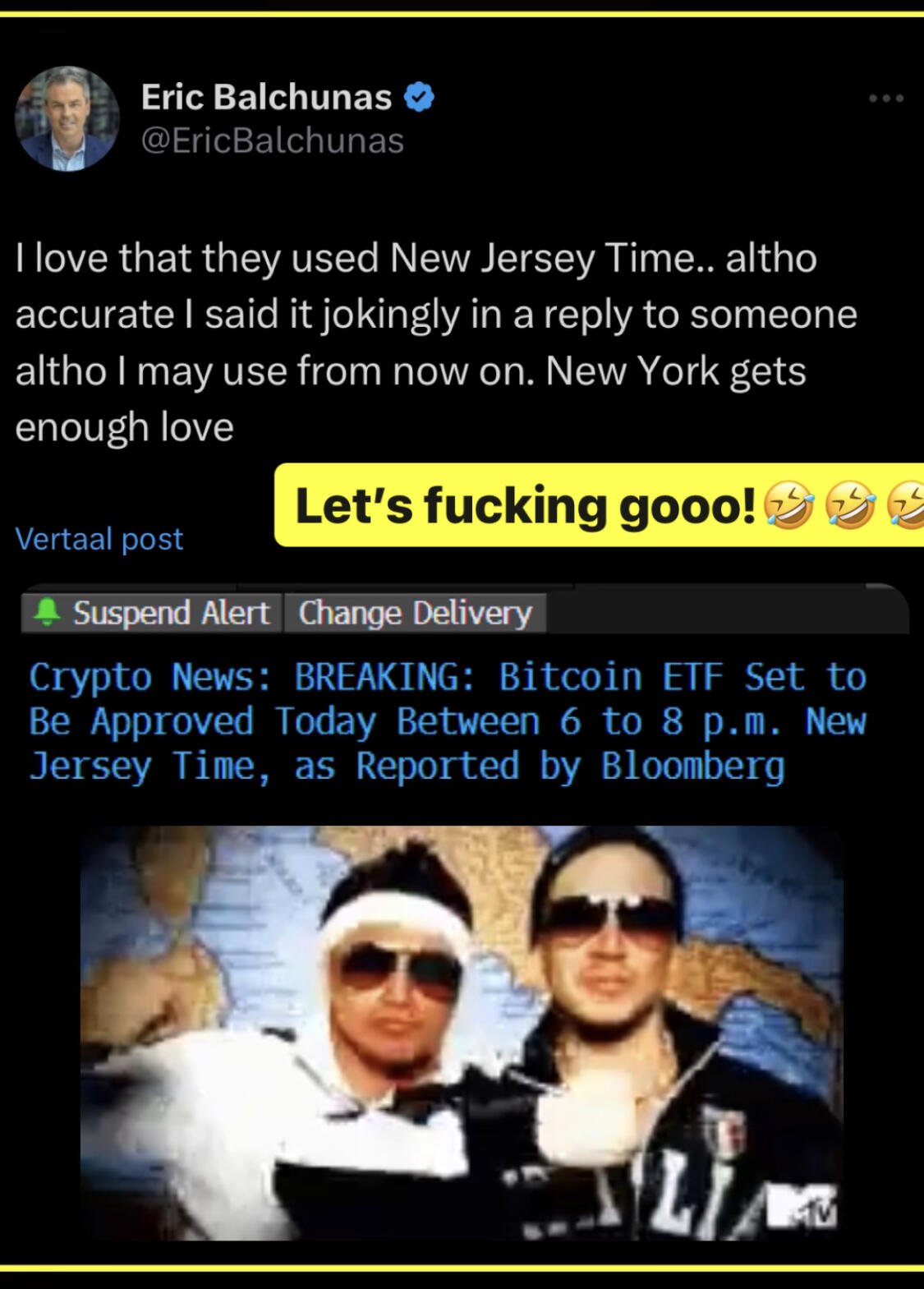

New Jerseyyy Time it is!

Fuckers!

#zap 🧡 #nostr #BTC #Bitcoin #plebchain #grownostr #stacksats #bitcoineducation #adoption #SEC

Fuckers!🤣🤣

Opt out: Bitcoin🧡

Study, learn, hodl, decouple.

#bitcoin 🧡

▃▃▃▃▃▃▃▃▃▃▃▃▃▃▃

My savings account: Bitcoin

The tool I recommend for setting up a Bitcoin savings plan: @Relai 🇨🇭 🇨🇭 especially suited for beginners or people who want to invest in Bitcoin with an automated investment plan once a week or monthly. Hence a DCA, Dollar cost Average Strategy. Check out my tutorial post (Instagram) & video (YouTube) for more info.

⠀⠀⠀⠀

Get your Bitcoin out of exchanges. Save them on a hardware wallet, run your own node...be your own bank. Not your keys, not your coins. It’s that simple.🎯

⠀⠀⠀⠀⠀⠀⠀⠀

Do you think this post is helpful to you? If so, please share it and support my work with sats. 🧡

Felipe - BitcoinFriday

#zap 🧡 #nostr #BTC #Bitcoin #plebchain #grownostr #stacksats #bitcoineducation #adoption #SEC

💀🤣🤣🤣 this is hilarious!

Study, learn, hodl, decouple.

#bitcoin 🧡

▃▃▃▃▃▃▃▃▃▃▃▃▃▃▃

Felipe - BitcoinFriday

#zap 🧡 #nostr #BTC #Bitcoin #plebchain #grownostr #stacksats #bitcoineducation #adoption #SEC

Awesome job, sir!🎯

Fuckers!

Opt out: Bitcoin🧡

Study, learn, hodl, decouple.

#bitcoin 🧡

▃▃▃▃▃▃▃▃▃▃▃▃▃▃▃

My savings account: Bitcoin

The tool I recommend for setting up a Bitcoin savings plan: @Relai 🇨🇭 🇨🇭 especially suited for beginners or people who want to invest in Bitcoin with an automated investment plan once a week or monthly. Hence a DCA, Dollar cost Average Strategy. Check out my tutorial post (Instagram) & video (YouTube) for more info.

⠀⠀⠀⠀

Get your Bitcoin out of exchanges. Save them on a hardware wallet, run your own node...be your own bank. Not your keys, not your coins. It’s that simple.🎯

⠀⠀⠀⠀⠀⠀⠀⠀

Do you think this post is helpful to you? If so, please share it and support my work with sats. 🧡

Felipe - BitcoinFriday

#zap 🧡 #nostr #BTC #Bitcoin #plebchain #grownostr #stacksats #bitcoineducation #adoption #SEC

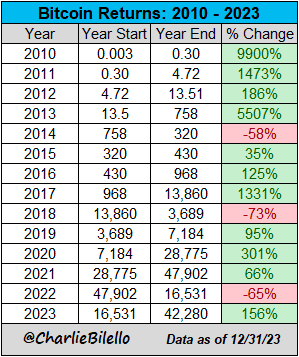

Bitcoin has only been above its current price for 3.83% of the time it's existed.

I have no feeling, I am numb.l regarding the price.

LFG!🧡

Opt out: Bitcoin🧡

Study, learn, hodl, decouple.

#bitcoin 🧡

▃▃▃▃▃▃▃▃▃▃▃▃▃▃▃

My savings account: Bitcoin

The tool I recommend for setting up a Bitcoin savings plan: @Relai 🇨🇭 🇨🇭 especially suited for beginners or people who want to invest in Bitcoin with an automated investment plan once a week or monthly. Hence a DCA, Dollar cost Average Strategy. Check out my tutorial post (Instagram) & video (YouTube) for more info.

⠀⠀⠀⠀

Get your Bitcoin out of exchanges. Save them on a hardware wallet, run your own node...be your own bank. Not your keys, not your coins. It’s that simple.🎯

⠀⠀⠀⠀⠀⠀⠀⠀

Do you think this post is helpful to you? If so, please share it and support my work with sats. 🧡

Felipe - BitcoinFriday

#zap 🧡 #nostr #BTC #Bitcoin #plebchain #grownostr #stacksats #bitcoineducation #adoption

🧠Quote(s) of the week:

"Events in 2024 with probability %:

- Spot Bitcoin ETF 10th of Jan (90%)

- Rate cuts in March (75%)

- Bitcoin Halving in April (100%)

- QE by the Fed second half of 2024 (90%)" -BTCforFreedom

"Wall Street thinks it will change Bitcoin but it will be Bitcoin that will change Wall Street." - BitVolt

🧡Bitcoin news🧡

➡️ I quote Daniel Batten: "Another first: a well-respected sustainability magazine just published an article with the headline

"In an unexpected twist,

Bitcoin mining could help wind and solar development"

It takes some time to get it. But when you commit to taking the time, you will finally realize that Bitcoin functions as an "economic battery" and Bitcoin mining will improve the economics of renewables. Take the time. Gradually, then suddenly!

read the article here:

"A new analysis demonstrates how Bitcoin mining could ease financial stresses in the early phases of renewable energy deployment."

➡️ Another example of how the narrative has quickly shifted.

The author of the following article mentioned to Daniel Batten that this was the most popular post on Coinpost Global last year.

https://medium.com/@coinpost.gb/bitcoin-is-crucial-climate-tech-btp-ep-1-recap-854d3ebbe573…

And this was the most watched talk from Plan₿

https://planb.lugano.ch/why-bitcoin-is-the-worlds-best-esg-asset/…

Now let's connect that with the Bitcoin ETF...are you ready?

➡️ Bitcoin ETF: 63 million boomer brokerage accounts with 2X margin are about to gain easy access to spot Bitcoin price exposure.

➡️ According to PwC, 30% of the $23 Trillion in ESG Funds ($ 6.9 trillion) is struggling to find a home.

This French ruling against fossil fuels in ESG funds will make that harder. Bitcoin has never looked so ripe to fill the gap for sophisticated ESG investors.

Implication: Bitcoin & ESG is often the most popular Bitcoin topic for pre-coiners

Today we learned that Blackrock was cutting their ESG division, but staffing their Bitcoin division.

Remember:

ESG = force behavior

Bitcoin = incentive behavior

Bitcoin will be the trend, it is inevitable.

Regarding the Bitcoin ETF, I can be very clear.

1. If you understand Bitcoin a bit and have a low time preference you hope the SEC rejects the ETF this week so you can stack more sats. People with high time preferences hope they approve it. Know the difference!

2. I really don't care what will happen. I’m not looking forward to buying Bitcoin at all-time highs this year but, that’s exactly what’s going to happen. "I’ll be buying at the top forever”

3. If you own a spot Bitcoin ETF, you don't hold Bitcoin.

extra info regarding point 2:

But Felipe I don't want to buy the top...

If you bought the top of 2013 you would have 3840% profit.

If you bought the top of 2017 you would have 140% profit.

Soon the 2022 top purchases will still be in good profit.

If you want to trade your Bitcoin, fine, just know that HODLing Bitcoin isn't a bad thing. It's all about perspective.

https://twitter.com/VailshireCap/status/1742239078043541944

extra info on point 3:

"Bitcoin vs Bitcoin ETF:

Bitcoin:

- Decentralized

- Secure

- Permissionless

- Money

Bitcoin ETF

- Decentralized

- Secure

- Permissionless

- Money

Choose wisely."

Now for the people who want to know more information on the Bitcoin ETF, read the following bit:

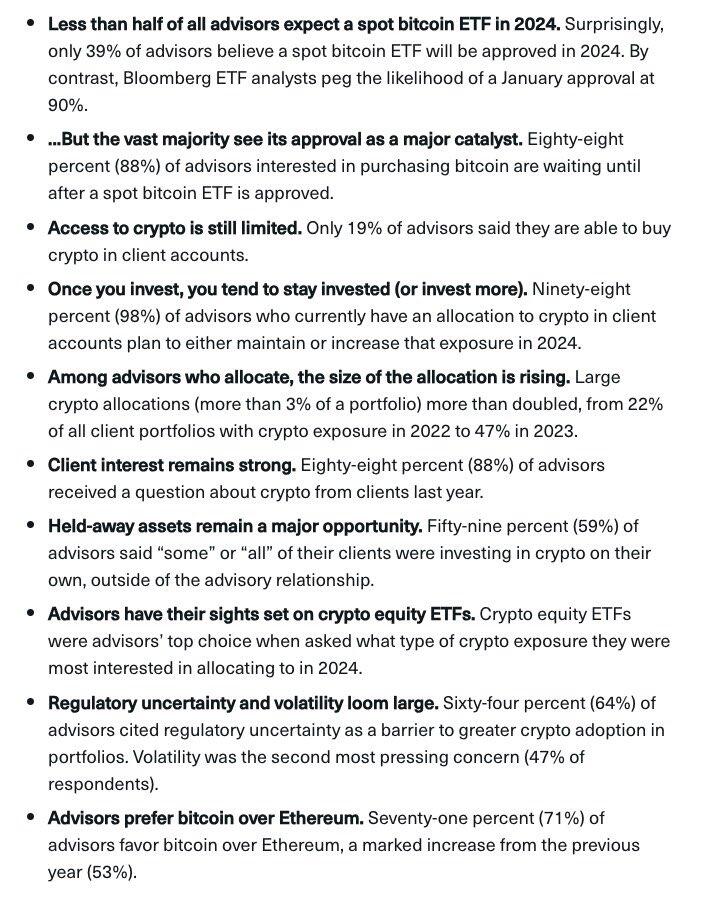

➡️ Let's start with a survey conducted by BitWise:

source: https://bitwiseinvestments.com/crypto-market-insights/the-bitwise-vettafi-2024-benchmark-survey

- Only 39% of financial advisors believe a spot bitcoin ETF will be approved in 2024.

- 88% of said advisors interested in purchasing Bitcoin are waiting until after a spot ETF is approved.

- Only 19% said they are able to currently buy in client accounts.

- 71% of advisors favor #bitcoin over Ethereum. 29% should not be giving out advice.

The above makes me wonder that we are still early and it is still early to get into Bitcoin. Just stating the obvious, the approval itself won't change that face.

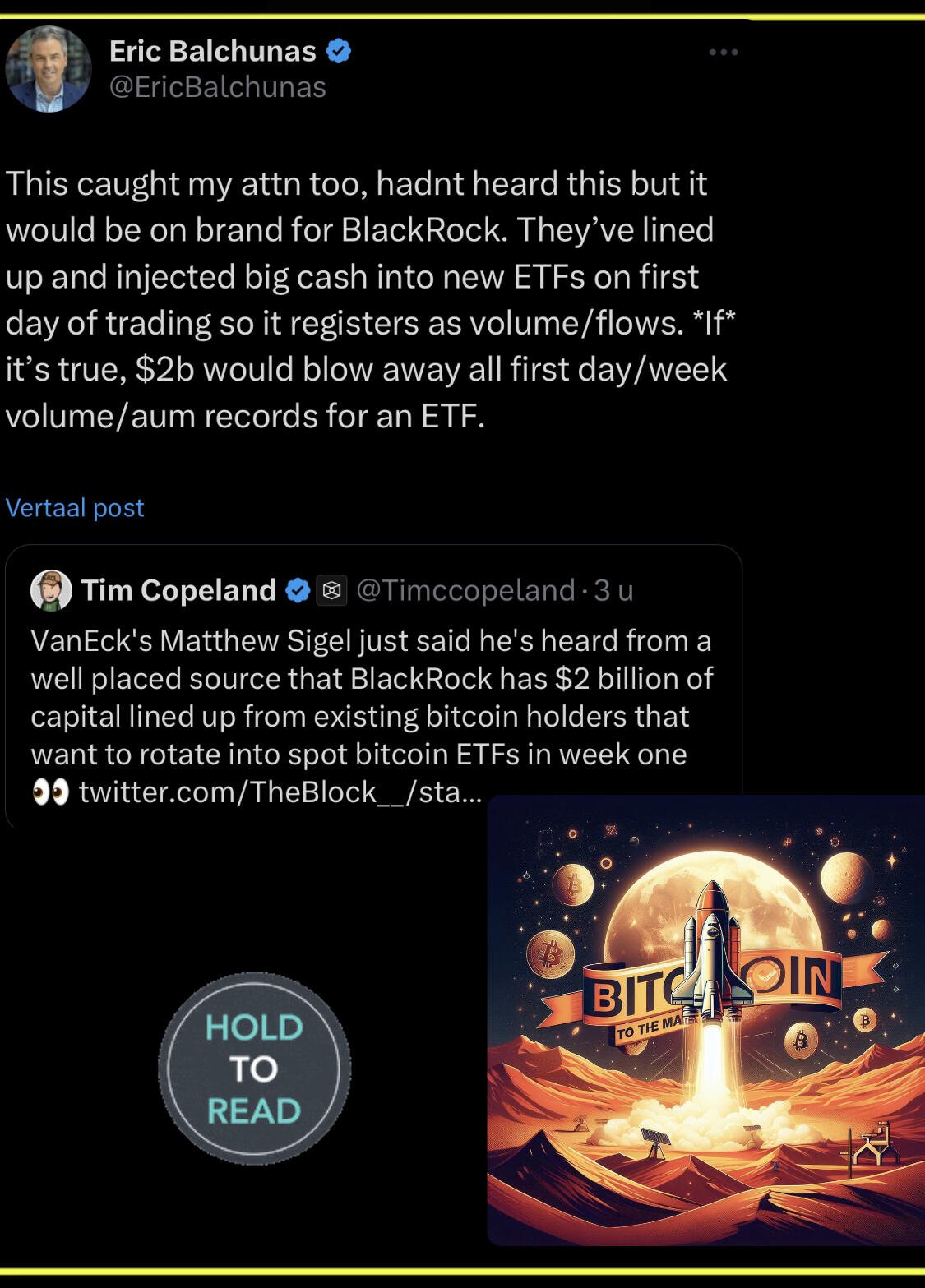

➡️ BlackRock sources say the SEC will take until the end of this week to approve Bitcoin ETFs - Fox Business

➡️ https://twitter.com/BitcoinNewsCom/status/1742998017454555438

If I am right Fidelity is the only ETF applicant in which you can self custody of your Bitcoin.

➡️The fight for customers has started...

Today Bitcoin ETF applicants filled in last-minute amendments to lower their fees

BlackRock and ARK have slashed their Bitcoin ETF fees.

ARK

- down from 0.80% to 0.25%

BlackRock

- 0.20% for the first 12 months, or first $5 billion AUM.

https://twitter.com/CaitlinLong_/status/1744336024845578539

Please do yourself a favor and read Caitlin's tweets, all of them. And do understand this all smells like rehypothecation baby. Remember Celsius? Remember FTX?

➡️Now what will happen with Bitcoin price when a wall of money hits a scarce and illiquid asset like Bitcoin?

https://twitter.com/Capital15C/status/1743899674841378862

Today multinational bank Standard Chartered calling for $50b-$100b of inflows into spot Bitcoin ETFs in 2024. To give you some context that is like the equivalent of 10 more MicroStrategy's / Michael Saylor's entering the market.

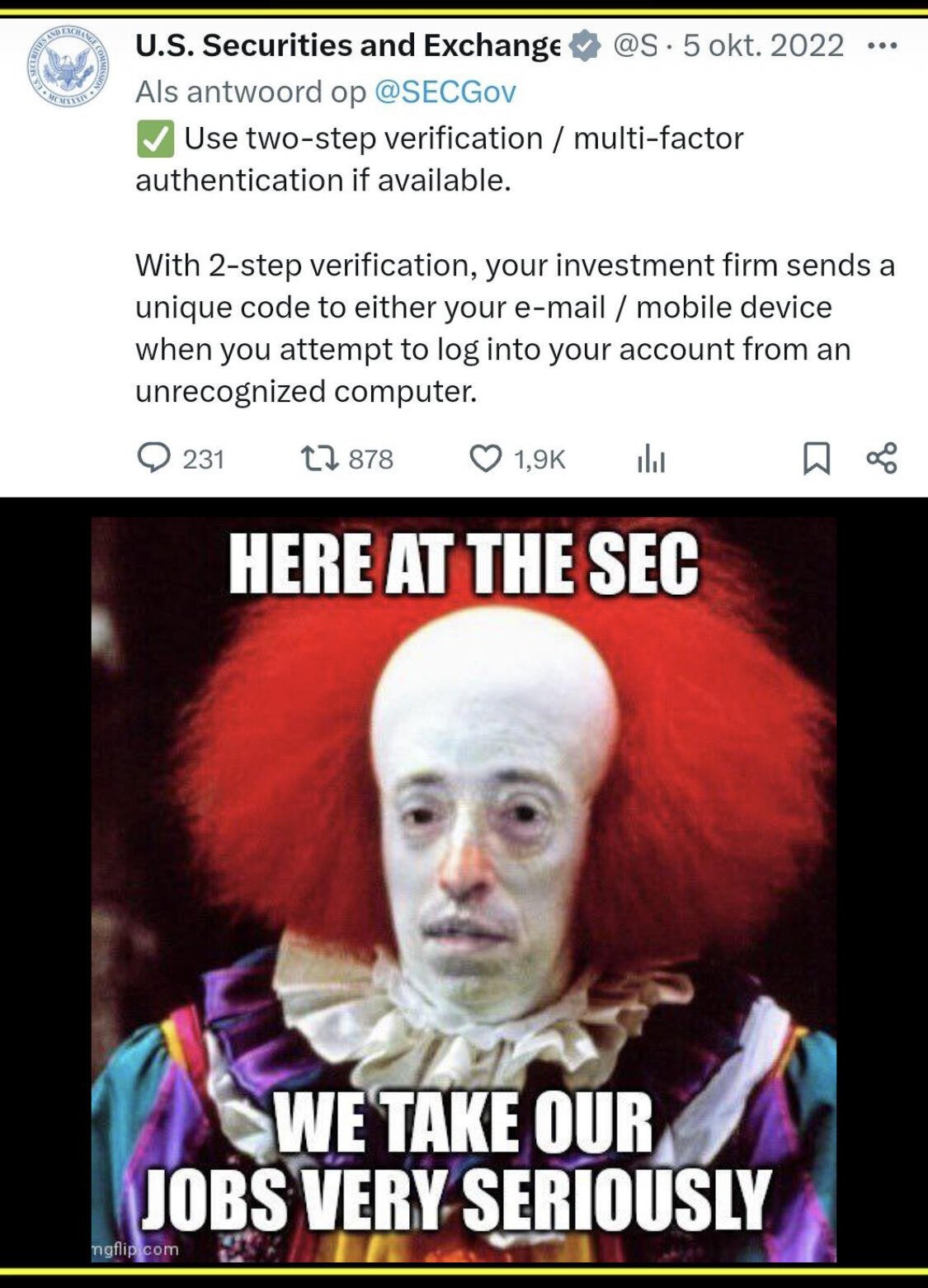

We know the Bitcoin ETF is inevitable. When even the SEC is releasing statements & warning investors not to "FOMO" into digital assets, you know this thing can't be stopped. By the way, the SEC are just freaking morons by warning people not to FOMO into digital assets...by doing that the opposite will happen. People will FOMO with a vengeance into the Bitcoin ETFs (unfortunately).

I fully subscribe to the following statement made by BitPaine:

https://twitter.com/BitPaine/status/1743250516417851864

Funny how the narrative is shifting on Bitcoin mining, Bitcoin ESG, etc.

The puppets of the mainstream media are doing their part:

On the 6th of January the Financial Times, perhaps the most 'authoritative' financial news publication in the UK, published a bullish article on Bitcoin. https://www.ft.com/content/59bb430b-a5b1-4469-b05a-482b951109a2

"There is no bigger investment story right now. Google searches for “bitcoin ETF” have tripled over the past week."

"I would be mad to miss out."

This is the Number 1 European financial news source giving readers the green light to buy into the ETF. Which will start trading this week.

The author pushes back on a lot of the FUD in giving his reasons for buying into the Bitcoin ETF when it is eventually launched:

- volatility

- risk

- no income

- hard to value

- speculative

- intangible

Imagine how far we have come that FT is orange-pilled.

➡️ Bitcoin has been approved as a unit of account in the free private city jurisdiction of Próspera in Honduras. This essentially validates Bitcoin’s legitimacy and its acceptance in commercial, tax, and financial dealings in the zone

https://twitter.com/duczko/status/1743848879932805510

➡️Monthly Bitcoin miner revenue set a new all-time high in December at $320 million

➡️Marathon sets a record Bitcoin duction of 1,853 Bitcoin in December, taking the total 2023 production to 12,852. Marathon holds currently over 15K Bitcoin.

Talking about Miners:

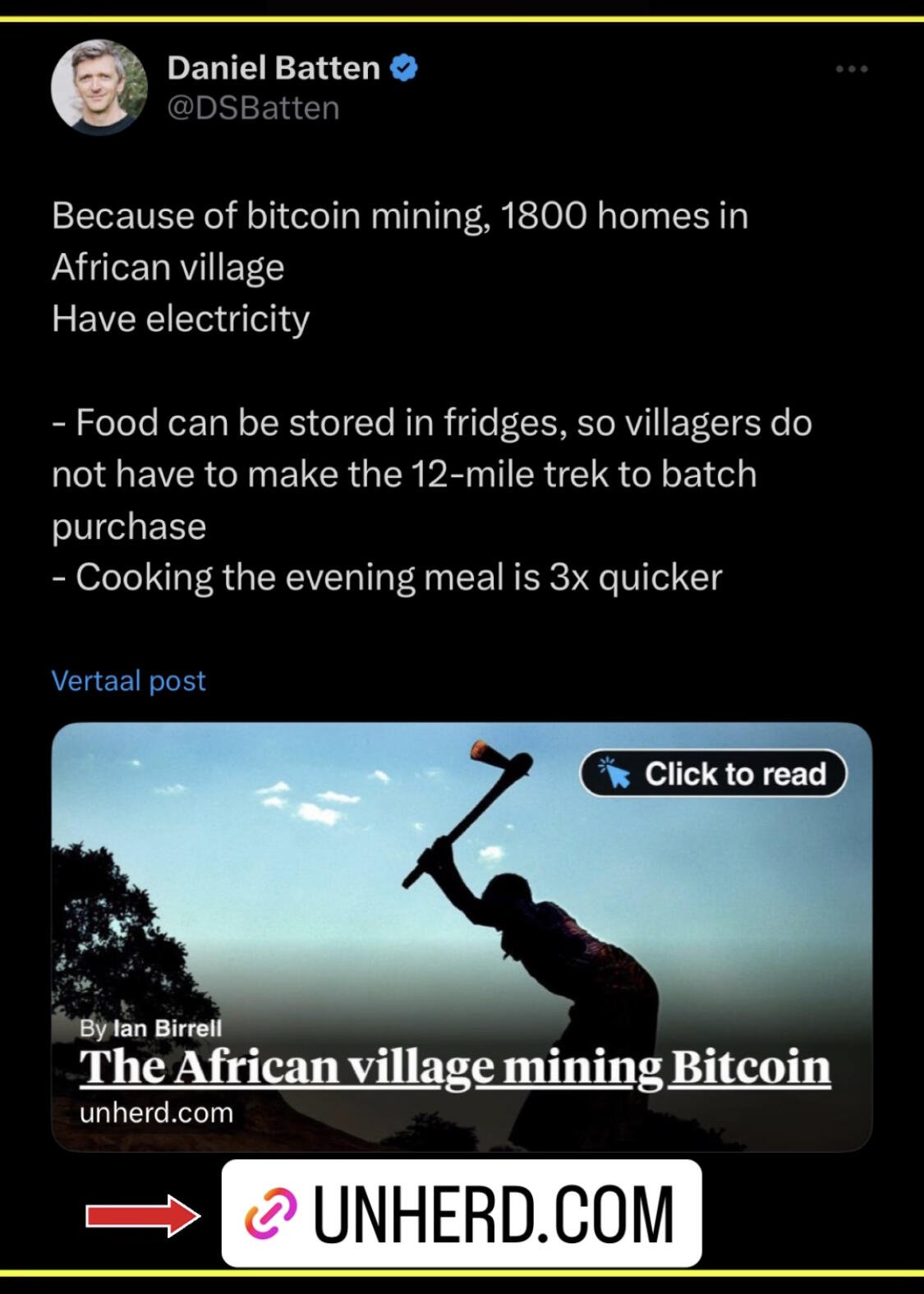

➡️ Because of Bitcoin mining, 1800 homes in this (read the article) African village Bondo have electricity:

- Food can be stored in fridges, so villagers do not have to make the 12-mile trek to batch purchase

- Cooking the evening meal is 3x quicker

“Yet the big surprise in Bondo is not simply the supply of energy to such an isolated community, in a country where only one in eight citizens has access to grid electricity and on a continent where almost half the 1.2 billion population still lack this life-changing supply. The real eye-opener is the stack of 32 computers inside the concrete pump shed. This innovative mini-grid — located more than two hours from Malawi’s second city of Blantyre along bumpy roads and tracks that can become impassable in a torrential downpour — is mining Bitcoin to fund its operation.”

“Bitcoin has also become a helpful tool for activists and journalists in dictatorships since it makes it far harder to track funds.”

Bitcoin is financial inclusion, Bitcoin is financial empowerment!

Full article: https://unherd.com/2024/01/the-african-village-mining-bitcoin/

➡️ https://twitter.com/olvelez007/status/1741998751697289588

➡️The #17 largest Bitcoin holder bought 1,500 Bitcoin on the fourth of January for $65 million.

➡️ https://twitter.com/thepowerfulHRV/status/1743008302231875874/photo/1

It’s only a matter of time until most companies adopt this strategy. For now...MicroStrategy is sitting on some $4B in profits. Talk about C O N V I C T I O N

(picture 3)

➡️ 76% of Bitcoin supply is held by Long-Term HODLers - ARK Invest

➡️ "In countries where those in power weaponize the financial system, Bitcoin offers a way out to retain control over one's financial destiny" - Forbes

➡️The number of up-to-date merchants accepting BTC cataloged by @btcmap increased 174% in 2023. (picture 4)

➡️ Japanese e-commerce giant Mercari to accept Bitcoin payments. It has +20m monthly customers...

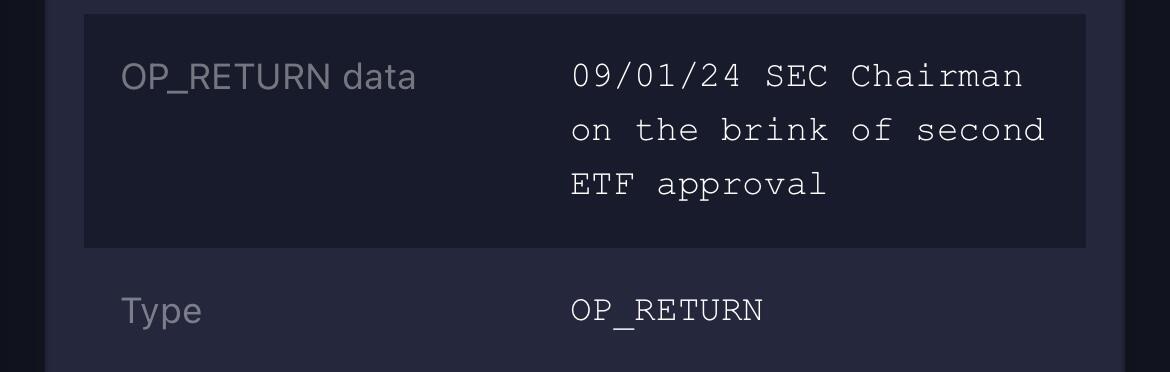

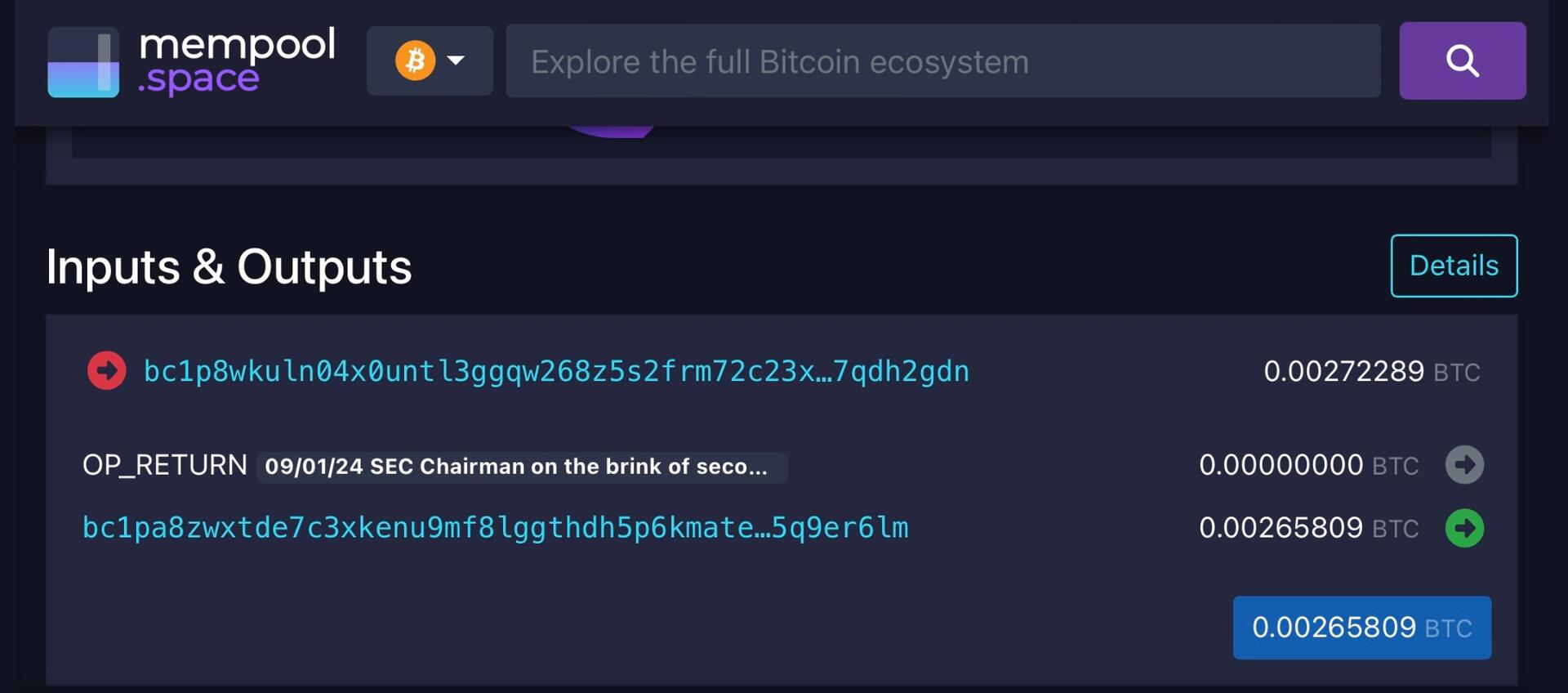

➡️On the 3rd of January, 15 years ago Bitcoin went online!

Bitcoin Genesis Block Day! This block is unspendable. Satoshi also waited 6 days before mining block #2 so others had time to join the network.

Now that Bitcoin has existed for 15 years! Lindy effect says that Bitcoin would at least exist for another 15 years.

January 3, 2009. Satoshi undermines block 0 on a difficulty 1 CPU and incorporates into the Genesis Block hexadecimal code base the headline of that day's Times "The Times 03/Jan/2009 Chancellor on the brink of second bailout for banks". The bank bailout plan ‘cause of the subprime mortgage crisis in the TGFC.

The Bitcoin close on its 15th anniversary was its second-highest birthday close in history.

➡️ Last item on the Bitcoin segment. Please do not forget that Bitcoin is the 9th most valuable asset in the world. In less than 15 years, it surpassed 7,963 other assets to accomplish this. By the end of 2025, I suspect it to be in the top five.

💸Traditional Finance / Macro:

Wealth concentration. Just simple, raw data:

https://twitter.com/LynAldenContact/status/1741960890134475090

While Wall Street celebrates, Main Street mourns.

To make it even worse I will quote Aaron Layman:

"The part Lyn left out is that the top 1% accounted for 53.9% of this wealth coming out of the pandemic, a record high. The gap between the middle class and the top 1% has grown wider over the past decade.

This is the essence of the Cantillon Effect in the Fed's trickle-down wealth inequality machine. It's also why you see several Fed apologists among the Fintwit ecosphere.

To put things in context, the Federal Reserve is still in cover-up mode when it comes to the self-dealing and trading by some of its former members who are part of that 1% (or 0.1%) club.

Congress continues to ignore the self-dealing by many of its members as they front-run legislation and line their own pockets."

bingo!

🏦Banks:

👉🏽"The Fed's BTFP emergency loan facility reached $141.2 billion in outstanding loans this week. It is up almost $30 billion in a month.

Borrowing from BTFP is accelerating as banks look to secure a sweetheart loan before the facility restricts itself or shuts off on March 11th."

As mentioned in one of my previous Weekly Recaps:

"Regulatory Arbitrage. Arbitraging the Fed itself. No risk. Absolute clown show. Classic bank mindset - making money at the expense of the public.

source: https://archive.ph/xhUg5"

(picture 5)

🌎Macro/Geopolitics:

👉🏽"10 of the last 11 months have seen downward revisions in their jobs number, according to Zerohedge.

The November 2023 jobs number was revised lower, from 199,000 to 173,000.

This means that the November jobs report actually missed expectations of 180,000.

The October jobs report was also revised lower from 150,000 to 105,000.

This means that the October jobs report was an even bigger miss than expected.

For September, the jobs number was revised lower by 74,000 jobs." - TKL

Either they don't fully understand/comprehend their own data (by they I mean the government). That itself is concerning but not surprising OR the establishment is trying to bury the data so it doesn’t destroy their narrative that the economy is strong.

👉🏽 https://twitter.com/jameslavish/status/1742982672492974376

The perfect analogy by James Lavish.

👉🏽 https://twitter.com/KobeissiLetter/status/1744058890029813829

"4 years ago, banks were sitting on ~$100 billion of unrealized gains.

Now, they are sitting on ~$700 billion of unrealized losses.

The question becomes, what happens when the BTFP expires in just a few months?"- TKL

👉🏽https://twitter.com/jsblokland/status/1741906043720868090

This means that not only Germany should be worried, but also Europe.

Who knew that shutting down your nuclear reactors and trying to run the green agenda to run your economy on intermittent wind and solar would be a bad idea?

One word: Deindustrialization

The following bit is from the Weekly Recap on the 4th of December 2023:

"Deutsche Bundesbank cuts German 2024 GDP forecast by a whopping 0.5ppts to -0.2% due to the budget crisis following the Constitutional Court hearing.

"The state pension is looking increasingly shaky. The federal govt now has to contribute more than €100bn a year. And the fact that the introduction of the so-called equity pension, i.e. the funded pension, has now also been postponed does not make things any easier."

"There was a statement last year by the president of the Confederation of German Employers’ Associations: “Germany’s pension system is “on the verge of collapse. It won’t be financially viable in five years without reform. The costs will explode” Labor shortages, an aging population, and lower productivity - are all material factors for the viability of this system"

Germany is the sick man of Europe. This is going to be a massive issue in so many countries, not only in Germany."

👉🏽https://twitter.com/NickTimiraos/status/1743667579011371388

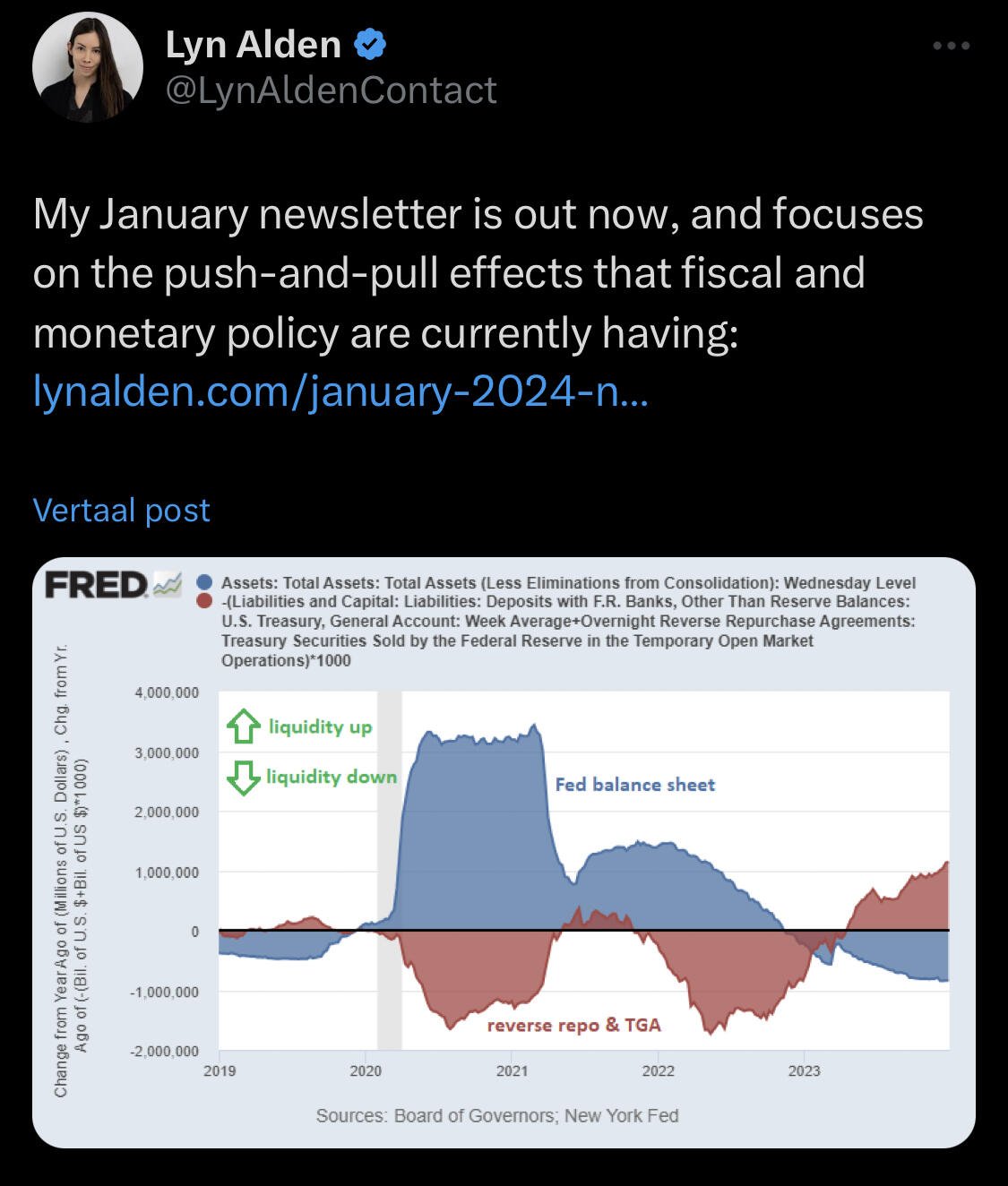

Slowing QT means slowly switching to QE, which means more liquidity, which means markets go up. Liquidity is important.

🎁If you have made it this far I would like to give you a little gift:

Lyn Alden's January newsletter is out now and focuses on the push-and-pull effects that fiscal and monetary policy are currently having.

Lyn's monthly writings are always a must-read for me, but the recent one is particularly good! What I like the most about this newsletter is that she used information from her previous write-ups and connected them to the economic changes over the last few years.

https://lynalden.com/january-2024-newsletter/

Today / this week I feel extra special, as I started a new chapter in my life, so I will share an additional 'gift':

"The release of the 2023 Q4 Advisory Board Call: Broken Money – And How to Fix It, featuring the remarkable Lyn Alden"

https://www.incrementum.li/en/journal/advisory-board-call-q4-2023/

Free knowledge!

And please order her book 'Broken Money':

Credit: I have used multiple sources!

My savings account: Bitcoin

The tool I recommend for setting up a Bitcoin savings plan: @Relai 🇨🇭 especially suited for beginners or people who want to invest in Bitcoin with an automated investment plan once a week or monthly. Hence a DCA, Dollar cost Average Strategy. Check out my tutorial post (Instagram) & video (YouTube) for more info.

⠀⠀⠀⠀

Get your Bitcoin out of exchanges. Save them on a hardware wallet, run your own node...be your own bank. Not your keys, not your coins. It's that simple.

⠀⠀⠀⠀⠀⠀⠀⠀

Do you think this post is helpful to you? If so, please share it and support my work with sats. #zap 🧡 #weeklyrecap #nostr #plebchain #BTC #Bitcoin #zap🧡 #plebchain #grownostr #stacksats #bitcoineducation #adoption

https://void.cat/d/YbQrhobQ1ciQzPqkwEr3MV.webp

https://void.cat/d/LBGtDCUfyprVZvGDpzBHFw.webp

https://void.cat/d/StKYGxA2Ux1K18LfVFQU9n.webp

Here you go, some weekend reading:

https://www.lynalden.com/january-2024-newsletter/

As always nostr:npub1a2cww4kn9wqte4ry70vyfwqyqvpswksna27rtxd8vty6c74era8sdcw83a is killing it, but what I like the most from this newsletter is that she used information from her previous write-ups and connected them to the economic changes over the last few years.

Please do yourself a favor and order her book ‘Broken Money’:

Opt out: Bitcoin🧡

Study, learn, hodl, decouple.

#bitcoin 🧡

▃▃▃▃▃▃▃▃▃▃▃▃▃▃▃

My savings account: Bitcoin

The tool I recommend for setting up a Bitcoin savings plan: @Relai 🇨🇭 🇨🇭 especially suited for beginners or people who want to invest in Bitcoin with an automated investment plan once a week or monthly. Hence a DCA, Dollar cost Average Strategy. Check out my tutorial post (Instagram) & video (YouTube) for more info.

⠀⠀⠀⠀

Get your Bitcoin out of exchanges. Save them on a hardware wallet, run your own node...be your own bank. Not your keys, not your coins. It’s that simple.🎯

⠀⠀⠀⠀⠀⠀⠀⠀

Do you think this post is helpful to you? If so, please share it and support my work with sats. 🧡

Felipe - BitcoinFriday

#zap 🧡 #nostr #BTC #Bitcoin #plebchain #grownostr #stacksats #bitcoineducation #adoption #lynalden #brokenmoney

“Yet the big surprise in Bondo is not simply the supply of energy to such an isolated community, in a country where only one in eight citizens has access to grid electricity and on a continent where almost half the 1.2 billion population still lack this life-changing supply. The real eye-opener is the stack of 32 computers inside the concrete pump shed. This innovative mini-grid — located more than two hours from Malawi’s second city of Blantyre along bumpy roads and tracks that can become impassable in a torrential downpour — is mining Bitcoin to fund its operation.”

“Bitcoin has also become a helpful tool for activists and journalists in dictatorships, since it makes it far harder to track funds.”

Full article: https://unherd.com/2024/01/the-african-village-mining-bitcoin/

Bitcoin is financial inclusion, Bitcoin is financial empowerment!

Opt out: Bitcoin🧡

Study, learn, hodl, decouple.

#bitcoin 🧡

▃▃▃▃▃▃▃▃▃▃▃▃▃▃▃

My savings account: Bitcoin

The tool I recommend for setting up a Bitcoin savings plan: @Relai 🇨🇭 🇨🇭 especially suited for beginners or people who want to invest in Bitcoin with an automated investment plan once a week or monthly. Hence a DCA, Dollar cost Average Strategy. Check out my tutorial post (Instagram) & video (YouTube) for more info.

⠀⠀⠀⠀

Get your Bitcoin out of exchanges. Save them on a hardware wallet, run your own node...be your own bank. Not your keys, not your coins. It’s that simple.🎯

⠀⠀⠀⠀⠀⠀⠀⠀

Do you think this post is helpful to you? If so, please share it and support my work with sats. 🧡

Felipe - BitcoinFriday

#zap 🧡 #nostr #BTC #Bitcoin #plebchain #grownostr #stacksats #bitcoineducation #adoption #financialinclusion

Bitcoin ETF approval is basically done....

SEC is trying to line everyone up for Jan 11th launch - Eric Balchunas Bloomberg's Senior ETF analyst

Anywayyyyy, stack sats & stay humble!🧡

Opt out: Bitcoin🧡

Study, learn, hodl, decouple.

#bitcoin 🧡

▃▃▃▃▃▃▃▃▃▃▃▃▃▃▃

My savings account: Bitcoin

The tool I recommend for setting up a Bitcoin savings plan: @Relai 🇨🇭 🇨🇭 especially suited for beginners or people who want to invest in Bitcoin with an automated investment plan once a week or monthly. Hence a DCA, Dollar cost Average Strategy. Check out my tutorial post (Instagram) & video (YouTube) for more info.

⠀⠀⠀⠀

Get your Bitcoin out of exchanges. Save them on a hardware wallet, run your own node...be your own bank. Not your keys, not your coins. It’s that simple.🎯

⠀⠀⠀⠀⠀⠀⠀⠀

Do you think this post is helpful to you? If so, please share it and support my work with sats. 🧡

Felipe - BitcoinFriday

#zap 🧡 #nostr #BTC #Bitcoin #plebchain #grownostr #stacksats #bitcoineducation #adoption

"71% of advisors favor #bitcoin over Ethereum.

29% should not be giving out advice."

source:

https://bitwiseinvestments.com/crypto-market-insights/the-bitwise-vettafi-2024-benchmark-survey

h/t to BitwiseInvest for conducting this survey.

Now, I am not giving financial advice, but you know I am Bitcoin only.

Bitcoin is going to stay forever. Cryptos like Ethereum will not. Period!

Bitcoin is the only thing really decentralized. Anything else apart from Bitcoin, including basically all other cryptocurrencies, is not really decentralized.

My savings account: Bitcoin

The tool I recommend for setting up a Bitcoin savings plan: @Relai 🇨🇭 🇨🇭 especially suited for beginners or people who want to invest in Bitcoin with an automated investment plan once a week or monthly. Hence a DCA, Dollar cost Average Strategy. Check out my tutorial post (Instagram) & video (YouTube) for more info.

⠀⠀⠀⠀

Get your Bitcoin out of exchanges. Save them on a hardware wallet, run your own node...be your own bank. Not your keys, not your coins. It’s that simple.🎯

⠀⠀⠀⠀⠀⠀⠀⠀

Do you think this post is helpful to you? If so, please share it and support my work with sats. 🧡

Felipe - BitcoinFriday

#zap 🧡 #nostr #plebchain #BTC #Bitcoin #zap🧡 #plebchain #grownostr #stacksats #bitcoineducation #adoption #shitcoins

On this day 15 years ago Bitcoin went online!

Happy Bitcoin Genesis Block Day! This block is unspendable. Satoshi also waited 6 days before mining block #2 so others had time to join the network.

Now that Bitcoin has existed for 15 years! Lindy effect says that Bitcoin would at least exist for another 15 years.

January 3, 2009. Satoshi undermines block 0 on a difficulty 1 CPU and incorporates into the Genesis Block hexadecimal code base the headline of that day’s Times “The Times 03/Jan/2009 Chancellor on the brink of second bailout for banks”. The bank bailout plan ‘cause of the subprime mortgage crisis in the TGFC.

Since that day, the network has grown dramatically. Now, millions of people all over earth use Bitcoin. And while it’s great to hear about other countries like El Salvador embracing Bitcoin, I can’t help but wish my own country 🇳🇱 was embracing Bitcoin too.

Some stats (repost @relai.app ):

“In that time, it achieved:

📈$800M market cap

🆙+ 6 billion % price increase

⏲️+ 99.99% uptime

☠️Declared dead 475

⛏93% of supply mined

#⃣ Hashrate at 500 EH/s

💸+ 947 million transactions”

Tick tick, next block without fail, Bitcoin continues to provide us with the most significant tool for freedom of speech and monetary sovereignty in the digital age!

Bitcoin is about financial inclusion and economic empowerment.

Bitcoin is secured by the most powerful computing network in the world!🧡

My savings account: Bitcoin

The tool I recommend for setting up a Bitcoin savings plan: nostr:npub1sqzr42dj8vx32yd5jcvvl3ytux45kl0etgf6y2ymjvmd7lqmuwmqk9vk7v 🇨🇭 especially suited for beginners or people who want to invest in Bitcoin with an automated investment plan once a week or monthly. Hence a DCA, Dollar cost Average Strategy. Check out my tutorial post (Instagram) & video (YouTube) for more info.

⠀⠀⠀⠀

Get your Bitcoin out of exchanges. Save them on a hardware wallet, run your own node...be your own bank. Not your keys, not your coins. It’s that simple.🎯

⠀⠀⠀⠀⠀⠀⠀⠀

Do you think this post is helpful to you? If so, please share it and support my work with sats. 🧡

Felipe - BitcoinFriday

#zap 🧡 #weeklyrecap #nostr #plebchain #BTC #Bitcoin #zap🧡 #plebchain #grownostr #stacksats #bitcoineducation #adoption #happybirthdaybitcoin

Bitcoin had its best year after a bear market in its history.🧡

This year will be wild. No matter what.

The goal is to end up with more Bitcoin than you started with.

Happy new year fam!🧡

#BTC #Bitcoin #zap🧡 #nostr #plebchain #grownostr #stacksats #bitcoineducation #adoption

The video says it all! 🧡

#noderunners #zap 🧡 #3KD #nostr #plebchain #grownostr #stacksats #bitcoinfriends https://video.nostr.build/49ddb64722c7ca427803f14ea5cfef752d3ebe76e78c5fe8c12aaa4ed5ff06de.mp4

🧠Quote(s) of the week:

"On Christmas Day, exactly 15 years ago, Satoshi Nakamoto was still at work perfecting the 1st Bitcoin code. Truly a gift to all mankind." - Pete Rizzo

"Bitcoin cannot tell lies, nor can it ever be covered up. Lying is the counterfeiting of facts, and truth cannot be counterfeited. The word Truth translates from the Ancient Greek word Aletheia (ἀλήθεια) which meant “unconcealed”—a nearly perfect adjective for digitally native, open-source money. For these reasons, Bitcoin is the truth that will bring an end to the counterfeiting of money." - Breedlove

"By saving Bitcoin, you are increasing the purchasing power of all other individuals holding Bitcoin around the world. By holding public equities and bonds, you’re perpetually funding the largest corporations and largest governments. It’s an easy choice. Fund the people." - Joe Burnett

As I said so often. Bitcoin is financial inclusion and financial empowerment. Our current system consolidates power, evident in the 1% owning 43% of global wealth. Bitcoin is promoting inclusivity with its 2.7 billion unbanked potential users worldwide.

🧡Bitcoin news🧡:

Before I start this Weekly Recap - Christmas special I want to wish you, my amazing Crypto Friday follower, a Merry Christmas! Your support has been the greatest gift of all. May your day be filled with joy, laughter, love, and the magic of Christmas. Best Wishes!

➡️For the Dutch plebs, please have a look at the following thread:

"We all know Bitcoin is dead but the #noderunners are snowballing into 2024! In honor to my frens, brothers, sisters, and fam a thread to reflect on 2023.."

https://twitter.com/onthebrinkie/status/1737454169613636004

https://twitter.com/onthebrinkie/status/1737454363944116558

The only thing that I can say: What a thread! I'm proud to be a part of this group. On to 2024!

Noderunners!

➡️Bitcoin leaves the rest of the crypto market behind - Financial Times

There is no second best…the narrative is shifting.

➡️Explain Bitcoin to your relative in 55 seconds this Christmas.

https://twitter.com/BitcoinNewsCom/status/1739103861971763403

➡️Bitcoin Price on Christmas Day:

https://twitter.com/BTC_Archive/status/1739246752115347943

➡️https://twitter.com/BitwiseInvest/status/1736755061127020794

Business ware will bring more glory to Bitcoin than any regulation or regulators. Have you noticed how Bitcoin just keeps getting more and more traction and attention? Both from mainstream media, universities, and regulators, but also the financial big boys. This ad is in anticipation of the Bitcoin ETFs and is a great example. There is NO WAY an ETF won't happen. They (top dogs) are so confident they released an ad.

Fasten your seatbells.

➡️ FOX Business confirmed "the date for final amendments to all" spot Bitcoin ETFs is December 29th. SEC has told issuers that applications that are fully finished and filed by Friday will be considered in the first wave."

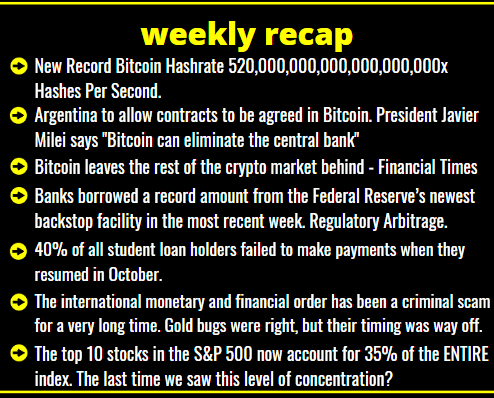

➡️ New Record Bitcoin Hashrate 520,000,000,000,000,000,000x Hashes Per Second.

Let the hash ware begin. Hashrate increasing at this rate indicates a controlling government is expending resources on Bitcoin mining. If I had to guess why Bitcoin's hash rate is going bonkers.

Nonetheless, all I see is Bitcoin's robustness. Miner fee revenue is near an all-time high, and so are hashrate and Difficulty. Bitcoin is as safe, secure, and sound as it has ever been. Bitcoin's security and resilience are unmatched! If you have no clue what I just said.. send me a DM or comment below, and I will send you some study material.

➡️https://twitter.com/lopp/status/1739137817731530819

➡️ Last week I wrote a bit on Elizabeth Warren: 'US Senator Elizabeth Warren introduces bill to crack down on crypto and Warren adds 5 new Senators as co-sponsors to The Digital Asset Anti-Money Laundering Act of 2023.'

Elizabeth Warren and a few eager politicians want to *ban* people from owning or using Bitcoin. Your Brain is an "unhosted wallet" according to Warren and she wants to ban it! Meanwhile, Blackrock, Invesco, Fidelity, et al. want to make investing in Bitcoin easy for anyone by listing it on public market exchanges.

Who do you think wins this one?

Oh, by the way, a co-sponsor of the bill was the American Bankers Association. They helped write the bill. Classic!

➡️Argentina to allow contracts to be agreed in Bitcoin. President Javier Milei says "Bitcoin can eliminate the central bank" Legal tender next? He repealed forced legal tender and legalized currency competition. Not every country has to make Bitcoin legal tender like El Salvador. Each country will have its own unique path, and all roads lead to Bitcoin.

➡️ "Over 70% of all Bitcoin hasn't moved in the past year. HODLERs certainly aren't selling their Bitcoin to buy Christmas presents this year." - CoinBeast

➡️ Russian BitCluster to build a 120 MW Bitcoin mining facility in Ethiopia, aiming to turn the country into a global mining hub.

➡️ SEC tells spot Bitcoin ETF applicants to update submissions by December 29 if they want to be approved in the first wave - Reuters

💸Traditional Finance / Macro:

Week ahead: The markets are wrapping up a busy 2023 with a quiet week.

🏦Banks:

👉🏽"Banks are pocketing real money by borrowing money from the Fed's newest backstop facility, which charges a lower rate, and then parking it at another unit of the Fed, which pays higher interest. Banks are borrowing record amounts from this new facility."

"Banks borrowed a record amount from the Federal Reserve’s newest backstop facility in the most recent week as increasing wagers on interest-rate cuts made it a more attractive choice.

Data from the Fed showed an all-time high of $131 billion in borrowing from the Bank Term Funding Program, or BTFP, in the week through Dec. 20. That compares to a previous record of $124 billion, reached in the week ended Dec. 13."

Regulatory Arbitrage. Arbitraging the Fed itself. No risk. Absolute clown show. Classic bank mindset - making money at the expense of the public.

source: https://archive.ph/xhUg5

🌍Macro/Geopolitics:

👉🏽 As mentioned in the Bitcoin News segment, President Javier Milei says "Bitcoin can eliminate the central bank" Legal tender next? He repealed forced legal tender and legalized currency competition.

During his campaign, he promised to abandon the Peso and will focus on becoming 'dollarize'. It's free competition among currencies, people will have to choose. I think Milei has a plan to go beyond the god-damned Dollar, but can't talk about it yet for obvious reasons. Good thing people are free to use Bitcoin. We'll see which currency the market demands...eventually.

https://twitter.com/steve_hanke/status/1738333600590803109

I will quote Lyn Alden and Alex Gladstein for more in-depth

Lyn Alden: "Whenever a country dollarizes, it increases demand for dollars and thus boosts the United States’ ability to print money and run deficits with mitigated inflation. They subsidize us, in other words. That’s the part about dollarization that doesn’t get said out loud too often.

There are about 160 currencies, and each of which is a centralized ledger. When you think about it, the fact that when a country’s currency fails, they must rely on the biggest country’s currency, is rather antiquated tech. If only there was a decentralized ledger alternative."

Alex Gladstein: "The peso system is truly awful and of course, its users should have dollar access (it’s only fair) — but if Argentina dollarizes it cedes a lot of power to the US and subsidizes our way of life This is precisely why we need a neutral apolitical decentralized global currency."

Remember most of the world runs on IOUs for dollars… not actual dollars. Deposits in banks are not actual dollars but claims for them. Importantly, the system considers IOUs for dollars as ‘money good’ as the actual cash in your hand.

👉🏽 https://twitter.com/LawrenceLepard/status/1739300775430660504

👉🏽"For all the technical analysts out there: The S&P 500 is now trading with a DAILY RSI of ~81, by far the most overbought level in years. The last time the daily RSI was at 81+? On September 2nd, 2020 the day before the S&P 500 fell 11% in 3 weeks. Since the October 27th low, the S&P 500 is up 16% in 36 trading days. Pullbacks have become nonexistent in this market." - TKL

👉🏽"The top 10 stocks in the S&P 500 now account for 35% of the ENTIRE index. The last time we saw this level of concentration? In 2001 when the Dot-com bubble busted. The "Magnificent 7" are now approaching +100% for 2023. Meanwhile, the remaining 493 stocks are still up less than 10%. All while the S&P 500 is up a massive 23% because of these 10 technology stocks. Truly a historic time for markets." - TKL

To put it down in figures:

2023 Returns...

Magnificent Seven: 75%

S&P 500: +23%

S&P 493 (excluding Mag 7): +12%

Personally, I think this dominance will only grow in 2024.

👉🏽 https://twitter.com/MichaelAArouet/status/1736646018588942693

Nothing really special. We, here in Europe, are the world leaders in regulations and we just had a decade-long, ultra-low interest rates in Europe that created many zombie businesses.

👉🏽 "40% of all student loan holders failed to make payments when they resumed in October. This means that 8.8 million out of 22 million borrowers missed student loan payments. Currently, we have a record $1.6 trillion of outstanding student loans. The average payment is ~$500/month and comes at a time with record low levels of affordability."- TKL

👉🏽"The new IMF term for the plateauing of trade openness since the financial crisis is "slowbalization".

(foto)

👉🏽 https://twitter.com/KobeissiLetter/status/1737110229597458591

I kid you not! 12 days apart!

👉🏽 "On July 7, 1971, Paul Volcker arrived in The Netherlands to tell then President of the Dutch central bank, Jelle Zijlstra, to cancel a request for converting 250 million dollars into gold. Zijlstra said he would not cancel the request because he only held on to dollars as working stock, to which Volcker said: “You are rocking the boat.” Zijlstra replied that if a conversion of 250 million dollars rocks the boat, that boat has already sunk. On August 15, 1971, the US suspended dollar conversion into gold altogether." - JanGold

For your information: Paul Volcker was an American economist who served as the 12th chairman of the Federal Reserve from 1979 to 1987. BUT!!

Appointed by the Nixon Administration, Volcker served as undersecretary of the Treasury for international monetary affairs from 1969 to 1974.

You could say this was the day the dollar became worthless. Zijlstra & Volcker had a historic behind-the-scenes look at the chaos just before America betrayed the world post-WWII monetary system by eventually introducing inside money instead (treasuries) of outside money (gold). By doing that the current US dollar fiat standard emerges.

Dutch rocked the both first...just to give you some context:

"At $42 an ounce, $250M works out to 5.9M ounces of gold. Out of a supposed 252M stockpile. Jelle was right, if removing 2% of the US's gold was such a problem, then the problem was much larger than advertised."

After that France, Switzerland, and the UK did the same. France and Switzerland converted 200mill and 50mill respectively at that time. Which ultimately led to the historical moment on the 15th of Augustus, 1971. The US feared a run on the gold...

US President Richard Nixon completely stopped dollar convertibility to gold, "temporarily" he said. It has been 50+ years since the meaning of the word "temporarily" has been converted to "never".

Richard Nixon's decision to suspend gold convertibility of the dollar on August 15, 1971, resulted in the collapse of the Bretton Woods system.

The international monetary and financial order has been a criminal scam for a very long time. Gold bugs were right, but their timing was way off.

Look at the damage of that scam: https://wtfhappenedin1971.com/

Bitcoin opt-out!

Imagine a future where central banks are replaced by national Bitcoin mining operations. A bold blend of tech and economics!

I quote Luke Gromen: "The use case of Bitcoin is political freedom & the preservation of democratic values. Simply put, once you control the money, voting becomes irrelevant. That this is not immediately obvious & valued to many policymakers should be an important signpost (red flag?) in and of itself."

I will say it again. Bitcoin offers an opt-out from the financial system. When you, for the love of god, still decide to buy a Bitcoin ETF...you are selling this valuable option and paying a fee to do so. Holding your own Bitcoin is key in the upcoming years/decades.

"Afraid of the government banning Bitcoin? The US government banned ownership of gold in 1933 when it was $20 an ounce Gold is $1800 an ounce now, up 90X since it was banned. Stack sats & hold your keys. They can't take your BTC if you hold it yourself."

https://twitter.com/RealSpikeCohen/status/1738696879917957561

🎁If you have made it this far I would like to give you a little gift:

In the following interview/podcast 'What Bitcoin Did - WBD751" you will learn:

- Currency devaluation's impact on Malawian people

- Globalisation, debt & manipulation

- Economic dependence & exploitation in Africa

- Bitcoin: empowerment & energy independence

It is a great discussion of the global economic structure and how it impacts non-dollarized economies.

"If Bitcoin becomes a bigger part of the global economy we take this weapon away from states…then they’re going to have to look at the other options…if they try to impose those things, that will probably lead to their downfall." - @gladstein WBD751

https://www.whatbitcoindid.com/podcast/bitcoin-a-30000ft-view

or watch it on YouTube: https://www.youtube.com/watch?v=8sY19BRtYuc

Credit: I have used multiple sources!

My savings account: Bitcoin

The tool I recommend for setting up a Bitcoin savings plan: @Relai 🇨🇭 especially suited for beginners or people who want to invest in Bitcoin with an automated investment plan once a week or monthly. Hence a DCA, Dollar cost Average Strategy. Check out my tutorial post (Instagram) & video (YouTube) for more info.

⠀⠀⠀⠀

Get your Bitcoin out of exchanges. Save them on a hardware wallet, run your own node...be your own bank. Not your keys, not your coins. It's that simple.

⠀⠀⠀⠀⠀⠀⠀⠀

Is this post helpful to you? If so, please share it and support my work with sats. #zap 🧡 #weeklyrecap #nostr #plebchain #grownostr #stacksats

Greg Foss: “All of your “assets” are melting ice cubes denominated in #bitcoin .”

#BTC #Bitcoin #zap🧡 #nostr #plebchain #grownostr #stacksats #bitcoineducation #adoption

Merry xmas.

I wish you a wonderful time with your loved one. 🎄

Wishing you a joyful Bitmas, may the magic internet money bring your life happiness.

#MerryChristmasEve #BTC #Bitcoin #zap🧡 #nostr #plebchain #grownostr #stacksats #bitcoineducation #adoption https://video.nostr.build/1272f9d90580ca182b09cd8a82402a2093621577b0e4e5bd0beb1ca616538f17.mp4