Just use Nostr🧡💜

Study, learn, hodl, decouple.

#bitcoin 🧡

▃▃▃▃▃▃▃▃▃▃▃▃▃▃

My savings account: Bitcoin

The tool I recommend for setting up a Bitcoin savings plan: @Relai 🇨🇭 🇨🇭 especially suited for beginners or people who want to invest in Bitcoin with an automated investment plan once a week or monthly. Hence a DCA, Dollar cost Average Strategy. Check out my tutorial post (Instagram) & video (YouTube) for more info.

⠀⠀⠀⠀⠀⠀⠀⠀

Felipe - BitcoinFriday

#zap 🧡 #nostr #BTC #Bitcoin #plebchain #grownostr #stacksats #bitcoineducation #adoption

Better late than never… the latest Weekly Recap🧡

🧠Quote(s) of the week:

'The main reason people don’t buy Bitcoin is because they don’t understand that money printing causes inflation, that inflation is time theft, and that time theft is slow murder.

The main reason people are not buying Bitcoin is because they think they’re late:

- You can’t be late to a perfect battery

- It does not have a CEO or foundation

- We’re at less than 1% global adoption

- It’s the only asset that is decentralized' - Bitcoin for Freedom

🧡Bitcoin news🧡

Oranje🇳🇱 into the semi finals and Nostr is vibin'.

1st of July:

➡️'Bitcoin ATMs surge from 10K in Oct 2020 to over 38K globally, with continued growth expected.' -Bitcoin News

➡️More than 65% of all Bitcoin in circulation has been held for more than 1 year.

2nd of July:

The German government! Their Industrial Production YoY plunges to -6.7% (est. -4.3%) and every nuclear power plant is shut down. So what is the stupidest thing to do? Sell your Bitcoin!

German Government sends another 282 Bitcoin worth $18 million to exchanges.

German parliament member Joana Cotar says the government selling Bitcoin is “not sensible.”

Urges “holding BTC as a strategic reserve currency.”

3rd of July:

➡️ Trump sparks talks of Bitcoin as a strategic reserve asset.

FORBES: “That game theory would only accelerate if the United States… were the first developed country to begin accumulating bitcoin as a strategic reserve asset. This decision would fast-track the global acceptance of Bitcoin as a long-term savings instrument and a form of digital gold. In this scenario, the United States would enjoy the greatest windfall in profit among OECD countries as a result of holding first-mover advantage.”

Every nation will recognize Bitcoin as a strategic reserve asset.

Some will be first...like El Salvador.

➡️The largest US Bitcoin miner Riot Platforms increased their hash rate by 50% in just one month. Currently, the world's largest Bitcoin mining facility is being built in Texas by Riot Platforms.

200 MW of the 1 GW total capacity is already operational.

5th of July:

➡️MT GOX has started Bitcoin repayments to creditors.

'MtGox distributions are considered a price risk for Bitcoin and indeed they are. But it's a one-time risk and if prices must drop to absorb supply (certainly possible) that supply will be transferred to much stronger hands. Once completed, supply risk is virtually eliminated.'

➡️'Celsius is going after over 5000 people who withdrew their money from Celsius within 90 days of their bankruptcy.

Imagine withdrawing your funds from a crypto exchange that has been lying about their reserves and they declare bankruptcy days after you escaped.

And now you’re being sued.

All the more reason to withdraw sooner rather than later.' -Bitfinexed

Just don't have your corn on centralized exchanges or services like Celcius. Once again:

NOT YOUR KEYS, NOT YOUR COINS!🔑

➡️El Salvador keeps buying one Bitcoin a day, undeterred. By purchasing Bitcoin I am confident that El Salvador will become one of the fastest developing countries thanks to deflation of their currency and having Bitcoin as their new national currency.

➡️'Bitcoin's all-time longest winning streak has just ended. 427 days without a 25% drawdown. Beat the 2012 record by 63 days. Pretty incredible run we've had and well overdue for a correction.' - Charles Edwards

💸Traditional Finance / Macro:

👉🏽 No news

🏦Banks:

👉🏽

🌎Macro/Geopolitics:

On the 1st of July:

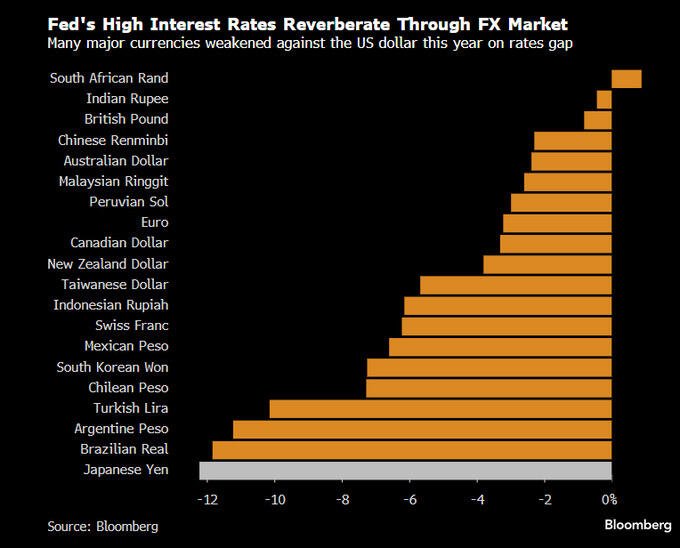

👉The yen's 12-year crash against the dollar continues. The Japanese currency buys half the amount of dollars it did in 2012. This is what currency collapse looks like.

On the 2nd of July:

(Picture 1)

👉WW1 and WW2 were discrete events with a defined goal. The main question is, what the actual fuck are they spending on?

And it is not only in the US, put the deficits and debt bubble on a country like Germany or Europe in general and you would have a bigger problem. Wonder why the world has a problem? Government deficits relative to GDP are out of control.

Regarding the spending problem:

'Annual US government spending reached a MASSIVE $6.5 trillion in May, just $1.1 trillion below the March 2021 record.

The government's total outlays have DOUBLED in just a decade.

To put this into perspective, this is more than the size of most world economies except the US and China.

Meanwhile, the US budget deficit hit $1.7 trillion, or 6.2% of GDP over the last 12 months.

In the past, such levels of spending have only occurred during major crises.' -TKL

Meanwhile, Chair Powell says the U.S. deficit is better fixed sooner rather than later.

'The U.S. government deficit is unsustainable, Chair Powell said in Europe, while avoiding comment on fiscal policy, as usual. The subject arose as markets brace for the possibility of the same party controlling the Executive branch and both houses of Congress after the November election, a combination that investors typically see as an open door to higher spending. "The U.S. is running a very large deficit at a time when we are at full employment," Powell said. "This is something that should be a top-level issue" for elected officials. "In the longer run we will have to do something sooner or later and sooner would be better than later," he said.'

Meanwhile, US debt increases by $109B in 1 day. Just to give you one more stat:

It took 165 years for the US to accumulate its first $1 trillion of debt. Now, the US amasses $1 trillion in debt every 150 days.

👉'US manufacturing activity fell to 48.5 points in June, the third consecutive month of contraction.

The latest reading of the ISM manufacturing PMI index missed expectations of 49.1 points.

The decline has been primarily driven by contracting employment, production, and new orders.

Overall, US manufacturing has shrunk in 19 of the last 20 months, the longest streak since the 2008 Financial Crisis.

Is the economy slowing down?'- TKL

👉Eurozone core inflation unexpectedly sticky: Headline CPI slows to +2.5% in June from 2.6% in May, in line with forecasts. However, core inflation is at 2.9% – a notch higher than forecasted. Experts had expected it to cool to 2.8%.

👉Last week I already mentioned that Javier Milei slashed Argentina's annual inflation by 95% in just seven months. Monthly inflation has fallen from 25.5% to 4.2% since he took office.

From a 1355% inflation rate to a surplus budget, his economic policies have transformed the economy.

This week Argentina's President Milei says the nation will no longer print money: We are going to the zero issuance stage....what we aim for is that the broad monetary base does not vary."

Inflation in Argentina was 64% in the first 4 months of 2024.

Who could have guessed that cutting government spending and not printing was going to reduce inflation...Who could have guessed...

Now don't get me wrong it is a great move by Milei but it's still only as good as the honesty of governments (always lying and always finding a reason to print more). That's why only money that CANNOT be debased matters. Bitcoin!

👉'With Biden 2.0 no longer an option, the Treasury has also stopped pretending and the US government jumped by $109 billion in one day - the biggest one-day increase since Oct '23 - to a record $34.831 trillion. And now the debt starts to really move again.' - Zerohedge

Funny stat:

'Since Jan 1, 2000:

2 Money Supply (USD) has increased by an average of:

- $81M PER HOUR

- $1.9B/day

- $700B/year

$17T increase in 24yrs (8,948 days)

THERE IS NO LIMIT TO HOW MUCH FIAT MONEY CENTRAL BANKS WILL CREATE.' -DenverBitcoin

On the 3rd of July:

👉'Italy's real wage misery: inflation-adjusted wages in 2023 were 4.4% lower than in 1990. Even real wages in Greece performed a little better.' -Phillip Heimberger

I wonder if this is a contributing factor to Meloni's win.

Before joining the Eurozone Greece, Italy & Co. were staying competitive by continually devaluing their currencies. Now the only avenues left are reduction of real wages or productivity growth.

👉'Secured Overnight Financing Rate (SOFR) jumps to 5.4%, the highest level in history

*The SOFR is the benchmark interest rate that measures the cost of borrowing cash overnight.' -CarlBMenger

On the 5th of July:

👉'BOTH May and April jobs report numbers were just revised lower by a combined 111,000 jobs.

The May jobs report was revised from 272,000 to 218,000 while the April jobs report was revised from 165,000 to 108,000.

This means that 10 out of the last 15 monthly jobs reports have been revised lower.

On a net basis, the US economy really only added 95,000 jobs this month.

Meanwhile, the unemployment rate is now at 4.1% since December 2021.

The labor market is slowing down rapidly. The US economy really only added a net 95,000 jobs in June...

...until that number is revised lower next month after all the headlines say the labor market is thriving.

The labor market is declining.' - TKL

Jobs look OK if the government just hires everyone.

41% of jobs added since 2019 were by the government burning taxpayer dollars.

On the 6th of July:

👉'That‘s the most scary chart I have seen in a while. Unfunded pension entitlements in major European countries are between 300% and 500% of GDP. Mixed with collapsing demographics it’s a recipe for debt disaster.' - Michael A. Arouet

(Picture 2)

🎁If you have made it this far I would like to give you a little gift:

Is the Bitcoin Cycle Broken? With @therationalroot

They discuss:

- BitcoinSpiral Chart 3D & cycle alignment

- ETF flows & supply dynamics

- Liquid supply & the HODL model

- Power law, S2F, & the price multiplier effect

https://www.youtube.com/watch?v=6kcq5mevS6M

Credit: I have used multiple sources!

My savings account: Bitcoin

The tool I recommend for setting up a Bitcoin savings plan: @Relai 🇨🇭 especially suited for beginners or people who want to invest in Bitcoin with an automated investment plan once a week or monthly. Hence a DCA, Dollar cost Average Strategy. Check out my tutorial post (Instagram) & video (YouTube) for more info.⠀⠀⠀⠀

Get your Bitcoin out of exchanges. Save them on a hardware wallet, run your own node...be your own bank. Not your keys, not your coins. It's that simple.⠀⠀⠀⠀⠀⠀⠀⠀

Do you think this post is helpful to you? If so, please share it and support my work with sats.

#zap 🧡 #weeklyrecap #nostr

#plebchain

#BTC

#Bitcoin

#zap🧡

#plebchain

#grownostr

#stacksats

#bitcoineducation

#adoption

Ferguson’s Law states that any great power that spends more on debt service (interest payments on the national debt) than on defense will not stay great for very long. True of Hapsburg Spain, true of ancien régime France, true of the Ottoman Empire, true of the British Empire. -Nial Ferguson

Happy Sunday!

Plebs, whisky & meat!🧡

Felipe - BitcoinFriday

#zap 🧡 #nostr #BTC #Bitcoin #plebchain #grownostr #stacksats #bitcoineducation #adoption

🧠Quote(s) of the week:

'Last month, we've absorbed:

US Gov selling

German selling

Mt Gox distribution fears

Miner capitulation

Yet, Bitcoin is consolidating at $61K, just 20% below ATH.

Tops are the exact opposite, driven by FOMO and greed. This is nothing like that. We're going much higher.' - Thomas Fahrer

🧡Bitcoin news🧡

Oranje into the Quarter-Finals and Nostr is vibin'.

I want to start the Weekly Recap with a short story. I put the following post on Instagram and Nostr: https://njump.me/nevent1qqs0uzqg3nnuvsz0tycu4ydl2m4gnm245m0n3gsppxm4pttrgy8j3gqprpmhxue69uhhyetvv9ujumn0wdmksetjv5hxxmmdqy28wumn8ghj7un9d3shjtnyv9kh2uewd9hsygpu0hpvtplweczsl0r9szd3vzw3jgrlsfwawe65hxg9a89gq4jz4q5vzdpe

On IG (945 followers): 3 likes

On Nostr (273 followers): It has 68 likes, 14 reposts, 8 replies, and 12 zaps (people sent me small amounts of BTC)

On Nostr:

-No KYC or info required

-Instant final settlement (just press the Lightning button and boom it’s done)

-Bitcoin native

-Use any client (Damus and Primal on iOS, Amethyst on Android, or Primal on the web)

But far more important you own your own content + money!

Nostr is looking better every day.

Less doom, more hope. More you in control.

Great quote by nostr:npub1trr5r2nrpsk6xkjk5a7p6pfcryyt6yzsflwjmz6r7uj7lfkjxxtq78hdpu :

'We wouldn’t need Nostr

-If we could trust social media companies

-If we could trust admins

-If we could trust could regulators

But we can’t. That’s why we need Plan N'

Bitcoin is an uncensorable transfer of value. Nostr is an uncensorable transfer of information.

24th of June:

➡️Louisiana passes the bill to protect the right to custody of Bitcoin and ban CBDCs.

Louisiana joins Oklahoma, Montana, & Arkansas in setting a pro-Bitcoin policy blueprint for the nation.

25th of June:

➡️'The German government sold 900 Bitcoin ($54M) on June 25th.

This included 200 BTC each to Coinbase and Kraken, with the remaining going to an unknown wallet ("139Po").' - Bitcoin News

Weak hands! These 900 Bitcoins are now (hopefully) safely in the hands of ultra-hardcore maxis with diamond hands.

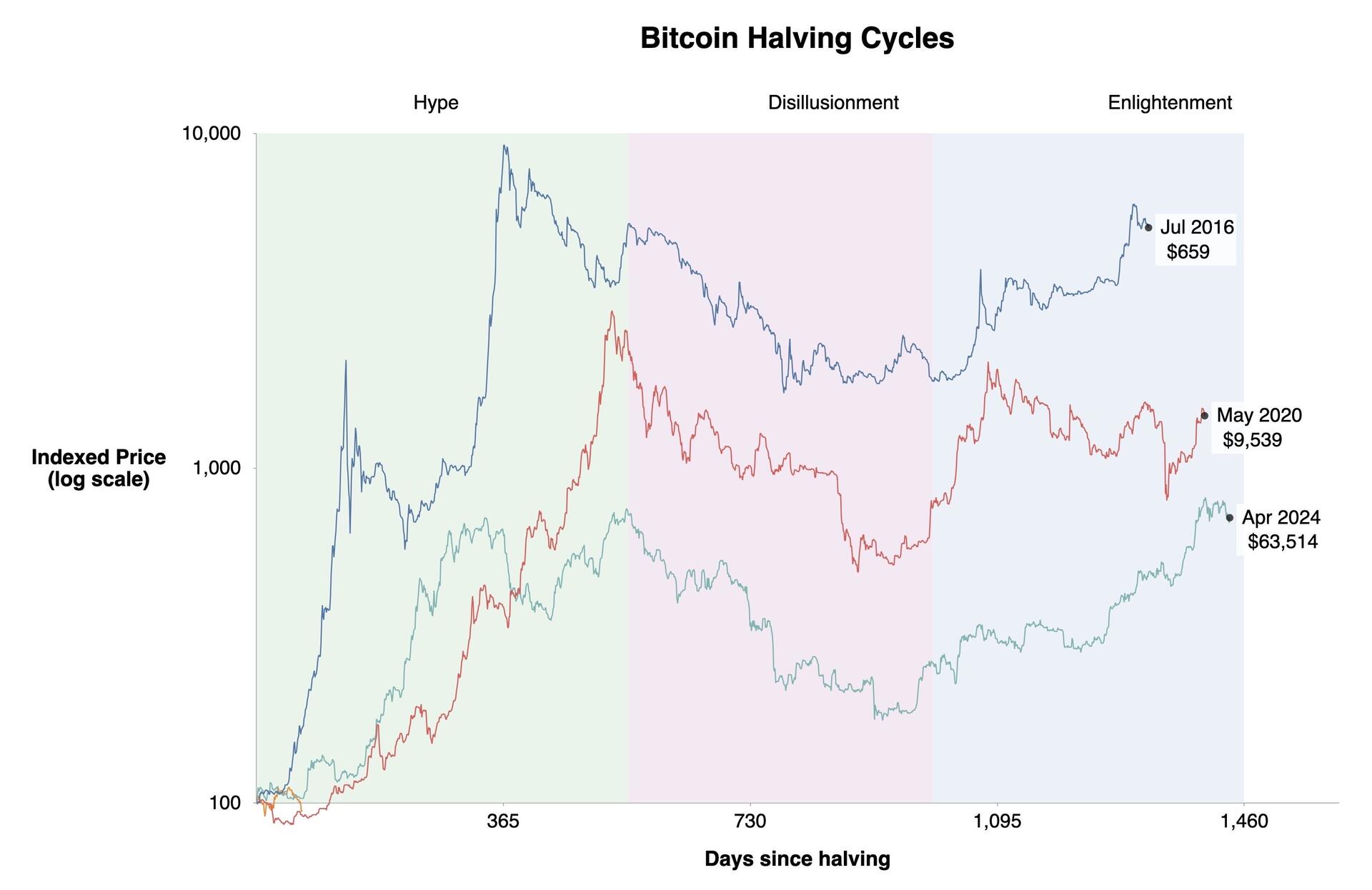

➡️'The current Bitcoin halving cycle is still outperforming the second halving cycle if you zoom in a lot on the bottom left of the chart. We are so early, very bullish!' - Pierre Rochard

(Picture 1)

➡️Bitcoin lightning payments app Strike launches to millions across the UK.

Watch the full video (announcement) by Jack Mallers here: https://x.com/jackmallers/status/1806423520370364640

➡️'Hedge Fund strategy:

Push down the Bitcoin price by shorting it until more and more miners need to sell because of the low price. The price goes even lower. Meanwhile, Hedge Funds buy up everything available then close their shorts and we go to $1M.'

Now you might say this is not realistic, but is it?

'When Blackrock has 500,000 Bitcoin and they've pushed the price to $1M.

Blackrock will make $1.25B in Fees. Not mining fees, the IBIT management fees.

Every. Year. Forever.' - Thomas Fahrer

➡️Bitcoin balance on exchanges continues to steadily decline.

Since the beginning of the year, about 250,000 Bitcoins have left the exchanges. Less Bitcoin on exchanges means more short-term volatility.

➡️ Morgan Stanley is set to approve Bitcoin ETFs on their wealth management platform for all clients by the end of August (at the latest), according to a senior source.

➡️Latin American digital bank Nubank is integrating the Bitcoin Lightning Network for its 100 million customers. Nubark is owned by Warren Buffett.

➡️Last week I mentioned that the German government sold roughly $425 million BTC. One of the best quotes on this topic by Alex Gladstein:

'Germany selling large amounts of Bitcoin for euros *that it can print* will go right up there with ditching nuclear power in exchange for relying on Putin for fuel as biggest self-inflicted wounds of the 21st century'

26th of June:

Bitcoin hashrate is down nearly 10% off the all-time highs that were hit at the end of April

27th of June:

➡️'BlackRock disclosed buying Bitcoin for its Global Allocation Fund in the latest SEC filing.

This is the THIRD internal BlackRock fund that has bought Bitcoin through the IBIT Bitcoin ETF' - Bitcoin Archive

'Looking at the past 5 years, Bitcoin is up 422%, mid-cap altcoins 145% and small-cap altcoins 8%. You missed 400% chasing shiny things instead of embracing Bitcoin. Choose wisely on how you store your value, allocate your time, and invest your resources.' - Gabor Gurbacs

(Picture 2)

As usual and in every cycle most people think they're a genius with impeccable timing until the rugs, dumps, scams, and 'capital rotations' hit, and then they're left holding dust.

➡️Cleanspark will acquire bitcoin miner GRIID for $155 million, with plans to expand over 400 MW in Tennessee.

Under the merger agreement, CleanSpark will purchase all GRIID common stock in an all-stock transaction, with GRIID stockholders receiving CleanSpark shares. The South is now Bitcoin miner territory, as it started in Georgia, then Mississippi, and now Tennessee. If I am right the South holds more available energy than any other region in America.

➡️Bolivia makes Bitcoin trading and payments legal again in an effort to modernize the financial system.

Ecuador is now the only country in Latin America that prohibits Bitcoin payments.

28th of June:

➡️ In the previous Weekly Recap I mentioned that Michael Dell, CEO of multi-billion dollar tech firm Dell Technologies, just dipped his toes into the Bitcoin waters, and this recent jest did make a splash.

Now last week Michael Dell posted a tweet with a poll 'The most important thing':

👉🏽AI

👉🏽Bitcoin

👉🏽Love and relationships

👉🏽None of the above.

'Is Dell coming for the throne? Is 23 times more fiat enough to overtake Saylor in Bitcoin holdings? Maybe not, but will be a fun match to watch.' - Bitcoin for Freedom

➡️Bitcoin holdings at OTC desks have seen a significant increase in the last two months.

29th of June:

➡️Bitcoin miner capitulation has reached levels comparable to December 2022 (7.6%), which marked the cycle bottom after the FTX collapse.

➡️In June, U.S. Spot Bitcoin ETF Monthly Net Inflow: $+668 million

- Price down to $61,000 from $67,500

- Blackrock adds 15,416 Bitcoin, a $1.1 billion inflow, and owns 306,979 Bitcoin

- 2nd Fidelity with $276 million inflow

- 3rd Bitwise Invest with $56 million inflow

Ergo: Added almost $700 million and price down 10%.

Also, Saylor bought $800 million more.

➡️'About 99.5% of all the Bitcoin in circulation is held in 16.5 million UTXOs that have a value of 1m sats or more. Most of the other 169 million UTXOs will likely become economically unspendable in the future assuming they aren't consolidated into larger ones relatively soon.' - Wicked

If you want to learn more on the topic please read the following article:

https://river.com/learn/bitcoins-utxo-model/#what-is-bitcoin-utxo-management

1st of July:

➡️SONY to launch Bitcoin and CrApTo exchange. According to a statement on July 1, Sony will take ownership of Amber Japan’s WhaleFin exchange, which will be renamed S.BLOX Co.

➡️Japanese company Metaplanet has acquired an additional ~20.195 BTC for ¥200 million

As of July 1st, Metaplanet now holds ~161.26 BTC, equivalent to ~9% of its market cap.

➡️'Bitcoin difficulty is expected to drop -6% on Friday, the biggest drop since Dec'22 (the FTX collapse), which marked the cycle bottom. Even the May 10 drop at -5.6% has so far marked the bottom. Again, I wouldn't be surprised if this marked another local bottom. Relief is coming for miners.' - James van Straten

💸Traditional Finance / Macro:

👉🏽 No news

🏦Banks:

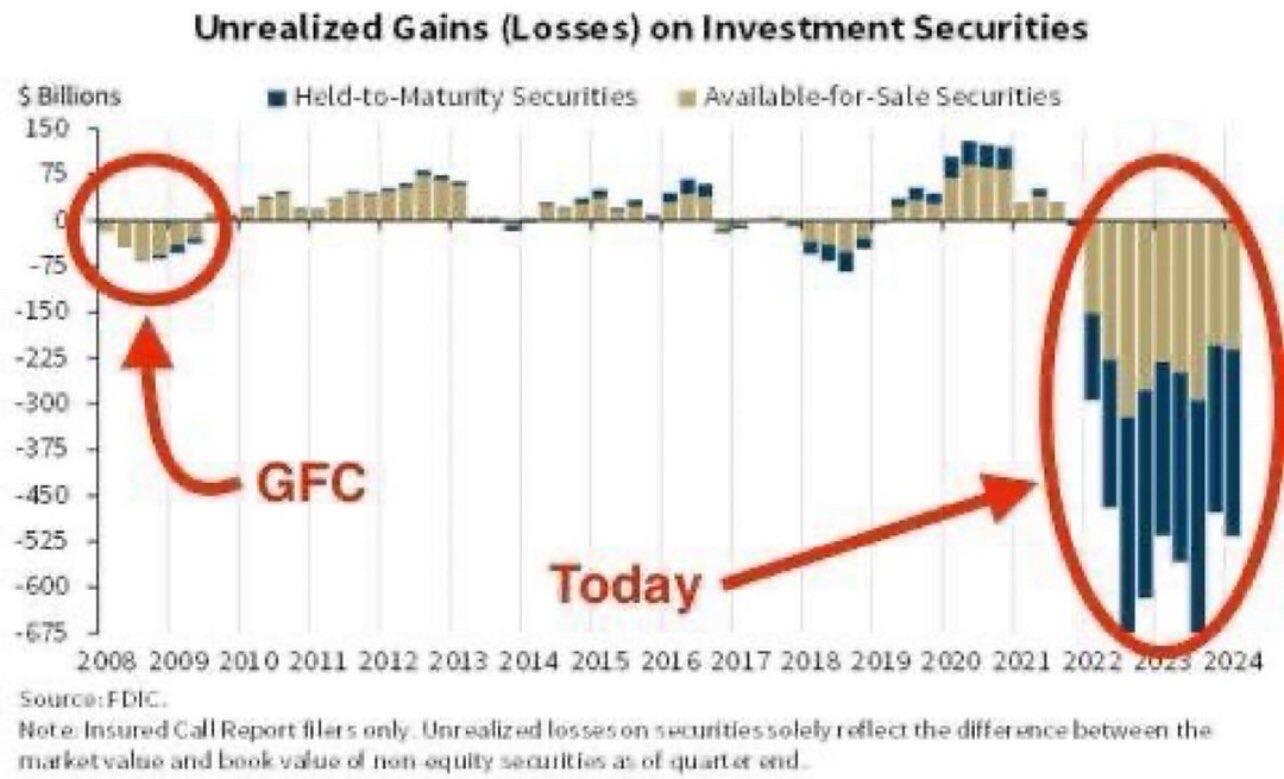

👉🏽 U.S. bank's unrealized losses have accumulated to $525 billion, almost 7 times bigger than during the GFC. (Picture 3)

Banks are the most highly regulated scams of our lifetime. Look at the picture and ask yourself, is this fine? FDIC report shows that the investment securities of US banks 'under water' big time, almost 7x worse than in the subprime crisis (GFC). this does not include losses on their regular loan portfolios.

One day the chicken will come home to roost.

Oh well, a little brrr can fix this...right?

🌎Macro/Geopolitics:

On the 24th of June:

👉Argentina has recorded zero Inflation in its food and beverage sector for the first time in 30 years. It's a great stat, but still not great. They need 120 quarters of negative inflation to make up for the damage. Javier Milei slashed Argentina's annual inflation by 95% in just seven months.

Monthly inflation has fallen from 25.5% to 4.2% since he took office.

From a 1355% inflation rate to a surplus budget, his economic policies have transformed the economy.

As Milei said, the reforms he is making will have lasting benefits in years to come. The population will settle into stability as time goes on. At the moment 60% of Argentina’s population wants Milei to continue with these profound reforms.

Who could have guessed that cutting government spending and not printing was going to reduce inflation...Who could have guessed...

👉The best news I have heard for a long time: JULIAN ASSANGE IS FREE

He left Belmarsh maximum security prison on the morning of 24 June, after having spent 1901 days there. He was granted bail by the High Court in London and was released at Stansted Airport during the afternoon, where he boarded a plane and departed the UK.

1 out, 2 to go

Julian Assange’s jet and recovery costs totaled $520,000 and most of it was paid in Bitcoin

Someone from the community donated 8BTC in a single anonymous donation.

👉'The Japanese Yen against the US dollar just hit a fresh 34-year low.

The USD-JPY currency pair closed on Friday slightly below 160, the level which was previously defended by Japan’s Ministry of Finance intervention.

According to government data, Japan spent a record 9.8 trillion Yen ($62 billion) to support the currency between April 26th and May 29th.

This is all despite the Bank of Japan raising rates for the 1st time in 17 years in March from -0.1% to a range of 0%-0.1%.

Overall, the Japanese currency has lost 13% of its purchasing power against the US Dollar year-to-date.' -TKL

Over the last 12.5 years, the Japanese Yen has lost a whopping 53% of its value against the US Dollar! Yikes! To make it even worse Japan's Q1 GDP was revised down to -2.9%

Fire up the printers, banzai!

(Picture 4)

'Dear Bank of Japan congratulations, your toilet paper of a currency is now the worst performing in the world, with the lira, peso, and real all stronger.' - Zerohedge

On the 25th of June:

👉'Real retail sales are on track for their 2nd consecutive quarter of year-over-year declines. US retail sales adjusting for inflation fell by 0.9% in May and are now 3.8% below their April 2021 peak.

To put this into perspective, during the 2008 Financial Crisis, this metric dropped by ~13% and by ~4% in the early 2000s recession.

The largest decline in history took place during the 2020 Pandemic with a 20% decline.

Meanwhile, consumer sentiment has decreased for a 3rd straight month to its lowest level since November 2023.' - TKL

On the 27th of June:

👉After a shallow dip, Eurozone M3 Money Supply is making new highs.

Christine Lagarde, President of the ECB, has already fired up the money printer. It's only a matter of time before others follow suit.

ps.: on the 1st of July -> US M2 Money Supply turns up.

Oh please bear in mind meaning the ESG debt is ballooning in Europe as the ECB is trying to add sustainability to its mandate.

👉U.S. Treasury Liquidity is now at its worst point in AT LEAST the last 14 years, surpassing even the GFC.

On the 28th of June:

👉'US consumers have exhausted their savings:

$2.3 trillion of accumulated savings have been depleted by Americans since August 2021.

In other words, $67.6 billion of savings has been spent by US consumers PER MONTH.

As savings have declined, consumer credit card debt has spiked by $290 billion, or ~40% in 3 years.

In other words, to fight rising prices and elevated interest rates, US households have gone into debt at the fastest pace since the 2008 Financial Crisis.

Consumers are struggling.' -TKL

🎁If you have made it this far I would like to give you a little gift:

I want to give you a great conversation/podcast:

https://www.youtube.com/watch?v=lBqLz5hvSHA

Credit: I have used multiple sources!

My savings account: Bitcoin

The tool I recommend for setting up a Bitcoin savings plan: @Relai 🇨🇭 especially suited for beginners or people who want to invest in Bitcoin with an automated investment plan once a week or monthly. Hence a DCA, Dollar cost Average Strategy. Check out my tutorial post (Instagram) & video (YouTube) for more info.⠀⠀⠀⠀

Get your Bitcoin out of exchanges. Save them on a hardware wallet, run your own node...be your own bank. Not your keys, not your coins. It's that simple.⠀⠀⠀⠀⠀⠀⠀⠀

Do you think this post is helpful to you? If so, please share it and support my work with sats.

#zap 🧡 #weeklyrecap #nostr

#plebchain

#BTC

#Bitcoin

#zap🧡

#plebchain

#grownostr

#stacksats

#bitcoineducation

#adoption

Picture 1, 2, 3, and 4.

🧠Quote(s) of the week:

'Last month, we've absorbed:

US Gov selling

German selling

Mt Gox distribution fears

Miner capitulation

Yet, Bitcoin is consolidating at $61K, just 20% below ATH.

Tops are the exact opposite, driven by FOMO and greed. This is nothing like that. We're going much higher.' - Thomas Fahrer

🧡Bitcoin news🧡

Oranje into the Quarter-Finals and Nostr is vibin'.

I want to start the Weekly Recap with a short story. I put the following post on Instagram and Nostr: https://njump.me/nevent1qqs0uzqg3nnuvsz0tycu4ydl2m4gnm245m0n3gsppxm4pttrgy8j3gqprpmhxue69uhhyetvv9ujumn0wdmksetjv5hxxmmdqy28wumn8ghj7un9d3shjtnyv9kh2uewd9hsygpu0hpvtplweczsl0r9szd3vzw3jgrlsfwawe65hxg9a89gq4jz4q5vzdpe

On IG (945 followers): 3 likes

On Nostr (273 followers): It has 68 likes, 14 reposts, 8 replies, and 12 zaps (people sent me small amounts of BTC)

On Nostr:

-No KYC or info required

-Instant final settlement (just press the Lightning button and boom it’s done)

-Bitcoin native

-Use any client (Damus and Primal on iOS, Amethyst on Android, or Primal on the web)

But far more important you own your own content + money!

Nostr is looking better every day.

Less doom, more hope. More you in control.

Great quote by nostr:npub1trr5r2nrpsk6xkjk5a7p6pfcryyt6yzsflwjmz6r7uj7lfkjxxtq78hdpu :

'We wouldn’t need Nostr

-If we could trust social media companies

-If we could trust admins

-If we could trust could regulators

But we can’t. That’s why we need Plan N'

Bitcoin is an uncensorable transfer of value. Nostr is an uncensorable transfer of information.

24th of June:

➡️Louisiana passes the bill to protect the right to custody of Bitcoin and ban CBDCs.

Louisiana joins Oklahoma, Montana, & Arkansas in setting a pro-Bitcoin policy blueprint for the nation.

25th of June:

➡️'The German government sold 900 Bitcoin ($54M) on June 25th.

This included 200 BTC each to Coinbase and Kraken, with the remaining going to an unknown wallet ("139Po").' - Bitcoin News

Weak hands! These 900 Bitcoins are now (hopefully) safely in the hands of ultra-hardcore maxis with diamond hands.

➡️'The current Bitcoin halving cycle is still outperforming the second halving cycle if you zoom in a lot on the bottom left of the chart. We are so early, very bullish!' - Pierre Rochard

(Picture 1)

➡️Bitcoin lightning payments app Strike launches to millions across the UK.

Watch the full video (announcement) by Jack Mallers here: https://x.com/jackmallers/status/1806423520370364640

➡️'Hedge Fund strategy:

Push down the Bitcoin price by shorting it until more and more miners need to sell because of the low price. The price goes even lower. Meanwhile, Hedge Funds buy up everything available then close their shorts and we go to $1M.'

Now you might say this is not realistic, but is it?

'When Blackrock has 500,000 Bitcoin and they've pushed the price to $1M.

Blackrock will make $1.25B in Fees. Not mining fees, the IBIT management fees.

Every. Year. Forever.' - Thomas Fahrer

➡️Bitcoin balance on exchanges continues to steadily decline.

Since the beginning of the year, about 250,000 Bitcoins have left the exchanges. Less Bitcoin on exchanges means more short-term volatility.

➡️ Morgan Stanley is set to approve Bitcoin ETFs on their wealth management platform for all clients by the end of August (at the latest), according to a senior source.

➡️Latin American digital bank Nubank is integrating the Bitcoin Lightning Network for its 100 million customers. Nubark is owned by Warren Buffett.

➡️Last week I mentioned that the German government sold roughly $425 million BTC. One of the best quotes on this topic by Alex Gladstein:

'Germany selling large amounts of Bitcoin for euros *that it can print* will go right up there with ditching nuclear power in exchange for relying on Putin for fuel as biggest self-inflicted wounds of the 21st century'

26th of June:

Bitcoin hashrate is down nearly 10% off the all-time highs that were hit at the end of April

27th of June:

➡️'BlackRock disclosed buying Bitcoin for its Global Allocation Fund in the latest SEC filing.

This is the THIRD internal BlackRock fund that has bought Bitcoin through the IBIT Bitcoin ETF' - Bitcoin Archive

'Looking at the past 5 years, Bitcoin is up 422%, mid-cap altcoins 145% and small-cap altcoins 8%. You missed 400% chasing shiny things instead of embracing Bitcoin. Choose wisely on how you store your value, allocate your time, and invest your resources.' - Gabor Gurbacs

(Picture 2)

As usual and in every cycle most people think they're a genius with impeccable timing until the rugs, dumps, scams, and 'capital rotations' hit, and then they're left holding dust.

➡️Cleanspark will acquire bitcoin miner GRIID for $155 million, with plans to expand over 400 MW in Tennessee.

Under the merger agreement, CleanSpark will purchase all GRIID common stock in an all-stock transaction, with GRIID stockholders receiving CleanSpark shares. The South is now Bitcoin miner territory, as it started in Georgia, then Mississippi, and now Tennessee. If I am right the South holds more available energy than any other region in America.

➡️Bolivia makes Bitcoin trading and payments legal again in an effort to modernize the financial system.

Ecuador is now the only country in Latin America that prohibits Bitcoin payments.

28th of June:

➡️ In the previous Weekly Recap I mentioned that Michael Dell, CEO of multi-billion dollar tech firm Dell Technologies, just dipped his toes into the Bitcoin waters, and this recent jest did make a splash.

Now last week Michael Dell posted a tweet with a poll 'The most important thing':

👉🏽AI

👉🏽Bitcoin

👉🏽Love and relationships

👉🏽None of the above.

'Is Dell coming for the throne? Is 23 times more fiat enough to overtake Saylor in Bitcoin holdings? Maybe not, but will be a fun match to watch.' - Bitcoin for Freedom

➡️Bitcoin holdings at OTC desks have seen a significant increase in the last two months.

29th of June:

➡️Bitcoin miner capitulation has reached levels comparable to December 2022 (7.6%), which marked the cycle bottom after the FTX collapse.

➡️In June, U.S. Spot Bitcoin ETF Monthly Net Inflow: $+668 million

- Price down to $61,000 from $67,500

- Blackrock adds 15,416 Bitcoin, a $1.1 billion inflow, and owns 306,979 Bitcoin

- 2nd Fidelity with $276 million inflow

- 3rd Bitwise Invest with $56 million inflow

Ergo: Added almost $700 million and price down 10%.

Also, Saylor bought $800 million more.

➡️'About 99.5% of all the Bitcoin in circulation is held in 16.5 million UTXOs that have a value of 1m sats or more. Most of the other 169 million UTXOs will likely become economically unspendable in the future assuming they aren't consolidated into larger ones relatively soon.' - Wicked

If you want to learn more on the topic please read the following article:

https://river.com/learn/bitcoins-utxo-model/#what-is-bitcoin-utxo-management

1st of July:

➡️SONY to launch Bitcoin and CrApTo exchange. According to a statement on July 1, Sony will take ownership of Amber Japan’s WhaleFin exchange, which will be renamed S.BLOX Co.

➡️Japanese company Metaplanet has acquired an additional ~20.195 BTC for ¥200 million

As of July 1st, Metaplanet now holds ~161.26 BTC, equivalent to ~9% of its market cap.

➡️'Bitcoin difficulty is expected to drop -6% on Friday, the biggest drop since Dec'22 (the FTX collapse), which marked the cycle bottom. Even the May 10 drop at -5.6% has so far marked the bottom. Again, I wouldn't be surprised if this marked another local bottom. Relief is coming for miners.' - James van Straten

💸Traditional Finance / Macro:

👉🏽 No news

🏦Banks:

👉🏽 U.S. bank's unrealized losses have accumulated to $525 billion, almost 7 times bigger than during the GFC. (Picture 3)

Banks are the most highly regulated scams of our lifetime. Look at the picture and ask yourself, is this fine? FDIC report shows that the investment securities of US banks 'under water' big time, almost 7x worse than in the subprime crisis (GFC). this does not include losses on their regular loan portfolios.

One day the chicken will come home to roost.

Oh well, a little brrr can fix this...right?

🌎Macro/Geopolitics:

On the 24th of June:

👉Argentina has recorded zero Inflation in its food and beverage sector for the first time in 30 years. It's a great stat, but still not great. They need 120 quarters of negative inflation to make up for the damage. Javier Milei slashed Argentina's annual inflation by 95% in just seven months.

Monthly inflation has fallen from 25.5% to 4.2% since he took office.

From a 1355% inflation rate to a surplus budget, his economic policies have transformed the economy.

As Milei said, the reforms he is making will have lasting benefits in years to come. The population will settle into stability as time goes on. At the moment 60% of Argentina’s population wants Milei to continue with these profound reforms.

Who could have guessed that cutting government spending and not printing was going to reduce inflation...Who could have guessed...

👉The best news I have heard for a long time: JULIAN ASSANGE IS FREE

He left Belmarsh maximum security prison on the morning of 24 June, after having spent 1901 days there. He was granted bail by the High Court in London and was released at Stansted Airport during the afternoon, where he boarded a plane and departed the UK.

1 out, 2 to go

Julian Assange’s jet and recovery costs totaled $520,000 and most of it was paid in Bitcoin

Someone from the community donated 8BTC in a single anonymous donation.

👉'The Japanese Yen against the US dollar just hit a fresh 34-year low.

The USD-JPY currency pair closed on Friday slightly below 160, the level which was previously defended by Japan’s Ministry of Finance intervention.

According to government data, Japan spent a record 9.8 trillion Yen ($62 billion) to support the currency between April 26th and May 29th.

This is all despite the Bank of Japan raising rates for the 1st time in 17 years in March from -0.1% to a range of 0%-0.1%.

Overall, the Japanese currency has lost 13% of its purchasing power against the US Dollar year-to-date.' -TKL

Over the last 12.5 years, the Japanese Yen has lost a whopping 53% of its value against the US Dollar! Yikes! To make it even worse Japan's Q1 GDP was revised down to -2.9%

Fire up the printers, banzai!

(Picture 4)

'Dear Bank of Japan congratulations, your toilet paper of a currency is now the worst performing in the world, with the lira, peso, and real all stronger.' - Zerohedge

On the 25th of June:

👉'Real retail sales are on track for their 2nd consecutive quarter of year-over-year declines. US retail sales adjusting for inflation fell by 0.9% in May and are now 3.8% below their April 2021 peak.

To put this into perspective, during the 2008 Financial Crisis, this metric dropped by ~13% and by ~4% in the early 2000s recession.

The largest decline in history took place during the 2020 Pandemic with a 20% decline.

Meanwhile, consumer sentiment has decreased for a 3rd straight month to its lowest level since November 2023.' - TKL

On the 27th of June:

👉After a shallow dip, Eurozone M3 Money Supply is making new highs.

Christine Lagarde, President of the ECB, has already fired up the money printer. It's only a matter of time before others follow suit.

ps.: on the 1st of July -> US M2 Money Supply turns up.

Oh please bear in mind meaning the ESG debt is ballooning in Europe as the ECB is trying to add sustainability to its mandate.

👉U.S. Treasury Liquidity is now at its worst point in AT LEAST the last 14 years, surpassing even the GFC.

On the 28th of June:

👉'US consumers have exhausted their savings:

$2.3 trillion of accumulated savings have been depleted by Americans since August 2021.

In other words, $67.6 billion of savings has been spent by US consumers PER MONTH.

As savings have declined, consumer credit card debt has spiked by $290 billion, or ~40% in 3 years.

In other words, to fight rising prices and elevated interest rates, US households have gone into debt at the fastest pace since the 2008 Financial Crisis.

Consumers are struggling.' -TKL

🎁If you have made it this far I would like to give you a little gift:

I want to give you a great conversation/podcast:

https://www.youtube.com/watch?v=lBqLz5hvSHA

Credit: I have used multiple sources!

My savings account: Bitcoin

The tool I recommend for setting up a Bitcoin savings plan: @Relai 🇨🇭 especially suited for beginners or people who want to invest in Bitcoin with an automated investment plan once a week or monthly. Hence a DCA, Dollar cost Average Strategy. Check out my tutorial post (Instagram) & video (YouTube) for more info.⠀⠀⠀⠀

Get your Bitcoin out of exchanges. Save them on a hardware wallet, run your own node...be your own bank. Not your keys, not your coins. It's that simple.⠀⠀⠀⠀⠀⠀⠀⠀

Do you think this post is helpful to you? If so, please share it and support my work with sats.

#zap 🧡 #weeklyrecap #nostr

#plebchain

#BTC

#Bitcoin

#zap🧡

#plebchain

#grownostr

#stacksats

#bitcoineducation

#adoption

Just my opinion:

For long term savings you wanna have larger UTXOs. So try to bundle the small amounts (UTXO's).

You can use lightning but I would use it whilst running your own node.

I doubt that since mining is such a competitive industry. I wouldn't count on it.

‘About 99.5% of all the Bitcoin in circulation is held in 16.5 million UTXOs that have a value of 1m sats or more. Most of the other 169 million UTXOs will likely become economically unspendable in the future assuming they aren’t consolidated into larger ones relatively soon.’ - nostr:npub14uhkst639zvc2trx2nlsvk4yqkjp690zk89keytnzgmq2az0qmnq58ez89

People please do some UTXO management and whilst doing that buy some sats.

Bitcoin’s Unspent Transaction Outputs (UTXOs) can be classified into different segments based on their age.

UTXO Management for Dummies:

If everyone pays you in quarters you’ll have to lug around a big heavy bag. It’ll also cost you more time to spend as you have to count quarters when paying. So ask for $20s or $100s as payment, or change your quarters into bills from time to time.

Now I can hear you say...wtf is a UTXO?

A UTXO stands for unspent transaction output. Don’t worry about those unnecessarily complicated words. Just use “UTXO” and understand the concept of what it is…

If you want to learn/study the topic: https://armantheparman.com/utxo/

Credit picture: nostr:npub14uhkst639zvc2trx2nlsvk4yqkjp690zk89keytnzgmq2az0qmnq58ez89

Study, learn, hodl, decouple.

#bitcoin 🧡

▃▃▃▃▃▃▃▃▃▃▃▃▃▃

My savings account: Bitcoin

The tool I recommend for setting up a Bitcoin savings plan: @Relai 🇨🇭 🇨🇭 especially suited for beginners or people who want to invest in Bitcoin with an automated investment plan once a week or monthly. Hence a DCA, Dollar cost Average Strategy. Check out my tutorial post (Instagram) & video (YouTube) for more info.

⠀⠀⠀⠀⠀⠀⠀⠀

Felipe - BitcoinFriday

#zap 🧡 #nostr #BTC #Bitcoin #plebchain #grownostr #stacksats #bitcoineducation #adoption

🧠Quote(s) of the week:

Ferguson’s Law states that any great power that spends more on debt service (interest payments on the national debt) than on defense will not stay great for very long. True of Hapsburg Spain, true of ancien régime France, true of the Ottoman Empire, true of the British Empire. -Niall Ferguson

🧡Bitcoin news🧡

I want to start the Weekly Recap with a picture & a story. Someone posted the following quote/picture: (Picture 1)

What can you learn from this? His fundamental mistake was not gaining the understanding that Bitcoin differs from, and is superior to all CrYpTO.

‘This guy probably would’ve had a cost basis below $10k had he just started regularly dollar cost averaging into Bitcoin instead of trading shitcoins. The shortcut IS saving in Bitcoin.’ — nostr:npub14uhkst639zvc2trx2nlsvk4yqkjp690zk89keytnzgmq2az0qmnq58ez89

That's because CrYpTo isn't Bitcoin. If he were saving in Bitcoin since 2017, he would be retired.

Let me explain that with data:

If he bought Bitcoin in 2017 at the pico top he’d be up 300% right now

if he bought Bitcoin in 2017 at the bottom he’d be up 8,500% right now

Yikes! Anyway let's continue:

17th of June:

➡️SEC's chief of the crypto asset enforcement division David Hirsch has left the role.

The timing of these things is almost like a script. weird, huh? Probably he will be hired by a financial corporation to lobby their 'CrYpTo' division.

➡️BlackRock CEO Larry Fink: "No matter how much we tax, cut, or reduce debt, it will not be enough. Building new infrastructure is critical." -Simply Bitcoin

When he mentions new infrastructure, what do you think he means? CBDCs? Or Bitcoin? Is that why they're buying Bitcoin?

➡️'Daily active Bitcoin addresses fell from 700K to 613K in the past month.' - Bitcoin News

19th of June:

➡️'Bitcoin illiquid supply has increased since May, suggesting investors are choosing to hodl rather than trade.' -Bitcoin News

➡️'Cleanspark announces the acquisition of five new Bitcoin mining facilities in Georgia for $25.8M.

The deal will boost Cleanspark's operational hashrate to +20 EH/s by the end of June.' -Bitcoin News

➡️'People think DCAing forever into the S&P 500 is much safer than Bitcoin.

I question that severely. ~7% of your portfolio is now Nvidia, another 30% are mega-cap US tech, and the remaining 63% are just zombie companies.' - Joe Burnett

➡️'Bitcoin mining distribution worldwide.' -Blockware (Picture 2)

20th of June:

'Bitcoin miner reserves fell to 1.90M BTC, the lowest level in the last 14 years.' - Bitcoin News

➡️International Business Times says Bitcoin mining can help achieve “net zero by 2050,"

This is a mainstream media channel, based in NY. It’s a well-researched article on Bitcoin mining, aware of contemporary research including:

👉🏽Cornell study showing bitcoin can create “a self-sustaining cycle for renewable energy expansion”

👉🏽Digital Assets Research Institute study showing Bitcoinwell-researched uses 54.5% sustainable sources

👉🏽Various studies show Bitcoin mining can turn [wasted] “Excess Energy Into Economic Value”

➡️MicroStrategy just bought $786 MILLION Bitcoin at an average cost of $65,883.

They acquired 11,931 more Bitcoin and continued their unwavering strategy of accumulating BTC. With this latest purchase, the company's total holdings now stand at approximately 226,331 Bitcoin.

➡️Winklevoss twins donated 30 Bitcoin worth +$2 Million to Donald Trump’s campaign to "put an end to the Biden Admin's war on crypto."

On one hand, my first reaction is why on earth would you give away your precious Bitcoin to any politician? But on the other hand, it's kinda a power move. Bitcoin is now political. Bitcoin is now a topic in the upcoming US election.

The reasoning is worth the read: https://x.com/tyler/status/1803872859938549920

➡️'Michael Dell, CEO of multi-billion dollar tech firm Dell Technologies, just dipped his toes into the Bitcoin waters, and this recent jest did make a splash.

It all started when Dell tweeted “Scarcity creates value.” Enter Michael Saylor, MicroStrategy’s possibly Bitcoin-obsessed executive chairman, who couldn’t resist chiming in with a hashtagged reply saying “Bitcoin is Digital Scarcity.” Dell, apparently intrigued, hit that retweet button faster than you can say “blockchain.”

The real kicker here is this: Dell later shared a meme of Sesame Street’s Cookie Monster, probably generated by AI or photoshopped to show the blue fuzzball munching on Bitcoin instead of his usual chocolate chip treats.

Dell Technologies is sitting comfortably with $34.6 billion in current assets (including a not-too-shabby $5.8 billion in cash), there’s no mention of Bitcoin anywhere in their recent filings. So, for now, this looks more like a playful flirtation than a full-on pursuit of Bitcoin.' - Crypto Briefing (Picture 3)

If Dell were to implement a Bitcoin treasury strategy, it would be by far the largest corporation to do so. As a founder-CEO-led company, Dell has the visionary leadership required to make such a bold move. Although we all know that cash is like a melting ice cube.

22nd of June:

➡️Bitcoin dips 3,5% as the German government sells $325 million BTC over two days. This, and that total outflows last week was $544.1 million.

24th of June:

➡️Mt. Gox will begin Bitcoin repayments starting at the beginning of July 2024.

➡️Metaplanet issues ¥1 billion in 0.5% bonds; proceeds to fund additional purchases of $BTC.

💸Traditional Finance / Macro:

On the 19th of June:

👉🏽 Nvidia is now larger than:

1. GDP of every country in the world except 7

2. The entire Crypto market combined

3. 5x the market cap of Tesla

4. 6x the market cap of Walmart

5. The market cap of the entire French stock market

6. Canada's GDP plus $1.2 trillion in cash

7. 13x the market cap of AMD

8. 3x the GDP of the city of Los Angeles

9. Amazon and Berkshire Hathaway COMBINED

10. Collective net worth of the 12 richest people in the world

Nvidia's market cap is now worth more than the entire US oil and gas industry.

It's also worth more than every building in New York City COMBINED.

Since October 2023, Nvidia has added $2.3 TRILLION in market cap.

Funny stat: Nvidia insiders are selling the stock at the fastest pace in years.

Jensen Huang just sold another $31 million of NVDA. That brings his total sales this week to over $90 million. It’s his largest cluster of sales in 19 years. But bear in mind this is just a tiny fraction of his total holdings. Shit, I would sell some if I had some.

🏦Banks:

👉🏽 No news

🌎Macro/Geopolitics:

Let's start this segment with a the quote:

'Ferguson’s Law states that any great power that spends more on debt service (interest payments on the national debt) than on defense will not stay great for very long. True of Hapsburg Spain, true of ancien régime France, true of the Ottoman Empire, true of the British Empire.' -Niall Ferguson

On the 17th of June:

👉'The US Treasury estimates net interest costs on federal debt will hit a record $890 billion in 2024.

This would be $331 billion higher than a year ago and almost double the amount from 2022.

To put this into perspective, net interest expenses will be ~3% of the ENTIRE US GDP, the highest in over 30 years and higher than World War II levels.

On a non-net basis, interest payments have already surpassed $1 trillion when annualized.

Total interest payments are set to reach as high as $1.6 trillion by the end of the year if the Fed does not cut rates.

The debt crisis is an understatement.' - TKL (Picture 4)

On the 18th of June:

👉'The Bank of England pays out so much interest on bank reserves that it impacts the UK’s fiscal situation. This is part of the overall “fiscal dominance” situation and is common to many countries, but accounting treatments differ.' - Lyn Alden

The UK but also other countries are now spending more and more tax revenue on past debt rather than on future growth.

👉🏽 On this day the CBO (Congressional Budget Office) boots the 2024 US budget deficit estimate to 1.9$T from 1.5$T.

Classic! What is 0.4T between friends, right?

CBO's 10-year projections have historically underestimated federal debt by an average of 58% (using data from 2006-2023).

Thus, their $50 trillion deficit estimate is more than likely to actually be $75T. Oh, how I love data!

On the 19th of June:

(Picture 5)

👉'RE: The Goldman report on foreign UST demand, a picture is worth 1,000 words:

Total US Federal debt 1990-present in blue.

Total foreign holdings of USTs in green.

Foreign official (CB) holdings of USTs in red.

"Mind the Gap".' - Luke Gromen

So you might wonder who is buying all of the debt (USTs)? The answer is simple:

The Fed, US banks, US retail.

Hard to get inflation under control when the gap is being filled in with the printing press...

👉'Japan's biggest banks (Norinchukin is Japan's 5th largest bank with $840 billion in assets) today the proverbial canary stepped on a neutron bomb inside the Japanese coalmine because according to Nikkei, Norinchukin Bank "will sell more than 10 trillion yen ($63 billion) of its holdings of U.S. and European government bonds during the year ending March 2025 as it aims to stem its losses from bets on low-yield foreign bonds, a main cause of its deteriorating balance sheet, and lower the risks associated with holding foreign government bonds.' -Zerohedge

Is this the reason why the Japanese Yen is against the dollar hitting levels not seen since 1990?

Now just read the headlines above again and ask yourself: Is this the reason why better should a bit own Bitcoin?

If not, just read the following statement:

👉'The US debt stampede is back: federal debt jumps by $70BN in one day to a record $34.750 trillion, the biggest one-day jump since February.' - Zerohedge

👉🏽 'UK inflation has dropped to the magic level of 2.0%! The last time UK inflation was at the target of the Bank of England was three years ago.

So expect central bank policymakers to cheer their achievement but not to say a word about the fact that consumer prices rose by a staggering 21% in those three years.

For central banks, the arbitrarily chosen 12-month rate of change in prices is the only thing that counts.

The good news is that this will open the door to rate cuts, providing more liquidity for financial markets.' -Jeroen Blokland

On the 21st of June:

👉🏽'To meet reformed EU fiscal rules, Italy and France would have to go for fiscal consolidations over 2025-2028 that are larger than during the Euro Crisis (2011-2014). Spain has to do about half.

Do we properly remember the effects and political debates of €zone austerity?' - Phillip Heimberger (Picture 6)

Remember Draghi, former ECB president 'Whatever it takes'. The above is just another example of a one-size-fits-all approach that does not work.

🎁If you have made it this far I would like to give you a little gift:

I want to give you two video's.

First video Jack Mallers: There is no second Best (BTC Prague 2024 Keynote)

“A failure to understand proof of work is a failure to understand Bitcoin.”

Jack opens his keynote with this quote by Gigi, and closes this comparison of bitcoin and altcoins: “We can't decide for you. We can educate you.” — Jack Mallers

https://www.youtube.com/watch?v=--IFcOIEfl4&t=510s

Second video Lyn Alden: Lyn Alden is a macroeconomist and investment strategist. In this interview, they discuss the role of the Fed and central banks, fractional reserve vs free banking, how bitcoin could change these dynamics and if we should actually end the Federal Reserve System.

“We actually now have ways to do fast settlement…payments and settlements that can’t be reversed, it’s starting to show that maybe you actually don’t even need a central bank.” — Lyn Alden

https://www.youtube.com/watch?v=CdEJHUqT0XE

Only invest in Bitcoin what you can’t afford to have gradually stolen from you by the government.

Credit: I have used multiple sources!

My savings account: Bitcoin

The tool I recommend for setting up a Bitcoin savings plan: @Relai 🇨🇭 especially suited for beginners or people who want to invest in Bitcoin with an automated investment plan once a week or monthly. Hence a DCA, Dollar cost Average Strategy. Check out my tutorial post (Instagram) & video (YouTube) for more info.⠀⠀⠀⠀

Get your Bitcoin out of exchanges. Save them on a hardware wallet, run your own node...be your own bank. Not your keys, not your coins. It's that simple.⠀⠀⠀⠀⠀⠀⠀⠀

Do you think this post is helpful to you? If so, please share it and support my work with sats.

#zap 🧡 #weeklyrecap #nostr

#plebchain

#BTC

#Bitcoin

#zap🧡

#plebchain

#grownostr

#stacksats

#bitcoineducation

#adoption

Noderunners🧡💜

🧠Quote(s) of the week:

"Bitcoin is a strange game where the only winning move is to play." -Bitstein

'I’m prepared to lose everything over Bitcoin. Everything I have is riding on this one trade. If Bitcoin fails, I will be absolutely wrecked. It will take years to recover.

I told myself a long time ago I’d rather lose everything than miss out on the most asymmetric opportunity of my lifetime.

I bought the top in 2021. I purchased the bottom in 2022. I’m still buying now.

I’m more allocated as a percentage of my portfolio to Bitcoin than I have ever been before.

This may seem irresponsible as fuck but when you see the world through the Bitcoin lens it makes much more sense. It’s perfect math.

I don’t know how many fully longed degenerate Bitcoin hodlers are out there riding this colossal Bitcoin wave with me but you’re all fucking legends in my book.' -The Bitcoin Therapist

🧡Bitcoin news🧡

9th of June:

➡️ Paraguay is earning more money selling its energy to Bitcoin miners than by selling it to Brazil.

'Paraguay to sell excess hydro-energy to miners as part of its new Economic Development strategy.

Paraguay's Itaipu hydro-power station is one of the world's biggest, yet only 20% of the generated power is used.' - Bitcoin Archive

10th of June:

➡️ If we took the official inflation rate Bitcoin would have to hit $79,000 to reach a new all-time high. But we all know the real inflation is much higher. (Picture 1)

➡️ 'Canadian public company DeFi Technologies has adopted Bitcoin as its primary treasury reserve asset. It just bought 110 BTC.' - Bitcoin Magazine

The game theory associated with putting Bitcoin on the balance sheet is starting to heat up. (more on that later on)

Funny isn't it, a 'defi' company buying Bitcoin. No NFT, no Crapyto....Bitcoin.

'The three newest public companies to announce they have added Bitcoin to their balance sheets—Defi Technologies, Semler Scientific, and Metaplanet—are all up between 30-50% over the past 5 days'

11th of June:

➡️Last week I mentioned that Metaplanet directors authorized the purchase of an additional ¥250 million of Bitcoin. Now this week Metaplanet jumped 9.88% after announcing its third Bitcoin purchase. Call it conviction.

12th of June:

➡️Trump pushing Bitcoin as a tool for US Energy is an amazing turnaround. 2024-2028 is going to be insane.

➡️World's largest bank, ICBC, says "Bitcoin retains scarcity similar to gold and solves gold's divisibility and portability issues."

➡️Taunton Firefighters become the fourth union in the US to add Bitcoin to its balance sheet.

13th of June:

➡️Supply on exchanges fell to ~939K BTC, the lowest since 2021.

➡️ERCOT recommends (Senate Committee on Business and Commerce) that Bitcoin mining be integrated as a Controllable Load Resource to ensure grid reliability.

'𝗘𝗫𝗣𝗟𝗔𝗡𝗔𝗧𝗜𝗢𝗡:

ERCOT runs the power grid in Texas to make sure everyone gets electricity.

Bitcoin miners can turn off their big power using mining machines quickly, which helps ERCOT manage the grid better during high demand.

This helps ERCOT avoid blackouts, and Bitcoin miners get paid for helping and can save money on their operations.' -Explainbriefly

I love the following nostr:npub1trr5r2nrpsk6xkjk5a7p6pfcryyt6yzsflwjmz6r7uj7lfkjxxtq78hdpu quote: "Once politicians and tax authorities learn that other people are willing to *pay them* to stabilize their energy grids and expand electricity production and bootstrap green energy, it’s game over for mainstream Bitcoin mining denialism."

➡️Microstrategy is raising $500M through convertible senior notes to buy more Bitcoin. With over 214,400 BTC already, the company remains the largest publicly traded Bitcoin holder.

➡️'Australia’s largest bank just put the Bitcoin ETF [IBTC] onto its trading platform! Commonwealth Bank of Australia has 17 million customers!' - BitcoinArchive

➡️Biden’s SEC is suing Coinbase in federal court arguing it doesn’t have a right to exist as an exchange. At the same time, the Biden campaign is preparing to accept crypto donations via Coinbase. A freaking clown show!

On the other side of the aisle. Trump had a dinner with Bitcoin mining executives. A few days later... check out the 15th of June.

14th of June:

➡️MicroStrategy increased its offering by $200m for a total of $700 MILLION to buy more.

15th of June:

➡️BIDEN ADMIN TO ATTEND BITCOIN ROUNDTABLE WITH KEY CONGRESSIONAL OFFICIALS IN DC

‘The primary objective of this meeting is to strategize on how to keep "Bitcoin and blockchain innovation in the United States.”’ - Dylan LeClair

➡️T-Mobile, partly owned by the German state and which owns T-Mobile US and Magenta, the world's largest telecom company with 3 times the footprint of Verizon and double the footprint of AT&T just announced that they are currently running Bitcoin nodes and they are planning to launch into Bitcoin mining. This has to be one of the most bullish news to come out of BTC Prague.

➡️Brazil's largest bank now offers Bitcoin trading to 60M customers via its Ion app!

17th of June:

➡️'We are currently 33 days into a Bitcoin miner capitulation, with the average duration over the past five years being 41 days.

Miner addresses collectively hold a substantial treasury of 700,000 BTC, but their balance has decreased by 30,000 BTC since October.

This period marks the longest distribution phase for miners since 2017, adding to headwinds.

Despite this, the hash rate has only decreased by 12% from its peak as unprofitable miners continue to sell Bitcoin to sustain operations.' - James van Straten

💸Traditional Finance / Macro:

24th of May:

👉🏽 Magnificent 7 stocks have officially exceeded $15 trillion in combined market cap for the 1st time ever.

The group's combined market cap now equals over 50% of US GDP.

In just 2 months the Magnificent 7's value has surged by a whopping $2 trillion.

The Magnificent 7 stocks have rallied by over 60% over the last 12 months compared to only a 20% gain in the other 493 S&P 500 stocks.

Combined they reflect over a record 30% of the entire S&P 500.

Big tech is getting even bigger. This is unsustainable and quite frankly it's the magnificent 1: NVIDIA.

From the movie The Big Short: 'They call him chicken little, bubble boy!'

🏦Banks:

👉🏽No news

🌎Macro/Geopolitics:

Let's start this segment with the following statement by Fed Chair Powell:

'Fed Chair Powell says the Fed does not have high confidence in their forecasts.'

I mean who has...? They have like 1400 PhD at the office, but hey..what about forecasting? This is quite reassuring right? Monetary policy is just vibes right now. Ffs.

On the 9th of June

👉🏽How expensive is the US national debt and how dangerous the US debt crisis has become?

'The average interest rate on $34.6 trillion of Treasury debt is now 3.2%, the highest since 2010.

$5.9 trillion of the national debt is in Treasury Bills, with an average interest rate of 5.4%.

Meanwhile, a record $9.3 trillion of national debt is going to mature within the next 12 months.

Even if the Fed cuts rates by 1-2 times, this debt will have to be refinanced at much higher rates.

All while annualized interest payments have already surpassed $1 trillion for the first time in history.' -TKL

The federal government's current annualized interest payment expenditure stands at $1.025 trillion, slightly surpassing the annualized defense expenditure of $1.022 trillion. To make it even worse the US government expenditures as % of GDP just hit 43%, matching levels seen during the 2008 Financial Crisis. To put this into perspective, spending as a % of GDP is just 1% below World War 2 levels. Even at the peak of World War 1, US government spending as a % of GDP was 20 percentage points lower.

From my point of view the US has reached the point of no return, no matter the outcome of the upcoming US election.

It took 220 years for the U.S. to accumulate 11 trillion dollars in debt. This is the same amount of debt that the U.S. just added since 2020. Unsustainable. Why?

'In the first 8 months of Fiscal Year 2024, the US deficit hit a whopping $1.2 trillion, or $4.9 billion PER DAY.

In May alone, deficit spending was $348 billion or $11.2 billion a day, according to the CBO.

Over the last 12 months, the US deficit totaled $1.7 trillion equaling 6.2% of US GDP.

Deficit spending as a % of GDP is above all previous recessionary levels except for the 2008 Financial Crisis, the 2020 pandemic, and World War 2.

At the same time, government expenditures hit $6.5 trillion which is 23% of US GDP.

The government is spending as if we are in a recession.' Unsustainable. (Picture 2) No political party will stop this.

👉🏽Bureau of Labor Statistics, making up numbers: Remember. Jobs are everything.

'The difference between the headline jobs number and the household survey hit 4.1 million in May, the largest difference in history.

The household survey is important because workers are only counted once, even if they hold more than one job.

This data shows that over the last 6 months, 1 MILLION Americans have become unemployed.

The number of people working MULTIPLE jobs in the US hit a near-record of 8.4 MILLION in May 2024.

Many Americans are now working multiple jobs in an effort to fight inflation.' -TKL

On the 11th of June:

M2 is now positive with rates at 5.5%. And rate cuts/QE/YCC are just a matter of time. The first-rate cut is already in place by the ECB, probably the Fed will do the same in the next two/three months.

So why is M2 important, what should you take away from this all?

M2 (money supply growing) + Debt growing = liquidity growing.

More money (liquidity) means higher asset prices, but it also means more monetary inflation. Oh well, it's about to get really fun in the upcoming months. (Picture 3)

👉🏽'Sky News admits the official inflation data DOES NOT accurately reflect the HUGE increase in prices.'

Great video: https://x.com/RadarHits/status/1800089422744195337

James Lavish: 'Controlling party politicians and establishment economists will never outwardly admit it, but consumers are smart enough to know that prices have not just settled at levels far higher than just a few years ago but are *still rising*.

What they tell you is that 'inflation is easing' or 'inflation is falling'. And what they show you is a highly manipulated index that *admits* a month-to-month or year-over-year measure.

But never this, the ongoing impact to you, the consumer.' (Picture 4)

On the 12th of June:

US inflation falls to 3.3%, lower than expectations.

On the 13th of June:

Yellen: We are creating jobs at a very rapid pace.

(Picture 5)

The US lost 1.2 Million full-time jobs during the last 12 months, but government jobs are booming. Let’s celebrate this job wonder.

On the 14th of June:

Argentina's monthly inflation rate in May was the lowest since 2022, dropping for the fifth consecutive month to 4.2% amid an austerity drive by President Milei.

The annual inflation rate has fallen from 133% in December to 40%. Wonder how? Cut government spending! Don't get me wrong I am not celebrating because this is a monthly inflation number. Now add that to the inflation from the past 10 years. And compound it. It is still off the charts. But hey... baby steps. Slash spending, balance budgets, and bring down taxes so the economy has more to work with. But apparently, that’s too complicated for most governments to figure out.

On the 15th of June:

👉🏽'Institutions like the IMF keep wading into countries' debt problems by getting them into more debt.

There are hardly any countries that went from "developing" to "developed" status over the past five decades. The global monetary system is structured to keep countries dependent.' (Picture 6)

I have said it before and will say it again, especially after reading Alex Gladstein's great book & articles, the IM is just a modern-day colonizer.

👉🏽The cost of insuring against a French default (CDS price) has shot up by 16bps this week. The probability of default is priced at 3.5%. The cost of insuring France's debt against default and the risk premium investors demand to hold French government debt both reached their highest since 2022.

👉🏽 Canada bankrupted 532 companies. 𝗛𝗶𝗴𝗵𝗲𝘀𝘁 𝘀𝗶𝗻𝗰𝗲 𝘁𝗵𝗲 𝗚𝗹𝗼𝗯𝗮𝗹 𝗙𝗶𝗻𝗮𝗻𝗰𝗶𝗮𝗹 𝗖𝗿𝗶𝘀𝗶𝘀! Canada is a G7 nation. Cleaning the system I guess, low interest rates, and cheap money allowed a lot of businesses to get off the ground that simply were not viable long-term businesses...or is Canada the new Iceland with many millionaires with billions in debt

🎁If you have made it this far I would like to give you a little gift:

The theme of this year’s Oslo Freedom Forum (OFF): Reclaim Democracy.

Great article by Lyn Alden:

'Implications of Open Monetary and Information Networks'

https://www.lynalden.com/open-networks/

TLDR: Open systems and you really should check out Nostr if you haven't already.

Only invest in Bitcoin what you can’t afford to have gradually stolen from you by the government.

Credit: I have used multiple sources!

My savings account: Bitcoin

The tool I recommend for setting up a Bitcoin savings plan: @Relai 🇨🇭 especially suited for beginners or people who want to invest in Bitcoin with an automated investment plan once a week or monthly. Hence a DCA, Dollar cost Average Strategy. Check out my tutorial post (Instagram) & video (YouTube) for more info.⠀⠀⠀⠀

Get your Bitcoin out of exchanges. Save them on a hardware wallet, run your own node...be your own bank. Not your keys, not your coins. It's that simple.⠀⠀⠀⠀⠀⠀⠀⠀

Do you think this post is helpful to you? If so, please share it and support my work with sats.

#zap 🧡 #weeklyrecap #nostr

#plebchain

#BTC

#Bitcoin

#zap🧡

#plebchain

#grownostr

#stacksats

#bitcoineducation

#adoption

Due to sickness no Weekly Recap this week.

Study, learn, hodl, decouple.

#bitcoin 🧡

▃▃▃▃▃▃▃▃▃▃▃▃▃▃

My savings account: Bitcoin

The tool I recommend for setting up a Bitcoin savings plan: @Relai 🇨🇭 🇨🇭 especially suited for beginners or people who want to invest in Bitcoin with an automated investment plan once a week or monthly. Hence a DCA, Dollar cost Average Strategy. Check out my tutorial post (Instagram) & video (YouTube) for more info.

⠀⠀⠀⠀⠀⠀⠀⠀

Felipe - BitcoinFriday

#zap 🧡 #nostr #BTC #Bitcoin #plebchain #grownostr #stacksats #bitcoineducation #adoption

🧠Quote(s) of the week:

'It is incredibly important to understand that Bitcoin is not a piece of software like Microsoft Word, to be endlessly tinkered with.

It is a protocol for value transfer; an immutable foundation on which to build a new monetary order.'

- Vijah Boyapati

'You do not custody the Bitcoin...you only custody the private keys that can spend the Bitcoin.' - Wicked

🧡Bitcoin news🧡

27th of May:

➡️ $290 million worth of Bitcoin has been taken off from Binance in the last few hours.

*on the 29th of May Bitcoin whale withdraws 1,195 BTC ($81.95M) from Binance.

➡️'El Salvador keeps stacking Bitcoin. As of May 27, the nation-state holds a total of ~5,763 BTC worth over $395.8 million.' - CarlBMenger

28th of May:

➡️'BlackRock has been buying Bitcoin for its fund, the Strategic Income Opportunities Portfolio' - SEC filing

➡️Bitcoin ETF Update:

Total Net Inflows +632 BTC ($43.3m)

- BlackRock +1505 BTC ($102m) (and flips GBTC!)

- Fidelity +505 BTC ($34m)

- Grayscale -1550 BTC ($105m)

BlackRock is now officially the biggest Bitcoin ETF after overtaking Grayscale.

Incredible achievement in just 4 months!

Grayscale started with OVER 600,000 BITCOIN 4 months ago.

Blackrock had 0. IBIT is killing it. IBIT, Blackrock spot Bitcoin ETF, will become the fastest ETF to reach $20b in assets, at 137 days.

Bitcoin ETFs have accumulated 250k Bitcoin (on top of Grayscale's 619k) since January.

BlackRock and Fidelity at the moment own a combined 451,338 BTC worth $30.9 billion for their spot Bitcoin ETFs. These ETFs now hold 236,938 more bitcoin than MicroStrategy.

Supply & demand people, supply & demand!

➡️Health-Tech Semlar Scientific, a company specializing in developing healthcare technology, announced today that its board has adopted Bitcoin as its primary treasury reserve asset.

Semlar Scientific Inc. has bought $40m Bitcoin and adopted a Bitcoin Treasury Strategy. They added over $70,000,000 in market cap on the 28th of May, just by adopting Bitcoin as their primary treasury reserve asset.

The market is trying to tell the 58,000 public companies a valuable lesson...

Corporate adoption of Bitcoin is accelerating...

If you don't believe read the Semler Scientific statement below: (picture 2)

➡️Metaplanet directors authorize the purchase of an additional ¥250 million of Bitcoin.

➡️The Nigerian Naira is now worth less than one Satoshi.

➡️Someone just moved $3 billion worth of Bitcoin with $2.8 fees.

$2.8 FEES FOR $3 BILLION TRANSFER. Now try this with the current system, banks can't relate I guess.

➡️El Salvador President, Nayib Bukele, met with Cathie Wood to discuss Bitcoin, new capital markets, and innovation opportunities.

CATHIE WOOD: “President Bukele's determination to turn El Salvador into an oasis for the bitcoin and AI communities - two of the biggest economic and technology revolutions in history - is the reason I believe that its real GDP could scale 10-fold during the next five years.”

The funny part about this statement and the meeting. Five days later she ditches the Ethereum ETF to focus on Bitcoin. Are you paying attention anon?

➡️FINBOLD: “Perhaps the most interesting among the top stocks owned by Soros through the first quarter of 2024 is the shares of MicroStrategy (NASDAQ: MSTR), valued at approximately $135 million.”

29th of May:

➡️Jack Dorsey-backed Bitcoin mining company Ocean Mining has adopted El Salvador as its global headquarters.

➡️'Bitcoin miner Riot Platforms acquires a 9.25% stake in Bitfarms, becoming a major shareholder, after Bitfarms rejected Riot's $950M acquisition offer.' - Bitcoin News

➡️'Mastercard just launched Crypto Credential, which allows you to send Bitcoin to any customer at an exchange with a simple username, instead of a wallet address.' - Bitcoin Archive

I wouldn't use it because of KYC and still not your keys, but great news regarding the institutional adoption of Bitcoin.

30th of May:

➡️In case you missed it, Alex de Vries (Digiconomist), the most quoted source in the Whitehouse's OSTP 2022 report on crypto-mining and historically the most referenced source for mainstream news reporting on Bitcoin and energy, had his methodologies fundamentally discredited in March this year in a peer-reviewed paper by Sai & Vranken:

https://twitter.com/DSBatten/status/1796232365544468899

https://www.sciencedirect.com/science/article/pii/S2096720923000441?via%3Dihub

Misleading journalism needs to continue to be punished by social ossification. 'De Vries was the SBF of the press'. The truth will always prevail!

➡️A record $2 billion worth of Bitcoin taken off from Kraken yesterday. Bitcoin exchange reserves at the lowest ever.

31st of May:

➡️'Legendary cryptographer Ralph Merkle on the power of Bitcoin at $500, exactly 8 years ago.

"It is a new form of life. It is unstoppable." - Pete Rizzo

➡️'Bitcoin firm Unchained partners with the University of Austin to create a $5M endowment fund entirely in Bitcoin. The university plans to hold the Bitcoin for at least five years.' - Bitcoin News

1st of June:

➡️Biden vetos the bill that would revoke the SEC’s SAB 121, maintaining the ban on large financial institutions from taking custody of Bitcoin.

'The President has decided to reject a bill, passed by the majority of US lawmakers in both the House and Senate. Does he think he represents the people’s interest better than those elected to make laws?' - Hunger Horsley

2nd of June:

➡️'Donald Trump to accept Bitcoin Lightning payments for campaign donations.'

This wasn't on my Bitcoin 2024 bingo card, but just my two sats...I wouldn't pay one sat to a politician.

But do you think, that accepting Bitcoin Lightning payments, will change the landscape of politician campaign funding?

➡️Marquette University professor emeritus David Krause describes the Wisconsin pension system's $160 million purchase into a Bitcoin ETF and why the small purchase matters.

Video: https://twitter.com/ts_hodl/status/1797364548388753664

'Worth watching this video, someone always has to go first and someone’s going next. 0.1% of Wisconsin state pension = $160 million. Fully funded pension, trial balloon. Other state pensions on notice.' -Parker Lewis

Do you still think Bitcoin is a Ponzi, now that one of the largest pensions, a well-run one that is fully funded, is allocating to Bitcoin?

3rd of June:

➡️'Australia is set to launch its first spot Bitcoin ETF on June the 4th!

MonochromeAsset's ETF, trading as IBTC on CBOE, will offer regulated Bitcoin exposure with a 0.98% management fee.' - BTCTimes

I hope people 'Down Under' will stick to self-custody. Why...well just look at the next example:

➡️'Japanese crypto exchange DMM confirms 4,502.9 BTC ($305M) hack.

They suspended crypto withdrawals and limited buying activity to "prevent further losses," and warned of delays in withdrawing Japanese yen.

DMM says it will reimburse affected users.' - Bitcoin News

Not your keys, not your coins people! Act accordingly.

💸Traditional Finance / Macro:

24th of May:

👉🏽Distinction with a difference...

'S&P 500 Total Return in USD terms since Jan 1, 2020: Up 75%.

S&P 500 Total Return in gold terms since Jan 1, 2020: Up 15%.

S&P 500 Total Return in BTC terms since Jan 1, 2020: Down 81%.

"US with Argentine characteristics." Argentine stocks have been up huge...in peso terms.' - Luke Gromen (Picture 3)

🏦Banks:

👉🏽 Unrealized losses in the U.S. Banking System increased to $517 billion in Q1. (Picture 4)

FDIC warns that 63 Lenders are on the brink of insolvency due to banks sitting on $517 billion in unrealized losses.

🌎Macro/Geopolitics:

On the 27th of May:

👉🏽'China creates $47.5 Billion fund to boost domestic semi-conductor industry after USA stopped selling advanced chips to China.' - Radar

👉🏽 'The Congression Budget Office forecasts that the US budget deficit will not fall below 5% of GDP in the next decade.' - CBO (picture 5)

On the 30th of May:

👉🏽A record $9.3 trillion in government bonds will mature and need refinancing within the next 12 months.

Did someone say debt spiral?

The US needs cheap refinancing, not with the current high rates.(5%) So cutting rates, yes. Print more money, yes. hello inflation (eventually), yes! Who is buying the new debt tho?

👉🏽'In today's post, the authors note that the narratives about declining dollar shares in official reserves, and increasing roles for gold holdings by central banks, inappropriately generalize the actions of a small group of countries.' -New York Fed

The Fed now admits some countries are moving to gold. But says it’s a small group.

The decline in the dollar preferences of a small group of countries (notably China, India, Russia, and Turkey)...'

These four countries make up:

37% of world population

25% of global GDP

19% of global exports

The Fed now admits some countries are moving to gold. But says it’s a small group.

So 37.5% of the world is moving away from dollars towards gold.