Your savings represent the stored hours of your life -- a battery charged with your labor and expertise. Inflation is the slow, silent drain that weakens that battery day after day, until the energy you stored can buy almost nothing. That leak isn’t accidental. Inflation is a feature and not a bug of the modern fiat, fractional-reserve monetary system. Tonight, check your battery: is it still holding the hours you traded? How will you preserve your battery's charge?

Question for the hive mind: 10 years from now, you've lost all conviction in Bitcoin. What caused it?

Mining centralization? Custodian centralization? Regulatory crackdowns? Quantum exploits? Protocol flaw? Other?

Still uncertain whether this is a nostr feature or a bug. I understand nostr is decentralized, so no central authority can suppress free expression. However, the freedom to edit or retract statements is also part of free expression. While users can post clarification notes, that seems an imperfect solution for the user experience.

The best thing I read recently:

“People will almost always say, if asked, that they want as much money as they can get! But what they really want is not more units of money -- more gold ounces or "dollars" -- but more effective units, i.e., greater command of goods and services bought by money. We have seen that society cannot satisfy its demand for more money by increasing its supply -- for an increased supply will simply dilute the effectiveness of each ounce, and the money will be no more really plentiful than before.”

- What Has Government Done to Our Money? By Murray N. Rothbard

Until now, Bitcoin's adoption curve has been filled with people who have done the work to understand it. If Bitcoin adoption experiences hockey stick growth, then later adopters will not do the work. The idea that billions of people will read and absorb The Bitcoin Standard is absurd. The vast majority of late adopters will expect the same level of convenience they have with TradFi. They will not bother to learn how the Bitcoin plumbing works. They will grow frustrated if the systems are inconvenient or impose too many frictions on use. They won't care about or understand self-custody. They won't care about or understand self-sovereignty. They will trade it all for convenience. An ETF is one step down the path of convenience. A 0.39% OER will be a small price to pay in their minds for that convenience.

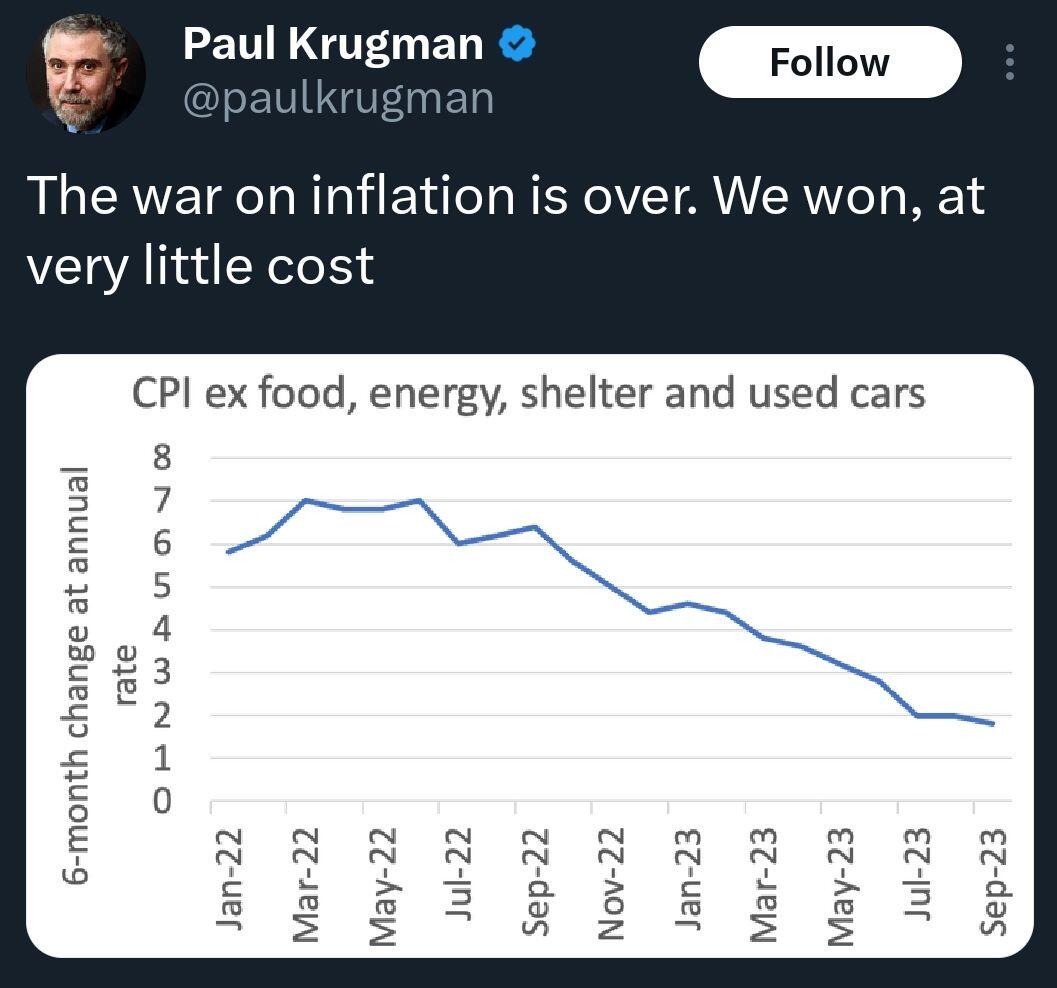

Nobel Prize winning economist thinks inflation looks great when you exclude routine consumer purchases. 🤦 You can't make this up! #inflation #CPI

At the family dinner tonight...

Wife (to kids): Mama and Baba have an anniversary coming up. Do you kids know how long we've been married?

Daughter (8): Um, what year did you get married again?

Wife: 2009.

Daughter: 2009!?!? Baba, that's the same year the first block was discovered!

Me (spitting out drink): Omg. Holy 💩!

#Bitcoin #ProudParent

Visualization of the U.S. Treasury Marketable Debt Maturity Schedule as of June 30, 2023. About 30% or $7.4 Trillion of the total marketable debt is due in the next 12 months.

The interest payments on U.S. Government Debt is approaching $1T

You do not need permission to buy or sell #Bitcoin

You will need permission to buy or sell a #BitcoinETF

Know the difference