Insane volatility today with a $12k candle. Lots of bitcoin changed hands, almost 2X the transfer volume of yesterday.

nostr:note1ed2vwjetg3e4tq8qw647qdzdnlxg5m6q8xrr9gwmmk7lp0gy5qcsxkley4

Due to API limits, nostr:npub12kuj6mzr39h0nchlfryv2k5qgwvms6kck0uywjxxr4ap69wh88mqycrwze will now only include a few daily updates on X, e.g. transfers over $1B. For a full view, follow BBB on Nostr.

Every time I try to go back to Twitter, Elon finds new creative ways of making the experience miserable.

Without much fanfare, Tether has started reinvesting some of their profits/excess reserves into Bitcoin. How much have they acquired in Q1, you ask? Just around 52,670.

If there is any silver lining, #BRC20 completely killed ordinals by spamming them with pointless json messages and pricing out the monkey jpegs. The originals dot com website is completely unusable and doesn’t even load at the moment.

Stop focusing on the fees, they are a temporary nuisance and there will be high fees in the future regardless.

The real issue is dumping of toxic waste on the blockchain and especially the UTXO set which may never get cleaned up.

#[0] what was the biggest price swing of BTC on a single day in percent terms and when did it occur?

Thanks for the dip, Fed! Now back to our regularly scheduled bull market.

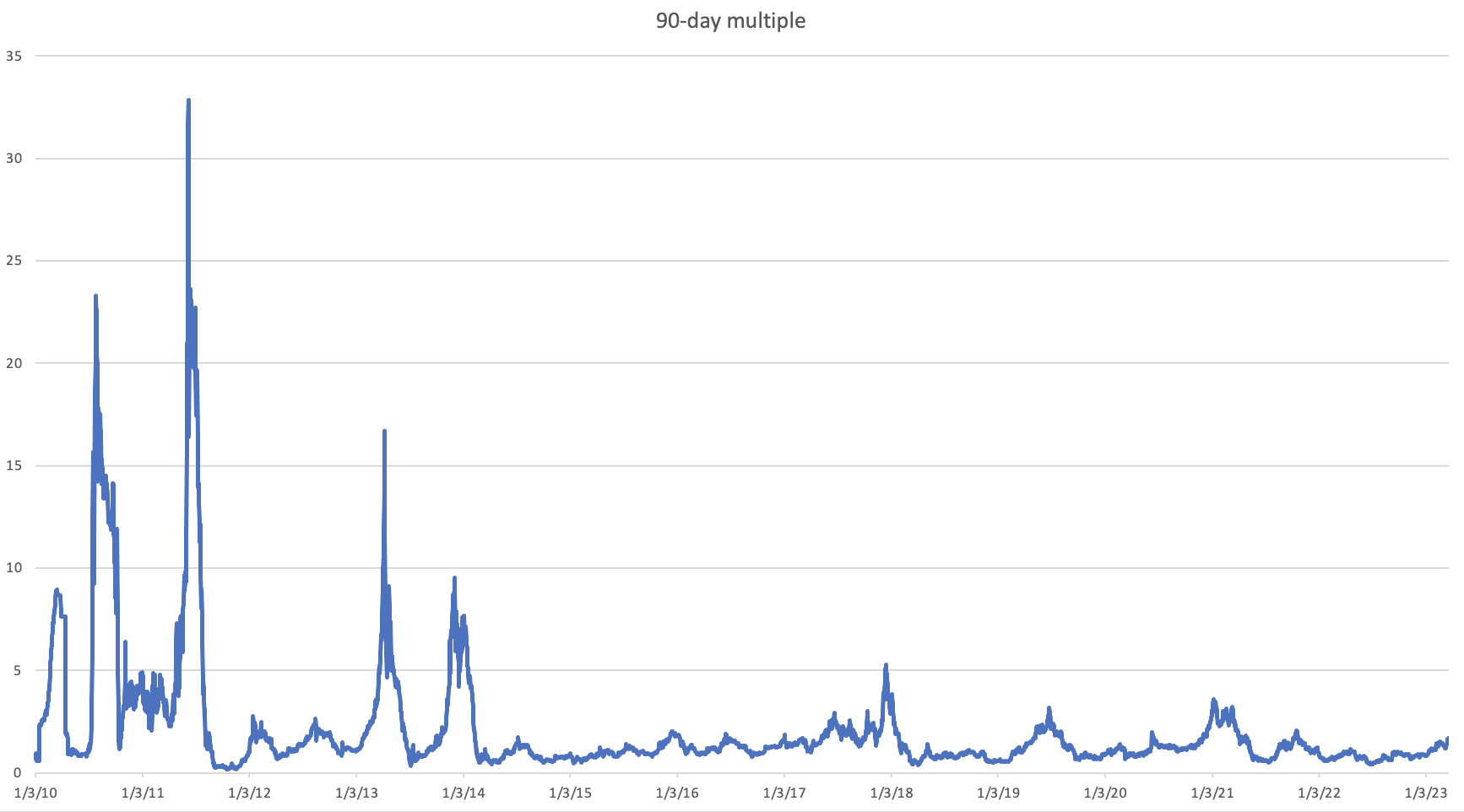

We would all love Balaji’s prediction to come true, but it is extremely unlikely. In fact, the BTC price has never previously increased 40X in a 90-day period. The closest it came was in June of 2011 with a 33X increase. This was during the wild days of MtGox hacks. In most recent bull markets we barely hit 4X-5X.

(Obviously there are other sources of buying and selling, but this gives you some context)

For BTC to hit $1,000,000 *and remain there sustainably*, every American needs to buy an average of $2.72 of BTC per day. This would cover all the newly mined coins.

After the next halving, the amount required becomes $1.36 per day.

It’s not a zero sum game. I can sell you 1 BTC for $1,000,000 today and the market cap will become $20T. But trillions of dollars did not actually go anywhere.

In reality, with a large enough amount of buyers and sellers there will be a great number of banks involved both getting withdrawals and deposits. At the end of the day, it will probably balance out.

For every Bitcoin buyer, there is a Bitcoin seller. No amount of fiat actually leaves the banking system and buying BTC is not a bank run.

His net worth is $1.5 bn+, so this is the equivalent of an average Joe with $150k betting $100. Still risks potential damage to his reputation though.

Have you started front-running the 4th halving yet?

People always assume Bitcoin will moon during a financial crisis, but it doesn't make sense. People are going to need liquidity if their money is frozen or lost by banks and they lost their source of income. Even the most hardcore maximalist will need to sell some to pay for basic needs. The mooning happens in between crises, not during.

I’m calling for a complete and total withdrawal of deposits from fiat banks until we can figure out what’s going on.

Who actually bothers opening multiple accounts to stay under the $250k FDIC limit? Few understand this.

Your family and your company should be keeping at least an emergency fund in BTC in case of a banking collapse.