We’re Still Waiting for the Next Big Leap in AI

Anthropic’s latest Claude AI model pulls ahead of rivals from OpenAI and Google. But advances in machine intelligence have lately been more incremental than revolutionary. #press

https://www.wired.com/story/were-still-waiting-for-the-next-big-leap-in-ai/?utm_source=press.coop

Wtf wrong language

Click here https://developer.android.com/guide/topics/ui/notifiers/toasts

Just use Android?

FYI Android/Obtainium not having Testflight issues at all.

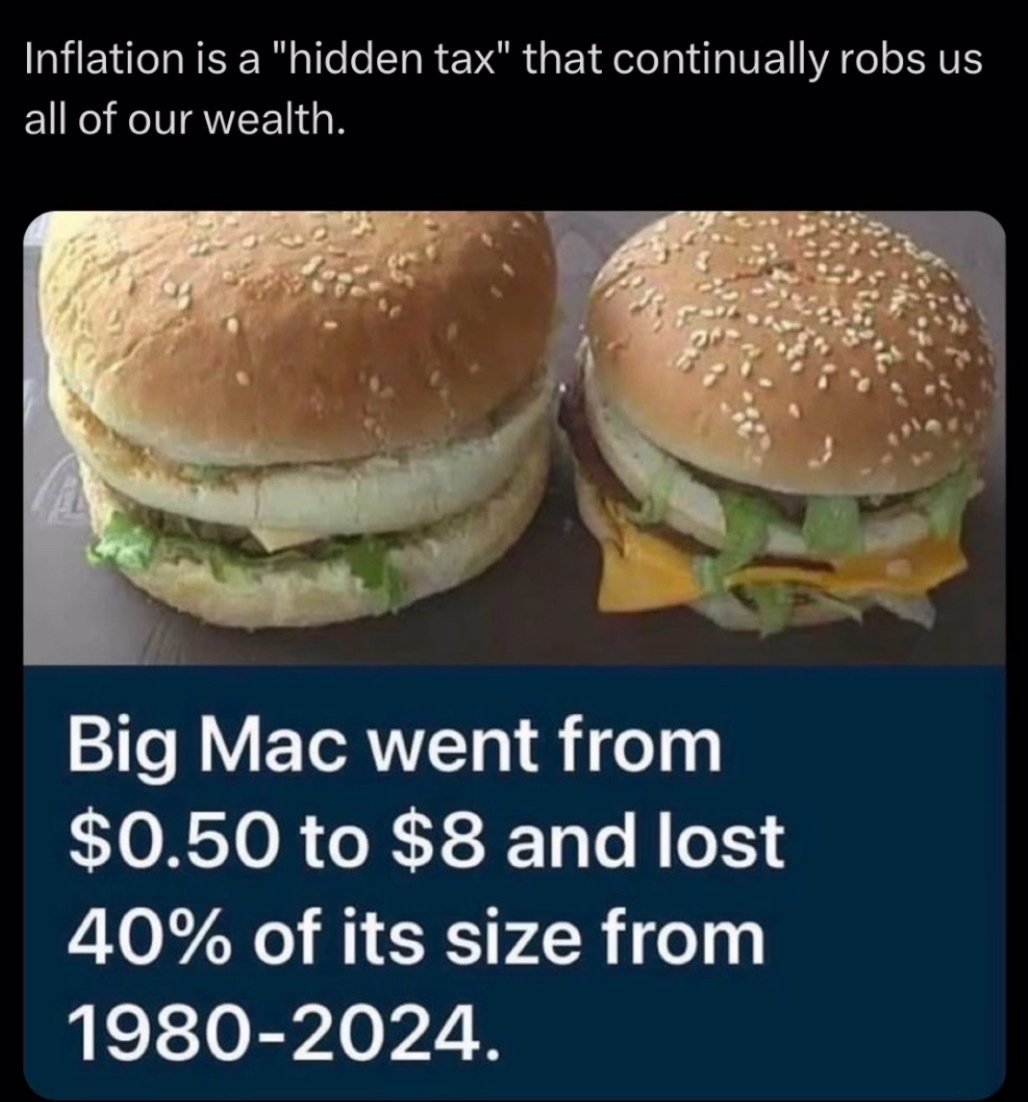

A weird asset to compare against but if that's your thing ...

I take the devil part as a compliment. I'm here to ask the hard questions.

You could start selling Bitcoin for fiat while there are still greater fools.

Then create a better fiat that does a better job at growing and shrinking the money supply in line with a growing and shrinking economy to maintain stable prices.

This is covered in Silvio Gesell's "The Natural Economic Order" and the movie "Shillings from Heaven" that you can find on YouTube.

It has to be deflationary if the economy grows because the same amount of Bitcoin will represent an increasing amount of goods and services on offer and it can only do that by lowering the price per good or service.

A deflationary currency discourages spending which in turn tampers the economy. It's Bitcoin's self defeating mechanism, or for that matter the self defeating mechanism of any fixed supply currency.

That's why the dollar had to be detached from gold. While the amount of gold is increasing it's nowhere increasing as fast as the economy.

Ok. "Outperform" is your weird way of saying "the price went up" I guess.

Presumably those are things you can buy food for.

Good morning, reminder that if you hear a politician blame "greedy corporations" for inflation, then you know they are full of shit. https://nostrcheck.me/media/4f44ff626cb4761bcba7451261b8ff35b798d798e12474d5aaad8ce9516ae4ca/e014f46b8bd939d9021dbf5a453b5f6bef20be894116491eb3732e98807f02b4.webp

In a growing economy money supply grows and and prices stay the same.

Then you have a problem with your income, not with inflation.