Pic or it didn't happened.

Ostensibly it's about Bitcoin but prices (and prizes) in US$: https://ns.com/school

Exactly my sense of humor.

The people get the government they deserve.

Don't honor low lives by responding to them.

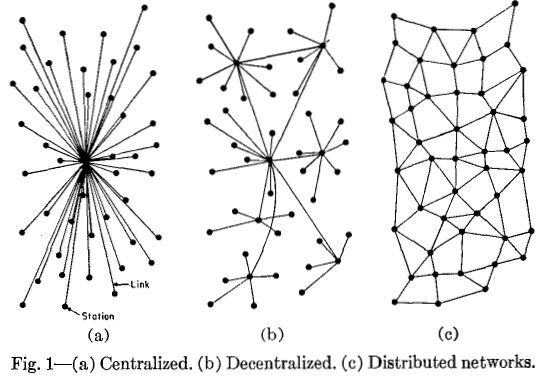

The shifting meaning of decentralized

It used to be only b)

Nodes attached to distributed servers.

Now that's called federated and decentralized means not a)

https://networkcultures.org/unlikeus/resources/articles/what-is-a-federated-network/

So nostr is (b) because it has relays?

You need to have a cycle of continually devaluing issued money that sits in store to encourage circulation, and reissue new money at the same time to make up for the difference. This is the best way to control the amount of money in circulation to match the size of the economy.

If money isn't circulating its amount can't be regulated. You can only reduce the value of money by printing more of it which is a poor hack that governments worldwide are doing because they don't have demurrage. This way prices will vary (meaning increase) but still in a somewhat controlled and predictable way as opposed to the wild fluctuations we would have with no control over the supply.

Silvio Gesell's "The Natural Economic Order" does a pretty good job explaining it, or the movie "Shillings from Heaven" as a teaser maybe.

Your Bitcoin friends say that. Representative example:

Here you have all the Tesla subsidies, so I can even make a car that runs on chocolate profitable.

https://subsidytracker.goodjobsfirst.org/parent/tesla-inc

nostr:note1690pr50rt7ez88gn07cue9h0ft484xzw8mm5mvgtfn26dh0wqqnqmejxul

True that but they're not particular to Tesla but new energy in general.

"In 1893 Tesla and Westinghouse got the contract to install all the electrical and lighting systems for the Chicago World's Fair."

Example Tesla government contract.

https://www.corrosion-doctors.org/Biographies/TeslaBio-2.htm

SpaceX got public loans not subsidies.

As for government contracts, I don't know how your space business is going but his would be stupid to eschew the government as a customer as the government is a significant player in the space field, unlike the field of, say, toilet paper.

nostr:nprofile1qqsw4v882mfjhq9u63j08kzyhqzqxqc8tgf740p4nxnk9jdv02u37ncpz4mhxue69uhhyetvv9uju6mpd4czuumfw3jsz9nhwden5te0wfjkccte9ec8y6tdv9kzumn9wsq3yamnwvaz7tmsw4e8qmr9wpskwtn9wvql3tqm you're sure scoring high on the mindless fanboi follower scale

Why is nostr:nprofile1qqsw4v882mfjhq9u63j08kzyhqzqxqc8tgf740p4nxnk9jdv02u37ncpz4mhxue69uhhyetvv9uju6mpd4czuumfw3jsz9nhwden5te0wfjkccte9ec8y6tdv9kzumn9wsq3yamnwvaz7tmsw4e8qmr9wpskwtn9wvql3tqm worried about the government banning Bitcoin then. She doesn't know how it works.

I would strongly recommend this book

It hasn't gotten a lot of attention but is definitely worth it

The thesis is simple

Just as the dollar moved from being based on gold to being based on oil (the petrodollar), it is today in the process of moving to a new base of Bitcoin, with the help of stablecoins

But thankfully the book doesn't end there with that dark outcome

It heavily implies that through proper engineering and layering and technologies like ecash, we can defeat the fiat system

https://store.bitcoinmagazine.com/products/the-bitcoin-dollar-book

Because the dollar is based on Bitcoin that's why the exchange rate fluctuates so widely.