I'm ready!

Just more difficult to value the conversion. But true.

He is in a unique position because being a publicly traded company he can use the stock price to wage an attack on the monetary system.

He can offer convertible notes so he doesn't have to pay any of the loans back. The more he takes and locks in cold storage the tighter the supply the more BTC will go up the lower the chances the stock price won't out pace the bond payment.

Once others take note and start doing the same thing look out above. BTC price will crash up. He will hit a point where no company no matter how successful will ever be able to accumulate as much btc as mstr and they will be a force to be recond with when the BTC economy takes over the planet.

Right now they own 1.2% of the entire future global economy.

Mitsubishi UFJ Financial has the most cash on hand of any company at 780billion.

If there is 100T dollars in FIAT in the world Mitsubishi only has .78%

I have a feeling saylor won't be happy stopping and might get to 2.1% before this play starts to top out.

I thought block and report as spam would work for these things but they keep showing up. Annoying.

Hahaha, I lived in El Paso for 5 yrs. 100% read it as I-10 at first.

Was up in Halifax for the FIAT mine this weekend got to sneak off to the park during lunch.

Do they tally write in votes for president?

If so would it be awesome if we could get over 1% of the vote for Bitcoin.

That would be hilarious.

#meme #nostrmeme #memes

#zap it, Feels good man.

🌑🌒🌓🌔🌕🌖🌗🌘🌚 🤦🙋♂️

Cute

https://video.nostr.build/5dab394cdbf8d67a54b890149609f33bc575592dc2dc811a6959d78719c7a9d0.mp4

That AI. AI ain't cute. AI is creepy.

I'm amping up for this run. ATH in the next few weeks then we see if btc stops at 180k in 2025 or hits 900k.

Is rainbow chart right or stock to flow. We will have a pretty solid answer in the next 15 months.

I think we are going to find out it is stock to flow. Because of hivemind, adoption curves and scarcity.

It doesn't "need" a token but they can make a token for free and sell it to dipshits.

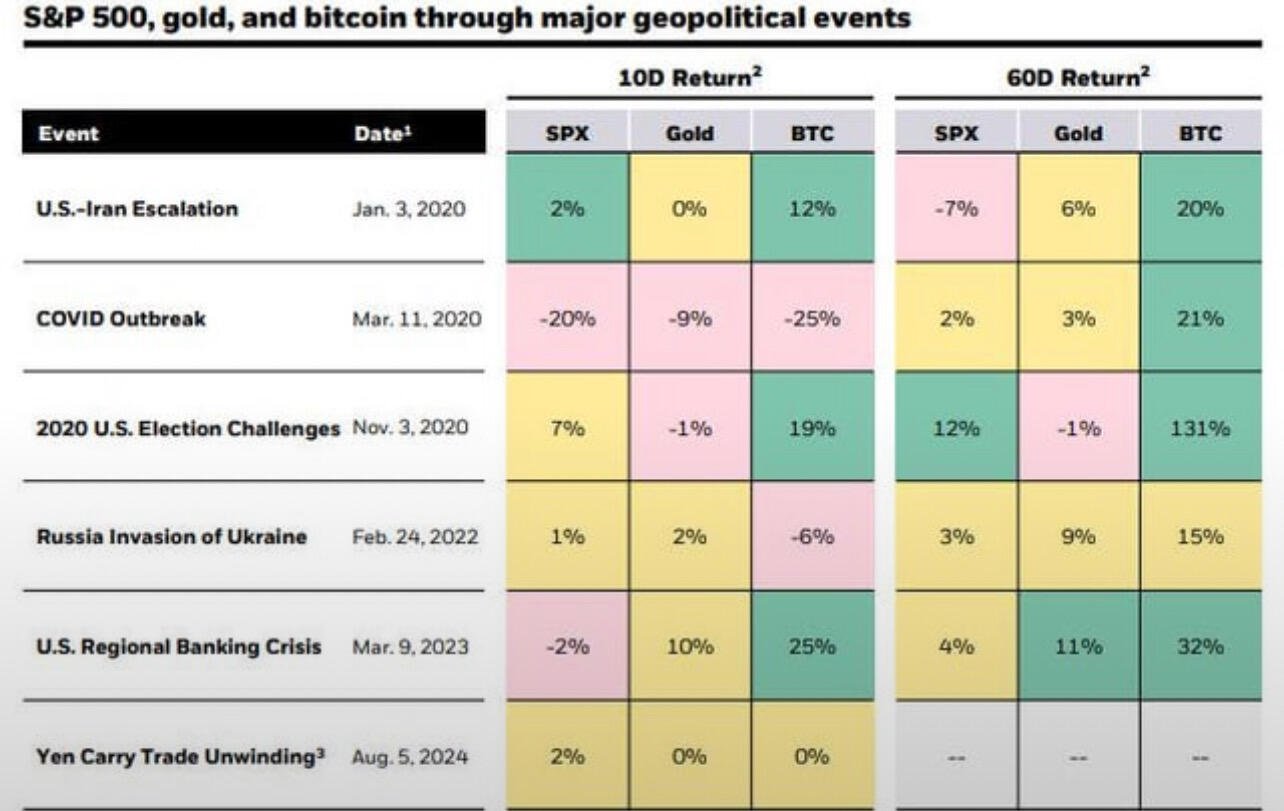

Blackrock has just released a new report titled "#Bitcoin: A Unique Diversifier" in which they compare the performance of #Bitcoin to other assets following major geopolitical events.

To summarise: #Bitcoin leaves everything else in the dust.

https://www.blackrock.com/us/individual/literature/whitepaper/bitcoin-a-unique-diversifier.pdf

Bitcoin is still a risky asset... yeah, risky to not own it.

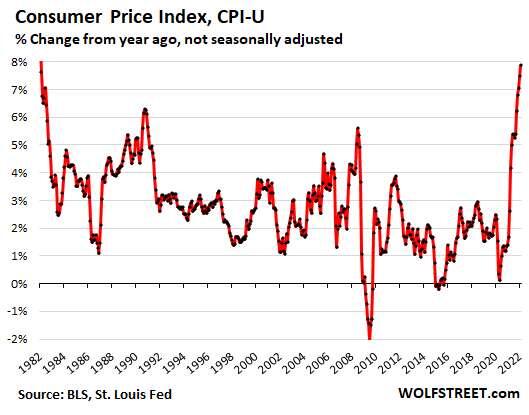

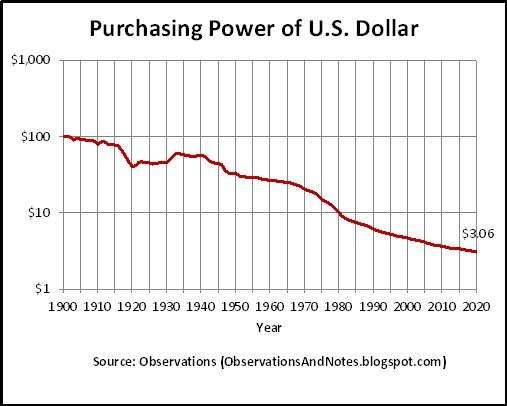

It's not slowing. It's only going to get worse now that we past the event horizon of the debt death spiral.

Just need a chart that shows % drop each year instead of cumulative lose of value over time or cpi and real cpi overlaying purchasing power drop on log scale.

Someone should clean one up from 1900 to 2024

In 2024, no countries were completely debt-free in terms of their national budgets. However, some countries, like El Salvador, made significant strides toward reducing their debt. President Nayib Bukele of El Salvador announced plans to submit a debt-free budget for 2025, marking a significant shift from a $338 million budget deficit in 2024.

Probably nothing.

ktickticktick.

ktickticktick.