DC housing inventory on  the rise!

the rise!

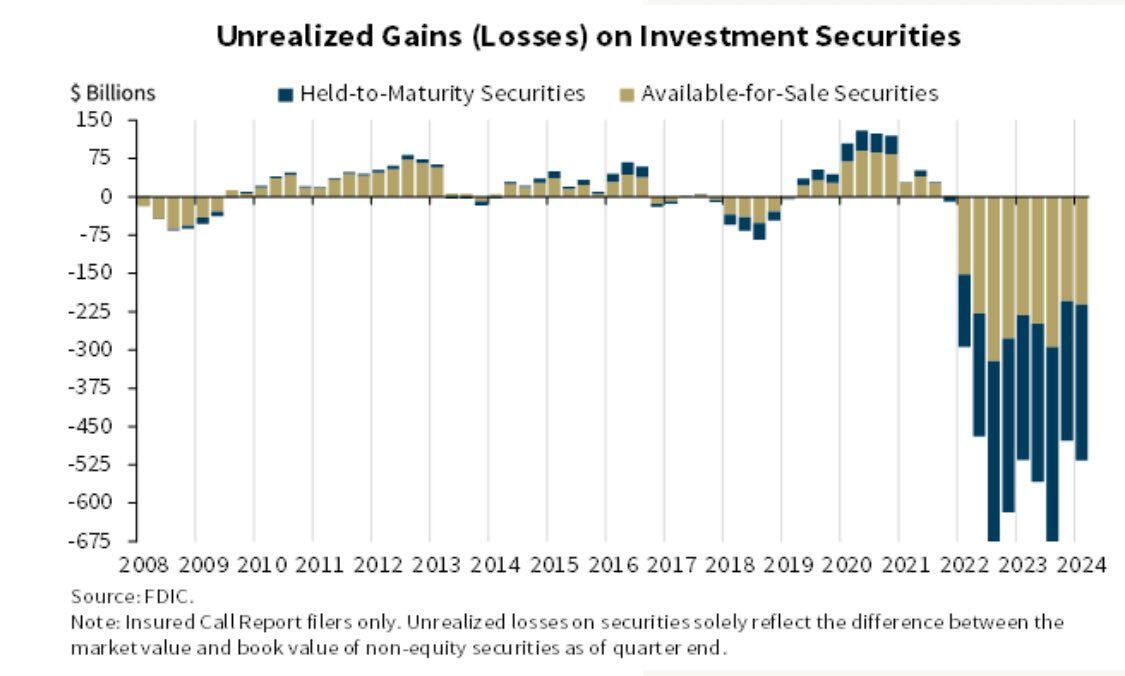

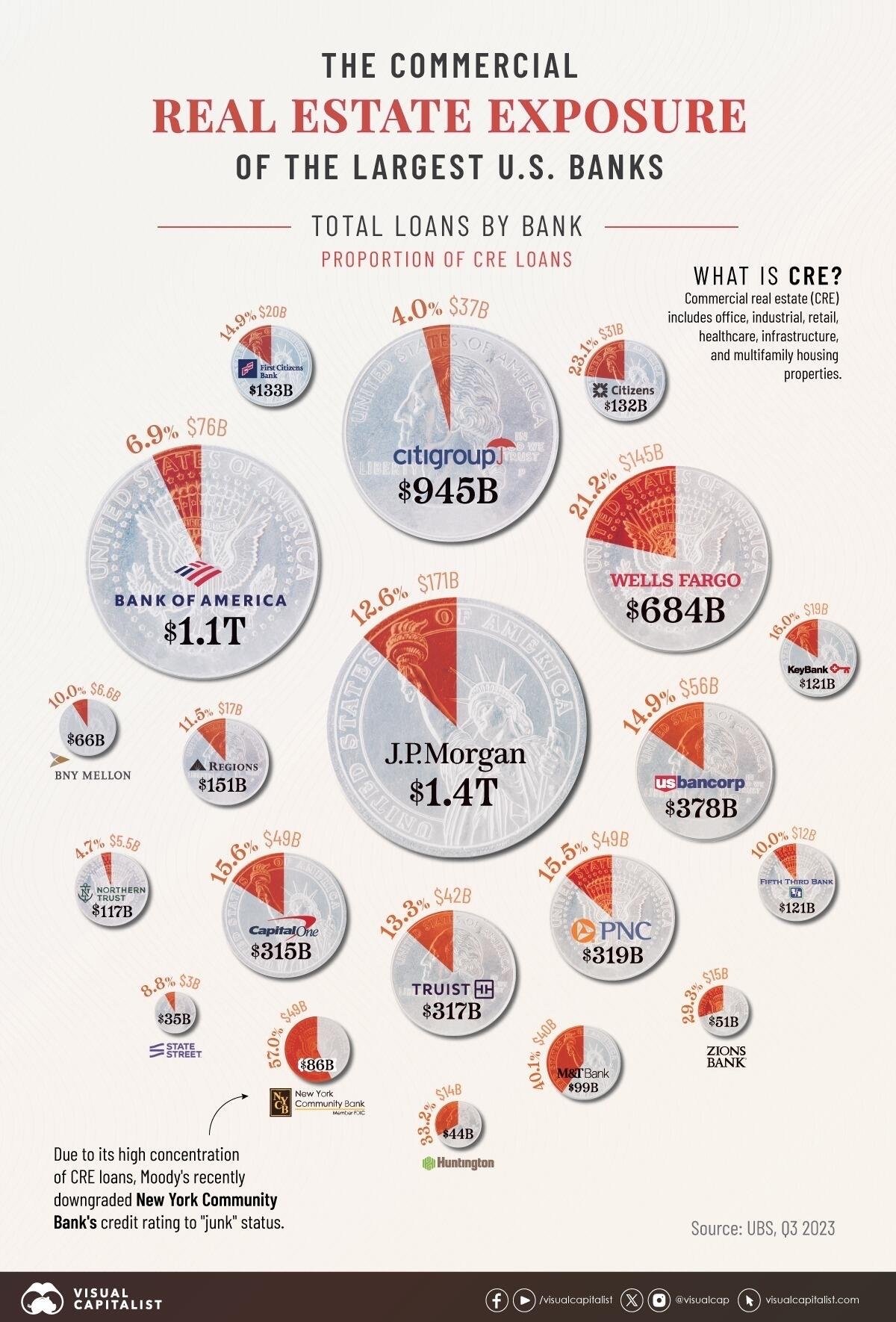

“Higher unrealized losses on residential mortgage-backed securities drove the increase.”

fdic.gov/news/speeches/…

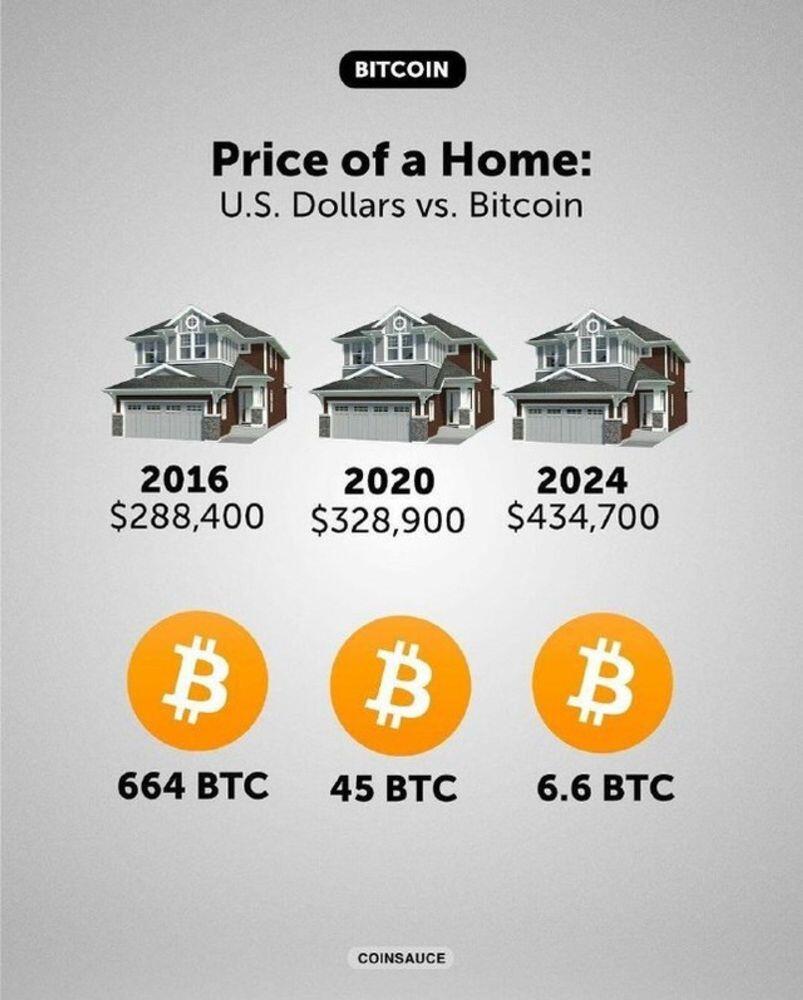

I post about residential real estate and urbanism to show how understanding how the housing market is relevant to bitcoiners. It's a not entirely bitcoin ...? Haha.

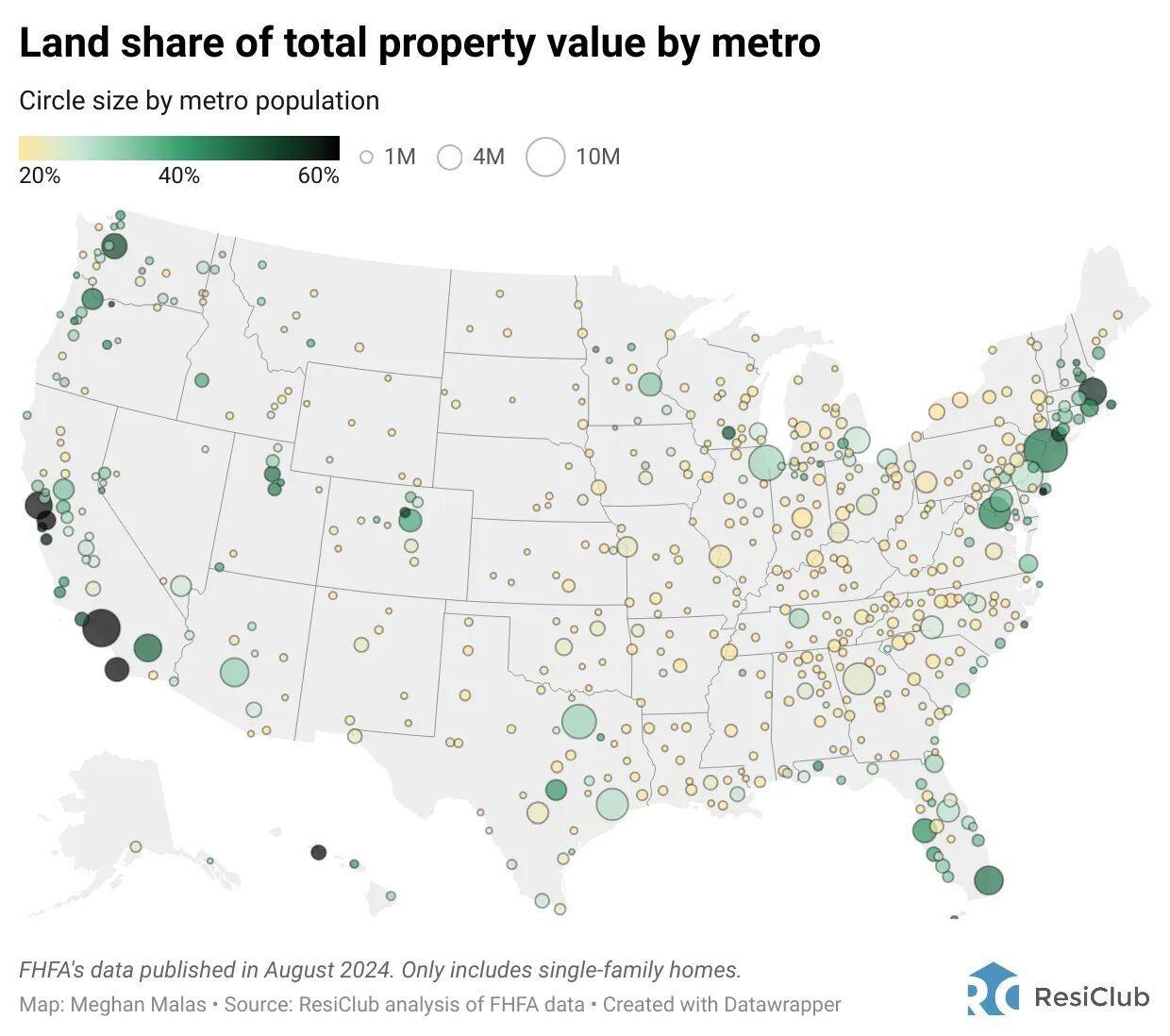

This chart is a good reference for what areas of the USA have the highest monetary premium on property. Because "land" is the rare aspect of real estate (as opposed to buildings, which we can make more of) the ratio of land to other upgrades gives a sense of where the use of the land as a store of value tool is playing a large role in the price.

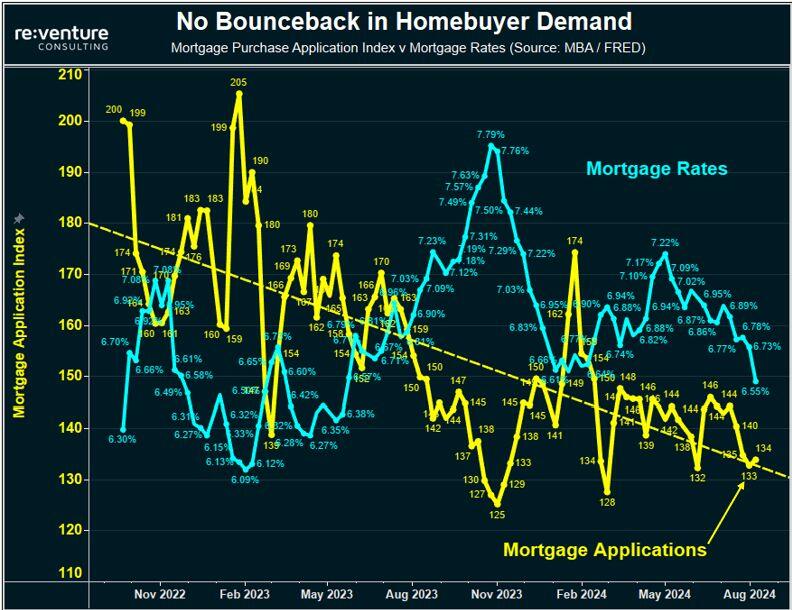

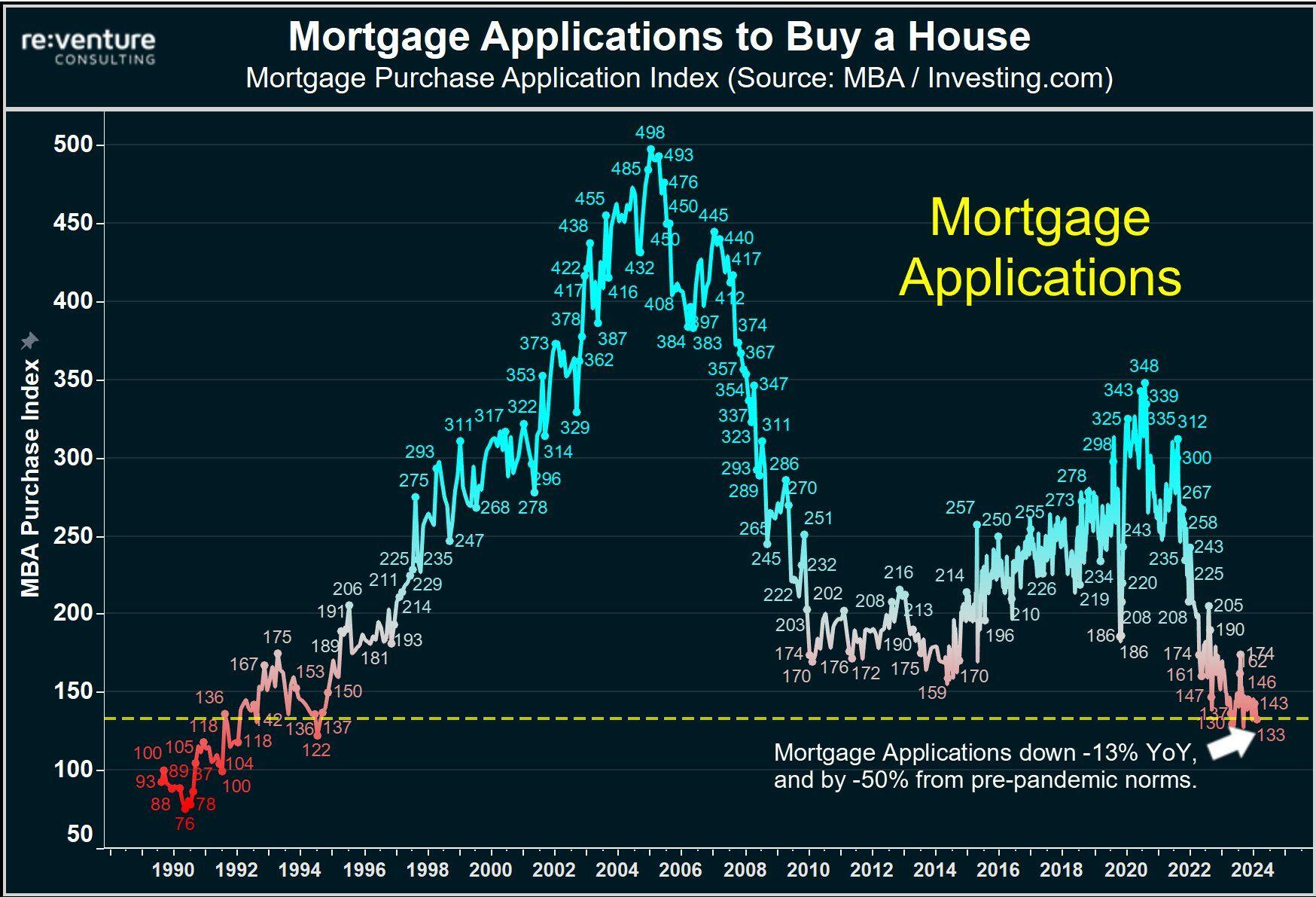

No increase in home buyer sentiment from recent rate drops- experts indictate that rate will need to go back into the 5 percent rage with price cuts to begin to lure buyers back in.

Mortgage applications down 50% from prepandemic - currently lower than the lowest point of the 2008 housing crash.

Anticipated rate cuts no  t yet moving the needle.

t yet moving the needle.

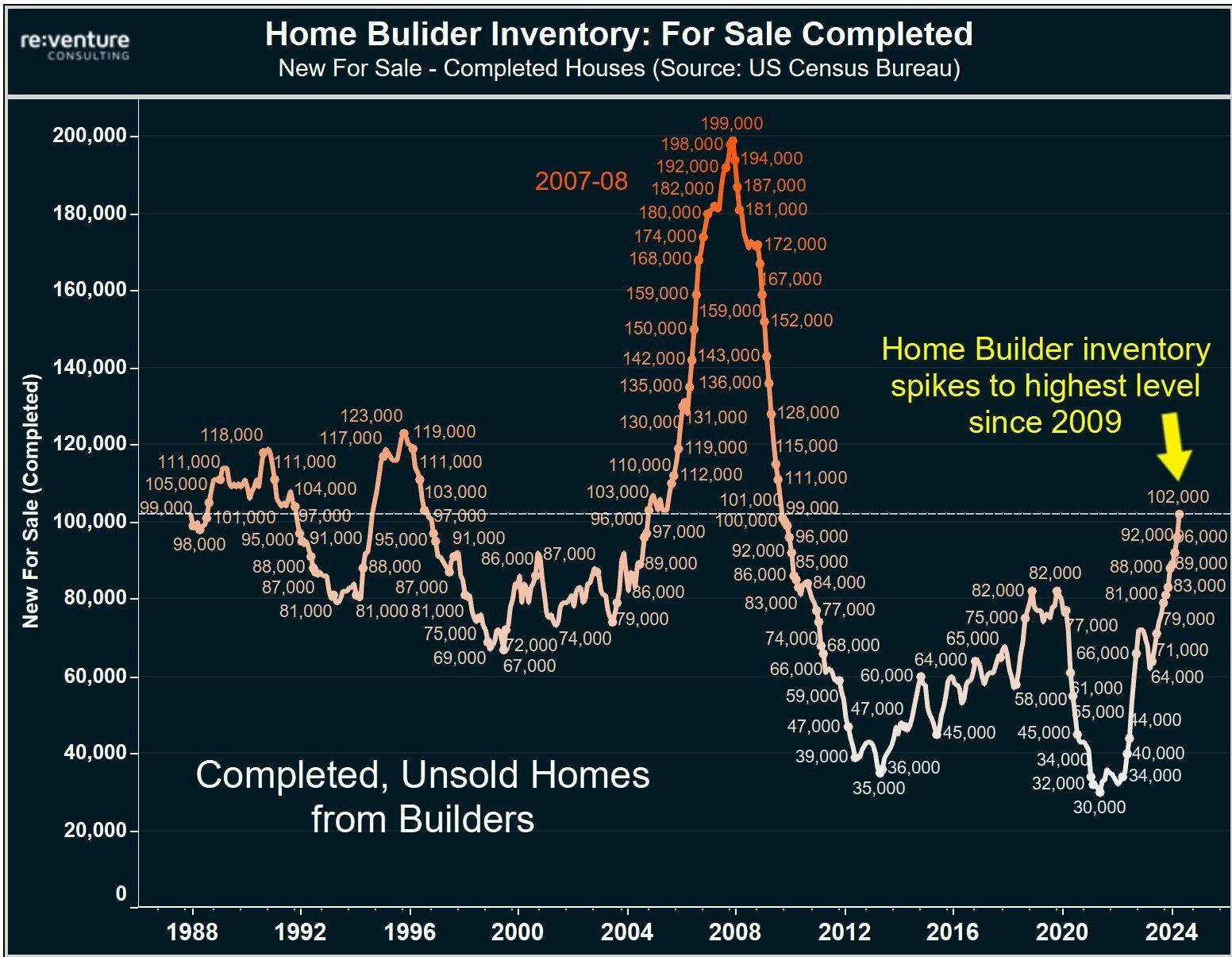

Housing inventories are rising however with few ways to finance them affordably-not a good time to be in building/real estate industry. even if land owners can perhaps expectsideways action generally it's net bad news.

What happened to cheap mass producedhousing in 1971?

Read this article of the history of the failure of the levittown mass production housing company.

https://www.construction-physics.com/p/why-levittown-didnt-revolutionize

Note this startling series of statements which bitcoiners will understand immediately:

" .....Levitt’s fourth Levittown was stopped in its tracks in 1971 when Loudoun County, Virginia refused the rezoning required, ......

....Not only did land use controls and development restrictions slow down and prevent new home construction, but they drove up the price of land, and thus the cost of all other homes. A 1968 report from the National Commission on Urban Problems noted that “the net effect of public land use policy is to reduce the supply of land available for modest cost housing and thus to increase its cost.”

Yes, in 1971 20 years of cheap mass produced housing came to halt due to the sudden appearance of supposed "environmental" foces implementing new land use laws and procedures known to drive up housing costs.

Read more about the rise and fall of levvittown at ConstructionPhysics

https://www.construction-physics.com/p/why-levittown-didnt-revolutionize

New home inventories highest since 2009

It's been surprising to watch across the spectrum who is and is not willing to make a switch. The crowd that has moved to different places is pretty consistent tho.

The network effect is strong.

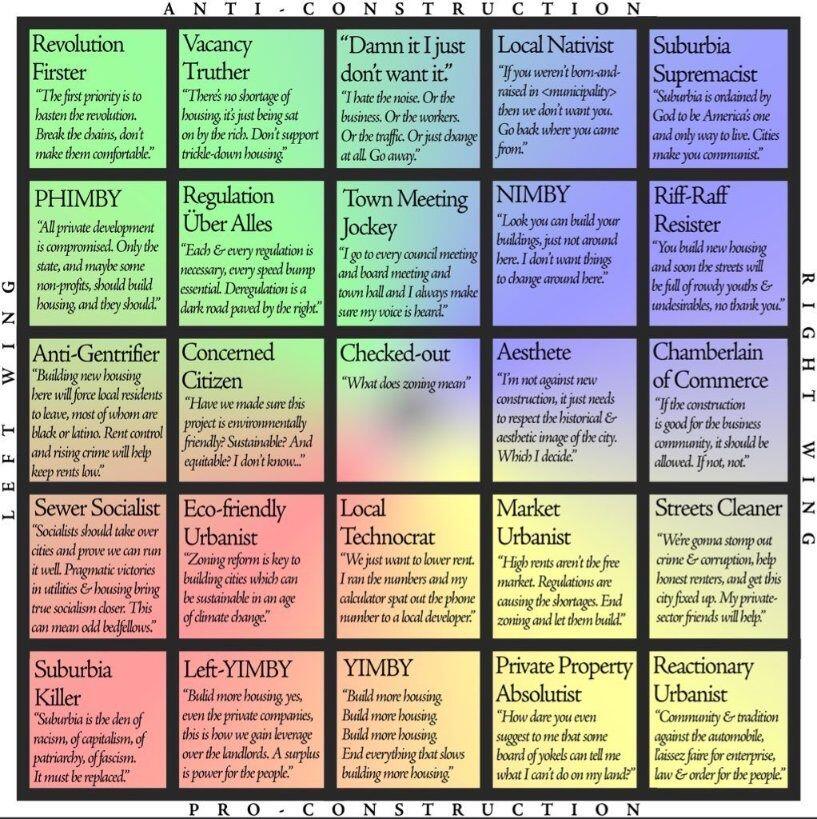

Housing political compass

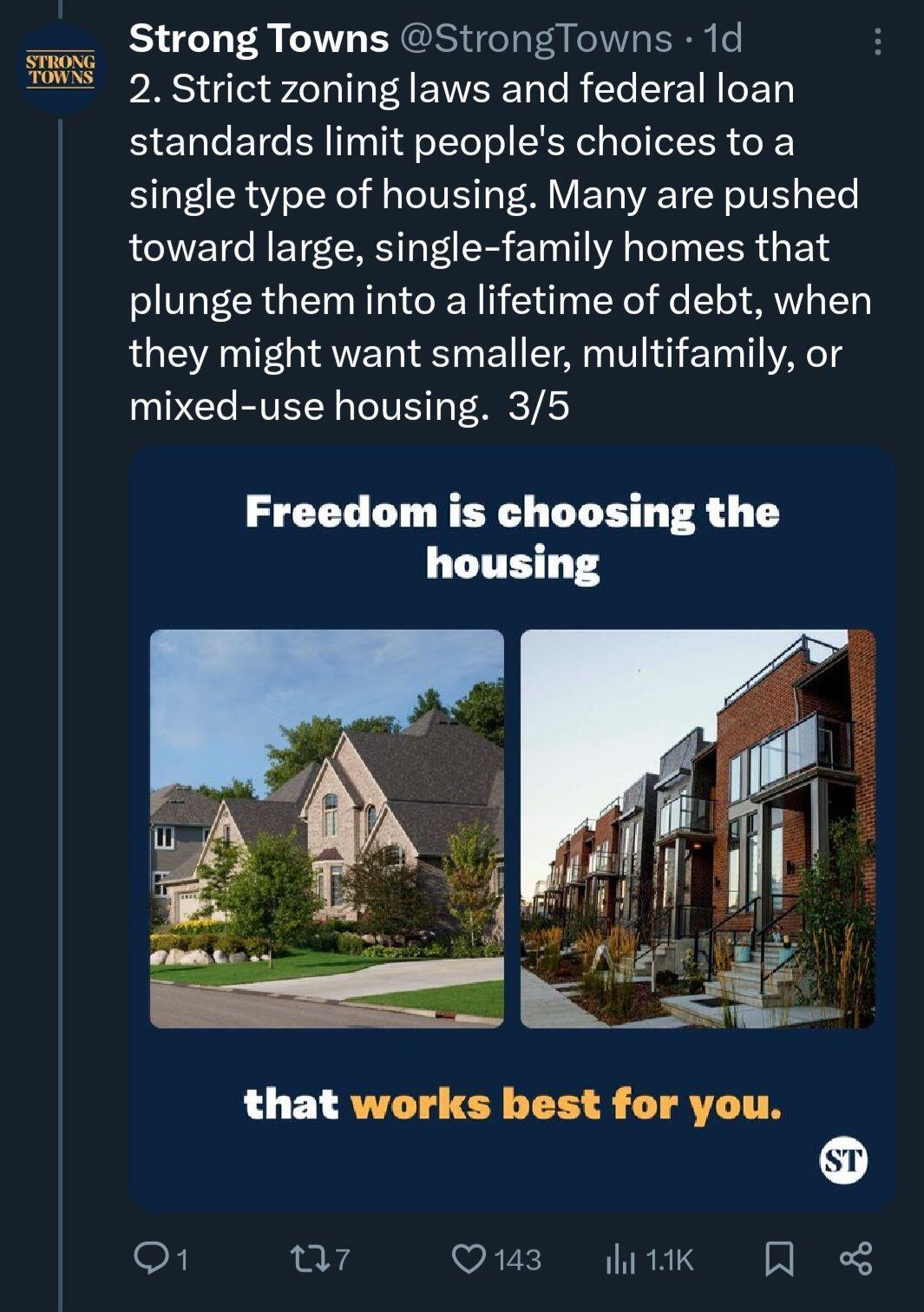

Limiting housing types and forcing people to get federally backed loans for often 30 years puts people into a position where being in a lifetime of debt seems normal.

It doesn't have to be that way

Housing is fundamentally shelter for people- it's use as store of value for banks means we can never fix the housing crises without crashing banks- hence the unsolvable perpetual crisis.

Bitcoin can fix this.

100% This is because the use of housing as a store of values means banks want a homogenised product that is easy to evaluate even if you are just a finance guy-

Houses are designed  to be liked by this dude.

to be liked by this dude.

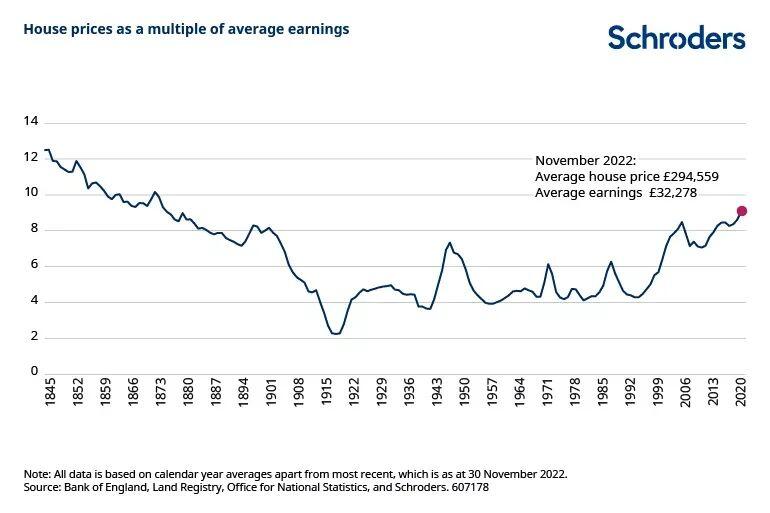

Reposting this fantastic graph by Saifedean-

Before fiat- decreasing house prices and more, better housing

After fiat- housing used as store of value and becomes harder to achieve

Leon Wankum makes the case that the real estate market it being demonetized as a store of value by bitcoin- and makes the case for adding bitcoin to the balence sheet if real estate development companies. Great listen!

nostr:note1g36hengtfljpuznqf29vtjd6w52q2skh9wrvfhdmpq8h0hy8grfqekdk5k

nostr:note1g36hengtfljpuznqf29vtjd6w52q2skh9wrvfhdmpq8h0hy8grfqekdk5k