On weathering Bitcoin price

𝗨𝗦 𝗧𝗿𝗲𝗮𝘀𝘂𝗿𝗶𝗲𝘀, 𝗧𝗿𝗮𝗱𝗲 𝗖𝗵𝗮𝗼𝘀 & 𝗕𝗶𝘁𝗰𝗼𝗶𝗻 𝗕𝗼𝗻𝗱𝘀

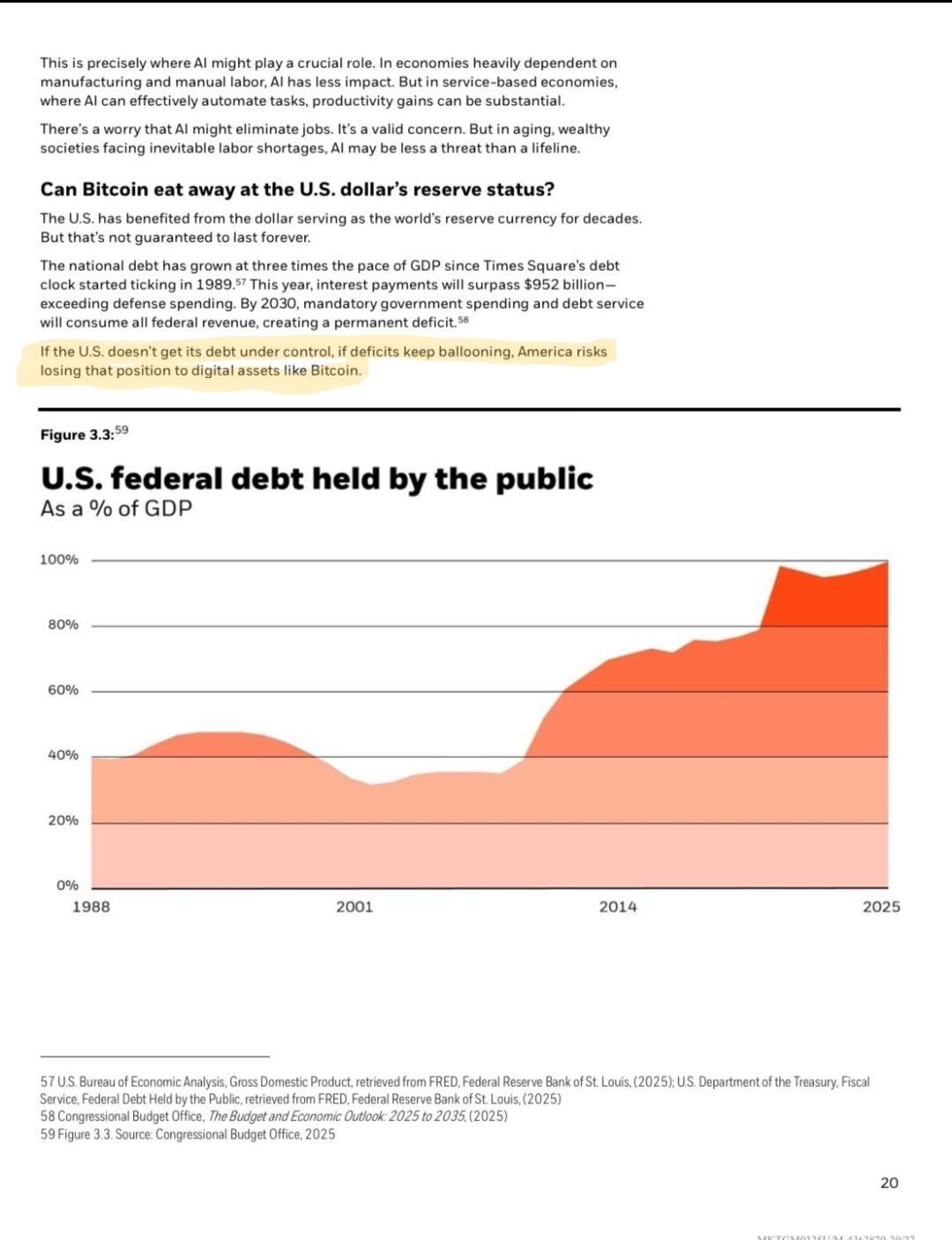

In his 2025 letter to shareholders this week, Blackrock's CEO warns, “The U.S. has benefited from the dollar serving as the world’s reserve currency for decades... If the U.S. doesn’t get its debt under control, if deficits keep ballooning, America risks losing that position to digital assets like Bitcoin.”

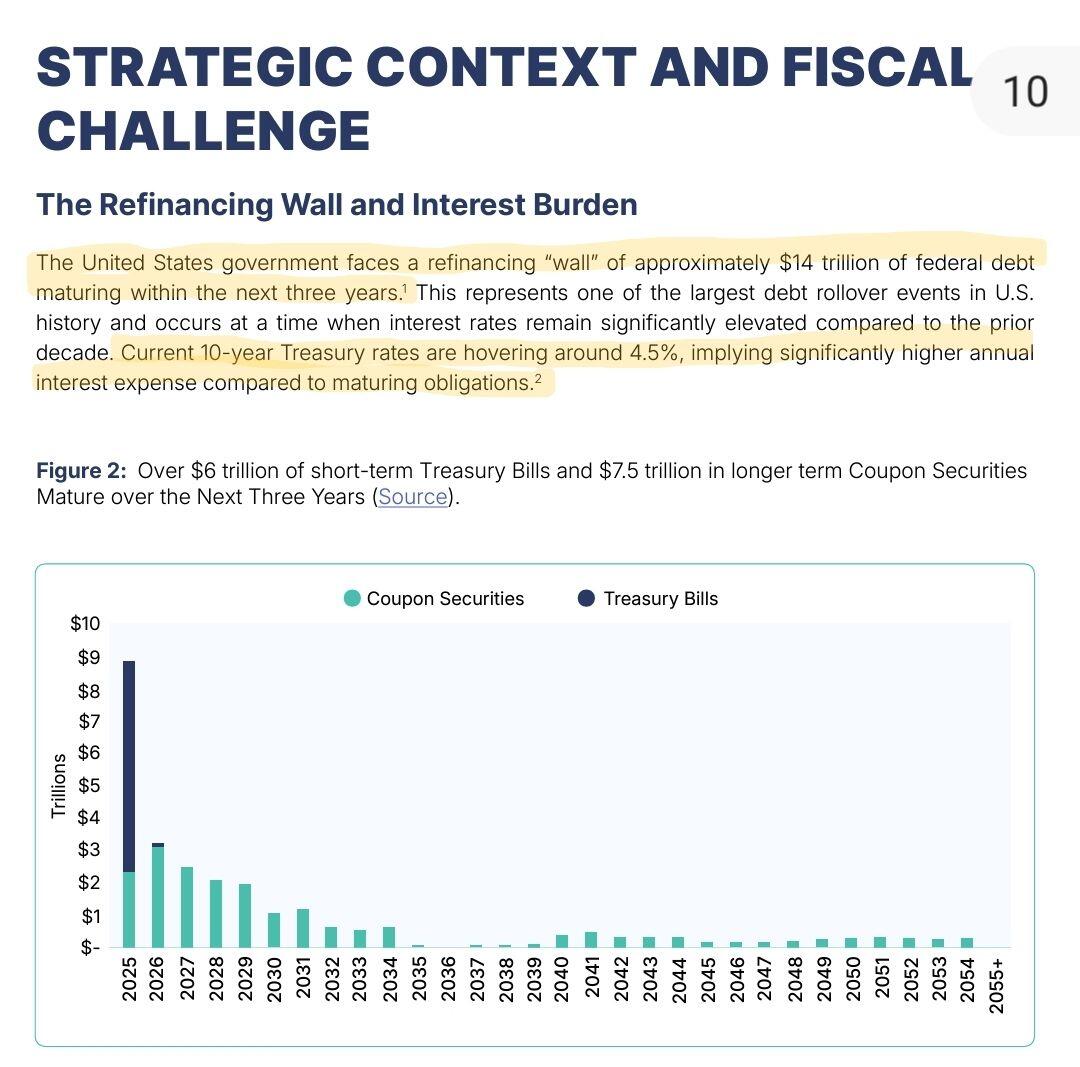

A factor driving the trade war (or at minimum indirectly benefiting from it) is the looming refinancing "wall" faced by the US, with approx $14 trillion in federal debt maturing over the next three years.

In January, 10-year Treasury rates hit 4.8% — these rates would have meant high interest expenses from debt refinancing (compared to the last decade). Cue, the trade war. It's indirectly influencing debt refinancing in 2 ways:

1. Flight to Safety: Heightened economic uncertainty tends to push global investors toward safe haven assets, like US treasuries. And increased demand for Treasuries drives down yields lower

2. Economic Slowdown: prolonged trade conflict can create global economic concerns, causing central banks (incl. the Fed) to reconsider rate hikes & even implement rate cuts, reducing borrowing costs further

And viola, with the chaos of the trade war, the 10-year Treasury yield dropped below 4% today. Lower 10-year yields mean lower future refinancing costs, helping the US gov manage its refinancing wall. But, this is a piece in solving for the massive debt puzzle.

𝗕𝗶𝘁𝗕𝗼𝗻𝗱𝘀

There's an alternative — or parallel — path to manage interest payments without inciting market chaos: Bitcoin-backed bonds.

In a new Bitcoin Policy Institute report, Andrew Hohn & nostr:nprofile1qqs9r4l3kumdr9v054h3z05z5fuc0gav5ncwd53hl28ux6wvzcyvtsqppemhxue69uhkummn9ekx7mp046mgt6 propose "Bitcoin-Enhanced Treasury Bonds." They recommend that 90% of bond proceeds finance standard gov operations or refinance existing debt, & 10% be allocated toward acquiring Bitcoin to establish a Strategic Bitcoin Reserve. By issuing these bonds at a significantly lower interest rate—such as 1% compared to current rates—the gov can substantially cut its debt-servicing expenses. Furthermore, considering Bitcoin’s historical performance, BitBonds have the potential to considerably reduce or even eliminate the federal debt burden over time.

Adopting Bitcoin-enhanced bonds could thus offer the US a financial advantage, aligning debt management with a new era of fiscal and monetary policy.

Me, when the omega candle is delayed another month

The Golden Age of Crypto:

Buying shitcoins & meme coins is like panning for fools gold, hoping to strike it rich

https://video.nostr.build/87553891a306a24fd967d2c0c9a2ca3860678c9a98c1abba394f7dd53a4589fa.mp4

The highest number of transactions in one block (so far) was in block 367853 with 12,239 transactions! 🤯

https://mempool.space/block/00000000000000001080e6de32add416cd6cda29f35ec9bce694fea4b964c7be

Bhutan, the small Himalayan kingdom rich in Buddhist traditions and known for measuring progress based on a Gross National Happiness Index, has been mining Bitcoin under its state holding company Druk Holding and Investments (DHI) since 2019.

Given its limited economic development options, Bhutan sees Bitcoin mining as a better way to capitalize on its abundant hydroelectric power over exporting electricity at low rates. Bitcoin mining is also being used to make up for falling tourism revenue.

DHI partnered with Bitdeer in May 2023 to significantly expand Bhutan’s mining capacity. Bitdeer’s filings indicate that a 100 megawatt datacenter became operational September 2023 in Gedu and a 500 megawatt datacenter is expected to be complete by mid-2025 in Jigmeling.

In a March 2025 interview, the Prime Minister, Tshering Tobgay, revealed that Bhutan’s Bitcoin holdings have been used to fund public services; primarily a pay rise for civil servants, but also healthcare and environmental initiatives. The Prime Minister believes the world is moving toward broader Bitcoin adoption, treating it like any other currency.

👀 Bhutan has sold 4,000 Bitcoin since Oct 2024 (from a peak of 13k to 9k). It is unclear why at this time, but I would guess it will fund the development of the Gelephu Mindfulness City.

In 2023, Bhutan sold US$100million worth of BTC to fund a 50% pay rise for civil servants.

If you're using stratum v2 & making your own block templates & running a node, you're decentralizing. Last I checked, mining with ocean is decentralizing mining too

The open source mining mafia is after me! Here's a Bitaxe version 🔥🤣

I stopped paying for a while but started it up again when I was hitting limits. Grok is good for searching Twitter and explaining posts. If it makes me more productive, its a win (but today i lost time playing with pics lolol). For Chatgpt last week I was brainstorming a business idea. I also had it pqrce through botdeer Financials for how many MW they have in Bhutan. I would like to get into vibe coding too, soon, but need to research what tools!

Its the one I've been using & im finding 4.5 useful rn wrt helping me organize writing & looking for sources; ots also good at taking me through a process. It also has my history, which i still need access to or add additional prompts to. Ive alao had it troubleshoot PC issues. I have access to grok & use it for different things. Google i dont like other than to search images (eg at a second hand store). At some point, I'll probably switch to one that i can keep on my PC only and/or an app that let's me pick across different models (depending on need)

Depends on the pool

Are you?