Fascism and communism are not two opposites, but two rival gangs fighting over the same territory—that both are variants of statism, based on the collectivist principle that man is the rightless slave of the state.

- Ayn Rand

It is only because the control of the means of production is divided among many people acting independently that nobody has complete power over us, that we as individuals can decide what to do with ourselves.

— Friedrich Hayek

Since the value of freedom rests on the opportunities it provides for unforeseen and unpredictable actions, we will rarely know what we lose through a particular restriction of freedom.

— Friedrich Hayek

As long as government has the power to regulate business, business will control government by funding the candidate that legislates in their favor.

- Dr. Mary Ruwart

Stay humble, stack sats, and starve the State.

https://fountain.fm/episode/DztyvQjEDZH9mTjv82bn

nostr:nevent1qvzqqqpxquqzpmftx9p8syrxncvjn9wf3zumv5sjdy7w7hpymnd43ky286dfxm2rujtv6m

If I had asked people what they wanted, they would have said faster horses.

-Henry Ford

"We should only make changes to Bitcoin that are absolutely necessary."

This is pushing the goalpost to an absurdly insurmountable threshold. Almost nothing is "necessary."

Take SegWit / time locks / taproot for example. It's hard to argue that they have significantly increased adoption in recent years - we'd likely be at a similar place without them. Lightning felt necessary at the time due to the scaling debate, but we haven't achieved mass adoption due to it.

However, it's very good that we have those functions available to build on top of! For example, now we have developers working on using Lightning to "glue" together different layers to effectively make them interoperable. Nobody was envisioning doing that 7 years ago.

The narrative that we shouldn't make "unnecessary" changes without "clear market demand" seems to be one made by folks who aren't willing to admit that there is always fog ahead when it comes to exploring the design space of what can be built.

We should not fear venturing forth into the unknown; that attitude would have prevented us from ever journeying this far.

BITCOIN CORE'S LOSS OF FOCUS

The legacy technical leadership in bitcoin is becoming increasingly less effective

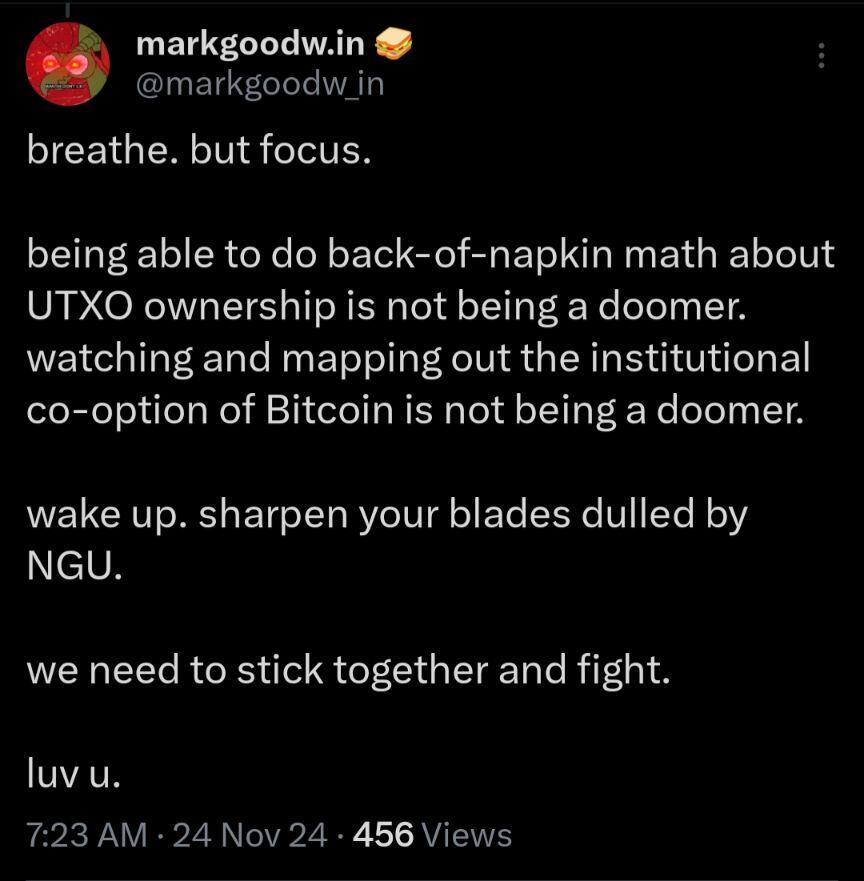

Almost universally, Core and "graybeard" devs are not focusing on _the_ fundamental problem in bitcoin: preserving trustless UTXO ownership.

Instead they are distracted with valuable but secondary issues like mempool policy, Core code architecture, and minor IBD performance. These things are important in their own right, but they fundamentally don't matter if in times of trouble most users can't take possession of their own coins.

Core devs are exceptionally talented people. The brightest engineers. But the priorities of the project are out of whack.

The aggregate focus does not reflect the thing that makes bitcoin a unique asset: trustless custody.

--

Given the current limits of bitcoin, even upper-middle class Americans will not be able to self-custody, let alone the rest of the world.

If bitcoin doesn't figure out how to ensure that most users have a trustless way of owning and sometimes moving coins, it will become basically indistinguishable from a gold ETF. A row in some OFAC-compliant database. Another financial widget that is subject to the regulatory dictates of government.

In fact, if bitcoin does not scale UTXO ownership, gold will have the advantage that at least small amounts of it *can* be self-custodied and traded peer-to-peer. The same won't be able to be said for bitcoin. In a world where on-chain fees are in the thousands of dollars and there is not a workable, trustless layer two, most coins will be stuck with custodians.

Forget payments. I'm talking about savings. I'm talking about less than checking-account volume. 1-2 transactions a month.

If you think that most people should be able to DCA and withdrawal to self-custody once a month, maybe spend once every few years for big purchases, I've got news for you:

Given bitcoin's current limitations, only 18 million users can do that. A little over 5% of Americans.

--

Right now, the chain capacity is able to meet demand for self-custody because we are in a time of relative peace.

Most don't feel at risk keeping their bitcoin with a custodian. That can change very rapidly.

As bitcoin grows in value and challenges fiat currency, governments will increasingly want to control it. They won't ban it, which is now obvious, but almost certainly they will impose OFAC-like restrictions and possible wealth taxes.

When the regulatory hammer comes down, tens of millions will look to withdrawal their coins into self-custody. But they may not be able to.

--

Unfortunately this risk does not seem to be top of mind in the current Core culture.

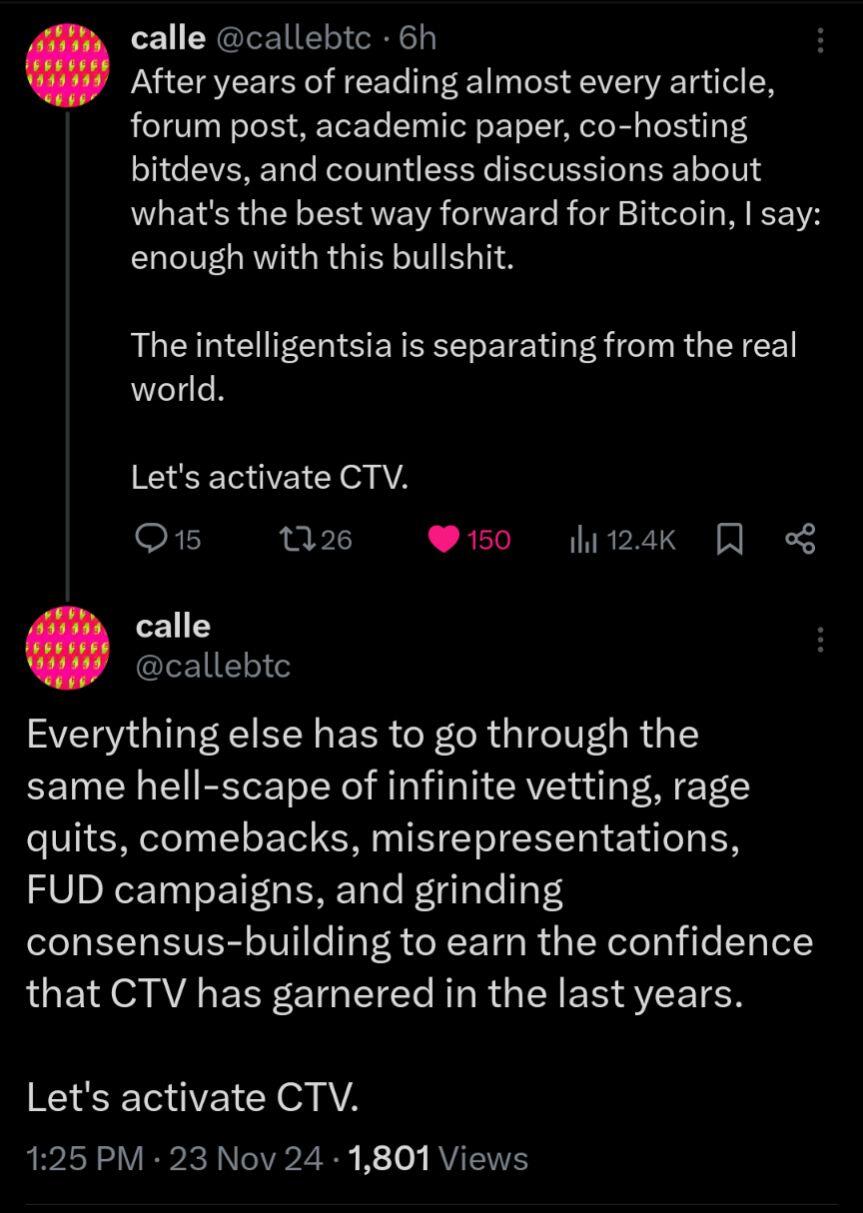

One instance of a tone-deaf Core response to this kind of problem relates to CTV. As @JeremyRubin has been pointing out for years, CTV would be the most efficient way to guarantee that people can withdrawal coins from institutions in times of chain-panic and congestion, allowing exit to happen during crises without fully "unrolling" transactions. I wrote about this at length in 2023, and why it seems there is no more efficient way to do this (delvingbitcoin.org/t/thoughts-on-…).

And yet technical figureheads like @TheBlueMatt and @murchandamus downplay the value of CTV, claiming that it has no compelling uses.

CTV is one of the primitive building blocks that we need to figure out UTXO scaling solutions. (Not to mention its use in applications like vaults.)

Some Core devs might argue "well okay, maybe we need that functionality - but CTV isn't the right way to do it. We need to think harder!"

The problem is that time is running out. As nation-states begin to enter the technical ecosystem, soft forks that promote scaling and self-custody will be more difficult to deploy. Powerful actors will not want bitcoin to change - they're perfectly happy letting regulated custodians act as the L2.

As the market cap grows, the stakes of change go up, and it will be much harder to get economically relevant actors to run new consensus.

Because Core devs aren't paying close attention to the covenants conversation, they may not realize that CTV is upgradeable, simple, and well-tested. It's good enough.

This gap in understanding partially reveals that those devs prefer to work on more smaller self-contained puzzle problems that are more tractable. Maybe this is understandable given the fraught Core development process and historical drama of soft forks, but neither of those are an excuse for abandoning the core challenge of realizing bitcoin.

--

Segwit and Taproot were massive changes, and I can almost understand why so much drama was spent on them. They both basically reinvented how locking scripts are stored and executed in bitcoin.

But to make significant headway on finding a scaling solution for self-custody, it may only take a few opcodes - much more narrowly scoped bits of functionality. Changes that are much easier to test and reason about, and don't reinvent the engine of bitcoin.

--

As I continue campaigning for a renewed focus on scaling coin ownership, some may compare me to the "big blockers" of the 2017 scaling wars.

The big-blockers camp wanted to raise the blocksize for the sake of housing the world's P2P payments. They resisted the use of Lightning and other second layer solutions.

The reality is that they have been partially vindicated. Lightning has not solved our problems, and given the on-chain footprint that existing channel constructions require, it categorically cannot. Lightning certainly helps reduce on-chain payment volume once someone has opened a channel - but to do that for most people will require a layer 1 innovation.

I don't share the big blockers' objectives.

I don't think that trying to fit the world's P2P payments on the base chain is a reasonable target.

But the ability to resist near complete capture of UTXO custody by third-party financial institutions - *that* is intertwined with the core purpose of bitcoin.

In Satoshi's whitepaper, the first sentence claims

"A purely peer-to-peer version of electronic cash would allow online payments to be sent directly from one party to another without going through a financial institution."

If most users become unable to even take possession of their own coins a few times a year, we have failed on the objective.

--

I am not writing this out of any sense of antagonism. Yes, I am frustrated that after numerous attempts, Core devs are not engaging more productively with the few people trying to translate scaling strategies to the base layer.

But I'm hoping that by calling attention to this issue, we can get some of these great minds to refocus on bitcoin's critical mission, and to realize that ossification will come sooner than we thought.

The existing (and well-funded) power structures *want* stasis.

The recent show of rapid institutional affinity should make you suspicious that bitcoin in its current form isn't a threat to the fiat order.

The lack of "ivory tower" attendance in the recent OP_NEXT and the broader covenants discourse demonstrates that, like many of America's elite institutions, there has been mission drift in bitcoin's technical elite. I hope this changes.

--

The risk of merging many of the opcodes proposed during the last few years is limited.

OP_CAT, OP_CTV, lnhance, probably OP_CCV, some others; they're all fine. If sufficiently tested, great additions to bitcoin.

We can pretty easily mitigate what risk there is with comprehensive testing and analysis, provided the focus is there.

The upside is almost infinite: a reasonable attempt to continue the preservation of bitcoin's unique function - trustless self-custody that is practically available to most.

A medium of exchange is any good acquired to facilitate future exchanges, regardless of when those exchanges occur. The time delay between Bitcoin exchanges doesn't change its essential nature - it simply reflects how people subjectively value and choose to use it.

watch out for my interview with nostr:npub17u5dneh8qjp43ecfxr6u5e9sjamsmxyuekrg2nlxrrk6nj9rsyrqywt4tp, which i will be publishing tomorrow

we talk about bitcoin upgrades vs ossification, we share some hot takes on hardware wallets & self-custody solutions

jameson even names the 3 cryptos he doesn’t believe are scams (hint: running grin)

Bitcoin Audible Chat_118 - Reviving Resiliency, Autonomy, and Masculinity with the nostr:nprofile1qqsqt94cze77fkfxhgt9s2rfxmht6gjn96n8asf2jrq8szkkdhclexgprfmhxue69uhhyetvv9ujuumgd96xvmmjvdjjummwv5hszxnhwden5te0wfjkccte9emk2mrvdaexgetj9ehx2ap0qy88wumn8ghj7mn0wvhxcmmv9uvturtf

It is no measure of health to be well adjusted to a profoundly sick society.

- J. Krishnamurti

Bitcoin and Ossification w/ nostr:nprofile1qqs0w2xeumnsfq6cuuynpaw2vjcfwacdnzwvmp59flnp3mdfez3czpspzpmhxue69uhkummnw3ezumt0d5hstp5new

Will DEI Ever DIE?

If they can get you asking the wrong questions, they don't have to worry about answers.

— Thomas Pynchon

Cc nostr:npub1t42gfjzfv74v8xrv65f2lrwd65jr85ysrtdmkkfrvqgcss5r4g0qk487qz what do you think explains this?

The media's ignorance of the Triffin dilemma reflects their entrenched Keynesian bias and institutional reluctance to acknowledge fundamental flaws in the fiat currency system that benefits establishment powers.

THE CONSENSUS CONUNDRUM

Bitcoin faces a one-of-a-kind leadership problem

—

A lot of consensus-change proposals for bitcoin are on the table at the moment. All of them have good motivations, whether it's scaling UTXO ownership or making self-custody more tractable. I won’t rehash them here, you’re probably already familiar. Some have been actively developed for years.

The past two such changes that have been made to bitcoin successfully, Segwit and Taproot, were massive engine-lift-style deployments fraught with drama. There have been smaller changes in bitcoin’s past, like the introduction of locktimes, but for some reason the last two have been kitchen sink affairs.

The reality not often talked about by many bitcoin engineers is that up until Taproot, bitcoin’s consensus development was more or less operating under a benevolent dictatorship model. Project leadership went from Satoshi to Gavin to… well, I’ll stop naming names.

Core developers will likely quibble with this characterization, but we all know deep down that to a first order approximation that it’s basically true. The “final say” and big ideas were implicitly signed off on by one guy, or maybe a small oligarchy of wizened autists.

In many ways there’s really nothing wrong with this - most (all?) major opensource projects operate similarly with pretty clear leadership structures. Oftentimes they have benevolent dictators who just “make the call” in times of high-dimensional ambiguity. Everyone knows Guido and Linus and the based Christian sqlite guy.

Bitcoin is aesthetically loathe to this but the reality, whether we like it or not, is that this is how it worked up until about 2021.

Given that, there are three factors that create the CONSENSUS CONUNDRUM facing bitcoin right now:

(1) The old benevolent dictators (or high-caste oligarchy) have abdicated their power, leaving a vacuum that shifts the project from “conventional mode of operation” to “novel, never-before-tried” mode: an attempt at some kind of supposedly meritocratic leaderlessness.

This change is coupled with the fact that

(2) the possible design space for improvements and things to care about in bitcoin is wide open at this point. Do you want vaults? Or more L2s? What about rollups? Or how about a generic computational tool like CAT? Or should we bundle the generic things with applications (CTV + VAULT) to make sure they really work?

The problem is that all of these are valid opinions. They all have merit, both in terms of what to focus on and how to get to the end goal. There really isn’t a clear “correct” design pattern.

(3) A final factor that makes this situation poisonous is that faithfully pursuing, fleshing out, building, “doing the work” of presenting a proposal IS REALLY REALLY TIME CONSUMPTIVE AND MIND MELTING.

Getting the demos, specs, implementation, and "marketing" material together is a long grind that takes years of experience with Core to even approach.

I was well paid to do this fulltime for years, and the process left me with disgusted with the dysfunction and having very little desire to continue contribution. I think this is a common feeling.

A related myth is that businesses will do something analogous to aid the process. The idea that businesses will build on prospective forks is pretty laughable. Most bitcoin companies have a ton on their backlog, are fighting for survival, and have basically no one dedicated to R&D. The have a hard enough time integrating features that actually make it in.

Many of the ones who do have the budget for R&D are shitcoin factories that don’t care about bitcoin-specific upgrades.

I’ve worked for some of the rare companies that care about bitcoin and do have the money for this kind of R&D, and even then the resources are not sufficient to build a serious product demo on top of 1 of N speculative softforks that may never happen.

---

This kind of situation is why human systems evolve leadership hierarchies. In general, to progress in a situation like this someone needs to be in a position to say “alright, after due consideration we’re doing X.”

Of course what makes this seem intractable is that the Bitcoin mythology dictates (rightly) that clear leadership hierarchies are how you wind up, in the limit, with the Fed.

Sure, bitcoin can just never change again in any meaningful way ("ossify"). But at this point that almost certainly resigns it to yet another financial product that can only be accessed with the benefit of a large institution.

If you grant that bitcoin should probably keep tightening its rules for more and better functionality, but that we should go "slow and steady," I think there are issues with that too.

Because another factor that isn’t talked about is that as bitcoin rises in price, and as nation-states start buying in size, the rules will be harder to change. So inaction — not deciding — is actually a very consequential decision.

I do not know how this resolves.

—

There’s another uncomfortable subject I want to touch on: where the power actually lies.

The current mechanism for changing bitcoin hinges on what Core developers will merge. This of course isn’t official policy, but it’s the unintended reality.

Other less technically savvy actors (like miners and exchanges) have to pick some indicator to pay attention to that tells them what changes are safe and when they are coming. They have little ability or interest to size these things up for themselves, or do the development necessary to figure them out.

My Core colleagues will bristle at this characterization. They’ll say “we’re just janitors! we just merge what has consensus!” And they’re not being disingenuous in saying that. But they’re also not acknowledging that historically, that is how consensus changes have operated.

This is something that everyone knows semi-consciously but doesn’t really want to own.

Core devs saying “yes” and clicking merge has been a necessary precursor every time. And right now none of the Core devs are paying attention to the soft fork conversations - sort of understandable, there’s a bunch to do in bitcoin.

But let’s be honest here, a lot of the work happening in Core has been sort of secondary to bitcoin’s realization.

Mempool work is interesting, but the whole model is more or less upside down anyway because it’s based on altruism. For-profit darkpools and accelerators seem inevitable to me, although that could be argued. Much of the mempool work is rooted in support for Lightning, which is pretty obviously not going to solve the scaling problem.

Sure, encrypted P2P connections are great, but what’s even the point if we can’t get on-chain ownership to a level beyond essentially requiring the use of an exchange, ecash mint, sidechain, or some other trusted third party?

My main complaint is that Core has developed an ivory tower mindset that more or less sneers at people piatching long-run consensus stuff instead of trying to actually engage with the hard problems.

And that could have bitcoin fall short of its potential.

—

I don’t know what the solution to any of this is. I do know that self-custody is totally nervewracking and basically out of the question for casual users, and I do know that bitcoin in its current form will not scale to twice-monthly volume for even 10% of the US, let alone most of the world.

The people who don’t acknowledge this, and who want to spend critical time and energy wallowing in the mire of proposing the perfect remix of CTV, are making a fateful choice.

Most of the longstanding, fully specified fork proposals active today are totally fine, and conceptually they’d be great additions to bitcoin.

Hell, probably a higher block size is safe given features like compactblocks and assumeutxo and eventually utreexo. But that’s another post for another day.

---

I've gone back and forth about writing a post like this, because I don't have any concrete prescriptions or recommendations. I guess I can only hope that bringing up these uncomfortable observations is some distant precursor to making progress on scaling self-custody.

All of these opinions have probably been expressed by @JeremyRubin years ago in his blog. I’m just tired of biting my tongue.

Thanks to nostr:nprofile1qqsdnpcgf3yrjz3fpawj5drq8tny74gn0kd54l7wmrqw4cpsav3z5fgpz4mhxue69uhk2er9dchxummnw3ezumrpdejqz9rhwden5te0wfjkccte9ejxzmt4wvhxjmcprpmhxue69uhhyetvv9ujuumwdae8gtnnda3kjctvl3x2lg and nostr:nprofile1qqsph0g2tcj80mm676qwtegey77gdu682vt7v067aq792spvdvv23gspzamhxue69uhhyetvv9ujumn0wd68ytnzv9hxgtc5a5hjp for feedback on drafts of this.

Bitcoin consensus is dictated by the economic actors actually using it. If Bitcoin becomes a simple financialized asset dominated by the legacy institutions and actors that it was built to free us from, then proportionally to their level of use they decide consensus.

https://bitcoinmagazine.com/takes/the-trump-pump-a-road-to-capture-and-failure

The Federal Reserve Exposed

A fundamental and constant truth about human action is that man prefers his end to be achieved in the shortest possible time. Given the specific satisfaction, the sooner it arrives, the better. This results from the fact that time is always scarce, and a means to be economized. The sooner any end is attained, the better. Thus, with any given end to be attained, the shorter the period of action, i.e., production, the more preferable for the actor. This is the universal fact of time preference. At any point of time, and for any action, the actor most prefers to have his end attained in the immediate present. Next best for him is the immediate future, and the further in the future the attainment of the end appears to be, the less preferable it is. The less waiting time, the more preferable it is for him

- Murray Rothbard

Can Interest Rates Fall to Zero on the Free Market?

How Trump Will Serve The CBDC Agenda with nostr:nprofile1qqsy86rlt3pvtvfuryalrehjjaqv4g2recqj9zhyh49svf2gx3vqe2spzamhxue69uhhyetvv9ujumn0wd68ytnzv9hxgtcmrm0a9 & Mark Goodwin

Man, Economy, and State

GM ☕

Remember to count your blessings each day.