Matt’s on the nose with his analysis. I’d add Dave’s lack of humility and the fact he seems to be on cruise control with his messaging for his opposition to #bitcoin.

It’s going to be hard for Dave to see it at this point.

Too bad, b/c his messaging regarding debt and saving is in line with #Bitcoin’s properties.

How is it that flows are EXACTLY zero for three consecutive days?

Root, is there any possibility that flows aren’t being reported because of a technology or paperwork issue?

Is it common for an ETF with a volatile asset like #bitcoin to show zero change over 3 consecutive days of trading? Especially one as large IBIT?

Is there precedent from greyscale in the past?

The biggest hurdle is capital gains imo. I think the aps are getting better and better.

We had UBI during Covid on a small scale. It led to rampant inflation. Ultimately it hurt the very people it was supposed to help by diluting their purchasing power.

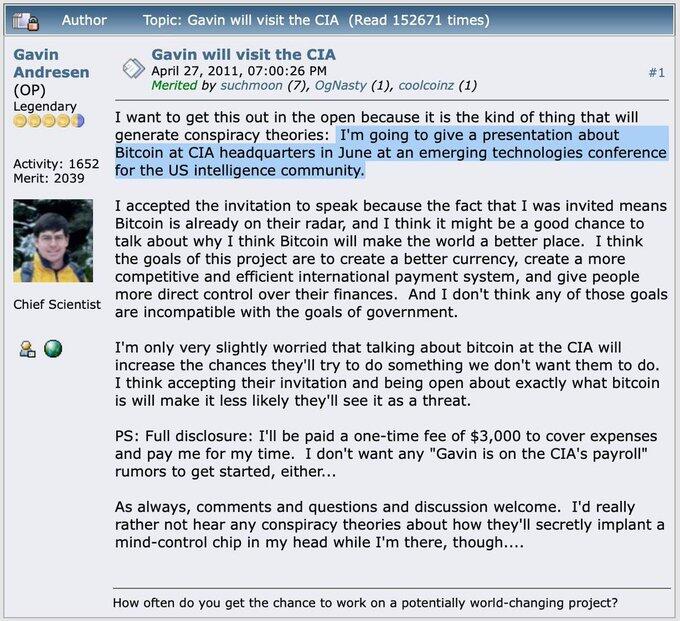

I’m class of 2020. Can you provide context about Gavin’s role in the early history of Bitcoin?

🤣

Yep. Was with my father mother and 36 y.o. Brother just recently talking about the state of the world. The conversation was centered on politics.

It’s so crystal clear to me that broken money is the fundamental issue driving every other piss poor political decision. Everything is a downstream symptom.

The longer we talked and I explained how broken money impacted everything, the more they would… shut down? (Searching for the correct description). In short, there’s nothing a politician is going to do until the money is fixed. Once that clicks, it can’t be unseen.

To wrap the babble with a nice ribbon, you’re right. Bitcoin has turned me into a stoic. I certainly was in that conversation. Great post!

I literally just pulled that book off my shelf tonight to give to my son to read. See him up with rich dad poor dad as well. He’s thinking about college. I want him thinking about debt vs assets. Enjoy the read!

Deleted the twitter app off my phone about a week ago. There are a few follows I miss, but I had enough of the noise and propaganda. #bitcoin # nostr

He learned about the #BTC “having” from Poor Dad maybe?

Bitcoin standard. Helped me bypass shitcoins and go straight to BTC

I’ll set that up today. Borderline boomer here; might take a minute🤣

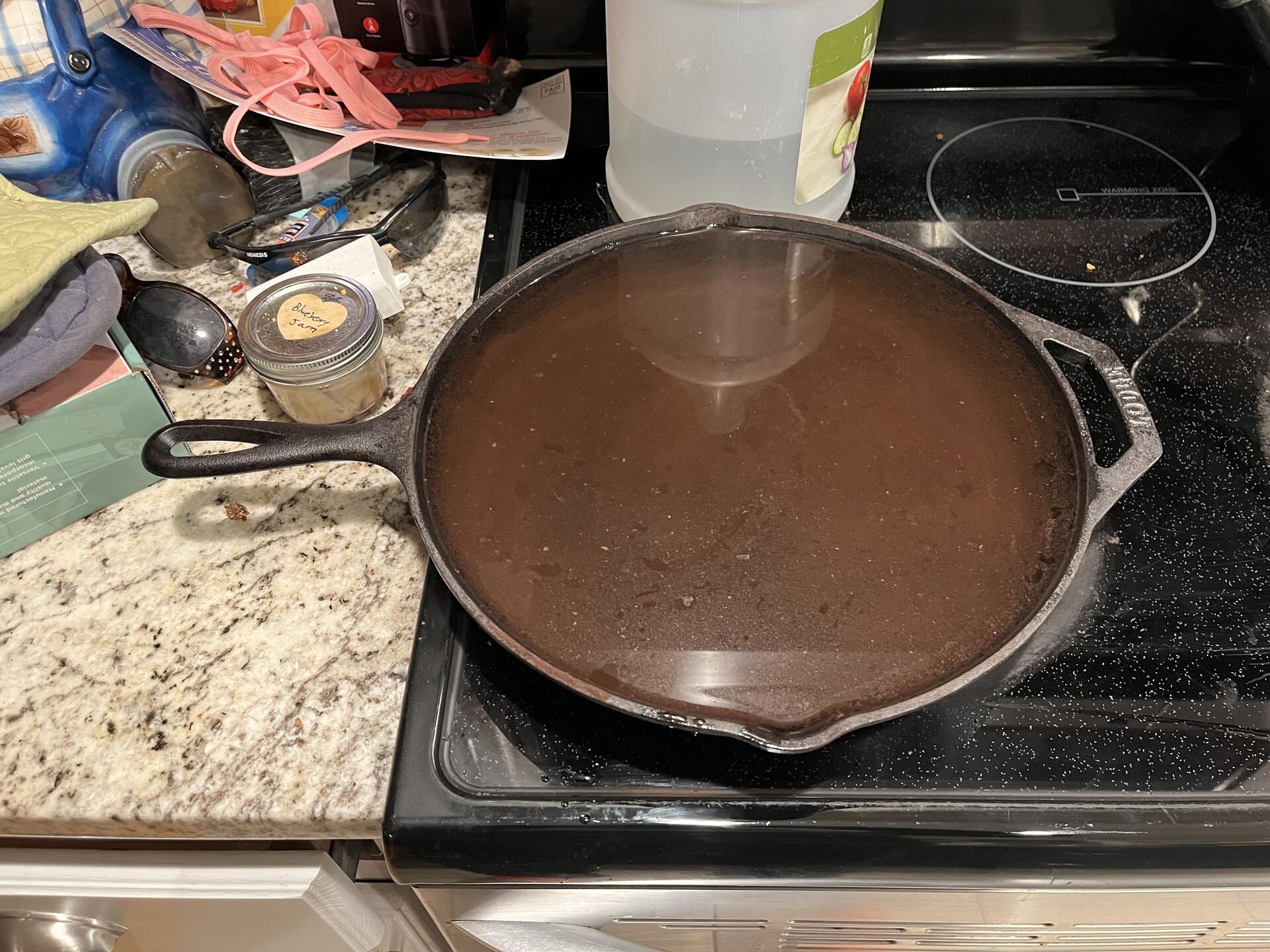

Let one of my cast irons get away from me. Started the vinegar and water bath. Seasoning time. Saif is probably right about stainless pans, but I’m still a cast iron maxi.

Great RHR this week. I decided to delete twitter after listening to you get after Marty. I’m all set with Elon. Freedom tech for the win!

Saw this come across my timeline and loved it!

Hey guys, I’m trying to get one going in Connecticut. I am putting together a Bitcoin meetup at Brewery Legitimus, 283 Main Street, New Hartford, CT on Thursday, April 27 at 6:00 pm.

Can you please share to help to get the word out about it?

CTBTC.info

Thanks guys!