To be clear, I oppose all government regulation because it is involuntary. My two question test is how I might recommend Samurai approach their defense.

I’m not a lawyer. But by my reading of the FinCEN guidance, eCash issuers and federated chains (Liquid) are probably engaging in transmission.

I’m less sure about Lightning liquidity providers. I’m guessing they’re not. Once the channel is established, neither party can steal.

Yes, a provider could fail to deliver the service. For example, my cable company could fail to deliver my bandwidth. But failure to provide service isn’t, IMO, proof of money transmission.

The purpose of my test was as a negative. If there’s NO opportunity to steal, then there’s NO transmission. But the inverse does not necessarily follow. That is, the statement “if there IS opportunity, then there IS transmission” is false.

#100pushups a day until #Bitcoin $100k

Day 038: 2024-04-28 - 4x25

Keep on pushing, brother! 💪

#asknostr

nostr:note1rar8n8xgmj0yy9tukap6rpr0vh8qwf3d7wdq3c72hu9tu38kev7sht38nz

I propose the “opportunity to steal”, two-question test:

1. Does the service provider have the opportunity to steal from the users?

2. Do the users have the opportunity to steal from the provider?

If the answer to both is “no”, then the provider cannot be a money transmitter.

By this test, ISPs, nodes and CoinJoin services would NOT be transmitters. But existing MSBs like banks and exchanges still would be.

#100pushups a day until #Bitcoin $100k

Day 037: 2024-04-27 - 5x20

Keep it up lads! 💪💪

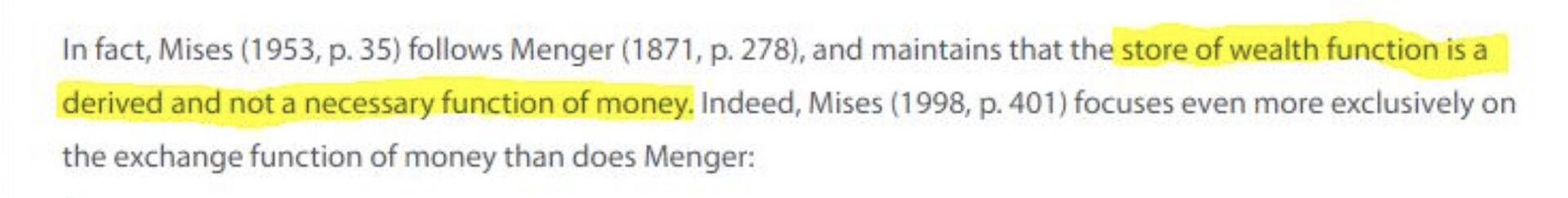

“Is” arguments are among the most vociferous and yet inconsequential. What “is” money, etc.

The question was why do Bitcoiners consider Monero to be a poor store of value. My answer remains that as a shitcoin, of which there are and will be countless, Monero lacks and cannot gain first mover advantage against Bitcoin.

Fair enough, moneyness is continuously reinvented by people.

It is simply too easy to create shitcoins, and the motivation to print one’s own money too strong to imagine that we’ll ever be totally rid of them. There will be a long tail of shitcoins and their promoters, forever.

All of them suffer lack of first-mover advantage to Bitcoin.

The question was what makes Monero a weak store of value. What you’ve listed are currencies, which are also weak stores of value—by design. Currency issuers compete to weaken their currencies to boost their numbers (exports, GDP etc.)

TAXATION IS THEFT

nostr:note1hx8ef73vcd78xjecers2xw86x7au3fg482t7v7wj9hx9lkndjzus080n3w

FUD is the only tool they have

S U P E R C Y C L E

nostr:note1nd8xxudcmwnulglflf3me2djjp9hd326tr6ac5mjcu5z64uwcars63hke7

NEVER nostr:note1y76xtvdzvf5duf5ghxnrt4q0mlp9z2kmapy58e96rfjxer7ljrasnkesvr

#100pushups a day until #Bitcoin $100k

Day 036: 2024-04-26 - 2x20, 3x10, 3x10 deficit (feet on bench)

Did the sets of 10 in between 5x5 deadlifts. Keep it up gents!

If you haven’t started, it’s not too late! Just do what you can each day and work up to it. 💪

The author of The Mandibles just wrote #Bitcoin out of existence with a one liner:

“The dollar is a historied currency that’s stabilized the international economy for over a century, Wilbur. The bancor is an upstart pretender whose constraints are unworkably strict. We just have to hold our nerve. After all—look at what happened to bitcoin.”

But she kinda had to do it. A world with Bitcoin would have turned out quite different. The populace was only victimized because they were trapped in fiat.

#100pushups a day until #Bitcoin $100k

Day 035: 2024-04-25 - 4x25

Started late in the day, but still got them done. ✅

Verizon must be the biggest money transmitter out there.

It lacks first-mover advantage. Money is a winner-take-all contest.