Elon’s America Party is controlled opposition.

It’s cute how Elon thinks he can fix this

* nostr:npub1a2cww4kn9wqte4ry70vyfwqyqvpswksna27rtxd8vty6c74era8sdcw83a enters stage right*

*Ahem*, “Nothing stops this train, Elon”

Controlled opposition

I know that the plural of “Whopper Jr.” is “Whoppers Jr.”

But what is the plural of “root beer float”? #asknostr

1. The #Bitcoin mempool just cleared.

2. All these Bitcoin treasury companies are supposedly buying.

Conclusion: it’s all a fugazi.

Never allow facts to stand in the way of a good story.

It also makes people more themselves, magnifying the direction they were already heading.

Probably best served by legacy systems. Consider the enormous Boomer contingent for whom stonks, bonds and real estate have performed sufficiently.

Had to return a refurbished ThinkPad T490s today after less than two weeks of use. The number keys stopped working (except 5 and 6).

Thankfully, NewEgg made it easy to return and get a replacement. #linux

S U P E R C Y C L E

nostr:note1704l6zzvef4x86eg9t8cllyg8fwctk9vxwruw7mgpem3mh7wwf4ssz9x3c

Sounds revoluting

Good! Let’s hope more States follow suit. The longer governments ban themselves from #Bitcoin, the better for the rest of us.

Fool me once, shame on you… A fool can’t get fooled again.

#asknostr

nostr:note1uzf2h2nvw9q2q7zusahcjf5m9cmn7xvsexgy5fru9g3ps8q6487slywxhc

If there’s a bug or something, no problem! Just vibe code a whole replacement app. Done!

If you’re the kind of person who can use real estate to yield income, it could be a reasonable approach, providing it’s not cutting into better opportunities.

The real trick here is that when you get a loan to buy real estate, the loan to-value (LTV) isn’t going to be 100%. It’ll be something like 70%.

Throwing some numbers out there (ballpark):

- Real estate value: $1M

- Loan amount: $700k

- Your equity: $300k

- Your Bitcoin: 0

Now, this means you have $300k tied up in real estate that *could have been Bitcoin*. Is it worth it?

After 1 year:

- Real estate value: $1.08M

- Loan amount: $695k

- Your equity: $385k

At this point, you need some way to extract the paper profit of your increased equity if you want to use it to buy Bitcoin, and then you’ll buy it at Bitcoin’s future price.

Compare to using your $300k to buy Bitcoin directly:

- Your Bitcoin: 3BTC ($300k)

After 1 year:

- Your Bitcoin: 3BTC ($???k)

But here’s the trick. We have to guess what Bitcoin’s compound annual appreciation rate (CAGR) is going to be. We can guess that it’ll be the same as your hypothesized real estate equity growth:

- Your Bitcoin: 3BTC ($385k) => +28% return

That would be a bad year for Bitcoin, historically speaking. The ballpark that I tend to use is 40%. So:

- Your Bitcoin: 3BTC ($420k) at 40% CAGR

The difference between these numbers is your opportunity cost for engaging in the real estate trade. That is: $420k - $385k = $35k. Or in BTC terms, about 0.35 BTC.

All of this has to be napkin math because we cannot possibly predict with fidelity the Bitcoin price in dollars a year out.

But *to me* it seems like a bad trade because of the necessary equity that one must hold to get the loan, and the difficulty of liquidating/refinancing the real estate to extract the appreciation.

What are the “profits” from “real estate”? Do you mean speculative appreciation? Or do you mean income from leasing?

#Smug woman with a PhD gets put in her place by #IQ test #results

https://blossom.primal.net/4127c2d6e06dffa6a0a683255d733893bc93285b92e1dfd502a533afb4050d35.mp4

Dunning? Meet Krueger.

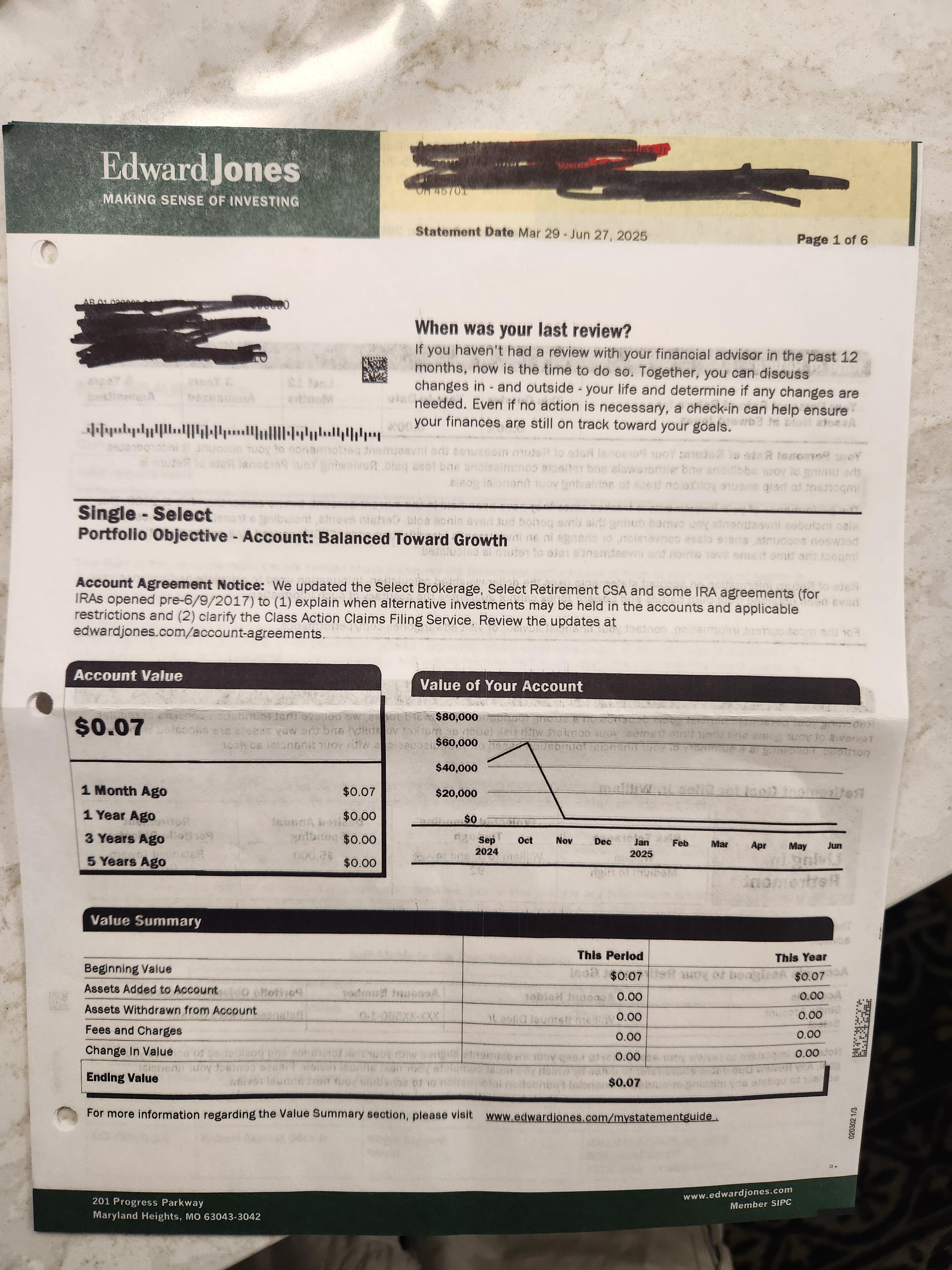

When a boomer nocoiner complains their portfolio is down 20% and now they can’t retire this year like they planned.

Me:

Decreasing the block size to 1/4 the current limit has the same effect without abandoning useful functionality.

This article does a great job laying out the current OP_RETURN policy debate, IMO. https://antoinep.com/posts/relay_policy_drama/