It’s been a busy year so I figured let’s take a break on a lake for my own sake.

Looking forward to all the content we’ll be releasing at nostr:npub1xkere5pd94672h8w8r77uf4ustcazhfujkqgqzcykrdzakm4zl4qeud0en in the next half 😄

The amount of backend stuff for various systems that Nostr can improve is immense.

Decentralized social media is a big deal, but that use case goes up against very large existing network effects. If you judge Nostr’s success based on not gaining traction on that front quickly enough, you’ll likely be disappointed. That’s why a lot of people come to Nostr, post a bit, and then leave for a while, and then come back when there’s some sort of catalyst, post a bit, and then leave again. That’s fine. It’ll take time. It’s a slow burn.

But in the meantime, the amount of development going on under the hood for all sorts of things is huge. In particular, I think the open-source social graph aspect is under-appreciated for how important it can be beyond just socials. Payments being the next obvious one, and probably bigger than people think. And many other things.

https://pippellia.com/pippellia/Social+Graph/Navigating+the+social+graph

How about some of this?

We're hiring a Product Marketing Manager at nostr:npub1xkere5pd94672h8w8r77uf4ustcazhfujkqgqzcykrdzakm4zl4qeud0en to work with me on our go-to-market for new products, and our product marketing as a whole.

Because we build #Bitcoin products, we need a Bitcoiner for this role!

Come join our awesome team 🧡

Job description for Product Marketing Manager: https://boards.greenhouse.io/riverfinancial/jobs/5195403004

We're hiring for more roles, check them out: https://boards.greenhouse.io/riverfinancial

With the Bitcoin halving almost upon us, I made a fun little treat 😄

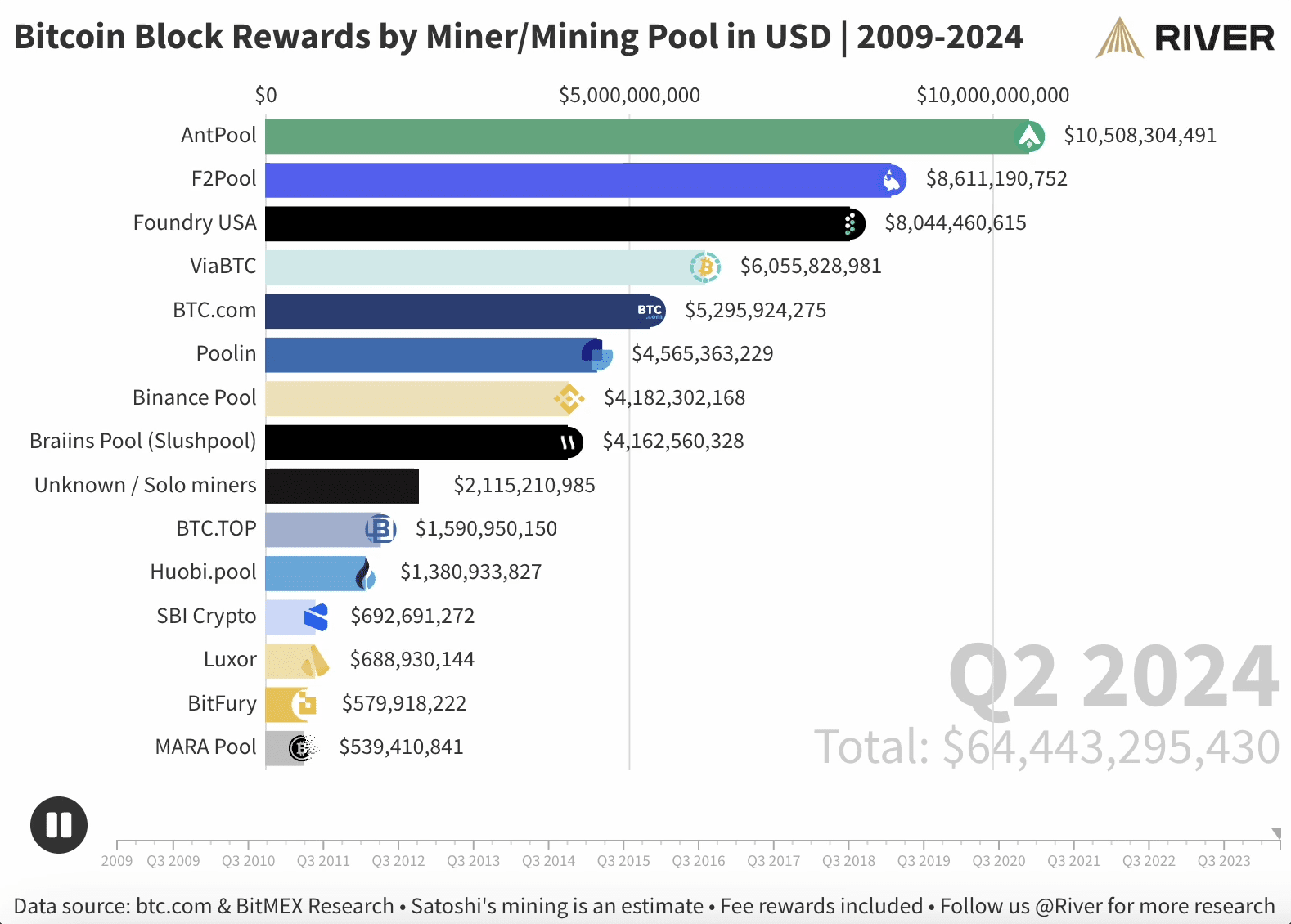

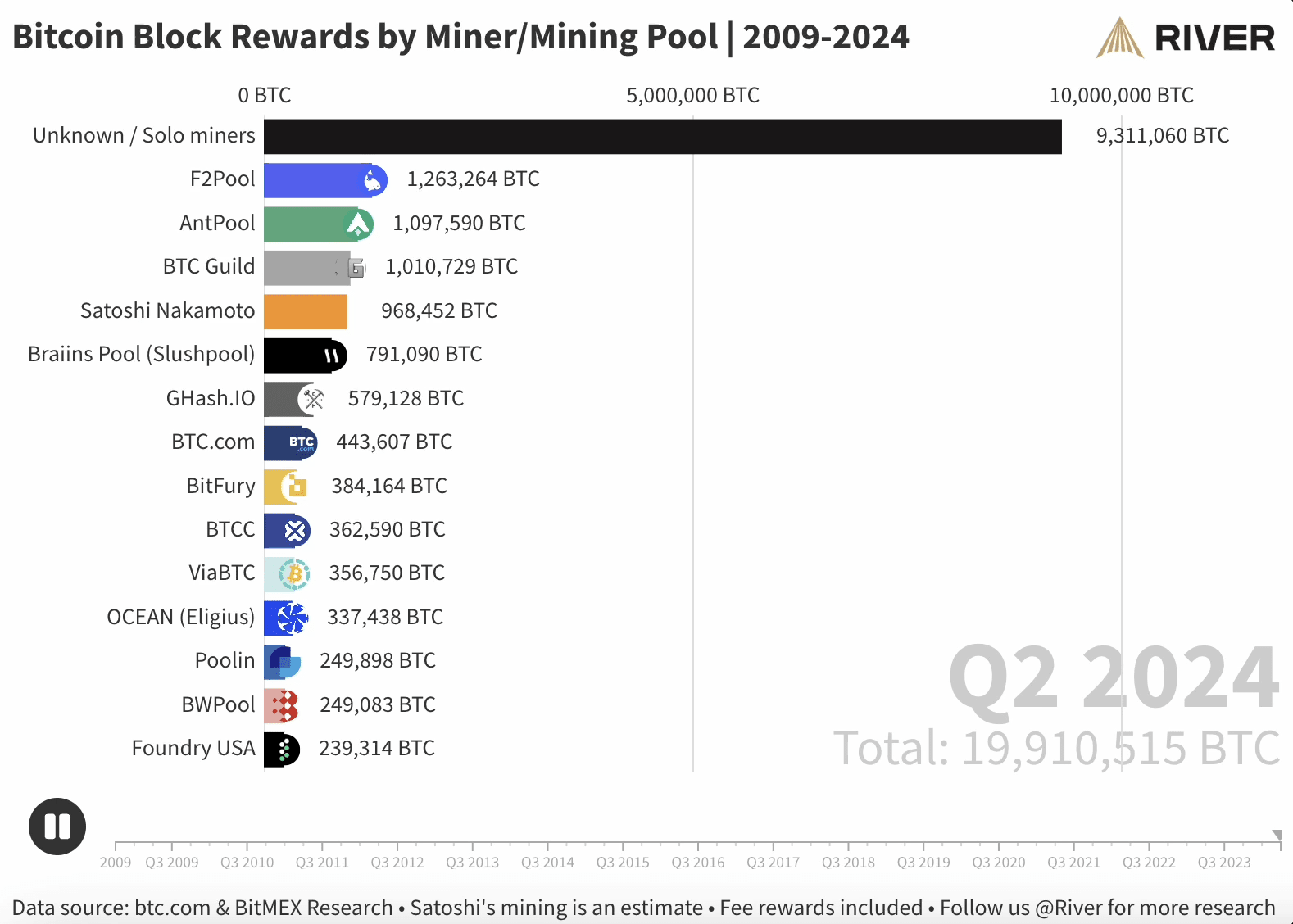

Here is how much miners/pools have been earning in USD over the past 4 Bitcoin epochs!

These are actually animated race charts across 15 years, but my Nostr client keeps crashing when I try to upload those, so I’ll just link to then here. https://twitter.com/SDWouters/status/1780594555429290311

https://twitter.com/SDWouters/status/1780594557853577610

Hope you enjoy, took a lot of time to make these 🙂

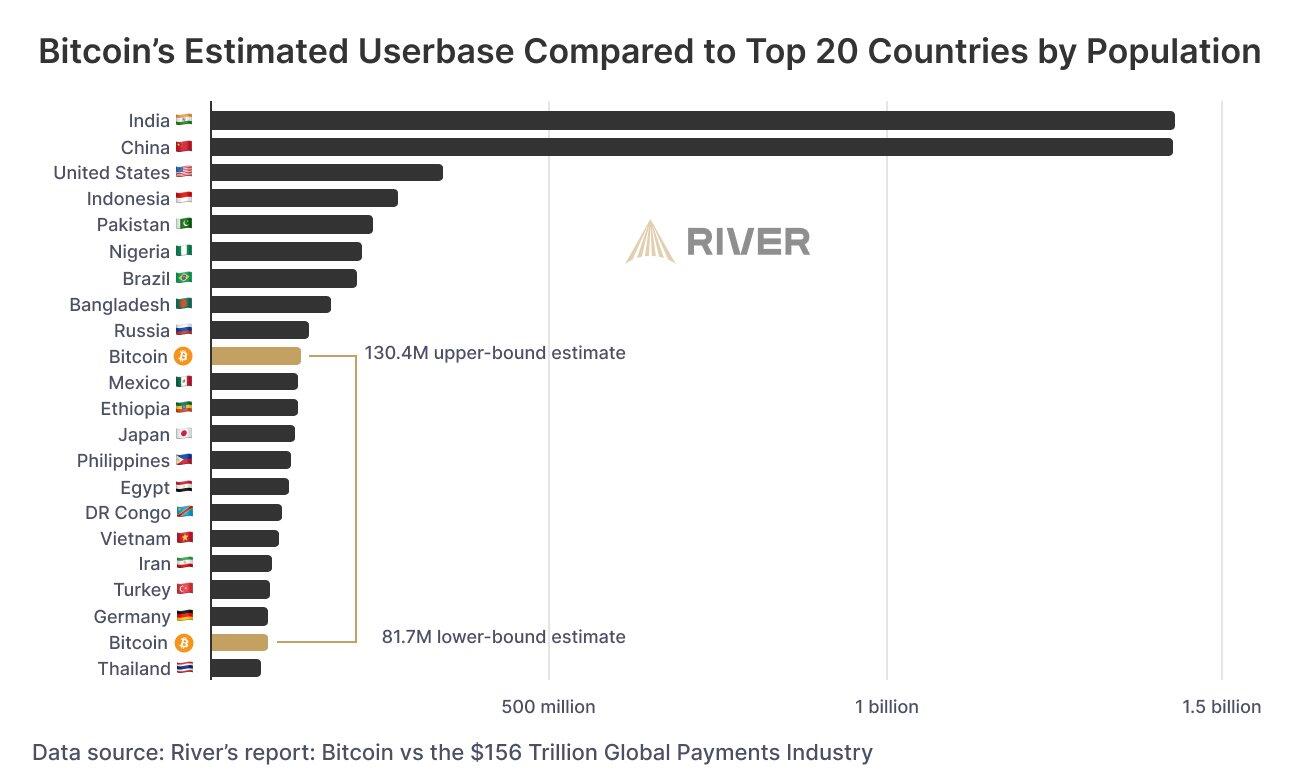

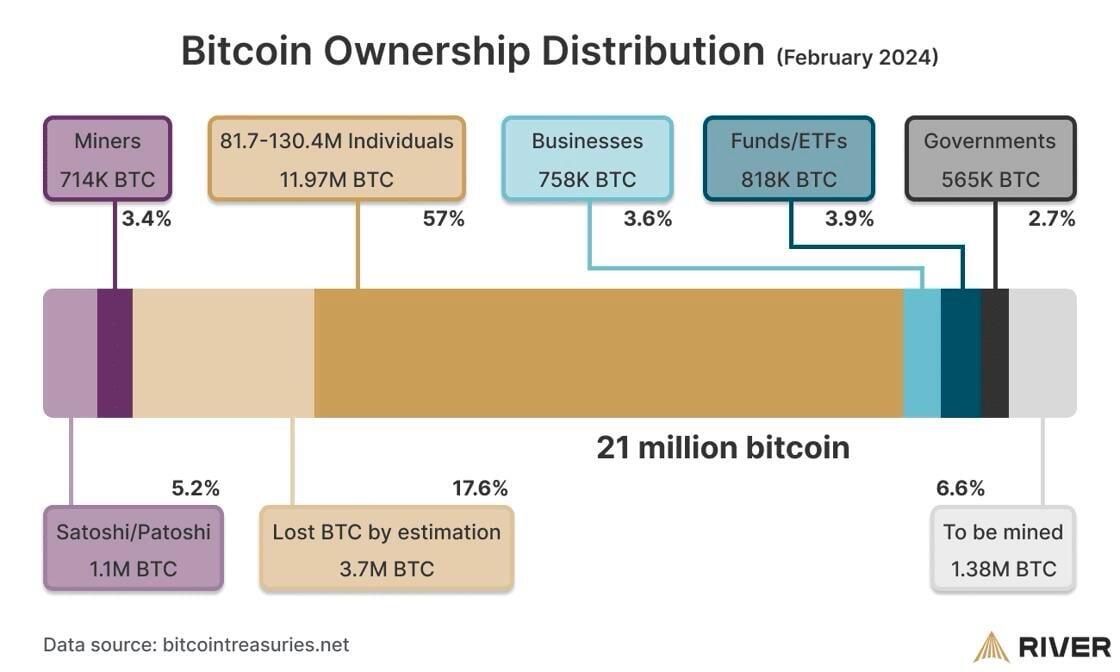

If Bitcoin was a country, it would rank somewhere between 10-20 in population size.

Something tells me we're going to enter the top 10 very soon 👀

If you're curious to learn more, you can find the analysis here https://river.com/learn/how-many-people-use-bitcoin/

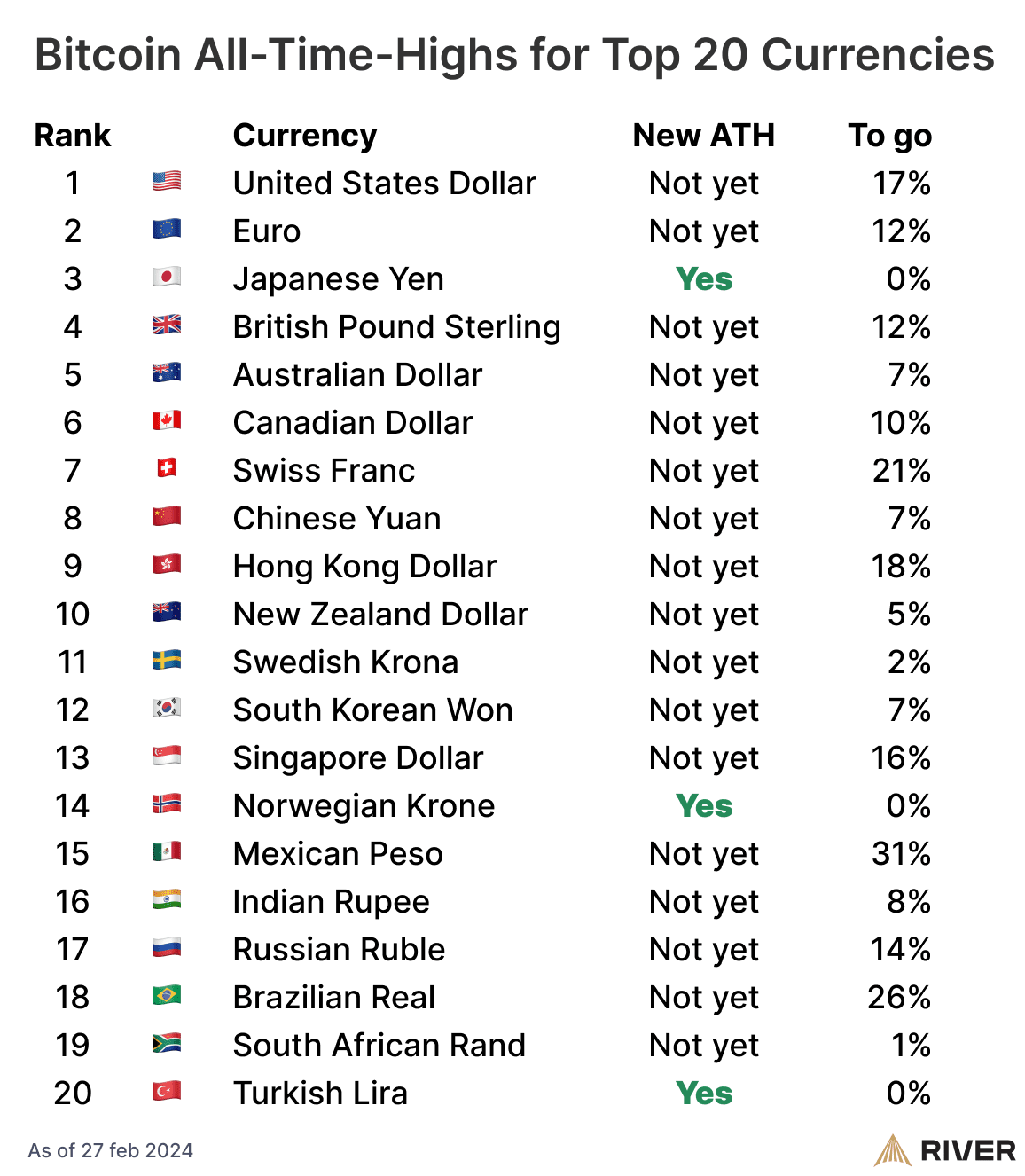

#Bitcoin has already reached all-time-high prices in 3 of the top 20 global currencies.

The rest will follow as governments continue to print money to cover for their deficit spending.

People are opting out of this madness around the world, and we get called crazy for it 🙋♂️

I am a Bitcoiner, I know some of us are passionate about it, I also know the vast majority of people are not.

There is only so much information you can put into a graphic before it gets too crowded. People were also suggesting to subdivide by all kinds of things, but the data just isn’t available. Sometimes simplicity is better rather than everything having their own nuanced descriptions in small font sizes.

Based on your description I’m not sure you understand what a hot wallet is. It is a wallet that is on an internet connected device. Nothing about it being internet connected makes it not in your custody, it just means that there are more attack vectors to take it from you. Lightning nodes have hot wallets for example. The “cold” part of cold storage refers to not internet connected.

I sure hope Binance custodial accounts aren’t represented as an Individuals in this chart…

I even read https://river.com/learn/who-owns-the-most-bitcoin/ and it did not expand.

I have a bad feeling this chart is misleading and all those “individuals” do not cold store.

Yes they are counted as individuals. They are the owners, it’s just that when they use middlemen, those middlemen can do something about that ownership. In a similar way, people own their house in a particular country, and that country can still do something about that ownership. In the case of Bitcoin, the exchange losing or gambling away your coins still makes you a creditor in their bankruptcy, which means even if you lose the money, there is some kind of ownership claim.

If a graphic shows 80% of all bitcoin is held by a handful of people, all it does is give ammo to people who don’t understand the nuances. We already see this happen with the tables of addresses per wealth bracket. This particular graphic focuses on how much different categories are invested in Bitcoin, which is what people are mostly interested in. Everyone already knows much is held at exchanges.

On your final note, cold storage is not a requirement for individual ownership. You can own bitcoin non-custodially in a hot wallet.

I added a new section to nostr:npub1xkere5pd94672h8w8r77uf4ustcazhfujkqgqzcykrdzakm4zl4qeud0en's Lightning report on how much space the Lightning Network⚡️takes up on the #Bitcoin blockchain, and how many Lightning payments have been made with that space.

Key findings:

- Lightning's on-chain footprint was ~0.08% of all on-chain transactions in the past 7 years, or about 617k transactions.

- The average on-chain transaction has historically facilitated at least 50-53 routed Lightning payments, which can increase significantly. (168 in Aug 2023)

- In August 2023, Lightning increased Bitcoin's transaction throughput by at least 47.2% with just 0.06% of all on-chain transactions in that month.

I go deeper into the stats in a video on Twitter https://twitter.com/SDWouters/status/1760680060573675757 and what they mean in practice. These findings don't change Lightning's challenges or Bitcoin's UTXO challenges, but they may give some insights to developers.

You can find the full report below, the new part is on P29. https://river.com/learn/files/river-lightning-report-2023.pdf

A while ago I had my last day at nostr:npub1xkere5pd94672h8w8r77uf4ustcazhfujkqgqzcykrdzakm4zl4qeud0en as a Bitcoin Research Analyst.

I had an amazing time creating reports that will hopefully continue to be useful to many people.

Management asked me to head up marketing; a big honor and responsibility, and a unique opportunity to help Bitcoin win!

This doesn't mean no more research from River. We'll be expanding the team with outstanding people and I'll keep diving into areas that deserve attention.

Thanks to everyone who has been supporting me! And thank you to our management for their faith in me.

That’s not what the bars refer to, if you look into the report you’ll see they’re for something else 🙂

Is there a best time and day to DCA #Bitcoin ? Could you stack more sats by choosing carefully?

With nostr:npub1xkere5pd94672h8w8r77uf4ustcazhfujkqgqzcykrdzakm4zl4qeud0en's zero-fee recurring orders, we get these questions sometimes, now we also have answers!

Based on our research, we found that:

1. Historically, the daily high price happened within a 4-hour window 38.5% of the time, and the daily low price happened within that same 4-hour window 39.4% of the time. This pattern has shifted over time and the window has shrunk.

2. There is a one-hour window with over 3 times as many price bottoms than peaks in the past twelve months.

3. Mondays have historically had the highest odds of having the weekly low price relative to the weekly high price falling on this day.

4. The first and second days of each month have historically had the highest odds of having the lowest price relative to the monthly high price happening on those days.

5. Due to the variance of the exact moments when price peaks and bottoms happen, the achievable practical advantage on timing a recurring order is around 1.2%.

You can read more about this in the report here https://blog.river.com/best-time-and-day-to-dca-bitcoin/

We’re hiring a Content Strategist at nostr:npub1xkere5pd94672h8w8r77uf4ustcazhfujkqgqzcykrdzakm4zl4qeud0en to work with me on leveling up our content.

It’s a fantastic company full of smart and awesome people 🧡

You can apply here if you have a portfolio of content https://boards.greenhouse.io/riverfinancial/jobs/5012722004

What's more fun than doing #Bitcoin research? Sharing the results in person!

My deadline for the research on 1212% growth in Lightning activity was Bitcoin Amsterdam.

If you're not much of a reader, you can get a bunch of insights from the presentation.

https://youtu.be/BaL_wExuR3c?si=yiu4J-MXnTL-ByDE

It's been a wild ride. I hope the report continues to be a useful tool for people around the industry to show the activity that is happening and combat misinformation.

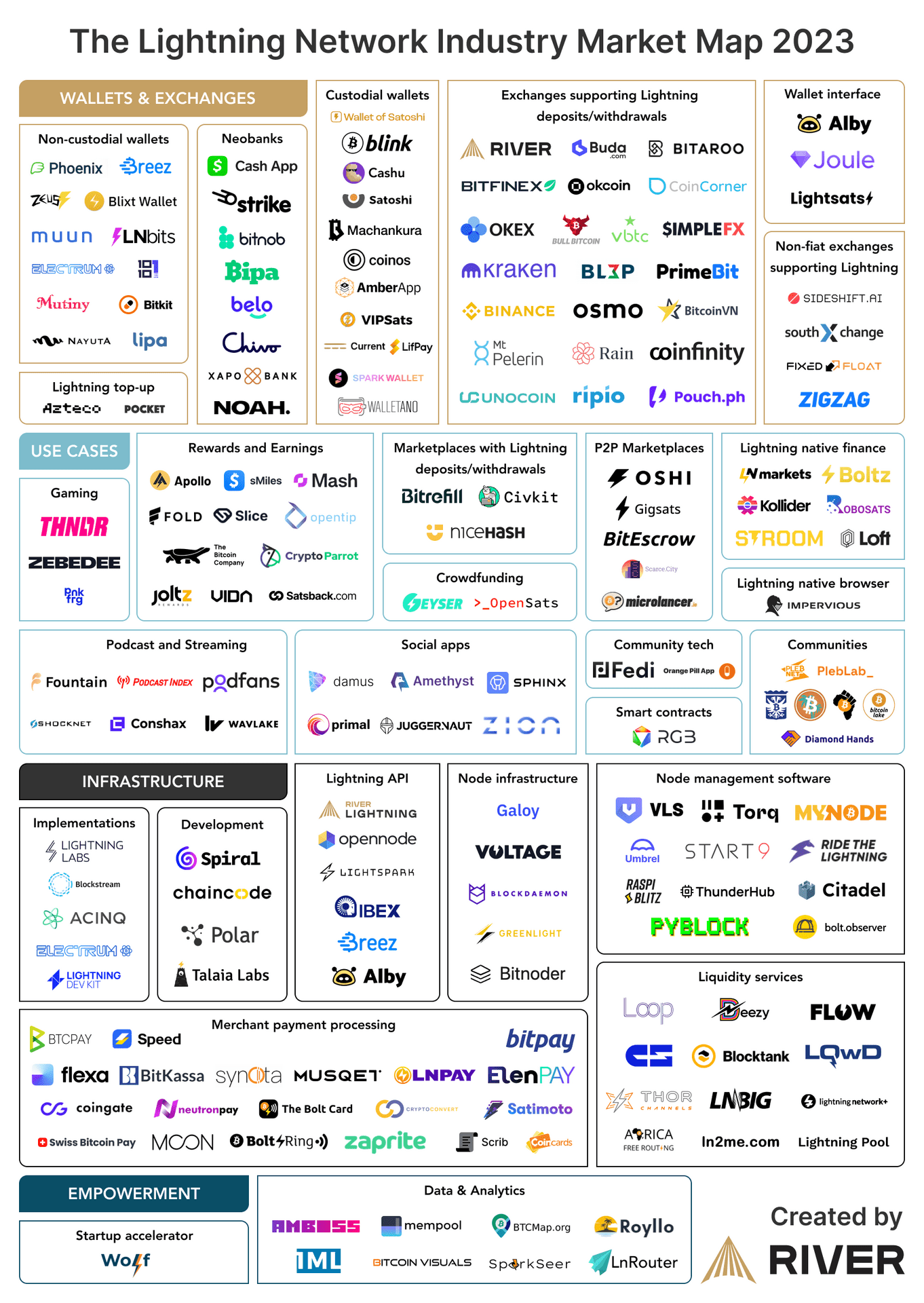

Yeah it has been fixed along with a bunch of others. I forgot to categorize a few wallets after first just listing all the others. Still need to upload the new version to the report but the map is already on socials.

As part of the new Lightning research, I’ve attempted to map out and categorize all companies in the Lightning space.

179 companies across 28 categories 🤯

If you’re interested in the full research on how the Lightning Network has been growing, you can find it here https://blog.river.com/the-lightning-network-in-2023/

My bad, I’ll make a note to fix this, thank you.

“Nobody is using Lightning” should now be a dead meme.

Launching a new Bitcoin report from nostr:npub1xkere5pd94672h8w8r77uf4ustcazhfujkqgqzcykrdzakm4zl4qeud0en: How the Lightning Network grew by 1212% in 2 years ⚡

It’s time to pay attention to the incredible work of so many people in the space.

In this report:

- How many transactions on Lightning

- How much volume

- How many users

- Industry overview of 173 companies

- Funding overview

- River-specific insights

- Why are companies interested in Lightning

- Growth accelerators

And yes, an executive summary 😉

You can find the report here https://blog.river.com/the-lightning-network-in-2023/

It would mean a lot if you could share this post and/or the report 🧡

I'll be sharing this report at The Bitcoin Conference in Amsterdam in 2 days!

nostr:note1vclsfndcx84yg6ajrpl5vrecj9h55zxxaut80nfkkvs28e55rmtqcpj95w

nostr:note1vclsfndcx84yg6ajrpl5vrecj9h55zxxaut80nfkkvs28e55rmtqcpj95w