„Think about it logically, if it costs $80k to mine a Bitcoin today then it would require roughly tripling the hashrate of the mining network to bring it's marginal cost of production to $250k. Bitcoin is already the largest computational network on earth by a significant margin after 15 years. Do you really think that in less than 1 year we can triple it? This becomes more unlikely the older and larger the network gets.”

Can we say that marginal cost of production is BTC fair price and market price in long term follows it? This might be another explanation of price pumps and following corrections. When market price is detached from fair value it must collaps. This detachment in bull run goes higher as financial markets liquidity is higher than commodity (ASIC) market liquidity.

Not sure if I get it right.

Now that’s a spirit!

We used to say that one has to raise a child, build a house and plant a tree but now there is that one more important task - buy bitcoin and retire your bloodline. Become a legend. Oow it is that time. It will not last for long. If you waste it for some shit you’d better been remived from gene pool.

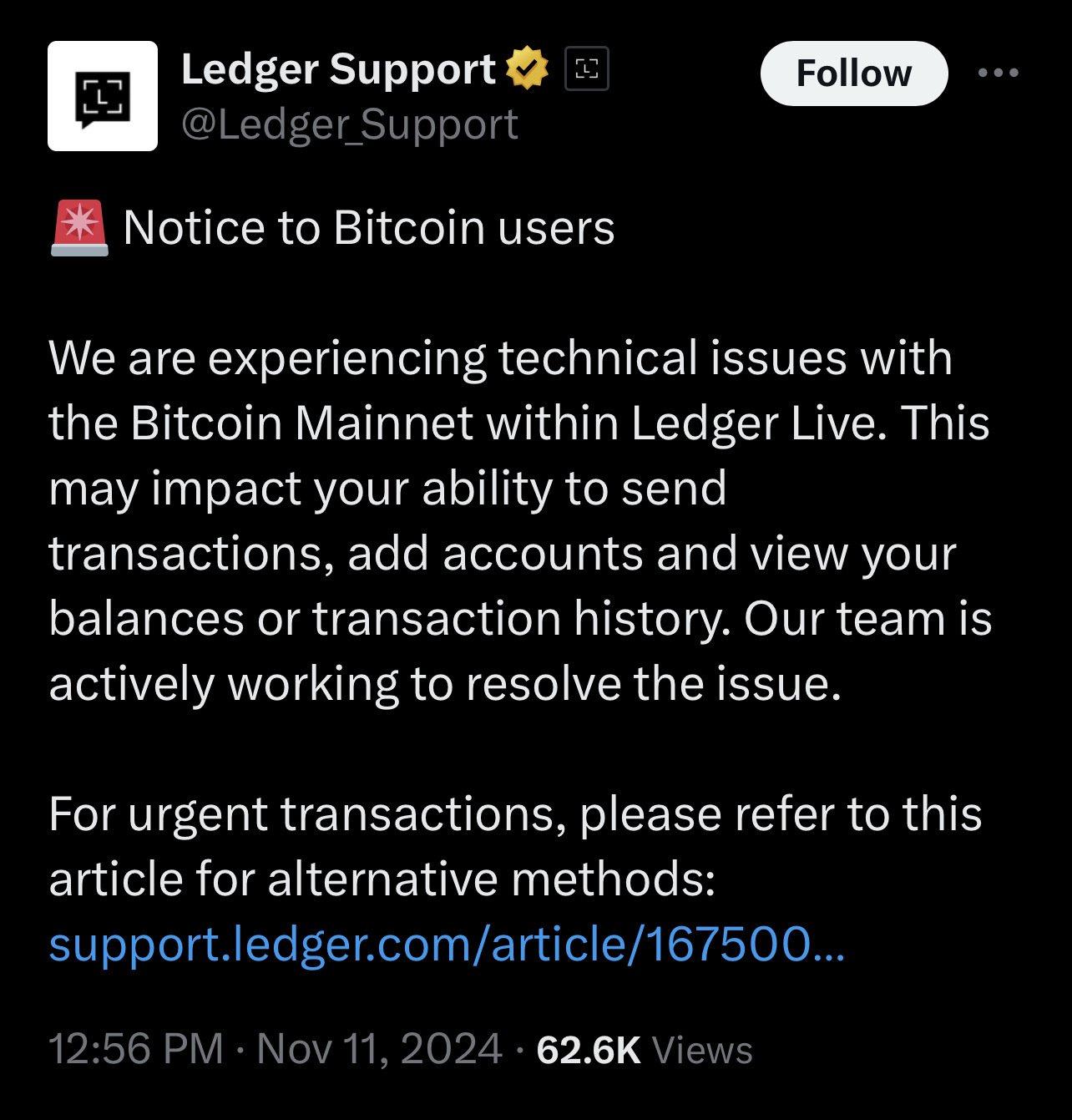

Randomly saw this an hour before we were due to meet! Let them know and they decided to get a nostr:npub1s0vtkgej33n7ec4d7ycxmwt78up8hpfa30d0yfksrshq7t82mchqynpq6j Passport instead and wait to transfer 😅👍

Passport is very good choice. One of the best on the market.

As for Ledger’s post, this is regarding using Ledger Live for creating accounts and transactions which is bad choice as user is sharing his data (xpub, metadata, not sure if IP) with Ledger. So again, if you are about to use Ledger us Ledger App only to load firmware and nothing more.

Every single bet is on Bitcoin hitting 90k this month.

https://www.bitcoinprediction.market/predictions/34/will-bitcoin-hit-$90k-in-november

Why not today?

The problem with wabisabi coinjoin transactions is that you end up with dust UTXOs and need to consolidate them after coinjoin: https://mempool.space/tx/b893d2f3dccf0b4ce22e572e431b97b7a14fdf00992fbfb344937ba717eec793

Didn’t this consolidation ruin all the work done coinjoining not only for the utxo owner but also other coin join participants?

Just released Holesail version 1.8.0 ⛵️ with UDP support.

That means we are now one step closer to launching Holesail on nostr:npub126ntw5mnermmj0znhjhgdk8lh2af72sm8qfzq48umdlnhaj9kuns3le9ll and it now support a wider range of applications and gaming.

It is frogging awesome 🥳

I need to give it a try.

In my opinion Ledger as device is fine. Better than nothing. I would obviously help and make sure he does not create any account on Ledger Live. Use an app for firmware updates only.

Glad to see other opinions.

Transaction B may depend on some prior transaction A which is not yet confirmed. Imagine a chain of unconfirmed transactions. Mempool has to track them all.

Everything is going to be fine as they have got plenty of cheap energy from reliable sources so that their manufacturing can expand … wait, what?

Damn, maybe there is still hope that EUR will weaken making their products competitive on the markets. Germans will appreciate it and gladly accept their EUR savings goin to shit, even without negative interest rates which ECB will gladly reinrtroduce soon … wait, what?

At least Germany is as it always was safe and well organized country … wait, what?

🫡🤡💩🖕

Agreed but retiring your children is better target. 🫡

She was not in charge of her campaign or the money the same as would not be in charge of the country if she won.

Puppet, expendable asset.