nostr:npub1lrnvvs6z78s9yjqxxr38uyqkmn34lsaxznnqgd877j4z2qej3j5s09qnw5 you have been warned!

"When cities build their future around the hopes of distant aid, they make decisions that prioritize outside approval over local needs. That’s not strength. That’s dependency."

"A strong city doesn’t mean a wealthy city, or a growing city, or even a city with all the answers. It’s a place with options."

https://www.strongtowns.org/journal/2025/4/21/the-opposite-of-strong-isnt-weak-its-dependent

While the focus of the article is on cities, the same could be applied to individuals.

"A strong individual doesn't mean wealthy or ripped, or brilliant. It's a person with options."

Stack sats to have options.

https://www.strongtowns.org/journal/2025/4/14/cities-are-already-defaulting-on-their-debts

Just wait until you go down the infrastructure rabbit hole and realize just how bad it actually is.

I specialize in Municipal Finance and something that has forever infuriated me is that folks are more than happy to spend the debt to build a bridge or other piece of infrastructure but then never bother to set aside the money to maintain or replace it in the future, expecting future generations to not only choke on their long-term bond debt load from folks not wanting to pay the price now but also for fixing their expensive overbuilt decisions down the road.

The idea of time-locking a reserve of BTC on a release schedule over the life of a piece of infrastructure would flip this paradigm on its head by committing to not burdening future generations but instead throwing our present energy far into the future to fix it when the need eventually arises.

By incorporating a time-locked 5% reserve with a clear release schedule, you could plan for the periodic maintenance and the eventual full replacement. If it was in a multi-sig setup of multiple local officials (DOT commissioner, budget director, CFO, Mayor and head of council for example in a 3/5) so that funds were responsibly allocated to the project on release you also help future capital planning for the City and make things easier rather than harder.

Below is a sample disbursement table with simple math to illustrate the concept. I would love some thoughts from folks as Bitcoiners are one of the few groups with actual low-time preference decision making mindsets. nostr:npub1s5yq6wadwrxde4lhfs56gn64hwzuhnfa6r9mj476r5s4hkunzgzqrs6q7z nostr:npub16le69k9hwapnjfhz89wnzkvf96z8n6r34qqwgq0sglas3tgh7v4sp9ffxj

I know they got swamped over the holidays with unexpected demand and they are only now getting shipping timelines back under control. And they are still building out the new factory's capacity.

Hope you guys can get something going in the future.

nostr:npub16le69k9hwapnjfhz89wnzkvf96z8n6r34qqwgq0sglas3tgh7v4sp9ffxj ever since you guys first talked to Michael Dunworth about the idea of time locking Bitcoins in the future for people to find I've been thinking about how Cities could use it to responsibly maintain long term infrastructure projects.

https://youtu.be/dx-Fxcz3xPk?feature=shared

Build a new bridge for $100M with a 100BTC reserve that is time locked on a 10 year release cycle for repairs with a replacement kicker arriving in year 70 as the final unlock.

Actually throw our current energy forward into the future instead of just stealing from our children with costly long-term bonds just to build it and never setting money aside to fix the things we build.

nostr:npub1zzmxvr9sw49lhzfx236aweurt8h5tmzjw7x3gfsazlgd8j64ql0sexw5wy is a man of his word. These just arrived in the mail and I'm looking forward to trying them out tomorrow. Thanks again!

Note to self, next time you want to buy some soap from nostr:npub1zzmxvr9sw49lhzfx236aweurt8h5tmzjw7x3gfsazlgd8j64ql0sexw5wy , remember to check your spending lightning wallet's balance first.... got there eventually.

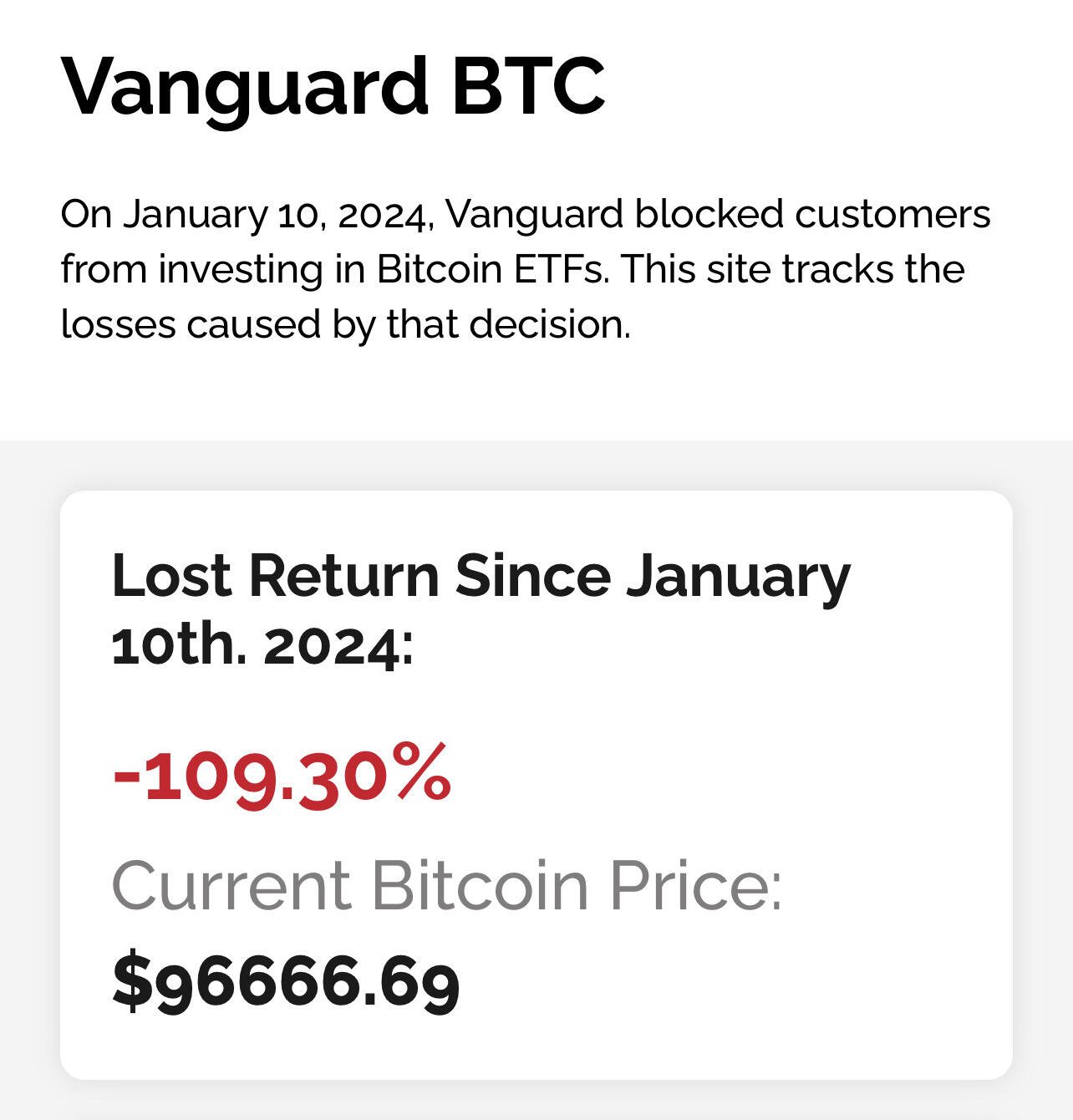

Vanguard Refuses to Adopt #Bitcoin - and their customers pay the price. Vanguard customers can track their losses here: https://vanguard-btc.com/

Vanguard didn't block us from vindictively buying a boatload of MSTR on that day with the funds we were going to buy the ETFs with in our IRAs though!

"Our last Primal update was a real banger with cross-app wallet functionality, Primal Web now being even more functional for our users, now we're going back to basics."

nostr:npub1s5yq6wadwrxde4lhfs56gn64hwzuhnfa6r9mj476r5s4hkunzgzqrs6q7z I loved the recent conversations about Microstrategy.

Given that most folks are focused on the Treasury value only, I was wondering your thoughts on their ability to use things like Amboss to generate sats streams on even a small portion of their holdings and what role the "Bitcoin Development Company " plays in our broader ecosystem's evolution. They seem like one of the sole sources very large institutions will have available for a counter party that can be trusted.

Seeing how easy it was to zap on this video finally got me to make the effort of figuring it out. Here's the first 21.