Let me see if I got this right. Buying into a Bitcoin ETF, is essentially taking bitcoin off the market and locking it up in a cage, never to be used as it was designed to be used. It’s being seen as a commodity, but this commodity is not used to make anything with, and also never disintegrates or spoils. It’s not being used as a utility of which it was meant to be. It’s just a storage container for Fiat money. You put the Fiat in the storage compartment, and hopefully like a fine wine, the fiat appreciates in value. You can then take the Fiat out of storage and spend it. The storage container which is Bitcoin remains with the ETF, waiting for more Fiat to be stored in it. But isn’t the value of Bitcoin really in its utility. What if Bitcoin has no utility any longer because the ETF’s have captured so much of it, that the network is not really used any longer. Wouldn’t the value of this container become less over time if its utility was diminished. Kind of like a barrel storing a fine wine, but instead the wine spoils in the barrel. The barrel is no good any longer and must be discarded. If the people that have their fiat stored in this container find that the fiat is not appreciating as they expected, they will want to remove their fiat from these containers and store it somewhere else. Will the ETF’s then be stuck with these containers that will never spoil, and find themselves in a spot that they will need to dump these empty containers on the open market, so that they may eventually become the utility that they were supposed to be. Will the network survive this?

Looking at the Fiat price of Bitcoin in the last few years always reminds me of the Song Lyrics - “Push it down, it comes out sideways.”

As much as the manipulators try to keep the price down, it usually comes out sideways. It’s a fools game to short Bitcoin.

As much as they try, they cannot manipulate the innovation that is Bitcoin.

Innovators, continue to innovate around the core value of the technology that is Bitcoin. The innovator’s continue to enhance daily, the ease of use for the everyday person to be able to safely make use of this new innovation. As they do, the adoption curve rises exponentially, pushing it thru any down pressure that can be exerted by governments or institutions wanting to see this innovation squashed, or at least brought under their control.

Don’t dare let them lead you to believe that some new fangled ETF is the true innovation of Bitcoin. It’s not. The ETF is only a tool the institutions will use to line their own pockets with Fiat money from trusting clients that will never take the time to understand what Bitcoin really is. The internet is a truly remarkable world wide phenomenon, and Bitcoin is the money of the internet. Making it also the money of the World. Don’t forget how important that is.

This is on Facebook!

Genius investor James Altucher is predicting between now and January 9, a new generation of A.I. will create a brief “wealth window” in America. It could make crypto look like pocket change

Looks like he bought his wig from same place my grandmother did.

In nature, becoming a weakling in the heard, depending on the heard to protect you, then the predator will eventually pick you off to feed their need. The heard won’t always help you. Learn to protect yourself. Don’t be a weakling.

Lets not forget that in 2023 alone 5 banks failed.

How many do you think will close in 2024? 🤔 https://video.nostr.build/f2bed1e7206bc4e495059fb544af6c42475f89eb34a9dbdc25d82419e488e12a.mp4

Jaimie Dimon sits in on a congressional committee seeking to ban Bitcoin, all while monopolizing the banking industry.

Early on, I got hacked goofing around with a shit coin. It taught me a lesson. Either learn this stuff, or trust somebody else to learn it for you. When it comes to hard earned money, I prefer to learn it myself. Bitcoin is the easiest, simplest to learn. All other Crypto is a big mess of goobly glop.

The US dollar will drain your natural resources. The US will endlessly print money to buy your resources. As they do your classes of your people will divide into more disperse upper, middle and lower classes of people. As the printed money filters down to the lower class it will buy them less, and they will need social welfare to survive. As your upper class requires more dollars for your resources, the US will print more $ and send them to you. No skin off them. They have a license to print endlessly. Your food supply will be bought up by the US for amounts of dollars that makes it non-sense for your producers to sell there product into your own economy, therefore starving out your lower class, or at least providing to them a inferior source of nutrition leading to obesity in many people in your nation. You only need to look at the lower class of America to see that has already happened to them. Bitcoin is your real defense against this scenario playing out. Force foreign money printers to buy your resources with Bitcoin. The value of your Bitcoin will rise faster then inflation.

A friend of mine sent me this from his Senator. Sensible legislation written by industry experts is reasonable, but legislation submitted by Sen. Warren written by the Banking Industry in their own self interest is just wrong.

Dick Durbin writes;l

Thank you for contacting me about cryptocurrencies. I appreciate hearing from you.

Cryptocurrencies are virtual currencies that rely on a decentralized electronic payment system instead of third-party intermediaries, such as banks.

Cryptocurrency is not considered legal tender in the United States and is classified as property by the Internal Revenue Service. The national currency of the United States is the dollar, which is printed by the Bureau of Engraving and Printing and circulated by the Federal Reserve System. There are currently no discussions to replace the dollar as the national currency of the United States.

The emergence of virtual currency seems to present a number of exciting new frontiers, but in practice can pose a serious risk to consumers. In many cases of cryptocurrency investment, proper disclosures and consumer protections are forgone. Working class Americans, lured by the promise of quick and easy financial freedom, are putting their hard-earned cash on the line, only to find that these major selling points of cryptocurrency are a ruse, and that their money is lost. In 2022 alone, fraud schemes involving cryptocurrencies totaled more than $9 billion.

On July 19, 2023, Chair Gary Gensler of the Securities and Exchange Commission testified before the Senate Appropriations Subcommittee on Financial Services and General Government. I asked Chair Gensler about the risks associated with cryptocurrency. In response, Chair Gensler confirmed that the cryptocurrency industry has become subject to fraud, scams, and abuse perpetuated by bad actors looking to prey upon American investors. Chair Gensler also stated that further resources for cryptocurrency enforcement would be beneficial in improving regulation of these digital assets.

I will keep your views in mind as Congress continues to explore policies related to cryptocurrencies.

Thank you again for contacting me. Please feel free to keep in touch.

Sincerely,

Richard J. Durbin

One of the things in this that ruffles my feathers is the notion that Bitcoin wants to replace the national currency. I don’t think that needs to be true. National currencies could still exist. Bitcoin would be a choice that free people could use as an alternative as needed. A world wide internet currency that knows no boundaries. A currency that may force national fiat currencies to behave themselves as not to lose their peoples confidence of it’s value.

Just thought I would bring this over to Nostr from X, because this guy does not seem to be here yet, and this is a well written piece about Africa.

It may be that Venezuela is heading in the same direction by adopting the US dollar as their currency. The US will be able to drain their natural resources simply by printing worthless dollars and distributing them into their economy.

Now if instead, Venezuela were to sell it’s natural resources for Bitcoin, then World Governments would be forced to Buy Bitcoin with those worthless printed fiat currencies, which would in turn raise the value of Bitcoin that Venezuelan’s have earned, and in turn stop inflation in their country.

danieleripoll (@Rip VanWinkle ⚡️) posted: #Bitcoin is one of Africa's greatest hopes.

While the continent of Africa is considered "poor" by most Western standards, the reality is that Africa is one of the wealthiest continents on Earth when measured by the resources that exist within it. Africa arguably possesses more… https://x.com/danieleripoll/status/1737944177990860828?s=66&t=f6DRXWOGWTC12gg5G_HlXQ

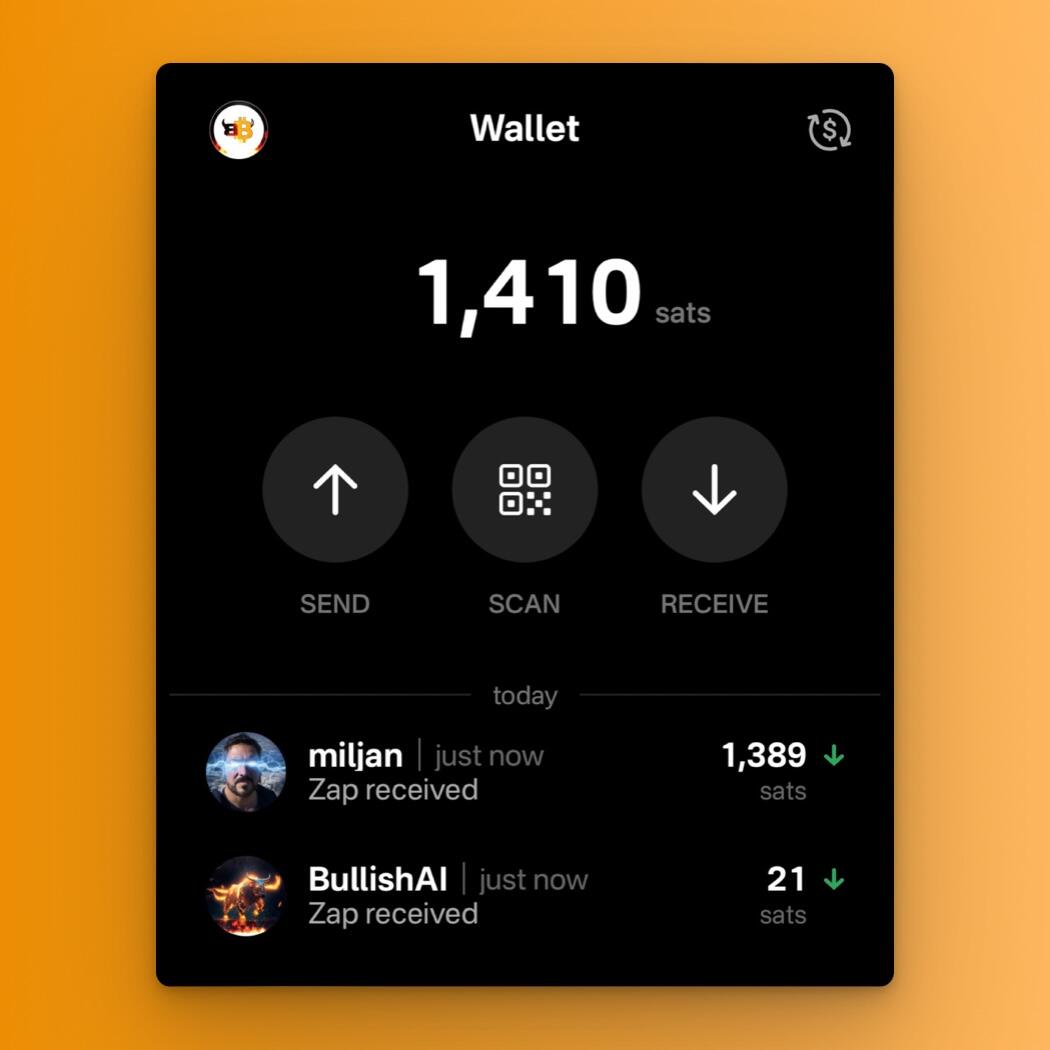

My credit card commercial asks; “what do you have in your wallet?” I say SATS, how about you.

Higher fees make it even easier to Hodl down. Does not break my spirit. Hope traders get burned. Trading Bitcoin is fools fiat.

Apparently Senator Warren believes USA CBDC’s will render Bitcoin useless. However she’s trying to kill Bitcoin before CBDC’s release. Why not leave Bitcoin alone, and let the public decide what’s better? She obviously does not want to compete. She knows she’ll lose against superior technologically sound money.

Just asking for a friend: under Sen. Warrens rules, if I swap a pig for a cow with my local farmer, do I need a money transmission license?

I’m on Damus. Just get Zap failed to create invoice. Have zapped others without this problem. Using alby wallet

"Sending a super high transaction fee to put an ordinal on the #BTC blockchain is kinda like paying for a 1st class Emirates ticket to fly ur beanie baby collection across the Atlantic Ocean. I'm a capitalist. If you wanna do that, that's your prerogative."🤷♂️

— nostr:npub1rtlqca8r6auyaw5n5h3l5422dm4sry5dzfee4696fqe8s6qgudks7djtfs

How come nostr:npub1a3hrd4wfawr578d5y5l0qgmh7lx8q6tumfq0h7eymmttt52veexqkcfg37 does not have Zaps set up.

Stay out of the fiat system. Spend Bitcoin with another Bitcoiner. Earn Bitcoin from another bitcoiner.

I think the USA should take a hard look at a different tax scheme. Income, and Capital Gains taxes have been gamed so badly, that the IRS is just a big mess. I think Consumption Tax, which exempts direct labor, property rental, and Charitable contributions, would be more straight forward and fair to all. You could abolish the IRS, and the cost of all that documentation and cost of chasing down tax evasion. And I mean no other taxation at the state levels either. No additional taxes from property tax, etc. A straight forward % across the board to fund the Fed, and state governments. Collection of this tax would be from point of purchase, and sent directly to one government department. That government department would redistribute the collected funds to Fed, state, and communities as necessary to fund their operations.

It’s only right that nostr:npub16c0nh3dnadzqpm76uctf5hqhe2lny344zsmpm6feee9p5rdxaa9q586nvr came through with the first zap on the shiny new #Primal Lightning address! Also had to zap myself ofc. 😁  nostr:note1y5s3a2mn2jpg46w55zh790kh2w4lwhuz625lfe3vf3gy6xg77r9q09x2t6

nostr:note1y5s3a2mn2jpg46w55zh790kh2w4lwhuz625lfe3vf3gy6xg77r9q09x2t6

I put primal on my iPad, but struggling with set up. Transferred my pub key from Damus. Went in and picked everything up, but won’t let me comment, add, Zap or anything at all. Went into profile and added my lightning wallet address, but it won’t stick. I hit save, exit the setup and come back and it’s not there any longer.